- Average Moore car insurance cost is $2,796 per year for a full coverage policy. Average cost per month is approximately $233.

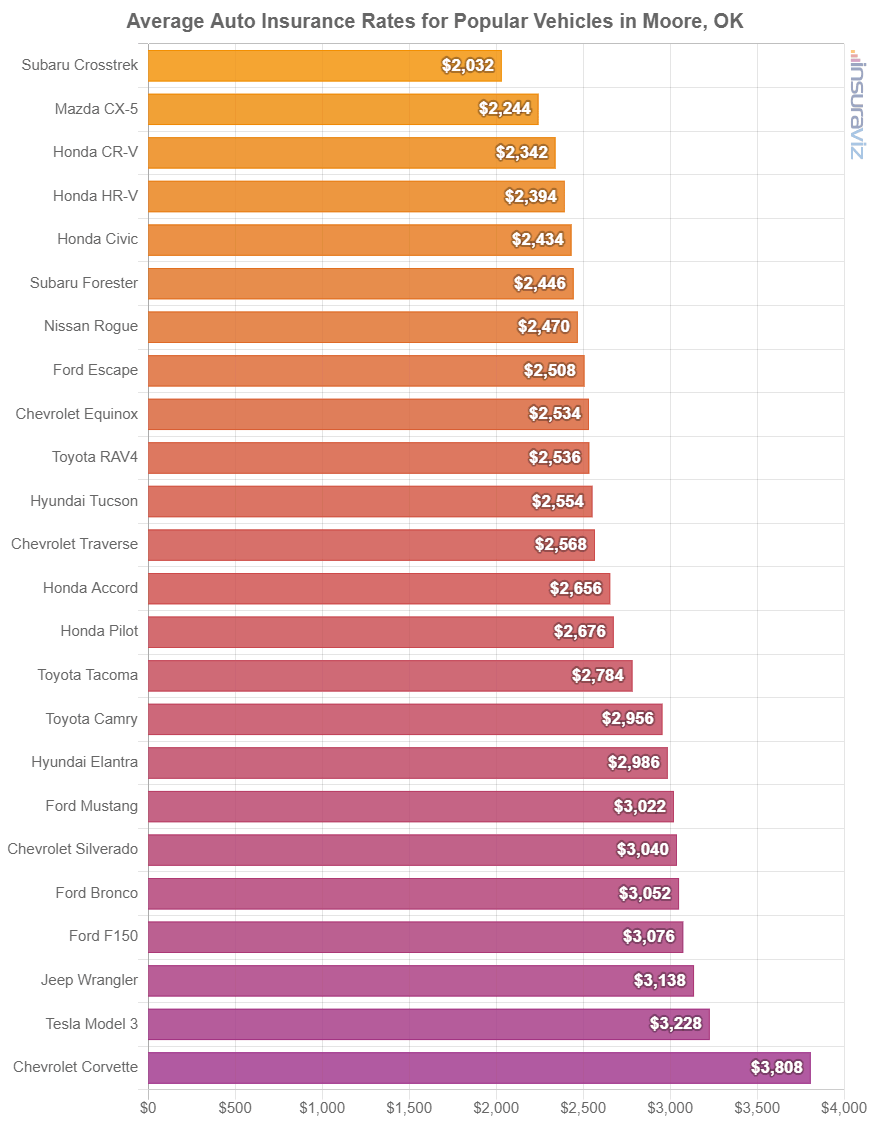

- Car insurance rates for a few popular models in Moore include the Toyota Camry at $3,002 per year, Ford F150 at $3,126, and Toyota RAV4 at $2,576.

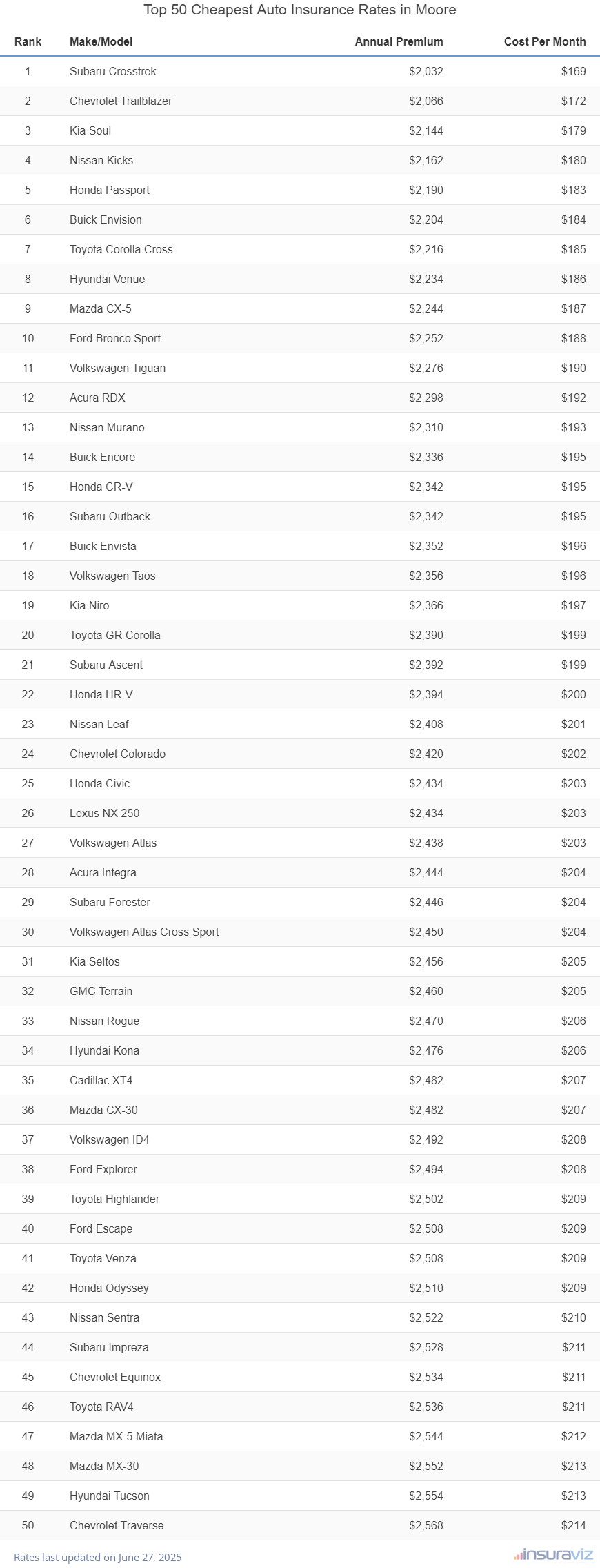

- For the cheapest car insurance in Moore, Oklahoma, crossover vehicles like the Chevrolet Trailblazer, Nissan Kicks, and Buick Envision cost less to insure than most other makes and models.

- A few models with segment-leading car insurance rates include the Audi A5 ($277 per month), Acura RDX ($195 per month), Infiniti QX80 ($261 per month), and Jaguar E-Pace ($218 per month).

How much is car insurance in Moore?

Average auto insurance cost in Moore is $2,796 per year, or around $233 per month for a full-coverage car insurance policy. It costs 20.5% more to insure the average vehicle in Moore, Oklahoma, than the national average rate of $2,276.

In Oklahoma, the average car insurance expense is $2,698 per year, so the cost to insure the average vehicle in the city of Moore is $98 more per year.

The average cost of car insurance in Moore compared to other Oklahoma locations is about $72 per year more than in Norman, $70 per year cheaper than in Oklahoma City, and $34 per year more than in Broken Arrow.

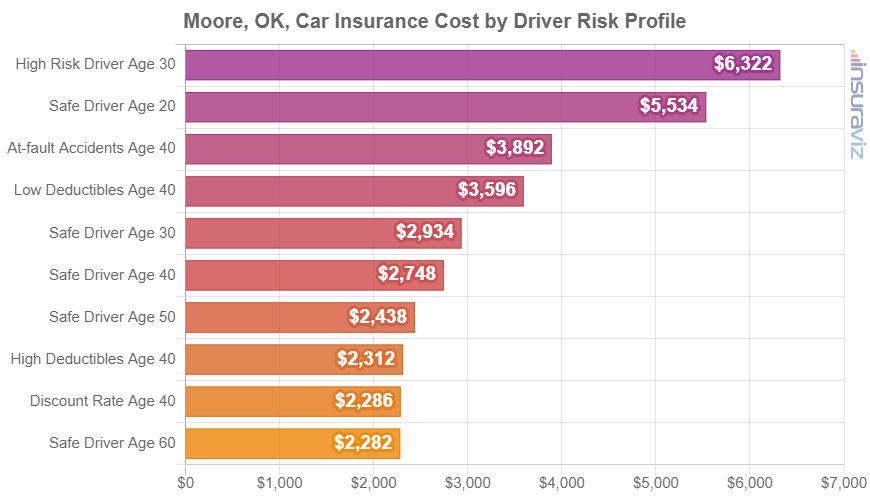

Driver age is probably the number one factor that determines the price of auto insurance. The list below illustrates these differences by showing average car insurance rates based on the age of the driver.

Car insurance cost in Moore, OK, for drivers age 16 to 60

- 16-year-old driver – $9,948 per year or $829 per month

- 17-year-old driver – $9,640 per year or $803 per month

- 18-year-old driver – $8,637 per year or $720 per month

- 19-year-old driver – $7,868 per year or $656 per month

- 20-year-old driver – $5,620 per year or $468 per month

- 30-year-old driver – $2,980 per year or $248 per month

- 40-year-old driver – $2,796 per year or $233 per month

- 50-year-old driver – $2,474 per year or $206 per month

- 60-year-old driver – $2,318 per year or $193 per month

The chart below shows examples of average Moore car insurance cost. Rates are averaged for all Moore Zip Codes and shown based on a range of driver ages and common risk profiles.

Average car insurance rates in the prior chart range from $2,320 per year for a 40-year-old driver who qualifies for a cheap discount rate to $6,426 per year for a 30-year-old driver who is required to buy high risk car insurance.

When the average rates are converted to monthly figures, the average cost of car insurance per month in Moore ranges from $193 to $536.

Moore car insurance rates can have significant differences in cost and can also be very different depending on the company. This amount of variability reinforces the need for multiple auto insurance quotes when trying to find more affordable car insurance.

Car insurance rates for popular vehicles

Average auto insurance rates are fantastic for making comparisons like the cost between two locations. But drivers generally want to compare rates for specific models of vehicles rather than an overall average rate.

The following chart displays average car insurance rates in Moore for some of the more popular vehicles sold in the state of Oklahoma.

Popular vehicle models in Moore tend to be small or midsize cars like the Toyota Corolla, Nissan Sentra, and Toyota Camry and compact and midsize SUVs like the Honda CR-V, Toyota RAV4, and Subaru Outback.

Other popular vehicles from other vehicle segments include luxury models like the Acura ILX and Infiniti QX60, pickup trucks like the Ford Ranger and Ram 1500, and sports cars like the Porsche 911 and Nissan GT-R.

Which cars are cheapest to insure?

The vehicles with the cheapest average car insurance quotes in Moore tend to be small SUVs and crossovers like the Kia Soul, Subaru Crosstrek, and Nissan Kicks. Average car insurance prices for the cheapest vehicles run about $2,288 or less per year, or $191 per month, for full coverage.

A few other models that come in near the top in our car insurance price comparison are the Honda CR-V, Volkswagen Taos, Buick Envista, and Nissan Murano.

Insurance is somewhat higher for those models than the small SUVs that rank at the top, but they still have an average cost of $2,424 or less per year.

Let’s take a look at the complete ranking of the top 50 cheapest cars to insure in the city of Moore, Oklahoma.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,062 | $172 |

| 2 | Chevrolet Trailblazer | $2,098 | $175 |

| 3 | Kia Soul | $2,180 | $182 |

| 4 | Nissan Kicks | $2,200 | $183 |

| 5 | Honda Passport | $2,226 | $186 |

| 6 | Buick Envision | $2,236 | $186 |

| 7 | Toyota Corolla Cross | $2,252 | $188 |

| 8 | Hyundai Venue | $2,268 | $189 |

| 9 | Mazda CX-5 | $2,276 | $190 |

| 10 | Ford Bronco Sport | $2,288 | $191 |

| 11 | Volkswagen Tiguan | $2,310 | $193 |

| 12 | Acura RDX | $2,334 | $195 |

| 13 | Nissan Murano | $2,346 | $196 |

| 14 | Buick Encore | $2,372 | $198 |

| 15 | Subaru Outback | $2,378 | $198 |

| 16 | Honda CR-V | $2,382 | $199 |

| 17 | Buick Envista | $2,386 | $199 |

| 18 | Volkswagen Taos | $2,392 | $199 |

| 19 | Kia Niro | $2,406 | $201 |

| 20 | Toyota GR Corolla | $2,424 | $202 |

| 21 | Honda HR-V | $2,430 | $203 |

| 22 | Subaru Ascent | $2,432 | $203 |

| 23 | Nissan Leaf | $2,446 | $204 |

| 24 | Chevrolet Colorado | $2,460 | $205 |

| 25 | Lexus NX 250 | $2,472 | $206 |

| 26 | Honda Civic | $2,474 | $206 |

| 27 | Volkswagen Atlas | $2,476 | $206 |

| 28 | Acura Integra | $2,484 | $207 |

| 29 | Subaru Forester | $2,484 | $207 |

| 30 | Volkswagen Atlas Cross Sport | $2,488 | $207 |

| 31 | Kia Seltos | $2,494 | $208 |

| 32 | GMC Terrain | $2,500 | $208 |

| 33 | Nissan Rogue | $2,508 | $209 |

| 34 | Hyundai Kona | $2,514 | $210 |

| 35 | Mazda CX-30 | $2,518 | $210 |

| 36 | Cadillac XT4 | $2,522 | $210 |

| 37 | Volkswagen ID4 | $2,532 | $211 |

| 38 | Ford Explorer | $2,534 | $211 |

| 39 | Toyota Highlander | $2,542 | $212 |

| 40 | Toyota Venza | $2,546 | $212 |

| 41 | Ford Escape | $2,548 | $212 |

| 42 | Honda Odyssey | $2,552 | $213 |

| 43 | Nissan Sentra | $2,560 | $213 |

| 44 | Subaru Impreza | $2,566 | $214 |

| 45 | Chevrolet Equinox | $2,572 | $214 |

| 46 | Toyota RAV4 | $2,576 | $215 |

| 47 | Mazda MX-5 Miata | $2,586 | $216 |

| 48 | Mazda MX-30 | $2,592 | $216 |

| 49 | Hyundai Tucson | $2,596 | $216 |

| 50 | Chevrolet Traverse | $2,606 | $217 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Moore, OK Zip Codes. Updated October 24, 2025

A few additional vehicles worth noting that made the top 50 above include the Chevrolet Equinox, the Nissan Sentra, the Hyundai Kona, the Chevrolet Traverse, and the Toyota Venza. Rates for those vehicles cost between $2,424 and $2,610 per year.

One interesting thing to point out about the table above, is when you compare the top 50 cheapest vehicles to the prior chart showing popular models, only about nine models made both datasets. That just shows that popular models are not always the cheapest to insure.

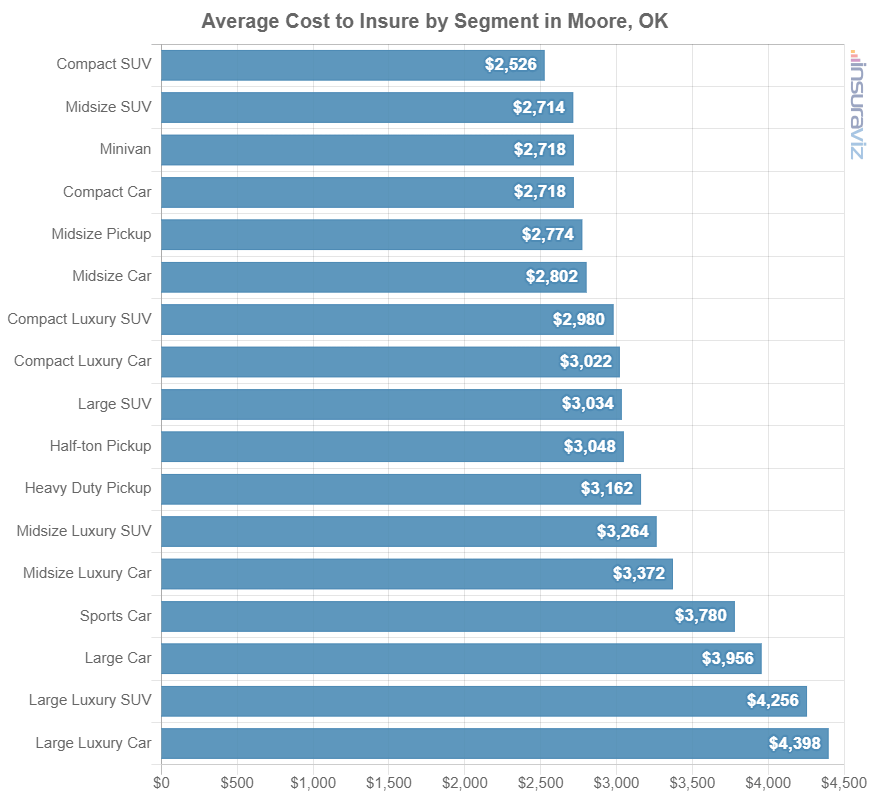

The next section of this article goes into detail about average car insurance cost by vehicle segment. The average rates shown in the chart should give you a decent idea of which types of vehicles have the overall most affordable average auto insurance rates.

Cheapest insurance cost by automotive segment

If you’re looking to buy a different vehicle and don’t know what kind to buy, it’s useful to have an idea of which kinds of vehicles have more favorable insurance rates.

As an example, you may be wondering if compact cars are more affordable to insure than midsize cars or if heavy duty pickups are more expensive to insure than half-ton pickups.

The next chart displays the average car insurance cost in Moore for each automotive segment. In general, vehicles like compact and midsize SUVs, midsize pickups, and compact and midsize non-luxury cars tend to have the most affordable car insurance rates.

Due to rate variation inherent with each segment, we recommend using segment average rates just as a starting point. It’s more accurate to compare rates for specific models to find out which vehicles in each segment have the best insurance rates.

For example, in the midsize luxury SUV segment, rates range from the Jaguar E-Pace at $2,610 per year for full coverage insurance to the Mercedes-Benz AMG GLE63 costing $4,708 per year, a difference of $2,098 just for that segment.

In the large SUV segment, average rates in Moore, OK, can vary from the Chevrolet Tahoe at $2,624 per year up to the Toyota Sequoia at $3,494 per year.

These two examples show some extreme variation in the cost of car insurance within the same segment. So it’s wise to get accurate car insurance quotes from multiple companies to ensure you have a good basis for comparison.

We covered a ton of concepts and data in this article, so let’s make a quick revue of some of the important concepts and takeaways.

- Car insurance with low deductibles costs more – A 40-year-old driver pays an average of $904 more per year for $250 physical damage deductibles versus $1,000.

- Teen females have cheaper rates than teen males – Teenage females pay $1,216 to $655 less annually than males of the same age.

- Moore auto insurance prices are more expensive than the Oklahoma state average – $2,796 (Moore average) versus $2,698 (Oklahoma average)

- Car insurance rates fall considerably from age 20 to 30 – The average 30-year-old Moore, OK, driver will pay $2,640 less each year than a 20-year-old driver, $2,980 compared to $5,620.

- Car insurance is generally cheaper the older you are – Rates for a 60-year-old driver in Moore are $3,302 per year cheaper than for a 20-year-old driver.

- Moore, OK, car insurance costs more than the U.S. average – $2,796 (Moore average) versus $2,276 (U.S. average)