- Sacramento car insurance rates average $2,382 per year for full coverage, or approximately $199 per month.

- Sacramento auto insurance averages $110 per year more than the California state average cost and $499 per year more than the United States national average.

- Monthly car insurance rates for a few popular models in Sacramento include the Chevrolet Equinox at $183, Tesla Model 3 at $233, and Ford F150 at $222.

- For cheap car insurance in Sacramento, California, compact SUV models like the Chevrolet Trailblazer, Kia Soul, Honda CR-V, and Volkswagen Tiguan have better auto insurance rates.

How much is car insurance in Sacramento, CA?

The average price for car insurance in Sacramento is $2,382 per year, which is 23.4% more than the U.S. overall average rate of $1,883. Average car insurance cost per month in Sacramento is $199 for a full coverage policy.

In the state of California, the average car insurance cost is $2,272 per year, so the average cost in Sacramento is $110 more per year. The average cost to insure a vehicle in Sacramento compared to other California locations is about $494 per year cheaper than in Los Angeles, $340 per year more than in San Diego, and $250 per year more expensive than in San Jose.

The age of the rated driver is one of the biggest factors in determining the price of auto insurance, so the list below details how driver age influences cost by showing average car insurance rates for different driver ages.

Average car insurance cost for Sacramento, California, drivers age 16 to 60

- 16-year-old driver – $8,477 per year or $706 per month

- 17-year-old driver – $8,211 per year or $684 per month

- 18-year-old driver – $7,361 per year or $613 per month

- 19-year-old driver – $6,702 per year or $559 per month

- 20-year-old driver – $4,788 per year or $399 per month

- 30-year-old driver – $2,540 per year or $212 per month

- 40-year-old driver – $2,382 per year or $199 per month

- 50-year-old driver – $2,110 per year or $176 per month

- 60-year-old driver – $1,976 per year or $165 per month

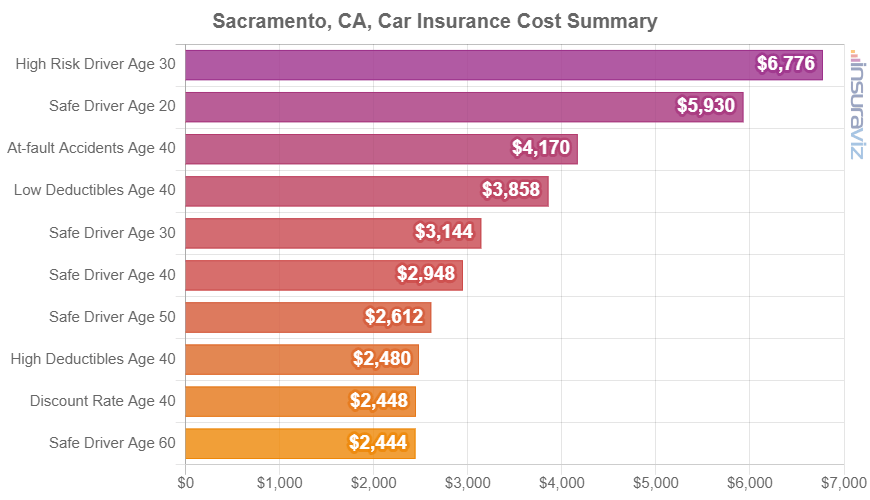

The next chart shows different average Sacramento auto insurance rates for a variety of different driver ages, deductibles, and risk profiles.

The average cost of car insurance per month in Sacramento is $199, with prices ranging from $165 to $456 for the data in the prior chart.

Car insurance rates can have wide price ranges and can also be very different depending on the company. The likelihood of a wide range of rates stresses the need for multiple auto insurance quotes when looking for the cheapest policy.

Popular vehicles and the cost of insurance

The previous car insurance rates in this article are averaged for every 2024 model year vehicle, which is practical for making big picture comparisons such as the average cost difference between different locations in California. Average auto insurance rates are a good metric when answering questions like “are Sacramento car insurance rates cheaper than in Fresno?” or “is California car insurance cheaper than Texas?”.

But for more useful cost comparisons, we will get better data if we look at the specific make and model of vehicle being insured. Each make and model has slightly different risk exposures for determining auto insurance prices and this data provides for detailed cost analysis.

The following chart breaks down average insurance rates in Sacramento for some of the most popular cars, trucks, and SUVs. Later on, we explore additional situations that affect the cost of insuring some of these vehicles in much more detail.

Which cars have cheap insurance in Sacramento, California?

The models with the best insurance rates in Sacramento tend to be crossovers and compact SUVs like the Kia Soul, Subaru Crosstrek, Nissan Kicks, and Hyundai Venue. Average car insurance quotes for those models cost $1,934 or less per year ($161 per month) for full coverage.

A few other vehicles that rank towards the top in the comparison table below are the Honda CR-V, Subaru Outback, Kia Niro, and Nissan Murano.

Average insurance cost is a little bit more for those models than the crossover SUVs at the top of the list, but they still have an average cost of $170 or less per month in Sacramento.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,758 | $147 |

| 2 | Chevrolet Trailblazer | $1,788 | $149 |

| 3 | Kia Soul | $1,856 | $155 |

| 4 | Nissan Kicks | $1,872 | $156 |

| 5 | Honda Passport | $1,896 | $158 |

| 6 | Buick Envision | $1,906 | $159 |

| 7 | Toyota Corolla Cross | $1,918 | $160 |

| 8 | Hyundai Venue | $1,934 | $161 |

| 9 | Mazda CX-5 | $1,942 | $162 |

| 10 | Ford Bronco Sport | $1,948 | $162 |

| 11 | Volkswagen Tiguan | $1,970 | $164 |

| 12 | Acura RDX | $1,988 | $166 |

| 13 | Nissan Murano | $2,000 | $167 |

| 14 | Buick Encore | $2,020 | $168 |

| 15 | Subaru Outback | $2,026 | $169 |

| 16 | Honda CR-V | $2,028 | $169 |

| 17 | Buick Envista | $2,034 | $170 |

| 18 | Chevrolet Colorado | $2,038 | $170 |

| 19 | Volkswagen Taos | $2,038 | $170 |

| 20 | Kia Niro | $2,040 | $170 |

| 21 | Toyota GR Corolla | $2,068 | $172 |

| 22 | Subaru Ascent | $2,070 | $173 |

| 23 | Honda HR-V | $2,072 | $173 |

| 24 | Nissan Leaf | $2,084 | $174 |

| 25 | Honda Civic | $2,106 | $176 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 23, 2024

The table above that contains 25 ranked vehicles is great if you’re just looking for low rates. A more thorough way to look at auto insurance rates in an analytical manner is to organize them by the segment they belong to.

This next article section discusses the average cost of car insurance for each vehicle segment. The average rates shown in the chart should provide a better idea of which vehicles have the cheapest rates. The subsequent sections break out and rank the top 20 cheapest models for each segment.

Average cost to insure by segment

If you’re shopping for a new vehicle, it’s important to know which categories of vehicles have cheaper car insurance rates in Sacramento.

For instance, you may be wondering if midsize SUVs have cheaper insurance than small SUVs or which size of pickup has more affordable insurance.

The next chart displays average car insurance cost by vehicle segment in Sacramento. From a segment perspective, small and midsize SUVs, vans and minivans, and midsize pickup trucks tend to have the best average rates, while sports cars and performance luxury models have the most expensive overall car insurance rates.

Rates by different vehicle segments are handy to form a general comparison, but the insurance cost for specific vehicles ranges considerably within each vehicle segment shown in the above chart.

For example, in the small car segment, rates range from the Toyota GR Corolla at $2,068 per year for full coverage insurance to the Toyota Mirai at $2,962 per year, a difference of $894 within that segment.

As another example, in the midsize truck segment, rates range from the Chevrolet Colorado at $2,038 per year to the Rivian R1T costing $2,968 per year.

In these next sections, we eliminate a lot of this variability by looking at the cost of car insurance in Sacramento at the model level rather than the segment level.

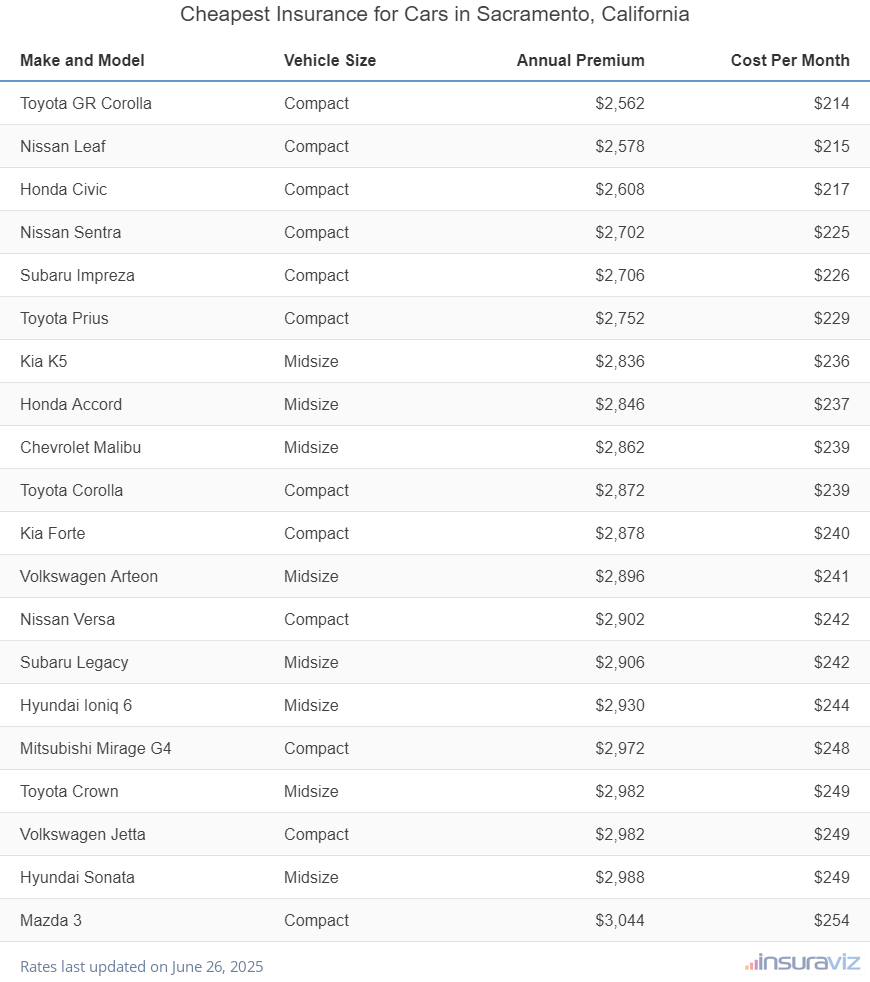

Cars with the best auto insurance rates in Sacramento, CA

Ranking near the top for the most affordable Sacramento car insurance rates in the car segment (excluding luxury models) are the Subaru Impreza, Nissan Sentra, Nissan Leaf, Toyota GR Corolla, and Honda Civic. Auto insurance rates for these 2024 models average $182 or less per month.

Other models that have cheaper rates include the Hyundai Ioniq 6, Honda Accord, Toyota Prius, and Chevrolet Malibu, with an average car insurance cost of $2,310 per year or less.

From a monthly standpoint, full-coverage auto insurance on this segment in Sacramento for a middle-age safe driver starts at around $172 per month, depending on the company and where you live.

The next table ranks the cars with the lowest-cost insurance rates in Sacramento, starting with the Toyota GR Corolla at $172 per month and ending with the Mazda 3 at $205 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,068 | $172 |

| Nissan Leaf | Compact | $2,084 | $174 |

| Honda Civic | Compact | $2,106 | $176 |

| Nissan Sentra | Compact | $2,180 | $182 |

| Hyundai Ioniq 6 | Midsize | $2,186 | $182 |

| Subaru Impreza | Compact | $2,188 | $182 |

| Toyota Prius | Compact | $2,224 | $185 |

| Kia K5 | Midsize | $2,292 | $191 |

| Honda Accord | Midsize | $2,296 | $191 |

| Chevrolet Malibu | Midsize | $2,310 | $193 |

| Toyota Corolla | Compact | $2,318 | $193 |

| Kia Forte | Compact | $2,324 | $194 |

| Volkswagen Arteon | Midsize | $2,338 | $195 |

| Nissan Versa | Compact | $2,346 | $196 |

| Subaru Legacy | Midsize | $2,350 | $196 |

| Mitsubishi Mirage G4 | Compact | $2,404 | $200 |

| Toyota Crown | Midsize | $2,408 | $201 |

| Volkswagen Jetta | Compact | $2,408 | $201 |

| Hyundai Sonata | Midsize | $2,414 | $201 |

| Mazda 3 | Compact | $2,462 | $205 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 23, 2024

For more car insurance comparisons, see our guides for compact car insurance, midsize car insurance, and full-size car insurance.

Don’t see your vehicle? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Sacramento car insurance quotes from top-rated companies in California.

SUVs with the best car insurance rates in Sacramento

Ranking in the top five for the cheapest Sacramento car insurance rates in the SUV segment (excluding luxury models) are the Nissan Kicks, Honda Passport, Kia Soul, Chevrolet Trailblazer, and Subaru Crosstrek. Car insurance quotes for these 2024 models average $158 or less per month.

Some other SUVs that have cheaper rates include the Toyota Corolla Cross, Hyundai Venue, Ford Bronco Sport, and Mazda CX-5, with an average cost to insure of $1,948 per year or less.

Additional models that rank well include the Kia Niro, Honda CR-V, Subaru Ascent, Honda HR-V, and Subaru Outback, which cost between $1,948 and $2,072 per year for full-coverage insurance.

From a monthly standpoint, car insurance rates on this segment in Sacramento for a middle-age safe driver can cost as low as $147 per month, depending on your company and location.

When prices are compared by SUV size, the cheapest compact SUV to insure in Sacramento is the Subaru Crosstrek at $1,758 per year, or $147 per month. For midsize SUVs, the Honda Passport has the cheapest rates at $1,896 per year, or $158 per month. And for full-size SUVs, the Chevrolet Tahoe is cheapest to insure at $2,234 per year, or $186 per month.

The rate comparison table below ranks the twenty SUVs with the most affordable insurance rates in Sacramento.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,758 | $147 |

| Chevrolet Trailblazer | Compact | $1,788 | $149 |

| Kia Soul | Compact | $1,856 | $155 |

| Nissan Kicks | Compact | $1,872 | $156 |

| Honda Passport | Midsize | $1,896 | $158 |

| Buick Envision | Compact | $1,906 | $159 |

| Toyota Corolla Cross | Compact | $1,918 | $160 |

| Hyundai Venue | Compact | $1,934 | $161 |

| Mazda CX-5 | Compact | $1,942 | $162 |

| Ford Bronco Sport | Compact | $1,948 | $162 |

| Volkswagen Tiguan | Compact | $1,970 | $164 |

| Nissan Murano | Midsize | $2,000 | $167 |

| Buick Encore | Compact | $2,020 | $168 |

| Subaru Outback | Midsize | $2,026 | $169 |

| Honda CR-V | Compact | $2,028 | $169 |

| Buick Envista | Midsize | $2,034 | $170 |

| Volkswagen Taos | Compact | $2,038 | $170 |

| Kia Niro | Compact | $2,040 | $170 |

| Subaru Ascent | Midsize | $2,070 | $173 |

| Honda HR-V | Compact | $2,072 | $173 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 23, 2024

See our guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view any vehicles not shown in the table.

Don’t see your vehicle? Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top companies in California.

Pickup trucks with cheap car insurance in Sacramento

Ranking at the top for the most affordable Sacramento car insurance rates in the pickup segment are the Ford Ranger, Chevrolet Colorado, Ford Maverick, Nissan Titan, and Nissan Frontier. Car insurance rates for these vehicles average $192 or less per month.

Not the cheapest, but still very affordable, are trucks like the GMC Canyon, Hyundai Santa Cruz, Honda Ridgeline, and Toyota Tacoma, with an average car insurance cost of $2,448 per year or less.

As a cost per month, full-coverage insurance in Sacramento on this segment for the average driver starts at around $170 per month, depending on your location and insurance company.

The next table ranks the twenty pickups with the most affordable average car insurance rates in Sacramento, starting with the Chevrolet Colorado at $2,038 per year and ending with the Ram Truck at $2,752 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,038 | $170 |

| Nissan Titan | Full-size | $2,228 | $186 |

| Nissan Frontier | Midsize | $2,250 | $188 |

| Ford Ranger | Midsize | $2,274 | $190 |

| Ford Maverick | Midsize | $2,306 | $192 |

| Honda Ridgeline | Midsize | $2,362 | $197 |

| Hyundai Santa Cruz | Midsize | $2,402 | $200 |

| Toyota Tacoma | Midsize | $2,410 | $201 |

| GMC Sierra 2500 HD | Heavy Duty | $2,420 | $202 |

| GMC Canyon | Midsize | $2,448 | $204 |

| Jeep Gladiator | Midsize | $2,508 | $209 |

| GMC Sierra 3500 | Heavy Duty | $2,524 | $210 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,544 | $212 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,612 | $218 |

| GMC Sierra | Full-size | $2,628 | $219 |

| Chevrolet Silverado | Full-size | $2,630 | $219 |

| Nissan Titan XD | Heavy Duty | $2,630 | $219 |

| Ford F150 | Full-size | $2,664 | $222 |

| GMC Hummer EV Pickup | Full-size | $2,728 | $227 |

| Ram Truck | Full-size | $2,752 | $229 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 23, 2024

See our guides for midsize pickup insurance and large pickup insurance to view any trucks not shown in the table.

Don’t see your pickup model? That’s no problem! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in California.

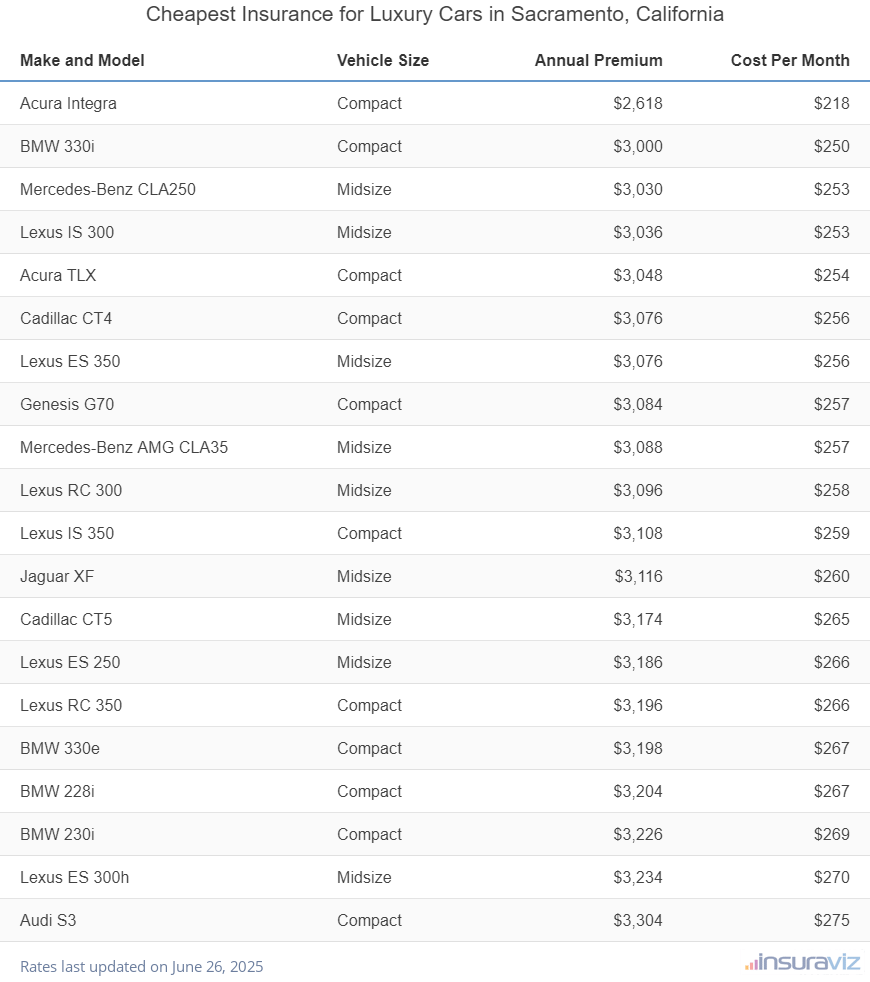

Most affordable luxury car insurance rates in Sacramento, CA

The four top-ranked luxury car models with the most affordable auto insurance in Sacramento are the Acura Integra at $2,114 per year, BMW 330i at $2,422 per year, Mercedes-Benz CLA250 at $2,450 per year, and Lexus IS 300 at $2,452 per year.

Not the cheapest luxury cars to insure, but still very reasonable, are luxury cars like the Mercedes-Benz AMG CLA35, Cadillac CT4, Genesis G70, and Lexus RC 300, with average rates of $2,502 per year or less.

Auto insurance for this segment in Sacramento can cost as low as $176 per month, depending on your location.

The lowest-cost compact luxury car to insure in Sacramento is the Acura Integra at $2,114 per year. For midsize 2024 models, the Mercedes-Benz CLA250 is the cheapest model to insure at $2,450 per year. And for full-size models, the Audi A5 has the best rates at $2,820 per year.

The table below ranks the twenty luxury cars with the most affordable average car insurance rates in Sacramento.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,114 | $176 |

| BMW 330i | Compact | $2,422 | $202 |

| Mercedes-Benz CLA250 | Midsize | $2,450 | $204 |

| Lexus IS 300 | Midsize | $2,452 | $204 |

| Acura TLX | Compact | $2,462 | $205 |

| Lexus ES 350 | Midsize | $2,484 | $207 |

| Cadillac CT4 | Compact | $2,486 | $207 |

| Genesis G70 | Compact | $2,492 | $208 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,494 | $208 |

| Lexus RC 300 | Midsize | $2,502 | $209 |

| Lexus IS 350 | Compact | $2,504 | $209 |

| Jaguar XF | Midsize | $2,518 | $210 |

| Cadillac CT5 | Midsize | $2,564 | $214 |

| Lexus ES 250 | Midsize | $2,574 | $215 |

| Lexus RC 350 | Compact | $2,582 | $215 |

| BMW 330e | Compact | $2,584 | $215 |

| BMW 228i | Compact | $2,588 | $216 |

| BMW 230i | Compact | $2,610 | $218 |

| Lexus ES 300h | Midsize | $2,612 | $218 |

| Audi S3 | Compact | $2,668 | $222 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 22, 2024

See our guide for luxury car insurance to compare rates for all makes and models.

Don’t see insurance cost for your luxury car? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Sacramento car insurance quotes from top companies in California.

Luxury SUVs with cheap auto insurance in Sacramento

Ranking highest for the cheapest Sacramento auto insurance rates in the luxury SUV segment are the Cadillac XT4, Jaguar E-Pace, Cadillac XT5, Lexus NX 250, and Acura RDX. Rates for these models average $2,246 or less per year.

Other luxury SUVs that have affordable insurance rates include the Lincoln Corsair, Mercedes-Benz GLB 250, Lexus NX 450h, and Lexus NX 350h, with an average cost to insure of $2,294 per year or less.

In the bottom half of the top 20, models like the Lexus RX 350, Acura MDX, Land Rover Evoque, Infiniti QX50, Infiniti QX60, and Cadillac XT6 average between $2,294 and $2,388 per year to insure.

Car insurance in Sacramento for this segment for an average middle-age driver starts at around $166 per month, depending on where you live.

The lowest-cost small luxury SUV to insure in Sacramento is the Acura RDX at $1,988 per year. For midsize 2024 models, the Jaguar E-Pace is the cheapest model to insure at $2,226 per year. And for full-size luxury SUVs, the Infiniti QX80 has the best rates at $2,668 per year.

The comparison table below ranks the luxury SUVs with the cheapest car insurance rates in Sacramento, starting with the Acura RDX at $1,988 per year and ending with the Lexus NX 350 at $2,388 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,988 | $166 |

| Lexus NX 250 | Compact | $2,106 | $176 |

| Cadillac XT4 | Compact | $2,148 | $179 |

| Jaguar E-Pace | Midsize | $2,226 | $186 |

| Lexus NX 350h | Compact | $2,244 | $187 |

| Cadillac XT5 | Midsize | $2,246 | $187 |

| Lincoln Corsair | Compact | $2,272 | $189 |

| Mercedes-Benz GLB 250 | Compact | $2,278 | $190 |

| Lexus UX 250h | Compact | $2,282 | $190 |

| Lexus NX 450h | Compact | $2,294 | $191 |

| Infiniti QX50 | Midsize | $2,312 | $193 |

| Mercedes-Benz GLA250 | Compact | $2,314 | $193 |

| Cadillac XT6 | Midsize | $2,328 | $194 |

| Mercedes-Benz GLA35 AMG | Compact | $2,328 | $194 |

| Infiniti QX60 | Midsize | $2,342 | $195 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,344 | $195 |

| Land Rover Evoque | Compact | $2,374 | $198 |

| Acura MDX | Midsize | $2,378 | $198 |

| Lexus RX 350 | Midsize | $2,380 | $198 |

| Lexus NX 350 | Compact | $2,388 | $199 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 23, 2024

See our guide for luxury SUV insurance to view luxury vehicles not shown in the table.

Don’t see your luxury SUV in the table above? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Sacramento car insurance quotes from top-rated companies in California.

Sports cars with cheap auto insurance

The four top-ranked sports cars with the cheapest auto insurance in Sacramento are the Mazda MX-5 Miata at $2,202 per year, Toyota GR86 at $2,508 per year, Ford Mustang at $2,616 per year, and BMW Z4 at $2,628 per year.

Some other sports cars that have cheaper rates include the Lexus RC F, Toyota GR Supra, Subaru BRZ, and BMW M2, with an average car insurance cost of $2,846 per year or less.

Additional 2024 models worth mentioning include the Chevrolet Camaro, BMW M3, Mercedes-Benz AMG GT53, and Porsche Taycan, which cost between $2,846 and $4,032 per year for auto insurance.

From a cost per month standpoint, full-coverage insurance in this segment will start around $184 per month, depending on the company and your location.

The table below ranks the twenty sports cars with the lowest-cost average auto insurance rates in Sacramento, starting with the Mazda MX-5 Miata at $184 per month and ending with the Porsche Taycan at $336 per month.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,202 | $184 |

| Toyota GR86 | Sports Car | $2,508 | $209 |

| Ford Mustang | Sports Car | $2,616 | $218 |

| BMW Z4 | Sports Car | $2,628 | $219 |

| Subaru WRX | Sports Car | $2,670 | $223 |

| Toyota GR Supra | Sports Car | $2,672 | $223 |

| BMW M2 | Sports Car | $2,750 | $229 |

| Nissan Z | Sports Car | $2,756 | $230 |

| Lexus RC F | Sports Car | $2,812 | $234 |

| Subaru BRZ | Sports Car | $2,846 | $237 |

| BMW M3 | Sports Car | $3,006 | $251 |

| Porsche 718 | Sports Car | $3,062 | $255 |

| Chevrolet Camaro | Sports Car | $3,092 | $258 |

| Chevrolet Corvette | Sports Car | $3,296 | $275 |

| Porsche 911 | Sports Car | $3,408 | $284 |

| BMW M4 | Sports Car | $3,554 | $296 |

| Lexus LC 500 | Sports Car | $3,570 | $298 |

| Jaguar F-Type | Sports Car | $3,754 | $313 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,940 | $328 |

| Porsche Taycan | Sports Car | $4,032 | $336 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Sacramento, CA Zip Codes. Updated February 23, 2024

Don’t see rates for your sports car? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from top companies in Sacramento.

Examples of rate variation

To help show how much the cost of car insurance can deviate for different drivers (and also underscore the importance of accurate price quotes), the sections below have detailed auto insurance rates for four popular vehicles in Sacramento: the Chevrolet Silverado, Nissan Sentra, Honda CR-V, and Honda Accord.

The example for each vehicle uses a range of risk profiles to illustrate how rates can be very different based on driver risk profile and policy coverages.

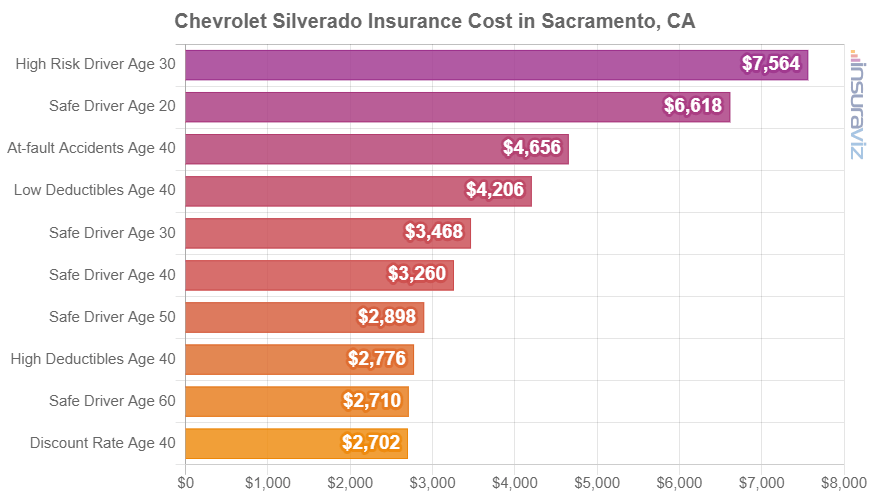

Chevrolet Silverado insurance rates

In Sacramento, Chevrolet Silverado insurance costs an average of $2,630 per year ($219 per month) and ranges from $2,182 to $6,108 per year.

The Chevrolet Silverado is classified as a full-size truck, and other similar models from the same segment include the Toyota Tundra, GMC Sierra, and Ford F150.

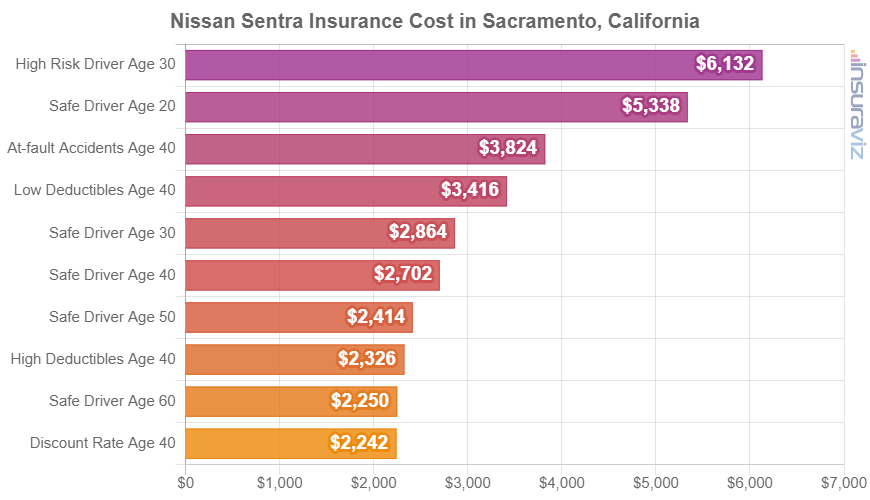

Nissan Sentra insurance rates

Nissan Sentra insurance in Sacramento averages $2,180 per year, or about $182 per month, and has a range of $1,810 to $4,954 per year.

The Nissan Sentra is part of the compact car segment, and other models popular in Sacramento include the Hyundai Elantra, Honda Civic, and Volkswagen Jetta.

Honda CR-V insurance rates

Auto insurance for a Honda CR-V in Sacramento averages $2,028 per year (about $169 per month) and ranges from $1,686 to $4,664 annually.

The Honda CR-V belongs to the compact SUV segment, and additional similar models from the same segment include the Toyota RAV4, Nissan Rogue, and Ford Escape.

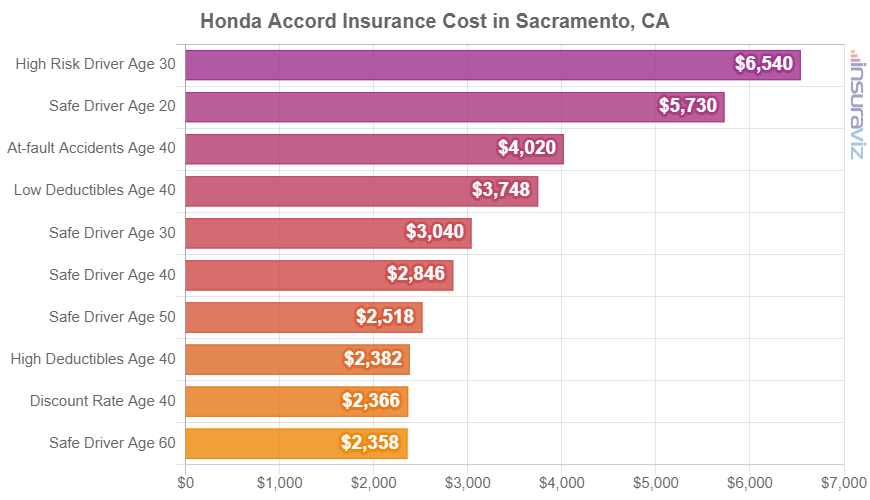

Honda Accord insurance rates

Auto insurance for a Honda Accord in Sacramento averages $2,296 per year (about $191 per month) and ranges from $1,910 to $5,284 annually.

The Honda Accord is considered a midsize car, and additional models from the same segment that are popular in Sacramento include the Hyundai Sonata, Kia K5, and Chevrolet Malibu.

How to save on auto insurance in Sacramento

Resourceful drivers in Sacramento are always looking to reduce the monthly expense for car insurance So take a minute to review the money-saving tips in this next list and it’s very possible you can save a few bucks on your next policy purchase.

- Your occupation could lower your rates. Some auto insurance companies offer discounts for occupations like doctors, scientists, lawyers, emergency medical technicians, engineers, and others. Being employed in a qualifying profession could save between $71 and $232 on your yearly insurance bill, depending on the age of the driver.

- Auto insurance is cheaper with higher deductibles. Raising your policy deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Stay claim free and save. Most auto insurance companies offer discounts if you have no claims on your account. Auto insurance is intended to be used to protect you from significant financial loss, not small claims that can be paid out-of-pocket.

- Choose vehicles that have low cost car insurance. Vehicle performance is one of the primary factors in the cost of car insurance. As an example, a Subaru Crosstrek costs $1,650 less per year to insure in Sacramento than a Porsche 911. Choose vehicles with less performance to save money.

- Bring up your credit score to save money. Having a high credit rating of over 800 may save up to $374 per year over a credit score ranging from 670-739. Conversely, a weak credit score could cost up to $434 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Fewer accidents means cheaper auto insurance rates. At-fault accidents raise insurance rates, as much as $3,396 per year for a 20-year-old driver and even $580 per year for a 60-year-old driver. So be a careful driver and save!

- Compare insurance costs before buying a car. Different cars, trucks, and SUVs have very different costs for insurance, and insurers charge a wide range of costs. Check rates before you purchase to prevent price shock when you get the bill.