- Richmond car insurance averages $1,954 per year, or around $163 per month for a full coverage policy.

- The cost to insure a car in Richmond is $80 per year less than the Kentucky state average and $71 per year more than the U.S. national average car insurance rate.

- SUV models like the Buick Envision, Kia Soul, and Chevrolet Trailblazer are a few picks for the cheapest car insurance in Richmond.

- Vehicles with the cheapest car insurance in their respective segments include the Acura RDX (compact luxury SUV), Subaru Crosstrek (compact SUV), Jaguar E-Pace (midsize luxury SUV), and Chrysler 300 (full-size car).

How much is car insurance in Richmond, KY?

The average car insurance cost in Richmond is $1,954 per year, which is 3.7% more than the overall U.S. national average rate of $1,883. Average car insurance cost per month in Richmond is $163 for a policy that provides full coverage.

Average auto insurance cost in Kentucky is $2,034 per year, so Richmond drivers pay an average of $80 less per year than the overall Kentucky rate.

When compared to other larger cities in Kentucky, the average cost of insurance in Richmond is about $82 per year more than in Owensboro, $10 per year less than in Covington, and $816 per year cheaper than in Louisville.

The age of the rated driver has a significant impact the price you pay for car insurance, so the list below details how age impacts cost by breaking down average car insurance rates in Richmond for drivers from 16 to 60.

Richmond, KY, car insurance cost by driver age

- 16-year-old rated driver – $6,954 per year or $580 per month

- 17-year-old rated driver – $6,736 per year or $561 per month

- 18-year-old rated driver – $6,037 per year or $503 per month

- 19-year-old rated driver – $5,499 per year or $458 per month

- 20-year-old rated driver – $3,928 per year or $327 per month

- 30-year-old rated driver – $2,084 per year or $174 per month

- 40-year-old rated driver – $1,954 per year or $163 per month

- 50-year-old rated driver – $1,728 per year or $144 per month

- 60-year-old rated driver – $1,620 per year or $135 per month

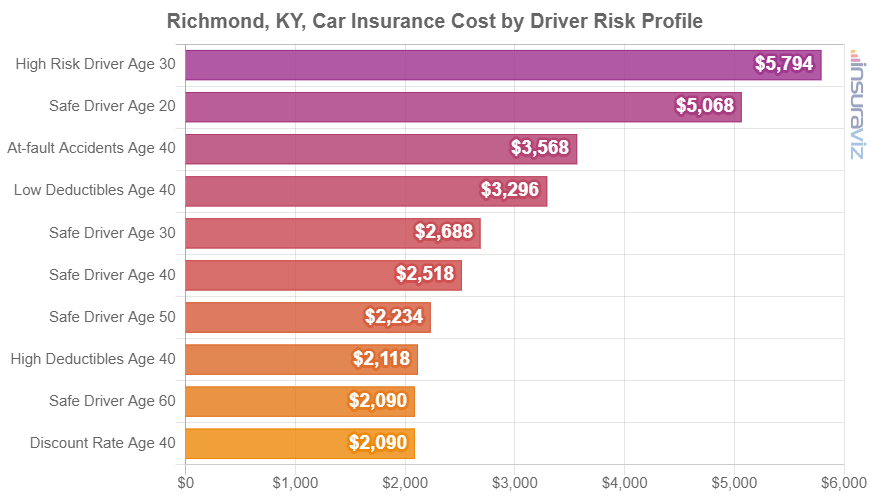

The next chart shows examples of average Richmond car insurance cost broken out for a number of different driver ages and risk profiles. Rates are averaged for all 2024 model year vehicles including luxury brand cars and SUVs.

Average rates in the chart above range from $1,620 per year for a 40-year-old driver with many policy discounts to $4,490 per year for a 20-year-old driver who is required to buy high-risk auto insurance. The overall average rate we use for comparison of different segments, models, and locations is the 40-year-old safe driver rate, which has an average cost of $1,954 per year in Richmond.

As a monthly amount, average car insurance cost in Richmond ranges from $135 to $374 for the same driver ages shown in the chart.

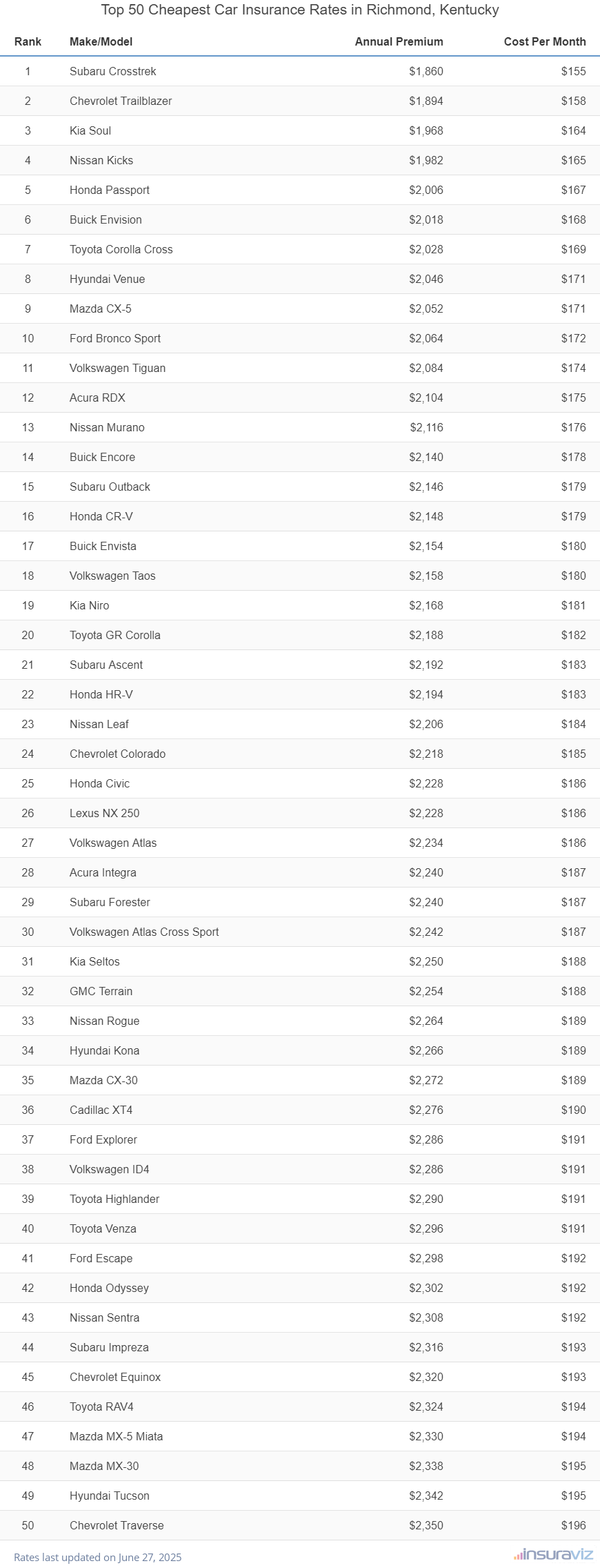

Top 50 cheapest cars to insure in Richmond

The vehicles with the cheapest car insurance quotes in Richmond, KY, tend to be crossovers and small SUVs like the Kia Soul, Subaru Crosstrek, and Toyota Corolla Cross. Average insurance prices for models in the top 10 cost $133 or less per month for a full coverage policy.

Examples of other models that are ranked high in the cost comparison table are the Subaru Outback, Honda CR-V, Buick Envista, and Acura RDX.

Rates are slightly more for those models than the small SUVs and crossovers that rank at the top, but they still have average rates of $1,672 or less per year, or around $139 per month in Richmond.

The following table breaks down the top 50 models with the cheapest car insurance rates in Richmond, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,440 | $120 |

| 2 | Chevrolet Trailblazer | $1,466 | $122 |

| 3 | Kia Soul | $1,522 | $127 |

| 4 | Nissan Kicks | $1,536 | $128 |

| 5 | Honda Passport | $1,554 | $130 |

| 6 | Buick Envision | $1,562 | $130 |

| 7 | Toyota Corolla Cross | $1,572 | $131 |

| 8 | Hyundai Venue | $1,586 | $132 |

| 9 | Mazda CX-5 | $1,590 | $133 |

| 10 | Ford Bronco Sport | $1,596 | $133 |

| 11 | Volkswagen Tiguan | $1,612 | $134 |

| 12 | Acura RDX | $1,630 | $136 |

| 13 | Nissan Murano | $1,640 | $137 |

| 14 | Buick Encore | $1,656 | $138 |

| 15 | Subaru Outback | $1,660 | $138 |

| 16 | Honda CR-V | $1,664 | $139 |

| 17 | Buick Envista | $1,668 | $139 |

| 18 | Chevrolet Colorado | $1,668 | $139 |

| 19 | Volkswagen Taos | $1,670 | $139 |

| 20 | Kia Niro | $1,672 | $139 |

| 21 | Toyota GR Corolla | $1,694 | $141 |

| 22 | Honda HR-V | $1,698 | $142 |

| 23 | Subaru Ascent | $1,698 | $142 |

| 24 | Nissan Leaf | $1,708 | $142 |

| 25 | Lexus NX 250 | $1,726 | $144 |

| 26 | Volkswagen Atlas | $1,728 | $144 |

| 27 | Honda Civic | $1,730 | $144 |

| 28 | Acura Integra | $1,734 | $145 |

| 29 | Volkswagen Atlas Cross Sport | $1,736 | $145 |

| 30 | Subaru Forester | $1,738 | $145 |

| 31 | Kia Seltos | $1,742 | $145 |

| 32 | GMC Terrain | $1,746 | $146 |

| 33 | Nissan Rogue | $1,752 | $146 |

| 34 | Hyundai Kona | $1,756 | $146 |

| 35 | Mazda CX-30 | $1,760 | $147 |

| 36 | Cadillac XT4 | $1,762 | $147 |

| 37 | Volkswagen ID4 | $1,768 | $147 |

| 38 | Ford Explorer | $1,770 | $148 |

| 39 | Toyota Highlander | $1,778 | $148 |

| 40 | Toyota Venza | $1,778 | $148 |

| 41 | Ford Escape | $1,780 | $148 |

| 42 | Honda Odyssey | $1,782 | $149 |

| 43 | Nissan Sentra | $1,788 | $149 |

| 44 | Hyundai Ioniq 6 | $1,790 | $149 |

| 45 | Subaru Impreza | $1,792 | $149 |

| 46 | Chevrolet Equinox | $1,796 | $150 |

| 47 | Toyota RAV4 | $1,798 | $150 |

| 48 | Mazda MX-5 Miata | $1,804 | $150 |

| 49 | Mazda MX-30 | $1,812 | $151 |

| 50 | Hyundai Tucson | $1,814 | $151 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Richmond, KY Zip Codes. Updated February 22, 2024

Additional vehicles that rank in the top 50 above include the Mazda CX-30, the Hyundai Ioniq 6, the Kia Seltos, the Subaru Impreza, and the Acura Integra. Car insurance rates for those vehicles cost between $1,672 and $1,822 per year.

In contrast to the vehicles with cheap rates, a few vehicles that cost more to insure include the Hyundai Sonata that averages $165 per month, the Audi S3 which costs $182, and the Lexus LC 500h which averages $244.

And for very high-priced insurance, high-performance and luxury models like the Mercedes-Benz Maybach GLS 600, Audi RS 6, and BMW M760i have average rates that can cost as much as triple the rates of the cheapest vehicles.

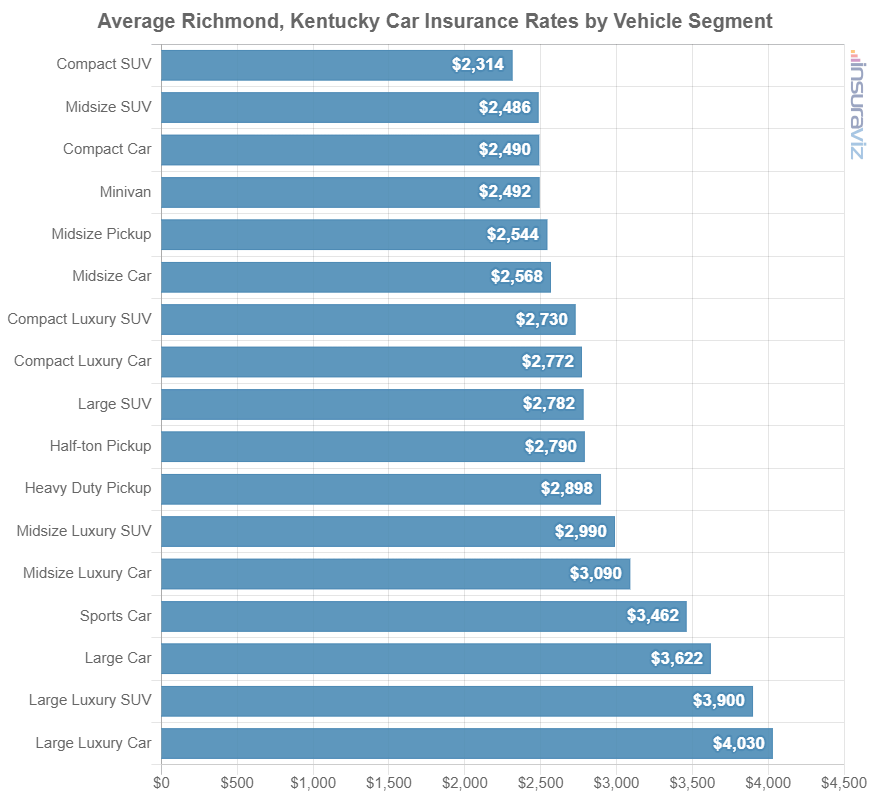

The section below goes into the cost of insurance based on different automotive segments. The average rates shown should provide a good idea of the general vehicle types that have the overall most affordable average car insurance rates.

Average cost to insure by segment

Some types of vehicles are inherently more expensive to insure than others. As a general rule, small and midsize SUVs, vans and minivans, and midsize pickup trucks have the most affordable average car insurance rates, while luxury and performance models tend to cost the most to insure.

The chart below displays average auto insurance cost by vehicle segment in Richmond.

When comparing rates by segment, it’s important to understand that rates can vary substantially within each segment.

For example, in the midsize luxury car segment, car insurance rates in Richmond range from the Mercedes-Benz CLA250 costing $2,008 per year up to the BMW M8 at $3,288 per year, a difference of $1,280 just within that segment.

In the small luxury SUV segment, insurance rates range from the Acura RDX at $1,630 per year up to the Aston Martin DBX costing $3,800 per year, a difference of $2,170 within that segment.

Lastly, in the midsize SUV segment, the average cost of insurance can range from the Honda Passport costing $1,554 per year to the Rivian R1S costing $2,392 per year, a difference of $838 just for that segment.

In the list below, we detail the model with the cheapest overall insurance rates in Richmond, KY, in each automotive segment. Annual and monthly average car insurance quotes are displayed for each vehicle.

- Cheapest compact car insurance – Toyota GR Corolla at $1,694 per year or $141 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,440 per year or $120 per month

- Cheapest midsize car insurance – Hyundai Ioniq 6 at $1,790 per year or $149 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,554 per year or $130 per month

- Cheapest full-size car insurance – Chrysler 300 at $1,852 per year or $154 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $1,832 per year or $153 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,668 per year or $139 per month

- Cheapest full-size pickup insurance – Nissan Titan at $1,826 per year or $152 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $1,988 per year or $166 per month

- Cheapest minivan insurance – Honda Odyssey at $1,782 per year or $149 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $1,804 per year or $150 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,734 per year or $145 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,630 per year or $136 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,008 per year or $167 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $1,822 per year or $152 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,312 per year or $193 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,186 per year or $182 per month