- For the cheapest car insurance in Arvada, small SUVs like the Buick Envision, Chevrolet Trailblazer, Kia Soul, and Nissan Kicks cost less to insure than most other vehicles.

- The average cost of car insurance in Arvada is 14.1% more than the national average rate of $2,276.

Which cars are cheapest to insure in Arvada?

When comparing vehicles from every automotive segment, the models with the best car insurance prices in Arvada tend to be crossovers and small SUVs like the Kia Soul, Chevrolet Trailblazer, and Buick Envision. Average auto insurance prices for cars and SUVs that rank in the top 10 cost $2,148 or less per year, or $179 per month, to get full coverage.

Some additional vehicles that are ranked high in our auto insurance cost comparison are the Nissan Murano, Subaru Outback, Ford Bronco Sport, and Kia Niro.

The average insurance cost is a little higher for those models than the small SUVs at the top of the rankings, but they still have average rates of $2,280 or less per year ($190 per month).

The following table lists the 40 models with the cheapest car insurance in Arvada, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,938 | $162 |

| 2 | Chevrolet Trailblazer | $1,970 | $164 |

| 3 | Kia Soul | $2,046 | $171 |

| 4 | Nissan Kicks | $2,066 | $172 |

| 5 | Honda Passport | $2,090 | $174 |

| 6 | Buick Envision | $2,102 | $175 |

| 7 | Toyota Corolla Cross | $2,116 | $176 |

| 8 | Hyundai Venue | $2,134 | $178 |

| 9 | Mazda CX-5 | $2,140 | $178 |

| 10 | Ford Bronco Sport | $2,148 | $179 |

| 11 | Volkswagen Tiguan | $2,172 | $181 |

| 12 | Acura RDX | $2,194 | $183 |

| 13 | Nissan Murano | $2,204 | $184 |

| 14 | Buick Encore | $2,226 | $186 |

| 15 | Honda CR-V | $2,234 | $186 |

| 16 | Subaru Outback | $2,236 | $186 |

| 17 | Buick Envista | $2,244 | $187 |

| 18 | Volkswagen Taos | $2,248 | $187 |

| 19 | Kia Niro | $2,258 | $188 |

| 20 | Toyota GR Corolla | $2,280 | $190 |

| 21 | Honda HR-V | $2,284 | $190 |

| 22 | Subaru Ascent | $2,284 | $190 |

| 23 | Nissan Leaf | $2,298 | $192 |

| 24 | Chevrolet Colorado | $2,312 | $193 |

| 25 | Lexus NX 250 | $2,322 | $194 |

| 26 | Honda Civic | $2,324 | $194 |

| 27 | Volkswagen Atlas | $2,326 | $194 |

| 28 | Acura Integra | $2,332 | $194 |

| 29 | Subaru Forester | $2,334 | $195 |

| 30 | Volkswagen Atlas Cross Sport | $2,338 | $195 |

| 31 | Kia Seltos | $2,344 | $195 |

| 32 | GMC Terrain | $2,346 | $196 |

| 33 | Nissan Rogue | $2,358 | $197 |

| 34 | Hyundai Kona | $2,362 | $197 |

| 35 | Mazda CX-30 | $2,366 | $197 |

| 36 | Cadillac XT4 | $2,368 | $197 |

| 37 | Volkswagen ID4 | $2,378 | $198 |

| 38 | Ford Explorer | $2,380 | $198 |

| 39 | Toyota Highlander | $2,388 | $199 |

| 40 | Ford Escape | $2,394 | $200 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Arvada, CO Zip Codes. Updated October 24, 2025

A few other popular vehicles that made the top 40 table above include the Toyota Highlander, Acura Integra, Kia Seltos, and Volkswagen Atlas. Average car insurance rates for those models fall between $2,280 and $2,394 per year in Arvada.

To see how cheap these rates are, some examples of insurance that is considerably higher include the Hyundai Sonata at an average of $2,660 per year, the Chevrolet Camaro which costs $3,410, and the Audi e-tron at $3,272.

For very high-priced insurance, vehicles like the Mercedes-Benz Maybach GLS 600, BMW M5, BMW 750i, and BMW M760i have average rates that cost double and even triple those of the cheapest cars.

How much does car insurance cost in Arvada?

In Arvada, the average cost to insure a vehicle is $2,622 per year, which is 14.1% more than the U.S. overall average rate of $2,276. Per month, Arvada drivers can expect to pay an average of $219 for a full coverage policy.

In the state of Colorado, the average car insurance cost is $2,644 per year, so the cost in Arvada averages $22 less per year.

When prices are compared to other locations in Colorado, the average cost to insure a vehicle in Arvada is around $258 per year less than in Lakewood, $160 per year less than in Colorado Springs, and $430 per year less than in Pueblo.

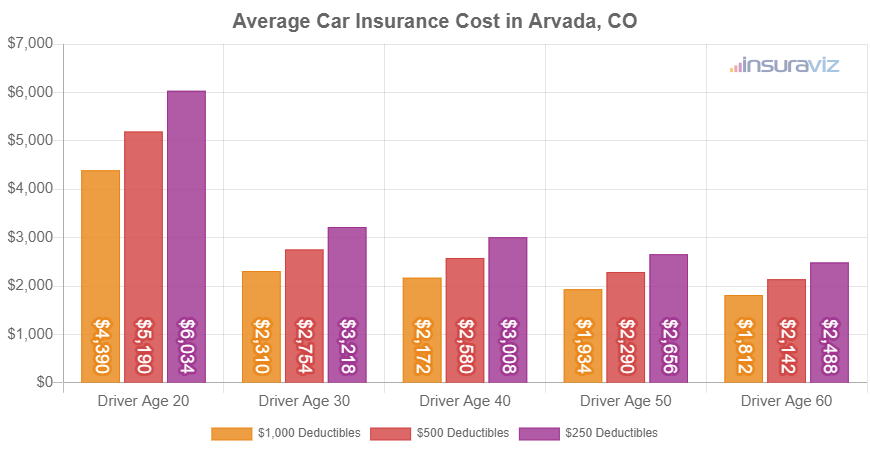

The next chart shows average auto insurance rates in Arvada, Colorado, for 2024 model year vehicles not only by driver age, but also by physical damage deductibles.

The average cost of car insurance per month in Arvada is $219, with prices ranging from $153 to $512 for the average costs shown in the previous chart.

Car insurance rates can have a very wide price range and depend on a lot of factors. The high chance of significant rate differences emphasizes the need for multiple auto insurance quotes when shopping for more affordable car insurance.

Driver age significantly impacts the price of auto insurance. The list below illustrates these differences by breaking out average car insurance rates for young, middle-age, and senior drivers.

Average cost of car insurance in Arvada for drivers age 16 to 60

- 16-year-old driver – $9,344 per year or $779 per month

- 17-year-old driver – $9,053 per year or $754 per month

- 18-year-old driver – $8,113 per year or $676 per month

- 19-year-old driver – $7,390 per year or $616 per month

- 20-year-old driver – $5,280 per year or $440 per month

- 30-year-old driver – $2,800 per year or $233 per month

- 40-year-old driver – $2,622 per year or $219 per month

- 50-year-old driver – $2,324 per year or $194 per month

- 60-year-old driver – $2,178 per year or $182 per month

The rates shown above for drivers age 16 to 19 were based on the rated driver being male. The chart below illustrates average car insurance rates for teenagers by gender. Teenage female drivers cost a lot to insure, but they are usually cheaper than male drivers of the same age.

Car insurance for a 16-year-old female in Arvada costs an average of $615 less per year than the cost for a male driver, while at age 19, it still costs $1,144 less per year for females than males.

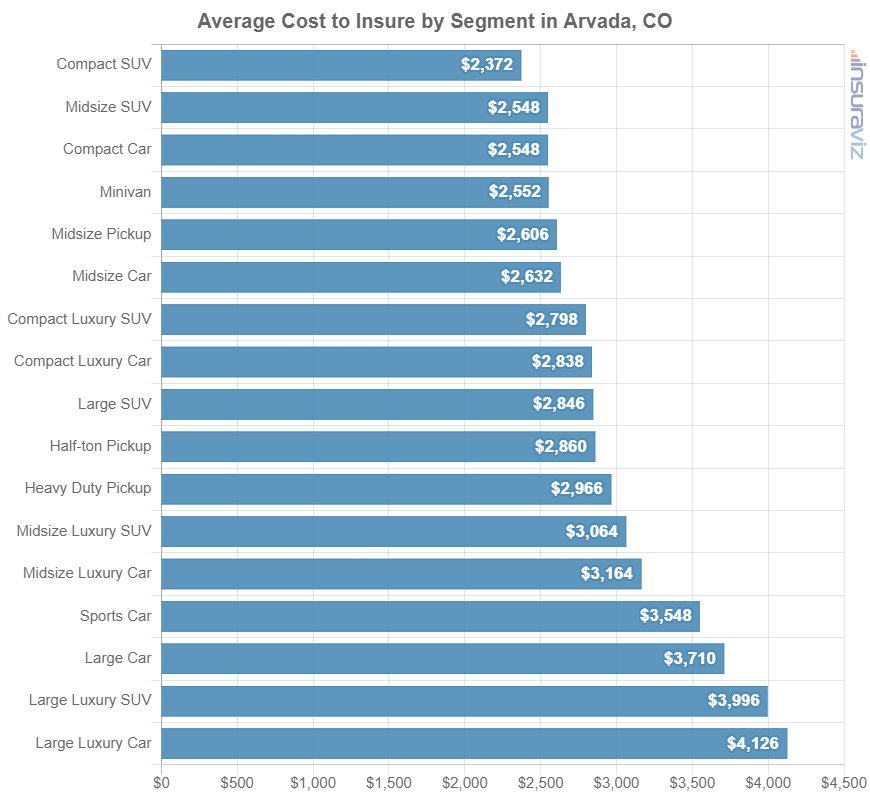

The section below illustrates the cost of car insurance based on automotive segment. The average rates shown in the chart will provide a better idea of the types of vehicles that have the most affordable average auto insurance rates.

Best types of vehicles for the cheapest rates

If you’re looking around at new or used cars, it is useful to know which categories of vehicles have more affordable car insurance rates.

As an example, you may be wondering if compact SUVs have more affordable insurance than minivans or if sports cars have cheaper auto insurance than luxury cars.

The chart below displays average car insurance cost by vehicle segment in Arvada. From an overal segment perspective, compact SUVs, midsize trucks, and minivans tend to have the cheapest average rates, with luxury cars and sports cars having the most expensive average cost to insure.

Car insurance rates by segment can be used for comparing estimates, but insurance rates for specific models range substantially within each segment displayed in the above chart.

For example, in the small luxury car segment, auto insurance rates in Arvada range from the Acura Integra costing $2,332 per year for a full coverage policy up to the BMW M340i at $3,204 per year, a difference of $872 just for that segment. Also, in the midsize car segment, the average cost of insurance can vary from the Kia K5 costing $2,528 per year to the Tesla Model 3 costing $3,080 per year, a difference of $552 just for that segment.

The list below shows the model with the best car insurance rates in Arvada, CO, for each segment shown in the chart above. Average annual and monthly insurance rates are calculated for each model. Click any model to view segment comparisons and insurance rates by trim level.

- Cheapest compact car insurance – Toyota GR Corolla at $2,280 per year or $190 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,938 per year or $162 per month

- Cheapest midsize car insurance – Kia K5 at $2,528 per year or $211 per month

- Cheapest midsize SUV insurance – Honda Passport at $2,090 per year or $174 per month

- Cheapest full-size car insurance – Chrysler 300 at $2,500 per year or $208 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $2,462 per year or $205 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $2,312 per year or $193 per month

- Cheapest full-size pickup insurance – Nissan Titan at $2,454 per year or $205 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $2,670 per year or $223 per month

- Cheapest minivan insurance – Honda Odyssey at $2,396 per year or $200 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $2,428 per year or $202 per month

- Cheapest compact luxury car insurance – Acura Integra at $2,332 per year or $194 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $2,194 per year or $183 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,698 per year or $225 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $2,454 per year or $205 per month

- Cheapest full-size luxury car insurance – Audi A5 at $3,118 per year or $260 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,940 per year or $245 per month

Tips for finding cheaper car insurance

The seven tips below give some great ways that you can cut the cost of car insurance.

- Be a responsible driver and save. At-fault accidents increase insurance cost, possibly by an additional $3,748 per year for a 20-year-old driver and even as much as $794 per year for a 50-year-old driver. So be safe and save.

- Your job could lower your rates. Some car insurance providers offer discounts for earning a living in occupations like dentists, firefighters, high school and elementary teachers, members of the military, police officers and law enforcement, engineers, and others. Working in a qualifying occupation may save between $79 and $255 on your annual auto insurance bill, depending on your policy.

- Compare car insurance rates before buying a car. Different vehicles can have significantly different car insurance premiums, and insurance companies can sell policies with a wide range of prices. Check prices before you purchase in order to prevent any surprises when insuring your new car.

- Stay claim free. Most auto insurance companies offer discounts for not filing any claims. Insurance should only be used for larger claims, not nickel-and-dime type claims.

- Buy vehicles with cheaper auto insurance rates. The vehicle you drive has a big impact on the price you pay for car insurance. As an example, a Kia Telluride costs $1,214 less per year to insure in Arvada than a Dodge Challenger. Drive cheaper models and save money.

- Clean up your credit for better rates. Having a credit score over 800 could save as much as $412 per year when compared to a decent credit rating of 670-739. Conversely, a lesser credit rating could cost up to $477 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Save by raising your deductibles. Raising your physical damage coverage deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.