- Average Indiana car insurance cost is $2,080 per year for a full coverage policy. Average cost per month is $173.

- Indiana ranks fourth out of 12 Midwestern states for cheapest car insurance and ranks 11th out of all 50 states.

- The vehicle segments with the cheapest insurance in Indiana are compact and midsize SUVs and compact pickups.

- Average rates for popular models vary from $1,534 for a Subaru Crosstrek to $2,282 for the Ford Mustang.

What is average car insurance cost in Indiana?

Average car insurance rates in Indiana cost $2,080 per year, or around $173 per month. When compared to the national average rate, Indiana car insurance cost is 9% less per year.

Some of the more popular vehicles and their average insurance rates include the Jeep Grand Cherokee at an average of $2,076 per year, the Ford Explorer at $1,884, the Mazda CX-5 at $1,694, the Chevrolet Equinox at $1,912, and the Ford Escape at $1,894 per year.

Luxury models like the Lexus NX 300, the Volvo S60, and the Lexus GX 460 cost an average of $2,062, $2,436, and $2,218 per year, respectively, for full-coverage car insurance in Indiana.

For larger SUVs and pickups, average rates on the most popular models include the Ford F-150 at an average cost of $2,324 per year, the Chevrolet Silverado 1500 at $2,300 per year, the Ram 1500 at $2,404 per year, the Chevrolet Suburban at $2,060 per year, and the Chevrolet Tahoe at $1,950 per year.

The chart below shows the cost of car insurance in Indiana averaged across all models for the 2024 model year.

Average rates in the chart above range from $1,458 per year for a 60-year-old driver with $1,000 deductibles to $4,860 per year for a 20-year-old driver with $250 deductibles. The overall average rate we use for comparison purposes is a 40-year-old driver with $500 deductibles which has an average cost of $2,080 per year.

As a monthly cost, car insurance quotes in Indiana range from $122 to $405 for the same risk profiles and driver ages shown in the previous chart.

Car insurance cost is dependent on many factors, and the list below shows some situations where rates may deviate from the average cost.

- Having an at-fault accident could trigger a rate increase of up to $860 each year, depending on the company.

- The type of vehicle you are insuring makes a big difference in the cost of insurance. For example, insuring a Toyota Tacoma instead of a Chevy Silverado 2500HD can save $176 or more per year on auto insurance.

- Avoiding serious traffic violations is the best way to get cheap rates, as getting a DUI or other serious conviction can raise rates by $1,926 or more per year.

- Even small traffic violations can result in significant increases in car insurance cost. Just one speeding ticket could increase the annual cost of car insurance in Indiana by $550, depending on the company and the vehicle insured.

- Qualifying for as many discounts as possible is a great way to find cheaper car insurance. Discounts like safe driver, claim-free, multi-vehicle, multi-policy, and customer loyalty could save as much as $640 per year.

How does Indiana car insurance cost compare?

When compared to surrounding states, average Indiana car insurance quotes are 4.3% more expensive than Ohio, 23.9% cheaper than Kentucky, 32.5% cheaper than Michigan, 2.8% more expensive than Wisconsin, and 10.2% cheaper than Illinois.

The chart below shows how average car insurance cost in Indiana compares to other Midwest states. Indiana ranks fourth in the Midwest. Out of all 50 states, Indiana ranks 11th for cheapest auto insurance rates.

When compared to states in other parts of the country, the average cost of car insurance in Indiana is 14% cheaper than Texas, 32.4% cheaper than California, 29.4% cheaper than New York, 13% more expensive than Maine, and 10.8% more expensive than North Carolina.

Here’s an example using dollar figures instead of percentages to illustrate how Indiana car insurance compares to other Midwest states.

We will use a 2024 Chevrolet Silverado as the rated vehicles for this example, which in Indiana costs $2,300 per year to insure on average. When compared to other states in the Midwest region, car insurance in Indiana is:

- $730 per year cheaper than insuring the same vehicle in Missouri ($3,030)

- $210 per year cheaper than in Minnesota ($2,510)

- $154 per year more expensive than in Iowa ($2,146)

- $456 per year cheaper than in Kansas ($2,756)

- $168 per year cheaper than in Nebraska ($2,468)

What are the cheapest cars to insure in Indiana?

When comparing all types of vehicles, the models with the most affordable car insurance quotes in Indiana tend to be small SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, and Hyundai Venue.

Average insurance prices for those crossover SUVs cost $1,688 or less per year for a policy with full coverage.

Additional vehicles that rank in the top 20 in our cost comparison are the Toyota GR Corolla, Buick Encore, Buick Envista, and Subaru Outback.

The average insurance cost is a little bit more for those models than the cheapest compact SUVs and crossovers at the top of the list, but they still have an average insurance cost of $1,806 or less per year ($151 per month) in Indiana.

For luxury cars, lower-cost insurance rates in Indiana can be found on models like the Acura Integra at $1,846 per year, the BMW 330i at $2,116 per year, and the Acura TLX at $2,150 per year.

The next table ranks the top 50 vehicles from the 2024 model year with the cheapest car insurance in Indiana.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,534 | $128 |

| 2 | Chevrolet Trailblazer | $1,560 | $130 |

| 3 | Kia Soul | $1,620 | $135 |

| 4 | Nissan Kicks | $1,634 | $136 |

| 5 | Honda Passport | $1,656 | $138 |

| 6 | Buick Envision | $1,664 | $139 |

| 7 | Toyota Corolla Cross | $1,672 | $139 |

| 8 | Hyundai Venue | $1,688 | $141 |

| 9 | Mazda CX-5 | $1,694 | $141 |

| 10 | Ford Bronco Sport | $1,700 | $142 |

| 11 | Volkswagen Tiguan | $1,718 | $143 |

| 12 | Acura RDX | $1,738 | $145 |

| 13 | Nissan Murano | $1,746 | $146 |

| 14 | Buick Encore | $1,764 | $147 |

| 15 | Subaru Outback | $1,770 | $148 |

| 16 | Honda CR-V | $1,772 | $148 |

| 17 | Buick Envista | $1,776 | $148 |

| 18 | Volkswagen Taos | $1,778 | $148 |

| 19 | Kia Niro | $1,788 | $149 |

| 20 | Honda HR-V | $1,806 | $151 |

| 21 | Toyota GR Corolla | $1,806 | $151 |

| 22 | Subaru Ascent | $1,808 | $151 |

| 23 | Nissan Leaf | $1,818 | $152 |

| 24 | Chevrolet Colorado | $1,830 | $153 |

| 25 | Honda Civic | $1,840 | $153 |

| 26 | Lexus NX 250 | $1,840 | $153 |

| 27 | Volkswagen Atlas | $1,842 | $154 |

| 28 | Acura Integra | $1,846 | $154 |

| 29 | Subaru Forester | $1,848 | $154 |

| 30 | Volkswagen Atlas Cross Sport | $1,850 | $154 |

| 31 | Kia Seltos | $1,854 | $155 |

| 32 | GMC Terrain | $1,860 | $155 |

| 33 | Nissan Rogue | $1,868 | $156 |

| 34 | Hyundai Kona | $1,870 | $156 |

| 35 | Mazda CX-30 | $1,872 | $156 |

| 36 | Cadillac XT4 | $1,876 | $156 |

| 37 | Volkswagen ID4 | $1,882 | $157 |

| 38 | Ford Explorer | $1,884 | $157 |

| 39 | Toyota Highlander | $1,888 | $157 |

| 40 | Ford Escape | $1,894 | $158 |

| 41 | Honda Odyssey | $1,898 | $158 |

| 42 | Toyota Venza | $1,898 | $158 |

| 43 | Nissan Sentra | $1,902 | $159 |

| 44 | Subaru Impreza | $1,910 | $159 |

| 45 | Chevrolet Equinox | $1,912 | $159 |

| 46 | Toyota RAV4 | $1,916 | $160 |

| 47 | Mazda MX-5 Miata | $1,922 | $160 |

| 48 | Mazda MX-30 | $1,928 | $161 |

| 49 | Hyundai Tucson | $1,930 | $161 |

| 50 | Chevrolet Traverse | $1,940 | $162 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Indiana Zip Codes. Updated October 24, 2025

Cheapest car insurance by vehicle segment

The previous table ranking the top 50 cheapest vehicles to insure in Indiana tends to show a lot of compact and mid-size cars and SUVs, which by nature are the most affordable segments for car insurance.

The list below shows the vehicle model with the cheapest average insurance rate in each segment. Some models are shown in the prior top 50 rankings, but most are not.

- Compact car – Toyota GR Corolla insurance at $1,806 per year or $151 per month

- Compact SUV – Subaru Crosstrek insurance at $1,534 per year or $128 per month

- Midsize car – Kia K5 insurance at $2,002 per year or $167 per month

- Midsize SUV – Honda Passport insurance at $1,656 per year or $138 per month

- Full-size car – Chrysler 300 insurance at $1,980 per year or $165 per month

- Full-size SUV – Chevrolet Tahoe insurance at $1,950 per year or $163 per month

- Midsize pickup – Chevrolet Colorado insurance at $1,830 per year or $153 per month

- Full-size pickup – Nissan Titan insurance at $1,942 per year or $162 per month

- Heavy duty pickup – GMC Sierra 2500 HD insurance at $2,114 per year or $176 per month

- Minivan – Honda Odyssey insurance at $1,898 per year or $158 per month

- Sports car insurance – Mazda MX-5 Miata insurance at $1,922 per year or $160 per month

- Compact luxury car insurance – Acura Integra insurance at $1,846 per year or $154 per month

- Compact luxury SUV – Acura RDX insurance at $1,738 per year or $145 per month

- Midsize luxury car – Mercedes-Benz CLA250 insurance at $2,138 per year or $178 per month

- Midsize luxury SUV – Jaguar E-Pace insurance at $1,942 per year or $162 per month

- Full-size luxury car – Audi A5 insurance at $2,468 per year or $206 per month

- Full-size luxury SUV – Infiniti QX80 insurance at $2,330 per year or $194 per month

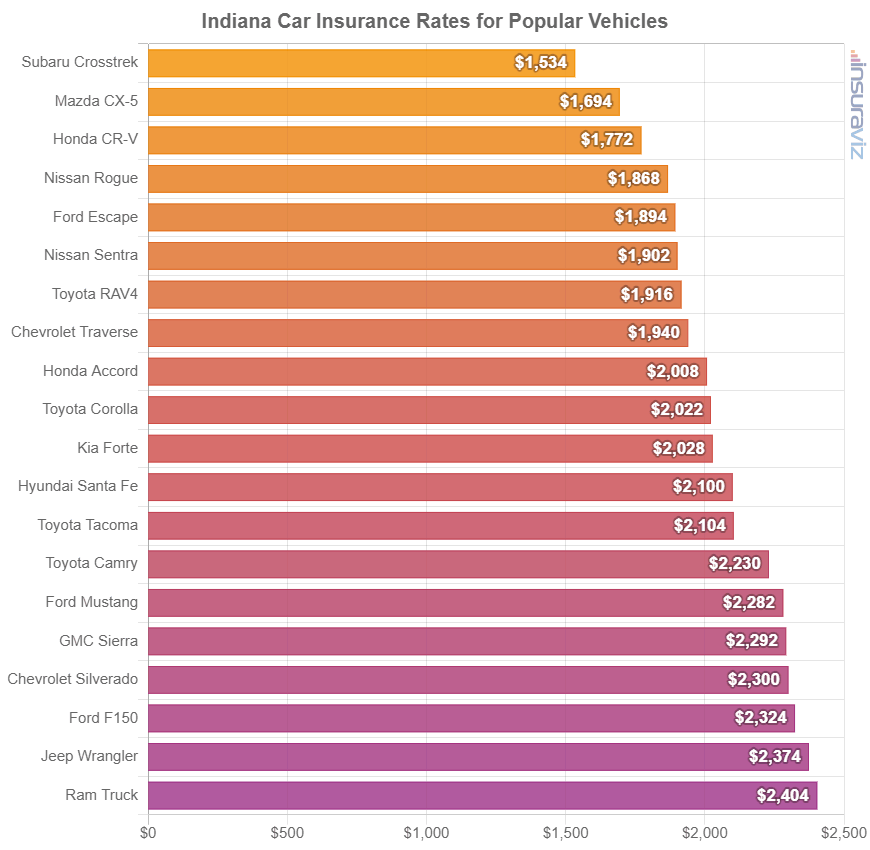

Average car insurance rates for popular Indiana vehicles

Many of the most popular vehicles sold in Indiana do not have the cheapest insurance rates. For this reason, the next chart takes the average car insurance cost for 25 of the most popular models and sorts them by cost.

Average rates in Indiana cities

Average annual and monthly car insurance rates are listed below for some of the larger cities in the state of Indiana. Click any city to view detailed insurance rate information, including cost comparisons and the cheapest vehicles to insure in each city.

- Indianapolis Car Insurance - $2,180 per year or $182 per month

- Fort Wayne Car Insurance - $2,038 per year or $170 per month

- Evansville Car Insurance - $2,110 per year or $176 per month

- South Bend Car Insurance - $2,024 per year or $169 per month

- Hammond Car Insurance - $2,362 per year or $197 per month

- Bloomington Car Insurance - $2,076 per year or $173 per month

- Gary Car Insurance - $2,478 per year or $207 per month

- Carmel Car Insurance - $2,004 per year or $167 per month