- Crossover vehicles like the Kia Soul, Chevrolet Trailblazer, and Buick Envision are the top picks for having cheap car insurance in Pueblo.

- Pueblo car insurance averages $3,052 per year for a full coverage policy, or approximately $254 on a monthly basis

- Monthly car insurance rates for a few popular models in Pueblo include the Toyota Camry at $273, Nissan Rogue at $229, and Toyota Tacoma at $258.

- Pueblo auto insurance costs $408 per year more than the Colorado state average rate ($2,644) and $776 per year more than the average rate for all 50 U.S. states ($2,276).

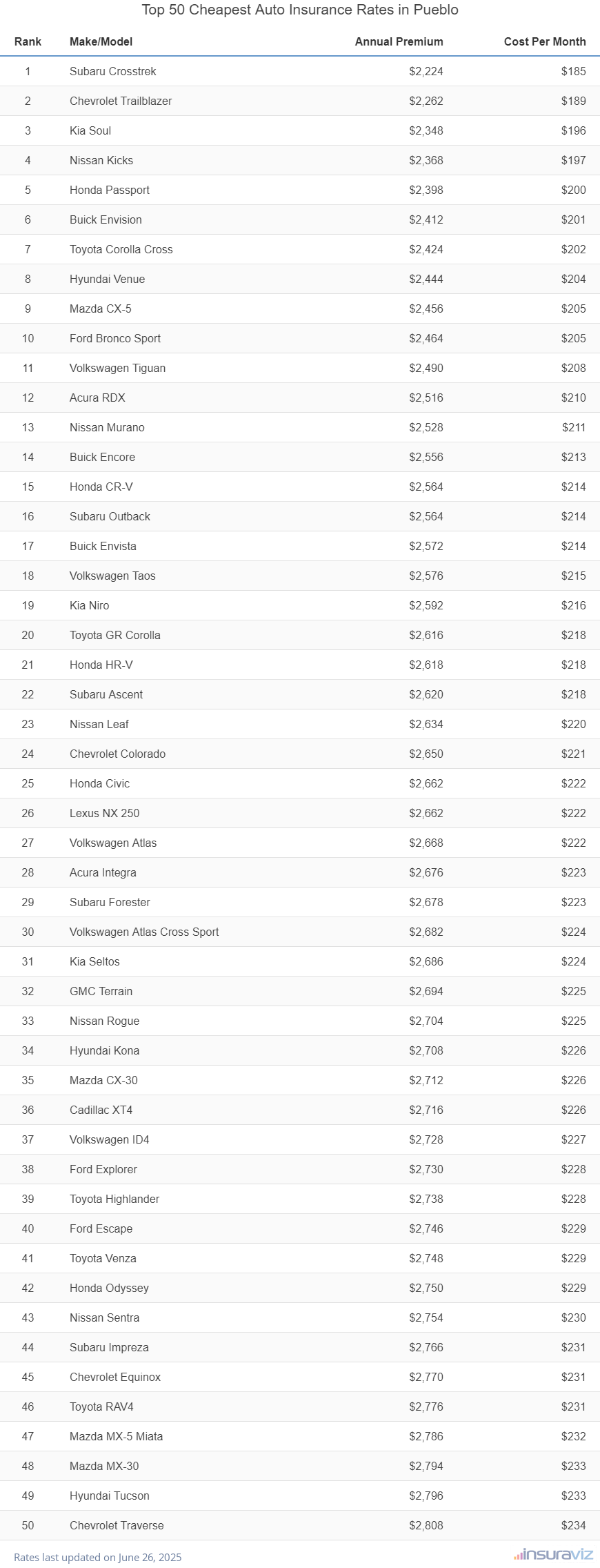

Cheapest cars to insure in Pueblo, CO

When comparing all car, SUV, and pickup models, the vehicles with the best auto insurance quotes in Pueblo tend to be crossovers and compact SUVs like the Chevrolet Trailblazer, Kia Soul, and Toyota Corolla Cross.

Average car insurance quotes for cars and SUVs that rank in the top 10 cost $2,500 or less per year for full coverage car insurance.

A few other models that rank very well in our cost comparison are the Buick Envista, Volkswagen Tiguan, Acura RDX, and Honda CR-V. Insurance is marginally higher for those models than the cheapest small SUVs and crossovers at the top of the rankings, but they still have an average insurance cost of $2,650 or less per year, or about $221 per month in Pueblo.

The following table shows the cheapest vehicles to insure in Pueblo, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,254 | $188 |

| 2 | Chevrolet Trailblazer | $2,292 | $191 |

| 3 | Kia Soul | $2,382 | $199 |

| 4 | Nissan Kicks | $2,402 | $200 |

| 5 | Honda Passport | $2,432 | $203 |

| 6 | Buick Envision | $2,444 | $204 |

| 7 | Toyota Corolla Cross | $2,458 | $205 |

| 8 | Hyundai Venue | $2,476 | $206 |

| 9 | Mazda CX-5 | $2,488 | $207 |

| 10 | Ford Bronco Sport | $2,500 | $208 |

| 11 | Volkswagen Tiguan | $2,524 | $210 |

| 12 | Acura RDX | $2,550 | $213 |

| 13 | Nissan Murano | $2,564 | $214 |

| 14 | Buick Encore | $2,592 | $216 |

| 15 | Subaru Outback | $2,600 | $217 |

| 16 | Honda CR-V | $2,602 | $217 |

| 17 | Buick Envista | $2,608 | $217 |

| 18 | Volkswagen Taos | $2,614 | $218 |

| 19 | Kia Niro | $2,628 | $219 |

| 20 | Toyota GR Corolla | $2,650 | $221 |

| 21 | Honda HR-V | $2,656 | $221 |

| 22 | Subaru Ascent | $2,656 | $221 |

| 23 | Nissan Leaf | $2,672 | $223 |

| 24 | Chevrolet Colorado | $2,688 | $224 |

| 25 | Honda Civic | $2,702 | $225 |

| 26 | Lexus NX 250 | $2,702 | $225 |

| 27 | Volkswagen Atlas | $2,706 | $226 |

| 28 | Acura Integra | $2,712 | $226 |

| 29 | Subaru Forester | $2,714 | $226 |

| 30 | Volkswagen Atlas Cross Sport | $2,718 | $227 |

| 31 | Kia Seltos | $2,724 | $227 |

| 32 | GMC Terrain | $2,730 | $228 |

| 33 | Nissan Rogue | $2,742 | $229 |

| 34 | Hyundai Kona | $2,746 | $229 |

| 35 | Mazda CX-30 | $2,752 | $229 |

| 36 | Cadillac XT4 | $2,756 | $230 |

| 37 | Volkswagen ID4 | $2,766 | $231 |

| 38 | Ford Explorer | $2,768 | $231 |

| 39 | Toyota Highlander | $2,776 | $231 |

| 40 | Ford Escape | $2,782 | $232 |

| 41 | Toyota Venza | $2,786 | $232 |

| 42 | Honda Odyssey | $2,788 | $232 |

| 43 | Nissan Sentra | $2,798 | $233 |

| 44 | Subaru Impreza | $2,804 | $234 |

| 45 | Chevrolet Equinox | $2,810 | $234 |

| 46 | Toyota RAV4 | $2,816 | $235 |

| 47 | Mazda MX-5 Miata | $2,822 | $235 |

| 48 | Mazda MX-30 | $2,832 | $236 |

| 49 | Hyundai Tucson | $2,838 | $237 |

| 50 | Chevrolet Traverse | $2,846 | $237 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Pueblo, CO Zip Codes. Updated October 24, 2025

Some other popular models making the top 50 above include the Toyota RAV4, Lexus NX 250, Chevrolet Traverse, Chevrolet Equinox, and Honda Civic. Auto insurance rates for those vehicles fall between $2,650 and $2,852 per year.

To help put these rates in perspective, a few examples of more expensive insurance rates include the Jeep Wagoneer which averages $316 per month, the Dodge Challenger that costs $383, and the Infiniti Q50 which averages $288.

And for really expensive insurance rates, cars like the BMW 750i, Nissan GT-R, and BMW Alpina B8 have rates that can cost at least double the cheapest models.

How much does Pueblo car insurance cost?

In Pueblo, average auto insurance cost is $3,052 per year, which is 29.1% more than the U.S. average rate of $2,276. Per month, Pueblo car insurance costs approximately $254 per month for full coverage.

In the state of Colorado, the average cost of car insurance is $2,644 per year, so the average rate in Pueblo is $408 more per year.

The average cost of insurance in Pueblo compared to other Colorado locations is around $172 per year more expensive than in Lakewood, $154 per year more than in Aurora, and $270 per year more expensive than in Colorado Springs.

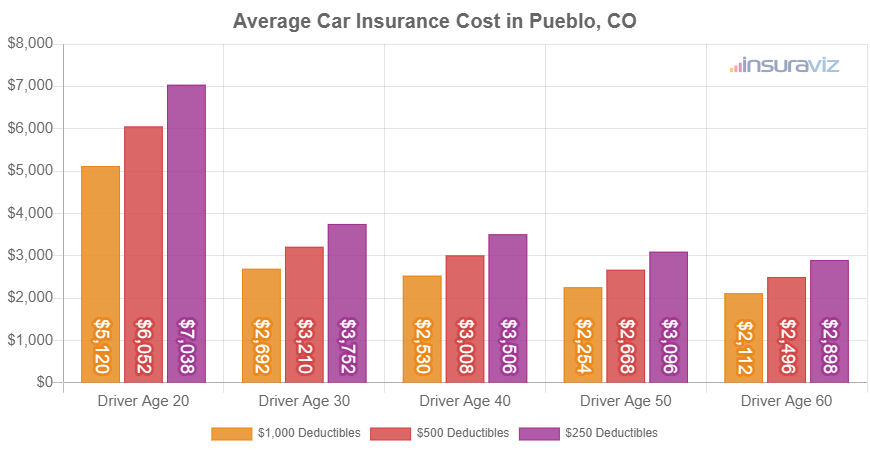

The age of the rated driver is one of the biggest factors in determining the cost of auto insurance, so the list below details how age impacts cost by breaking out average car insurance rates in Pueblo for young, middle-age, and senior drivers.

Average cost of car insurance in Pueblo, Colorado, for drivers age 16 to 60

- 16 year old – $10,869 per year or $906 per month

- 17 year old – $10,531 per year or $878 per month

- 18 year old – $9,439 per year or $787 per month

- 19 year old – $8,593 per year or $716 per month

- 20 year old – $6,140 per year or $512 per month

- 30 year old – $3,258 per year or $272 per month

- 40 year old – $3,052 per year or $254 per month

- 50 year old – $2,706 per year or $226 per month

- 60 year old – $2,532 per year or $211 per month

The chart below shows average auto insurance rates in Pueblo for 2024 model year vehicles for both different driver ages and physical damage coverage deductibles.

The average cost of car insurance per month in Pueblo is $254, with prices ranging from $179 to $595 for drivers age 20 to 60 and policy deductibles from $250 to $1,000.

Pueblo car insurance rates can have wide price ranges and small changes in a driver’s risk profile can cause considerable changes in car insurance premiums. The potential for large premium differences stresses the need for accurate auto insurance quotes when searching online for cheaper car insurance.

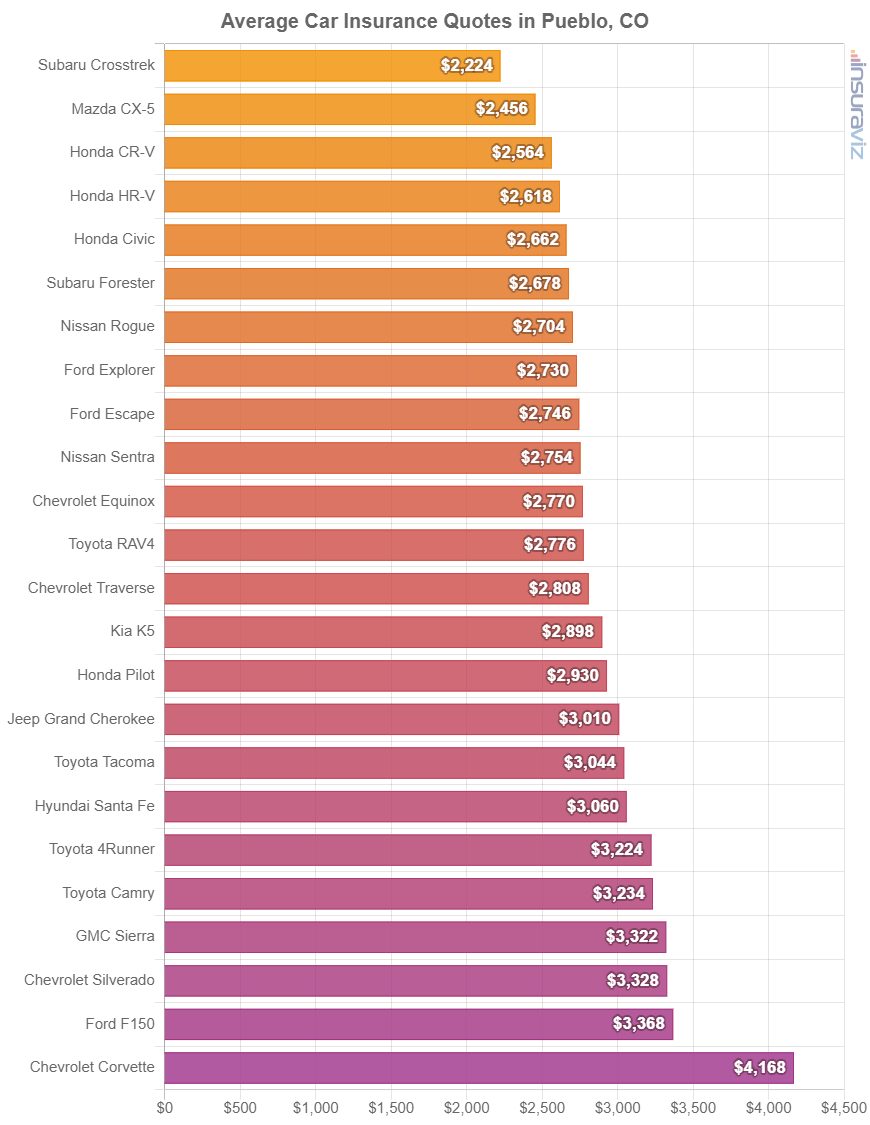

The cost to insure Pueblo’s favorite cars, pickups, and SUVs

The car insurance rates referenced up to this point take the cost to insure each 2024 vehicle model and average them, which is suitable when making overall comparisons like between locations or by driver risk profile.

But most people have a specific model of vehicle in mind, as they either own it or are considering purchasing it. Knowing how car insurance rates for a vehicle compare to other models is a great way to avoid sticker shock when you get your car insurance bill.

This next chart shows insurance rates for some of the more popular models found on the streets of Pueblo.

The most popular models are not always the cheapest to insure. If we see which models from the chart above are also listed in the previous table of the top 50 cheapest vehicles to insure, only about the top nine are included in both.

Expensive premiums can be caused by a higher vehicle value, like a Tesla Model X which has an average cost of $68,590, a Jeep Grand Wagoneer with an average MSRP of $91,190, or even a Hyundai Nexo that costs around $62,000.

Subpar safety ratings or a higher statistical likelihood of liability or passenger medical claims can also increase cost, with examples of these vehicles being the Dodge Charger or even the Toyota Corolla.

Tips for finding cheaper Pueblo auto insurance

We covered a lot of data in this article, so here are a few tips that could possibly save you some money on your next car insurance policy.

- Fewer accidents saves money. Too frequent at-fault accidents can raise rates, potentially as much as $4,358 per year for a 20-year-old driver and even $1,270 per year for a 40-year-old driver. So drive safe and save!

- You don’t have to stick with the same company. Taking the time to get a few free car insurance quotes is a fantastic way to save money. Companies make rate modifications frequently and you do not have to wait for your renewal to change companies.

- Your profession could earn you policy discounts. Some auto insurance providers offer policy discounts for specific professions like high school and elementary teachers, architects, doctors, lawyers, college professors, and others. If you’re employed in a qualifying profession, you could save between $92 and $297 on your car insurance premium, depending on the age of the rated driver.

- Fewer violations means cheaper insurance rates. In order to have cheap car insurance in Pueblo, it pays off to be a safe driver. Just a few minor traffic citations have the consequences of increasing insurance policy rates by up to $812 per year.

- Don’t file small claims. Auto insurance companies offer discounts if you have no claims. Insurance should only be used to protect you from significant financial loss, not for minor claims.

- Raise your credit for better rates. Having a high credit score of 800+ could save an average of $479 per year versus a slightly lower credit score between 670-739. Conversely, a lesser credit score could cost as much as $555 more per year. Not all states use credit score as a rating factor, so check with your agent or company.