- Subaru Forester insurance cost averages $2,134 per year or around $178 per month, depending on the trim level.

- The Subaru Forester is one of the cheaper compact SUVs to insure for the 2024 model year, costing $72 less per year on average when compared to the rest of the class.

- The cheapest Forester insurance is usually found on the base trim level costing an average of $1,982 per year, while the Forester Touring is the most expensive to insure at $2,244 per year.

- Insuring an older Subaru Forester could save around $730 per year, and even more if insuring for liability only.

How much does Subaru Forester insurance cost?

Subaru Forester insurance costs $2,134 per year for full coverage on average. Monthly insurance cost on a Subaru Forester averages $178 and ranges from $165 to $187, depending on the trim level.

The compact SUV segment’s average cost of insurance is $2,206 a year, so insuring a Subaru Forester could save an estimated $72 or more annually over other similar vehicles.

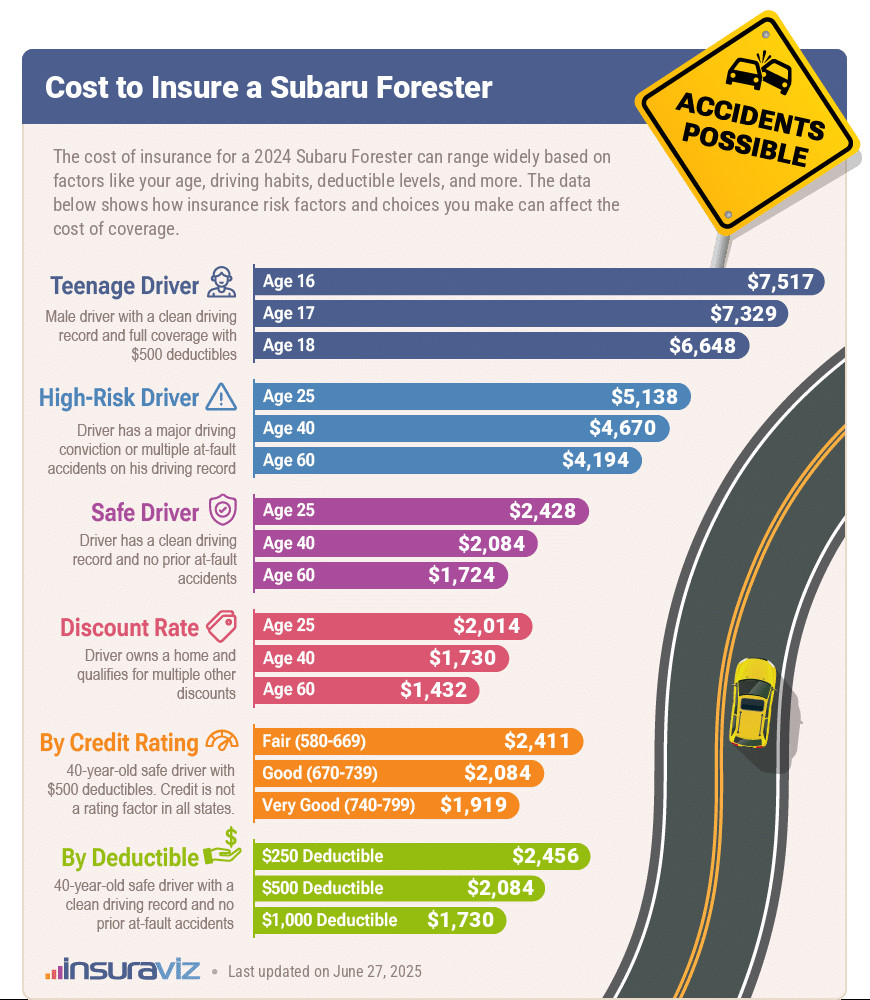

The following infographic demonstrates average car insurance rates on a 2024 Subaru Forester using an assortment of different driver ages and risk profiles.

There is a lot of data to digest in the graphic above, but let’s discuss the four key concepts.

- Teenagers are expensive to insure regardless of the vehicle. Even with the Forester being a relatively affordable model to insure, rates for young drivers are still astronomical.

- Contrasting the rates between high-risk and safe drivers should really make you want to avoid any high-risk driving convictions. Reckless driving, DUI, driving without insurance, and leaving the scene of an accident are some of the convictions you do not want on your driving record.

- Keeping an eye on your credit score benefits your insurance rates. It’s statistically proven that drivers with better credit scores file fewer claims, so that’s why insurers use your credit score to help determine the likelihood of future claims. Not all states allow insurers to use credit scores as a rate determining factor, however.

- If your goal when insuring your Forester is to keep rates down, consider a higher deductible. If your goal is to minimize out-of-pocket expenses if you have a claim, choose a lower deductible. Finding the balance between policy affordability and claim-time expense can be a struggle. If you tend to have few claims, then a higher deductible may save you in the long run.

How do Forester insurance rates compare?

When Subaru Forester car insurance rates are compared to the top-selling other small SUVs, the Forester costs $78 less per year to insure than the Toyota RAV4, $88 more than the Honda CR-V, $76 less than the Chevrolet Equinox, and $20 less than the Nissan Rogue.

When compared to all vehicles (not just compact SUVs), average Subaru Forester insurance costs 6.4% less than the national average auto insurance rate of $2,276 per year.

The chart below shows how Forester car insurance rates compare to other popular small SUVs and crossovers. Following the top ten chart, a larger data table is included after the chart that illustrates auto insurance cost for all 47 vehicles in the 2024 small SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$362 |

| 2 | Chevrolet Trailblazer | $1,804 | -$330 |

| 3 | Kia Soul | $1,872 | -$262 |

| 4 | Nissan Kicks | $1,888 | -$246 |

| 5 | Buick Envision | $1,922 | -$212 |

| 6 | Toyota Corolla Cross | $1,932 | -$202 |

| 7 | Hyundai Venue | $1,950 | -$184 |

| 8 | Mazda CX-5 | $1,956 | -$178 |

| 9 | Ford Bronco Sport | $1,966 | -$168 |

| 10 | Volkswagen Tiguan | $1,984 | -$150 |

| 11 | Buick Encore | $2,038 | -$96 |

| 12 | Honda CR-V | $2,046 | -$88 |

| 13 | Volkswagen Taos | $2,056 | -$78 |

| 14 | Kia Niro | $2,066 | -$68 |

| 15 | Honda HR-V | $2,088 | -$46 |

| 16 | Subaru Forester | $2,134 | -- |

| 17 | Kia Seltos | $2,144 | $10 |

| 18 | GMC Terrain | $2,148 | $14 |

| 19 | Nissan Rogue | $2,154 | $20 |

| 20 | Hyundai Kona | $2,158 | $24 |

| 21 | Mazda CX-30 | $2,164 | $30 |

| 22 | Volkswagen ID4 | $2,176 | $42 |

| 23 | Ford Escape | $2,188 | $54 |

| 24 | Chevrolet Equinox | $2,210 | $76 |

| 25 | Toyota RAV4 | $2,212 | $78 |

| 26 | Mazda MX-30 | $2,226 | $92 |

| 27 | Hyundai Tucson | $2,232 | $98 |

| 28 | Chevrolet Trax | $2,264 | $130 |

| 29 | Mini Cooper Clubman | $2,274 | $140 |

| 30 | Mini Cooper | $2,278 | $144 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $168 |

| 32 | Jeep Renegade | $2,308 | $174 |

| 33 | Mitsubishi Outlander | $2,336 | $202 |

| 34 | Kia Sportage | $2,350 | $216 |

| 35 | Hyundai Ioniq 5 | $2,358 | $224 |

| 36 | Fiat 500X | $2,368 | $234 |

| 37 | Mini Cooper Countryman | $2,374 | $240 |

| 38 | Subaru Solterra | $2,376 | $242 |

| 39 | Mazda CX-50 | $2,380 | $246 |

| 40 | Nissan Ariya | $2,386 | $252 |

| 41 | Toyota bz4X | $2,390 | $256 |

| 42 | Mitsubishi Mirage | $2,398 | $264 |

| 43 | Kia EV6 | $2,474 | $340 |

| 44 | Dodge Hornet | $2,554 | $420 |

| 45 | Jeep Compass | $2,594 | $460 |

| 46 | Hyundai Nexo | $2,648 | $514 |

| 47 | Ford Mustang Mach-E | $2,806 | $672 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

When the average cost for each model in the small SUV segment is factored in, it allows us to compare average cost between the Forester and compact SUVs with the most similar prices. A 2024 Subaru Forester has an average MSRP of $32,591, before dealer fees and destination charges.

The four compact SUV models most similar in price to the Forester for the 2024 model year are the Kia Sportage, Mitsubishi Outlander, Hyundai Kona, and Kia Niro. The data below shows how those models compare to a 2024 Forester by both purchase price and average insurance cost.

- Compared to the Kia Sportage – With an average price of $32,430 ($27,090 to $37,890), the 2024 Kia Sportage costs $161 less than the MSRP for the Forester. Drivers can expect to pay an average of $216 more every 12 months to insure the Kia Sportage compared to a Forester.

- Compared to the Mitsubishi Outlander – The 2024 Mitsubishi Outlander has an average MSRP of $32,758, ranging from $27,090 to $36,745, which is $167 more expensive than the average MSRP for the Forester. Buying insurance for the Mitsubishi Outlander costs an average of $202 more each year than the Subaru Forester.

- Compared to the Hyundai Kona – The Hyundai Kona retails for an average of $32,400 ($24,100 to $41,550), which is $191 cheaper than the average cost of the Forester. The cost to insure a Forester compared to the Hyundai Kona is $24 less each year on average.

- Compared to the Kia Niro – For the 2024 model year, the MSRP on the Kia Niro averages $370 more than the MSRP for the Forester ($32,961 compared to $32,591). Drivers can expect to pay approximately $68 less each year to insure the Kia Niro compared to a Forester.

For additional makes and models, please visit our car insurance cost comparison page.

What is the cheapest Subaru Forester insurance?

With average insurance cost ranging from $1,982 to $2,244 per year, the cheapest Forester trim levels to insure are the base Forester base model and the Premium at $2,082 per year.

On average, plan on budgeting around $165 per month to insure a Forester for full coverage. This amount is highly dependent on your location, age, and driving record, however.

On the high end of the cost spectrum, the three highest cost Forester trim levels to insure are the Subaru Forester Limited, the Wilderness, and the Touring trim levels at $2,178, $2,196, and $2,244 per year, respectively.

The next table displays average insurance rates, plus a monthly budget estimate, for each 2024 Subaru Forester trim level.

| 2024 Subaru Forester Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Base | $1,982 | $165 |

| Premium | $2,082 | $174 |

| Sport | $2,126 | $177 |

| Limited | $2,178 | $182 |

| Wilderness | $2,196 | $183 |

| Touring | $2,244 | $187 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

New vs. used Subaru Forester insurance rates

Insuring a Forester prior to the 2024 model year will definitely lower your insurance rates. Average rates for a 2018 Forester are $1,650 per year, while a 2014 model will cost around $1,464 each year to insure.

The next table details average full coverage Subaru Forester auto insurance cost for the 2013 through 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Subaru Forester | $2,134 | $178 |

| 2023 Subaru Forester | $1,974 | $165 |

| 2022 Subaru Forester | $1,900 | $158 |

| 2021 Subaru Forester | $1,890 | $158 |

| 2020 Subaru Forester | $1,836 | $153 |

| 2019 Subaru Forester | $1,744 | $145 |

| 2018 Subaru Forester | $1,650 | $138 |

| 2017 Subaru Forester | $1,590 | $133 |

| 2016 Subaru Forester | $1,580 | $132 |

| 2015 Subaru Forester | $1,506 | $126 |

| 2014 Subaru Forester | $1,464 | $122 |

| 2013 Subaru Forester | $1,512 | $126 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Subaru Forester trim levels for each model year. Updated October 24, 2025

Liability insurance rates on a Forester

Insuring an older Subaru Forester for just liability insurance could drop the average policy cost to well under $600 a year. Rates vary considerably by location, however, so the rate you pay could be significantly cheaper.

The table below compares the cost of full coverage insurance on a Subaru Forester to the cost of a liability-only policy for the 1998 to 2012 model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Subaru Forester | $1,454 | $772 |

| 2011 Subaru Forester | $1,400 | $764 |

| 2010 Subaru Forester | $1,344 | $758 |

| 2009 Subaru Forester | $1,290 | $750 |

| 2008 Subaru Forester | $1,244 | $744 |

| 2007 Subaru Forester | $1,228 | $736 |

| 2006 Subaru Forester | $1,204 | $730 |

| 2005 Subaru Forester | $1,166 | $722 |

| 2004 Subaru Forester | $1,140 | $716 |

| 2003 Subaru Forester | $1,117 | $702 |

| 2002 Subaru Forester | $1,095 | $688 |

| 2001 Subaru Forester | $1,073 | $674 |

| 2000 Subaru Forester | $1,051 | $660 |

| 1999 Subaru Forester | $1,030 | $647 |

| 1998 Subaru Forester | $1,010 | $634 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

During his career as an independent insurance agent,

During his career as an independent insurance agent,