The Honda CR-V is one of the more affordable compact SUVs to insure, ranking in 12th place out of 47 total comparison vehicles for the 2024 model year.

With trim levels ranging from the $29,500 LX model to the fully equipped $39,850 Sport Touring Hybrid AWD, average insurance premium ranges from $1,942 to $2,160 per year.

This article will look at how much it costs to insure a Honda CR-V, how it compares to insuring other similar SUVs, and what you might expect to pay for insuring pre-owned models back to the 2013 model year.

Honda CR-V Insurance at a Glance

- Average insurance cost for 2024 model: $2,046 per year or $171 per month

- Cheapest model to insure: LX at $1,942 per year

- Other affordable models to insure: LX AWD, EX, EX AWD

- Most expensive model to insure: Sport Touring Hybrid AWD at $2,160 per year

- Other expensive models to insure: EX-L AWD, Sport-L Hybrid AWD, EX-L

- Compared to 2024 model year all-vehicle average rate ($2,572): 22.8% cheaper

Driver profile: 40-year-old male, clean driving record, full coverage with $500 physical damage deductibles

How much you can expect to pay to insure a CR-V

2024 Honda CR-V insurance costs on average $2,046 per year for a full coverage policy. Monthly payments range from $162 to $180, depending on the trim level.

Two factors that have a direct impact on the price you pay for car insurance are the age of the driver and the age of the CR-V you’re insuring.

The table below details average car insurance rates by model year and driver age for 2024, 2021, and 2018 Honda CR-V models. The average cost per year and cost per month values assume a 40-year-old driver.

| 2024 Honda CR-V | 2021 Honda CR-V | 2018 Honda CR-V | |

|---|---|---|---|

| Average Insurance Cost Per Year | $2,046 | $1,730 | $1,500 |

| Insurance Cost Per Month | $171 | $144 | $125 |

| 16-year-old Driver | $7,301 | $6,176 | $5,373 |

| 18-year-old Driver | $6,321 | $5,377 | $4,621 |

| 20-year-old Driver | $4,112 | $3,488 | $3,010 |

| 25-year-old Driver | $2,374 | $2,374 | $2,374 |

| 30-year-old Driver | $2,178 | $1,844 | $1,594 |

| 40-year-old Driver | $2,046 | $1,730 | $1,500 |

| 50-year-old Driver | $1,814 | $1,534 | $1,334 |

| 60-year-old Driver | $1,702 | $1,436 | $1,252 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Other driver ages also have no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated October 24, 2025

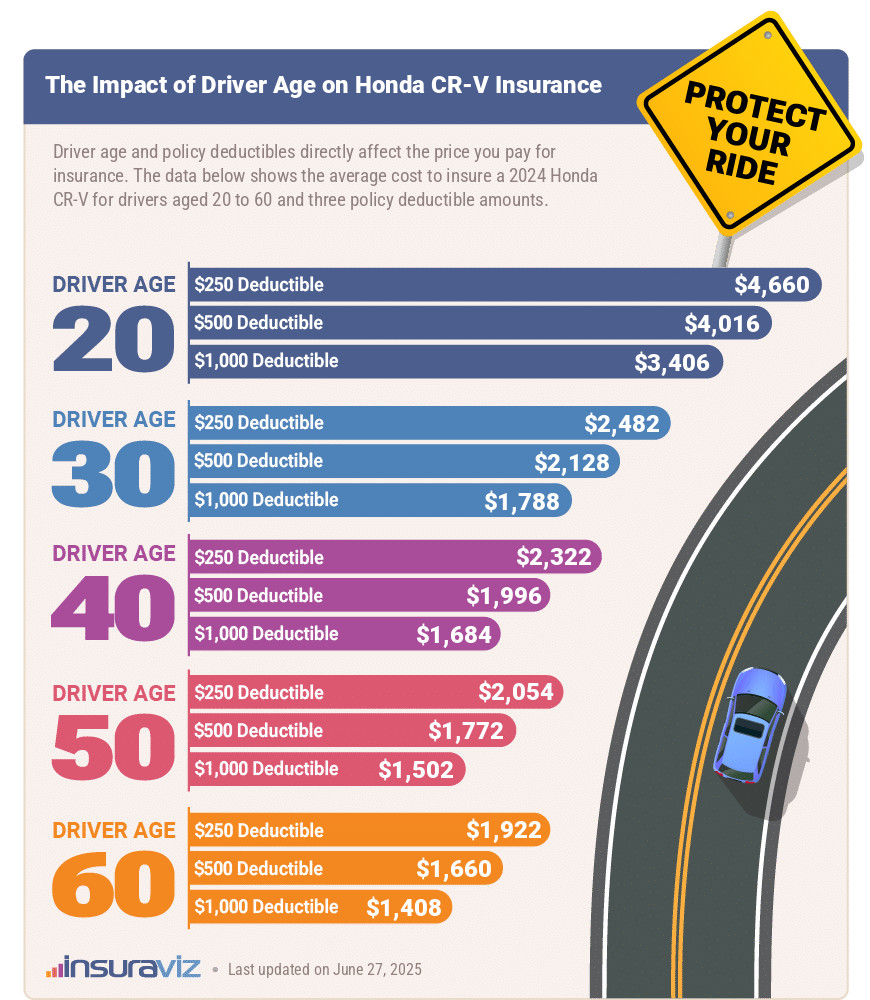

Another factor that affects the cost of CR-V insurance, and one that you can control unlike your age, is the physical damage coverage deductible you choose for your policy.

The next infographic illustrates how 2024 model year Honda CR-V car insurance rates vary based on different rated driver ages and policy deductible amounts.

The data shown in the image confirms two important points.

First, younger drivers pay higher car insurance rates. Less-experienced drivers have a higher frequency of accidents, which results in more expensive insurance.

The 20-year-old driver with a $500 deductible policy pays $2,298 more per year (77.6%) than a 50-year-old driver with the same coverage.

Second, higher deductibles save money on car insurance. This is clearly illustrated by the right-most bar for each age group in the chart. For the average 40-year-old driver, a $250 deductible policy costs around $650 more per year than a policy with $1,000 comprehensive and collision deductibles.

One of the best discounts on Honda CR-V insurance can be earned when you bundle it with your home insurance, if possible. Doing this can save an average of $225 per year when insuring a 2024 model year CR-V.

With the average 2024 model year compact sport utility vehicle costing $2,206 a year to insure, the Honda CR-V costs $160 less each year to insure than the segment average rate.

If we compare CR-V insurance rates to all other 2024 vehicles, not just compact SUVs, rates are 22.8% lower on the Honda than the overall 2024 model year rate of $2,572, as shown in the table below.

| Policy Coverage | 2024 Honda CR-V | 2024 All Vehicle Average | Difference |

|---|---|---|---|

| Comprehensive | $498 | $656 | -27.4% |

| Collision | $912 | $1,216 | -28.6% |

| Liability | $444 | $492 | -10.3% |

| Med/PIP Other | $192 | $208 | -8% |

| Total Policy Cost | $2,046 | $2,572 | -22.8% |

Lower than average cost Higher than average cost

Data Methodology: Rated driver is a 40-year-old male with no driving violations or at-fault accidents in the prior three years. Coverage premiums are averaged for all trim levels available for the 2024 Honda CR-V. Updated October 24, 2025

Annual premium estimates for larger insurers

In our comparison, we found USAA to have the best insurance rates on a 2024 Honda CR-V at $1,434 per year. However, USAA is only available to veterans, active members of the military, and their families.

The company you choose to insure your CR-V is obviously going to make a difference in the rate you pay. Each company sets its own rates and uses different factors when calculating prices.

After USAA, Progressive had the next cheapest rates at $1,725 per year, followed very closely by GEICO at $1,739.

It’s important to note that we compare just a select few large insurance companies in the chart, primarily because they are available nationwide. There are many companies that only sell insurance in a specific region of the U.S. or even just a state or two.

When comparing rates, it’s a good idea to not only get insurance quotes from the big companies but also from several smaller carriers as well. This helps ensure you have a good selection of rates and can make a better-informed decision about where to buy coverage from.

For more information on how car insurance companies set their rates, see our Car Insurance 101 article titled How Insurance Companies Calculate Car Insurance Premiums.

How trim level affects insurance cost

The trim level of a 2024 Honda CR-V affects insurance costs for several reasons, each tied to the specifics of the vehicle’s features, cost, and potential risk assessed by the insurance company.

- Replacement Cost – Higher trim levels typically come with more advanced features, better interior materials, and specialized technology. These enhancements increase the overall value of your CR-V. In the event of a total loss, the insurance company would have to pay out more to replace a higher trim level than a base model, which translates to higher premiums.

- Repair Costs – Similarly, after an accident, a higher trim level with more complex features, such as a touchscreen infotainment system, advanced navigation, or premium audio systems, will cost more to repair. Additionally, trims with special finishes or exclusive parts can also increase repair costs, impacting insurance rates.

- Safety Features – Higher CR-V trims often include additional safety features like lane departure warning, adaptive cruise control, collision mitigation braking, and blind spot information systems. While these can lead to discounts because they may reduce the likelihood of accidents or lessen their severity, they can also be expensive to repair or replace, potentially offsetting some of the insurance savings.

- Theft Rates – Insurance companies consider the likelihood of a vehicle being stolen when determining premiums. Higher trim levels can be more attractive to thieves because of their additional features and higher resale value, potentially leading to increased insurance costs.

With Honda CR-V car insurance ranging from $1,942 to $2,160 per year for an average driver, the cheapest trim level to insure is the LX. The next cheapest model to insure is the LX AWD at $1,982 per year.

For higher-end trim levels, the three most expensive CR-V models to insure are the Sport-L Hybrid AWD, the EX-L AWD, and the Sport Touring Hybrid AWD trim levels at $2,074, $2,098, and $2,160 per year, respectively.

The rate table below details average yearly and six-month car insurance costs, plus a monthly amount for budgeting, for each 2024 Honda CR-V model package and trim level.

| 2024 Honda CR-V Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| LX | $1,942 | $162 |

| LX AWD | $1,982 | $165 |

| EX | $2,004 | $167 |

| EX AWD | $2,042 | $170 |

| Sport-L Hybrid | $2,046 | $171 |

| EX-L | $2,068 | $172 |

| Sport-L Hybrid AWD | $2,074 | $173 |

| EX-L AWD | $2,098 | $175 |

| Sport Touring Hybrid AWD | $2,160 | $180 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

As with most other vehicles, the cost to insure a CR-V increases with the cost of the vehicle. So as you add options and step up to higher-end trim levels, you can expect to pay a little more for insurance.

For more information on other factors that determine the price you pay, see our Car Insurance 101 article titled Drive Your Car Insurance Cost Down: Understanding Rate Factors.

How the CR-V compares to other compact SUVs

The 2024 Honda CR-V ranks 12th out of 47 total vehicles in the 2024 small SUV category. The CR-V costs an average of $2,046 per year for full coverage insurance and the category average cost is $2,206 annually, a difference of $160 per year.

When compared directly to other top-selling small SUVs, insurance for a 2024 Honda CR-V costs $166 less per year than the Toyota RAV4, $164 less than the Chevrolet Equinox, $108 less than the Nissan Rogue, and $142 less than the Ford Escape.

The chart below shows how average Honda CR-V auto insurance rates compare to the other best-selling small SUVs in America. The average price of insurance for a 2024 Honda CR-V is shown in orange with the average cost for the entire segment shown in dark blue.

To see the full comparison of all 47 compact sport utility vehicles for the 2024 model year, simply click or tap the middle button in the lower-left corner of the chart above.

Honda CR-V vs. Toyota RAV4 vs. Chevy Equinox

The Honda CR-V is the second most popular compact SUV, with the Toyota RAV4 being the best-selling model. The Chevy Equinox comes in third, edging out the Nissan Rogue and Hyundai Tuscon which rank in the fourth and fifth spots.

How does insurance for a Honda CR-V compare to its closest competitors?

The table below breaks out the average insurance costs per year and per month for the CR-V, RAV4, and Equinox, plus shows the cheapest and most expensive models of each to insure along with the MSRP values.

| 2024 Honda CR-V | 2024 Toyota RAV4 | 2024 Chevrolet Equinox | |

|---|---|---|---|

| Average Insurance Cost Per Year | $2,046 | $2,212 | $2,210 |

| Insurance Cost Per Month | $171 | $184 | $184 |

| Cheapest Model to Insure | LX | LE AWD | LS |

| Cheapest to Insure MSRP | $29,500 | $29,875 | $27,995 |

| Cheapest Insurance Cost | $1,942 | $1,954 | $2,066 |

| Most Expensive Model to Insure | Sport Touring Hybrid AWD | Prime XSE AWD | EV 3RS |

| Most Expensive to Insure MSRP | $39,850 | $47,310 | $45,000 |

| Most Expensive Insurance Cost | $2,160 | $2,608 | $2,390 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated October 24, 2025

Purchase price vs. insurance price

Comparing the cost of insurance for a CR-V to compact SUV models with similar average MSRP can provide another useful insight into how affordable it is to insure a CR-V.

The 2024 Honda CR-V has an average sticker price of $33,954, ranging from the LX trim at $29,500 to the Sport Touring Hybrid AWD trim at $39,850.

The vehicles that have the most similar average cost to the Honda CR-V are the Chevrolet Equinox, Nissan Rogue, Volkswagen Tiguan, and Ford Bronco Sport. The list below shows how these models compare to a CR-V both by average purchase price and average car insurance cost.

- Honda CR-V vs. Chevrolet Equinox – The 2024 Honda CR-V has an average MSRP that is $142 cheaper than the Chevrolet Equinox ($33,954 versus $34,096). The cost to insure a Honda CR-V compared to the Chevrolet Equinox is $164 less each year on average.

- Honda CR-V vs. Nissan Rogue – The 2024 Nissan Rogue retails for an average of $34,225, ranging from $29,360 to $39,230, which is $271 more expensive than the average MSRP for the Honda CR-V. Drivers can expect to pay an average of $108 more annually for full-coverage insurance on the Nissan Rogue compared to a CR-V.

- Honda CR-V vs. Volkswagen Tiguan – The average MSRP for a 2024 Honda CR-V is $372 cheaper than the Volkswagen Tiguan, at $33,954 compared to $34,326. Insurance for the Volkswagen Tiguan costs an average of $62 less every 12 months than the Honda CR-V.

- Honda CR-V vs. Ford Bronco Sport – The 2024 Honda CR-V has an average MSRP that is $639 cheaper than the Ford Bronco Sport ($33,954 versus $34,593). Insuring a 2024 CR-V compared to the Ford Bronco Sport costs an average of $80 more each year.

Additional Honda CR-V insurance cost comparisons

- Honda CR-V vs. Toyota RAV4

- Honda CR-V vs. Honda Accord

- Honda CR-V vs. Honda HR-V

- Honda CR-V vs. Honda Pilot

- Honda CR-V vs. Subaru Forester

- Honda CR-V vs. Mazda CX-5

- Honda CR-V vs. Ford Escape

- View all 15 comparisons

These discounts can make insurance cheaper

Everyone wants cheaper car insurance, and discounts are a great way to make that happen. Every insurance company offers discounts, but some offer a more extensive list of discounts that can help bring down the cost.

Some discounts don’t require that you do anything to receive them, as they will be automatically applied when you buy or renew your policy. These are things like claim-free discounts and good driver discounts.

Other discounts may require you to first know about it, and second to qualify for it. This might be a discount like being a member of a professional organization, being employed in a specific occupation, or having a teen driver with good grades. These are discounts that should be made available in the application process but may require some follow-up paperwork to verify your eligibility.

The list below shows some of the best discounts available and the larger U.S. car insurers that offer them. If you are insured with a different company, it’s a good idea to have them double-check that you’re receiving every possible discount you qualify for.

| Policy Discount | Larger Companies that Offer this Discount | Average Savings |

|---|---|---|

| Good Driver Savings of 10% to 30% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers | $286 |

| Multi-Policy Bundling Savings of 1% to 17% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $225 |

| Usage-based Save up to 30% | Allstate, American Family, Esurance, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, Safeco, State Farm, Travelers, USAA | $190 |

| Safety Features Savings of 3% to 20% | American Family, Farmers, GEICO, Liberty Mutual, State Farm | $162 |

| Defensive Driving Savings of 5% to 10% | AAA, Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Travelers, USAA | $153 |

| Military Savings of 5% to 15% | Alfa, American Family, Direct General, Farmers, GEICO, Liberty Mutual, Shelter, USAA | $143 |

| Pay in Full Savings of 5% to 10% | Allstate, Nationwide, Progressive, State Farm, Travelers | $129 |

| Multiple Vehicles Savings of 4% to 15% | Allstate, Farmers, GEICO, Liberty Mutual, Nationwide, State Farm, Progressive, Travelers, USAA | $123 |

| Student Away at School Savings of 4% to 25% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $119 |

| Good Student Savings of 3% to 20% | Allstate, American Family, Farmers, GEICO, Liberty Mutual, Nationwide, Progressive, State Farm, Travelers, USAA | $106 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Available discounts and savings amounts vary by company. Updated October 24, 2025

Those are the ten discounts that can probably save you the most money on your policy. But there are a lot of other smaller discounts that can really add up.

This includes things like being a homeowner which can save around $82, using electronic billing could save $51, and even being a loyal customer could save around $61 when insuring a 2024 Honda CR-V. These are average savings amounts, and every company offers different discounts, so check with your company to find out which discounts they offer.

How much you can save by driving an older model

Skipping the 2024 model and instead driving an older model year Honda CR-V is a great way to save some money on car insurance. Current model year vehicles have a much higher replacement value, and older models have less value, which translates into a lower insurance cost.

The data below illustrates average full coverage Honda CR-V insurance rates for the 2013 through 2024 model years. Average full-coverage insurance rates range from the cheapest price of $1,210 for a 2013 Honda CR-V to the most expensive rate of $2,046 for a 2024 CR-V.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Honda CR-V | $2,046 | $171 |

| 2023 Honda CR-V | $1,976 | $165 |

| 2022 Honda CR-V | $1,918 | $160 |

| 2021 Honda CR-V | $1,730 | $144 |

| 2020 Honda CR-V | $1,678 | $140 |

| 2019 Honda CR-V | $1,560 | $130 |

| 2018 Honda CR-V | $1,500 | $125 |

| 2017 Honda CR-V | $1,438 | $120 |

| 2016 Honda CR-V | $1,382 | $115 |

| 2015 Honda CR-V | $1,320 | $110 |

| 2014 Honda CR-V | $1,256 | $105 |

| 2013 Honda CR-V | $1,210 | $101 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Honda CR-V trim levels for each model year. Updated October 24, 2025

As vehicles age, their value decreases, and at some point, it just doesn’t make sense to continue paying for full coverage insurance. The decision to drop full coverage and insure with only liability insurance is a personal one that you have to make based on your own financial situation.

If you no longer carry comprehensive physical damage coverage, you won’t be able to recoup the cost of repairs for things like hail, flood, fire, theft, or vandalism.

If you drop collision coverage, then obviously you won’t have any insurance coverage to reimburse you for the cost of repairs to your vehicle if you hit another car, a tree, the side of your garage, or things of that nature.

CR-V models that are approaching 8 to 10 years old are probably candidates for insuring with just liability insurance. But again, every situation is unique and some people just prefer to have the peace of mind of knowing that their vehicle is covered if something does happen.

During his career as an independent insurance agent,

During his career as an independent insurance agent,