- Average car insurance cost in Wisconsin is $2,022 per year, or around $169 per month. This is 11.8% less than the national average rate of $2,276.

- The top 50 cheapest cars to insure in Wisconsin include the Kia Soul, Honda Passport, Nissan Kicks, and Toyota Corolla Cross.

- When compared to nearby states, Wisconsin ranks third out of 12 Midwest states for cheapest car insurance rates.

What does average car insurance cost in Wisconsin?

The average cost of car insurance in Wisconsin is $2,022 per year, which is 11.8% less than the national average rate of $2,276. Car insurance cost per month in Wisconsin costs an average of $169 for full coverage.

The chart below shows average car insurance cost in Wisconsin for all 2024 models. Rates are averaged for all Wisconsin Zip Codes and shown for different driver ages and policy deductible amounts.

The average costs shown above range from $1,420 per year for a 60-year-old driver with a high deductible policy to $4,732 per year for a 20-year-old driver with low physical damage deductibles. From a monthly standpoint, the average cost ranges from $118 to $394 per month.

While the above data references an average rate for all models, the list below includes average rates for five of the most popular vehicles found in the state of Wisconsin. Each model includes the specific vehicle segment it belongs to along with the annual and monthly car insurance cost.

- Ford F-150 – Full-size pickup truck – $2,262 per year ($189 per month)

- Honda Accord – Midsize car – $1,952 per year ($163 per month)

- Honda Civic – Compact car – $1,790 per year ($149 per month)

- Nissan Altima – Midsize car – $2,192 per year ($183 per month)

- Toyota Corolla – Compact car – $1,968 per year ($164 per month)

What types of vehicles have the cheapest insurance?

From a segment perspective, the types of vehicles with the cheapest car insurance rates in Wisconsin are small SUVs, midsize pickups, utility vans, minivans, midsize SUVs, and compact cars.

The chart below shows the average annual cost of car insurance for each vehicle segment, with prices ranging from lower cost segments like compact SUVs and vans up to more expensive segments like luxury and performance cars.

Which vehicles are cheapest to insure in Wisconsin?

When comparing makes and models from all segments, the models with the most affordable auto insurance rates in Wisconsin tend to be compact SUVs and crossovers like the Kia Soul, Chevrolet Trailblazer, Toyota Corolla Cross, and Nissan Kicks. Average car insurance prices for those vehicles cost $1,642 or less per year to have full coverage.

Some additional vehicles that rank well in the cost comparison table are the Volkswagen Taos, Volkswagen Tiguan, Acura RDX, and Nissan Murano. Average rates are marginally higher for those models than the cheapest crossovers and compact SUVs that rank at the top, but they still have an average cost of $146 or less per month in Wisconsin.

Some of the cheapest luxury car and SUV insurance rates in Wisconsin can be found on the Acura Integra at $1,796 per year, the BMW 330i at $2,058 per year, the Mercedes-Benz CLA250 at $2,080 per year, the Acura RDX at $1,692 per year, the Lexus NX 250 at $1,790 per year, and the Cadillac XT4 at $1,826 per year.

The table below ranks the top 50 cheapest vehicles to insure in Wisconsin from the 2024 model year.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,492 | $124 |

| 2 | Chevrolet Trailblazer | $1,520 | $127 |

| 3 | Kia Soul | $1,578 | $132 |

| 4 | Nissan Kicks | $1,590 | $133 |

| 5 | Honda Passport | $1,610 | $134 |

| 6 | Buick Envision | $1,620 | $135 |

| 7 | Toyota Corolla Cross | $1,630 | $136 |

| 8 | Hyundai Venue | $1,642 | $137 |

| 9 | Mazda CX-5 | $1,648 | $137 |

| 10 | Ford Bronco Sport | $1,656 | $138 |

| 11 | Volkswagen Tiguan | $1,674 | $140 |

| 12 | Acura RDX | $1,692 | $141 |

| 13 | Nissan Murano | $1,700 | $142 |

| 14 | Buick Encore | $1,718 | $143 |

| 15 | Subaru Outback | $1,722 | $144 |

| 16 | Honda CR-V | $1,724 | $144 |

| 17 | Buick Envista | $1,728 | $144 |

| 18 | Volkswagen Taos | $1,732 | $144 |

| 19 | Kia Niro | $1,742 | $145 |

| 20 | Toyota GR Corolla | $1,756 | $146 |

| 21 | Honda HR-V | $1,760 | $147 |

| 22 | Subaru Ascent | $1,760 | $147 |

| 23 | Nissan Leaf | $1,772 | $148 |

| 24 | Chevrolet Colorado | $1,782 | $149 |

| 25 | Honda Civic | $1,790 | $149 |

| 26 | Lexus NX 250 | $1,790 | $149 |

| 27 | Volkswagen Atlas | $1,792 | $149 |

| 28 | Acura Integra | $1,796 | $150 |

| 29 | Subaru Forester | $1,800 | $150 |

| 30 | Volkswagen Atlas Cross Sport | $1,802 | $150 |

| 31 | Kia Seltos | $1,806 | $151 |

| 32 | GMC Terrain | $1,810 | $151 |

| 33 | Nissan Rogue | $1,816 | $151 |

| 34 | Hyundai Kona | $1,820 | $152 |

| 35 | Mazda CX-30 | $1,824 | $152 |

| 36 | Cadillac XT4 | $1,826 | $152 |

| 37 | Ford Explorer | $1,834 | $153 |

| 38 | Volkswagen ID4 | $1,834 | $153 |

| 39 | Toyota Highlander | $1,840 | $153 |

| 40 | Ford Escape | $1,844 | $154 |

| 41 | Toyota Venza | $1,844 | $154 |

| 42 | Honda Odyssey | $1,848 | $154 |

| 43 | Nissan Sentra | $1,854 | $155 |

| 44 | Subaru Impreza | $1,860 | $155 |

| 45 | Chevrolet Equinox | $1,862 | $155 |

| 46 | Toyota RAV4 | $1,864 | $155 |

| 47 | Mazda MX-5 Miata | $1,872 | $156 |

| 48 | Mazda MX-30 | $1,876 | $156 |

| 49 | Hyundai Tucson | $1,880 | $157 |

| 50 | Chevrolet Traverse | $1,888 | $157 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Wisconsin Zip Codes. Updated October 24, 2025

Wisconsin car insurance rates for popular vehicles

The charts below show more detailed average auto insurance quotes for five popular vehicles in Wisconsin. These charts include average rates for things like high-risk drivers, high and low deductible policies, different driver ages, and discount policy rates.

Honda CR-V insurance rates

Honda CR-V insurance in Wisconsin costs an average of $1,724 per year and ranges from $1,432 to $3,962 per year for the sample driver risk profiles shown in the chart below.

The Honda CR-V is considered a compact SUV, and other popular models include the Nissan Rogue, Toyota RAV4, Chevrolet Equinox, Subaru Forester, and Mazda CX-5.

Kia Sorento insurance rates

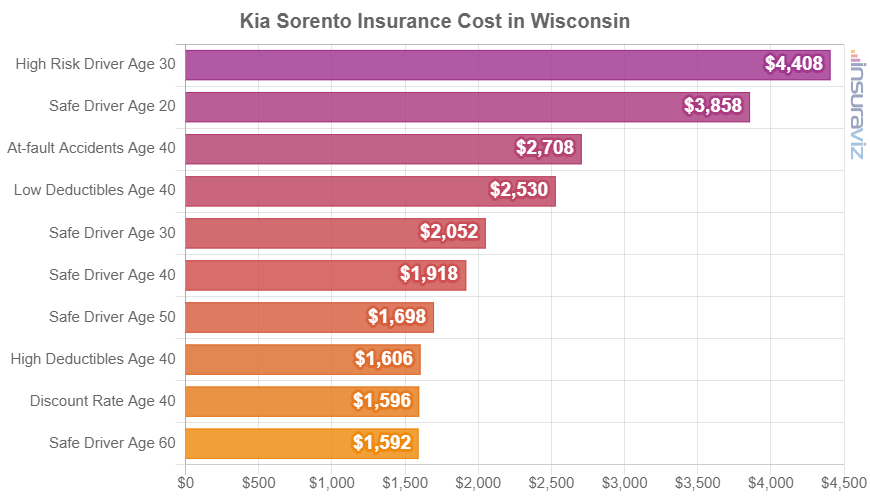

Kia Sorento car insurance rates in Wisconsin range from $1,596 to $4,408 per year for the driver profiles in the chart below. Kia Sorento insurance costs an average of $1,918 per year or $160 per month in Wisconsin.

The Kia Sorento belongs to the midsize SUV segment, and other popular models include the Ford Explorer, Honda Pilot, Kia Telluride, Toyota Highlander, and Jeep Grand Cherokee.

Ford Expedition insurance rates

The chart below shows average Ford Expedition insurance rates in Wisconsin for different driver ages and risk profiles. Annual cost ranges from $1,812 to $4,990 per year for the example driver risk profiles, with average cost being $2,180 per year.

The Ford Expedition is a large SUV and other similar models include the Toyota Sequoia, Chevrolet Tahoe, GMC Yukon, Chevrolet Suburban, and .

Honda Accord insurance rates

Average Honda Accord insurance rates in Wisconsin as shown in the chart below range from $1,622 to $4,488 per year, with the average cost being $1,952.

The Honda Accord is considered a midsize car, and other models in this segment include the Hyundai Sonata, Chevrolet Malibu, Nissan Altima, Kia K5, and Toyota Camry.

Chevrolet Camaro insurance rates

The average cost for Chevrolet Camaro insurance in Wisconsin is $2,626 per year. The chart below shows rates for additional driver profiles with prices ranging from $2,180 to $6,032 per year.

The Chevrolet Camaro is a sports car and other vehicles in this segment include the Ford Mustang, Toyota Supra, Chevrolet Corvette, Nissan 370Z, and Subaru BRZ.

Is Wisconsin car insurance expensive?

When compared to surrounding states, average Wisconsin car insurance rates are 11.6% cheaper than Minnesota, 4% more expensive than Iowa, 13% more expensive than Illinois, and 35.2% cheaper than Michigan.

When average rates are compared to other states in the Midwest that are not immediate neighbors, Wisconsin car insurance costs 1.5% more than Ohio, 2.8% more than Indiana, 9.4% less than North Dakota, and 10% less than Nebraska.

When compared to states in other regions of the country, the average car insurance cost in Wisconsin is 8% more expensive than North Carolina, 17.3% cheaper than Oregon, 26.7% cheaper than Colorado, 35.1% cheaper than California, and 32% cheaper than Florida.

The chart below shows how Wisconsin auto insurance rates compare to all other Midwest states. Wisconsin ranks 2nd out of the 12 Midwest states in the comparison, and ranks 7th overall out of all 50 states for cheapest car insurance rates.

Here’s an example that shows the difference between the cost of car insurance in Wisconsin and some other Midwest states as a dollar amount rather than percentages. This example uses the Toyota Camry as the rated vehicle with a 40-year-old male as the rated driver.

Average car insurance cost on a 2024 Toyota Camry in Wisconsin is $2,172 per year. This average rate is:

- $930 per year cheaper than insuring the same vehicle in Michigan ($3,102)

- $270 per year cheaper than in Minnesota ($2,442)

- $86 per year more expensive than in Iowa ($2,086)

- $508 per year cheaper than in Kansas ($2,680)

- $224 per year cheaper than in Nebraska ($2,396)

Overall, car insurance rates in Wisconsin are very good, almost ranking in the top 10 nationally. Cheaper rates can be found on small SUVs and most compact and midsize cars, while the more expensive insurance is generally found on large SUVs, heavy duty pickups, and luxury autos.

Wisconsin car insurance rates by city

Listed below are some of the larger cities in Wisconsin and the average car insurance rates for each. Visit any page to view detailed rate information, including average overall rates, yearly and monthly cost comparisons, and the cheapest models to insure in each city.

- Milwaukee Car Insurance - $2,472 per year or $206 per month

- Madison Car Insurance - $2,050 per year or $171 per month

- Green Bay Car Insurance - $1,890 per year or $158 per month

- Kenosha Car Insurance - $2,116 per year or $176 per month

- Racine Car Insurance - $2,320 per year or $193 per month

- Appleton Car Insurance - $1,888 per year or $157 per month

- Waukesha Car Insurance - $1,966 per year or $164 per month

- Oshkosh Car Insurance - $1,900 per year or $158 per month