- Models like the Chevrolet Trailblazer, Buick Envision, Subaru Crosstrek, and Kia Soul are the top picks for having the cheapest auto insurance in Carmel.

- Carmel car insurance rates average $1,394 per year for full coverage, or around $116 per month.

- Monthly car insurance rates for a few popular models in Carmel include the Chevrolet Equinox at $107, Tesla Model 3 at $137, and GMC Sierra at $128.

Which vehicles have cheap insurance in Carmel?

The models with the most affordable auto insurance rates in Carmel tend to be crossover SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, Toyota Corolla Cross, and Hyundai Venue.

Average insurance quotes for models ranked in the top 10 cost $1,142 or less per year to insure for full coverage in Carmel.

Some other vehicles that are in the top 20 in our cost comparison are the Volkswagen Tiguan, Honda CR-V, Nissan Murano, and Kia Niro. Insurance is slightly more for those models than the compact SUVs that rank at the top, but they still have an average cost of $1,194 or less per year, or $100 per month.

The next table shows the top 40 models with the cheapest car insurance rates in Carmel, ordered by cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,030 | $86 |

| 2 | Chevrolet Trailblazer | $1,048 | $87 |

| 3 | Kia Soul | $1,090 | $91 |

| 4 | Nissan Kicks | $1,096 | $91 |

| 5 | Honda Passport | $1,110 | $93 |

| 6 | Buick Envision | $1,118 | $93 |

| 7 | Toyota Corolla Cross | $1,122 | $94 |

| 8 | Hyundai Venue | $1,132 | $94 |

| 9 | Mazda CX-5 | $1,136 | $95 |

| 10 | Ford Bronco Sport | $1,142 | $95 |

| 11 | Volkswagen Tiguan | $1,154 | $96 |

| 12 | Acura RDX | $1,166 | $97 |

| 13 | Nissan Murano | $1,172 | $98 |

| 14 | Buick Encore | $1,184 | $99 |

| 15 | Buick Envista | $1,188 | $99 |

| 16 | Subaru Outback | $1,188 | $99 |

| 17 | Chevrolet Colorado | $1,190 | $99 |

| 18 | Honda CR-V | $1,190 | $99 |

| 19 | Volkswagen Taos | $1,192 | $99 |

| 20 | Kia Niro | $1,194 | $100 |

| 21 | Honda HR-V | $1,210 | $101 |

| 22 | Toyota GR Corolla | $1,212 | $101 |

| 23 | Subaru Ascent | $1,214 | $101 |

| 24 | Nissan Leaf | $1,218 | $102 |

| 25 | Honda Civic | $1,234 | $103 |

| 26 | Lexus NX 250 | $1,234 | $103 |

| 27 | Volkswagen Atlas | $1,236 | $103 |

| 28 | Acura Integra | $1,240 | $103 |

| 29 | Kia Seltos | $1,242 | $104 |

| 30 | Volkswagen Atlas Cross Sport | $1,242 | $104 |

| 31 | Subaru Forester | $1,244 | $104 |

| 32 | GMC Terrain | $1,248 | $104 |

| 33 | Nissan Rogue | $1,248 | $104 |

| 34 | Hyundai Kona | $1,252 | $104 |

| 35 | Mazda CX-30 | $1,254 | $105 |

| 36 | Cadillac XT4 | $1,260 | $105 |

| 37 | Ford Explorer | $1,264 | $105 |

| 38 | Volkswagen ID4 | $1,264 | $105 |

| 39 | Toyota Highlander | $1,266 | $106 |

| 40 | Ford Escape | $1,270 | $106 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Carmel, IN Zip Codes. Updated February 23, 2024

A few other popular vehicles that rank in the top 40 table above include the Volkswagen Atlas, Honda Civic, Volkswagen ID4, Hyundai Kona, and Subaru Ascent. Rates for those vehicles fall between $1,194 and $1,272 per year in Carmel.

To help put these rates in perspective, a few models with much more expensive insurance include the Toyota Mirai which costs $144 per month, the Audi A4 that costs $133, and the Lexus LC 500h at an average of $174.

How much does average car insurance cost in Carmel?

In Carmel, the average car insurance cost is $1,394 per year, which is 29.8% less than the overall national average rate of $1,883. Per month, Carmel drivers can expect to pay an average of $116 for a policy with full coverage.

In the state of Indiana, the average cost of car insurance is $1,468 per year, so the average rate in Carmel is $74 less per year.

When prices are compared to other larger cities in Indiana, the cost of insurance in Carmel is around $68 per year cheaper than in Bloomington, $22 per year less than in South Bend, and $108 per year cheaper than in Evansville.

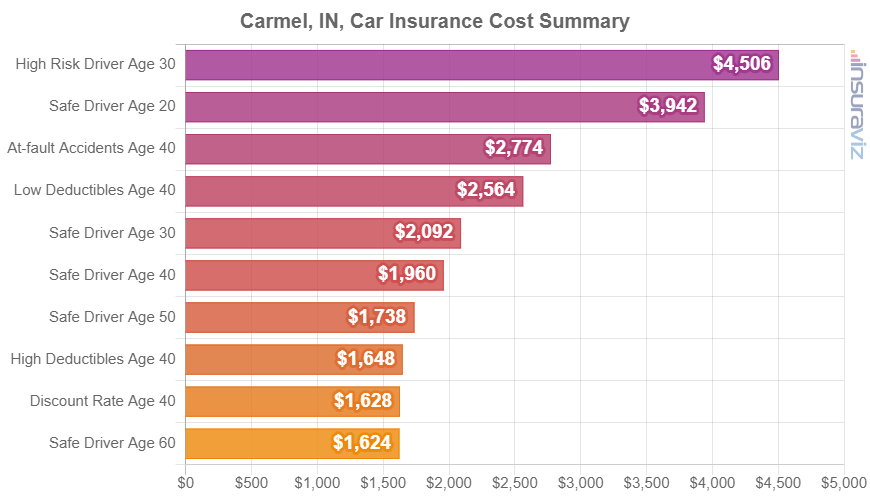

The next chart shows a summary of auto insurance rates in Carmel for 2024 model year vehicles, averaged based on a number of different driver ages and risk profiles.

Average car insurance rates in the chart range from $1,158 per year for a 40-year-old driver who receives an exceptional discount rate to $3,204 per year for a 30-year-old driver with too many violations and accidents.

For monthly budgeting purposes, the average cost of car insurance per month in Carmel ranges from $97 to $267.

Car insurance rates can have significant differences in cost and small changes in personal situations can cause substantial price changes. The potential for significant variability stresses the need to get multiple auto insurance quotes when shopping around for a better price on car insurance in Carmel.

The age of the rated driver has a big impact on the price of auto insurance, so the list below details how driver age influences cost by breaking down average car insurance rates in Carmel for different driver ages.

Average cost of car insurance in Carmel, IN, by driver age

- 16-year-old rated driver – $4,962 per year or $414 per month

- 17-year-old rated driver – $4,806 per year or $401 per month

- 18-year-old rated driver – $4,307 per year or $359 per month

- 19-year-old rated driver – $3,921 per year or $327 per month

- 20-year-old rated driver – $2,802 per year or $234 per month

- 30-year-old rated driver – $1,486 per year or $124 per month

- 40-year-old rated driver – $1,394 per year or $116 per month

- 50-year-old rated driver – $1,238 per year or $103 per month

- 60-year-old rated driver – $1,158 per year or $97 per month

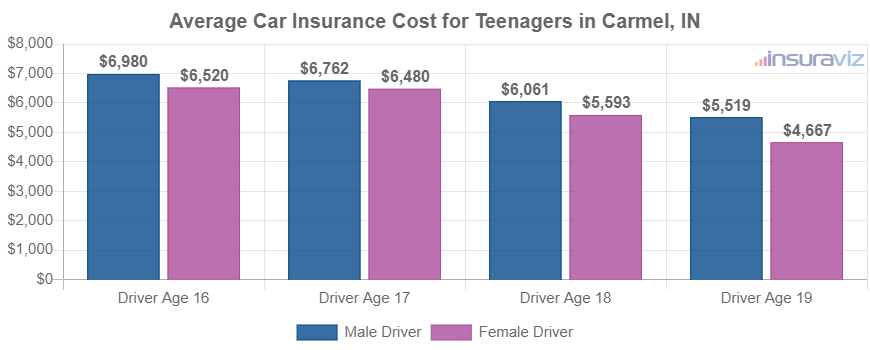

The rates listed above for insuring teenage drivers assumed the gender of the driver was male. The next chart goes into more detail for teenage car insurance rates and breaks out average car insurance rates for teen drivers by gender. Female drivers tend to have slightly cheaper auto insurance rates, especially at younger ages.

Car insurance for a female 16-year-old driver in Carmel costs an average of $329 less than a male driver per year, while at age 19, the cost difference is much less but is still $605 per year cheaper for females.

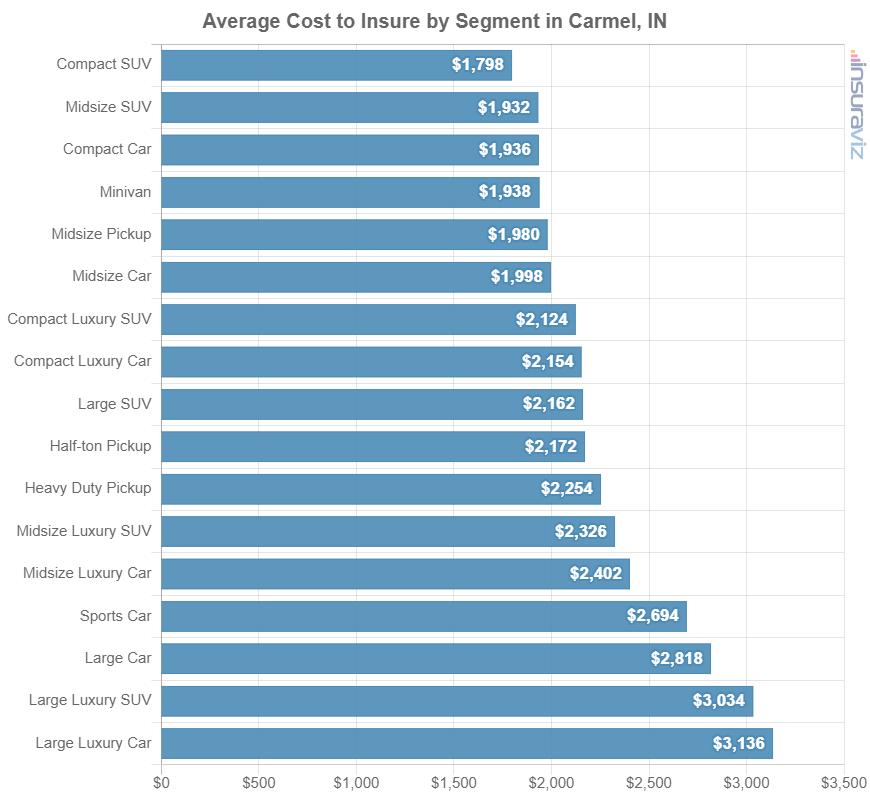

This next section illustrates the cost of car insurance based on automotive segment. The average rates shown in the chart will give you a better understanding of which vehicles have the most affordable Carmel auto insurance rates.

Cheapest auto insurance rates by segment

If a different vehicle is in your future, it’s useful to have a basic understanding of which kinds of vehicles are less expensive to insure.

For example, you may be wondering if compact cars are more affordable to insure than midsize cars or if full-size pickups have more affordable insurance than midsize pickups.

The next chart displays the average car insurance cost in Carmel for each automotive segment. As a general rule, compact SUVs, vans, and midsize pickups tend to have the least expensive rates, while large luxury, performance, and sports cars have the most expensive rates.

Segment rates are handy for making an overall comparison, but rates range considerably within each vehicle category displayed in the above chart.

For example, in the midsize SUV segment, average Carmel auto insurance rates range from the Honda Passport costing $1,110 per year for a full coverage policy up to the Dodge Durango at $1,708 per year. For another example, in the small luxury SUV segment, the cost of insurance can range from the Acura RDX at $1,166 per year up to the Aston Martin DBX at $2,710 per year.

In the following list, you can find the model with the cheapest overall insurance rates in Carmel, IN, for each different segment. Each model is linked to comparisons and rates by trim level.

- Cheapest compact car insurance – Toyota GR Corolla at $1,212 per year or $101 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,030 per year or $86 per month

- Cheapest midsize car insurance – Hyundai Ioniq 6 at $1,282 per year or $107 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,110 per year or $93 per month

- Cheapest full-size car insurance – Chrysler 300 at $1,322 per year or $110 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $1,310 per year or $109 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,190 per year or $99 per month

- Cheapest full-size pickup insurance – Nissan Titan at $1,302 per year or $109 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $1,418 per year or $118 per month

- Cheapest minivan insurance – Honda Odyssey at $1,274 per year or $106 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $1,290 per year or $108 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,240 per year or $103 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,166 per year or $97 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $1,434 per year or $120 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $1,304 per year or $109 per month

- Cheapest full-size luxury car insurance – Audi A5 at $1,648 per year or $137 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $1,562 per year or $130 per month

Specific vehicles and the cost of insurance

The previously discussed car insurance rates take the cost to insure each 2024 vehicle model and average them, which is helpful when making big picture comparisons such as the cost difference between two locations.

For more in-depth price comparisons, however, we need to instead use rates for the specific model of vehicle being insured. Let’s take a high-level look at the most common vehicles to discover how car insurance rates compare in Carmel.

This next list displays average insurance cost by year and month for popular cars, trucks, and SUVs that you can find on the streets of Carmel.

Auto insurance cost for popular vehicles in Carmel

- Chevrolet Equinox – $1,280 per year ($107 per month)

- Tesla Model 3 – $1,638 per year ($137 per month)

- GMC Sierra – $1,536 per year ($128 per month)

- Ram Truck – $1,610 per year ($134 per month)

- Mazda CX-5 – $1,136 per year ($95 per month)

- Chevrolet Silverado – $1,540 per year ($128 per month)

- Toyota Corolla – $1,358 per year ($113 per month)

- Ford Explorer – $1,264 per year ($105 per month)

- Toyota Tacoma – $1,410 per year ($118 per month)

- Hyundai Elantra – $1,516 per year ($126 per month)

If you compare the models listed above to the prior list of the 40 cheapest models to insure, most popular models do not have the most affordable rates.

Factors that can result in more expensive premiums include a higher purchase price, like a GMC Yukon which has an average cost of $59,295 or an Audi A7 that has an average price of $71,200, or perhaps an increased chance of liability claims like a Ford Bronco or a Ford F-250 Super Duty pickup.

Seven tips for finding cheaper auto insurance

Even though car insurance does cost quite a bit, there are some ways to help keep it within your monthly budget. The tips below are some of the best ways to cut the cost of insurance without sacrificing coverage.

- Compare insurance costs before buying a car. Different cars, and even different trim levels of the same car, have very different car insurance rates, and insurers can sell policies with very different rates. Check rates before you buy a new car so you can avoid any surprises when buying insurance.

- Auto insurance is cheaper with higher deductibles. Increasing your policy deductibles from $500 to $1,000 could save around $300 per year for a 40-year-old driver and $588 per year for a 20-year-old driver.

- Shop your coverage around. Taking a couple of minutes every year or so to get free car insurance quotes could significantly reduce the cost of insurance. Companies make rate modifications frequently and you can switch companies at any time.

- Pay small claims out-of-pocket. Car insurance companies give a discount if you have no claims on your account. Auto insurance should be used to protect you from large financial hits, not minor claims that should be paid out-of-pocket.

- Your profession could save you money. The large majority of insurance companies offer policy discounts for working in professions like dentists, engineers, nurses, doctors, emergency medical technicians, police officers and law enforcement, and others. If you qualify for this occupational discount, you could save between $42 and $136 on your yearly auto insurance bill, depending on the level of coverage purchased.

- Avoiding accidents keeps car insurance rates low. Having multiple accidents could cost you more, possibly up to $1,986 per year for a 20-year-old driver and even $338 per year for a 60-year-old driver. So be safe and save.