- Compact models like the Buick Envision, Nissan Kicks, and Subaru Crosstrek will have the cheapest auto insurance.

- Average car insurance cost in Hobbs is $1,690 per year, or about $141 per month.

- Car insurance rates for a few popular models include the Nissan Rogue at $127 per month, Mazda CX-5 at $115, and Subaru Outback at $120.

- Auto insurance quotes can vary from as low as $37 per month for just liability insurance to over $662 per month for teenagers and other high-risk drivers.

- Hobbs auto insurance averages $92 per year more than the New Mexico state average cost and $193 per year less than the United States national average.

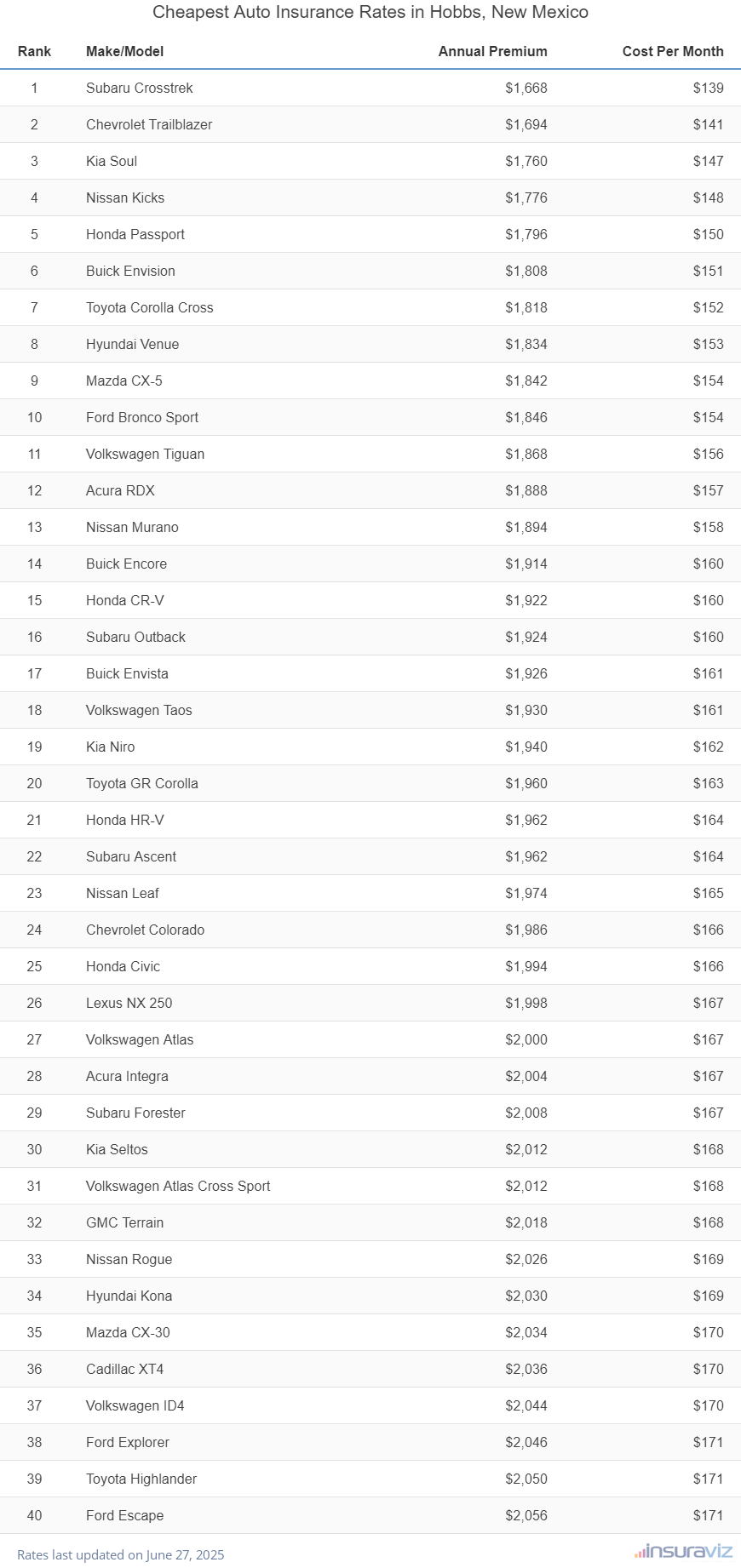

Which vehicles have cheap insurance in Hobbs?

The vehicles with the cheapest insurance prices in Hobbs, NM, tend to be crossovers and compact SUVs like the Kia Soul, Chevrolet Trailblazer, and Toyota Corolla Cross.

Average auto insurance rates for models ranked in the top 10 cost $1,384 or less per year to get full coverage.

A few other models that rank very well in the cost comparison table are the Ford Bronco Sport, Buick Envista, Acura RDX, and Subaru Outback. Insurance rates are slightly more for those models than the cheapest small SUVs that rank near the top, but they still have average rates of $1,450 or less per year ($121 per month).

The next table ranks the top 40 cheapest vehicles to insure in Hobbs, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,248 | $104 |

| 2 | Chevrolet Trailblazer | $1,270 | $106 |

| 3 | Kia Soul | $1,318 | $110 |

| 4 | Nissan Kicks | $1,330 | $111 |

| 5 | Honda Passport | $1,348 | $112 |

| 6 | Buick Envision | $1,352 | $113 |

| 7 | Toyota Corolla Cross | $1,362 | $114 |

| 8 | Hyundai Venue | $1,372 | $114 |

| 9 | Mazda CX-5 | $1,378 | $115 |

| 10 | Ford Bronco Sport | $1,384 | $115 |

| 11 | Volkswagen Tiguan | $1,398 | $117 |

| 12 | Acura RDX | $1,412 | $118 |

| 13 | Nissan Murano | $1,420 | $118 |

| 14 | Buick Encore | $1,434 | $120 |

| 15 | Subaru Outback | $1,438 | $120 |

| 16 | Honda CR-V | $1,440 | $120 |

| 17 | Buick Envista | $1,444 | $120 |

| 18 | Chevrolet Colorado | $1,448 | $121 |

| 19 | Volkswagen Taos | $1,448 | $121 |

| 20 | Kia Niro | $1,450 | $121 |

| 21 | Toyota GR Corolla | $1,466 | $122 |

| 22 | Honda HR-V | $1,470 | $123 |

| 23 | Subaru Ascent | $1,470 | $123 |

| 24 | Nissan Leaf | $1,478 | $123 |

| 25 | Lexus NX 250 | $1,494 | $125 |

| 26 | Honda Civic | $1,498 | $125 |

| 27 | Volkswagen Atlas | $1,498 | $125 |

| 28 | Acura Integra | $1,504 | $125 |

| 29 | Subaru Forester | $1,506 | $126 |

| 30 | Volkswagen Atlas Cross Sport | $1,506 | $126 |

| 31 | Kia Seltos | $1,508 | $126 |

| 32 | GMC Terrain | $1,512 | $126 |

| 33 | Nissan Rogue | $1,518 | $127 |

| 34 | Hyundai Kona | $1,520 | $127 |

| 35 | Mazda CX-30 | $1,524 | $127 |

| 36 | Cadillac XT4 | $1,526 | $127 |

| 37 | Volkswagen ID4 | $1,532 | $128 |

| 38 | Ford Explorer | $1,534 | $128 |

| 39 | Toyota Highlander | $1,536 | $128 |

| 40 | Ford Escape | $1,542 | $129 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Hobbs, NM Zip Codes. Updated February 23, 2024

A few additional vehicles worth noting that made the top 40 above include the Honda HR-V, the Subaru Ascent, the GMC Terrain, the Acura Integra, and the Hyundai Kona. Average auto insurance rates for those models cost between $1,450 and $1,542 per year.

In comparison to the cheapest rates, some models that cost much more to insure include the Jeep Grand Wagoneer at $1,962 per year, the Chevrolet Camaro that averages $2,198, and the Tesla Model X at $2,124.

How much does car insurance cost in Hobbs?

In Hobbs, the average cost of car insurance is $1,690 per year, which is 10.8% less than the U.S. overall average rate of $1,883. Per month, Hobbs drivers can expect to pay an average of $141 for a policy that provides full coverage.

In the state of New Mexico, the average car insurance expense is $1,598 per year, so the cost in Hobbs averages $92 more per year.

When compared to other cities in New Mexico, the average cost of car insurance in Hobbs is $142 per year cheaper than in Albuquerque, $192 per year more expensive than in Farmington, and $40 per year more expensive than in Santa Fe.

The age of the rated driver is one of the biggest determining factors on the price of auto insurance, so the list below illustrates this by showing the difference in average car insurance rates in Hobbs for drivers from 16 to 60.

Hobbs car insurance cost for drivers age 16 to 60

- 16 year old – $6,016 per year or $501 per month

- 17 year old – $5,828 per year or $486 per month

- 18 year old – $5,224 per year or $435 per month

- 19 year old – $4,760 per year or $397 per month

- 20 year old – $3,398 per year or $283 per month

- 30 year old – $1,800 per year or $150 per month

- 40 year old – $1,690 per year or $141 per month

- 50 year old – $1,498 per year or $125 per month

- 60 year old – $1,402 per year or $117 per month

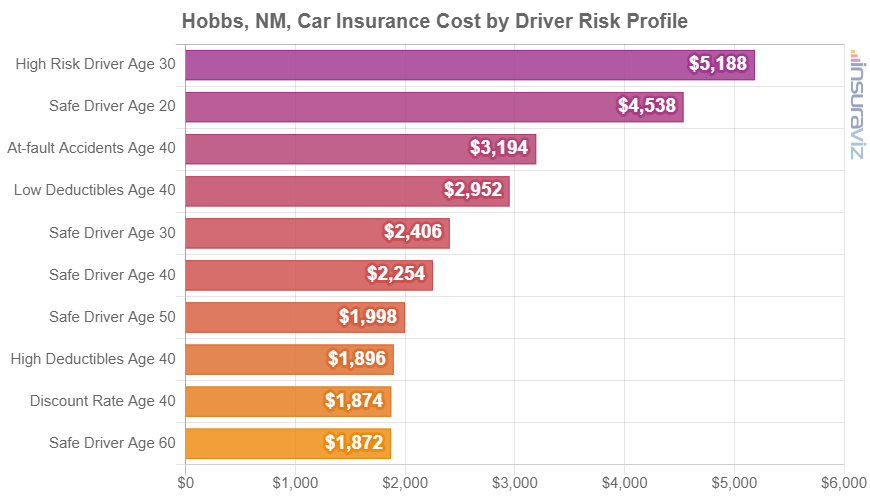

The chart below shows examples of average Hobbs car insurance cost. Rates are averaged for all Hobbs Zip Codes and shown for a range of driver ages, physical damage coverage deductibles, and driver risk profiles.

In the chart above, the cost of car insurance in Hobbs ranges from $1,406 per year for a 40-year-old driver with a discount rate policy to $3,886 per year for a 30-year-old driver with a history of violations and/or at-fault accidents. From a monthly standpoint, the average cost in the chart above ranges from $117 to $324 per month.

Hobbs car insurance rates can have a wide range and seemingly inconsequential changes in personal situations can cause enormous price changes. The possibility of a wide range of rates emphasizes the need for accurate auto insurance quotes when shopping around for cheaper auto insurance.

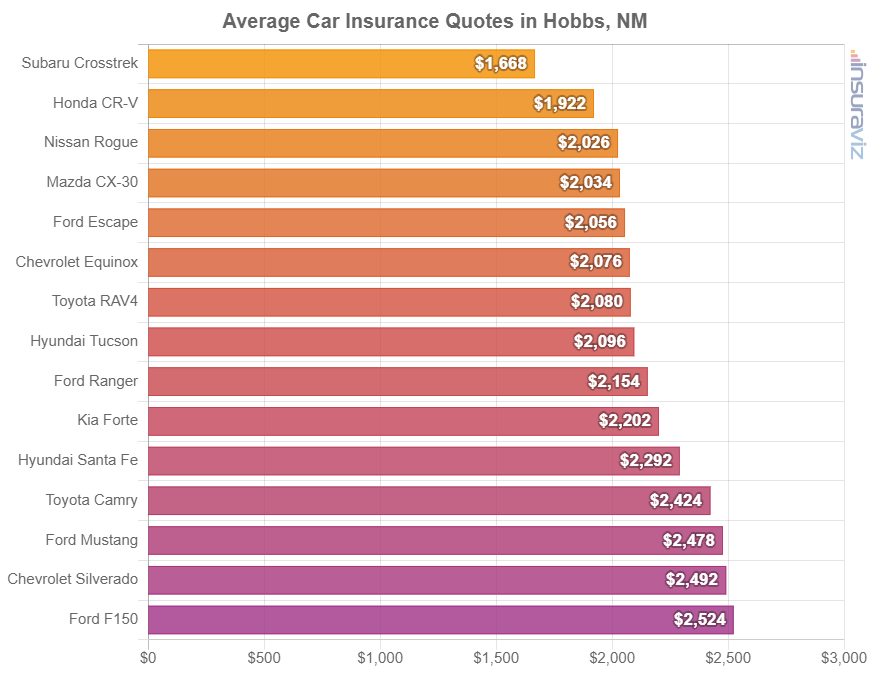

Average car insurance rates for popular vehicles

The previous car insurance rates in this article are averaged for all 2024 vehicle models, which is useful for making big picture comparisons like the cost difference between two locations. Average auto insurance rates are great for answering questions like “is Hobbs car insurance cheaper than Rio Rancho?” or “are car insurance rates in New Mexico cheaper than in California?”.

But for more comprehensive auto insurance rate comparisons, the data will be more accurate if we instead use rates for the exact make and model of vehicle being insured. Every model has a unique risk profile for determining auto insurance prices and this data allows us to make detailed cost comparisons.

The chart below details average insurance cost in Hobbs for some of the more popular cars, trucks, and SUVs.

If the list of popular models is compared to the prior list of the 40 models with the cheapest car insurance rates, the majority of popular vehicles did not rank in the top 40.

This higher cost could be due to a more expensive vehicle, like a Porsche Taycan that has an average price of $90,900 or a Lexus LX 570 with an average purchase price of $89,160, or maybe the cause is a greater likelihood of medical or liability insurance claims like a Ford Bronco or a Mazda 3.

Let’s quickly review the comparisons and concepts covered so far.

- Hobbs car insurance rates are more expensive than the New Mexico state average – $1,690 (Hobbs average) compared to $1,598 (New Mexico average)

- Low deductibles cost more than high deductibles – A 40-year-old driver pays an average of $548 more per year for a policy with $250 deductibles compared to $1,000 deductibles.

- Teen girls pay less than teen males – Teen females (age 16 to 19) pay $735 to $393 less each year than male drivers of the same age.

- Car insurance for a teenager can cost a lot – Rates range from $4,025 to $6,016 per year for teen driver car insurance in Hobbs, New Mexico.

- Insurance rates decline substantially from age 20 to 30 – The average 30-year-old Hobbs, New Mexico, driver will pay $1,598 less per year than a 20-year-old driver, $1,800 compared to $3,398.

- Average car insurance cost per month ranges from $117 to $501 – That’s the average car insurance cost range for drivers aged 16 to 60 in Hobbs.

- Car insurance gets more affordable the older you are – Insurance rates for a 40-year-old driver in Hobbs are $1,708 per year cheaper than for a 20-year-old driver.

To help illustrate the extent to which the cost of car insurance can change for different drivers (and also emphasize the importance of accurate rate quotes), the charts below present a wide range of rates for four popular vehicles in Hobbs: the Ford F150, Honda CR-V, Honda Pilot, and Toyota Camry.

The example for each vehicle shows average rates for different profiles to show the possible variation with only minor changes to the policy rating factors.

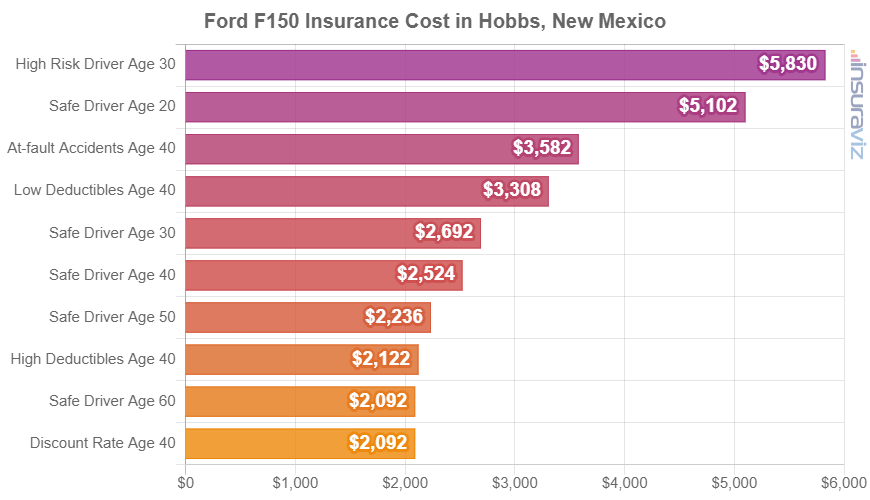

Ford F150 insurance rates

Ford F150 insurance in Hobbs averages $1,890 per year, with a range of $1,586 per year on the Ford F150 XL Super Cab 4WD trim level (MSRP of $46,195) up to $2,196 per year on the Ford F150 Lightning Platinum Black Special Edition trim (MSRP of $100,090).

When Hobbs insurance rates on a Ford F150 are compared with the average cost for the entire U.S. on the same model, rates are $198 to $274 cheaper per year in Hobbs, depending on which model is insured.

As a cost per month, auto insurance rates on a 2024 Ford F150 for a good driver can range from $132 to $183 per month, depending on the company and where you live in Hobbs.

The bar chart below illustrates how the cost of car insurance for a Ford F150 can vary based on different driver ages, physical damage deductibles, and driver risk profiles. In this example, cost varies from $1,570 to $4,366 per year, which is a difference of $2,796.

The Ford F150 is a full-size truck, and other popular models in the same segment include the Ram Truck, Chevrolet Silverado, and Toyota Tundra.

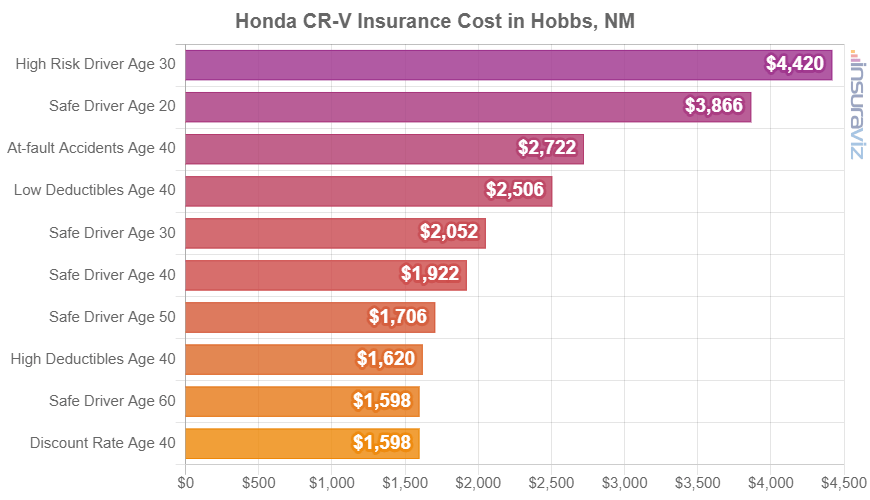

Honda CR-V insurance rates

Average Honda CR-V insurance cost in Hobbs ranges from $1,366 up to $1,520 per year. The least-expensive insurance is on the $29,500 Honda CR-V LX model, while the highest-cost model is the $39,850 Honda CR-V Sport Touring Hybrid AWD trim level.

From a monthly standpoint, full-coverage insurance for a Honda CR-V for an average middle-age driver can range from $114 to $127 per month, depending on policy limits and your Zip Code in Hobbs.

The next rate chart should be a good visualization how the cost of insurance for a Honda CR-V can range significantly based on an assortment of driver ages and policy risk profiles.

For our example, prices range from $1,198 to $3,310 per year, which is a cost difference of $2,112.

The Honda CR-V is part of the compact SUV segment, and other top-selling models from the same segment include the Subaru Forester, Nissan Rogue, and Chevrolet Equinox.

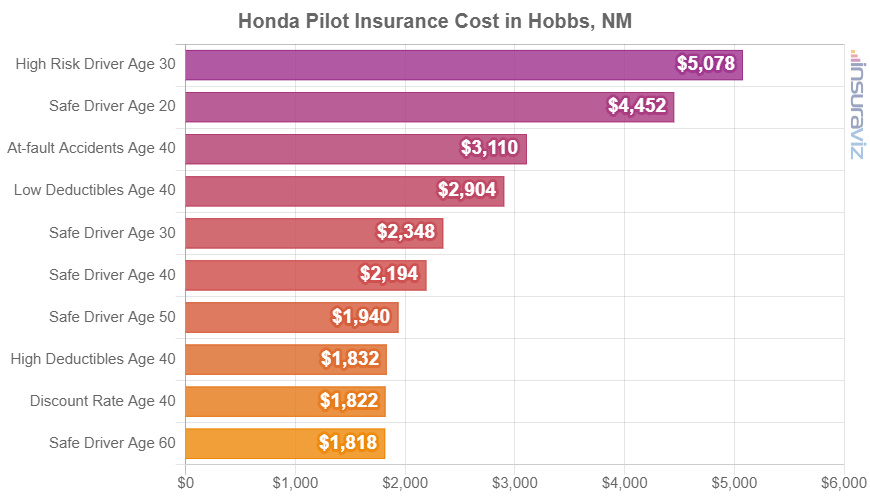

Honda Pilot insurance rates

Honda Pilot insurance in Hobbs averages $1,646 per year, ranging from $1,538 per year for the Honda Pilot LX trim level up to $1,748 per year on the Honda Pilot Elite AWD trim level.

When Hobbs car insurance quotes for a Honda Pilot are compared to the national average cost on the same model, the cost is $188 to $214 cheaper per year in Hobbs, depending on which model is insured.

As a cost per month, auto insurance on a Honda Pilot for a middle-age safe driver can cost from $128 to $146 per month, depending on various factors including your address in Hobbs.

The rate chart below illustrates how insurance quotes for a Honda Pilot can vary for different driver ages and policy risk profiles.

The Honda Pilot is classified as a midsize SUV, and other models in the same segment include the Kia Sorento, Kia Telluride, Jeep Grand Cherokee, and Ford Edge.

Toyota Camry insurance rates

With prices ranging from $26,420 to $33,120, average Hobbs car insurance quotes for a Toyota Camry range from $1,670 per year on the Toyota Camry LE model up to $1,906 per year on the Toyota Camry XSE AWD trim level.

When Hobbs auto insurance rates for a Toyota Camry are compared with the overall national average cost on the same model, rates are anywhere from $206 to $238 cheaper per year in Hobbs, depending on the model being insured.

From a cost per month standpoint, car insurance on the Toyota Camry can range from $139 to $159 per month, depending on the insurance company and where you live in Hobbs.

The chart displayed below visualizes how the price of car insurance on a Toyota Camry can be very different for different drivers, physical damage deductibles, and driver risk profiles.

The Toyota Camry is a midsize car, and other models popular in Hobbs include the Chevrolet Malibu, Kia K5, Nissan Altima, and Hyundai Sonata.

Eight ways to save on auto insurance

Hobbs drivers are always looking to reduce the monthly expense for car insurance, so scan the money-saving tips below and maybe you’ll find a way to save some money the next time you buy a policy.

- Compare insurance cost before buying a car. Different cars, trucks, and SUVs have significantly different auto insurance rates, and companies can charge a wide range of prices. Get quotes before you buy a new vehicle in order to avoid any surprises when buying insurance.

- Avoid driving violations to reduce rates. In order to get the cheapest auto insurance in Hobbs, it pays off to be a safe driver. As few as two traffic tickets can potentially raise auto insurance rates as much as $450 per year. Being convicted of a major violation like DWI/DUI and reckless driving could raise rates by an additional $1,570 or more.

- If your vehicle is older, remove optional coverages. Deleting comprehensive and collision coverage from older vehicles that are not worth a lot can cheapen the cost to insure considerably.

- Being a good driver saves money. Too many at-fault accidents will increase rates, possibly as much as $816 per year for a 30-year-old driver and even $512 per year for a 50-year-old driver. So be a cautious driver and save.

- Remain claim free and save. Insurance companies give a discounted rate for not having any claims. Auto insurance should be used in the case of significant claims, not small claims.

- A good credit rating can save money. Having a high credit score of 800+ could save as much as $265 per year when compared to a decent credit rating of 670-739. Conversely, an imperfect credit score below 579 could cost as much as $308 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Raising deductibles makes insurance more affordable. Boosting your physical damage deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Shop around. There are lots of options for coverage in Hobbs, so don’t settle for the first quote you get. Ideally, drivers get quotes from several captive agencies like State Farm and Allstate, as well as multiple quotes from independent agents which can price your insurance with multiple companies.