- Small SUV models like the Nissan Kicks, Buick Envision, and Chevrolet Trailblazer have the best chance of receiving cheap car insurance in Summerville.

- A few models with segment-leading auto insurance rates include the Toyota GR Corolla ($173 per month), Jaguar E-Pace ($186 per month), Chevrolet Colorado ($175 per month), and Infiniti QX80 ($223 per month).

- Car insurance quotes in Summerville have significant variability from as little as $36 per month for just liability insurance to over $704 per month for drivers requiring a high-risk policy.

Cheapest cars to insure in Summerville, SC

The vehicles with the lowest cost average car insurance rates in Summerville, SC, tend to be small SUVs like the Chevrolet Trailblazer, Kia Soul, and Hyundai Venue. Average car insurance quotes for models in the top ten cost $1,950 or less per year for a full coverage policy.

Some additional models that rank in the top 20 in our cost comparison are the Acura RDX, Honda CR-V, Volkswagen Taos, and Toyota GR Corolla.

The average cost is slightly more for those models than the crossovers and compact SUVs at the top of the rankings, but they still have average rates of $173 or less per month in Summerville.

The table below details the cheapest vehicles to insure in Summerville, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,760 | $147 |

| 2 | Chevrolet Trailblazer | $1,790 | $149 |

| 3 | Kia Soul | $1,860 | $155 |

| 4 | Nissan Kicks | $1,878 | $157 |

| 5 | Honda Passport | $1,898 | $158 |

| 6 | Buick Envision | $1,910 | $159 |

| 7 | Toyota Corolla Cross | $1,922 | $160 |

| 8 | Hyundai Venue | $1,936 | $161 |

| 9 | Mazda CX-5 | $1,942 | $162 |

| 10 | Ford Bronco Sport | $1,950 | $163 |

| 11 | Volkswagen Tiguan | $1,972 | $164 |

| 12 | Acura RDX | $1,992 | $166 |

| 13 | Nissan Murano | $2,002 | $167 |

| 14 | Buick Encore | $2,024 | $169 |

| 15 | Subaru Outback | $2,030 | $169 |

| 16 | Honda CR-V | $2,032 | $169 |

| 17 | Buick Envista | $2,038 | $170 |

| 18 | Volkswagen Taos | $2,040 | $170 |

| 19 | Kia Niro | $2,050 | $171 |

| 20 | Toyota GR Corolla | $2,072 | $173 |

| 21 | Honda HR-V | $2,074 | $173 |

| 22 | Subaru Ascent | $2,074 | $173 |

| 23 | Nissan Leaf | $2,086 | $174 |

| 24 | Chevrolet Colorado | $2,100 | $175 |

| 25 | Honda Civic | $2,108 | $176 |

| 26 | Lexus NX 250 | $2,108 | $176 |

| 27 | Volkswagen Atlas | $2,114 | $176 |

| 28 | Acura Integra | $2,118 | $177 |

| 29 | Subaru Forester | $2,122 | $177 |

| 30 | Volkswagen Atlas Cross Sport | $2,122 | $177 |

| 31 | Kia Seltos | $2,128 | $177 |

| 32 | GMC Terrain | $2,134 | $178 |

| 33 | Nissan Rogue | $2,142 | $179 |

| 34 | Hyundai Kona | $2,146 | $179 |

| 35 | Mazda CX-30 | $2,148 | $179 |

| 36 | Cadillac XT4 | $2,150 | $179 |

| 37 | Volkswagen ID4 | $2,160 | $180 |

| 38 | Ford Explorer | $2,162 | $180 |

| 39 | Toyota Highlander | $2,170 | $181 |

| 40 | Ford Escape | $2,174 | $181 |

| 41 | Toyota Venza | $2,174 | $181 |

| 42 | Honda Odyssey | $2,176 | $181 |

| 43 | Nissan Sentra | $2,184 | $182 |

| 44 | Subaru Impreza | $2,188 | $182 |

| 45 | Chevrolet Equinox | $2,194 | $183 |

| 46 | Toyota RAV4 | $2,200 | $183 |

| 47 | Mazda MX-5 Miata | $2,204 | $184 |

| 48 | Mazda MX-30 | $2,212 | $184 |

| 49 | Hyundai Tucson | $2,214 | $185 |

| 50 | Chevrolet Traverse | $2,222 | $185 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Summerville, SC Zip Codes. Updated October 24, 2025

Other models that rank in the top 50 above include the Hyundai Kona, Nissan Sentra, Subaru Forester, and Lexus NX 250. Insurance rates for those models cost between $2,072 and $2,228 per year.

As a comparison to the cheapest car insurance rates, some models that have much higher car insurance rates include the Tesla Model 3 which averages $2,798 per year, the Dodge Challenger that costs $3,590, and the Lexus LC 500h which costs $3,570.

How much does car insurance cost in Summerville?

The average cost to insure a vehicle in Summerville, South Carolina, is $2,384 per year, which is about $199 per month. Summerville car insurance costs 4.6% more than the overall U.S. national average rate of $2,276.

Average car insurance cost in South Carolina is $2,238 per year, so drivers in Summerville pay an average of $146 more per year than the average rate across the entire state.

When rates are compared to other cities in South Carolina, the average cost to insure a vehicle in Summerville is around $58 per year more expensive than in Rock Hill, $186 per year more than in Greenville, and $14 per year less than in North Charleston.

The next chart shows average Summerville, SC, auto insurance cost for all 2024 models. Rates are averaged for all Summerville Zip Codes and shown by driver age and physical damage coverage deductibles.

Average rates in the prior chart range from $1,672 per year for a 60-year-old driver with $1,000 deductibles for comprehensive and collision coverage to $5,580 per year for a 20-year-old driver with $250 deductibles. The rate we use for comparison purposes is a 40-year-old driver with $500 policy deductibles, which is an average cost of $2,384 per year.

As a monthly amount, average car insurance cost in Summerville ranges from $139 to $465 for the same driver ages and deductibles shown in the previous chart.

Driver age is one of the biggest determining factors on the price you pay for car insurance. The list below details how age impacts cost by showing average car insurance rates for driver ages 16 through 60.

Summerville, South Carolina, car insurance cost for drivers age 16 to 60

- 16-year-old driver – $8,492 per year or $708 per month

- 17-year-old driver – $8,228 per year or $686 per month

- 18-year-old driver – $7,376 per year or $615 per month

- 19-year-old driver – $6,715 per year or $560 per month

- 20-year-old driver – $4,798 per year or $400 per month

- 30-year-old driver – $2,544 per year or $212 per month

- 40-year-old driver – $2,384 per year or $199 per month

- 50-year-old driver – $2,114 per year or $176 per month

- 60-year-old driver – $1,976 per year or $165 per month

The previous rates shown for drivers age 16 to 19 were based on the rated driver being male. The chart below shows the average cost for car insurance for teen drivers in Summerville by gender. Female drivers are usually cheaper to insure than male drivers, notably in the teenage years.

Auto insurance for a 16-year-old female driver in Summerville costs an average of $558 less per year than the cost to insure a 16-year-old male driver, while at age 19, the cost difference is much less but is still $1,037 per year cheaper for females.

To stress the importance of how much auto insurance premiums can change from one person to the next, the sections below contain comprehensive car insurance rates for four popular vehicles in Summerville: the Ram Truck, Nissan Sentra, Honda CR-V, and Toyota Camry.

Each vehicle example uses different risk profiles to illustrate the potential rate difference based on driver and coverage changes.

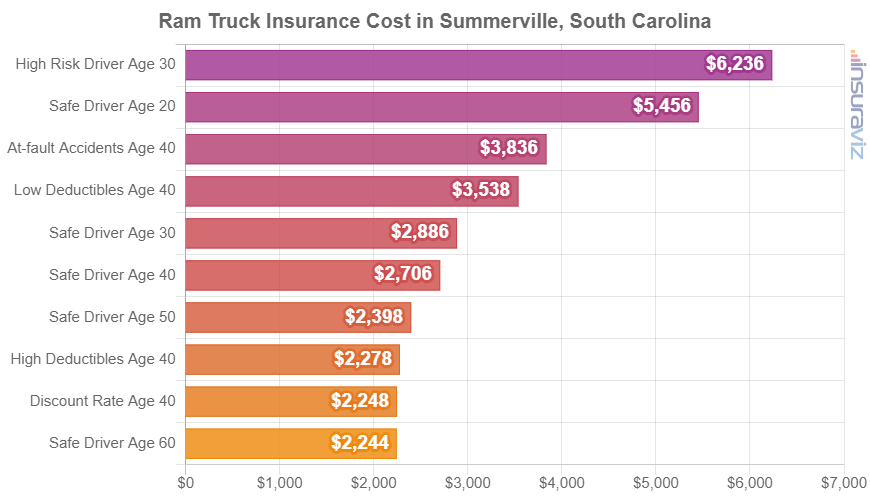

Ram Truck insurance rates

With MSRP ranging from $43,270 to $109,435, average Summerville car insurance quotes on a Ram Truck cost from $2,434 per year on the Ram Truck Tradesman Crew Cab 4WD model up to $3,016 per year for the Ram Truck TRX Final Edition 4WD.

When Summerville insurance rates for a Ram Truck are compared with the overall national average cost for the same model, rates are anywhere from $18 to $20 cheaper per year in Summerville, depending on which trim level is insured.

From a cost per month standpoint, car insurance quotes for a Ram Truck can range from $203 to $251 per month, depending on various factors including your address in Summerville.

The chart displayed below can help explain how the cost of car insurance on a Ram Truck can range significantly for a variety of driver ages and policy risk profiles.

The Ram Truck is considered a full-size truck, and other top-selling models from the same segment include the GMC Sierra, Toyota Tundra, and Ford F150.

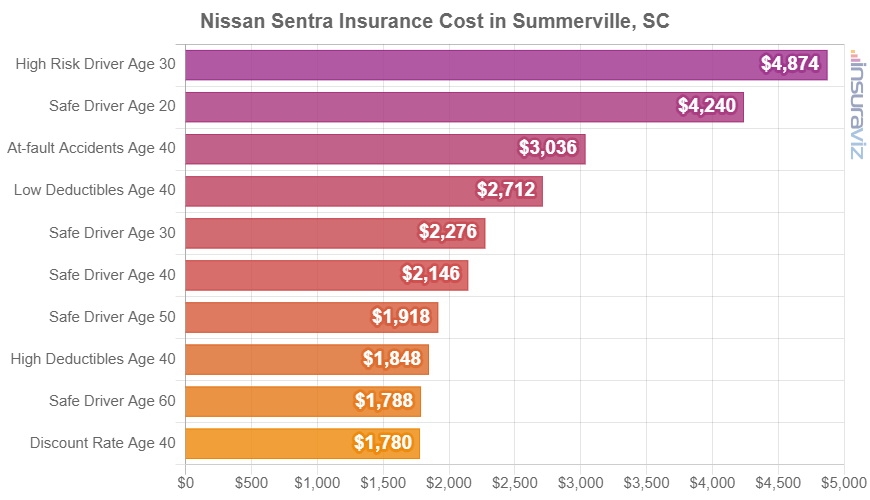

Nissan Sentra insurance rates

Average Nissan Sentra insurance cost in Summerville ranges from $2,134 up to $2,244 per year. The least-expensive model to insure is the $20,630 Nissan Sentra S model, while the most expensive is the $23,720 Nissan Sentra SR trim.

The bar chart below might help you understand how auto insurance quotes for a Nissan Sentra can be very different based on driver age, policy deductibles, and risk profiles.

For our example risk profiles, the cost ranges from $1,814 to $4,964 per year, which is a cost difference of $3,150.

The Nissan Sentra belongs to the compact car segment, and other models in the same segment include the Toyota Corolla, Hyundai Elantra, and Chevrolet Cruze.

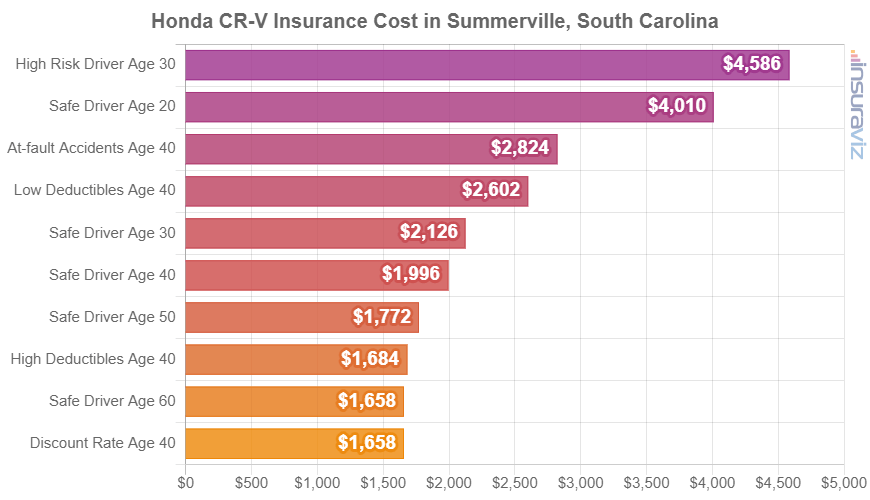

Honda CR-V insurance rates

Honda CR-V insurance in Summerville costs an average of $2,032 per year, ranging from $1,926 per year for the Honda CR-V LX model (MSRP of $29,500) up to $2,144 per year on the Honda CR-V Sport Touring Hybrid AWD trim level (MSRP of $39,850).

The chart below illustrates how the cost of car insurance for a Honda CR-V can be very different based on driver age, policy deductibles, and driver risk scenarios.

The Honda CR-V is considered a compact SUV, and additional models from the same segment that are popular in Summerville include the Chevrolet Equinox, Subaru Forester, Mazda CX-5, and Toyota RAV4.

Toyota Camry insurance rates

In Summerville, the lowest-cost insurance rates on a 2024 Toyota Camry are on the LE trim model, costing an average of $2,356 per year, or about $196 per month. This model has a sticker price of $26,420.

The most expensive 2022 Toyota Camry trim level to insure in Summerville is the XSE AWD model, costing an average of $2,690 per year, or about $224 per month. The retail cost for this trim level is $33,120, before destination and documentation fees.

When Summerville insurance rates on the Toyota Camry are compared with the cost averaged for the entire U.S. on the same model, the cost is anywhere from $16 to $18 less per year in Summerville, depending on the specific model being insured.

From a cost per month standpoint, auto insurance on a Toyota Camry for a safe driver can cost from $196 to $224 per month, but your exact rate can vary based on your address in Summerville.

The chart below illustrates how auto insurance quotes on a Toyota Camry can change based on different driver ages, risk profiles, and policy deductibles.

For our selected driver profiles, prices range from $2,128 to $5,888 per year, which is a price difference of $3,760.

The Toyota Camry belongs to the midsize car segment, and other similar models include the Kia K5, Honda Accord, and Chevrolet Malibu.

Tips for finding cheaper Summerville auto insurance quotes

Summerville drivers should always be looking to pay less for insurance. So take a minute and read through the money-saving ideas in the list below and maybe you’ll find a way to save some money.

- Your occupation could lower your rates. The vast majority of car insurance companies offer discounts for specific professions like college professors, accountants, firefighters, nurses, high school and elementary teachers, and others. By qualifying for this discount, you may save between $72 and $232 on your annual insurance bill, subject to the policy coverages selected.

- Choose vehicles that have cheaper insurance. The type of vehicle you drive has a huge impact on the cost of car insurance in Summerville. For example, a Volkswagen Atlas costs $1,188 less per year to insure in Summerville than a Chevrolet Corvette. Drive cheaper models and save money.

- Avoid accidents and save. Multiple at-fault accidents raise rates, possibly as much as $3,404 per year for a 20-year-old driver and even as much as $584 per year for a 60-year-old driver. So be safe and save.

- Obey the law to get lower insurance rates. To get cheap car insurance in Summerville, it’s necessary to to be a conservative driver. In fact, just a couple traffic citations can potentially raise insurance rates as much as $636 per year. Serious misdemeanors like driving on a suspended license could raise rates by an additional $2,216 or more.

- Don’t file small claims. Insurance companies give a discounted rate if you have no claims on your account. Car insurance is intended to be used in the case of significant claims, not minor claims.

- Make your policy cheaper by raising deductibles. Increasing your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.