- For the cheapest car insurance in Caldwell, Idaho, SUV models like the Nissan Kicks, Chevrolet Trailblazer, Subaru Crosstrek, and Kia Soul rank very well for overall cost.

- Average car insurance in Caldwell costs $2,014 per year, or $168 per month for full coverage.

- Car insurance rates for a few popular models in Caldwell include the GMC Sierra at $186 per month, Jeep Cherokee at $181, and Ford Explorer at $152.

- Auto insurance quotes in Caldwell can vary significantly from as little as $34 per month for liability-only insurance to well over $674 per month for teenagers and other high-risk drivers.

Top 30 cheapest cars to insure in Caldwell

The vehicles with the best auto insurance quotes in Caldwell, ID, tend to be crossovers and small SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, Buick Envision, and Toyota Corolla Cross.

Average auto insurance prices for models ranked in the top 10 cost $1,650 or less per year, or $138 per month, for full coverage.

Examples of other models that are highly ranked in our cost comparison are the Volkswagen Tiguan, Volkswagen Taos, Buick Envista, and Subaru Outback. Insurance is slightly more for those models than the compact SUVs that rank near the top, but they still have an average insurance cost of $1,752 or less per year in Caldwell.

The table below ranks the top 30 models with the cheapest car insurance rates in Caldwell, sorted by average cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,446 | $121 |

| 2 | Chevrolet Trailblazer | $1,474 | $123 |

| 3 | Kia Soul | $1,530 | $128 |

| 4 | Nissan Kicks | $1,544 | $129 |

| 5 | Honda Passport | $1,558 | $130 |

| 6 | Buick Envision | $1,566 | $131 |

| 7 | Toyota Corolla Cross | $1,580 | $132 |

| 8 | Hyundai Venue | $1,594 | $133 |

| 9 | Mazda CX-5 | $1,596 | $133 |

| 10 | Ford Bronco Sport | $1,604 | $134 |

| 11 | Volkswagen Tiguan | $1,620 | $135 |

| 12 | Acura RDX | $1,636 | $136 |

| 13 | Nissan Murano | $1,646 | $137 |

| 14 | Buick Encore | $1,664 | $139 |

| 15 | Subaru Outback | $1,666 | $139 |

| 16 | Honda CR-V | $1,670 | $139 |

| 17 | Buick Envista | $1,680 | $140 |

| 18 | Volkswagen Taos | $1,682 | $140 |

| 19 | Kia Niro | $1,686 | $141 |

| 20 | Toyota GR Corolla | $1,698 | $142 |

| 21 | Subaru Ascent | $1,702 | $142 |

| 22 | Honda HR-V | $1,708 | $142 |

| 23 | Nissan Leaf | $1,718 | $143 |

| 24 | Chevrolet Colorado | $1,726 | $144 |

| 25 | Lexus NX 250 | $1,730 | $144 |

| 26 | Volkswagen Atlas | $1,732 | $144 |

| 27 | Honda Civic | $1,734 | $145 |

| 28 | Acura Integra | $1,740 | $145 |

| 29 | Subaru Forester | $1,740 | $145 |

| 30 | Volkswagen Atlas Cross Sport | $1,742 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Caldwell, ID Zip Codes. Updated October 24, 2025

Additional vehicles making the list of the top 30 above include the Subaru Ascent, Lexus NX 250, Chevrolet Colorado, Acura Integra, and Subaru Forester. Insurance rates for those models fall between $1,752 and $1,794 per year in Caldwell.

To put the rates for the cheapest vehicles in perspective, a few models that have much higher car insurance rates include the Toyota Mirai that costs $2,508 per year, the Ram Truck that averages $2,330, and the BMW X3 which averages $2,376.

What is average car insurance cost in Caldwell?

In Caldwell, the average cost to insure a vehicle is $2,014 per year, which is 12.2% less than the overall national average rate of $2,276. Per month, Caldwell car insurance costs about $168 per month for a policy with full coverage.

In the state of Idaho, the average cost of car insurance is $2,016 per year, so the cost in Caldwell is very similar to the state as a whole. The cost to insure a car in Caldwell compared to other Idaho locations is about $52 per year cheaper than in Idaho Falls, $30 per year less than in Pocatello, and $2 per year more expensive than in Nampa.

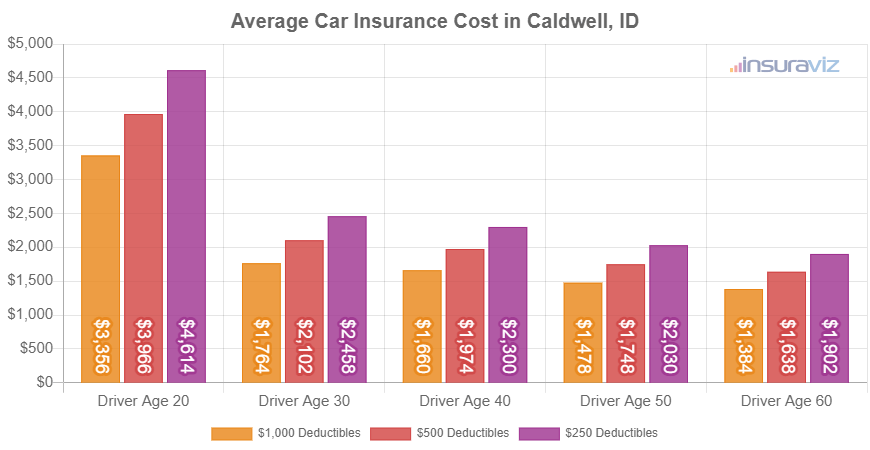

The age of the rated driver is the largest factor that influences the cost of auto insurance, so the list below details how age impacts cost by breaking out average car insurance rates in Caldwell depending on driver age.

Average car insurance cost for Caldwell drivers age 16 to 60

- 16-year-old driver – $7,179 per year or $598 per month

- 17-year-old driver – $6,953 per year or $579 per month

- 18-year-old driver – $6,235 per year or $520 per month

- 19-year-old driver – $5,675 per year or $473 per month

- 20-year-old driver – $4,056 per year or $338 per month

- 30-year-old driver – $2,148 per year or $179 per month

- 40-year-old driver – $2,014 per year or $168 per month

- 50-year-old driver – $1,786 per year or $149 per month

- 60-year-old driver – $1,672 per year or $139 per month

The chart below shows average auto insurance cost in Caldwell broken out not only by driver age, but also by policy deductibles. Rates are averaged for all 2024 vehicle models including luxury brand cars and SUVs.

Average car insurance rates in the previous chart range from $1,414 per year for a high deductible policy for a 60-year-old driver to $4,714 per year for a 20-year-old driver with a low deductible policy.

From a monthly budgeting standpoint, the average cost of car insurance per month in Caldwell ranges from $118 to $393.

Caldwell car insurance rates can cost very different amounts for different drivers and can also be very different depending on the company. Due to the fact that rates are so variable, this emphasizes the need to get accurate auto insurance quotes when shopping around for cheaper coverage.

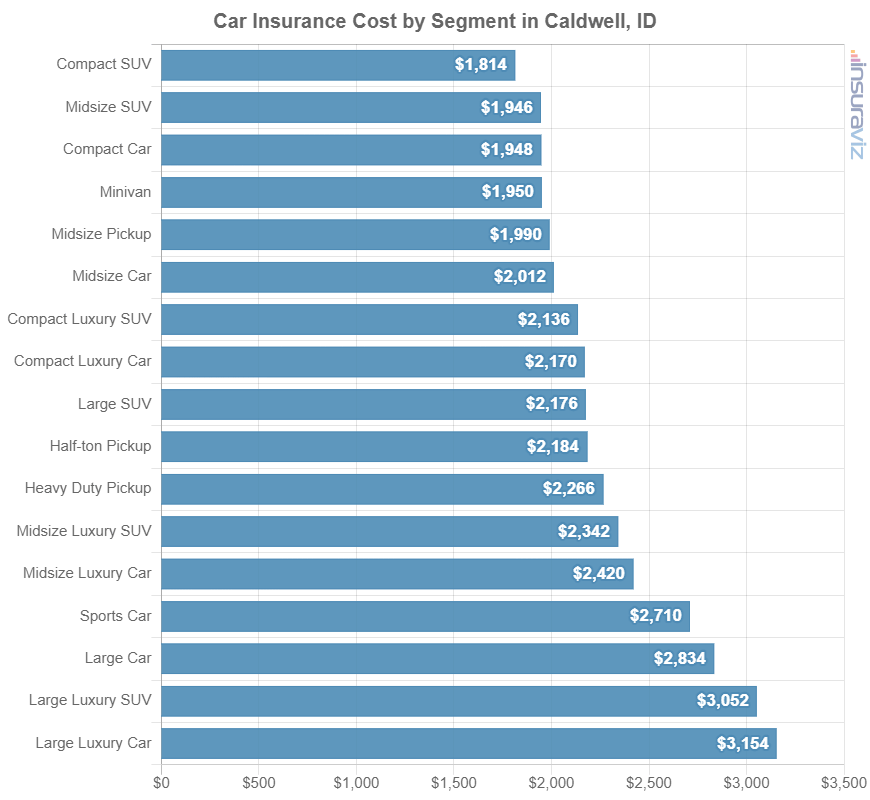

The section below details the average cost to insure each different vehicle segment. The average rates shown should give a good understanding of the types of vehicles that have the cheapest auto insurance rates in Caldwell. Then the subsequent sections rank the 20 cheapest models in each automotive segment.

Best vehicles for the cheapest insurance rates

If you’re shopping around for a new or used car, it’s useful to know which kinds of vehicles cost less to insure. Buying a vehicle with cheap car insurance rates can possibly fit a more expensive car payment into your monthly budget.

For instance, maybe you want to know if compact cars have cheaper auto insurance than midsize cars or if full-size SUVs are more expensive to insure than midsize or compact SUVs.

The next chart displays average car insurance cost by vehicle segment in Caldwell. When comparing rates from a segment perspective, compact SUVs, midsize trucks, and minivans tend to have the best rates, while exotic performance cars have the most expensive overall rates.

Average insurance rates by segment are accurate enough for getting an initial comparison, but rates range significantly within each automotive segment displayed in the previous chart.

For example, in the midsize car segment, Caldwell auto insurance rates range from the Kia K5 at $1,942 per year for a full coverage policy up to the Tesla Model 3 costing $2,366 per year. As another example, in the large luxury car segment, the average insurance cost can range from the Audi A5 costing $2,394 per year up to the Mercedes-Benz Maybach S680 costing $4,222 per year, a difference of $1,828 within that segment.

In the next list, we detail the model with the best car insurance rates in Caldwell, ID, for each segment. Annual and monthly average insurance quotes are shown for each model.

- Cheapest compact car to insure – Toyota GR Corolla at $1,752 per year or $146 per month

- Cheapest compact SUV to insure – Subaru Crosstrek at $1,488 per year or $124 per month

- Cheapest midsize car to insure – Kia K5 at $1,942 per year or $162 per month

- Cheapest midsize SUV to insure – Honda Passport at $1,606 per year or $134 per month

- Cheapest full-size car to insure – Chrysler 300 at $1,920 per year or $160 per month

- Cheapest full-size SUV to insure – Chevrolet Tahoe at $1,892 per year or $158 per month

- Cheapest midsize pickup to insure – Chevrolet Colorado at $1,776 per year or $148 per month

- Cheapest full-size pickup to insure – Nissan Titan at $1,884 per year or $157 per month

- Cheapest heavy duty pickup to insure – GMC Sierra 2500 HD at $2,048 per year or $171 per month

- Cheapest minivan to insure – Honda Odyssey at $1,840 per year or $153 per month

- Cheapest sports car to insure – Mazda MX-5 Miata at $1,864 per year or $155 per month

- Cheapest compact luxury car to insure – Acura Integra at $1,792 per year or $149 per month

- Cheapest compact luxury SUV to insure – Acura RDX at $1,684 per year or $140 per month

- Cheapest midsize luxury car to insure – Mercedes-Benz CLA250 at $2,074 per year or $173 per month

- Cheapest midsize luxury SUV to insure – Jaguar E-Pace at $1,884 per year or $157 per month

- Cheapest full-size luxury car to insure – Audi A5 at $2,394 per year or $200 per month

- Cheapest full-size luxury SUV to insure – Infiniti QX80 at $2,260 per year or $188 per month

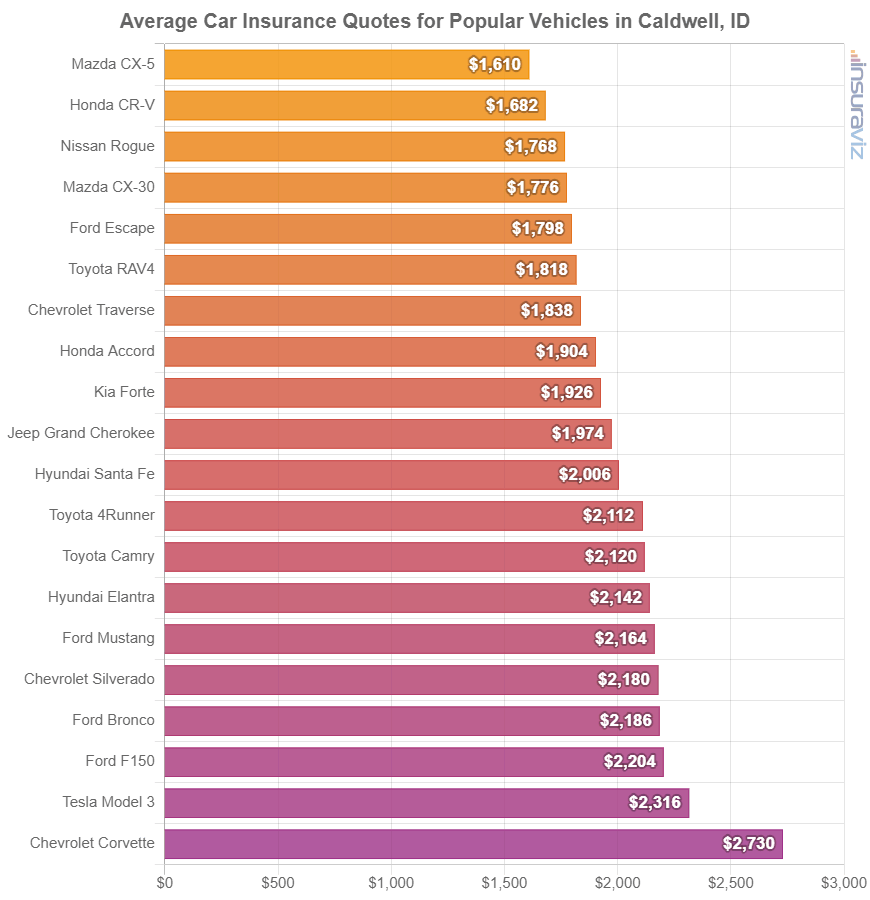

Insurance for the most popular vehicles in Caldwell, ID

The car insurance rates discussed up to this point are averaged for all 2024 vehicle models, which is handy for making generalized comparisons like the cost difference between two locations.

Average auto insurance rates are great for getting the answer to questions like “is car insurance cheaper in Caldwell or Meridian?” or “is Idaho car insurance cheaper than Texas?”.

But for more useful cost comparisons, we should do a rate analysis for the specific vehicle being insured. Each individual model has it’s own exposure profile for car insurance rating and this data provides the means to perform better insurance cost comparisons.

This next chart displays average insurance rates for popular cars, trucks, and SUVs bought and insured in Caldwell. Some, like the Mazda CX-5 and Honda CR-V are ranked in the top 30 table from earlier in the article, but most popular models did not make the top rankings.

Only a handful of the popular models in the chart above ranked in the top 30 for cheapest insurance rates.

This higher cost could be due to buying a pricey vehicle, like a Chevrolet Corvette with an average purchase price of $69,995 or a Porsche Taycan that has an average price of $90,900.

Another reason could be the higher chance of liability or medical claims like on a Mazda 3, Volkswagen Jetta, or Kia Rio. Some models just have higher likelihood of having substantial claims due to design or safety issues.

Saving money on auto insurance

Caldwell drivers are always looking to cut the monthly cost of insurance, so take a minute to review the money-saving ideas in this next list and it’s very likely you can save a little dough on your next policy.

- Be a safe driver and save on Caldwell car insurance. Being the cause of frequent accidents will raise rates, potentially up to $2,876 per year for a 20-year-old driver and even as much as $492 per year for a 60-year-old driver. So drive safe and save money!

- Get cheaper insurance cost by avoiding traffic tickets. In order to get cheap car insurance in Caldwell, it’s necessary to drive safe. Just a few speeding tickets have the potential to raise insurance policy cost by as much as $540 per year. Major infractions such as DUI/DWI and leaving the scene of an accident could raise rates by an additional $1,872 or more.

- Better credit scores yield better car insurance rates. Having a good credit rating over 800 could save up to $316 per year versus a slightly lower credit score between 670-739. Conversely, a lesser credit rating could cost around $367 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Compare insurance costs before buying a car. Different models, and even different trim levels of the same model, have very different costs for insurance, and insurance companies can price policies with a wide range of prices. Check prices before you buy so you can avoid any surprises when you receive your bill.

- Remain claim free. Insurance companies give a discounted rate if you do not file any claims. Auto insurance should only be used in the case of large financial hits, not minor claims.

- Choose vehicles that have cheaper auto insurance. The performance of the vehicle you drive is a big factor in the price you pay for car insurance. As an example, a Kia Sportage costs $1,062 less per year to insure in Caldwell than a Dodge Challenger. Lower performance vehicles cost less to insure.