- Audi RS 6 insurance costs an average of $3,564 per year, or around $297 per month, for full coverage.

- Audi RS 6 ranks as the most expensive luxury midsize SUV to insure for the 2022 model year. It costs $714 more per year on average as compared to the rest of the vehicles in the segment.

How much does Audi RS 6 insurance cost?

Audi RS 6 insurance rates cost an average of $3,564 yearly, or $297 monthly. Drivers can expect to pay around $714 more annually to insure an Audi RS 6 compared to the average rate for midsize luxury SUVs, and $1,288 more per year than the $2,276 national average.

The bar chart below illustrates average insurance cost for an Audi RS 6 for different driver age groups and policy risk profiles.

How does Audi RS 6 insurance cost compare?

When average rates are compared to some other models in the midsize luxury SUV category, car insurance rates for an Audi RS 6 cost $1,158 more per year than the Lexus RX 350, $496 more than the BMW X5, and $1,168 more than the Acura MDX.

The Audi RS 6 ranks 38th out of 41 total vehicles in the 2024 midsize luxury SUV category for most affordable insurance cost. The RS 6 costs an average of $3,564 per year for an auto insurance policy with full coverage, while the category average auto insurance cost is $2,850 per year, a difference of $714 per year.

The chart displayed below shows how average RS 6 car insurance cost compares to the best-selling midsize luxury SUVs like the Cadillac XT5, Infiniti QX60, and the Lexus GX 460. A table is also added following the chart that shows average auto insurance rates for the entire midsize luxury SUV class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Jaguar E-Pace | $2,242 | -$1,322 |

| 2 | Cadillac XT5 | $2,264 | -$1,300 |

| 3 | Infiniti QX50 | $2,330 | -$1,234 |

| 4 | Cadillac XT6 | $2,348 | -$1,216 |

| 5 | Infiniti QX60 | $2,358 | -$1,206 |

| 6 | Mercedes-Benz AMG GLB35 | $2,364 | -$1,200 |

| 7 | Acura MDX | $2,396 | -$1,168 |

| 8 | Lexus RX 350 | $2,406 | -$1,158 |

| 9 | Lexus TX 350 | $2,440 | -$1,124 |

| 10 | Lexus RX 350h | $2,468 | -$1,096 |

| 11 | Lexus TX 500h | $2,506 | -$1,058 |

| 12 | Lexus RX 500h | $2,514 | -$1,050 |

| 13 | Lincoln Nautilus | $2,534 | -$1,030 |

| 14 | Lexus RX 450h | $2,538 | -$1,026 |

| 15 | Volvo V90 | $2,558 | -$1,006 |

| 16 | Audi SQ5 | $2,646 | -$918 |

| 17 | Mercedes-Benz GLE350 | $2,680 | -$884 |

| 18 | Lincoln Aviator | $2,698 | -$866 |

| 19 | Lexus GX 550 | $2,728 | -$836 |

| 20 | Volvo V60 | $2,808 | -$756 |

| 21 | Land Rover Discovery Sport | $2,814 | -$750 |

| 22 | Mercedes-Benz GLE450 | $2,826 | -$738 |

| 23 | Cadillac Lyriq | $2,852 | -$712 |

| 24 | Volvo EX90 | $2,876 | -$688 |

| 25 | Audi Q7 | $2,912 | -$652 |

| 26 | Genesis GV80 | $2,926 | -$638 |

| 27 | Mercedes-Benz AMG GLC43 | $2,938 | -$626 |

| 28 | Audi e-tron | $2,994 | -$570 |

| 29 | Tesla Model X | $3,016 | -$548 |

| 30 | BMW X5 | $3,068 | -$496 |

| 31 | Audi Q8 | $3,082 | -$482 |

| 32 | Land Rover Discovery | $3,100 | -$464 |

| 33 | Mercedes-Benz AMG GLE53 | $3,120 | -$444 |

| 34 | Audi SQ7 | $3,224 | -$340 |

| 35 | BMW iX | $3,272 | -$292 |

| 36 | BMW X6 | $3,350 | -$214 |

| 37 | Land Rover Range Rover Sport | $3,492 | -$72 |

| 38 | Audi RS 6 | $3,564 | -- |

| 39 | Porsche Cayenne | $3,594 | $30 |

| 40 | BMW XM | $3,938 | $374 |

| 41 | Mercedes-Benz AMG GLE63 | $4,046 | $482 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

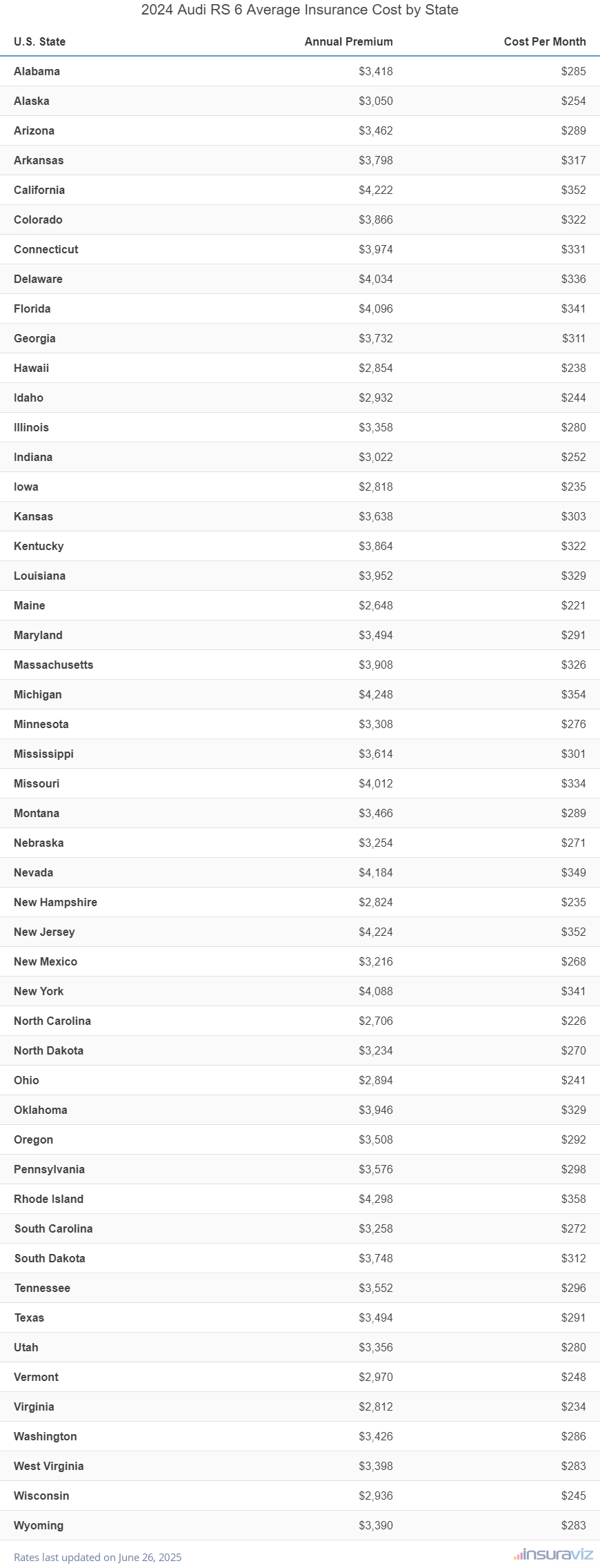

Audi RS 6 insurance cost by U.S. State

Your location makes a large difference in the price you’ll pay for car insurance. The table below shows the average cost to insure an Audi RS 6 in all 50 U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $3,484 | $290 |

| Alaska | $3,114 | $260 |

| Arizona | $3,526 | $294 |

| Arkansas | $3,864 | $322 |

| California | $4,286 | $357 |

| Colorado | $3,930 | $328 |

| Connecticut | $4,038 | $337 |

| Delaware | $4,098 | $342 |

| Florida | $4,146 | $346 |

| Georgia | $3,800 | $317 |

| Hawaii | $2,922 | $244 |

| Idaho | $3,000 | $250 |

| Illinois | $3,426 | $286 |

| Indiana | $3,086 | $257 |

| Iowa | $2,884 | $240 |

| Kansas | $3,704 | $309 |

| Kentucky | $3,926 | $327 |

| Louisiana | $4,004 | $334 |

| Maine | $2,710 | $226 |

| Maryland | $3,556 | $296 |

| Massachusetts | $3,974 | $331 |

| Michigan | $4,290 | $358 |

| Minnesota | $3,376 | $281 |

| Mississippi | $3,680 | $307 |

| Missouri | $4,074 | $340 |

| Montana | $3,530 | $294 |

| Nebraska | $3,316 | $276 |

| Nevada | $4,252 | $354 |

| New Hampshire | $2,886 | $241 |

| New Jersey | $4,290 | $358 |

| New Mexico | $3,282 | $274 |

| New York | $4,152 | $346 |

| North Carolina | $2,774 | $231 |

| North Dakota | $3,298 | $275 |

| Ohio | $2,960 | $247 |

| Oklahoma | $4,012 | $334 |

| Oregon | $3,570 | $298 |

| Pennsylvania | $3,640 | $303 |

| Rhode Island | $4,362 | $364 |

| South Carolina | $3,324 | $277 |

| South Dakota | $3,814 | $318 |

| Tennessee | $3,616 | $301 |

| Texas | $3,556 | $296 |

| Utah | $3,420 | $285 |

| Vermont | $3,036 | $253 |

| Virginia | $2,874 | $240 |

| Washington | $3,488 | $291 |

| West Virginia | $3,462 | $289 |

| Wisconsin | $3,004 | $250 |

| Wyoming | $3,456 | $288 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional RS 6 insurance rates and insights

Other noteworthy conclusions about Audi RS 6 insurance rates include:

- Teenage drivers are expensive to insure. Average rates for full coverage RS 6 insurance costs $12,394 per year for a 16-year-old driver, $12,119 per year for a 17-year-old driver, $11,069 per year for an 18-year-old driver, and $10,003 per year for a 19-year-old driver.

- Being a safe driver saves money. Too many at-fault accidents will increase rates, possibly as much as $1,702 per year for a 30-year-old driver and even as much as $808 per year for a 60-year-old driver.

- RS 6 insurance is expensive for high-risk drivers. For a 30-year-old driver, having to buy a high-risk policy due to excessive accidents and/or violations could inflate rates by $4,354 or more per year.

- Polish up your credit rating for lower rates. Having an excellent credit rating above 800 could save up to $560 per year over a lower credit score of 670-739. Conversely, a poor credit score could cost up to $649 more per year.

- Earn a discount from your choice of occupation. Many car insurance companies offer policy discounts for occupations like firefighters, lawyers, scientists, doctors, architects, nurses, and others. If your job can earn you this discount, you could potentially save between $107 and $233 on your RS 6 insurance cost, subject to the policy coverages selected.

- Policy discounts mean cheaper RS 6 insurance. Discounts may be available if the insureds drive low annual mileage, belong to certain professional organizations, insure multiple vehicles on the same policy, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average driver as much as $604 per year.

- Raising physical damage deductibles lowers cost. Increasing your policy deductibles from $500 to $1,000 could save around $638 per year for a 40-year-old driver and $1,260 per year for a 20-year-old driver.

- Low physical damage deductibles increases cost. Decreasing deductibles from $500 to $250 could cost an additional $670 per year for a 40-year-old driver and $1,332 per year for a 20-year-old driver.