- Average car insurance in O’Fallon costs $2,774 per year, or $231 per month for full coverage.

- Monthly auto insurance rates for a few popular models in O’Fallon include the Honda Accord at $223, Mazda CX-5 at $189, and Toyota RAV4 at $213.

- Models like the Kia Soul, Toyota Corolla Cross, and Chevrolet Trailblazer have top rankings for cheap car insurance in O’Fallon.

Average cost of car insurance in O’Fallon, MO

The average car insurance expense in O’Fallon is $2,774 per year, which is 19.7% more than the overall national average rate of $2,276. Car insurance in O’Fallon per month costs approximately $231 per month for a full-coverage car insurance policy.

The average car insurance cost in Missouri is $2,742 per year, so O’Fallon drivers pay an average of $32 more per year than the Missouri state-wide average rate. When prices are compared to other cities in Missouri, the average cost of car insurance in O’Fallon is about $238 per year more expensive than in Columbia, $28 per year more than in Independence, and $212 per year more than in Springfield.

The age of the rated driver is the factor that has the most impact on the cost of car insurance. The list below illustrates these differences by showing the difference in average car insurance rates for drivers from age 16 to 60.

Average cost of car insurance in O’Fallon, MO, for drivers age 16 to 60

- 16-year-old driver – $9,882 per year or $824 per month

- 17-year-old driver – $9,573 per year or $798 per month

- 18-year-old driver – $8,581 per year or $715 per month

- 19-year-old driver – $7,815 per year or $651 per month

- 20-year-old driver – $5,582 per year or $465 per month

- 30-year-old driver – $2,960 per year or $247 per month

- 40-year-old driver – $2,774 per year or $231 per month

- 50-year-old driver – $2,460 per year or $205 per month

- 60-year-old driver – $2,300 per year or $192 per month

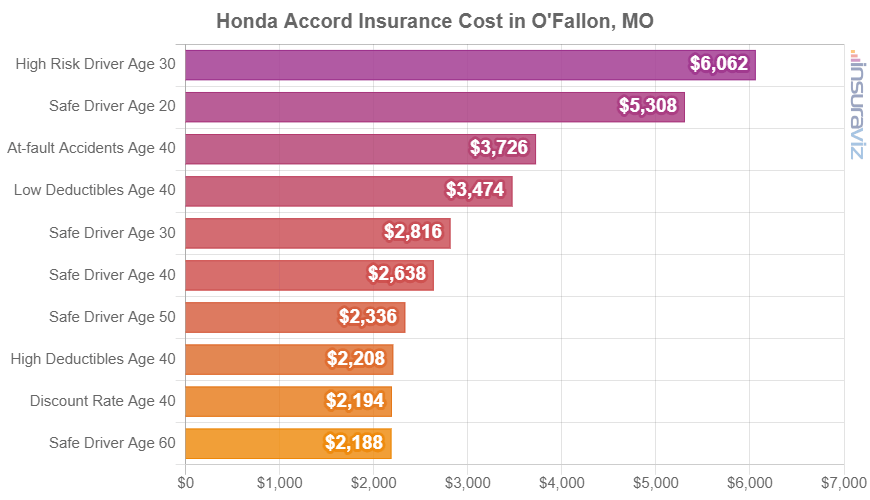

The chart below shows additional information for drivers age 20 to 60 by showing a range of rates for a range of driver ages, physical damage coverage deductibles, and driver risk profiles.

In the chart above, the cost of auto insurance in O’Fallon ranges from $2,306 per year for a 40-year-old driver with many policy discounts to $6,384 per year for a 30-year-old driver with a history of violations and/or at-fault accidents. From a monthly budget point of view, the average cost in the previous chart ranges from $192 to $532 per month.

O’Fallon auto insurance rates can have wide price ranges and subtle changes in driver risk profiles can have considerable effects on car insurance cost. This large rate variability stresses the need for multiple car insurance quotes when searching online for a better price on car insurance in O’Fallon.

Popular vehicles and the cost to insure them

The rates mentioned previously take all 2024 vehicle models and average them, which is practical when making big picture comparisons such as the cost for different driver ages or locations.

Average car insurance rates work well for answering questions like “is auto insurance cheaper in O’Fallon or St Louis?” or “are Missouri auto insurance rates cheaper than in Florida?”.

But for more in-depth rate comparisons, it makes better sense to perform a rate analysis for the specific vehicle being insured. Every model has unique characteristics for calculating the cost of car insurance and this data enables us to make insurance cost projections and comparisons.

The following list breaks down average insurance cost by year and month in O’Fallon for some of the more popular models. Later, we’ll cover insurance cost for some of these vehicles in much more detail.

Average car insurance cost for popular O’Fallon vehicles

- Honda Accord – $2,680 per year or $223 per month

- Mazda CX-5 – $2,264 per year or $189 per month

- Toyota RAV4 – $2,560 per year or $213 per month

- Hyundai Elantra – $3,012 per year or $251 per month

- Toyota Camry – $2,982 per year or $249 per month

- Chevrolet Silverado – $3,068 per year or $256 per month

- Ford F150 – $3,104 per year or $259 per month

- Subaru Outback – $2,364 per year or $197 per month

- Tesla Model 3 – $3,256 per year or $271 per month

- Toyota Highlander – $2,524 per year or $210 per month

The vehicles that have high popularity in O’Fallon tend to be small or midsize cars like the Hyundai Elantra and Toyota Camry and compact or midsize SUVs like the Chevy Equinox and Chevy Traverse.

Some additional popular vehicles from other segments include luxury models like the Lexus ES 350, Infiniti QX60, and Lexus RX 350 and sports cars like the Audi TT, Nissan GT-R, and Ford Mustang.

Let’s make a quick review of some of the ideas that were covered up to this point.

- Teen female drivers pay less than teen males – Teenage females age 16 to 19 pay $1,208 to $652 less each year than their male counterparts.

- Car insurance rates drop a lot between ages 20 and 30 – The average 30-year-old O’Fallon, Missouri, driver will pay $2,622 less annually than a 20-year-old driver, $2,960 compared to $5,582.

- O’Fallon car insurance rates are more expensive than the Missouri state average – $2,774 (O’Fallon average) compared to $2,742 (Missouri average)

- Auto insurance gets cheaper as you get older – Rates for a 40-year-old driver in O’Fallon are $2,808 per year cheaper than for a 20-year-old driver.

- O’Fallon, Missouri, average car insurance cost is more than the U.S. average – $2,774 (O’Fallon average) compared to $2,276 (U.S. average)

- Average cost per month ranges from $192 to $824 – That’s the average auto insurance cost range for drivers aged 16 to 60 in O’Fallon.

Cheapest car insurance in O’Fallon, MO

When comparing vehicles from every automotive segment, the models with the most affordable car insurance quotes in O’Fallon tend to be crossovers and compact SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, and Toyota Corolla Cross.

Average insurance prices for vehicles in the top 10 cost $2,270 or less per year, or $189 per month, for full coverage.

Some additional vehicles that rank very well in our auto insurance cost comparison are the Buick Encore, Volkswagen Tiguan, Acura RDX, and Subaru Outback. Insurance rates are a little bit more for those models than the small SUVs and crossovers at the top of the rankings, but they still have an average cost of $2,412 or less per year ($201 per month) in O’Fallon.

The table below shows the 40 car, truck, and SUV models with the cheapest auto insurance in O’Fallon, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,050 | $171 |

| 2 | Chevrolet Trailblazer | $2,084 | $174 |

| 3 | Kia Soul | $2,164 | $180 |

| 4 | Nissan Kicks | $2,184 | $182 |

| 5 | Honda Passport | $2,212 | $184 |

| 6 | Buick Envision | $2,224 | $185 |

| 7 | Toyota Corolla Cross | $2,236 | $186 |

| 8 | Hyundai Venue | $2,254 | $188 |

| 9 | Mazda CX-5 | $2,264 | $189 |

| 10 | Ford Bronco Sport | $2,270 | $189 |

| 11 | Volkswagen Tiguan | $2,296 | $191 |

| 12 | Acura RDX | $2,320 | $193 |

| 13 | Nissan Murano | $2,330 | $194 |

| 14 | Buick Encore | $2,354 | $196 |

| 15 | Honda CR-V | $2,364 | $197 |

| 16 | Subaru Outback | $2,364 | $197 |

| 17 | Buick Envista | $2,374 | $198 |

| 18 | Volkswagen Taos | $2,378 | $198 |

| 19 | Kia Niro | $2,388 | $199 |

| 20 | Toyota GR Corolla | $2,412 | $201 |

| 21 | Honda HR-V | $2,416 | $201 |

| 22 | Subaru Ascent | $2,416 | $201 |

| 23 | Nissan Leaf | $2,430 | $203 |

| 24 | Chevrolet Colorado | $2,444 | $204 |

| 25 | Honda Civic | $2,456 | $205 |

| 26 | Lexus NX 250 | $2,458 | $205 |

| 27 | Volkswagen Atlas | $2,460 | $205 |

| 28 | Acura Integra | $2,466 | $206 |

| 29 | Subaru Forester | $2,470 | $206 |

| 30 | Volkswagen Atlas Cross Sport | $2,472 | $206 |

| 31 | Kia Seltos | $2,480 | $207 |

| 32 | GMC Terrain | $2,482 | $207 |

| 33 | Nissan Rogue | $2,494 | $208 |

| 34 | Hyundai Kona | $2,500 | $208 |

| 35 | Mazda CX-30 | $2,502 | $209 |

| 36 | Cadillac XT4 | $2,504 | $209 |

| 37 | Volkswagen ID4 | $2,514 | $210 |

| 38 | Ford Explorer | $2,516 | $210 |

| 39 | Toyota Highlander | $2,524 | $210 |

| 40 | Ford Escape | $2,532 | $211 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all OFallon, MO Zip Codes. Updated October 24, 2025

A few additional vehicles worth noting ranking in the top 40 above include the Volkswagen Atlas Cross Sport, the Ford Explorer, the Cadillac XT4, and the Nissan Rogue. Insurance rates for those models cost between $2,412 and $2,532 per year in OFallon, MO.

In comparison to the cheapest rates, some examples that have more expensive auto insurance include the Dodge Charger costing an average of $3,992 per year, the Audi A4 at $3,194, and the Lexus LX 570 that averages $3,920.

Auto insurance cost variability illustrations

To stress the importance of the extent to which the cost of auto insurance can change from one person to the next, the charts below visualize comprehensive car insurance rates for five popular models in O’Fallon: the Chevrolet Silverado, Kia Forte, Nissan Rogue, Toyota Highlander, and Honda Accord.

The example for each vehicle uses a variety of different driver profiles to demonstrate how rates can be very different when changes are made to the driver rated on the policy.

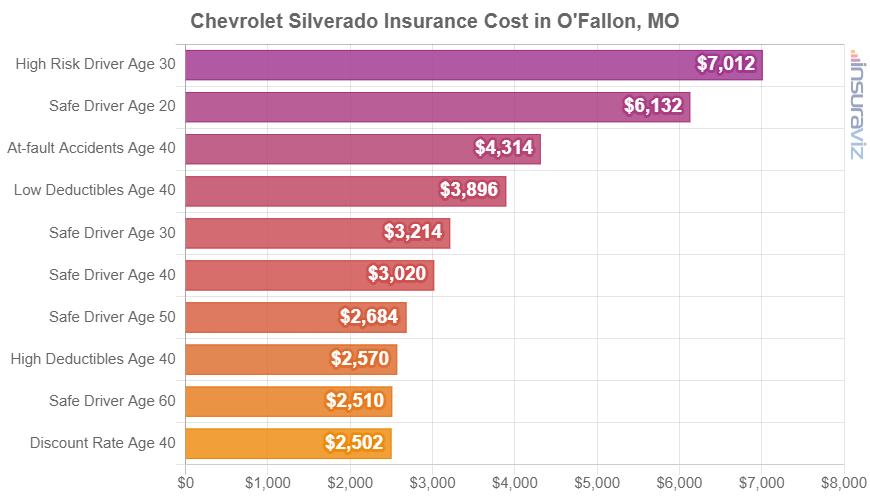

Chevrolet Silverado insurance rates

Average Chevrolet Silverado insurance cost in O’Fallon costs from $2,598 to $3,638 per year. The least-expensive model to insure is the $39,900 Chevrolet Silverado EV WT model, while the model with the most expensive insurance rates is the $105,000 Chevrolet Silverado EV RST First Edition model.

When O’Fallon insurance rates on a Chevrolet Silverado are compared to the average cost for the entire U.S. on the same model, rates are anywhere from $350 to $492 more per year in O’Fallon, depending on the model being insured.

The rate chart below illustrates how car insurance quotes on a Chevrolet Silverado can be significantly different based on driver age, policy deductibles, and risk profiles.

The Chevrolet Silverado is part of the full-size truck segment, and other models in that segment include the Toyota Tundra, Nissan Titan, GMC Sierra, and Ram Truck.

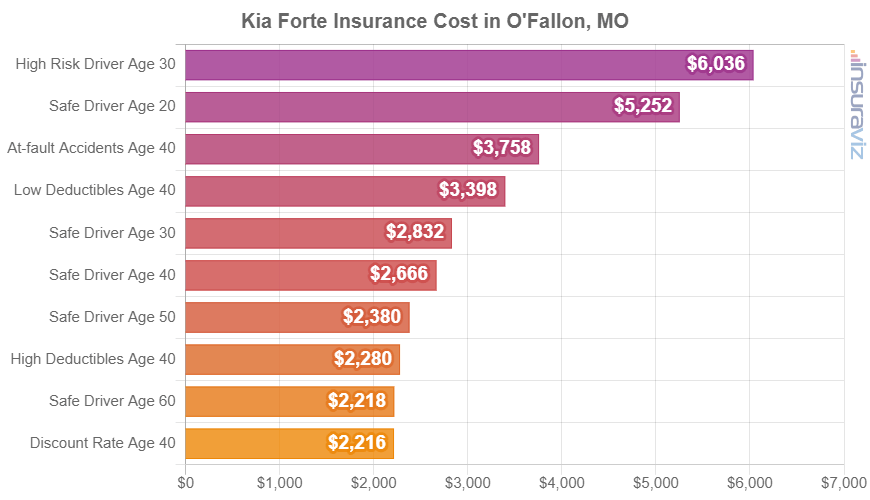

Kia Forte insurance rates

The lowest-cost 2024 Kia Forte trim level to insure in O’Fallon is the LX model, costing an average of $2,594 per year, or about $216 per month. This trim level stickers at $19,790.

The most expensive 2022 Kia Forte to insure in O’Fallon is the GT Manual, costing an average of $2,816 per year, or around $235 per month. The retail cost for this trim level is $25,190, not including charges and fees.

When O’Fallon auto insurance rates for the Kia Forte are compared to the average cost for the entire U.S. on the same vehicle, the cost is $350 to $378 more expensive per year in O’Fallon, depending on which trim level is insured.

The bar chart below can help explain how car insurance rates on a Kia Forte can be significantly different based on different driver ages, physical damage deductibles, and driver risk profiles.

For this example, cost varies from $2,248 to $6,130 per year, which is a difference of $3,882 based on different driver risks.

The Kia Forte is considered a compact car, and other popular models include the Volkswagen Jetta, Nissan Sentra, and Chevrolet Cruze.

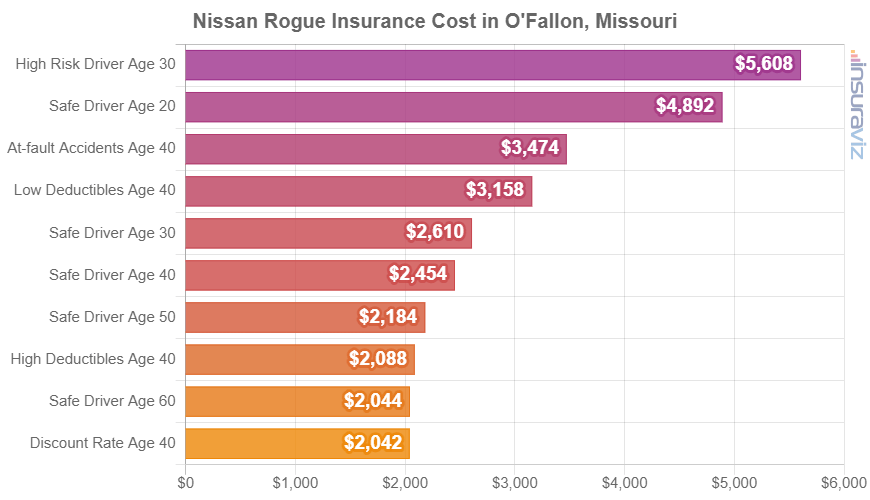

Nissan Rogue insurance rates

Nissan Rogue insurance in O’Fallon averages $2,494 per year, with a range of $2,364 per year on the Nissan Rogue S 2WD trim level (MSRP of $29,360) up to $2,614 per year for the Nissan Rogue Platinum AWD (MSRP of $39,230).

When O’Fallon car insurance rates on the Nissan Rogue are compared to the national average cost for the same vehicle, the cost is $320 to $356 more expensive per year in O’Fallon, depending on the specific trim level being insured.

The bar chart below can help explain how the price of car insurance for a Nissan Rogue can vary for a variety of different driver ages and policy risk profiles. For our example risk profiles, the cost ranges from $2,074 to $5,698 per year, which is a price difference of $3,624 when insuring the same vehicle.

The Nissan Rogue is classified as a compact SUV, and additional similar models include the Subaru Forester, Toyota RAV4, Mazda CX-5, and Ford Escape.

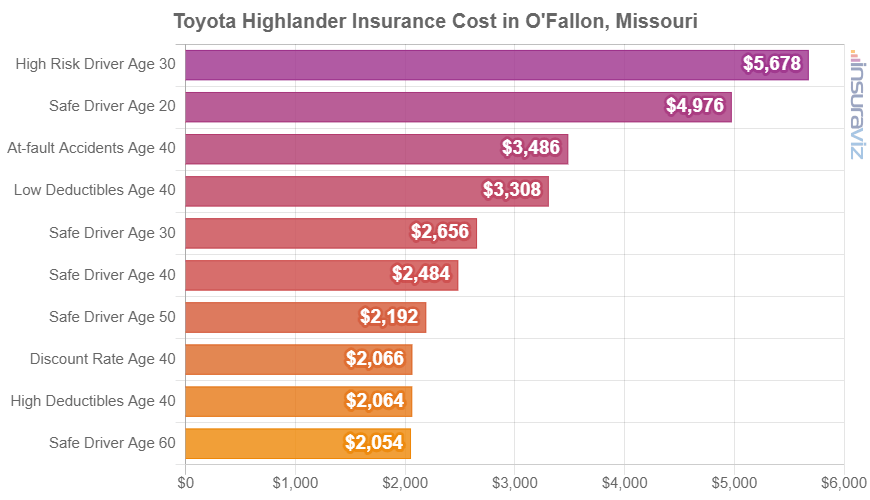

Toyota Highlander insurance rates

Toyota Highlander insurance in O’Fallon costs an average of $2,524 per year, ranging from a low of $2,320 per year for the Toyota Highlander LE 2WD trim (MSRP of $37,625) up to $2,742 per year on the Toyota Highlander Hybrid XLE AWD (MSRP of $43,825).

When O’Fallon auto insurance rates for the Toyota Highlander are compared to the average cost for the entire U.S. for the same vehicle, rates are $314 to $372 more expensive per year in O’Fallon, depending on the trim level being insured.

The chart below helps to visualize how the cost of car insurance on a Toyota Highlander can be very different for a number of different driver ages and risk profiles. For our example risk profiles, the cost ranges from $2,100 to $5,768 per year, which is a price difference of $3,668 for insurance on the same vehicle with different rated drivers.

The Toyota Highlander is classified as a midsize SUV, and other popular same-segment models include the Jeep Grand Cherokee, Ford Explorer, Kia Sorento, and Kia Telluride.

Honda Accord insurance rates

In O’Fallon, the cheapest auto insurance rates for a 2024 Honda Accord are on the EX-L Hybrid model, costing an average of $2,584 per year, or about $215 per month. This model costs $34,190.

The most expensive 2022 Honda Accord trim to insure in O’Fallon is the LX model, costing an average of $2,748 per year, or around $229 per month. The retail cost for this model is $27,895, not including destination charges and documentation fees.

When O’Fallon car insurance rates for a Honda Accord are compared to the cost averaged for the entire U.S. on the same vehicle, the cost is anywhere from $352 to $370 more expensive per year in O’Fallon, depending on the model being insured.

The next rate chart may help you understand how car insurance rates for a Honda Accord can range considerably based on changes in driver age, policy deductibles, and driver risk scenarios.

For this example, rates vary from $2,226 to $6,162 per year, which is a difference in cost of $3,936.

The Honda Accord is considered a midsize car, and additional similar models include the Nissan Altima, Toyota Camry, Hyundai Sonata, and Kia K5.

Tips for saving money on O’Fallon auto insurance

Shrewd drivers are always looking to cut the monthly cost of insurance. So glance through the money-saving tips in this next list and maybe you’ll be able to save a few bucks when buying auto insurance.

- Shop around anytime. Take a couple of minutes to get some free car insurance quotes is a great way to save money. Rates are always changing and you can switch companies at any time.

- Compare the cost of insurance before buying a car. Different cars, and even different trim levels of the same car, have significantly different auto insurance rates, and auto insurance companies can charge a wide range of costs. Get quotes before you buy a different vehicle in order to prevent insurance sticker shock when you get your first insurance bill.

- Buy vehicles with cheaper auto insurance rates. The vehicle you choose to drive is a primary factor in the cost of car insurance in O’Fallon. For example, a Mazda CX-3 costs $3,296 less per year to insure in O’Fallon than a Audi R8. Lower performance vehicles cost less to insure.

- Stay claim free and save. Car insurance companies give a discounted rate for not filing any claims. Car insurance should be used in the case of larger claims, not nickel-and-dime type claims.

- Obey driving laws to keep insurance rates low. If you want to get affordable car insurance in O’Fallon, it’s necessary to avoid traffic citations. In fact, just a few minor traffic citations could increase car insurance cost by up to $738 per year. Being convicted of a crime such as reckless driving and leaving the scene of an accident, DUI, or driving on a revoked license could raise rates by an additional $2,578 or more.