- SUV models like the Buick Envision, Kia Soul, Subaru Crosstrek, and Chevrolet Trailblazer are the best options for the cheapest car insurance in Canton.

- Canton car insurance rates average $1,980 per year, or approximately $165 per month.

Vehicles with the cheapest car insurance

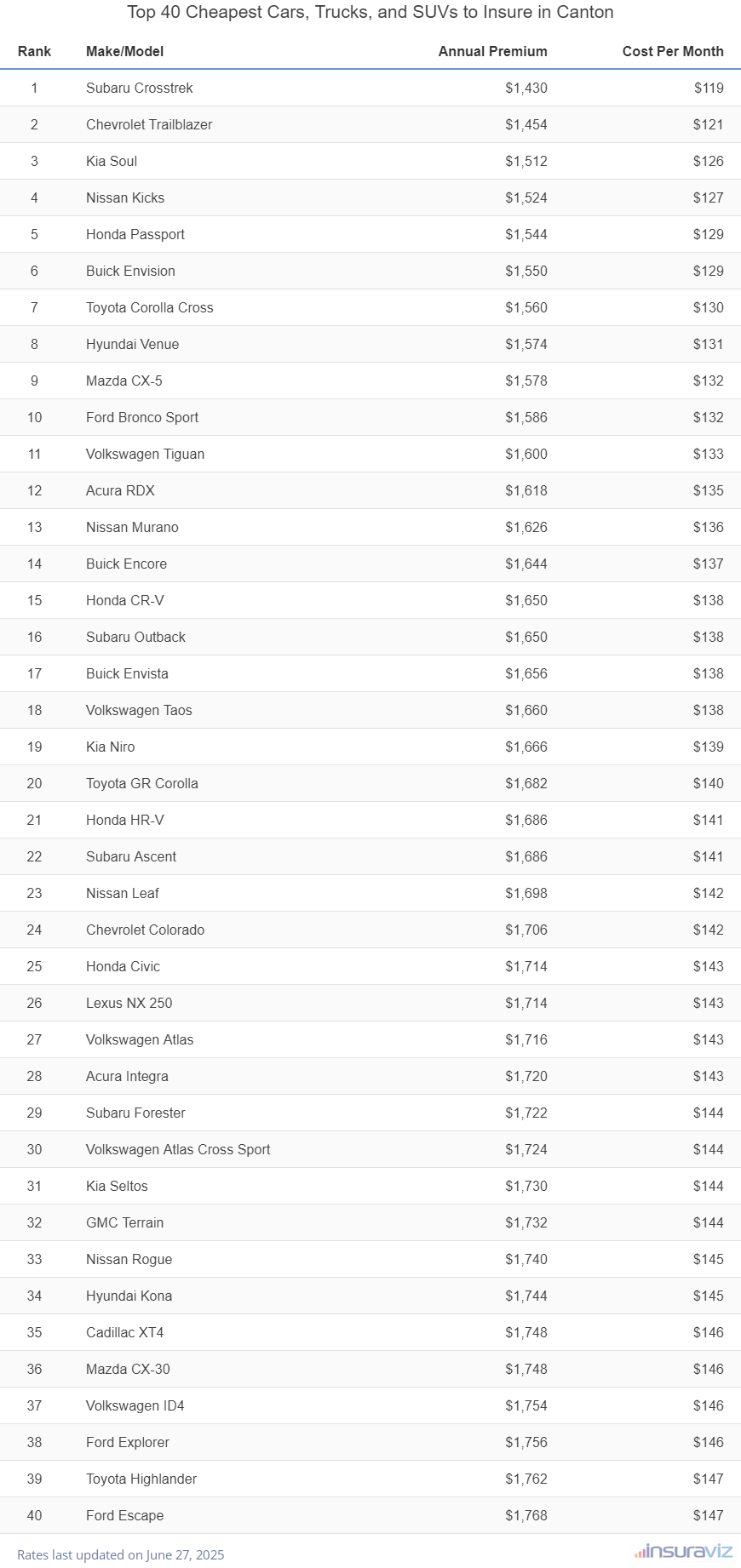

The models with the best insurance quotes in Canton tend to be crossover SUVs like the Kia Soul, Chevrolet Trailblazer, Toyota Corolla Cross, and Buick Envision. Average auto insurance prices for cars and SUVs in the top ten cost $1,622 or less per year, or $135 per month, to insure for full coverage in Canton.

A few other vehicles that are in the top 20 in our auto insurance cost comparison are the Honda CR-V, Buick Envista, Subaru Outback, and Nissan Murano.

Rates are marginally higher for those models than the cheapest small SUVs at the top of the rankings, but they still have an average cost of $1,722 or less per year, or about $144 per month.

The next table lists the 40 cars, trucks, and SUVs with the cheapest insurance rates in Canton, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,464 | $122 |

| 2 | Chevrolet Trailblazer | $1,490 | $124 |

| 3 | Kia Soul | $1,546 | $129 |

| 4 | Nissan Kicks | $1,560 | $130 |

| 5 | Honda Passport | $1,578 | $132 |

| 6 | Buick Envision | $1,588 | $132 |

| 7 | Toyota Corolla Cross | $1,598 | $133 |

| 8 | Hyundai Venue | $1,608 | $134 |

| 9 | Mazda CX-5 | $1,616 | $135 |

| 10 | Ford Bronco Sport | $1,622 | $135 |

| 11 | Volkswagen Tiguan | $1,640 | $137 |

| 12 | Acura RDX | $1,656 | $138 |

| 13 | Nissan Murano | $1,666 | $139 |

| 14 | Buick Encore | $1,682 | $140 |

| 15 | Subaru Outback | $1,688 | $141 |

| 16 | Buick Envista | $1,690 | $141 |

| 17 | Honda CR-V | $1,690 | $141 |

| 18 | Volkswagen Taos | $1,694 | $141 |

| 19 | Kia Niro | $1,706 | $142 |

| 20 | Honda HR-V | $1,722 | $144 |

| 21 | Toyota GR Corolla | $1,722 | $144 |

| 22 | Subaru Ascent | $1,726 | $144 |

| 23 | Nissan Leaf | $1,730 | $144 |

| 24 | Chevrolet Colorado | $1,744 | $145 |

| 25 | Honda Civic | $1,752 | $146 |

| 26 | Lexus NX 250 | $1,754 | $146 |

| 27 | Volkswagen Atlas | $1,756 | $146 |

| 28 | Acura Integra | $1,760 | $147 |

| 29 | Subaru Forester | $1,764 | $147 |

| 30 | Kia Seltos | $1,766 | $147 |

| 31 | Volkswagen Atlas Cross Sport | $1,766 | $147 |

| 32 | GMC Terrain | $1,772 | $148 |

| 33 | Nissan Rogue | $1,776 | $148 |

| 34 | Hyundai Kona | $1,780 | $148 |

| 35 | Mazda CX-30 | $1,784 | $149 |

| 36 | Cadillac XT4 | $1,788 | $149 |

| 37 | Volkswagen ID4 | $1,796 | $150 |

| 38 | Ford Explorer | $1,798 | $150 |

| 39 | Toyota Highlander | $1,802 | $150 |

| 40 | Ford Escape | $1,804 | $150 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Canton, OH Zip Codes. Updated October 24, 2025

A few additional models ranked in the top 40 table above include the Volkswagen ID4, the Honda Civic, the Toyota Highlander, and the Nissan Leaf. Auto insurance rates for those models fall between $1,722 and $1,804 per year in Canton.

In contrast with the cheapest car insurance rates, some examples of more expensive insurance rates include the Hyundai Sonata costing an average of $168 per month, the Chevrolet Camaro which costs $214, and the BMW X3 that averages $194.

How much does car insurance cost in Canton, OH?

Canton car insurance costs an average of $1,980 per year, which is 13.9% less than the national average rate of $2,276. The average cost per month for car insurance in Canton is $165 for full coverage auto insurance.

In Ohio, the average car insurance expense is $1,992 per year, so the average cost of auto insurance in Canton is $12 less per year.

The cost of car insurance in Canton compared to other Ohio cities is $50 per year cheaper than in Akron, $152 per year cheaper than in Cleveland, and $90 per year less than in Columbus.

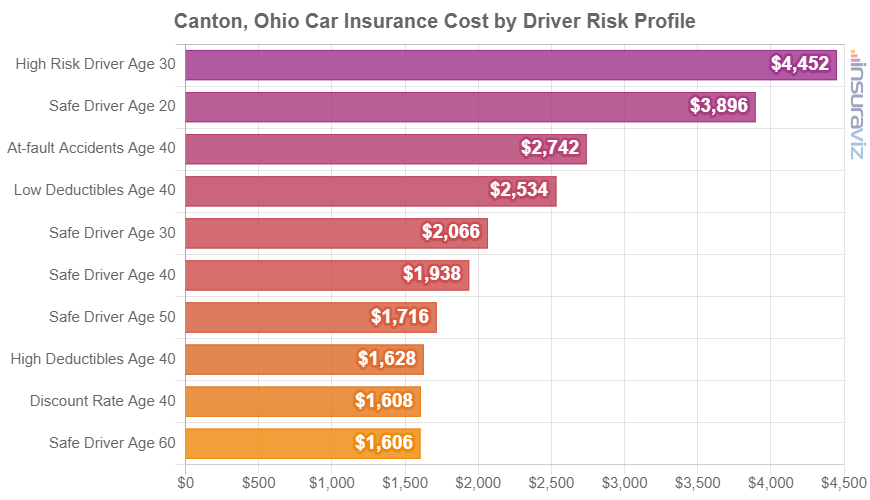

The chart below goes into more detail for drivers age 20 to 60 by showing a range of rates for a variety of driver ages, risk profiles, and policy deductibles.

In the chart above, the cost of auto insurance in Canton ranges from $1,648 per year for a 40-year-old driver who qualifies for most policy discounts to $4,552 per year for a 30-year-old driver who has to buy high risk car insurance. From a monthly standpoint, the average cost in the chart above ranges from $137 to $379 per month.

The age of the rated driver is one of the biggest factors in determining the price you pay for car insurance. The list below details how driver age influences cost by showing average car insurance rates for driver ages 16 through 60.

Canton, OH, car insurance cost by driver age

- 16-year-old rated driver – $7,050 per year or $588 per month

- 17-year-old rated driver – $6,831 per year or $569 per month

- 18-year-old rated driver – $6,121 per year or $510 per month

- 19-year-old rated driver – $5,574 per year or $465 per month

- 20-year-old rated driver – $3,982 per year or $332 per month

- 30-year-old rated driver – $2,114 per year or $176 per month

- 40-year-old rated driver – $1,980 per year or $165 per month

- 50-year-old rated driver – $1,756 per year or $146 per month

- 60-year-old rated driver – $1,644 per year or $137 per month

To help you understand the amount that the cost of identical car insurance can range from one driver to the next (and also point out the importance of getting multiple quotes), the examples below show detailed auto insurance rates for five popular models in Canton: the Ram 1500 pickup, Kia Forte, Nissan Rogue, Kia Sorento, and Toyota GR Supra.

Each example displays average rates for different driver profiles to illustrate how much car insurance cost can vary just by changing some characteristics for the rated driver.

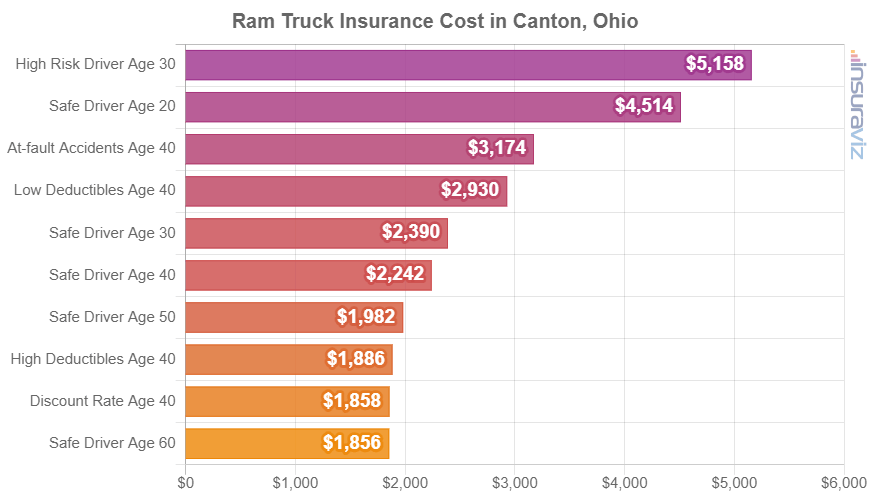

Ram 1500 insurance rates

In Canton, the cheapest insurance rates on a 2024 Ram Truck are on the Tradesman Crew Cab 4WD trim model, costing an average of $2,022 per year, or around $169 per month. This model stickers at $43,270.

The most expensive 2022 Ram Truck model to insure in Canton is the TRX Final Edition 4WD model, costing an average of $2,502 per year, or around $209 per month. The MSRP for this trim level is $109,435, not including delivery and documentation fees.

When Canton insurance rates for a Ram Truck are compared to national average insurance rates for the same vehicle, rates are $430 to $534 less per year in Canton, depending on which trim level is insured.

The bar chart below may help illustrate how the cost to insure a Ram Truck can range significantly based on different driver ages, policy deductibles, and risk profiles.

The Ram Truck is classified as a full-size truck, and other models popular in Canton include the Toyota Tundra, Chevrolet Silverado, and Ford F150.

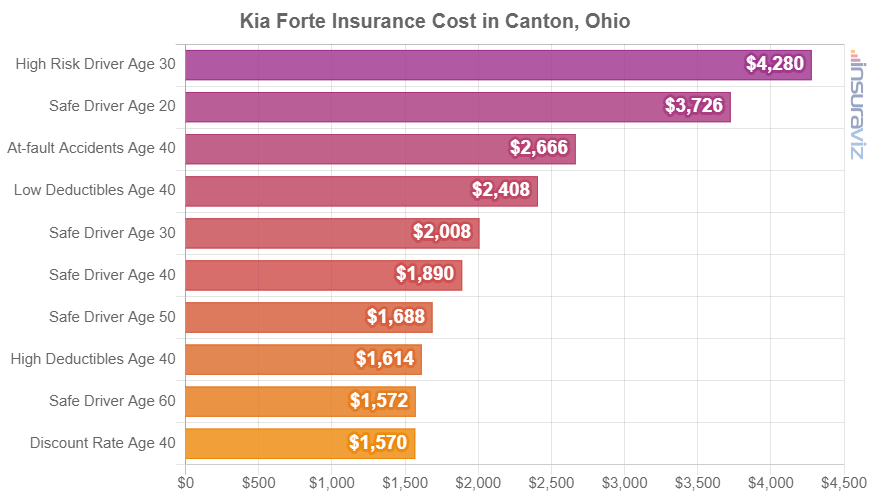

Kia Forte insurance rates

The lowest-cost 2024 Kia Forte trim to insure in Canton is the LX model, costing an average of $1,854 per year, or around $155 per month. This model sells for $19,790.

The most expensive 2022 Kia Forte to insure in Canton is the GT Manual, costing an average of $2,012 per year, or about $168 per month. The sticker price for this model is $25,190, before documentation and destination fees.

The chart displayed below shows how the cost of car insurance on a Kia Forte can range significantly based on changes in driver age and risk profiles. For this example, rates range from $1,604 to $4,378 per year, which is a difference in cost of $2,774 caused by changing from low-risk to high-risk drivers.

The Kia Forte is part of the compact car segment, and other similar models that are popular in Canton include the Hyundai Elantra, Chevrolet Cruze, and Toyota Corolla.

Nissan Rogue insurance rates

The average price paid for Nissan Rogue insurance in Canton is $1,776 per year. Costing from $29,360 to $39,230, average car insurance rates on a Nissan Rogue cost from $1,684 per year for the Nissan Rogue S 2WD model up to $1,862 per year for the Nissan Rogue Platinum AWD trim.

When Canton car insurance quotes on the Nissan Rogue are compared with the national average cost for the same vehicle, rates are $360 to $396 cheaper per year in Canton, depending on the exact trim being insured.

The rate chart below shows how the price of car insurance for a Nissan Rogue can range considerably based on changes in the age of the driver and policy risk profiles.

For our example drivers, cost ranges from $1,480 to $4,064 per year, which is a difference of $2,584 caused by changing the rated driver.

The Nissan Rogue is classified as a compact SUV, and other models from that segment that are popular in Canton include the Ford Escape, Honda CR-V, Chevrolet Equinox, and Subaru Forester.

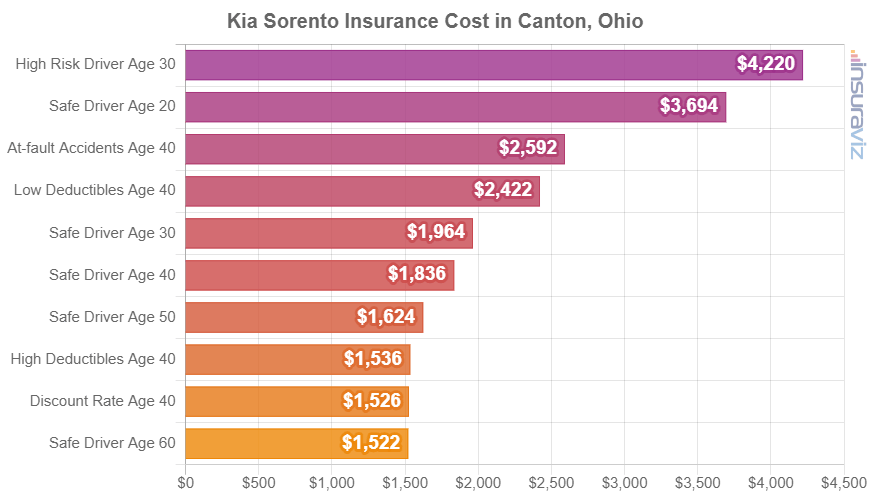

Kia Sorento insurance rates

In Canton, the least-expensive insurance quotes on a 2024 Kia Sorento are on the LX trim model, costing an average of $1,724 per year, or about $144 per month. This model costs $32,000.

The most expensive 2022 Kia Sorento model to insure in Canton is the SX Prestige Plug-in Hybrid model, costing an average of $2,024 per year, or around $169 per month. The MSRP for this trim is $52,000, not including documentation fees and destination charges.

When Canton car insurance quotes on a Kia Sorento are compared with the average cost for the entire U.S. for the same vehicle, rates are anywhere from $364 to $426 less per year in Canton, depending on the exact trim being insured.

The chart displayed below shows how the cost to insure a Kia Sorento can vary based on a variety of different driver ages and common risk profiles. For our example drivers, cost varies from $1,562 to $4,316 per year, which is a cost difference of $2,754.

The Kia Sorento is part of the midsize SUV segment, and other models popular in Canton include the Jeep Grand Cherokee, Kia Telluride, Ford Explorer, and Ford Edge.

Toyota GR Supra insurance rates

Toyota GR Supra insurance in Canton averages $2,222 per year, with rates ranging from a low of $2,100 per year on the Toyota GR Supra 2.0 Coupe trim level up to $2,388 per year on the Toyota GR Supra 45th Anniversary Edition trim level.

The bar chart below demonstrates how the cost of insurance for a Toyota GR Supra can be very different based on a number of different driver ages, policy deductibles, and policy risk factors. For this example, rates range from $1,850 to $5,082 per year, which is a difference of $3,232.

The Toyota GR Supra is part of the sports car segment, and other popular same-segment models include the Subaru BRZ, Chevrolet Camaro, Nissan Z, and Chevrolet Corvette.

Five tips for saving money on car insurance

Not everyone qualifies for the cheapest insurance rates, unfortunately, but you can take some steps to help ensure you’re not overpaying for coverage. The tips below are some of the best ways to keep rates down.

- The real world isn’t Grand Theft Auto. If you want the cheapest auto insurance in Canton, it pays to avoid traffic citations. In fact, just one or two blemishes on your motor vehicle report have the potential to increase auto insurance rates as much as $526 per year. Being convicted of a serious infraction like failing to stop at the scene of an accident could raise rates by an additional $1,838 or more.

- Reduce coverage on older vehicles. Dropping physical damage coverage (comprehensive and collision) from older vehicles whose value has decreased can cheapen the cost to insure significantly.

- Earn policy discounts to save money. Savings may be available if the policyholders are claim-free, sign their policy early, are loyal customers, are military or federal employees, or many other policy discounts which could save the average Canton driver as much as $332 per year.

- Be a responsible driver and save. Causing frequent accidents will increase insurance cost, as much as $2,826 per year for a 20-year-old driver and even as much as $484 per year for a 60-year-old driver. So be a cautious driver and save.

- Choose a vehicle that is cheaper to insure. Vehicle type is one of the primary factors in the cost of car insurance in Canton. For example, a Kia Soul costs $820 less per year to insure in Canton than a Subaru BRZ. Drive cheaper models and save money.