The Toyota 4Runner debuted over 40 years ago and has been a staple on off-road trails ever since. The reliability and ruggedness of this midsize SUV is only outdone by the loyalty of the people who drive it.

And with customer loyalty comes the desire to insure this off-road beast with coverage that drivers can count on when the going gets tough.

But how much does insurance cost for a 4Runner? And if you already have one and insure one, what factors might be causing your insurance to cost more than you’d like?

We tackle these questions and more in order to help you understand the how’s and why’s of Toyota 4Runner insurance.

Insuring Your 4Runner: What’s it Gonna Cost?

Toyota 4Runner insurance costs an average of $2,572 per year, or about $214 each month. With the average midsize SUV costing $2,370 a year to insure, the Toyota 4Runner ranks 26th out of 34 vehicles in the midsize SUV class for insurance affordability.

But wait. There’s a big asterisk on this average rate because of all the different things that go into calculating the rate you pay.

Unless you’re a 40-year-old male driver with a clean driving record and no prior claims, then your rate is probably going to vary from this benchmark. But how much?

Let’s first take a look at Toyota 4Runner insurance rates based on different driver ages and policy deductible levels. That’s as good a place to start as any.

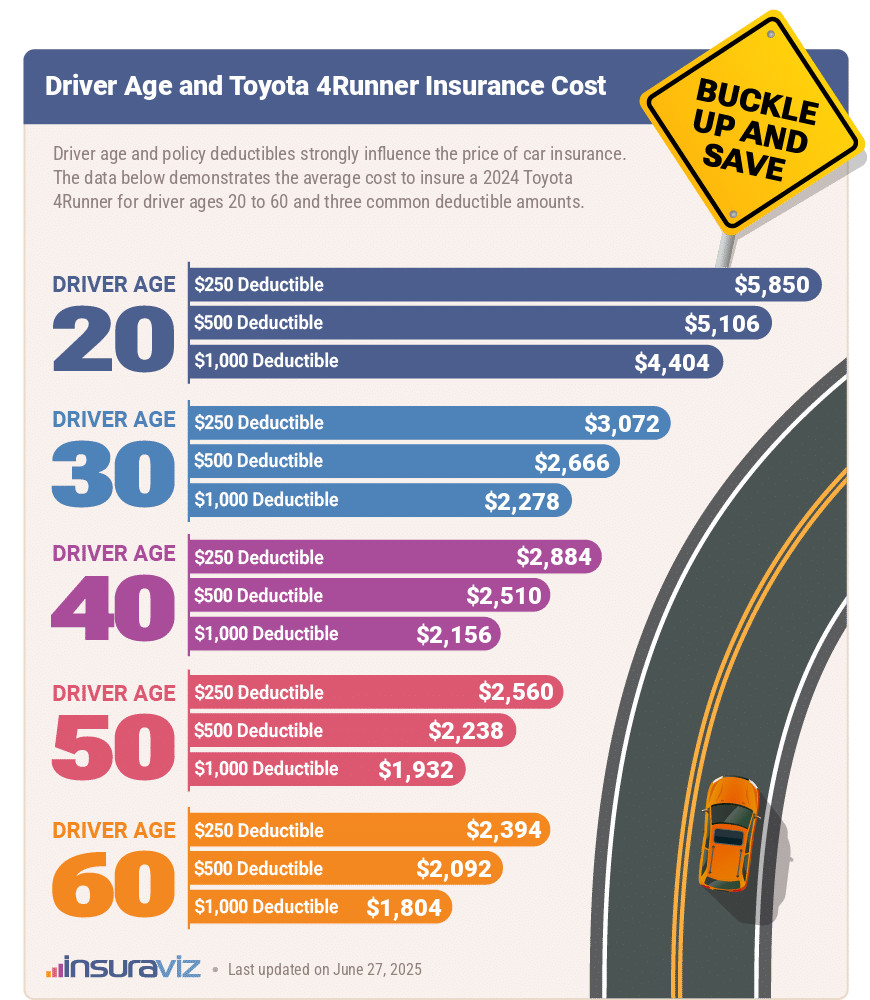

The infographic below shows 2024 Toyota 4Runner car insurance rates grouped by driver age for $250, $500, and $1,000 policy deductibles.

There are two trends in the data above that are important to point out:

Younger Drivers Pay More

The first and most obvious is the fact that the 20-year-old drivers pay a heck of a lot more to insure a 4Runner than the 60-year-old drivers. Why is this?

Honestly, it’s common sense. And what I mean is that 20-year-old drivers don’t always have a lot of it.

Younger drivers make some bad decisions behind the wheel, and because of that, they pay more for car insurance.

Distractions and an overestimation of their driving abilities make a hazardous combination that often leads to accidents or tickets. It’s because of this that car insurance companies assume more risk insuring younger drivers, and more risk means more premium is needed to cover that risk.

As we age, we tend to get a little more mellow behind the wheel, which in turn results in fewer accidents. We also have less tendency to file smaller claims, because we know that filing a claim can result in a premium increase.

Lower Deductibles Result in Higher Rates

The second key trend in the data we want to highlight is the difference that your choice of deductible makes on the rate you pay.

Your deductible is the amount you have to pay before your insurance company pays the rest.

Here’s an example of how a deductible works.

Let’s say you take your 4Runner overlanding in Moab and you misjudge the approach angle on a boulder. Your Falken Wildpeaks lose grip on the rock and your 4Runner slides and sustains $4,200 damage to the rocker panel, driver’s door, and undercarriage.

You have a $1,000 deductible for your collision coverage on your policy, which is the coverage that will pay for the repairs. You will pay the first $1,000 of the repair bill, and your insurance company will cover the remaining $3,200.

Now, had you elected a $250 deductible instead of a $1,000 deductible, you only would have paid $250 out-of-pocket and your insurance company would cover $3,950 of the repair bill.

However, from our data shown in the infographic for the average 40-year-old driver, the annual cost difference between a $250 deductible and a $1,000 deductible is $748.

So even though you paid an extra $750 out-of-pocket for the repairs with a $1,000 deductible, the savings on your car insurance premium almost made up that difference.

Whether you choose a low deductible or higher deductible really just boils down to the amount you’re comfortable paying in the event of a claim. If you don’t have the financial resources available to pay a higher deductible, or you tend to have more frequent claims, then a lower deductible may benefit your situation.

SR5 vs. TRD vs. Limited: Trim Level Matters

With 2024 Toyota 4Runner insurance rates ranging from $2,468 to $2,718 per year on average, the most budget-friendly model to insure is the SR5 2WD. The second cheapest trim level to insure is the SR5 4WD at $2,508 per year.

The Toyota 4Runner models with the most expensive insurance rates are the TRD Pro 4WD and the Limited 2WD at $2,642 per year. Those models will cost an extra $250 per year over the least expensive SR5 2WD model.

The table below shows the average car insurance cost for different policy terms for each trim level of 2024 Toyota 4Runner.

| 2024 Toyota 4Runner Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SR5 2WD | $2,468 | $206 |

| SR5 4WD | $2,508 | $209 |

| TRD Sport 2WD | $2,530 | $211 |

| SR5 Premium 2WD | $2,538 | $212 |

| TRD Off-Road 4WD | $2,550 | $213 |

| TRD Sport 4WD | $2,564 | $214 |

| SR5 Premium 4WD | $2,574 | $215 |

| Limited 4WD | $2,584 | $215 |

| TRD Off-Road Premium 4WD | $2,614 | $218 |

| Limited 2WD | $2,642 | $220 |

| TRD Pro 4WD | $2,718 | $227 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Toyota 4Runner Versus the Competition

The Toyota 4Runner ranks 26th out of 34 total vehicles in the midsize SUV category. A 2024 4Runner costs an estimated $2,572 per year to insure for full coverage and the class median average cost is $2,370 per year, a difference of $202 per year.

When compared directly to the most popular models in the midsize SUV category, insurance for a Toyota 4Runner costs $392 more per year than the Toyota Highlander, $174 more per year than the Jeep Grand Cherokee, $146 more per year than the Hyundai Santa Fe, and $334 more per year than the Chevrolet Traverse.

The chart below shows how Toyota 4Runner car insurance rates compare against other top-selling midsize SUVs. Following the chart, a table shows rankings for all 34 vehicles in the segment plus the amount each differs in cost to insure from the 4Runner.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$662 |

| 2 | Nissan Murano | $2,016 | -$556 |

| 3 | Subaru Outback | $2,042 | -$530 |

| 4 | Buick Envista | $2,050 | -$522 |

| 5 | Subaru Ascent | $2,088 | -$484 |

| 6 | Volkswagen Atlas | $2,128 | -$444 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$436 |

| 8 | Ford Explorer | $2,176 | -$396 |

| 9 | Toyota Highlander | $2,180 | -$392 |

| 10 | Toyota Venza | $2,190 | -$382 |

| 11 | Chevrolet Traverse | $2,238 | -$334 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$318 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$310 |

| 14 | Ford Edge | $2,270 | -$302 |

| 15 | Kia Sorento | $2,278 | -$294 |

| 16 | GMC Acadia | $2,316 | -$256 |

| 17 | Buick Enclave | $2,320 | -$252 |

| 18 | Honda Pilot | $2,336 | -$236 |

| 19 | Mazda CX-9 | $2,342 | -$230 |

| 20 | Jeep Grand Cherokee | $2,398 | -$174 |

| 21 | Hyundai Santa Fe | $2,426 | -$146 |

| 22 | Nissan Pathfinder | $2,440 | -$132 |

| 23 | Hyundai Palisade | $2,450 | -$122 |

| 24 | Chevrolet Blazer | $2,476 | -$96 |

| 25 | Kia Telluride | $2,504 | -$68 |

| 26 | Toyota 4Runner | $2,572 | -- |

| 27 | Mazda CX-90 | $2,582 | $10 |

| 28 | Toyota Grand Highlander | $2,610 | $38 |

| 29 | Kia EV9 | $2,630 | $58 |

| 30 | Tesla Model Y | $2,654 | $82 |

| 31 | Ford Bronco | $2,662 | $90 |

| 32 | Jeep Wrangler | $2,740 | $168 |

| 33 | Dodge Durango | $2,942 | $370 |

| 34 | Rivian R1S | $2,950 | $378 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Insurance Costs Less on Older Models

As your 4Runner gets older, it’s worth less. That goes for basically any vehicle. And with a reduced value comes reduced replacement cost. That’s the cost your insurance company would have to pay to replace your 4Runner if you totaled it out.

The good thing about this reduced value is it impacts your insurance rates in a positive manner. Lower replacement cost means cheaper rates.

The following table shows average full coverage insurance rates for a Toyota 4Runner for the 2013 to 2024 model years. Data includes average rates for drivers aged 20 to 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Toyota 4Runner | $5,230 | $2,572 | $2,146 |

| 2023 Toyota 4Runner | $4,422 | $2,188 | $1,814 |

| 2022 Toyota 4Runner | $4,328 | $2,134 | $1,774 |

| 2021 Toyota 4Runner | $4,398 | $2,162 | $1,798 |

| 2020 Toyota 4Runner | $4,272 | $2,098 | $1,746 |

| 2019 Toyota 4Runner | $3,730 | $1,838 | $1,530 |

| 2018 Toyota 4Runner | $3,536 | $1,746 | $1,456 |

| 2017 Toyota 4Runner | $3,400 | $1,680 | $1,404 |

| 2016 Toyota 4Runner | $3,306 | $1,646 | $1,374 |

| 2015 Toyota 4Runner | $3,264 | $1,614 | $1,348 |

| 2014 Toyota 4Runner | $3,112 | $1,542 | $1,288 |

| 2013 Toyota 4Runner | $3,234 | $1,594 | $1,336 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Toyota 4Runner trim levels for each model year. Updated October 24, 2025

Toyota 4Runner liability insurance

For older 4Runners, it makes sense to drop full coverage and just insure with liability insurance.

At some point in every vehicle’s life, it just doesn’t make sense to continue paying for comprehensive and collision coverage because the vehicle just isn’t worth enough to justify the extra cost.

The point at which you drop full coverage is really a personal decision. If you totaled out your vehicle would you have enough savings to buy a different one? Or if your vehicle is damaged and in the shop for a week do you have another vehicle to drive or funds available to rent a car?

Those are the kinds of things to think about when dropping full coverage from your policy.

As far as the cost difference between full coverage and liability-only insurance go, the table below details the average cost difference for the 2000 to 2012 4Runner model years.

| Vehicle Model Year | Full Coverage Insurance | Liability Insurance |

|---|---|---|

| 2012 Toyota 4Runner | $1,522 | $670 |

| 2011 Toyota 4Runner | $1,458 | $664 |

| 2010 Toyota 4Runner | $1,390 | $658 |

| 2009 Toyota 4Runner | $1,326 | $652 |

| 2008 Toyota 4Runner | $1,270 | $646 |

| 2007 Toyota 4Runner | $1,252 | $640 |

| 2006 Toyota 4Runner | $1,224 | $634 |

| 2005 Toyota 4Runner | $1,180 | $628 |

| 2004 Toyota 4Runner | $1,150 | $622 |

| 2003 Toyota 4Runner | $1,127 | $610 |

| 2002 Toyota 4Runner | $1,104 | $597 |

| 2001 Toyota 4Runner | $1,082 | $585 |

| 2000 Toyota 4Runner | $1,061 | $574 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Full coverage comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each model year. Updated October 24, 2025

Liability insurance prices on a 4Runner vary considerably depending on the state you live in, so it’s always a good idea to get some quotes to see how rates stack up. Each state has a minimum liability amount that is required, but that minimum amount is often inadequate in the case of more serious claims and accidents.

Toyota 4Runner Insurance Where You Live

If you live in a state like Virginia, Iowa, Maine, or North Carolina, consider yourself lucky to have some of the cheaper car insurance rates in the country.

On the flip side, if you live in Michigan, Louisiana, Florida, or Nevada, you’re going to be paying some of the highest rates to insure your 4Runner.

In the middle are states like Oregon, Tennessee, and Pennsylvania, with average Toyota 4Runner insurance rates of $2,574, $2,612, and $2,626 per year, respectively.

The table below shows average 2024 Toyota 4Runner insurance rates for all 50 states in the U.S.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,512 | $209 |

| Alaska | $2,248 | $187 |

| Arizona | $2,544 | $212 |

| Arkansas | $2,786 | $232 |

| California | $3,092 | $258 |

| Colorado | $2,836 | $236 |

| Connecticut | $2,912 | $243 |

| Delaware | $2,956 | $246 |

| Florida | $2,994 | $250 |

| Georgia | $2,742 | $229 |

| Hawaii | $2,104 | $175 |

| Idaho | $2,166 | $181 |

| Illinois | $2,472 | $206 |

| Indiana | $2,226 | $186 |

| Iowa | $2,082 | $174 |

| Kansas | $2,672 | $223 |

| Kentucky | $2,834 | $236 |

| Louisiana | $2,888 | $241 |

| Maine | $1,956 | $163 |

| Maryland | $2,566 | $214 |

| Massachusetts | $2,868 | $239 |

| Michigan | $3,094 | $258 |

| Minnesota | $2,434 | $203 |

| Mississippi | $2,654 | $221 |

| Missouri | $2,942 | $245 |

| Montana | $2,546 | $212 |

| Nebraska | $2,392 | $199 |

| Nevada | $3,066 | $256 |

| New Hampshire | $2,082 | $174 |

| New Jersey | $3,094 | $258 |

| New Mexico | $2,368 | $197 |

| New York | $2,996 | $250 |

| North Carolina | $1,998 | $167 |

| North Dakota | $2,380 | $198 |

| Ohio | $2,136 | $178 |

| Oklahoma | $2,894 | $241 |

| Oregon | $2,574 | $215 |

| Pennsylvania | $2,626 | $219 |

| Rhode Island | $3,146 | $262 |

| South Carolina | $2,398 | $200 |

| South Dakota | $2,752 | $229 |

| Tennessee | $2,612 | $218 |

| Texas | $2,566 | $214 |

| Utah | $2,470 | $206 |

| Vermont | $2,190 | $183 |

| Virginia | $2,074 | $173 |

| Washington | $2,518 | $210 |

| West Virginia | $2,498 | $208 |

| Wisconsin | $2,168 | $181 |

| Wyoming | $2,492 | $208 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional Rates and Observations

Other rate information pertaining to policy discounts, deductibles, and even savings tips can be found below.

- Increasing deductibles makes car insurance cheaper. Boosting your deductibles from $500 to $1,000 could save around $366 per year for a 40-year-old driver and $720 per year for a 20-year-old driver.

- Lowering deductibles results in a more expensive policy. Decreasing your policy deductibles from $500 to $250 could cost an additional $382 per year for a 40-year-old driver and $762 per year for a 20-year-old driver.

- Fewer violations mean cheaper insurance rates. If you want the cheapest 4Runner car insurance rates, it pays to avoid traffic citations. Just a few minor infractions on your driving record have the consequences of increasing policy cost as much as $704 per year.

- Improve your credit for cheaper 4Runner car insurance. In states that allow a policyholder’s credit rating to be used as a factor in determining insurance rates, drivers with high 800+ credit scores could possibly save as much as $404 per year versus a slightly lower credit rating between 670-739. Conversely, a mediocre credit rating could cost up to $468 more per year.

- Policy discounts save money. Discounts may be available if the insureds are homeowners, are claim-free, insure their home and car with the same company, are military or federal employees, or many other discounts which could save the average driver as much as $442 per year.

- High-risk drivers pay a lot more for insurance. For a 40-year-old driver, having enough accidents and violations to require a high-risk insurance policy can potentially increase rates by $3,202 or more per year.