- Tupelo car insurance rates cost an average of $2,294 per year, or approximately $191 per month, for a full coverage policy.

- Small SUV models like the Subaru Crosstrek, Kia Soul, and Toyota Corolla Cross are our top picks for having cheap car insurance in Tupelo.

- A few models with the cheapest car insurance in Tupelo in their respective segments include the Chevrolet Colorado, Toyota GR Corolla, Jaguar E-Pace, and Acura RDX.

Tupelo car insurance cost

Average car insurance rates in Tupelo, Mississippi, cost $2,294 per year, or approximately $191 per month. That’s 0.8% more expensive than the overall U.S. overall average rate of $2,276 per year.

In the state of Mississippi, the average cost of car insurance is $2,476 per year, so the cost in Tupelo averages $182 less per year.

The average cost to insure a vehicle in Tupelo compared to other Mississippi cities is around $262 per year cheaper than in Gulfport, $130 per year less than in Meridian, and $244 per year less than in Biloxi.

Driver age has a big impact on the price you pay for car insurance, so the list below details how driver age influences cost by showing average car insurance rates for drivers from age 16 to 60.

Average cost of car insurance in Tupelo, Mississippi, by driver age

- 16-year-old driver – $8,170 per year or $681 per month

- 17-year-old driver – $7,915 per year or $660 per month

- 18-year-old driver – $7,097 per year or $591 per month

- 19-year-old driver – $6,460 per year or $538 per month

- 20-year-old driver – $4,616 per year or $385 per month

- 30-year-old driver – $2,448 per year or $204 per month

- 40-year-old driver – $2,294 per year or $191 per month

- 50-year-old driver – $2,036 per year or $170 per month

- 60-year-old driver – $1,904 per year or $159 per month

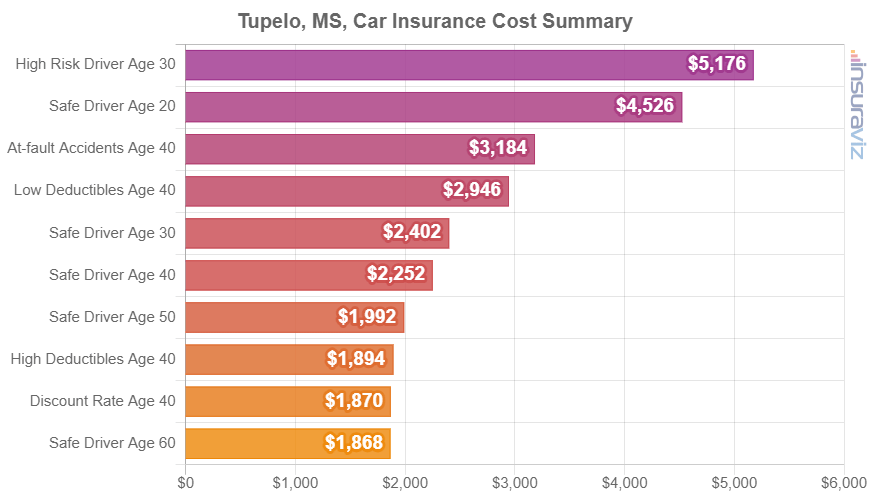

The next chart summarizes auto insurance cost in Tupelo, Mississippi, for different common policy situations. Rates are averaged for all Tupelo Zip Codes and shown for a range of different driver ages and risk profiles.

In the chart above, the cost of auto insurance in Tupelo ranges from $1,906 per year for a 40-year-old driver that qualifies for many policy discounts to $5,276 per year for a 30-year-old driver who has to buy high risk car insurance. From a monthly budget point of view, the average cost ranges from $159 to $440 per month.

In Tupelo, which vehicles are cheapest to insure?

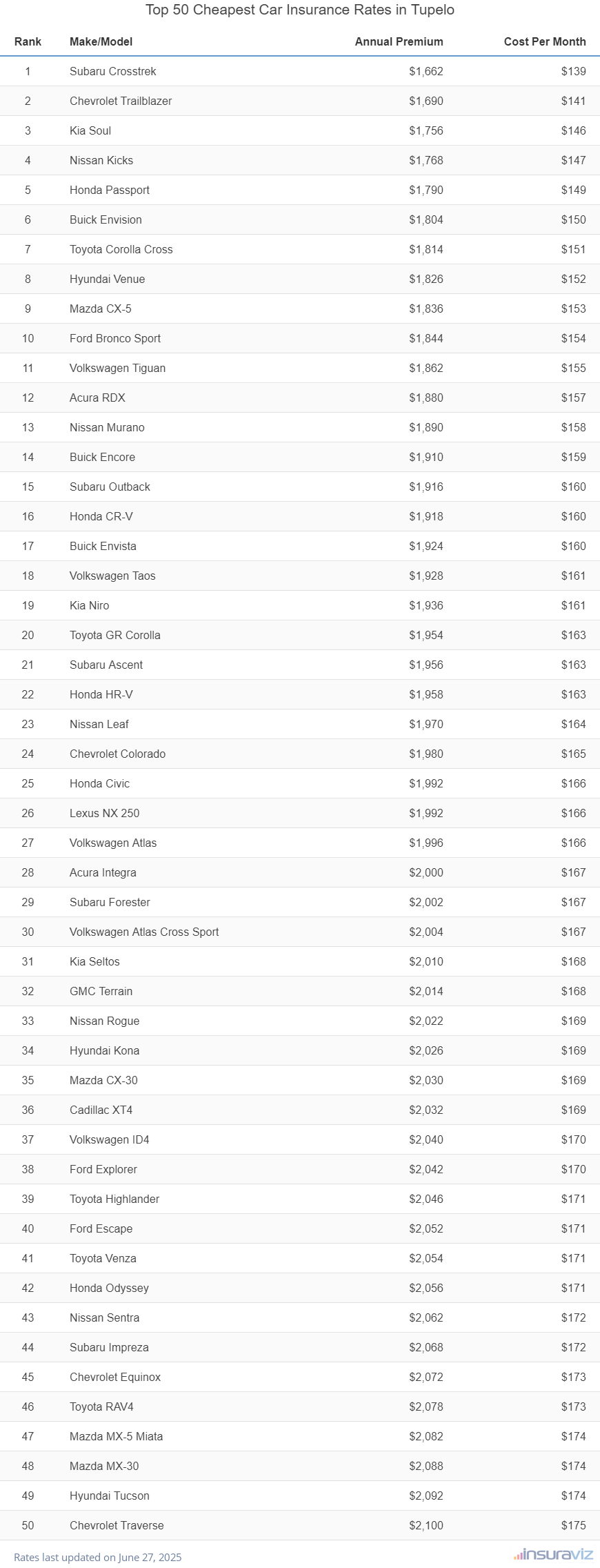

The models with the cheapest insurance quotes in Tupelo, MS, tend to be compact SUVs and crossovers like the Chevrolet Trailblazer, Kia Soul, Toyota Corolla Cross, and Buick Envision.

Average insurance prices for vehicles in the top ten cost $1,878 or less per year ($157 per month) for a full coverage policy.

Some other vehicles that rank very well in the cost comparison table below are the Subaru Outback, Volkswagen Tiguan, Buick Encore, and Acura RDX.

Average cost is slightly more for those models than the cheapest crossover SUVs that rank near the top, but they still have an average cost of $1,994 or less per year, or about $166 per month.

The following table shows the cheapest vehicles to insure in Tupelo, sorted by average cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,696 | $141 |

| 2 | Chevrolet Trailblazer | $1,724 | $144 |

| 3 | Kia Soul | $1,790 | $149 |

| 4 | Nissan Kicks | $1,806 | $151 |

| 5 | Honda Passport | $1,826 | $152 |

| 6 | Buick Envision | $1,838 | $153 |

| 7 | Toyota Corolla Cross | $1,850 | $154 |

| 8 | Hyundai Venue | $1,864 | $155 |

| 9 | Mazda CX-5 | $1,872 | $156 |

| 10 | Ford Bronco Sport | $1,878 | $157 |

| 11 | Volkswagen Tiguan | $1,898 | $158 |

| 12 | Acura RDX | $1,918 | $160 |

| 13 | Nissan Murano | $1,928 | $161 |

| 14 | Buick Encore | $1,948 | $162 |

| 15 | Honda CR-V | $1,956 | $163 |

| 16 | Subaru Outback | $1,956 | $163 |

| 17 | Buick Envista | $1,962 | $164 |

| 18 | Volkswagen Taos | $1,966 | $164 |

| 19 | Kia Niro | $1,976 | $165 |

| 20 | Toyota GR Corolla | $1,994 | $166 |

| 21 | Subaru Ascent | $1,996 | $166 |

| 22 | Honda HR-V | $1,998 | $167 |

| 23 | Nissan Leaf | $2,010 | $168 |

| 24 | Chevrolet Colorado | $2,022 | $169 |

| 25 | Lexus NX 250 | $2,030 | $169 |

| 26 | Honda Civic | $2,032 | $169 |

| 27 | Volkswagen Atlas | $2,034 | $170 |

| 28 | Acura Integra | $2,040 | $170 |

| 29 | Subaru Forester | $2,042 | $170 |

| 30 | Volkswagen Atlas Cross Sport | $2,044 | $170 |

| 31 | Kia Seltos | $2,048 | $171 |

| 32 | GMC Terrain | $2,052 | $171 |

| 33 | Nissan Rogue | $2,060 | $172 |

| 34 | Hyundai Kona | $2,066 | $172 |

| 35 | Cadillac XT4 | $2,070 | $173 |

| 36 | Mazda CX-30 | $2,070 | $173 |

| 37 | Volkswagen ID4 | $2,080 | $173 |

| 38 | Ford Explorer | $2,082 | $174 |

| 39 | Toyota Highlander | $2,086 | $174 |

| 40 | Ford Escape | $2,092 | $174 |

| 41 | Toyota Venza | $2,094 | $175 |

| 42 | Honda Odyssey | $2,096 | $175 |

| 43 | Nissan Sentra | $2,102 | $175 |

| 44 | Subaru Impreza | $2,110 | $176 |

| 45 | Chevrolet Equinox | $2,112 | $176 |

| 46 | Toyota RAV4 | $2,114 | $176 |

| 47 | Mazda MX-5 Miata | $2,122 | $177 |

| 48 | Mazda MX-30 | $2,128 | $177 |

| 49 | Hyundai Tucson | $2,132 | $178 |

| 50 | Chevrolet Traverse | $2,142 | $179 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Tupelo, MS Zip Codes. Updated October 24, 2025

A few other popular models that made the top 50 table above include the Kia Seltos, the Nissan Leaf, the Chevrolet Equinox, and the Nissan Sentra. Average rates for those vehicles fall between $1,994 and $2,144 per year.

As a comparison, some examples of much higher insurance rates include the Tesla Model Y which costs $212 per month, the Subaru BRZ which costs $229, and the Infiniti Q50 which costs $216.

The section below goes into detail about the cost of auto insurance based on automotive segment. This should provide a good idea of which types of cars, trucks, and SUVs that have the least expensive average car insurance rates.

Cost to insure by automotive segment

When comparing new or used vehicles, it’s a good idea to know which kinds of vehicles have more affordable auto insurance rates.

For instance, maybe you’re wondering if midsize SUVs are more affordable to insure than full-size SUVs or if luxury models have more expensive car insurance than regular vehicles.

The chart below displays the average cost of auto insurance rates in Tupelo for different vehicle segments. From an overal segment perspective, compact SUVs and midsize pickup trucks tend to have the least expensive average rates, with luxury, performance, and sports cars having the most expensive average insurance cost.

Rates by segment are practical for comparing estimates, but rates range substantially within each vehicle category listed above.

For example, in the small luxury SUV segment, average Tupelo insurance rates range from the Acura RDX at $1,918 per year for full coverage insurance to the Aston Martin DBX costing $4,466 per year.

As another example, in the midsize luxury car segment, the cost of insurance can range from the Mercedes-Benz CLA250 costing $2,360 per year to the BMW M8 at $3,866 per year.

As a third example, in the sports car segment, rates range from the Mazda MX-5 Miata at $2,122 per year up to the Mercedes-Benz SL 63 at $4,714 per year.

How much can rates vary for the same vehicle? A lot.

To help show the amount auto insurance premiums can range from one person to the next, the examples below show multiple rates for five popular models in Tupelo: the Ram Truck, Nissan Sentra, Toyota RAV4, Honda Accord, and Ford Mustang.

Each vehicle example shows average rates for different profiles to demonstrate the difference in cost based on a number of different rated drivers.

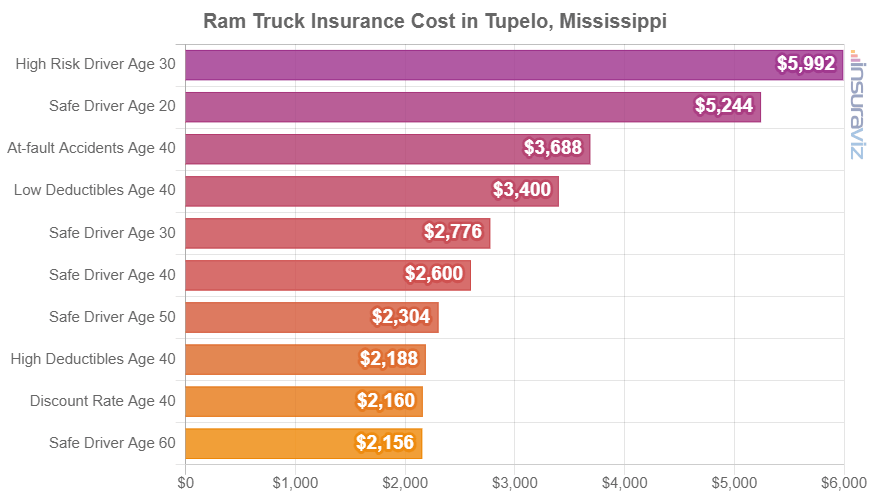

Ram Truck insurance rates

The average price paid for Ram Truck insurance in Tupelo is $2,652 per year. With MSRP ranging from $43,270 to $109,435, average car insurance rates on a 2024 Ram Truck cost from $2,346 per year for the Ram Truck Tradesman Crew Cab 4WD model up to $2,904 per year on the Ram Truck TRX Final Edition 4WD trim.

The rate chart below may help you understand how the prices of car insurance for a Ram Truck can change based on changes in the age of the driver and common policy situations.

For our example drivers, cost varies from $2,200 to $6,110 per year, which is a difference in cost of $3,910 per year to insure the same vehicle.

The Ram Truck belongs to the full-size truck segment, and additional similar models from the same segment include the Chevrolet Silverado, Toyota Tundra, Nissan Titan, and GMC Sierra.

Nissan Sentra insurance rates

Nissan Sentra insurance in Tupelo averages $2,102 per year, ranging from $2,056 per year for the Nissan Sentra S trim level (MSRP of $20,630) up to $2,160 per year for the Nissan Sentra SR (MSRP of $23,720).

When Tupelo insurance rates for the Nissan Sentra are compared to the average cost for the entire U.S. on the same model, the cost is anywhere from $94 to $100 more expensive per year in Tupelo, depending on which model is insured.

On a monthly basis, car insurance quotes on a Nissan Sentra can range from $171 to $180 per month, depending on exactly where you live in Tupelo.

The chart below shows how the cost of car insurance on a Nissan Sentra can be significantly different based on an assortment of driver ages, physical damage coverage deductibles, and driver risk profiles.

The Nissan Sentra is a compact car, and other models in the same segment include the Hyundai Elantra, Chevrolet Cruze, and Honda Civic.

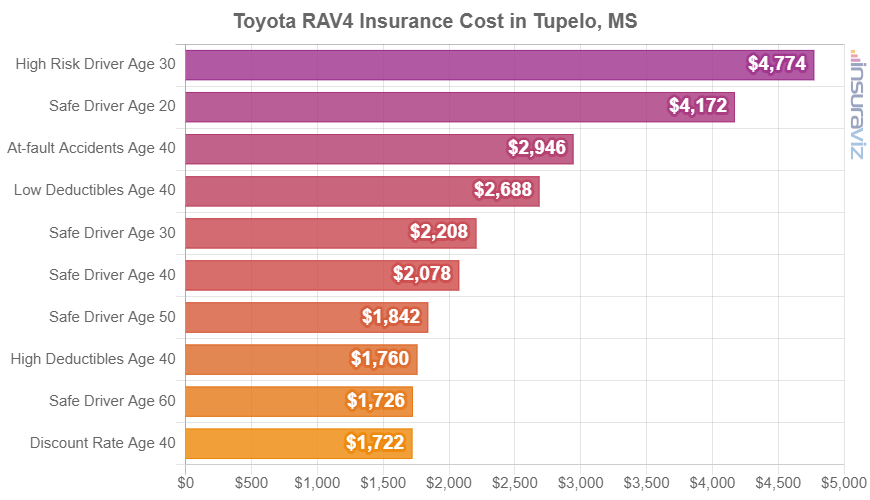

Toyota RAV4 insurance rates

With MSRP ranging from $29,875 to $47,310, average Tupelo insurance rates for a Toyota RAV4 cost from $1,870 per year for the Toyota RAV4 LE AWD model up to $2,492 per year on the Toyota RAV4 Prime XSE AWD trim.

On a monthly basis, car insurance quotes on a 2024 Toyota RAV4 for the average driver can range from $156 to $208 per month, depending on your car insurance company and your address in Tupelo.

The chart below may help illustrate how the cost of insurance for a Toyota RAV4 can be quite different based on a number of different driver ages and risk profiles. In this example, prices range from $1,760 to $4,868 per year, which is a price difference of $3,108 just based on different risk profiles.

The Toyota RAV4 is a compact SUV, and other popular same-segment models include the Nissan Rogue, Honda CR-V, Mazda CX-5, and Chevrolet Equinox.

Honda Accord insurance rates

In Tupelo, the cheapest insurance rates on a 2024 Honda Accord are on the EX-L Hybrid trim, costing an average of $2,138 per year, or around $178 per month. This model has a sticker price of $34,190.

The most expensive 2022 Honda Accord model to insure in Tupelo is the LX model, costing an average of $2,272 per year, or about $189 per month. The MSRP for this model is $27,895, not including documentation fees and destination charges.

When Tupelo insurance rates for a Honda Accord are compared with national average insurance rates for the same model, rates are $94 to $106 more expensive per year in Tupelo, depending on the specific model being insured.

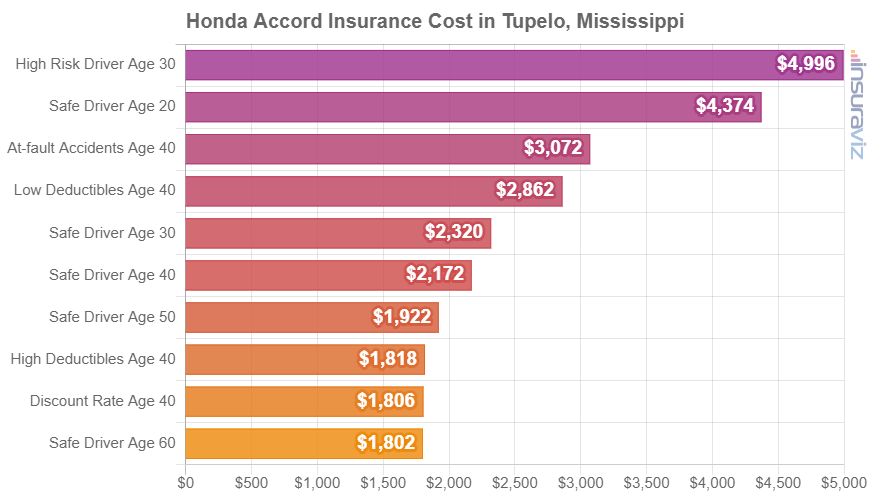

The chart below visualizes how insurance rates for a Honda Accord can range considerably for different drivers and policy risk profiles.

The Honda Accord is part of the midsize car segment, and additional similar models from the same segment include the Kia K5, Toyota Camry, Hyundai Sonata, and Chevrolet Malibu.

Ford Mustang insurance rates

The average cost for Ford Mustang insurance in Tupelo is $2,522 per year. With MSRP ranging from $30,920 to $63,265, average car insurance quotes for a Ford Mustang range from $2,160 per year for the Ford Mustang Ecoboost Fastback model up to $2,750 per year for the Ford Mustang Dark Horse Premium model.

From a cost per month standpoint, auto insurance rates on a Ford Mustang for a good driver can cost from $180 to $229 per month, depending on the insurance company and where you live in Tupelo.

The chart displayed below might help you understand how the cost to insure a Ford Mustang can range considerably based on a number of different driver ages and common policy situations.

The Ford Mustang is classified as a sports car, and other similar models that are popular in Tupelo include the Chevrolet Camaro, Subaru BRZ, and Toyota GR Supra.