- For the cheapest auto insurance in Augusta, compact SUV models like the Chevrolet Trailblazer, Subaru Crosstrek, and Kia Soul cost less to insure than most other vehicles.

- The average cost of car insurance in Augusta is 21.5% less than the national average rate of $2,276.

- Augusta car insurance averages $8 per year more than the Maine state average and $442 per year less than the average rate for all 50 states.

Which vehicles are cheapest to insure?

When every make and model is compared, the vehicles with the best auto insurance rates in Augusta, ME, tend to be small SUVs like the Subaru Crosstrek, Kia Soul, and Toyota Corolla Cross. Average car insurance rates for the vehicles ranked in the top 10 cost $1,502 or less per year ($125 per month) for full coverage.

Some other models that have low-cost car insurance prices in the comparison table below are the Nissan Murano, Subaru Outback, Acura RDX, and Honda CR-V. Insurance rates are somewhat higher for those models than the small SUVs and crossovers that rank near the top, but they still have average rates of $1,594 or less per year ($133 per month).

The table below details the 50 models with the cheapest car insurance in Augusta, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,354 | $113 |

| 2 | Chevrolet Trailblazer | $1,378 | $115 |

| 3 | Kia Soul | $1,432 | $119 |

| 4 | Nissan Kicks | $1,444 | $120 |

| 5 | Honda Passport | $1,460 | $122 |

| 6 | Buick Envision | $1,470 | $123 |

| 7 | Toyota Corolla Cross | $1,478 | $123 |

| 8 | Hyundai Venue | $1,488 | $124 |

| 9 | Mazda CX-5 | $1,494 | $125 |

| 10 | Ford Bronco Sport | $1,502 | $125 |

| 11 | Volkswagen Tiguan | $1,518 | $127 |

| 12 | Acura RDX | $1,532 | $128 |

| 13 | Nissan Murano | $1,542 | $129 |

| 14 | Buick Encore | $1,558 | $130 |

| 15 | Honda CR-V | $1,562 | $130 |

| 16 | Subaru Outback | $1,562 | $130 |

| 17 | Buick Envista | $1,566 | $131 |

| 18 | Volkswagen Taos | $1,570 | $131 |

| 19 | Kia Niro | $1,580 | $132 |

| 20 | Subaru Ascent | $1,594 | $133 |

| 21 | Toyota GR Corolla | $1,594 | $133 |

| 22 | Honda HR-V | $1,596 | $133 |

| 23 | Nissan Leaf | $1,606 | $134 |

| 24 | Chevrolet Colorado | $1,616 | $135 |

| 25 | Lexus NX 250 | $1,622 | $135 |

| 26 | Honda Civic | $1,624 | $135 |

| 27 | Volkswagen Atlas | $1,626 | $136 |

| 28 | Acura Integra | $1,630 | $136 |

| 29 | Subaru Forester | $1,632 | $136 |

| 30 | Volkswagen Atlas Cross Sport | $1,634 | $136 |

| 31 | Kia Seltos | $1,636 | $136 |

| 32 | GMC Terrain | $1,642 | $137 |

| 33 | Nissan Rogue | $1,648 | $137 |

| 34 | Hyundai Kona | $1,650 | $138 |

| 35 | Mazda CX-30 | $1,652 | $138 |

| 36 | Cadillac XT4 | $1,656 | $138 |

| 37 | Volkswagen ID4 | $1,662 | $139 |

| 38 | Ford Explorer | $1,664 | $139 |

| 39 | Toyota Highlander | $1,668 | $139 |

| 40 | Ford Escape | $1,672 | $139 |

| 41 | Toyota Venza | $1,674 | $140 |

| 42 | Honda Odyssey | $1,676 | $140 |

| 43 | Nissan Sentra | $1,680 | $140 |

| 44 | Subaru Impreza | $1,686 | $141 |

| 45 | Chevrolet Equinox | $1,688 | $141 |

| 46 | Toyota RAV4 | $1,692 | $141 |

| 47 | Mazda MX-5 Miata | $1,696 | $141 |

| 48 | Mazda MX-30 | $1,702 | $142 |

| 49 | Hyundai Tucson | $1,704 | $142 |

| 50 | Chevrolet Traverse | $1,710 | $143 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Augusta, ME Zip Codes. Updated October 24, 2025

A few additional models that made the top 50 table above include the Volkswagen Atlas, Honda HR-V, Ford Escape, and Toyota Venza. Average car insurance rates for those vehicles cost between $1,594 and $1,714 per year in Augusta, ME.

In contrast to the vehicles with cheap rates, some vehicles that cost considerably more to insure include the Ford Mustang Mach-E that costs $2,144 per year, the Ram Truck that costs $2,120, and the Lexus LX 570 at $2,594.

Average car insurance cost in Augusta

Average car insurance rates in Augusta, Maine, cost $1,834 per year, or around $153 per month. That’s 21.5% cheaper than the overall overall U.S. national average rate of $2,276 per year.

In Maine, the average car insurance expense is $1,826 per year, so the cost in Augusta is $8 more per year.

The cost of car insurance in Augusta compared to other Maine locations is approximately $40 per year more than in South Portland, $8 per year cheaper than in Bangor, and $32 per year cheaper than in Lewiston.

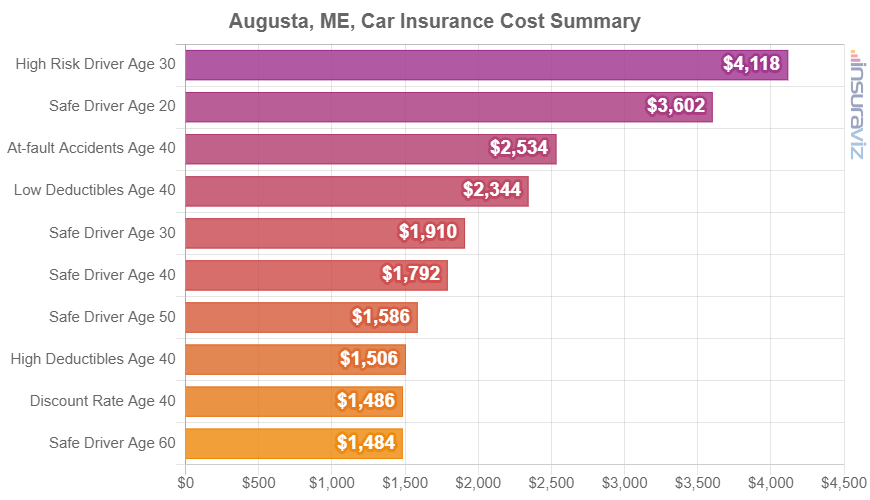

The next chart shows additional data for the 20 to 60-year-old age groups by showing a range of rates for a variety of driver ages, policy deductibles, and potential risk scenarios.

Average car insurance rates in the chart above range from $1,526 per year for a 40-year-old driver who qualifies for most policy discounts to $4,216 per year for a 30-year-old driver who has a few accidents and violations and has to buy a high risk policy.

When the average rates are converted to monthly figures, the average cost of car insurance per month in Augusta ranges from $127 to $351.

Augusta auto insurance rates are priced differently for every driver and depend on a lot of factors. This variability reinforces the need to get accurate car insurance quotes when looking for a cheaper car insurance policy.

Driver age is the single-largest factor that determines the price you pay for car insurance. The list below illustrates this by showing the difference in average car insurance rates in Augusta for different driver ages.

Car insurance cost in Augusta for drivers age 16 to 60

- 16-year-old driver – $6,532 per year or $544 per month

- 17-year-old driver – $6,327 per year or $527 per month

- 18-year-old driver – $5,673 per year or $473 per month

- 19-year-old driver – $5,165 per year or $430 per month

- 20-year-old driver – $3,690 per year or $308 per month

- 30-year-old driver – $1,958 per year or $163 per month

- 40-year-old driver – $1,834 per year or $153 per month

- 50-year-old driver – $1,626 per year or $136 per month

- 60-year-old driver – $1,522 per year or $127 per month

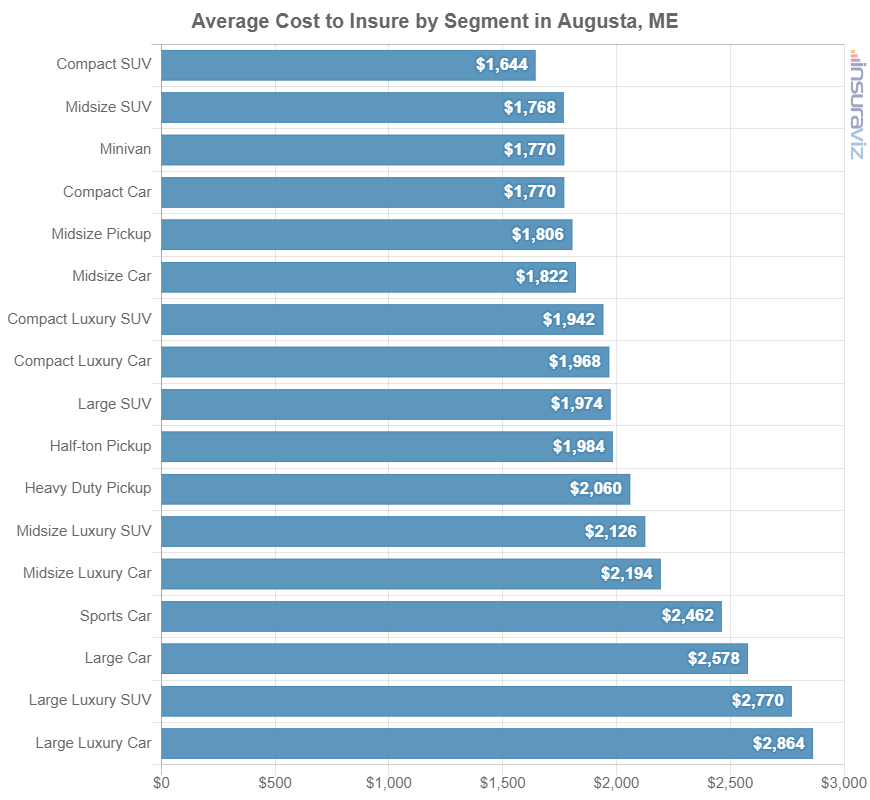

The next section of this article illustrates average auto insurance cost by vehicle segment. The rates shown will give you a good understanding of the vehicle segments that have the overall best Augusta car insurance rates.

Average cost to insure by automotive segment

When comparing new or used vehicles, it’s a good idea to know which styles of vehicles have more affordable auto insurance rates in Augusta. For instance, many people wonder if compact SUVs have cheaper insurance than minivans or if sports cars have more expensive insurance than regular cars.

The chart below shows the average auto insurance cost in Augusta for each automotive segment. As a general rule, compact SUVs, midsize trucks, and minivans tend to have the most affordable rates, with luxury and performance models having the highest average insurance cost.

Average rates by automotive segment are practical to make a general comparison, but the insurance cost for specific vehicles ranges significantly within each of the segments displayed in the above chart.

For example, in the large luxury SUV segment, car insurance rates in Augusta range from the Infiniti QX80 at $2,056 per year for a full coverage policy to the Mercedes-Benz G63 AMG at $3,942 per year, a difference of $1,886 just within that segment.

For another example, in the small car segment, the average cost of insurance ranges from the Toyota GR Corolla at $1,594 per year up to the Toyota Mirai costing $2,282 per year.

As a third example, in the midsize SUV segment, insurance rates can range from the Honda Passport at $1,460 per year to the Rivian R1S at $2,254 per year, a difference of $794 just for that segment.

The following list details the cheapest vehicle to insure in Augusta, ME, for each vehicle category. Annual and monthly average car insurance quotes are calculated for each one.

- Cheapest compact car to insure – Toyota GR Corolla at $1,594 per year or $133 per month

- Cheapest compact SUV to insure – Subaru Crosstrek at $1,354 per year or $113 per month

- Cheapest midsize car to insure – Kia K5 at $1,766 per year or $147 per month

- Cheapest midsize SUV to insure – Honda Passport at $1,460 per year or $122 per month

- Cheapest full-size car to insure – Chrysler 300 at $1,746 per year or $146 per month

- Cheapest full-size SUV to insure – Chevrolet Tahoe at $1,722 per year or $144 per month

- Cheapest midsize pickup to insure – Chevrolet Colorado at $1,616 per year or $135 per month

- Cheapest full-size pickup to insure – Nissan Titan at $1,716 per year or $143 per month

- Cheapest heavy duty pickup to insure – GMC Sierra 2500 HD at $1,868 per year or $156 per month

- Cheapest minivan to insure – Honda Odyssey at $1,676 per year or $140 per month

- Cheapest sports car to insure – Mazda MX-5 Miata at $1,696 per year or $141 per month

- Cheapest compact luxury car to insure – Acura Integra at $1,630 per year or $136 per month

- Cheapest compact luxury SUV to insure – Acura RDX at $1,532 per year or $128 per month

- Cheapest midsize luxury car to insure – Mercedes-Benz CLA250 at $1,888 per year or $157 per month

- Cheapest midsize luxury SUV to insure – Jaguar E-Pace at $1,714 per year or $143 per month

- Cheapest full-size luxury car to insure – Audi A5 at $2,180 per year or $182 per month

- Cheapest full-size luxury SUV to insure – Infiniti QX80 at $2,056 per year or $171 per month

Seven ways to get cheaper car insurance quotes

If you’re looking to cut your car insurance bill, the tips below are some of the best ways to make sure you’re not overpaying.

- Shop around often. Taking the time to get a few free car insurance quotes is the best way to save money. Rates change often and you do not have to wait for your renewal to change companies.

- Choose a vehicle with cheaper auto insurance rates. Vehicle performance is a big factor in the price you pay for car insurance in Augusta. As an example, a Kia Sportage costs $1,742 less per year to insure in Augusta than a Audi R8. Insure cheaper models and save money.

- Remain claim free. Auto insurance companies give a discounted rate if you have no claims. Auto insurance is intended to be used in the case of significant claims, not nickel-and-dime type claims.

- Get cheaper rates because of your job. The vast majority of car insurance companies offer policy discounts for occupations like firefighters, nurses, accountants, high school and elementary teachers, college professors, lawyers, and others. By working in a job that qualifies, you could save between $55 and $178 on your car insurance bill, depending on your age.

- Fewer accidents means cheaper car insurance. Too many at-fault accidents can cost more, possibly up to $2,618 per year for a 20-year-old driver and as much as $552 per year for a 50-year-old driver. So be a cautious driver and save.

- Clean up your credit to lower your rates. Having an excellent credit score over 800 may save up to $288 per year over a credit score between 670-739. Conversely, a less-than-perfect credit history could cost up to $334 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Find cheaper rates by qualifying for policy discounts. Savings may be available if the policyholders are claim-free, choose electronic billing, are military or federal employees, are good students, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average Augusta driver as much as $308 per year on car insurance.