- Ford Escape insurance costs an average of $2,188 per year, or about $182 per month for a policy with full coverage.

- With an insurance cost range of $232, the cheapest Escape trim level to insure is the Active model at around $2,050 per year, and the most expensive trim being the Plug-in Hybrid at $2,282 annually.

- The Escape ranks 23rd out of 47 vehicles in the 2024 compact SUV class for car insurance affordability.

How much does Ford Escape insurance cost?

Insurance on a Ford Escape costs an average of $2,188 per year for a full-coverage policy. Monthly insurance payments for a 2024 Ford Escape range from $171 to $190, but can vary considerably based on where you live.

With the average small SUV costing $2,206 a year to insure, a Ford Escape costs $18 less per year than the segment average rate.

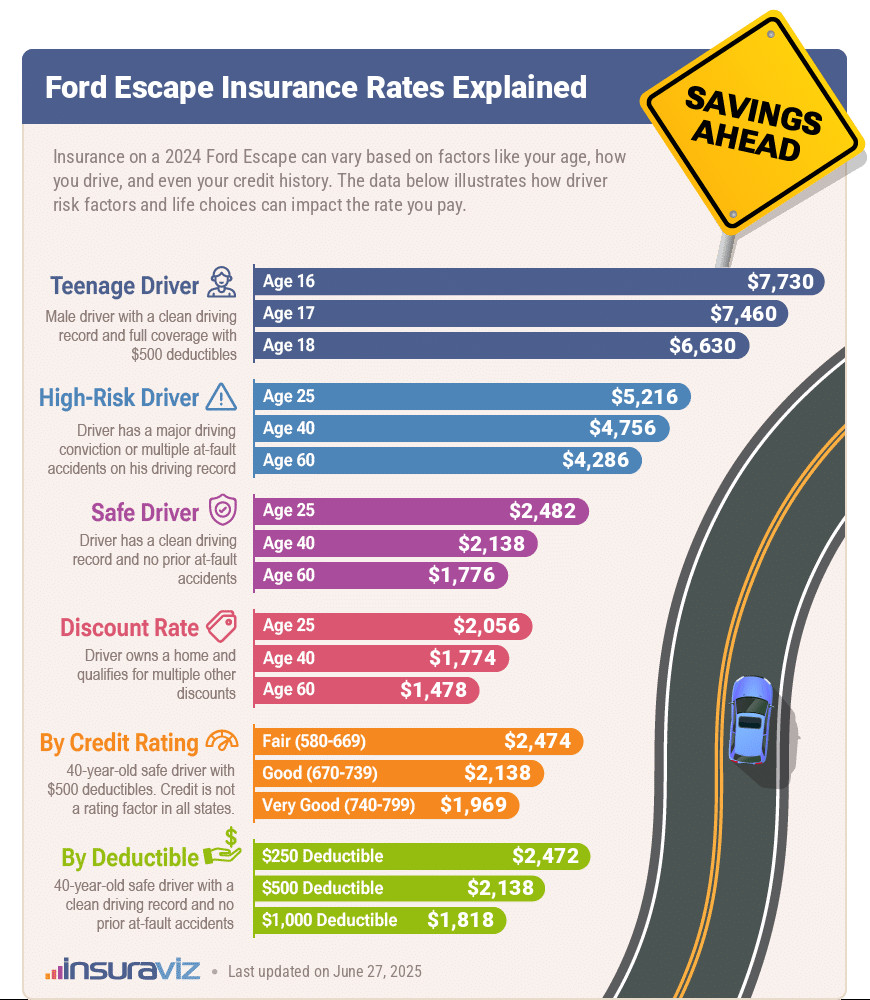

The graphic shown below breaks down average car insurance cost for a 2024 Escape using a range of driver ages, deductible levels, and risk profiles. Middle-aged drivers who have good driving records and high policy deductibles have the best chance of finding cheap insurance for a Ford Escape, while younger, high-risk drivers will generally pay more.

Keep in mind that the rates illustrated in the graphic use a lot of averaging. We average rates across all Escape trim levels and also for all U.S. locations. So the rate you pay could be significantly different than show based on the exact vehicle you drive and where you live.

In the next section, we detail insurance rates for each of the 2024 Ford Escape trim levels, so keep reading to see where your model fits into the mix.

Also, some states do not allow insurers to use credit as a factor in setting rates, so depending on your location, your credit score may not have an impact.

Other noteworthy conclusions regarding Escape insurance cost include:

- High-risk drivers pay higher Ford Escape insurance rates. For a 50-year-old driver, having to buy a high-risk policy due to excessive accidents and/or violations could end up with a rate increase of $2,604 or more per year.

- Save money due to your employment. Many auto insurance providers offer discounts for working in professions like engineering, nursing, law enforcement, farming, firefighting, medicine, and other occupations. Qualifying for an occupational discount may save between $66 and $233 on your yearly Escape insurance premium, subject to policy limits.

- Raising physical damage deductibles lowers cost. Boosting your deductibles from $500 to $1,000 could save around $328 per year for a 40-year-old driver and $640 per year for a 20-year-old driver.

- Choosing a low deductible may not make good financial sense. Decreasing your deductibles from $500 to $250 could cost an additional $342 per year for a 40-year-old driver and $678 per year for a 20-year-old driver.

- The cost to insure teen drivers is expensive. Average rates for full coverage Escape insurance costs $7,918 per year for a 16-year-old driver, $7,644 per year for a 17-year-old driver, and $6,792 per year for an 18-year-old driver.

- As driver age increases, insurance rates tend to go down. The difference in insurance rates for an Escape between a 60-year-old driver ($1,822 per year) and a 20-year-old driver ($4,420 per year) is $2,598, or a savings of 83.2%.

What is the cheapest Ford Escape insurance?

With Ford Escape insurance rates ranging from $2,050 to $2,282 annually, the most budget-friendly trim level to insure is the Active model. The second cheapest model to insure is the ST-Line trim level at $2,078 per year. Expect to pay a minimum of $171 per month for full coverage insurance.

For more equipped Escape trim levels, the three with the highest insurance rates are the ST-Line Elite, the ST-Line Elite Hybrid, and the Plug-in Hybrid trim levels at an estimated $2,248, $2,268, and $2,282 per year, respectively.

The rate table below displays average car insurance rates for the Ford Escape, in addition to a monthly budget amount, for each model and trim level.

| 2024 Ford Escape Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Active | $2,050 | $171 |

| ST-Line | $2,078 | $173 |

| ST-Line Hybrid | $2,150 | $179 |

| ST-Line Select | $2,168 | $181 |

| ST-Line Select Hybrid | $2,188 | $182 |

| Platinum Hybrid | $2,224 | $185 |

| Platinum | $2,234 | $186 |

| ST-Line Elite | $2,248 | $187 |

| ST-Line Elite Hybrid | $2,268 | $189 |

| Plug-in Hybrid | $2,282 | $190 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How do Ford Escape insurance rates rank vs. other SUVs?

The Ford Escape ranks 23rd out of 47 comparison vehicles in the small SUV category. The Escape costs an average of $2,188 per year to insure, while the category median average cost is $2,206 annually, a difference of $18 per year.

When Ford Escape auto insurance rates are compared directly to other small SUVs, insurance for an Escape costs $24 less per year than the Toyota RAV4, $142 more than the Honda CR-V, $22 less than the Chevrolet Equinox, and $34 more than the Nissan Rogue.

The chart below shows how average insurance cost for a Ford Escape compares to the rest of the top 10 selling small SUVs in the U.S., including the Mazda CX-5, the Chevy Equinox, and the Subaru Crosstrek. In addition, we also included a more comprehensive table after the chart that breaks down rates for all 47 models in the 2024 small SUV class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$416 |

| 2 | Chevrolet Trailblazer | $1,804 | -$384 |

| 3 | Kia Soul | $1,872 | -$316 |

| 4 | Nissan Kicks | $1,888 | -$300 |

| 5 | Buick Envision | $1,922 | -$266 |

| 6 | Toyota Corolla Cross | $1,932 | -$256 |

| 7 | Hyundai Venue | $1,950 | -$238 |

| 8 | Mazda CX-5 | $1,956 | -$232 |

| 9 | Ford Bronco Sport | $1,966 | -$222 |

| 10 | Volkswagen Tiguan | $1,984 | -$204 |

| 11 | Buick Encore | $2,038 | -$150 |

| 12 | Honda CR-V | $2,046 | -$142 |

| 13 | Volkswagen Taos | $2,056 | -$132 |

| 14 | Kia Niro | $2,066 | -$122 |

| 15 | Honda HR-V | $2,088 | -$100 |

| 16 | Subaru Forester | $2,134 | -$54 |

| 17 | Kia Seltos | $2,144 | -$44 |

| 18 | GMC Terrain | $2,148 | -$40 |

| 19 | Nissan Rogue | $2,154 | -$34 |

| 20 | Hyundai Kona | $2,158 | -$30 |

| 21 | Mazda CX-30 | $2,164 | -$24 |

| 22 | Volkswagen ID4 | $2,176 | -$12 |

| 23 | Ford Escape | $2,188 | -- |

| 24 | Chevrolet Equinox | $2,210 | $22 |

| 25 | Toyota RAV4 | $2,212 | $24 |

| 26 | Mazda MX-30 | $2,226 | $38 |

| 27 | Hyundai Tucson | $2,232 | $44 |

| 28 | Chevrolet Trax | $2,264 | $76 |

| 29 | Mini Cooper Clubman | $2,274 | $86 |

| 30 | Mini Cooper | $2,278 | $90 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $114 |

| 32 | Jeep Renegade | $2,308 | $120 |

| 33 | Mitsubishi Outlander | $2,336 | $148 |

| 34 | Kia Sportage | $2,350 | $162 |

| 35 | Hyundai Ioniq 5 | $2,358 | $170 |

| 36 | Fiat 500X | $2,368 | $180 |

| 37 | Mini Cooper Countryman | $2,374 | $186 |

| 38 | Subaru Solterra | $2,376 | $188 |

| 39 | Mazda CX-50 | $2,380 | $192 |

| 40 | Nissan Ariya | $2,386 | $198 |

| 41 | Toyota bz4X | $2,390 | $202 |

| 42 | Mitsubishi Mirage | $2,398 | $210 |

| 43 | Kia EV6 | $2,474 | $286 |

| 44 | Dodge Hornet | $2,554 | $366 |

| 45 | Jeep Compass | $2,594 | $406 |

| 46 | Hyundai Nexo | $2,648 | $460 |

| 47 | Ford Mustang Mach-E | $2,806 | $618 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

How much is car insurance on a used Ford Escape?

In most cases, insuring a used Ford Escape will be cheaper than insuring a new model. For example, when comparing insurance rates for a new 2024 model to a used 2017 model, the 2017 Escape will cost around $474 less per year. A 2013 model will cost around $724 less per year than insuring new.

The data table below shows average car insurance rates for a Ford Escape for the 2013 through 2024 model years. The average insurance cost ranges from the best rate of $1,400 for a 2014 Ford Escape to the most expensive rate of $2,188 for a 2024 model.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Ford Escape | $2,188 | $182 |

| 2023 Ford Escape | $2,136 | $178 |

| 2022 Ford Escape | $2,154 | $180 |

| 2021 Ford Escape | $1,914 | $160 |

| 2020 Ford Escape | $1,858 | $155 |

| 2019 Ford Escape | $1,906 | $159 |

| 2018 Ford Escape | $1,812 | $151 |

| 2017 Ford Escape | $1,714 | $143 |

| 2016 Ford Escape | $1,624 | $135 |

| 2015 Ford Escape | $1,450 | $121 |

| 2014 Ford Escape | $1,400 | $117 |

| 2013 Ford Escape | $1,464 | $122 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford Escape trim levels for each model year. Updated October 24, 2025

At some point down the road, vehicle owners have to make the decision to delete comprehensive and/or collision coverage from the policy. As vehicles age and depreciate, the sticker price of comprehensive and collision coverage surpasses the benefits provided by having it.

Dropping full coverage on an older Ford Escape could save in the ballpark of $788 per year, depending on how high the deductibles were and the age of the driver.

Deciding when to eliminate full coverage is a personal decision that only you can decide based on your financial situation. If you don’t have the resources necessary to purchase a different vehicle if you Escape gets totaled, then you might want to keep physical damage coverage in place.

Another option to save money is to look at increasing your comprehensive and collision deductibles. High deductible physical damage coverage can decrease rates to an estimated $1,860 a year from $2,188, a decrease of $328 a year or 16.2%. If you carry low deductibles on your policy now, the savings could be even more.

During his career as an independent insurance agent,

During his career as an independent insurance agent,