- SUV models like the Toyota Corolla Cross, Kia Soul, Chevrolet Trailblazer, and Nissan Kicks get the nod for the cheapest auto insurance in Parma.

- A few models with segment-leading car insurance rates in Parma include the Nissan Titan, Chrysler 300, Honda Passport, and Infiniti QX80.

- Monthly car insurance rates for a few popular vehicles in Parma include the Hyundai Elantra at $172, Toyota Highlander at $144, and Nissan Altima at $172.

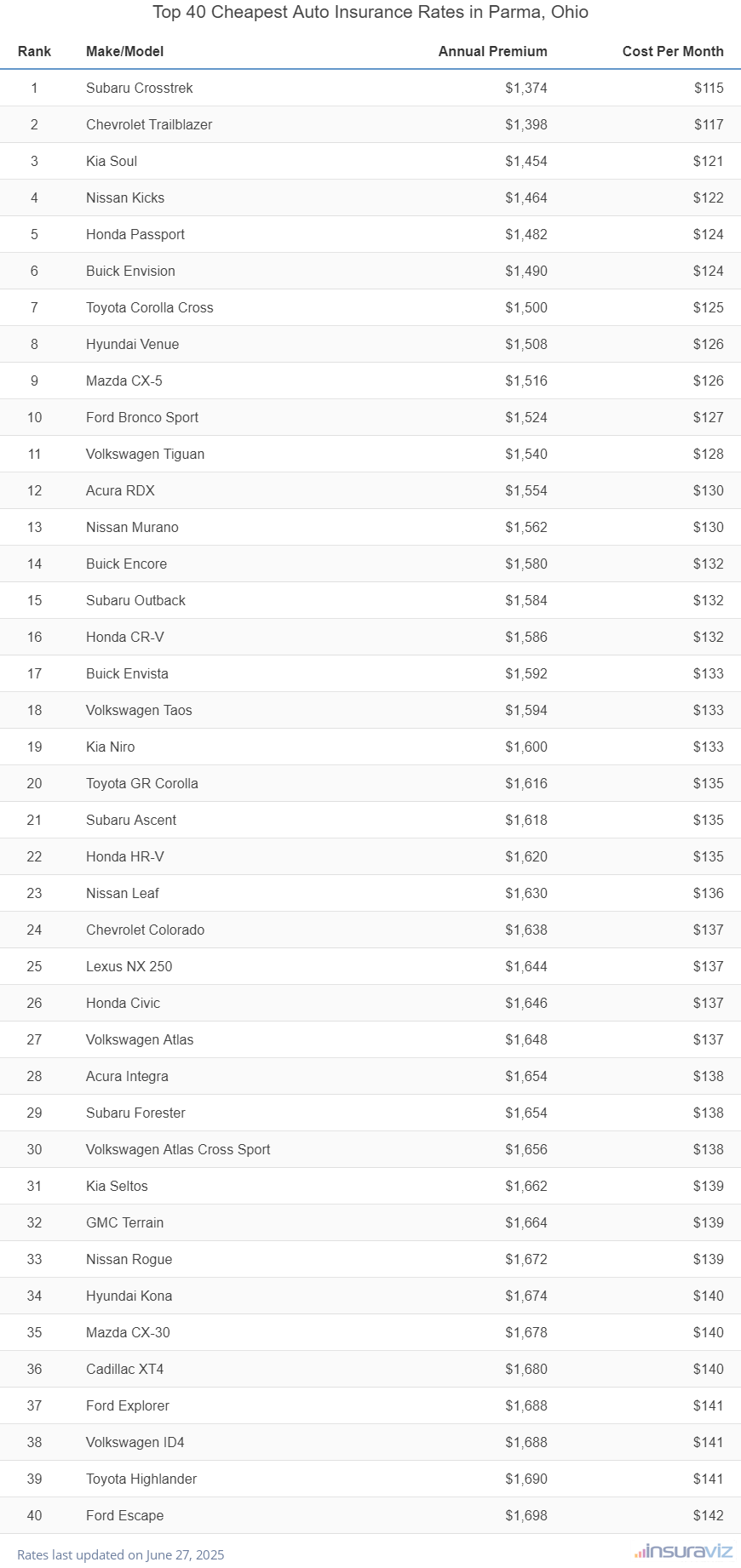

Cheapest cars to insure in Parma

When every make and model is compared, the models with the cheapest auto insurance prices in Parma tend to be compact SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, and Nissan Kicks.

Average insurance quotes for cars and SUVs in the top 10 cost $1,558 or less per year, or $130 per month, for a full-coverage insurance policy.

A few other vehicles that have low-cost auto insurance quotes in our auto insurance cost comparison are the Nissan Murano, Volkswagen Tiguan, Subaru Outback, and Honda CR-V. The average insurance cost is a few dollars per month higher for those models than the crossovers and compact SUVs that rank at the top, but they still have an average insurance cost of $138 or less per month.

The following table breaks down the 40 models with the cheapest car insurance in Parma, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,406 | $117 |

| 2 | Chevrolet Trailblazer | $1,430 | $119 |

| 3 | Kia Soul | $1,484 | $124 |

| 4 | Nissan Kicks | $1,498 | $125 |

| 5 | Honda Passport | $1,516 | $126 |

| 6 | Buick Envision | $1,526 | $127 |

| 7 | Toyota Corolla Cross | $1,532 | $128 |

| 8 | Hyundai Venue | $1,546 | $129 |

| 9 | Mazda CX-5 | $1,554 | $130 |

| 10 | Ford Bronco Sport | $1,558 | $130 |

| 11 | Volkswagen Tiguan | $1,576 | $131 |

| 12 | Acura RDX | $1,592 | $133 |

| 13 | Nissan Murano | $1,598 | $133 |

| 14 | Buick Encore | $1,616 | $135 |

| 15 | Honda CR-V | $1,622 | $135 |

| 16 | Subaru Outback | $1,622 | $135 |

| 17 | Buick Envista | $1,626 | $136 |

| 18 | Volkswagen Taos | $1,630 | $136 |

| 19 | Kia Niro | $1,638 | $137 |

| 20 | Toyota GR Corolla | $1,652 | $138 |

| 21 | Honda HR-V | $1,656 | $138 |

| 22 | Subaru Ascent | $1,658 | $138 |

| 23 | Nissan Leaf | $1,666 | $139 |

| 24 | Chevrolet Colorado | $1,678 | $140 |

| 25 | Honda Civic | $1,686 | $141 |

| 26 | Lexus NX 250 | $1,686 | $141 |

| 27 | Volkswagen Atlas | $1,688 | $141 |

| 28 | Acura Integra | $1,692 | $141 |

| 29 | Subaru Forester | $1,694 | $141 |

| 30 | Volkswagen Atlas Cross Sport | $1,696 | $141 |

| 31 | Kia Seltos | $1,700 | $142 |

| 32 | GMC Terrain | $1,704 | $142 |

| 33 | Nissan Rogue | $1,710 | $143 |

| 34 | Hyundai Kona | $1,712 | $143 |

| 35 | Mazda CX-30 | $1,716 | $143 |

| 36 | Cadillac XT4 | $1,718 | $143 |

| 37 | Ford Explorer | $1,726 | $144 |

| 38 | Volkswagen ID4 | $1,726 | $144 |

| 39 | Toyota Highlander | $1,732 | $144 |

| 40 | Ford Escape | $1,736 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Parma, OH Zip Codes. Updated October 24, 2025

Additional vehicles that made the top 40 table above include the Subaru Forester, the Volkswagen Atlas Cross Sport, the Lexus NX 250, and the Mazda CX-30. Average car insurance rates for those models cost between $1,652 and $1,736 per year in Parma, OH.

In comparison, some models that cost much more to insure include the Toyota Mirai that costs $197 per month, the Audi A4 which costs $183, and the Infiniti Q50 at $180.

And for extremely high insurance rates, high-performance luxury models like the Porsche 911 and Nissan GT-R have rates that often times cost double or triple the cheapest models.

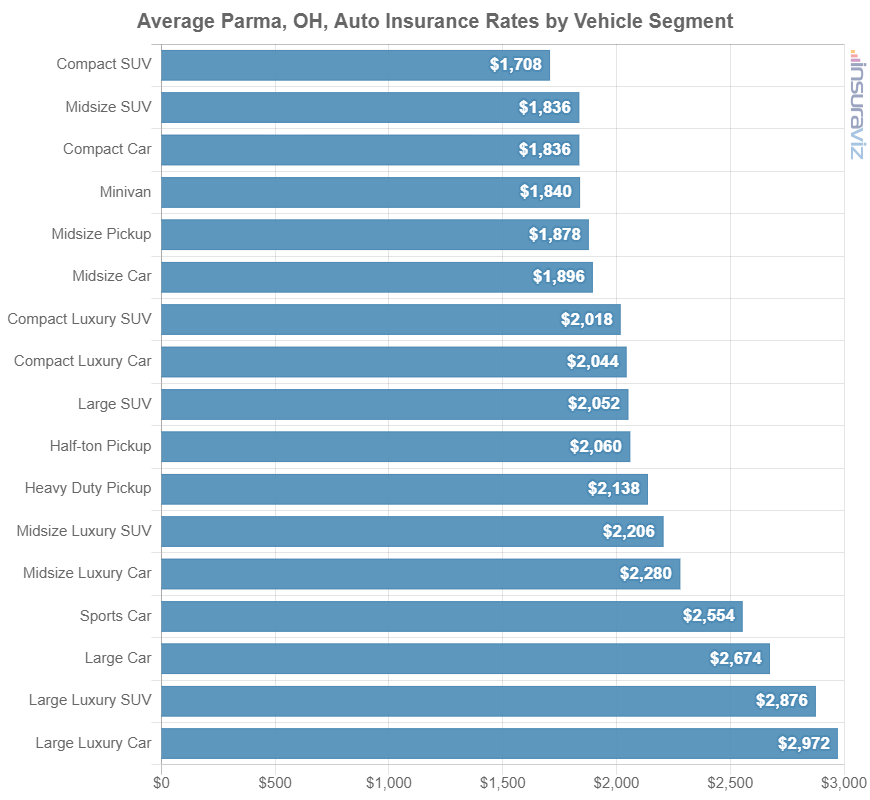

The section below illustrates the different automotive segments and the average cost of car insurance in Parma. The average rates shown will give you a better idea of which types of cars, trucks, and SUVs that have the most affordable Parma auto insurance rates.

Cost of insurance by automotive segment

If you’re shopping for a new or used car, it’s a good idea to know which types of vehicles are less expensive to insure.

Some common questions asked by car buyers are things like if midsize cars have more affordable insurance than midsize SUVs or if full-size SUVs have more expensive insurance than midsize or compact SUVs.

Knowing the answers to these types of questions can help point you in the right direction when starting your vehicle search.

The next chart displays average car insurance rates by segment in Parma. Typically, small SUVs, vans, and midsize pickups have the most affordable average auto insurance rates, while exotic performance cars have the most expensive average insurance cost.

Comparing average prices by segment are a good place to start, but just note that rates can vary substantially within any segment.

For example, in the small luxury car segment, rates range from the Acura Integra costing $1,692 per year to the BMW M340i costing $2,324 per year.

As another example, in the small car segment, rates can vary from the Toyota GR Corolla at $1,652 per year up to the Toyota Mirai costing $2,366 per year, a difference of $714 just for that segment.

Those examples show that once you decide on a few models, it’s best to start comparing rates on a model level rather than a segment level.

The average cost of car insurance in Parma

The average car insurance expense in Parma is $1,900 per year, which is 18% less than the overall U.S. national average rate of $2,276. Car insurance in Parma per month costs about $158 per month for a full coverage policy.

In the state of Ohio, the average car insurance expense is $1,992 per year, so the average rate in Parma is $92 less per year.

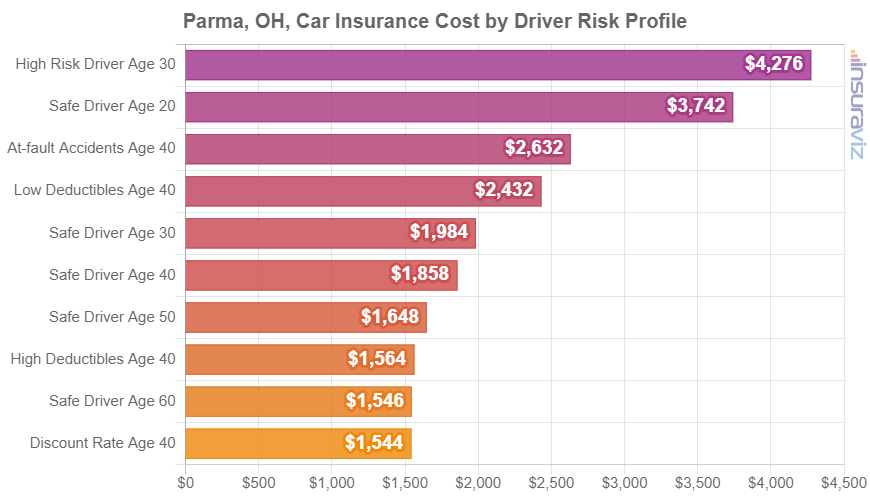

The next chart summarizes car insurance cost in Parma for different common policy situations. Rates are averaged for all Parma Zip Codes and shown for a range of different driver ages, policy physical damage deductibles, and risk scenarios.

Average car insurance rates in the prior chart range from $1,580 per year for a 40-year-old driver who receives many policy discounts to $4,376 per year for a 30-year-old driver with a history of violations and/or at-fault accidents.

From a monthly budgeting standpoint, the average cost of car insurance per month in Parma for the examples in the chart ranges from $132 to $365.

Car insurance rates can have a wide range and minor changes in a driver’s risk profile can have large effects on car insurance cost. The likelihood of a wide range of rates reinforces the need for accurate auto insurance quotes when looking for more affordable car insurance.

Driver age makes a big difference in the price of auto insurance, so the list below details how age impacts cost by breaking down average car insurance rates for drivers from age 16 to 60.

Average car insurance cost for Parma drivers age 16 to 60

- 16-year-old driver – $6,776 per year or $565 per month

- 17-year-old driver – $6,565 per year or $547 per month

- 18-year-old driver – $5,883 per year or $490 per month

- 19-year-old driver – $5,358 per year or $447 per month

- 20-year-old driver – $3,828 per year or $319 per month

- 30-year-old driver – $2,032 per year or $169 per month

- 40-year-old driver – $1,900 per year or $158 per month

- 50-year-old driver – $1,688 per year or $141 per month

- 60-year-old driver – $1,580 per year or $132 per month

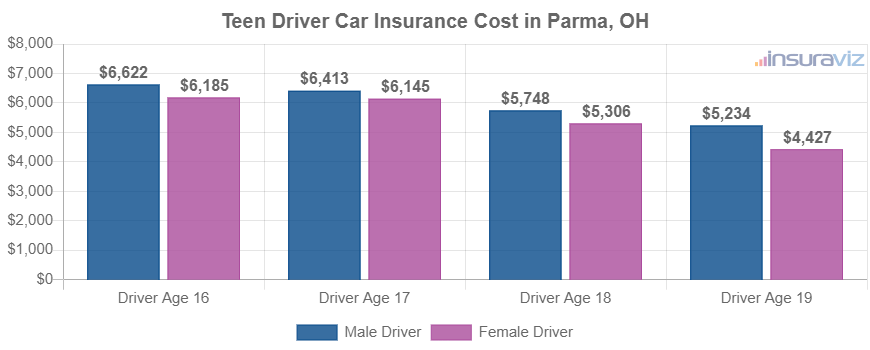

The chart below goes into more detail regarding the cost of insuring teen drivers and illustrates car insurance cost for teens by gender. For the most part, female drivers tend to pay less for auto insurance, especially ages 16 to 19.

Car insurance for a 16-year-old female driver in Parma costs an average of $446 less per year than the cost for a male driver, while at age 19, it still costs $827 less per year for females than males.

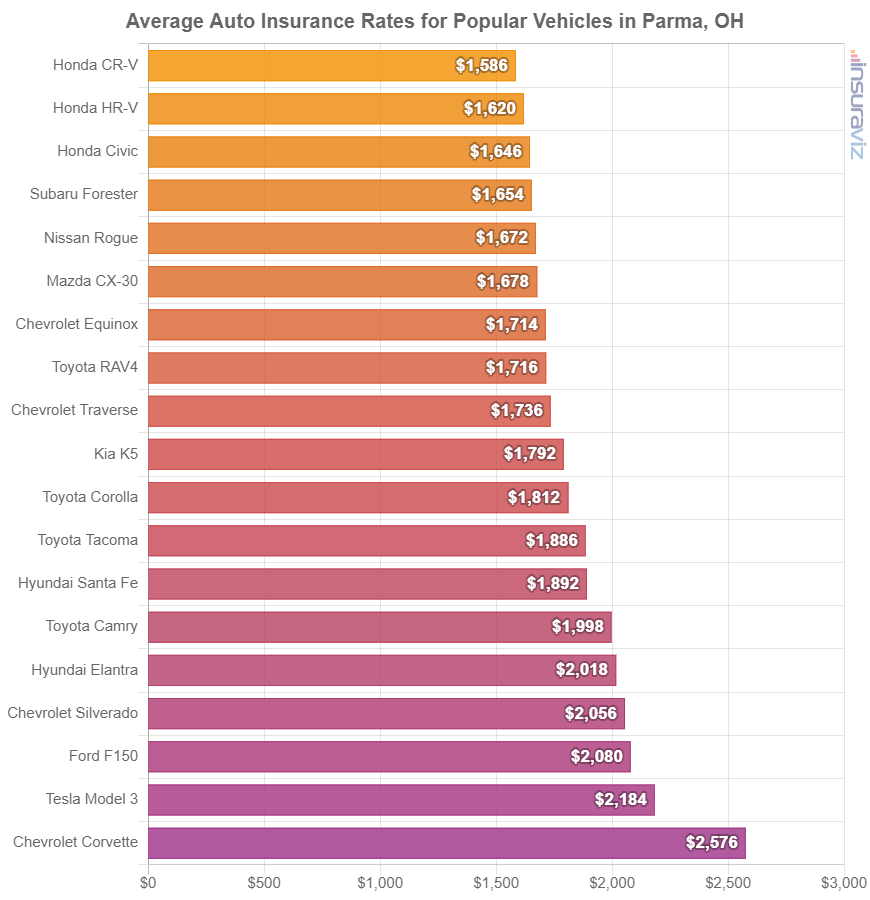

Rates for popular vehicles

The car insurance rates mentioned previously take all 2024 models and come up with an average cost, which is practical for making broad comparisons like the average cost difference by driver age or location.

For more in-depth auto insurance comparisons, however, it’s better if we compare rates at the model level.

Let’s look at just a few of the more popular vehicles to see how car insurance rates size up in Parma.

When these popular models are compared to the prior table showing the top 40 vehicles with the cheapest car insurance rates, only about the top five popular models made it into the cheapest list.

Some reasons for higher rates can include the MSRP, like a Lexus RC F that has an average MSRP of $68,295 or a Mercedes-Benz S560 with an average price of $140,000, or maybe the cause is the higher likelihood of medical or liability claims, like with a Dodge Challenger or a Ford F-250 Super Duty pickup.

We covered rates by segment and rates for individual popular models, but average rates include all types of driver risk, driver ages, and policy coverages.

The charts below go into even more detail and visualize the variability of car insurance for four popular models in Parma: the Chevrolet Silverado, Toyota Corolla, Toyota Highlander, and Toyota Camry.

Each vehicle example uses a variety of risk profiles to illustrate the difference in rates based on minor driver risk profile changes.

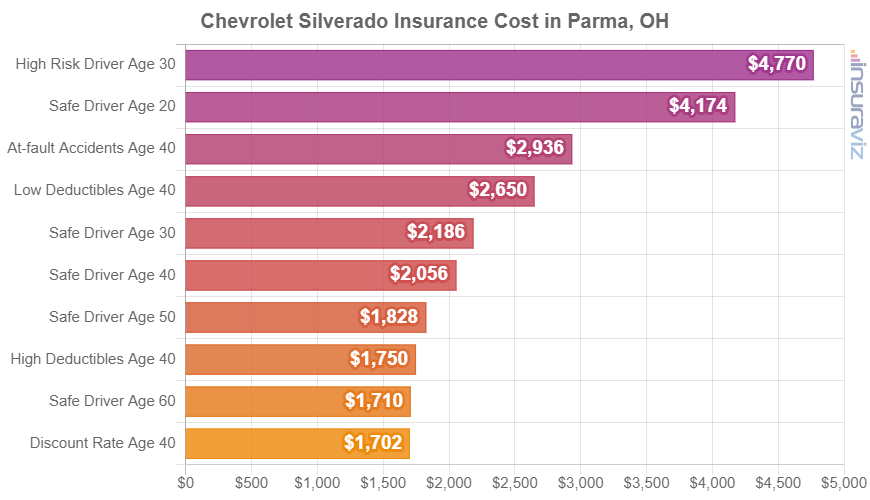

Chevrolet Silverado insurance rates

The cheapest 2024 Chevrolet Silverado trim level to insure in Parma is the EV WT model, costing an average of $1,784 per year, or about $149 per month. This model has a sticker price of $39,900.

The most expensive 2022 Chevrolet Silverado trim level to insure in Parma is the EV RST First Edition, costing an average of $2,496 per year, or about $208 per month. The cost for this model is $105,000, before destination and documentation charges.

The chart below illustrates how insurance rates on a Chevrolet Silverado can be significantly different based on an assortment of driver ages and policy risk profiles.

For our example drivers, cost ranges from $1,744 to $4,884 per year, which is a cost difference of $3,140 based on different drivers.

The Chevrolet Silverado is classified as a full-size truck, and additional similar models include the Ram Truck, Nissan Titan, and Toyota Tundra.

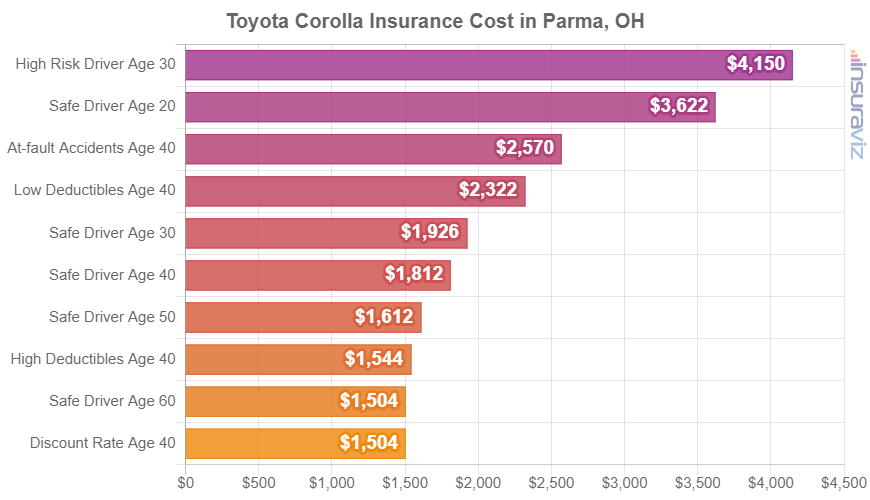

Toyota Corolla insurance rates

The cheapest 2024 Toyota Corolla trim to insure in Parma is the LE model, costing an average of $1,686 per year, or around $141 per month. This trim level sells for $21,900.

The most expensive 2022 Toyota Corolla model to insure in Parma is the XSE Hatchback, costing an average of $2,094 per year, or around $175 per month. The retail price for this trim level is $26,655, before destination charges and documentation fees.

As a cost per month, auto insurance rates on the Toyota Corolla for a safe driver can range from $141 to $175 per month, depending on various factors including your exact location in Parma.

The bar chart below should help you understand how the prices of car insurance for a Toyota Corolla can range significantly based on a variety of driver ages and possible risk profiles. For this example, cost varies from $1,538 to $4,248 per year, which is a difference in cost of $2,710 to insure the same vehicle.

The Toyota Corolla is a compact car, and other similar models include the Volkswagen Jetta, Kia Forte, and Hyundai Elantra.

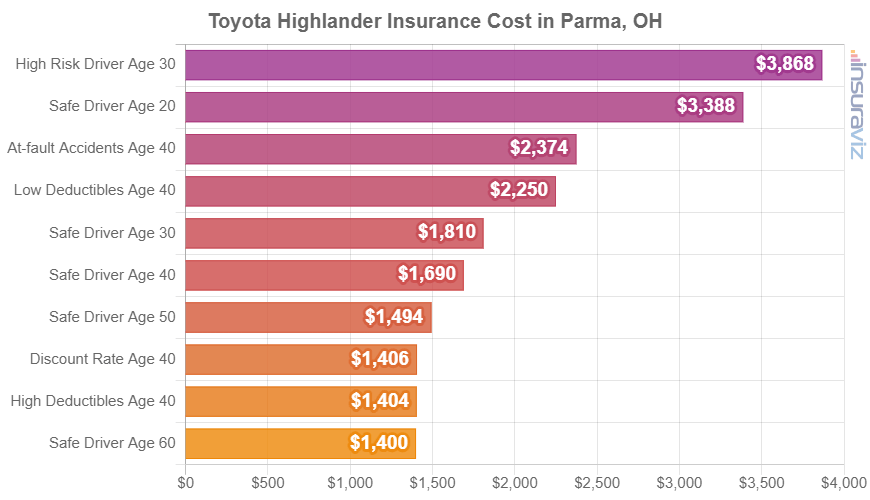

Toyota Highlander insurance rates

The lowest-cost 2024 Toyota Highlander model to insure in Parma is the LE 2WD model, costing an average of $1,590 per year, or about $133 per month. This trim level has a MSRP of $37,625.

The most expensive 2022 Toyota Highlander to insure in Parma is the Hybrid XLE AWD, costing an average of $1,880 per year, or around $157 per month. The MSRP for this trim is $43,825, before destination and documentation fees.

The next rate chart may help illustrate how the cost of car insurance on a Toyota Highlander can be very different for different driver ages and risk profiles.

For our example risk profiles, the cost ranges from $1,440 to $3,956 per year, which is a difference in cost of $2,516 to insure the same make and model of vehicle.

The Toyota Highlander is considered a midsize SUV, and other popular same-segment models include the Kia Sorento, Jeep Grand Cherokee, and Ford Edge.

Toyota Camry insurance rates

Toyota Camry insurance in Parma averages $2,044 per year, ranging from a low of $1,882 per year on the Toyota Camry LE trim level up to $2,148 per year on the Toyota Camry XSE AWD model.

When Parma car insurance rates for a Toyota Camry are compared to the average cost for the entire U.S. on the same model, rates are anywhere from $490 to $560 less per year in Parma, depending on the model being insured.

The next chart shows how car insurance rates on a Toyota Camry can range significantly based on different driver ages, policy deductibles, and potential risk scenarios.

For our example drivers, cost ranges from $1,700 to $4,698 per year, which is a difference in cost of $2,998.

The Toyota Camry belongs to the midsize car segment, and other models popular in Parma include the Honda Accord, Kia K5, and Chevrolet Malibu.