- Small crossovers like the Nissan Kicks, Chevrolet Trailblazer, and Kia Soul are our top picks for having the cheapest car insurance in Norwalk.

- Norwalk car insurance rates average $2,604 per year, or around $217 per month.

- Compared to the national average cost of $2,276, average rates in Norwalk are 13.4% more expensive per year.

Which vehicles are cheapest to insure?

When rates are compared for all models, the vehicles with the cheapest auto insurance prices in Norwalk tend to be compact SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, and Buick Envision.

Average car insurance quotes for vehicles ranked in the top 10 cost $2,136 or less per year to have full coverage.

Other models that have affordable car insurance rates in the cost comparison table below are the Honda CR-V, Subaru Outback, Volkswagen Taos, and Toyota GR Corolla.

The average cost is a little bit more for those models than the cheapest crossover SUVs that rank at the top, but they still have an average insurance cost of $2,262 or less per year.

Out of over 700 vehicles, the table below details the top 50 cheapest vehicles to insure in Norwalk, Connecticut.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,924 | $160 |

| 2 | Chevrolet Trailblazer | $1,960 | $163 |

| 3 | Kia Soul | $2,036 | $170 |

| 4 | Nissan Kicks | $2,050 | $171 |

| 5 | Honda Passport | $2,074 | $173 |

| 6 | Buick Envision | $2,086 | $174 |

| 7 | Toyota Corolla Cross | $2,098 | $175 |

| 8 | Hyundai Venue | $2,116 | $176 |

| 9 | Mazda CX-5 | $2,124 | $177 |

| 10 | Ford Bronco Sport | $2,136 | $178 |

| 11 | Volkswagen Tiguan | $2,154 | $180 |

| 12 | Acura RDX | $2,178 | $182 |

| 13 | Nissan Murano | $2,190 | $183 |

| 14 | Buick Encore | $2,214 | $185 |

| 15 | Subaru Outback | $2,220 | $185 |

| 16 | Honda CR-V | $2,222 | $185 |

| 17 | Buick Envista | $2,226 | $186 |

| 18 | Volkswagen Taos | $2,230 | $186 |

| 19 | Kia Niro | $2,244 | $187 |

| 20 | Toyota GR Corolla | $2,262 | $189 |

| 21 | Subaru Ascent | $2,266 | $189 |

| 22 | Honda HR-V | $2,268 | $189 |

| 23 | Nissan Leaf | $2,282 | $190 |

| 24 | Chevrolet Colorado | $2,292 | $191 |

| 25 | Lexus NX 250 | $2,304 | $192 |

| 26 | Honda Civic | $2,306 | $192 |

| 27 | Volkswagen Atlas | $2,310 | $193 |

| 28 | Acura Integra | $2,318 | $193 |

| 29 | Subaru Forester | $2,318 | $193 |

| 30 | Volkswagen Atlas Cross Sport | $2,320 | $193 |

| 31 | Kia Seltos | $2,328 | $194 |

| 32 | GMC Terrain | $2,334 | $195 |

| 33 | Nissan Rogue | $2,340 | $195 |

| 34 | Hyundai Kona | $2,346 | $196 |

| 35 | Mazda CX-30 | $2,348 | $196 |

| 36 | Cadillac XT4 | $2,354 | $196 |

| 37 | Volkswagen ID4 | $2,364 | $197 |

| 38 | Ford Explorer | $2,366 | $197 |

| 39 | Toyota Highlander | $2,372 | $198 |

| 40 | Ford Escape | $2,376 | $198 |

| 41 | Toyota Venza | $2,378 | $198 |

| 42 | Honda Odyssey | $2,382 | $199 |

| 43 | Nissan Sentra | $2,386 | $199 |

| 44 | Subaru Impreza | $2,394 | $200 |

| 45 | Chevrolet Equinox | $2,398 | $200 |

| 46 | Toyota RAV4 | $2,402 | $200 |

| 47 | Mazda MX-5 Miata | $2,412 | $201 |

| 48 | Mazda MX-30 | $2,418 | $202 |

| 49 | Hyundai Tucson | $2,422 | $202 |

| 50 | Chevrolet Traverse | $2,432 | $203 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Norwalk, CT Zip Codes. Updated October 24, 2025

Other models making the list of the top 50 table above include the Nissan Rogue, the Volkswagen Atlas Cross Sport, the Nissan Sentra, and the Nissan Leaf. Rates for those vehicles cost between $2,262 and $2,436 per year.

In contrast to the cheapest vehicles to insure, a few models that cost much more to insure include the Dodge Durango that averages $3,196 per year, the Subaru BRZ which averages $3,114, and the BMW X3 that costs $3,072.

Average car insurance cost in Norwalk, CT

Average car insurance rates in Norwalk cost $2,604 per year, or approximately $217 per month. When compared to the U.S. average rate, Norwalk car insurance cost is 13.4% more expensive per year.

In the state of Connecticut, the average cost of car insurance is $2,716 per year, so the cost in Norwalk averages $112 less per year. The cost to insure a car in Norwalk compared to other Connecticut cities is around $350 per year cheaper than in Waterbury, $452 per year less than in Hartford, and $512 per year less than in New Haven.

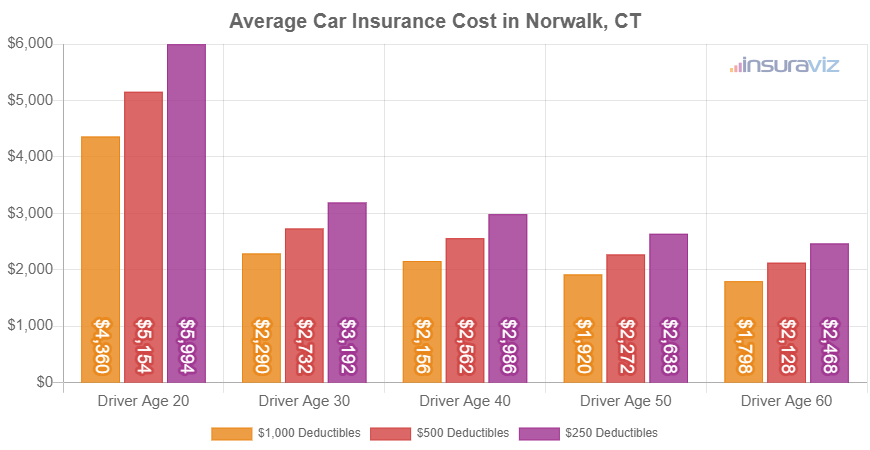

The next chart shows average Norwalk, CT, car insurance cost broken out not only by the age of the driver, but also by three different physical damage coverage deductibles. Rates are averaged for all 2024 vehicle models including luxury cars and SUVs.

In the chart above, the cost of auto insurance ranges from $1,828 per year for a 60-year-old driver with a policy with high physical damage deductibles to $6,096 per year for a 20-year-old driver with low physical damage deductibles. From a monthly point of view, the average cost ranges from $152 to $508 per month.

The age of the rated driver has a big impact on the price you pay for car insurance, so the list below illustrates this by breaking out average car insurance rates depending on driver age.

Norwalk car insurance cost by driver age

- 16-year-old driver – $9,278 per year or $773 per month

- 17-year-old driver – $8,986 per year or $749 per month

- 18-year-old driver – $8,053 per year or $671 per month

- 19-year-old driver – $7,337 per year or $611 per month

- 20-year-old driver – $5,242 per year or $437 per month

- 30-year-old driver – $2,780 per year or $232 per month

- 40-year-old driver – $2,604 per year or $217 per month

- 50-year-old driver – $2,308 per year or $192 per month

- 60-year-old driver – $2,164 per year or $180 per month

The rates listed above for teen drivers assumed the gender of the driver was male. The next chart goes into more detail for teenage car insurance rates and breaks out car insurance cost for teens by gender. Teenage females are expensive to insure, but do tend to have cheaper car insurance rates than males of the same age.

Auto insurance for a 16-year-old female driver in Norwalk costs an average of $610 less than male drivers each year, while at age 19, the cost difference is smaller, but females still pay an average of $1,134 less per year.

The next section of this article illustrates average auto insurance cost by vehicle segment. The rates shown in the chart should give you a decent idea of the vehicle segments that have the most affordable average car insurance rates.

Cheapest insurance cost by automotive segment

When shopping for a new or used vehicle, it’s very useful to know which kinds of vehicles are cheaper to insure. For example, do compact cars have cheaper insurance than midsize cars? Or do luxury cars have cheaper insurance than sports cars?

The chart below displays average auto insurance rates in Norwalk for different vehicle segments. From an overal segment perspective, compact and midsize SUVs, vans, and midsize pickups have the least expensive average car insurance rates, while sports cars, large luxury cars, and performance exotic cars have the most expensive average cost to insure.

For comparison sakes, it’s okay to use insurance cost by segment as a starting point. But you should compare rates for individual models within in each segment in order to find the cheapest rates.

For example, in the large truck segment, car insurance rates range from the Nissan Titan costing $2,436 per year up to the Toyota Tundra at $3,104 per year, a difference of $668 within that segment.

As another example, in the large SUV segment, insurance rates can range from the Chevrolet Tahoe costing $2,448 per year up to the Toyota Sequoia costing $3,262 per year, a difference of $814 just within that segment.

The next list identifies the specific model with the best car insurance rates in each automotive segment. Average annual and monthly insurance rates are shown for each model. Follow the link for any model to view additional trim-level rates and segment comparisons.

- Cheapest compact car to insure – Toyota GR Corolla at $2,262 per year or $189 per month

- Cheapest compact SUV to insure – Subaru Crosstrek at $1,924 per year or $160 per month

- Cheapest midsize car to insure – Kia K5 at $2,510 per year or $209 per month

- Cheapest midsize SUV to insure – Honda Passport at $2,074 per year or $173 per month

- Cheapest full-size car to insure – Chrysler 300 at $2,482 per year or $207 per month

- Cheapest full-size SUV to insure – Chevrolet Tahoe at $2,448 per year or $204 per month

- Cheapest midsize pickup to insure – Chevrolet Colorado at $2,292 per year or $191 per month

- Cheapest full-size pickup to insure – Nissan Titan at $2,436 per year or $203 per month

- Cheapest heavy duty pickup to insure – GMC Sierra 2500 HD at $2,648 per year or $221 per month

- Cheapest minivan to insure – Honda Odyssey at $2,382 per year or $199 per month

- Cheapest sports car to insure – Mazda MX-5 Miata at $2,412 per year or $201 per month

- Cheapest compact luxury car to insure – Acura Integra at $2,318 per year or $193 per month

- Cheapest compact luxury SUV to insure – Acura RDX at $2,178 per year or $182 per month

- Cheapest midsize luxury car to insure – Mercedes-Benz CLA250 at $2,682 per year or $224 per month

- Cheapest midsize luxury SUV to insure – Jaguar E-Pace at $2,436 per year or $203 per month

- Cheapest full-size luxury car to insure – Audi A5 at $3,094 per year or $258 per month

- Cheapest full-size luxury SUV to insure – Infiniti QX80 at $2,922 per year or $244 per month

To help illustrate the amount car insurance cost can fluctuate from one person to the next, the examples below contain comprehensive rates for three popular vehicles in Norwalk: the Toyota Corolla, Nissan Rogue, and Toyota Highlander.

The chart for each vehicle displays average rates for different profiles to show how much rates can vary simply by changing drivers and policy coverages.

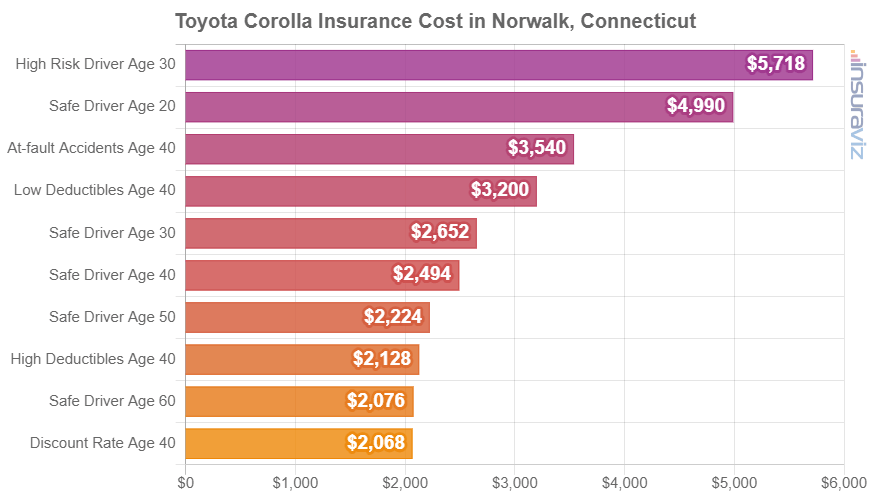

Toyota Corolla insurance rates

In Norwalk, the least-expensive car insurance quotes on a 2024 Toyota Corolla are on the LE trim version, costing an average of $2,310 per year, or about $193 per month. This model costs $21,900.

The most expensive 2022 Toyota Corolla model to insure in Norwalk is the XSE Hatchback model, costing an average of $2,868 per year, or around $239 per month. The retail cost for this model is $26,655, not including charges and fees.

The rate chart below can help explain how insurance quotes on a Toyota Corolla can be quite different based on driver age, policy deductibles, and policy risk factors.

For our selected driver profiles, prices range from $2,106 to $5,816 per year, which is a difference in cost of $3,710 to insure the same vehicle with different rated drivers.

The Toyota Corolla belongs to the compact car segment, and other similar models that are popular in Norwalk, CT, include the Volkswagen Jetta, Kia Forte, and Chevrolet Cruze.

Nissan Rogue insurance rates

Nissan Rogue insurance in Norwalk costs an average of $2,340 per year, with a range of $2,218 per year on the Nissan Rogue S 2WD trim up to $2,452 per year for the Nissan Rogue Platinum AWD.

The next rate chart should help you understand how the cost of car insurance on a Nissan Rogue can be significantly different based on driver age, policy deductibles, and potential risk scenarios. For our example drivers, cost varies from $1,946 to $5,348 per year, which is a difference in cost of $3,402 per year to insure the same vehicle.

The Nissan Rogue belongs to the compact SUV segment, and other popular same-segment models include the Ford Escape, Subaru Forester, and Toyota RAV4.

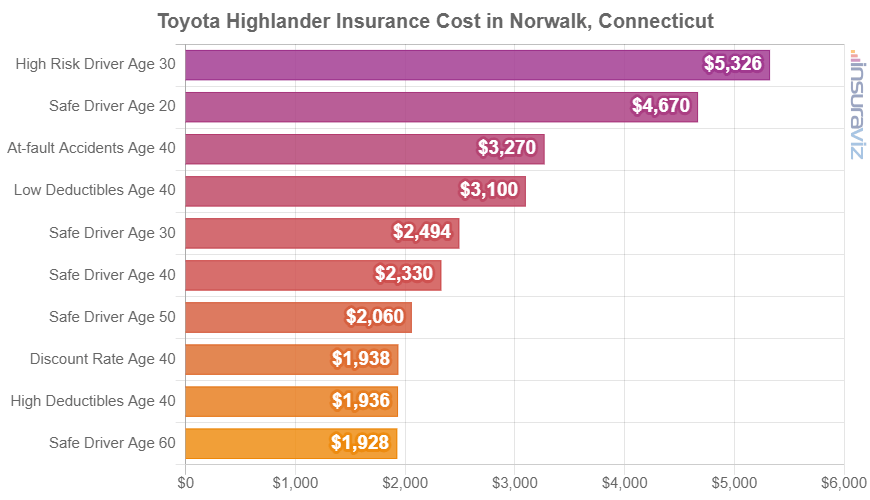

Toyota Highlander insurance rates

The average price paid for Toyota Highlander insurance in Norwalk is $2,372 per year. With prices ranging from $37,625 to $43,825, average car insurance quotes on a 2024 Toyota Highlander range from $2,178 per year on the Toyota Highlander LE 2WD model up to $2,572 per year on the Toyota Highlander Hybrid XLE AWD trim.

The chart displayed below should aid in understanding how car insurance quotes for a Toyota Highlander can vary for a variety of different driver ages and common risk profiles.

For this example, rates vary from $1,972 to $5,416 per year, which is a cost difference of $3,444 to insure the same vehicle with different rated drivers.

The Toyota Highlander is classified as a midsize SUV, and additional similar models from the same segment include the Kia Telluride, Ford Edge, and Jeep Grand Cherokee.