- Waukesha car insurance cost averages $1,966 per year for a full coverage insurance policy.

- Monthly auto insurance rates for a few popular models in Waukesha include the Subaru Forester at $146 per month, Nissan Rogue at $147, and Nissan Altima at $178.

- SUV models like the Buick Envision, Nissan Kicks, and Toyota Corolla Cross tend to have cheap car insurance in Waukesha.

- A few models with the lowest cost car insurance in their respective segments include the Jaguar E-Pace ($153 per month), Chevrolet Colorado ($144 per month), Toyota GR Corolla ($143 per month), and Mercedes-Benz CLA250 ($169 per month).

The average cost of car insurance in Waukesha

Waukesha car insurance costs an average of $1,966 per year, which is 14.6% less than the U.S. average rate of $2,276. Average car insurance cost per month in Waukesha is $164 for a full-coverage car insurance policy.

In the state of Wisconsin, average auto insurance cost is $2,022 per year, so the cost in Waukesha runs about $56 less per year.

When compared to other Wisconsin cities, insuring the average vehicle in Waukesha costs approximately $76 per year more than in Green Bay, $354 per year cheaper than in Racine, and $84 per year less than in Madison.

The age of the driver has the biggest impact on the price you pay for car insurance. The list below illustrates this by breaking out average car insurance rates for driver ages from 16 to 60.

Average cost of car insurance in Waukesha for drivers age 16 to 60

- 16-year-old driver – $7,005 per year or $584 per month

- 17-year-old driver – $6,788 per year or $566 per month

- 18-year-old driver – $6,082 per year or $507 per month

- 19-year-old driver – $5,538 per year or $462 per month

- 20-year-old driver – $3,956 per year or $330 per month

- 30-year-old driver – $2,098 per year or $175 per month

- 40-year-old driver – $1,966 per year or $164 per month

- 50-year-old driver – $1,742 per year or $145 per month

- 60-year-old driver – $1,632 per year or $136 per month

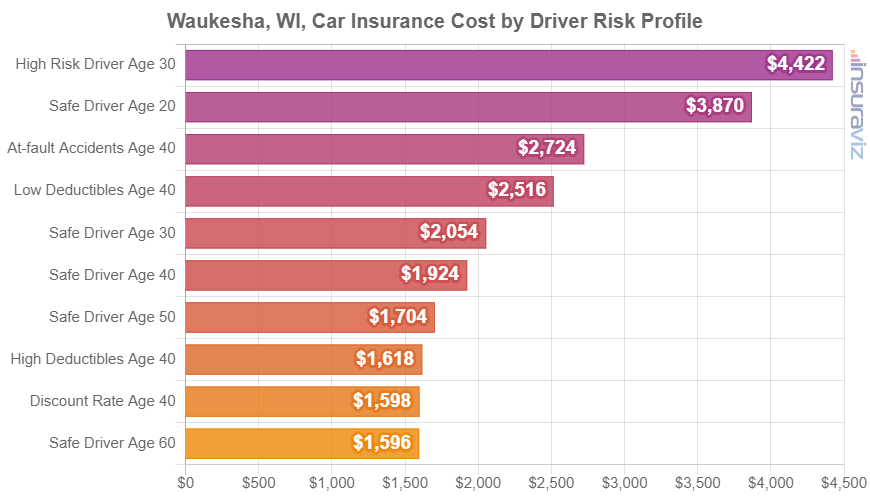

The chart below goes into more detail for drivers age 20 to 60 by showing a range of rates for a range of driver ages and risk profiles.

The average cost of auto insurance per month in Waukesha is $164, with policy prices ranging from $136 to $377 for the average costs shown in the chart.

Cost of car insurance for top-selling models

Average car insurance rates are great for getting answers to questions like “is auto insurance in Waukesha cheaper than Kenosha?” or “is Wisconsin auto insurance cheaper than Texas?”.

But most people are looking for rates on a specific make and model of vehicle. The list below breaks down average annual and monthly insurance rates in Waukesha for some of the more popular vehicles.

Auto insurance rates for popular Waukesha vehicles

- Subaru Forester – $1,752 per year ($146 per month)

- Nissan Rogue – $1,768 per year ($147 per month)

- Nissan Altima – $2,130 per year ($178 per month)

- Toyota RAV4 – $1,814 per year ($151 per month)

- Toyota Highlander – $1,788 per year ($149 per month)

- Ford Explorer – $1,784 per year ($149 per month)

- Jeep Grand Cherokee – $1,966 per year ($164 per month)

- Tesla Model 3 – $2,310 per year ($193 per month)

- Toyota Corolla – $1,918 per year ($160 per month)

- Chevrolet Equinox – $1,812 per year ($151 per month)

Are popular vehicles the cheapest to insure? The answer is a resounding “no”. In fact, in the next section, we break down the 30 cheapest vehicles to insure in Waukesha. Only one of the popular models in the list above makes the cut for the top 30. Can you find which one?

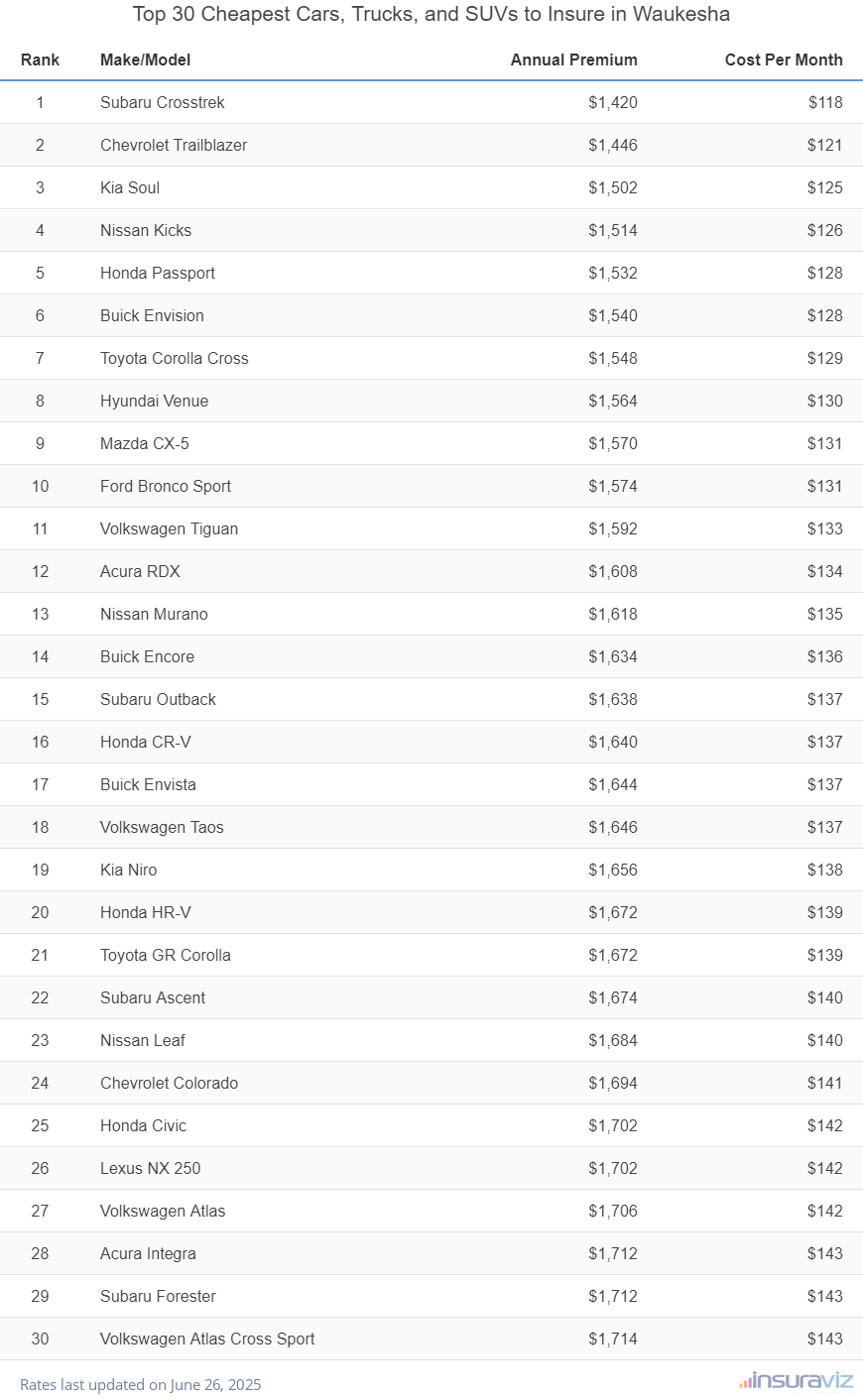

Top 30 cheapest cars to insure in Waukesha

The vehicles with the best auto insurance prices in Waukesha, WI, tend to be small SUVs like the Kia Soul, Chevrolet Trailblazer, Toyota Corolla Cross, and Hyundai Venue.

Average insurance rates for vehicles ranking in the top ten cost $1,610 or less per year to get full coverage.

Additional models that are highly ranked in our car insurance cost comparison are the Ford Bronco Sport, Volkswagen Tiguan, Buick Envista, and Buick Encore. Average insurance cost is slightly more for those models than the cheapest crossovers and small SUVs at the top of the list, but they still have an average cost of $1,710 or less per year.

The table below ranks the 30 models with the cheapest car insurance in Waukesha, sorted by annual and monthly insurance premium.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,454 | $121 |

| 2 | Chevrolet Trailblazer | $1,476 | $123 |

| 3 | Kia Soul | $1,534 | $128 |

| 4 | Nissan Kicks | $1,548 | $129 |

| 5 | Honda Passport | $1,564 | $130 |

| 6 | Buick Envision | $1,578 | $132 |

| 7 | Toyota Corolla Cross | $1,584 | $132 |

| 8 | Hyundai Venue | $1,598 | $133 |

| 9 | Mazda CX-5 | $1,604 | $134 |

| 10 | Ford Bronco Sport | $1,610 | $134 |

| 11 | Volkswagen Tiguan | $1,628 | $136 |

| 12 | Acura RDX | $1,646 | $137 |

| 13 | Nissan Murano | $1,650 | $138 |

| 14 | Buick Encore | $1,670 | $139 |

| 15 | Honda CR-V | $1,676 | $140 |

| 16 | Subaru Outback | $1,676 | $140 |

| 17 | Buick Envista | $1,682 | $140 |

| 18 | Volkswagen Taos | $1,686 | $141 |

| 19 | Kia Niro | $1,694 | $141 |

| 20 | Subaru Ascent | $1,708 | $142 |

| 21 | Honda HR-V | $1,710 | $143 |

| 22 | Toyota GR Corolla | $1,710 | $143 |

| 23 | Nissan Leaf | $1,722 | $144 |

| 24 | Chevrolet Colorado | $1,732 | $144 |

| 25 | Honda Civic | $1,738 | $145 |

| 26 | Lexus NX 250 | $1,740 | $145 |

| 27 | Volkswagen Atlas | $1,746 | $146 |

| 28 | Acura Integra | $1,748 | $146 |

| 29 | Subaru Forester | $1,752 | $146 |

| 30 | Volkswagen Atlas Cross Sport | $1,752 | $146 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Waukesha, WI Zip Codes. Updated October 24, 2025

A few additional models that made the top 30 table above include the Subaru Forester, Subaru Ascent, Volkswagen Atlas, and Honda HR-V. Rates for those vehicles cost between $1,710 and $1,752 per year.

To get a feel for how these cheaper rates compare to some models that are more expensive to insure, the Hyundai Sonata costs $1,996 per year, the Dodge Challenger averages $2,962, and the Lexus LX 570 averages $2,778.

The next section details the average price of auto insurance in Waukesha for each vehicle segment. The rates shown in the chart will give you a good idea of which types of vehicles have the most affordable rates.

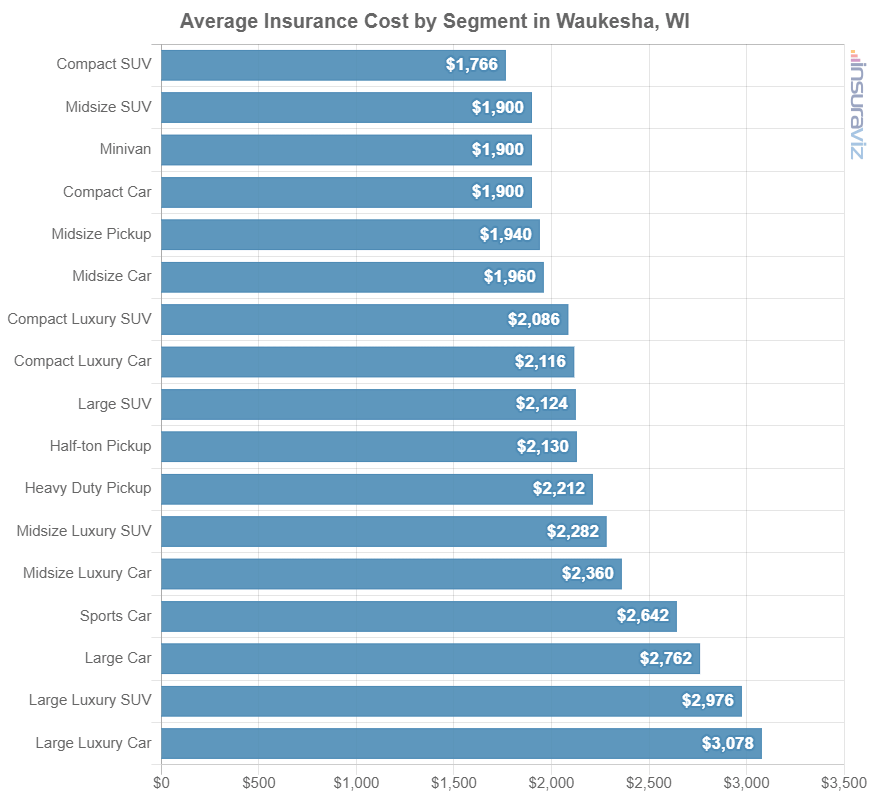

Average insurance cost by segment

If a different vehicle is in your future, it’s good to know which kinds of vehicles have less expensive insurance rates.

The chart below shows average auto insurance rates by segment, adjusted for the Waukesha area. Typically, compact and midsize SUVs, vans, and midsize pickups have the cheapest rates, with sports cars and performance luxury models having the highest average insurance cost.

It’s important to point out that the range of rates in each segment can be rather large, which just means that it’s important to look at rates for the specific make and model of vehicle, rather than the segment as a whole.

For example, in the midsize car segment, Waukesha insurance rates range from the Kia K5 at $1,894 per year for a full coverage policy up to the Tesla Model 3 at $2,310 per year.

Another example, in the large luxury SUV segment, rates can range from the Infiniti QX80 costing $2,206 per year up to the Mercedes-Benz G63 AMG at $4,228 per year.

When shopping for a different vehicle, you may know the type of vehicle you want (i.e. midsize SUV or full-size pickup), but you just want a model that has good insurance rates.

In the list below, you can find the specific model with the best car insurance rates in Waukesha, WI, for each individual category. Average yearly and monthly car insurance quotes are shown for each one. Click on any model for additional detailed rate comparisons.

- Cheapest compact car to insure – Toyota GR Corolla at $1,710 per year or $143 per month

- Cheapest compact SUV to insure – Subaru Crosstrek at $1,454 per year or $121 per month

- Cheapest midsize car to insure – Kia K5 at $1,894 per year or $158 per month

- Cheapest midsize SUV to insure – Honda Passport at $1,564 per year or $130 per month

- Cheapest full-size car to insure – Chrysler 300 at $1,872 per year or $156 per month

- Cheapest full-size SUV to insure – Chevrolet Tahoe at $1,846 per year or $154 per month

- Cheapest midsize pickup to insure – Chevrolet Colorado at $1,732 per year or $144 per month

- Cheapest full-size pickup to insure – Nissan Titan at $1,840 per year or $153 per month

- Cheapest heavy duty pickup to insure – GMC Sierra 2500 HD at $2,002 per year or $167 per month

- Cheapest minivan to insure – Honda Odyssey at $1,796 per year or $150 per month

- Cheapest sports car to insure – Mazda MX-5 Miata at $1,818 per year or $152 per month

- Cheapest compact luxury car to insure – Acura Integra at $1,748 per year or $146 per month

- Cheapest compact luxury SUV to insure – Acura RDX at $1,646 per year or $137 per month

- Cheapest midsize luxury car to insure – Mercedes-Benz CLA250 at $2,022 per year or $169 per month

- Cheapest midsize luxury SUV to insure – Jaguar E-Pace at $1,840 per year or $153 per month

- Cheapest full-size luxury car to insure – Audi A5 at $2,336 per year or $195 per month

- Cheapest full-size luxury SUV to insure – Infiniti QX80 at $2,206 per year or $184 per month

But wait, there’s more!

We’ve talked about average rates and the cheapest rates, but the last thing we want to touch on is how much rates can vary for specific models.

We took three popular vehicles, the Chevy Silverado, Honda Civic, and Honda CR-V, and rated them for different driver ages, risk profiles (like high-risk and safe drivers), and even used a combination of different policy deductibles.

The point of these examples is to show how much car insurance rates can vary just from minor differences in policy rating factors.

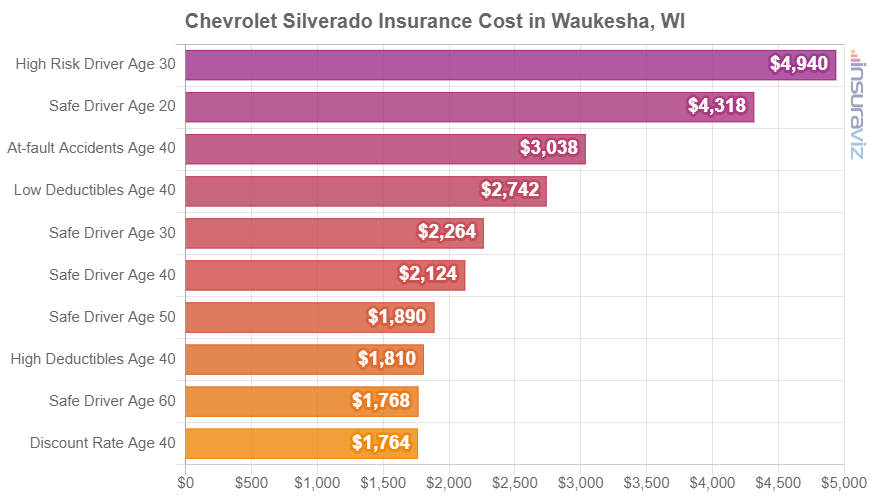

Chevrolet Silverado insurance rates

The average price paid for Chevrolet Silverado insurance in Waukesha is $2,178 per year. With Silverado purchase prices ranging from $39,900 to $105,000, average car insurance quotes on a 2024 Chevrolet Silverado cost from $1,844 per year on the Chevrolet Silverado EV WT model up to $2,580 per year for the Chevrolet Silverado EV RST First Edition model.

The rate chart below shows how the cost of car insurance for a Chevrolet Silverado can be very different based on different driver ages and common risk profiles.

For our example drivers, cost ranges from $1,802 to $5,048 per year, which is a price difference of $3,246 just by factoring different driver risk profiles.

The Chevrolet Silverado belongs to the full-size truck segment, and additional similar models from the same segment include the Toyota Tundra, GMC Sierra, Ford F150, and Nissan Titan.

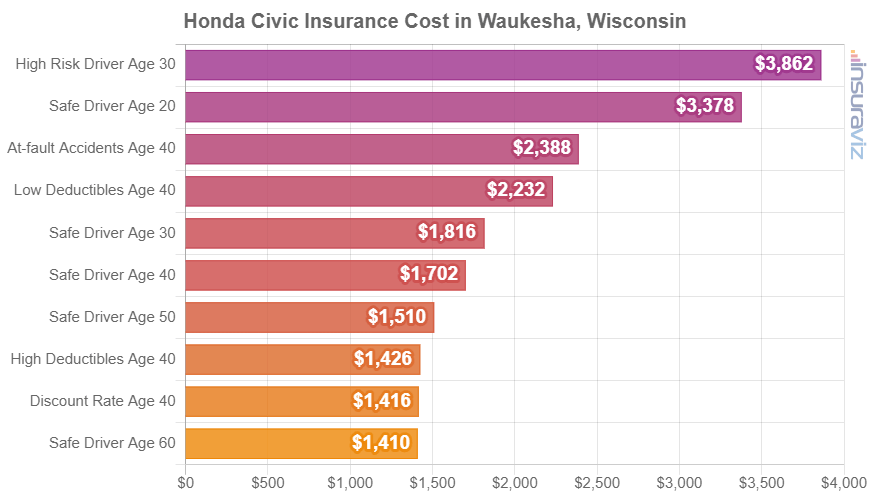

Honda Civic insurance rates

In Waukesha, the cheapest car insurance rates for a 2024 Honda Civic are on the LX trim model, costing an average of $1,558 per year, or about $130 per month. The average MSRP for the Civic is $23,950 when driving a new one off the dealer lot.

The most expensive 2022 Honda Civic trim level to insure in Waukesha is the Type R model, costing an average of $2,064 per year, or about $172 per month. The MSRP for this model is $43,795, not including charges and fees.

From a cost per month standpoint, full-coverage insurance for a Honda Civic for the average driver can cost from $130 to $172 per month, depending on policy limits and where you live in Waukesha.

The bar chart below might help you understand how car insurance rates on a Honda Civic can change based on different driver ages and common policy situations.

The Honda Civic belongs to the compact car segment, and other popular models in the same segment include the Kia Forte, Volkswagen Jetta, and Toyota Corolla.

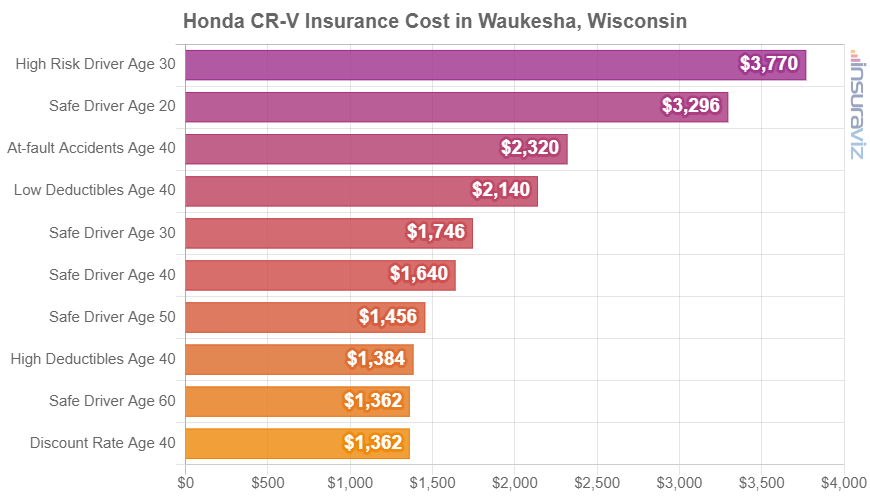

Honda CR-V insurance rates

The average cost of Honda CR-V insurance in Waukesha is $1,676 per year. With a purchase price ranging from $29,500 to $39,850, average car insurance quotes for a 2024 Honda CR-V cost from $1,588 per year on the Honda CR-V LX model up to $1,770 per year on the Honda CR-V Sport Touring Hybrid AWD trim level.

The next rate chart should aid in understanding how auto insurance quotes for a Honda CR-V can be quite different based on different driver ages and policy risk profiles.

For this example, rates vary from $1,392 to $3,854 per year, which is a price difference of $2,462 just for changes in rated drivers.

The Honda CR-V is classified as a compact SUV, and additional similar models from the same segment include the Toyota RAV4, Chevrolet Equinox, and Mazda CX-5.