- Ford Bronco insurance costs an average of $2,662 per year ($222 per month) for a full coverage policy.

- The Bronco is one of the more expensive midsize SUVs to insure, costing $292 more per year on average when compared to the rest of the vehicles in the segment.

- The cheapest Ford Bronco insurance is on the Bronco Big Bend model at an average cost of $2,386 per year.

- The most expensive trim to insure is the Bronco Raptor at $2,996 per year.

How much does Ford Bronco insurance cost?

Ford Bronco insurance costs an average of $2,662 a year for a full coverage policy. Depending on the trim level being insured, monthly car insurance cost for a 2024 Ford Bronco ranges from $199 to $250.

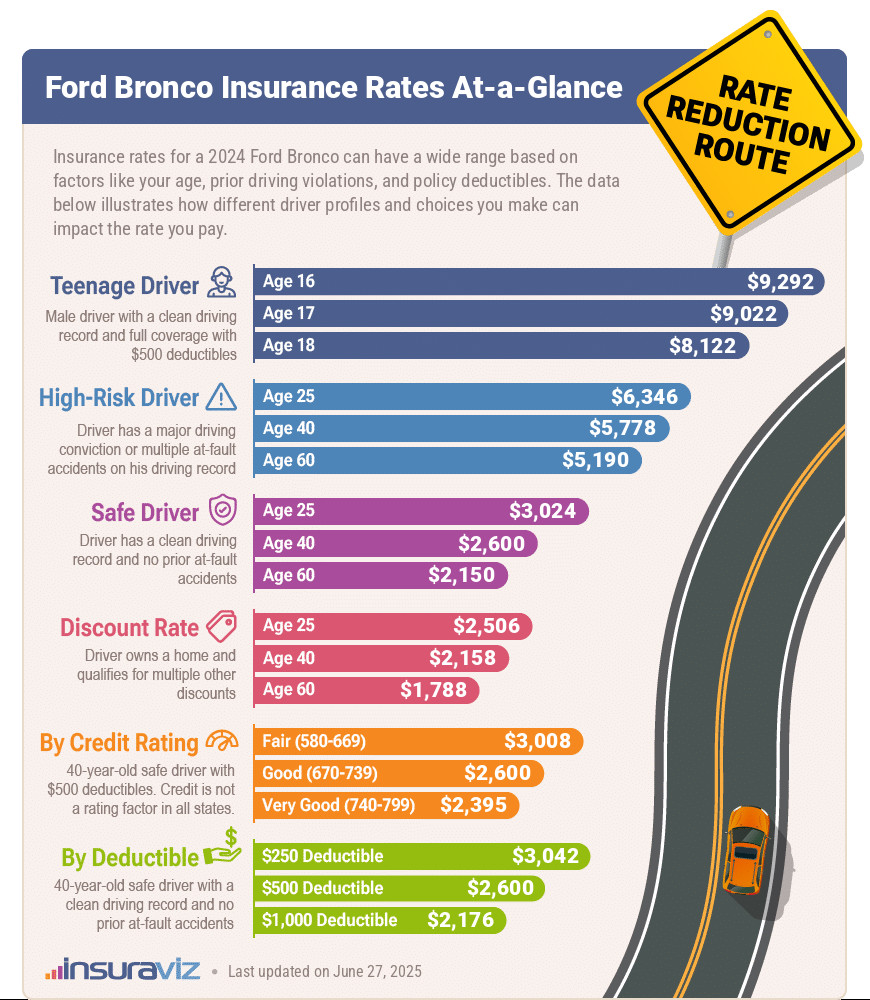

The graphic below shows average 2024 Ford Bronco insurance cost when rated for different driver ages and risk profiles.

As shown by the data in the infographic, young and high-risk drivers pay the highest car insurance rates. Also notable is the impact of your credit score and your deductible selection on the cost of insurance. Not all states use credit as a rating factor, but for those that do, maintaining a good credit rating can save quite a bit on car insurance.

A few additional key data insights regarding Bronco car insurance cost include:

- Improve your credit to save money. In states that give the green light for a driver’s credit score to be used as a pricing factor, having a high credit score of 800+ could get savings of $418 per year versus a credit score ranging from 670-739. Conversely, a subpar credit score could cost up to $484 more per year.

- Age and gender affect car insurance rates. For a 2024 Ford Bronco, a 20-year-old male pays an average rate of $5,396 per year, while a 20-year-old female will pay $3,856, a difference of $1,540 per year in the women’s favor by a large margin. But by age 50, the cost for men is $2,352 and the rate for females is $2,296, a difference of only $56.

- Be a careful driver and save. Too frequent at-fault accidents can raise rates, potentially by an additional $1,296 per year for a 30-year-old driver and as much as $804 per year for a 50-year-old driver.

- Increasing deductibles lowers insurance cost. Raising the comprehensive and collision deductibles from $500 to $1,000 could save around $436 per year for a 40-year-old driver and $856 per year for a 20-year-old driver.

- Low physical damage deductibles increase policy cost. Lowering your physical damage coverage deductibles from $500 to $250 could cost an additional $454 per year for a 40-year-old driver and $908 per year for a 20-year-old driver.

- Ford Bronco insurance rates for teens are expensive. Average rates for full coverage 2024 Ford Bronco insurance cost $9,519 per year for a 16-year-old driver, $9,244 per year for a 17-year-old driver, and $8,320 per year for an 18-year-old driver.

- Your choice of occupation could lower your rates. Some car insurance companies offer policy discounts for earning a living in occupations like farmers, members of the military, police officers and law enforcement, high school and elementary teachers, firefighters, engineers, and other occupations. By working in a profession that qualifies for this discount, you could potentially save between $80 and $233 on your car insurance premium, depending on the age of the driver.

Is a Bronco cheap to insure?

Insurance on a 2024 Ford Bronco ranks 31st out of 34 comparison vehicles for overall affordability. The Bronco costs an average of $2,662 per year to insure, while the midsize SUV category average cost is $2,370 annually, a difference of $292 more per year.

When rates for the most popular models in the segment are compared, insurance for a Ford Bronco costs $78 less per year than the Jeep Wrangler, $90 more than the Toyota 4Runner, $264 more than the Jeep Grand Cherokee, and $620 more than the Subaru Outback.

When average Ford Bronco insurance rates are compared to all vehicles (not just midsize SUVs), they cost 15.6% more than the national average car insurance rate of $2,276 per year.

The comparison chart below shows how well average Ford Bronco car insurance rates compare to other midsize SUVs, including the Jeep Wrangler, for the 2024 model year.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$752 |

| 2 | Nissan Murano | $2,016 | -$646 |

| 3 | Subaru Outback | $2,042 | -$620 |

| 4 | Buick Envista | $2,050 | -$612 |

| 5 | Subaru Ascent | $2,088 | -$574 |

| 6 | Volkswagen Atlas | $2,128 | -$534 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$526 |

| 8 | Ford Explorer | $2,176 | -$486 |

| 9 | Toyota Highlander | $2,180 | -$482 |

| 10 | Toyota Venza | $2,190 | -$472 |

| 11 | Chevrolet Traverse | $2,238 | -$424 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$408 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$400 |

| 14 | Ford Edge | $2,270 | -$392 |

| 15 | Kia Sorento | $2,278 | -$384 |

| 16 | GMC Acadia | $2,316 | -$346 |

| 17 | Buick Enclave | $2,320 | -$342 |

| 18 | Honda Pilot | $2,336 | -$326 |

| 19 | Mazda CX-9 | $2,342 | -$320 |

| 20 | Jeep Grand Cherokee | $2,398 | -$264 |

| 21 | Hyundai Santa Fe | $2,426 | -$236 |

| 22 | Nissan Pathfinder | $2,440 | -$222 |

| 23 | Hyundai Palisade | $2,450 | -$212 |

| 24 | Chevrolet Blazer | $2,476 | -$186 |

| 25 | Kia Telluride | $2,504 | -$158 |

| 26 | Toyota 4Runner | $2,572 | -$90 |

| 27 | Mazda CX-90 | $2,582 | -$80 |

| 28 | Toyota Grand Highlander | $2,610 | -$52 |

| 29 | Kia EV9 | $2,630 | -$32 |

| 30 | Tesla Model Y | $2,654 | -$8 |

| 31 | Ford Bronco | $2,662 | -- |

| 32 | Jeep Wrangler | $2,740 | $78 |

| 33 | Dodge Durango | $2,942 | $280 |

| 34 | Rivian R1S | $2,950 | $288 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

What is the cheapest Ford Bronco insurance?

With Ford Bronco insurance rates ranging from $2,386 to $2,996 per year on average, the cheapest model to insure is the Big Bend trim. The next cheapest model to insure is the Black Diamond at $2,476 per year.

The highest cost trim levels of Ford Bronco to insure are the Raptor at $2,996 and the Heritage Limited Edition at $2,856 per year. Those models will cost an extra $610 and $470 per year, respectively, over the cheapest Big Bend model.

The model comparison chart below shows average annual and semi-annual car insurance rates for each trim level available for the 2024 Ford Bronco.

| 2024 Ford Bronco Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Big Bend | $2,386 | $199 |

| Black Diamond | $2,476 | $206 |

| Heritage Edition | $2,584 | $215 |

| Outer Banks | $2,584 | $215 |

| Badlands | $2,610 | $218 |

| Everglades | $2,702 | $225 |

| Wildtrak | $2,760 | $230 |

| Heritage Limited Edition | $2,856 | $238 |

| Raptor | $2,996 | $250 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Average cost to insure a Ford Bronco in your state

Where you live is one of the largest factors that determine how much you’ll pay to insure your Bronco. Rates can vary significantly, even down to a zip code level, due to things like historical weather-related claims (hail and floods), crime (vehicle theft and vandalism), and even just the amount of traffic congestion on your daily commute.

The table below shows the average cost to insure a Ford Bronco in all 50 U.S. states. Click any state name to view additional rates and information.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,602 | $217 |

| Alaska | $2,324 | $194 |

| Arizona | $2,632 | $219 |

| Arkansas | $2,886 | $241 |

| California | $3,202 | $267 |

| Colorado | $2,934 | $245 |

| Connecticut | $3,016 | $251 |

| Delaware | $3,060 | $255 |

| Florida | $3,094 | $258 |

| Georgia | $2,836 | $236 |

| Hawaii | $2,180 | $182 |

| Idaho | $2,240 | $187 |

| Illinois | $2,558 | $213 |

| Indiana | $2,304 | $192 |

| Iowa | $2,154 | $180 |

| Kansas | $2,766 | $231 |

| Kentucky | $2,930 | $244 |

| Louisiana | $2,990 | $249 |

| Maine | $2,024 | $169 |

| Maryland | $2,656 | $221 |

| Massachusetts | $2,968 | $247 |

| Michigan | $3,202 | $267 |

| Minnesota | $2,522 | $210 |

| Mississippi | $2,748 | $229 |

| Missouri | $3,042 | $254 |

| Montana | $2,634 | $220 |

| Nebraska | $2,476 | $206 |

| Nevada | $3,176 | $265 |

| New Hampshire | $2,154 | $180 |

| New Jersey | $3,204 | $267 |

| New Mexico | $2,448 | $204 |

| New York | $3,100 | $258 |

| North Carolina | $2,072 | $173 |

| North Dakota | $2,462 | $205 |

| Ohio | $2,210 | $184 |

| Oklahoma | $2,994 | $250 |

| Oregon | $2,664 | $222 |

| Pennsylvania | $2,718 | $227 |

| Rhode Island | $3,258 | $272 |

| South Carolina | $2,482 | $207 |

| South Dakota | $2,848 | $237 |

| Tennessee | $2,700 | $225 |

| Texas | $2,656 | $221 |

| Utah | $2,554 | $213 |

| Vermont | $2,266 | $189 |

| Virginia | $2,146 | $179 |

| Washington | $2,606 | $217 |

| West Virginia | $2,584 | $215 |

| Wisconsin | $2,242 | $187 |

| Wyoming | $2,580 | $215 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

When viewing average rates, keep in mind that actual costs can be higher or lower, depending on things like your age, your driving record, your prior claim history, and possibly your credit rating.

Cost can be very different not only within any individual state but also within any city. We recommend getting a few free Ford Bronco insurance quotes using your zip code in order to narrow down your individual rate and ensure you’re getting the best price.