- For the cheapest auto insurance in Bethlehem, Pennsylvania, small SUVs like the Kia Soul, Chevrolet Trailblazer, Toyota Corolla Cross, and Subaru Crosstrek cost less to insure than most other vehicles.

- Bethlehem car insurance averages $2,326 per year for a full coverage policy, or about $194 on a monthly basis

- Monthly auto insurance rates for a few popular models in Bethlehem include the Ford Escape at $177, Toyota Highlander at $176, and Honda CR-V at $165.

- Bethlehem car insurance costs $124 per year less than the Pennsylvania state average but $50 per year more than the average rate for all 50 U.S. states.

Cheapest cars to insure in Bethlehem

The models with the lowest cost average auto insurance rates in Bethlehem tend to be compact SUVs like the Subaru Crosstrek, Kia Soul, Hyundai Venue, and Buick Envision.

Average insurance prices for models ranked in the top 10 cost $1,904 or less per year, or $159 per month, to get full coverage in Bethlehem.

Examples of other vehicles that are in the top 20 in our overall cost comparison are the Subaru Outback, Ford Bronco Sport, Kia Niro, and Honda CR-V. Average cost is a little higher for those models than the crossovers and small SUVs that rank near the top, but they still have an average cost of $2,022 or less per year, or $169 per month.

The table below ranks the 50 car, truck, and SUV models with the cheapest auto insurance in Bethlehem, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,720 | $143 |

| 2 | Chevrolet Trailblazer | $1,748 | $146 |

| 3 | Kia Soul | $1,816 | $151 |

| 4 | Nissan Kicks | $1,830 | $153 |

| 5 | Honda Passport | $1,852 | $154 |

| 6 | Buick Envision | $1,866 | $156 |

| 7 | Toyota Corolla Cross | $1,874 | $156 |

| 8 | Hyundai Venue | $1,886 | $157 |

| 9 | Mazda CX-5 | $1,898 | $158 |

| 10 | Ford Bronco Sport | $1,904 | $159 |

| 11 | Volkswagen Tiguan | $1,926 | $161 |

| 12 | Acura RDX | $1,944 | $162 |

| 13 | Nissan Murano | $1,954 | $163 |

| 14 | Buick Encore | $1,974 | $165 |

| 15 | Honda CR-V | $1,982 | $165 |

| 16 | Subaru Outback | $1,982 | $165 |

| 17 | Buick Envista | $1,988 | $166 |

| 18 | Volkswagen Taos | $1,992 | $166 |

| 19 | Kia Niro | $2,000 | $167 |

| 20 | Toyota GR Corolla | $2,022 | $169 |

| 21 | Honda HR-V | $2,024 | $169 |

| 22 | Subaru Ascent | $2,024 | $169 |

| 23 | Nissan Leaf | $2,038 | $170 |

| 24 | Chevrolet Colorado | $2,048 | $171 |

| 25 | Honda Civic | $2,060 | $172 |

| 26 | Lexus NX 250 | $2,060 | $172 |

| 27 | Volkswagen Atlas | $2,064 | $172 |

| 28 | Acura Integra | $2,068 | $172 |

| 29 | Subaru Forester | $2,070 | $173 |

| 30 | Volkswagen Atlas Cross Sport | $2,074 | $173 |

| 31 | Kia Seltos | $2,078 | $173 |

| 32 | GMC Terrain | $2,080 | $173 |

| 33 | Nissan Rogue | $2,090 | $174 |

| 34 | Hyundai Kona | $2,094 | $175 |

| 35 | Cadillac XT4 | $2,098 | $175 |

| 36 | Mazda CX-30 | $2,098 | $175 |

| 37 | Ford Explorer | $2,108 | $176 |

| 38 | Volkswagen ID4 | $2,108 | $176 |

| 39 | Toyota Highlander | $2,112 | $176 |

| 40 | Ford Escape | $2,120 | $177 |

| 41 | Toyota Venza | $2,122 | $177 |

| 42 | Honda Odyssey | $2,124 | $177 |

| 43 | Nissan Sentra | $2,132 | $178 |

| 44 | Subaru Impreza | $2,138 | $178 |

| 45 | Chevrolet Equinox | $2,142 | $179 |

| 46 | Toyota RAV4 | $2,146 | $179 |

| 47 | Mazda MX-5 Miata | $2,152 | $179 |

| 48 | Mazda MX-30 | $2,158 | $180 |

| 49 | Hyundai Tucson | $2,162 | $180 |

| 50 | Chevrolet Traverse | $2,170 | $181 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Bethlehem, PA Zip Codes. Updated October 24, 2025

A few additional vehicles worth noting ranking in the top 50 table above include the Lexus NX 250, Hyundai Kona, Nissan Sentra, Subaru Ascent, and Honda Civic. Average auto insurance rates for those models cost between $2,022 and $2,176 per year in Bethlehem, PA.

To see how cheap these rates are, a few examples that have more expensive auto insurance include the Jeep Grand Wagoneer at an average of $2,700 per year, the Audi A4 that costs $2,676, and the Lexus LC 500h that costs $3,482.

How much does Bethlehem car insurance cost?

The average price for car insurance in Bethlehem is $2,326 per year, which is 2.2% more than the national average rate of $2,276. The average cost per month for car insurance in Bethlehem is $194 for a full coverage policy.

In the state of Pennsylvania, average auto insurance cost is $2,450 per year, so the cost in Bethlehem averages $124 less per year. The cost of car insurance in Bethlehem compared to other Pennsylvania cities is around $94 per year less than in Reading, $124 per year cheaper than in Allentown, and $14 per year less than in Erie.

Driver age is one of the largest factors in the price of car insurance, so the list below details how driver age influences cost by breaking out average car insurance rates for different driver ages.

Average cost of car insurance in Bethlehem, Pennsylvania, for drivers age 16 to 60

- 16-year-old rated driver – $8,278 per year or $690 per month

- 17-year-old rated driver – $8,020 per year or $668 per month

- 18-year-old rated driver – $7,187 per year or $599 per month

- 19-year-old rated driver – $6,546 per year or $546 per month

- 20-year-old rated driver – $4,678 per year or $390 per month

- 30-year-old rated driver – $2,482 per year or $207 per month

- 40-year-old rated driver – $2,326 per year or $194 per month

- 50-year-old rated driver – $2,062 per year or $172 per month

- 60-year-old rated driver – $1,928 per year or $161 per month

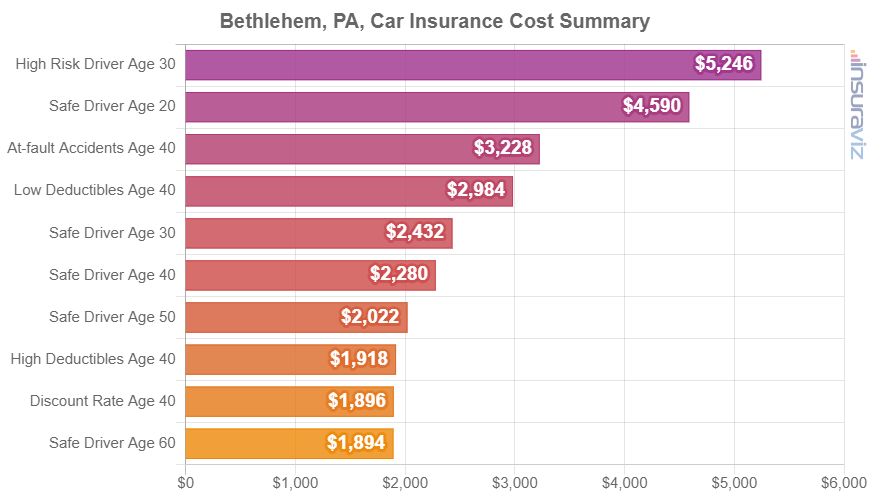

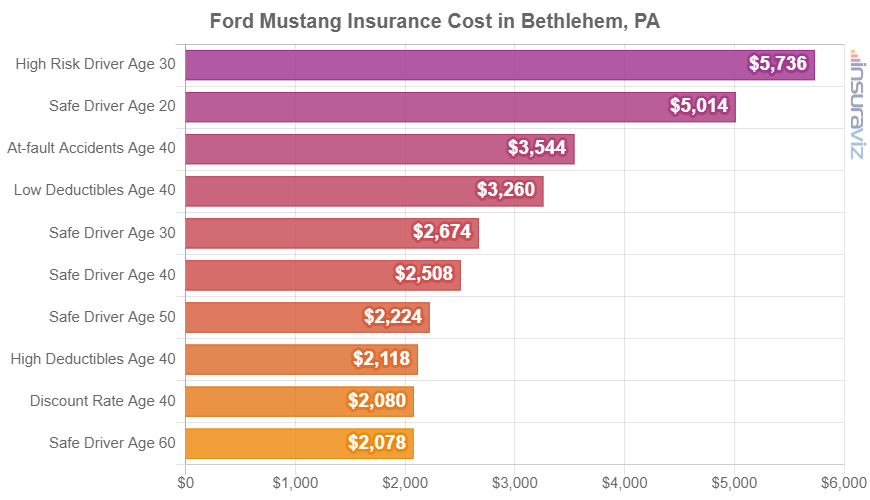

The next chart shows examples of average Bethlehem auto insurance cost. Rates are averaged for all Bethlehem Zip Codes and shown for a range of different driver ages, risk profiles, and policy deductibles.

Average rates in the chart above range from $1,932 per year for a middle-aged driver with a discount rate policy to $5,346 per year for a 20-year-old driver with a lot of violations and accidents. Throughout our site, the rate used to compare different vehicles or locations is the 40-year-old safe driver rate, which has an average cost of $2,326 per year.

As a monthly cost, the average cost to insure a car in Bethlehem ranges from $161 to $446 for the same driver risk profiles shown in the prior chart.

Bethlehem auto insurance rates can vary considerably and can also be significantly different between companies. The potential for large differences in cost reinforces the need for accurate car insurance quotes when searching online for the cheapest rate.

The cost to insure popular vehicles in Bethlehem

The auto insurance rates referenced previously take the cost to insure each 2024 vehicle model and average them, which is suitable for making general comparisons like the average cost difference between different locations in Pennsylvania.

However, for more comprehensive car insurance cost comparisons, we need to look at specific vehicles and see how rates compare between them.

The following chart breaks down insurance rates in Bethlehem for some of the more popular models sold in the state of Pennsylvania.

The vehicles that are popular in Bethlehem tend to be small or midsize sedans like the Hyundai Elantra and Nissan Altima and small or midsize SUVs like the Honda CR-V and Jeep Grand Cherokee.

A few additional popular vehicles in Bethlehem, Pennsylvania, from different automotive segments include luxury models like the Acura ILX, Infiniti QX60, and BMW X5 and sports cars like the Porsche 911, Chevy Corvette, and Ford Mustang.

If we look to see how many popular models are in the prior table showing the top 50 cheapest vehicles to insure, only about the first eight are included.

This could be simply due to the vehicle having a higher than average replacement cost, like a Chevy Corvette that has an average MSRP of $69,995, or a vehicle may have the potential for higher liability or medical claims like a Mitsubishi Outlander, Ford F-250 Super Duty pickup, or Ford Bronco.

The next sections take insurance rates even farther, by showing how much rates can vary for a particular vehicle simply by changing the driver age, risk profile, or policy coverages.

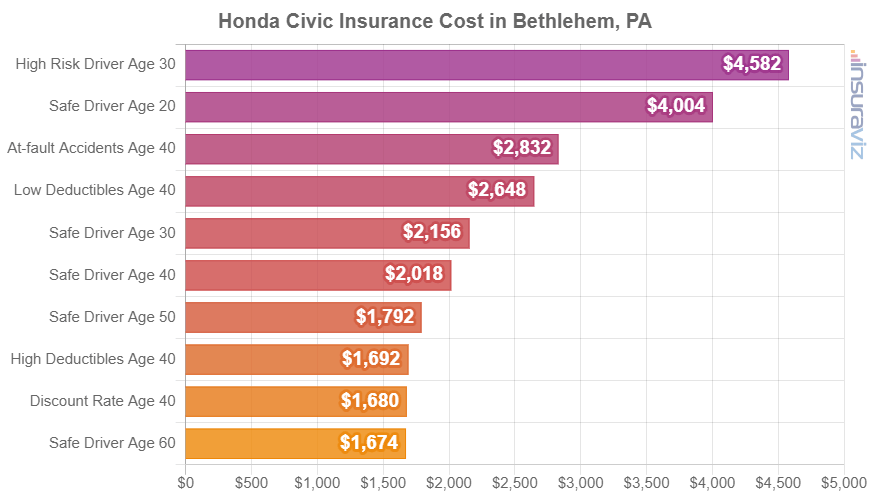

Honda Civic insurance rates

Honda Civic insurance in Bethlehem costs an average of $2,060 per year, ranging from a low of $1,842 per year on the Honda Civic LX model up to $2,440 per year for the Honda Civic Type R model.

When Bethlehem insurance rates for the Honda Civic are compared with the average cost for the entire U.S. on the same model, rates are $58 to $76 more per year in Bethlehem, depending on which model is insured.

The next chart shows how car insurance rates for a Honda Civic can be quite different for a number of different driver ages, policy deductibles, and potential risk scenarios.

For our example drivers, cost ranges from $1,712 to $4,672 per year, which is a price difference of $2,960 per year to insure the same vehicle.

The Honda Civic is part of the compact car segment, and other models in that segment include the Volkswagen Jetta, Nissan Sentra, and Toyota Corolla.

Honda CR-V insurance rates

The average cost of Honda CR-V insurance in Bethlehem is $1,982 per year. With a purchase price ranging from $29,500 to $39,850, average car insurance rates for a Honda CR-V range from $1,880 per year on the Honda CR-V LX model up to $2,092 per year on the Honda CR-V Sport Touring Hybrid AWD.

On a monthly basis, full-coverage car insurance on a 2024 Honda CR-V can range from $157 to $174 per month, depending on your company and exact Zip Code in Bethlehem.

The rate chart below shows how auto insurance quotes for a Honda CR-V can be quite different based on different driver ages, policy deductibles, and risk profiles. The rates in the chart range from $1,650 to $4,556 per year, which is a cost difference of $2,906 caused by changing the rated driver.

The Honda CR-V belongs to the compact SUV segment, and other popular models include the Chevrolet Equinox, Toyota RAV4, and Ford Escape.

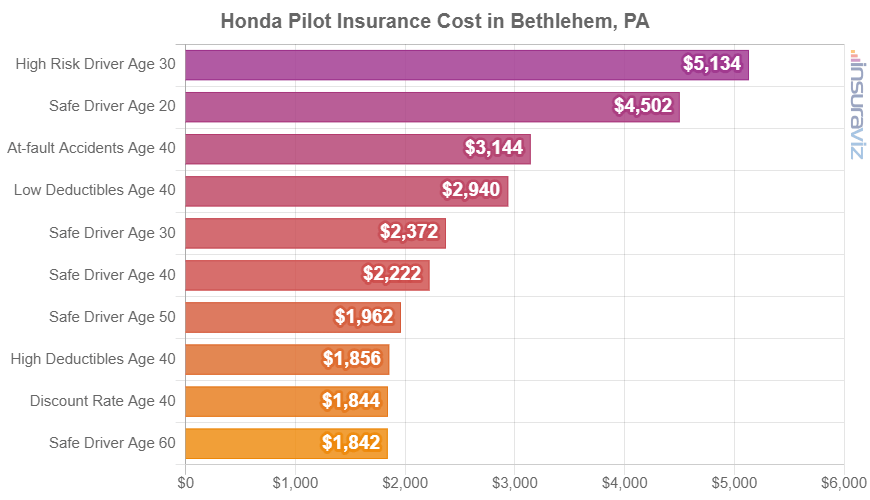

Honda Pilot insurance rates

Average Honda Pilot insurance cost in Bethlehem costs from $2,116 to $2,402 per year. The lowest-cost insurance will be on the $37,090 Honda Pilot LX model, while the most expensive to insure is the $52,480 Honda Pilot Elite AWD.

When Bethlehem insurance rates on a Honda Pilot are compared to the cost averaged for the entire U.S. on the same model, rates are anywhere from $70 to $80 more expensive per year in Bethlehem, depending on which model is insured.

From a cost per month standpoint, full-coverage insurance on a Honda Pilot for a good driver can cost from $176 to $200 per month, depending on your Zip Code in Bethlehem.

The chart displayed below might be helpful in explaining how the cost of car insurance on a Honda Pilot can be quite different based on different driver ages, policy physical damage deductibles, and risk scenarios. For our example drivers, rates range from $1,882 to $5,232 per year, which is a price difference of $3,350 just for changes in rated drivers.

The Honda Pilot belongs to the midsize SUV segment, and other models from that segment that are popular in Bethlehem, Pennsylvania, include the Jeep Grand Cherokee, Ford Explorer, and Ford Edge.

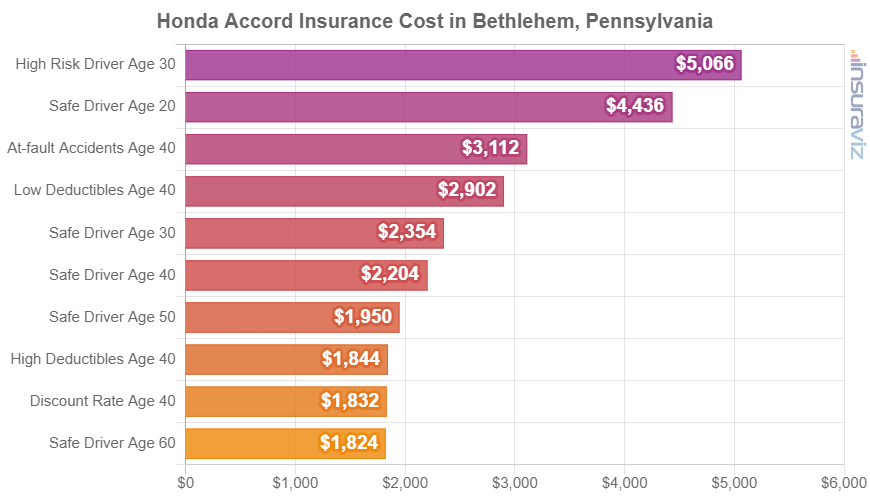

Honda Accord insurance rates

The least-expensive 2024 Honda Accord model to insure in Bethlehem is the EX-L Hybrid model, costing an average of $2,166 per year, or about $181 per month. This model has a retail price of $34,190.

The most expensive 2022 Honda Accord model to insure in Bethlehem is the LX, costing an average of $2,302 per year, or around $192 per month. The MSRP for this model is $27,895, not including documentation fees and destination charges.

When Bethlehem car insurance rates for the Honda Accord are compared with national average insurance rates on the same model, the cost is $66 to $76 more expensive per year in Bethlehem, depending on the specific trim level being insured.

The rate chart below shows how insurance quotes on a Honda Accord can be very different based on a variety of different driver ages, deductibles, and risk profiles. For our example risk profiles, the cost ranges from $1,864 to $5,160 per year, which is a cost difference of $3,296 based on different driver risks.

The Honda Accord is considered a midsize car, and other models in that segment include the Toyota Camry, Kia K5, Hyundai Sonata, and Nissan Altima.

Ford Mustang insurance rates

The cheapest 2024 Ford Mustang model to insure in Bethlehem is the Ecoboost Fastback model, costing an average of $2,190 per year, or around $183 per month. This trim level has a MSRP of $30,920.

The most expensive 2022 Ford Mustang model to insure in Bethlehem is the Dark Horse Premium, costing an average of $2,786 per year, or around $232 per month. The sticker price for this model is $63,265, before destination and documentation fees.

The rate chart below demonstrates how the cost of car insurance for a Ford Mustang can range significantly for a variety of different driver ages, deductibles, and risk profiles.

For this example, cost varies from $2,118 to $5,848 per year, which is a cost difference of $3,730 per year simply by increasing driver risk.

The Ford Mustang belongs to the sports car segment, and additional models from the same segment that are popular in Bethlehem, Pennsylvania, include the Chevrolet Corvette, Subaru BRZ, Toyota GR Supra, and Chevrolet Camaro.