- Average car insurance cost in California is $2,884 per year, or around $240 per month.

- When compared to the western region states, California ranks last out of 11 states for car insurance affordability and comes in at 45th overall for the entire U.S.

- The cheapest car insurance in California can be found on models like the Subaru Crosstrek, Nissan Kicks, Chevrolet Trailblazer, and Buick Envision.

- Teenage drivers cost the most to insure in California, with average rates ranging from $6,866 per year for a 19-year-old female driver up to $10,271 per year for a 16-year-old male driver.

What is average car insurance cost in California?

Average car insurance rates in California cost $2,884 per year, or about $240 per month, which is 23.6% more than the national average rate of $2,276.

Some of the cheaper cars to insure in California include the Honda CR-V at $2,458 per year, the Toyota Camry at $3,100 per year, and the Ford Edge at $2,728 per year.

High end models like the Mercedes-Benz AMG GT63, the Tesla Model Y, and the BMW M760i cost an average of $5,252, $3,192, and $5,496 per year, respectively, for full-coverage car insurance.

The chart below shows average car insurance rates in California for 2024 model year vehicles and different driver ages and policy deductible amounts. The overall average rate in the chart is the $500 deductible policy for a 40-year-old driver which costs $2,884 per year, or $240 per month. For the same deductible level, cost ranges from $2,394 for a 60-year-old driver to $5,802 for a 20-year-old driver.

As shown in the chart, the average cost of car insurance ranges from $2,024 per year for a 60-year-old driver with a policy with high deductibles to $6,746 per year for a 20-year-old driver with low physical damage deductibles. From a monthly standpoint, the average cost in the chart above ranges from $169 to $562 per month.

California car insurance rates for teenage drivers are not included in the chart, but expect to pay quite a bit if you are insuring a 16 to 19-year-old. Average rates range from $6,866 per year for a 19-year-old female driver up to $10,271 per year for a 16-year-old male driver.

For 17 and 18-year-olds, average car insurance rates in California will cost $9,537 to $9,952 per year for 17-year-olds and $8,230 to $8,916 per year for 18-year-olds. Rates will fluctuate considerably based on the vehicle driven, however, so the best way to nail down a rate for your specific vehicle, Zip Code, and risk profile, is to just get some California car insurance quotes.

Some additional factors and situations that can affect car insurance rates in California include:

- A 40-year-old driver with a DUI or other major driving violation could pay as much as $2,682 more per year.

- Increasing policy deductibles from $100 to $1,000 could save $1,348 or more each year.

- Even minor traffic violations like speeding tickets or failure to yield could increase the annual cost of car insurance in California by $770 for a 40-year-old driver.

- Earning multiple policy discounts could save as much as $896 per year. These discounts include things like multi-vehicle, multi-policy, safe driver, claim-free, customer loyalty, and others.

- Insuring multiple vehicles on one policy could save $152 per year.

- Being a homeowner could save around $40 per year.

- Bundling your auto and homeowners insurance with the same company could save an average of $372 per year.

- Having an at-fault accident could cause your rates to increase by as much as $1,200 each year.

- Driving a vehicle with lower insurance rates can save a lot. For example, driving a Honda CR-V instead of a Jeep Wrangler could save as much as $834 per year on insurance cost.

Is car insurance expensive in California?

When compared to surrounding states, California car insurance rates are 0.8% more than Nevada, 18.2% more than Oregon, and 19.3% more than Arizona.

When compared to other states outside the immediate western region, the average cost of car insurance in California is 3.1% more expensive than New York, 3.2% more expensive than Florida, and 18.6% more expensive than the average rate in Texas.

As an example, Tesla Model 3 insurance in California costs an average of $3,386 per year for full coverage. In Nevada, it would cost slightly less at around $3,360, but Washington and Oregon are considerably cheaper at $2,758 and $2,822 per year, respectively.

The chart below shows how car insurance in California compares to the other states in the U.S. west region. California car insurance cost ranks last out of the 11 states in the west region for affordability, which essentially means car insurance in California is pretty expensive.

The cost of insuring a vehicle in California varies considerably based on the area you live in. For example, in San Diego, Honda Civic insurance would cost around $2,348 per year. Living in Sacramento would cause the cost of insurance to increase to $2,646, and Los Angeles car insurance cost would average $3,088 per year.

When average rates are compared to the cost of car insurance in specific U.S. cities, average California auto insurance rates are 10.7% higher than Chicago, 8.3% higher than Miami, and 2.1% higher than Denver.

As mentioned earlier, rates can vary considerably based on where you live. Areas with higher crime, higher traffic congestion, or higher frequency of fire or hail can have more expensive rates. The best way to compare rates and know exactly how much each company costs is to get some free car insurance quotes.

Our simple-to-use form allows you to drill down to the best companies based on a few easy questions. No personal data is required, and it’s a great way to find out if you can save on your next policy.

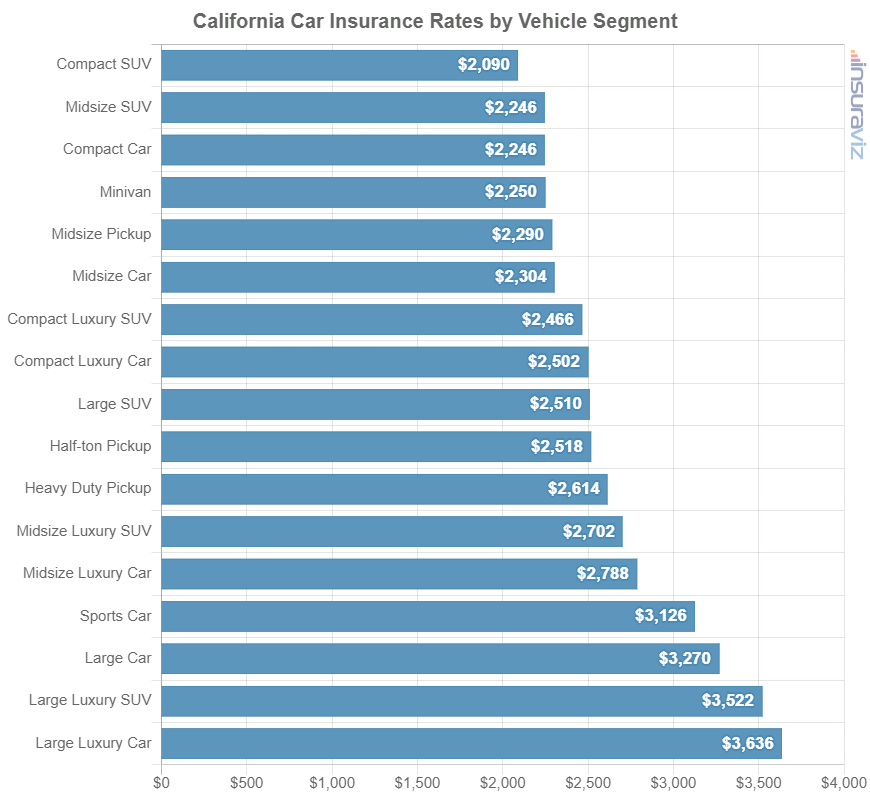

California car insurance rates by vehicle segment

The chart below shows average car insurance rates in California for different vehicle segments. Rates range from an average of around $1,500 per year for compact SUVs like the Ford Edge and Honda CR-V up to the highest rates for luxury car insurance and exotic performance cars at an average of over $2,500 per year for large luxury cars and over $3,400 per year for exotic performance models.

Cheapest car insurance in California

The models with the best car insurance rates in California are primarily compact SUVs like the Subaru Crosstrek, Kia Soul, Chevrolet Trailblazer, and Buick Envision, which cost an average of $193 or less per month for full coverage insurance.

Other vehicles that have some of the cheapest California car insurance rates are the Hyundai Venue at an average annual cost of $2,340, the Mazda CX-5 at $2,354, and the Volkswagen Tiguan at $2,386 per year.

The vehicle being insured is only part of the car insurance rate equation, however. Things like driving citations, at-fault accidents, policy deductibles, extra add-on coverages, your Zip Code, and many other factors all contribute to the bottom line cost of a policy.

Driving a Mercedes G63 AMG, a Tesla Model X, or a Porsche Cayenne will not be a good start in finding cheap car insurance in California. High-end models that cost a lot to drive off the lot are not going to be your best bet for cheap rates.

The models shown in the table below have below-average car insurance rates based on vehicle safety ratings, ease-of-repair, and liability loss history and are an excellent place to start when trying to find cheaper insurance in California, or really anywhere in the U.S.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,132 | $178 |

| 2 | Chevrolet Trailblazer | $2,166 | $181 |

| 3 | Kia Soul | $2,250 | $188 |

| 4 | Nissan Kicks | $2,270 | $189 |

| 5 | Honda Passport | $2,298 | $192 |

| 6 | Buick Envision | $2,312 | $193 |

| 7 | Toyota Corolla Cross | $2,328 | $194 |

| 8 | Hyundai Venue | $2,340 | $195 |

| 9 | Mazda CX-5 | $2,354 | $196 |

| 10 | Ford Bronco Sport | $2,360 | $197 |

| 11 | Volkswagen Tiguan | $2,386 | $199 |

| 12 | Acura RDX | $2,412 | $201 |

| 13 | Nissan Murano | $2,422 | $202 |

| 14 | Buick Encore | $2,450 | $204 |

| 15 | Subaru Outback | $2,456 | $205 |

| 16 | Honda CR-V | $2,458 | $205 |

| 17 | Buick Envista | $2,466 | $206 |

| 18 | Volkswagen Taos | $2,470 | $206 |

| 19 | Kia Niro | $2,482 | $207 |

| 20 | Toyota GR Corolla | $2,506 | $209 |

| 21 | Honda HR-V | $2,510 | $209 |

| 22 | Subaru Ascent | $2,510 | $209 |

| 23 | Nissan Leaf | $2,526 | $211 |

| 24 | Chevrolet Colorado | $2,540 | $212 |

| 25 | Honda Civic | $2,552 | $213 |

| 26 | Lexus NX 250 | $2,554 | $213 |

| 27 | Volkswagen Atlas | $2,558 | $213 |

| 28 | Acura Integra | $2,564 | $214 |

| 29 | Subaru Forester | $2,566 | $214 |

| 30 | Volkswagen Atlas Cross Sport | $2,570 | $214 |

| 31 | Kia Seltos | $2,576 | $215 |

| 32 | GMC Terrain | $2,580 | $215 |

| 33 | Nissan Rogue | $2,594 | $216 |

| 34 | Hyundai Kona | $2,596 | $216 |

| 35 | Mazda CX-30 | $2,602 | $217 |

| 36 | Cadillac XT4 | $2,604 | $217 |

| 37 | Volkswagen ID4 | $2,614 | $218 |

| 38 | Ford Explorer | $2,616 | $218 |

| 39 | Toyota Highlander | $2,626 | $219 |

| 40 | Ford Escape | $2,634 | $220 |

| 41 | Toyota Venza | $2,634 | $220 |

| 42 | Honda Odyssey | $2,636 | $220 |

| 43 | Nissan Sentra | $2,644 | $220 |

| 44 | Subaru Impreza | $2,652 | $221 |

| 45 | Chevrolet Equinox | $2,658 | $222 |

| 46 | Toyota RAV4 | $2,660 | $222 |

| 47 | Mazda MX-5 Miata | $2,668 | $222 |

| 48 | Mazda MX-30 | $2,678 | $223 |

| 49 | Hyundai Tucson | $2,680 | $223 |

| 50 | Chevrolet Traverse | $2,692 | $224 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all California Zip Codes. Updated October 24, 2025

Average rates in select California cities

Average annual and monthly car insurance rates are shown below for some of the larger cities in California. Click and visit any page for detailed rates including the cheapest cars, trucks, and SUVs to insure in each city.

- Los Angeles Car Insurance - $3,488 per year or $291 per month

- San Diego Car Insurance - $2,652 per year or $221 per month

- San Jose Car Insurance - $2,742 per year or $229 per month

- San Francisco Car Insurance - $3,124 per year or $260 per month

- Fresno Car Insurance - $2,754 per year or $230 per month

- Sacramento Car Insurance - $2,990 per year or $249 per month

- Long Beach Car Insurance - $2,926 per year or $244 per month

- Oakland Car Insurance - $3,110 per year or $259 per month