- Ford Edge car insurance costs an average of $2,270 per year or around $189 per month, depending on the trim level.

- When compared to other midsize SUVs, the Ford Edge is one of the cheaper midsize SUVs to insure, costing $100 less per year on average.

- The cheapest model of Ford Edge to insure is the SE trim at an estimated $2,186 per year, or about $182 per month.

Factors Affecting Ford Edge Insurance Cost

Car insurance isn’t a one-size-fits-all concept and finding the best coverage for your Edge depends on a lot of personalized rate factors.

Things like your driving record, your age, possibly even your credit score and your marital status all can have an impact on the rate you pay.

Most people know that being a safe driver can save you money on car insurance, but that’s just the tip of the iceberg.

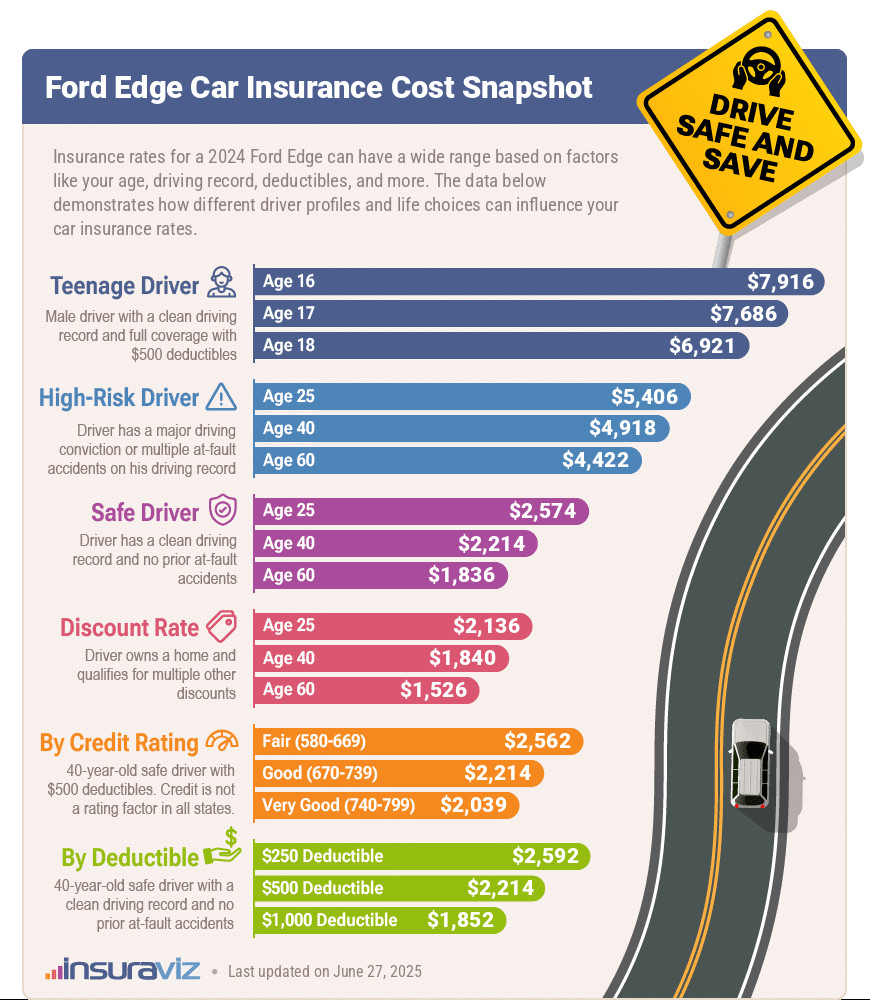

The infographic below helps illustrate some of the different factors that affect the cost to insure a 2024 Ford Edge.

As demonstrated in the graphic above, insurance rates for the 2024 Ford Edge vary widely based on factors like age, driving history, and chosen deductibles.

Teenage drivers face the highest premiums due to their inexperience, with a 16-year-old male driver paying about $8,111 annually.

High-risk drivers, such as those with major driving convictions, also pay significantly more. A 25-year-old high-risk driver faces an annual premium of around $5,538, while a 60-year-old high-risk driver pays about $4,530.

On the other hand, safe drivers with clean records benefit from lower premiums. A 25-year-old safe driver pays around $2,636 annually to insure a 2024 Ford Edge, and this drops to about $1,882 for a 60-year-old.

Multiple discounts, such as those for homeowners or multi-policy holders, can also reduce costs significantly. A 40-year-old driver with multiple discounts pays about $1,884 annually, which is a savings of $386 per year compared to not earning these discounts.

Your credit rating impacts premiums too, with fair credit resulting in an annual cost of around $2,626, whereas a very good credit rating reduces it to approximately $2,091.

Choosing a higher deductible can lower your premium. A $250 deductible for a 40-year-old driver costs about $2,656 annually, while a $1,000 deductible brings it down to $1,898.

Insuring a Ford Edge vs. Other SUVs

The Ford Edge ranks 14th out of 34 total vehicles in the midsize SUV category. The Edge costs an average of $2,270 per year to insure for full coverage, while the segment average is $2,370 per year, a difference of $100 per year.

Ford Edge average insurance cost compared to popular models

- $384 less per year than the Tesla Model Y

- $32 more per year than the Chevrolet Traverse

- $302 less per year than the Toyota 4Runner

- $234 less per year than the Kia Telluride

- $156 less per year than the Hyundai Santa Fe

The chart below shows how average insurance cost for a Ford Edge compares to the rest of the top 10 most popular midsize SUVs for the 2024 model year. For a full segment comparison, you will find an expanded table after the chart detailing average insurance rates for every vehicle in the midsize SUV class

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$360 |

| 2 | Nissan Murano | $2,016 | -$254 |

| 3 | Subaru Outback | $2,042 | -$228 |

| 4 | Buick Envista | $2,050 | -$220 |

| 5 | Subaru Ascent | $2,088 | -$182 |

| 6 | Volkswagen Atlas | $2,128 | -$142 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$134 |

| 8 | Ford Explorer | $2,176 | -$94 |

| 9 | Toyota Highlander | $2,180 | -$90 |

| 10 | Toyota Venza | $2,190 | -$80 |

| 11 | Chevrolet Traverse | $2,238 | -$32 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$16 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$8 |

| 14 | Ford Edge | $2,270 | -- |

| 15 | Kia Sorento | $2,278 | $8 |

| 16 | GMC Acadia | $2,316 | $46 |

| 17 | Buick Enclave | $2,320 | $50 |

| 18 | Honda Pilot | $2,336 | $66 |

| 19 | Mazda CX-9 | $2,342 | $72 |

| 20 | Jeep Grand Cherokee | $2,398 | $128 |

| 21 | Hyundai Santa Fe | $2,426 | $156 |

| 22 | Nissan Pathfinder | $2,440 | $170 |

| 23 | Hyundai Palisade | $2,450 | $180 |

| 24 | Chevrolet Blazer | $2,476 | $206 |

| 25 | Kia Telluride | $2,504 | $234 |

| 26 | Toyota 4Runner | $2,572 | $302 |

| 27 | Mazda CX-90 | $2,582 | $312 |

| 28 | Toyota Grand Highlander | $2,610 | $340 |

| 29 | Kia EV9 | $2,630 | $360 |

| 30 | Tesla Model Y | $2,654 | $384 |

| 31 | Ford Bronco | $2,662 | $392 |

| 32 | Jeep Wrangler | $2,740 | $470 |

| 33 | Dodge Durango | $2,942 | $672 |

| 34 | Rivian R1S | $2,950 | $680 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

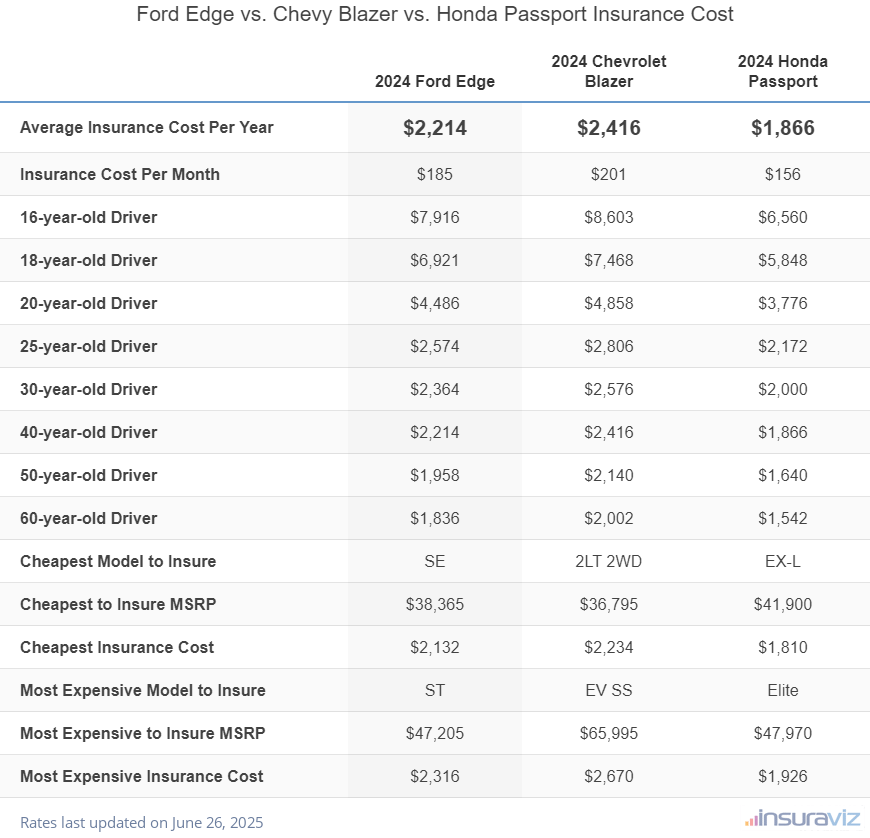

Ford Edge vs. Chevy Blazer vs. Honda Passport

Now let’s take a deeper dive into comparing insurance rates between the Edge and its two top competitors: the Chevy Blazer and Honda Passport.

This data shows not only the average cost of insuring all three models, but rates by driver age and the cheapest and most expensive trims of each model to insure.

| 2024 Ford Edge | 2024 Chevrolet Blazer | 2024 Honda Passport | |

|---|---|---|---|

| Average Insurance Cost Per Year | $2,270 | $2,476 | $1,910 |

| Insurance Cost Per Month | $189 | $206 | $159 |

| 16-year-old Driver | $8,111 | $8,815 | $6,719 |

| 18-year-old Driver | $7,090 | $7,650 | $5,990 |

| 20-year-old Driver | $4,596 | $4,980 | $3,868 |

| 25-year-old Driver | $2,636 | $2,878 | $2,224 |

| 30-year-old Driver | $2,422 | $2,640 | $2,048 |

| 40-year-old Driver | $2,270 | $2,476 | $1,910 |

| 50-year-old Driver | $2,008 | $2,192 | $1,678 |

| 60-year-old Driver | $1,882 | $2,050 | $1,578 |

| Cheapest Model to Insure | SE | 2LT 2WD | EX-L |

| Cheapest to Insure MSRP | $38,365 | $36,795 | $41,900 |

| Cheapest Insurance Cost | $2,186 | $2,288 | $1,854 |

| Most Expensive Model to Insure | ST | EV SS | Elite |

| Most Expensive to Insure MSRP | $47,205 | $65,995 | $47,970 |

| Most Expensive Insurance Cost | $2,372 | $2,734 | $1,972 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Other driver ages also have no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated October 24, 2025

Ford Edge Insurance Cost by Trim Level

With Ford Edge insurance rates ranging from $2,186 to $2,372 per year for an average driver, the cheapest model to insure is the SE trim level. The next cheapest model to insure is the SEL at $2,202 per year. Anticipate paying at least $182 per month for a policy with full coverage.

The least budget-friendly trim levels of Ford Edge to insure are the ST at $2,372 and the Titanium at $2,308 per year. Those models will cost an extra $186 per year over the least expensive SE model.

The next table breaks down the average annual premium and cost per month to insure each Ford Edge trim level.

| 2024 Ford Edge Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE | $2,186 | $182 |

| SEL | $2,202 | $184 |

| ST-Line | $2,276 | $190 |

| Titanium | $2,308 | $192 |

| ST | $2,372 | $198 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Insurance rates for new and used models

Buying a used model is usually a good way to reduce the cost of car insurance. The Ford Edge is no exception. For example, a 2018 Ford Explorer will cost around $150 a year less to insure that a new model. For a model that’s closer to ten years old, you could be looking at savings closer to $500 a year.

The table below details average rates for three different driver age groups back to the 2013 model year.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Ford Edge | $4,596 | $2,270 | $1,882 |

| 2023 Ford Edge | $3,958 | $1,978 | $1,638 |

| 2022 Ford Edge | $3,948 | $1,972 | $1,632 |

| 2021 Ford Edge | $3,668 | $1,828 | $1,508 |

| 2020 Ford Edge | $3,546 | $1,766 | $1,460 |

| 2019 Ford Edge | $3,706 | $1,824 | $1,516 |

| 2018 Ford Edge | $3,470 | $1,712 | $1,422 |

| 2017 Ford Edge | $3,336 | $1,648 | $1,370 |

| 2016 Ford Edge | $3,360 | $1,666 | $1,390 |

| 2015 Ford Edge | $3,186 | $1,580 | $1,320 |

| 2014 Ford Edge | $2,600 | $1,310 | $1,094 |

| 2013 Ford Edge | $2,692 | $1,350 | $1,132 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Ford Edge trim levels for each model year. Updated October 24, 2025

Average Insurance Rates by State

Location is a huge factor that determines the price you’ll pay to insure your Edge. Each state has their own set of insurance laws and regulations that can drastically impact the cost of car insurance.

Another big location factor is the weather. If you live in an area that is prone to flooding or hail, chances are good that you are paying higher rates already.

When evaluating Ford Edge insurance rates at the state level, states like Maine ($1,728) and Iowa ($1,834) tend to be cheaper, while states like Florida ($2,640), Michigan ($2,730), and Louisiana ($2,548) have more expensive auto insurance.

Most of the other states are closer to average, with states like Maryland and Texas included in this group. Those states have average Ford Edge insurance rates of $2,264 and $2,264 per year.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,218 | $185 |

| Alaska | $1,984 | $165 |

| Arizona | $2,244 | $187 |

| Arkansas | $2,458 | $205 |

| California | $2,728 | $227 |

| Colorado | $2,500 | $208 |

| Connecticut | $2,570 | $214 |

| Delaware | $2,610 | $218 |

| Florida | $2,640 | $220 |

| Georgia | $2,418 | $202 |

| Hawaii | $1,858 | $155 |

| Idaho | $1,908 | $159 |

| Illinois | $2,180 | $182 |

| Indiana | $1,964 | $164 |

| Iowa | $1,834 | $153 |

| Kansas | $2,356 | $196 |

| Kentucky | $2,498 | $208 |

| Louisiana | $2,548 | $212 |

| Maine | $1,728 | $144 |

| Maryland | $2,264 | $189 |

| Massachusetts | $2,530 | $211 |

| Michigan | $2,730 | $228 |

| Minnesota | $2,148 | $179 |

| Mississippi | $2,340 | $195 |

| Missouri | $2,592 | $216 |

| Montana | $2,244 | $187 |

| Nebraska | $2,110 | $176 |

| Nevada | $2,704 | $225 |

| New Hampshire | $1,840 | $153 |

| New Jersey | $2,730 | $228 |

| New Mexico | $2,086 | $174 |

| New York | $2,642 | $220 |

| North Carolina | $1,764 | $147 |

| North Dakota | $2,100 | $175 |

| Ohio | $1,884 | $157 |

| Oklahoma | $2,550 | $213 |

| Oregon | $2,272 | $189 |

| Pennsylvania | $2,314 | $193 |

| Rhode Island | $2,778 | $232 |

| South Carolina | $2,116 | $176 |

| South Dakota | $2,426 | $202 |

| Tennessee | $2,304 | $192 |

| Texas | $2,264 | $189 |

| Utah | $2,180 | $182 |

| Vermont | $1,934 | $161 |

| Virginia | $1,830 | $153 |

| Washington | $2,220 | $185 |

| West Virginia | $2,202 | $184 |

| Wisconsin | $1,912 | $159 |

| Wyoming | $2,198 | $183 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025