- Small SUV models like the Nissan Kicks, Kia Soul, and Toyota Corolla Cross are some of the best options for the cheapest car insurance.

- Models with the cheapest car insurance in Johnson City for their respective segments include the Mercedes-Benz CLA250 (midsize luxury car), Kia K5 (midsize car), Mazda MX-5 Miata (sports car), and Infiniti QX80 (full-size luxury SUV).

- Monthly auto insurance rates for a few popular vehicles in Johnson City include the Subaru Forester at $164, Nissan Altima at $199, and Jeep Grand Cherokee at $184.

What are the cheapest cars to insure in Johnson City, TN?

When comparing all types of vehicles, the models with the cheapest car insurance rates in Johnson City tend to be small SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, Toyota Corolla Cross, and Hyundai Venue.

Average insurance rates for the models in the top 10 cost $1,806 or less per year to insure for full coverage in Johnson City.

A few other vehicles that rank in the top 20 in our car insurance cost comparison are the Acura RDX, Buick Envista, Kia Niro, and Buick Encore.

The average insurance cost is slightly higher for those models than the cheapest crossovers and compact SUVs at the top of the list, but they still have an average cost of $160 or less per month in Johnson City.

The following table breaks down the 50 cars, trucks, and SUVs with the cheapest insurance rates in Johnson City, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,630 | $136 |

| 2 | Chevrolet Trailblazer | $1,658 | $138 |

| 3 | Kia Soul | $1,724 | $144 |

| 4 | Nissan Kicks | $1,738 | $145 |

| 5 | Honda Passport | $1,758 | $147 |

| 6 | Buick Envision | $1,770 | $148 |

| 7 | Toyota Corolla Cross | $1,778 | $148 |

| 8 | Hyundai Venue | $1,794 | $150 |

| 9 | Mazda CX-5 | $1,800 | $150 |

| 10 | Ford Bronco Sport | $1,806 | $151 |

| 11 | Volkswagen Tiguan | $1,826 | $152 |

| 12 | Acura RDX | $1,846 | $154 |

| 13 | Nissan Murano | $1,854 | $155 |

| 14 | Buick Encore | $1,874 | $156 |

| 15 | Honda CR-V | $1,880 | $157 |

| 16 | Subaru Outback | $1,880 | $157 |

| 17 | Buick Envista | $1,886 | $157 |

| 18 | Volkswagen Taos | $1,890 | $158 |

| 19 | Kia Niro | $1,898 | $158 |

| 20 | Toyota GR Corolla | $1,918 | $160 |

| 21 | Honda HR-V | $1,920 | $160 |

| 22 | Subaru Ascent | $1,922 | $160 |

| 23 | Nissan Leaf | $1,934 | $161 |

| 24 | Chevrolet Colorado | $1,946 | $162 |

| 25 | Lexus NX 250 | $1,954 | $163 |

| 26 | Honda Civic | $1,956 | $163 |

| 27 | Volkswagen Atlas | $1,958 | $163 |

| 28 | Acura Integra | $1,962 | $164 |

| 29 | Subaru Forester | $1,964 | $164 |

| 30 | Volkswagen Atlas Cross Sport | $1,966 | $164 |

| 31 | Kia Seltos | $1,970 | $164 |

| 32 | GMC Terrain | $1,976 | $165 |

| 33 | Nissan Rogue | $1,982 | $165 |

| 34 | Hyundai Kona | $1,986 | $166 |

| 35 | Mazda CX-30 | $1,990 | $166 |

| 36 | Cadillac XT4 | $1,992 | $166 |

| 37 | Ford Explorer | $2,002 | $167 |

| 38 | Volkswagen ID4 | $2,002 | $167 |

| 39 | Toyota Highlander | $2,008 | $167 |

| 40 | Ford Escape | $2,014 | $168 |

| 41 | Toyota Venza | $2,014 | $168 |

| 42 | Honda Odyssey | $2,016 | $168 |

| 43 | Nissan Sentra | $2,022 | $169 |

| 44 | Subaru Impreza | $2,028 | $169 |

| 45 | Chevrolet Equinox | $2,032 | $169 |

| 46 | Toyota RAV4 | $2,036 | $170 |

| 47 | Mazda MX-5 Miata | $2,042 | $170 |

| 48 | Mazda MX-30 | $2,048 | $171 |

| 49 | Hyundai Tucson | $2,052 | $171 |

| 50 | Chevrolet Traverse | $2,060 | $172 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Johnson City, TN Zip Codes. Updated October 24, 2025

Some other popular models making the list of the top 50 table above include the Ford Escape, Toyota RAV4, Hyundai Kona, and Hyundai Tucson. Insurance rates for those models cost between $1,918 and $2,064 per year in Johnson City.

In contrast to the vehicles with cheap rates, some examples of insurance that is considerably higher include the Toyota Mirai that averages $2,746 per year, the Ram Truck at an average of $2,554, and the Lexus LC 500h at an average of $3,306.

And for extremely expensive coverage in Johnson City, high-performance luxury models like the Aston Martin DBX and Audi RS 6 have rates that frequently cost two to three times those of the cheapest cars and SUVs.

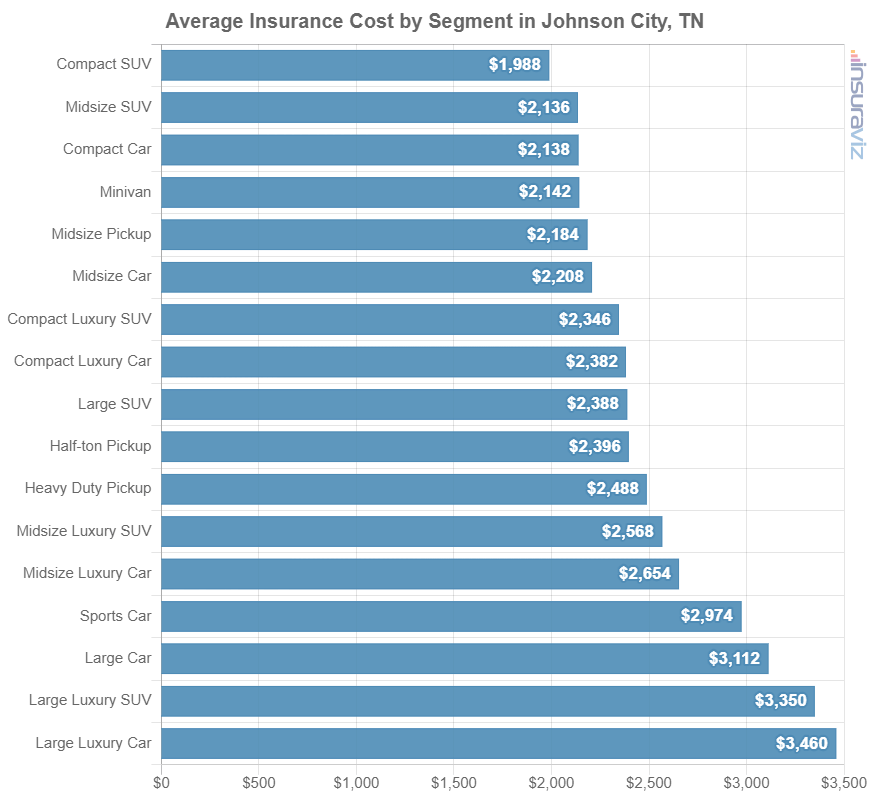

This next article section further discusses the average price of auto insurance in Johnson City for each vehicle segment. These rates will give you a better understanding of the types of vehicles that have the best rates.

Cheapest insurance rates by type of vehicle

If you’re shopping for a new or used vehicle, it’s a good idea to know which kinds of vehicles have cheaper insurance rates. To illustrate this, you may be curious if compact SUVs have more affordable insurance than minivans or if half-ton pickups cost less to insure than heavy duty pickups.

The next chart shows the average auto insurance cost in Johnson City for each automotive segment. As a general rule, small SUVs and midsize pickups tend to have the cheapest rates, with high-performance exotic models having the highest auto insurance rates.

Average rates by automotive segment are practical to form a general comparison, but insurance rates for specific models range quite a lot within each vehicle segment listed in the above chart.

For example, in the sports car segment, insurance rates range from the Mazda MX-5 Miata costing $2,042 per year up to the Mercedes-Benz SL 63 costing $4,534 per year.

For another example, in the midsize truck segment, rates can range from the Chevrolet Colorado at $1,946 per year up to the Rivian R1T at $2,752 per year.

As a third example, in the midsize luxury car segment, the average cost of insurance ranges from the Mercedes-Benz CLA250 at $2,270 per year up to the BMW M8 costing $3,720 per year, a difference of $1,450 just within that segment.

What is the average cost of car insurance in Johnson City?

Average car insurance rates in Johnson City cost $2,208 per year, or about $184 per month. When compared to the U.S. overall average rate, Johnson City car insurance cost is 3% cheaper per year.

In the state of Tennessee, the average cost of car insurance is $2,432 per year, so the cost in Johnson City is $224 less per year. The cost to insure a vehicle in Johnson City compared to other Tennessee cities is approximately $166 per year less than in Chattanooga, $616 per year less than in Memphis, and $272 per year less than in Nashville.

The age of the rated driver has a big impact on the cost of car insurance, so the list below illustrates this point by showing average car insurance rates in Johnson City for driver ages from 16 to 60.

Average cost of car insurance in Johnson City, TN, for drivers age 16 to 60

- 16-year-old rated driver – $7,864 per year or $655 per month

- 17-year-old rated driver – $7,617 per year or $635 per month

- 18-year-old rated driver – $6,829 per year or $569 per month

- 19-year-old rated driver – $6,215 per year or $518 per month

- 20-year-old rated driver – $4,440 per year or $370 per month

- 30-year-old rated driver – $2,356 per year or $196 per month

- 40-year-old rated driver – $2,208 per year or $184 per month

- 50-year-old rated driver – $1,956 per year or $163 per month

- 60-year-old rated driver – $1,832 per year or $153 per month

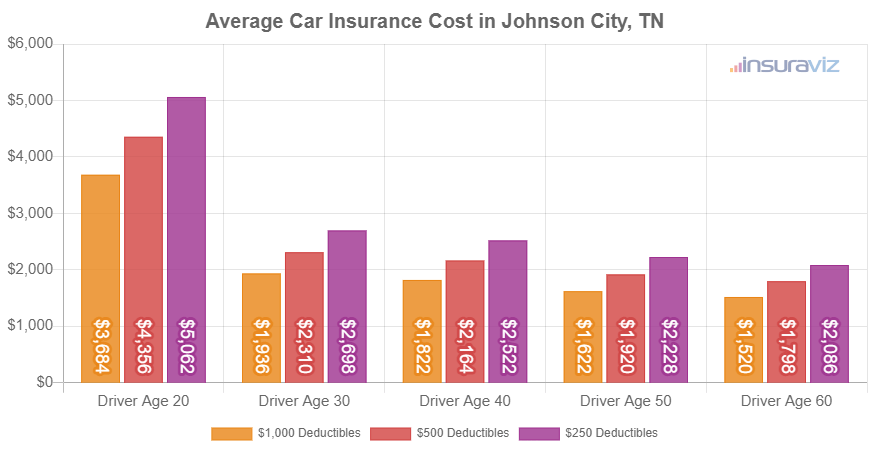

The next chart shows average Johnson City car insurance cost broken out for both different driver ages and physical damage coverage deductibles. Rates are averaged for all 2024 vehicle models including luxury brands.

Average rates in the prior chart range from $1,548 per year for a 60-year-old driver with $1,000 deductibles for comprehensive and collision coverage to $5,164 per year for a 20-year-old driver with $250 deductibles. The rate we use for comparison of different models and locations is a 40-year-old driver with $500 deductibles, which is an average cost of $2,208 per year.

As a monthly amount, car insurance in Johnson City ranges from $129 to $430 for the same driver ages shown in the chart.

Johnson City auto insurance rates can cost very different amounts for different drivers and minor changes in driver risk profiles can have measureable effects on car insurance cost. The likelihood of significant rate variability increases the need for accurate free car insurance quotes when shopping online for cheaper coverage.

Insuring popular models

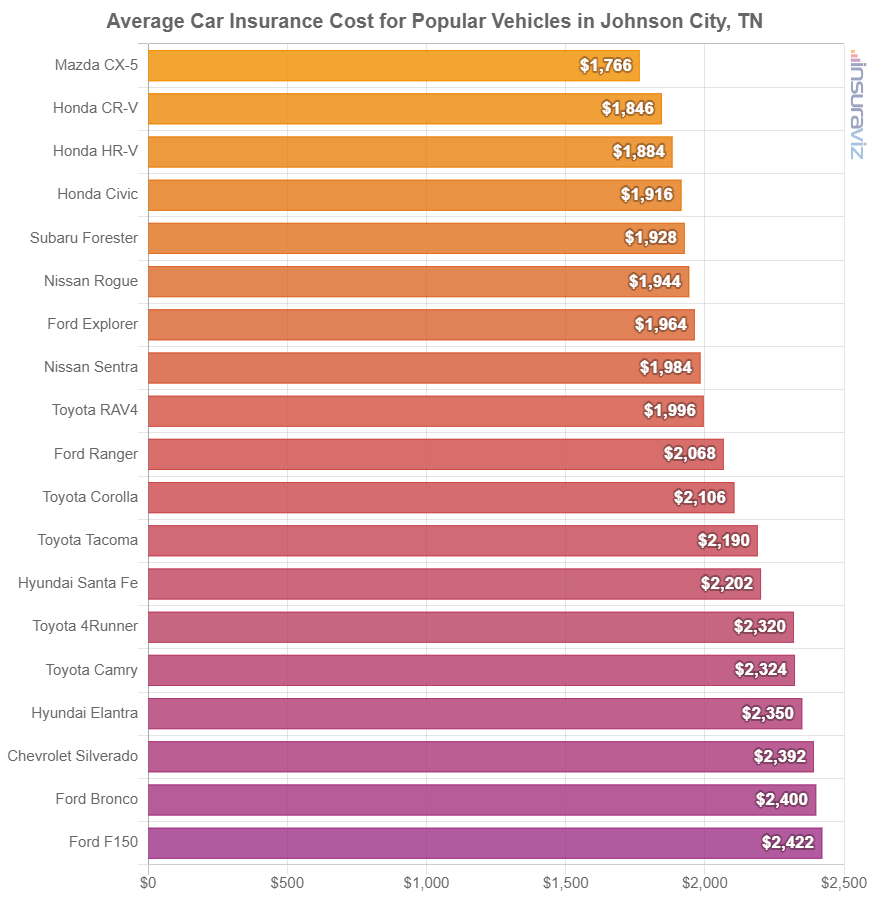

Now we will look at rates for some of the more popular vehicles models sold in the U.S.

The chart below breaks down average insurance cost in Johnson City for some of the most popular cars, trucks, and SUVs.

If we compare the above list of popular vehicles to the previous table of the top 50 cheapest vehicles to insure, the majority of popular vehicles actually have more expensive rates on average.

Expensive insurance could be due to a higher vehicle value, like a GMC Yukon which has an average cost of $59,295 or a Toyota Tundra that has an average MSRP of $39,965, or perhaps the cause is an increased chance of liability claims like a Kia Rio or a Jeep Cherokee.

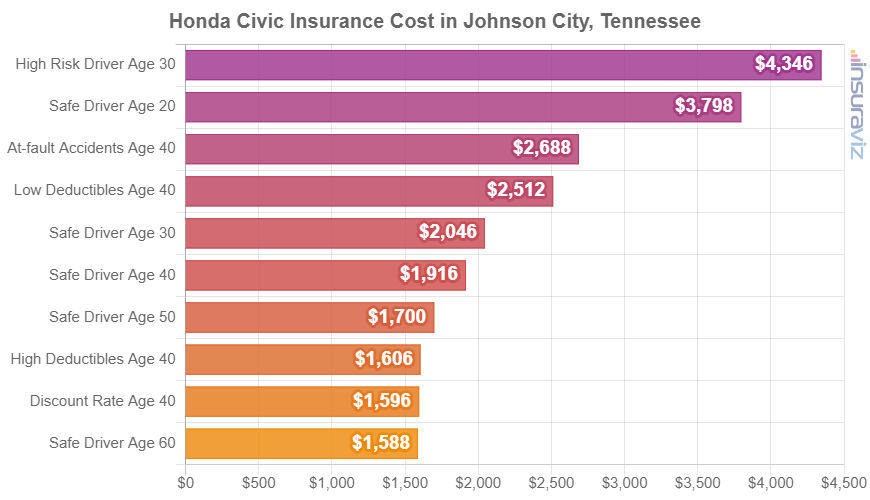

To help illustrate the amount the cost of the same car insurance policy can change for different drivers, the sections below visualize comprehensive rates for four popular models in Johnson City: the Honda Civic, Toyota RAV4, Toyota Highlander, and Kia K5.

Each chart displays average rates for a range of driver profiles to demonstrate the difference in price when using different driver profiles.

Honda Civic insurance rates

In Johnson City, the lowest-cost car insurance rates on a 2024 Honda Civic are on the LX model, costing an average of $1,746 per year, or about $146 per month. This model sells for $23,950.

The most expensive 2022 Honda Civic trim level to insure in Johnson City is the Type R model, costing an average of $2,316 per year, or about $193 per month. The retail cost for this model is $43,795, before destination charges and documentation fees.

From a monthly standpoint, auto insurance quotes for the Honda Civic for the average driver can cost from $146 to $193 per month, depending on exact policy limits and your Zip Code in Johnson City.

The next rate chart should aid in understanding how the cost of car insurance on a Honda Civic can be very different for different driver ages, physical damage deductibles, and driver risk profiles.

The Honda Civic is considered a compact car, and additional similar models include the Nissan Sentra, Hyundai Elantra, Chevrolet Cruze, and Toyota Corolla.

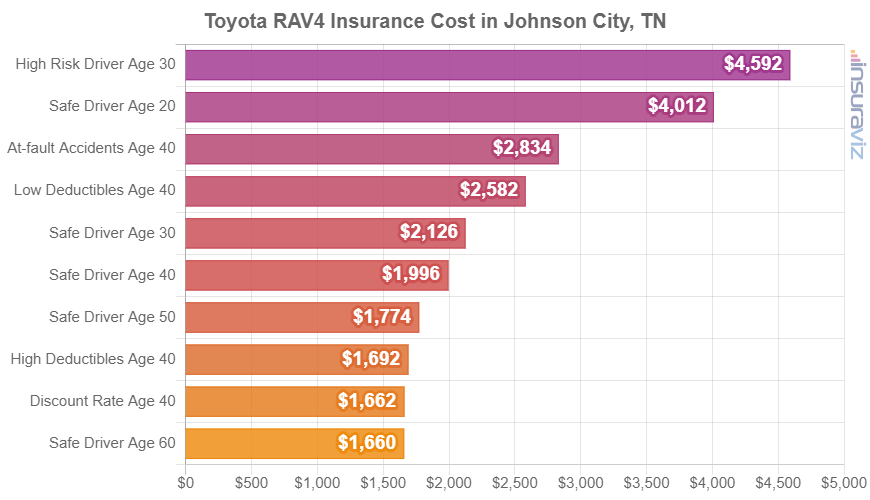

Toyota RAV4 insurance rates

Average Toyota RAV4 insurance cost in Johnson City ranges from $1,798 to $2,398 per year. The least-expensive model to insure is the $29,875 Toyota RAV4 LE AWD model, while the trim with the highest rates is the $47,310 Toyota RAV4 Prime XSE AWD.

As a cost per month, full-coverage auto insurance on a Toyota RAV4 can range from $150 to $200 per month, depending on your company and where you live in Johnson City.

The next rate chart illustrates how the price of car insurance on a Toyota RAV4 can be significantly different based on driver age, policy deductibles, and potential risk scenarios.

The Toyota RAV4 is a compact SUV, and other similar models that are popular in Johnson City include the Subaru Forester, Mazda CX-5, Honda CR-V, and Chevrolet Equinox.

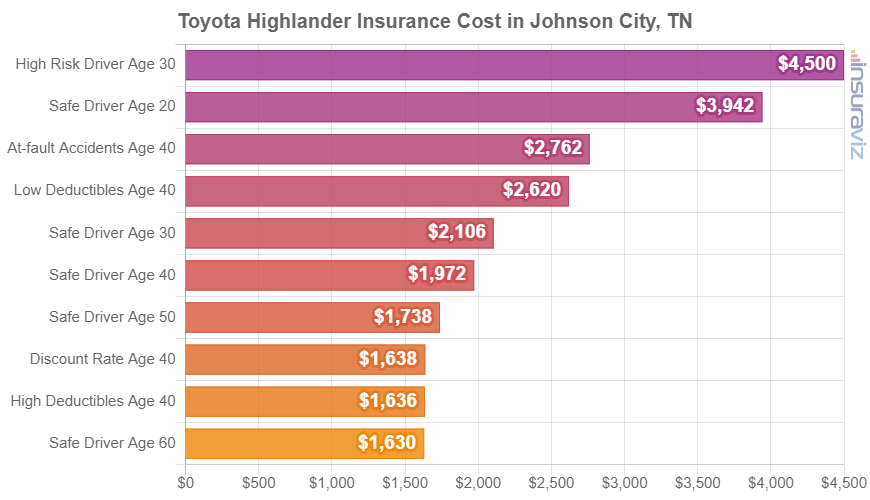

Toyota Highlander insurance rates

Toyota Highlander insurance in Johnson City costs an average of $2,008 per year, with a range of $1,844 per year for the Toyota Highlander LE 2WD model up to $2,182 per year for the Toyota Highlander Hybrid XLE AWD model.

The next rate chart demonstrates how insurance quotes for a Toyota Highlander can be significantly different for a variety of driver ages and risk profiles. For our example drivers, rates range from $1,672 to $4,592 per year, which is a difference in cost of $2,920 just for having different drivers insured.

The Toyota Highlander is considered a midsize SUV, and other popular same-segment models include the Kia Telluride, Kia Sorento, and Ford Edge.

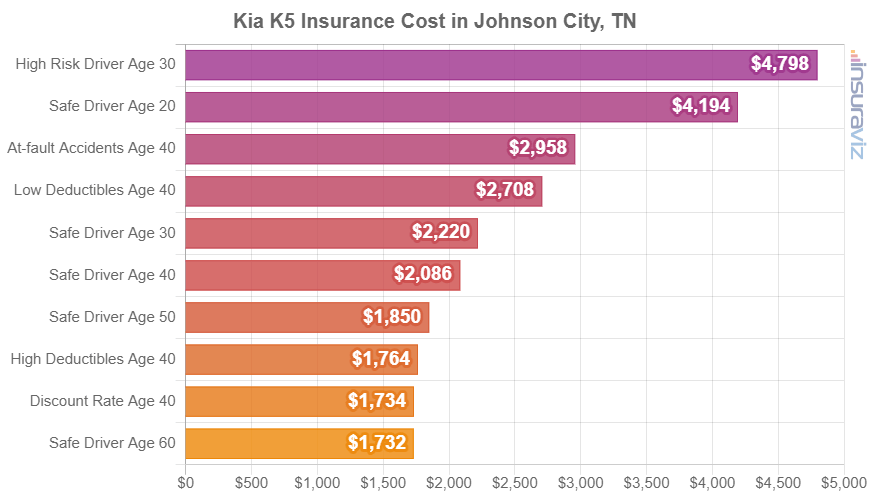

Kia K5 insurance rates

The average cost of Kia K5 insurance in Johnson City is $2,126 per year. With a purchase price ranging from $25,090 to $31,490, average insurance rates for a 2024 Kia K5 cost from $2,036 per year on the Kia K5 LXS model up to $2,216 per year for the Kia K5 GT model.

As a cost per month, full-coverage auto insurance on a 2024 Kia K5 for the average driver can range from $170 to $185 per month, but your actual rate can vary based on your Zip Code in Johnson City.

The next chart illustrates how insurance quotes on a Kia K5 can be significantly different based on driver age and common policy situations.

The Kia K5 is considered a midsize car, and other popular same-segment models include the Hyundai Sonata, Nissan Altima, and Honda Accord.