- Average car insurance in New Bedford costs $2,102 per year, or $175 per month for full coverage.

- New Bedford auto insurance averages $36 per year more than the Massachusetts state average and $219 per year more than the rate average for the entire United States.

- For the cheapest car insurance in New Bedford, Massachusetts, SUV models like the Chevrolet Trailblazer, Toyota Corolla Cross, and Subaru Crosstrek have the most affordable rates.

- A few vehicles with segment-leading car insurance rates include the Jaguar E-Pace ($1,964 per year), Hyundai Ioniq 6 ($1,930 per year), Mercedes-Benz CLA250 ($2,160 per year), and Mazda MX-5 Miata ($1,944 per year).

- Auto insurance quotes in New Bedford can range significantly from as little as $37 per month for just liability insurance to over $662 per month for teens and other high-risk drivers.

New Bedford car insurance cost

The average price for car insurance in New Bedford is $2,102 per year, which is 11% more than the overall national average rate of $1,883 per year. The average cost of car insurance per month in New Bedford is $175 for a full-coverage car insurance policy.

In the state of Massachusetts, average car insurance cost is $2,066 per year, so the cost in New Bedford averages $36 more per year.

When rates are compared to other locations in Massachusetts, the average cost of insurance in New Bedford is around $178 per year less than in Springfield, $66 per year more expensive than in Boston, and $30 per year cheaper than in Worcester.

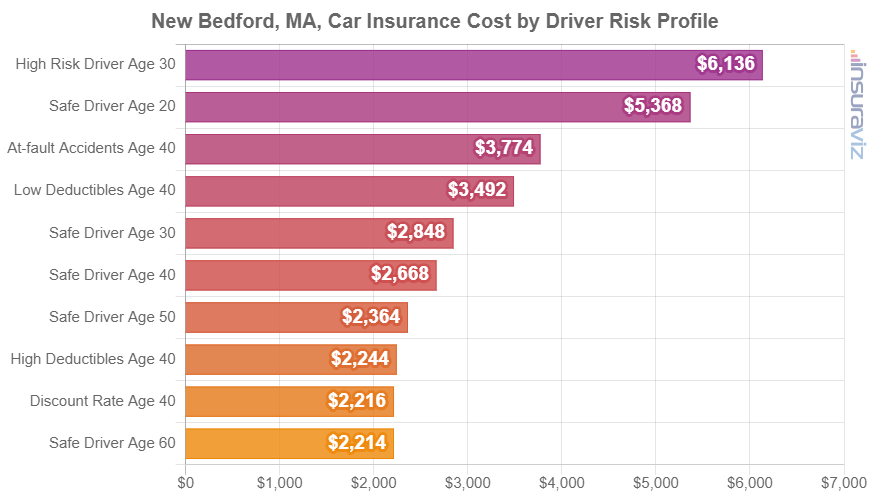

The next chart shows examples of average New Bedford auto insurance cost broken out based on a range of different driver ages, policy deductibles, and driver risk scenarios. Rates are averaged for all 2024 model year vehicles including luxury brands.

Average car insurance rates in the prior chart range from $1,744 per year for a 40-year-old driver who meets the requirements for many policy discounts to $4,832 per year for a 30-year-old driver with too many violations and accidents.

When average annual cost is converted to monthly rates, the average cost of car insurance per month in New Bedford ranges from $145 to $403.

New Bedford car insurance rates are different for every driver and small changes in personal situations can cause substantial price changes. This amount of variability emphasizes the need to get accurate auto insurance quotes when trying to find cheaper car insurance in New Bedford.

The age of the driver has the single biggest impact on the price you pay for auto insurance, so the list below illustrates this point by showing average car insurance rates in New Bedford for drivers from 16 to 60.

New Bedford, MA, car insurance cost by driver age

- 16-year-old driver – $7,483 per year or $624 per month

- 17-year-old driver – $7,251 per year or $604 per month

- 18-year-old driver – $6,494 per year or $541 per month

- 19-year-old driver – $5,915 per year or $493 per month

- 20-year-old driver – $4,228 per year or $352 per month

- 30-year-old driver – $2,242 per year or $187 per month

- 40-year-old driver – $2,102 per year or $175 per month

- 50-year-old driver – $1,864 per year or $155 per month

- 60-year-old driver – $1,742 per year or $145 per month

Which cars have the cheapest insurance rates?

The vehicles with the cheapest insurance rates in New Bedford tend to be small SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, Nissan Kicks, and Hyundai Venue.

Average car insurance quotes for cars and SUVs in the top ten cost $1,720 or less per year to insure for full coverage in New Bedford.

A few other models that rank very well in the cost comparison table below are the Buick Encore, Subaru Outback, Kia Niro, and Volkswagen Tiguan. Average auto insurance rates are a little bit more for those models than the cheapest compact SUVs and crossovers at the top of the list, but they still have an average cost of $150 or less per month in New Bedford.

The next table lists the 30 cars, trucks, and SUVs with the cheapest insurance rates in New Bedford, ordered by annual cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,552 | $129 |

| 2 | Chevrolet Trailblazer | $1,578 | $132 |

| 3 | Kia Soul | $1,640 | $137 |

| 4 | Nissan Kicks | $1,654 | $138 |

| 5 | Honda Passport | $1,672 | $139 |

| 6 | Buick Envision | $1,684 | $140 |

| 7 | Toyota Corolla Cross | $1,692 | $141 |

| 8 | Hyundai Venue | $1,706 | $142 |

| 9 | Mazda CX-5 | $1,712 | $143 |

| 10 | Ford Bronco Sport | $1,720 | $143 |

| 11 | Volkswagen Tiguan | $1,738 | $145 |

| 12 | Acura RDX | $1,756 | $146 |

| 13 | Nissan Murano | $1,766 | $147 |

| 14 | Buick Encore | $1,784 | $149 |

| 15 | Honda CR-V | $1,790 | $149 |

| 16 | Subaru Outback | $1,790 | $149 |

| 17 | Buick Envista | $1,794 | $150 |

| 18 | Chevrolet Colorado | $1,798 | $150 |

| 19 | Volkswagen Taos | $1,798 | $150 |

| 20 | Kia Niro | $1,802 | $150 |

| 21 | Honda HR-V | $1,826 | $152 |

| 22 | Toyota GR Corolla | $1,826 | $152 |

| 23 | Subaru Ascent | $1,828 | $152 |

| 24 | Nissan Leaf | $1,838 | $153 |

| 25 | Honda Civic | $1,858 | $155 |

| 26 | Lexus NX 250 | $1,858 | $155 |

| 27 | Volkswagen Atlas | $1,862 | $155 |

| 28 | Acura Integra | $1,868 | $156 |

| 29 | Volkswagen Atlas Cross Sport | $1,870 | $156 |

| 30 | Kia Seltos | $1,874 | $156 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all New Bedford, MA Zip Codes. Updated February 22, 2024

Some other popular models making the list of the top 30 above include the Nissan Leaf, the Honda HR-V, the Lexus NX 250, and the Toyota GR Corolla. Insurance rates for those models cost between $1,802 and $1,870 per year in New Bedford, MA.

As a comparison to the cheapest car insurance rates, some examples of insurance that is considerably higher include the Jeep Wrangler which averages $2,400 per year, the Toyota Tundra at an average of $2,504, and the Tesla Model X which averages $2,640.

The next section of this article goes into average car insurance cost by vehicle segment. The average rates shown in the chart should provide a good idea of which vehicles have the overall least expensive New Bedford auto insurance rates. The sections following the chart rank the specific models that have the cheapest insurance rates for the most popular automotive segments.

New Bedford auto insurance rates by automotive segment

If you’re considering buying a new car, it’s good to know which kinds of vehicles have more favorable insurance rates. For instance, maybe you’re curious if midsize SUVs cost less to insure than small SUVs or if full-size pickups have more expensive insurance than midsize pickups.

The next chart shows average car insurance rates in New Bedford for different vehicle segments. As a general rule, compact SUVs and midsize pickup trucks tend to have the best rates, with sports cars and performance luxury models having the highest average cost to insure.

Rates by automotive segment are accurate enough for comparing estimates, but auto insurance cost varies substantially within each vehicle segment listed above.

For example, in the midsize truck segment, average New Bedford auto insurance rates range from the Chevrolet Colorado costing $1,798 per year for a full coverage policy to the Rivian R1T costing $2,620 per year. In the midsize SUV segment, the average insurance cost varies from the Honda Passport at $1,672 per year up to the Dodge Durango at $2,576 per year.

The following list shows the model with the best car insurance rates in New Bedford, MA, for each individual category. Follow any model link to see detailed rate and comparison information.

- Cheapest compact car insurance – Toyota GR Corolla at $1,826 per year or $152 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,552 per year or $129 per month

- Cheapest midsize car insurance – Hyundai Ioniq 6 at $1,930 per year or $161 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,672 per year or $139 per month

- Cheapest full-size car insurance – Chrysler 300 at $1,994 per year or $166 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $1,972 per year or $164 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,798 per year or $150 per month

- Cheapest full-size pickup insurance – Nissan Titan at $1,968 per year or $164 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $2,138 per year or $178 per month

- Cheapest minivan insurance – Honda Odyssey at $1,920 per year or $160 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $1,944 per year or $162 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,868 per year or $156 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,756 per year or $146 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,160 per year or $180 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $1,964 per year or $164 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,488 per year or $207 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,356 per year or $196 per month

Detailed insurance rates for popular models

To aid in understanding how much the cost of auto insurance can fluctuate for different drivers (and also emphasize the importance of accurate rate quotes), the examples below show comprehensive car insurance rates for five popular vehicles in New Bedford: the Ford F150, Honda Civic, Honda CR-V, Honda Pilot, and Chevrolet Camaro.

Each illustration uses a variety of risk profiles to illustrate the variation with only minor changes in the driver profile.

Ford F150 insurance rates

The average cost of Ford F150 insurance in New Bedford is $2,352 per year. With a purchase price ranging from $46,195 to $100,090, average car insurance quotes for a 2024 Ford F150 cost from $1,974 per year for the Ford F150 XL Super Cab 4WD model up to $2,732 per year on the Ford F150 Lightning Platinum Black Special Edition trim.

The next rate chart may help to demonstrate how the cost to insure a Ford F150 can be very different based on changes in the age of the driver, deductibles, and risk profiles. For our example, prices range from $1,950 to $5,430 per year, which is a cost difference of $3,480.

The Ford F150 is part of the full-size truck segment, and other models in that segment include the Toyota Tundra, Nissan Titan, and Ram Truck.

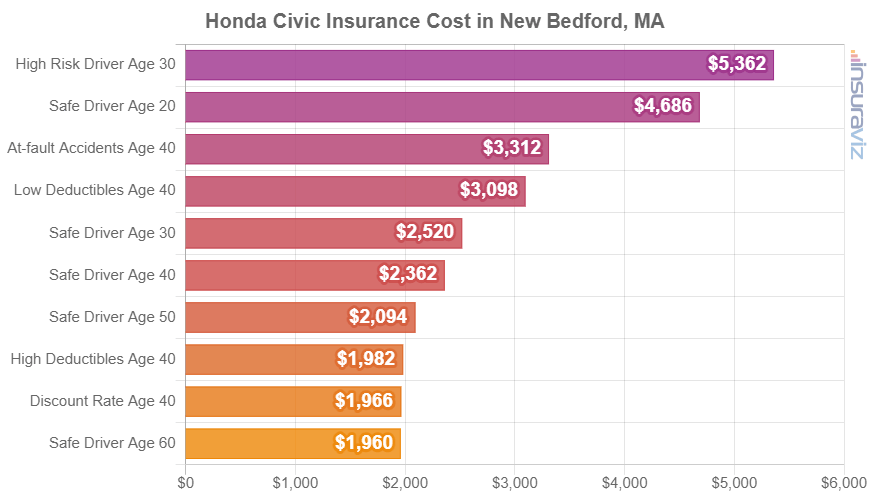

Honda Civic insurance rates

The lowest-cost 2024 Honda Civic trim to insure in New Bedford is the LX model, costing an average of $1,664 per year, or about $139 per month. This model costs $23,950.

The most expensive 2022 Honda Civic trim to insure in New Bedford is the Type R, costing an average of $2,204 per year, or about $184 per month. The retail cost for this trim level is $43,795, before documentation and destination fees.

As a cost per month, car insurance on a Honda Civic can cost from $139 to $184 per month, depending on various factors including your exact location in New Bedford.

The next chart shows how the prices of car insurance on a Honda Civic can be significantly different for a number of different driver ages and possible risk profiles. For our example, prices range from $1,550 to $4,226 per year, which is a price difference of $2,676.

The Honda Civic is classified as a compact car, and additional similar models include the Kia Forte, Hyundai Elantra, and Chevrolet Cruze.

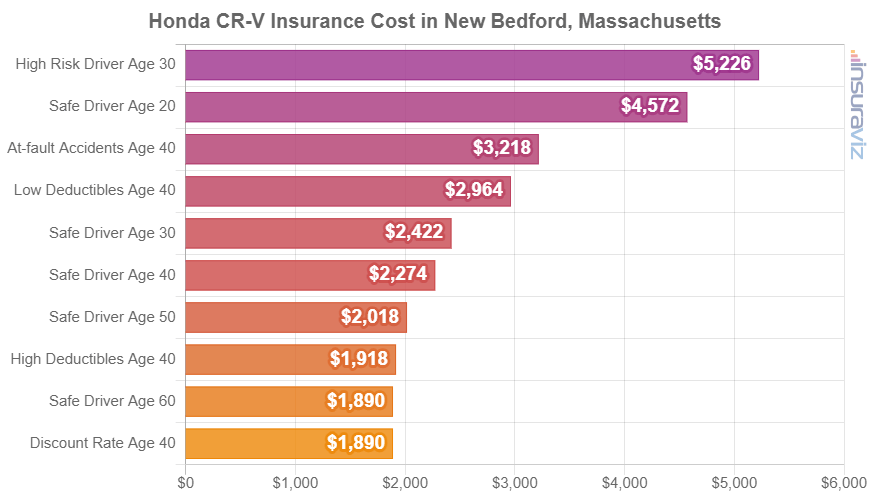

Honda CR-V insurance rates

The average cost for Honda CR-V insurance in New Bedford is $1,790 per year. With prices ranging from $29,500 to $39,850, average car insurance rates on a 2024 Honda CR-V cost from $1,698 per year for the Honda CR-V LX model up to $1,890 per year for the Honda CR-V Sport Touring Hybrid AWD trim level.

When New Bedford car insurance rates on a Honda CR-V are compared to the cost averaged for the entire U.S. on the same vehicle, rates are $164 to $184 more per year in New Bedford, depending on trim level.

From a monthly standpoint, full-coverage insurance on the Honda CR-V for an average middle-age driver can range from $142 to $158 per month, depending on your address in New Bedford.

The chart displayed below demonstrates how insurance quotes on a Honda CR-V can be significantly different for different drivers, policy physical damage deductibles, and risk scenarios.

The Honda CR-V is a compact SUV, and other similar models include the Nissan Rogue, Chevrolet Equinox, and Subaru Forester.

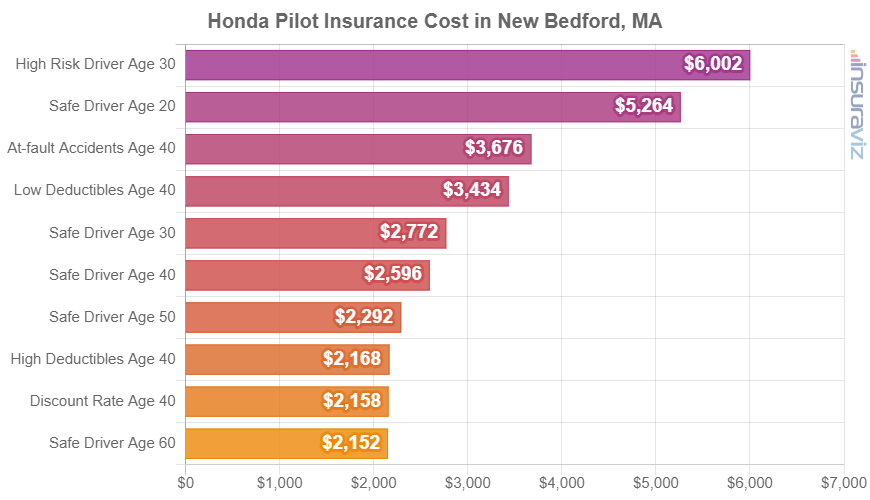

Honda Pilot insurance rates

Honda Pilot insurance in New Bedford costs an average of $2,044 per year, ranging from $1,912 per year on the Honda Pilot LX model (MSRP of $37,090) up to $2,172 per year on the Honda Pilot Elite AWD model (MSRP of $52,480).

The chart displayed below illustrates how the cost to insure a Honda Pilot can be significantly different based on a number of different driver ages, policy physical damage deductibles, and risk scenarios.

In this example, prices range from $1,700 to $4,728 per year, which is a difference in cost of $3,028 caused by changes in driver risk.

The Honda Pilot is classified as a midsize SUV, and additional similar models from the same segment include the Kia Telluride, Kia Sorento, Toyota Highlander, and Jeep Grand Cherokee.

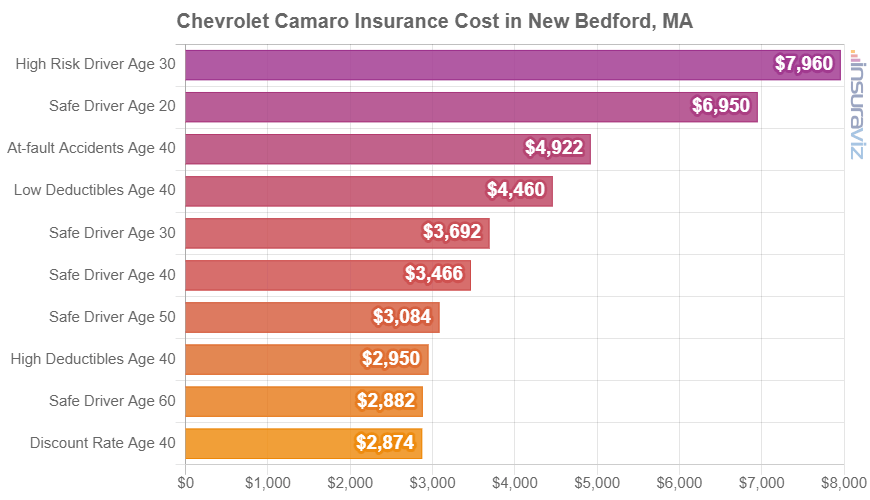

Chevrolet Camaro insurance rates

Chevrolet Camaro insurance in New Bedford averages $2,730 per year, with a range of $2,300 per year on the Chevrolet Camaro 1LT Convertible model (MSRP of $38,495) up to $3,342 per year on the Chevrolet Camaro ZL1 Coupe trim level (MSRP of $73,695).

On a monthly basis, car insurance on a 2024 Chevrolet Camaro for an average middle-age driver can range from $192 to $279 per month, depending on your car insurance company and exact Zip Code in New Bedford.

The chart below illustrates how insurance quotes on a Chevrolet Camaro can range significantly for a variety of driver ages, risk profiles, and policy deductibles.

The Chevrolet Camaro is a sports car, and other similar models from the same segment include the Nissan 370Z, Subaru BRZ, Chevrolet Corvette, and Ford Mustang.

Money-saving tips for finding cheaper New Bedford auto insurance

Smart drivers are always searching for ways to reduce the monthly expense for insurance. So take a minute to review the tips in this next list to see if you can save a few dollars on your next renewal or new policy.

- Shop around often. Taking the time to get free car insurance quotes is a great way to save money. Companies make rate modifications frequently and you can switch anytime.

- Your employer could reduce your rates. The large majority of car insurance companies offer discounts for earning a living in occupations like architects, doctors, accountants, dentists, emergency medical technicians, and others. If your occupation qualifies you for this discount, you could potentially save between $63 and $204 on your annual car insurance cost, subject to the policy coverages selected.

- Buy vehicles with cheaper insurance. The vehicle you drive is a big factor in the price you pay for insurance. As an example, a Honda CR-V costs $1,372 less per year to insure in New Bedford than a Dodge Challenger. Choose lower performance vehicles and save money.

- Bad drivers pay more for car insurance. Having frequent at-fault accidents will raise rates, potentially by an additional $2,998 per year for a 20-year-old driver and as much as $512 per year for a 60-year-old driver. So drive safe and save!

- A good driving record means cheaper insurance cost. If you want cheap car insurance in New Bedford, it pays to be a good, safe driver. Not surprisingly, just a couple of blemishes on your motor vehicle report could result in increasing insurance policy cost as much as $558 per year.

- Qualify for discounts to save money. Discounted rates may be available if the insured drivers drive a vehicle with safety or anti-theft features, are good students, are military or federal employees, belong to certain professional organizations, take a defensive driving course, or many other discounts which could save the average New Bedford driver as much as $358 per year on their insurance cost.