- Oshkosh car insurance costs an average of $1,900 per year, or approximately $158 per month.

- Small SUVs like the Subaru Crosstrek, Buick Envision, and Toyota Corolla Cross are the top picks for cheap car insurance in Oshkosh.

- A few vehicles with the most affordable car insurance in Oshkosh for their respective segments include the Nissan Titan (full-size pickup), Audi A5 (full-size luxury car), Mazda MX-5 Miata (sports car), and Mercedes-Benz CLA250 (midsize luxury car).

- Car insurance quotes in Oshkosh can vary significantly from as low as $33 per month for liability-only insurance to over $693 per month drivers with many accidents and violations.

How much does Oshkosh car insurance cost?

The average cost to insure a vehicle in Oshkosh is $1,900 per year, which is around $158 per month. Oshkosh car insurance costs 18% less than the U.S. overall average rate of $2,276.

In the state of Wisconsin, the average car insurance expense is $2,022 per year, so the average rate in Oshkosh is $122 less per year.

When compared to other locations in Wisconsin, the average cost of car insurance in Oshkosh is approximately $420 per year cheaper than in Racine, $150 per year less than in Madison, and $572 per year cheaper than in Milwaukee.

The age of the rated driver has a big impact on the price you pay for car insurance. The list below details how age impacts cost by breaking out average car insurance rates in Oshkosh based on the age of the driver.

Oshkosh car insurance cost by driver age

- 16-year-old rated driver – $6,774 per year or $565 per month

- 17-year-old rated driver – $6,563 per year or $547 per month

- 18-year-old rated driver – $5,881 per year or $490 per month

- 19-year-old rated driver – $5,356 per year or $446 per month

- 20-year-old rated driver – $3,824 per year or $319 per month

- 30-year-old rated driver – $2,028 per year or $169 per month

- 40-year-old rated driver – $1,900 per year or $158 per month

- 50-year-old rated driver – $1,686 per year or $141 per month

- 60-year-old rated driver – $1,578 per year or $132 per month

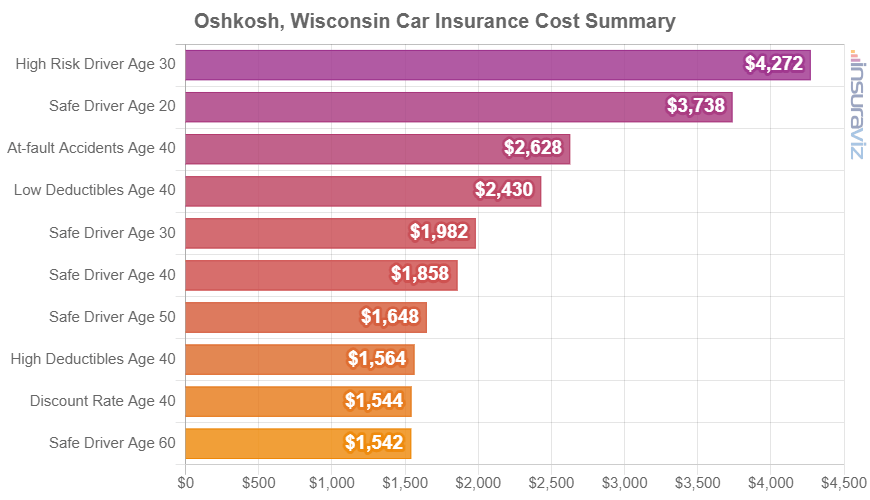

The next chart summarizes average car insurance cost in Oshkosh, Wisconsin, broken out for a variety of driver ages, risk profiles, and policy deductibles. Rates are averaged for all 2024 vehicle models including luxury brands.

In the chart above, the cost of auto insurance in Oshkosh ranges from $1,580 per year for a 40-year-old driver that qualifies for many policy discounts to $4,374 per year for a 30-year-old driver with a lot of violations and accidents. When converted to a monthly rate, the average cost ranges from $132 to $365 per month.

Oshkosh auto insurance rates can have a very wide price range and are impacted by a lot of factors. The possibility of a wide range of rates stresses the need to get accurate car insurance quotes when trying to find cheaper car insurance.

Cheapest car insurance in Oshkosh

When comparing all types of models, the vehicles with the cheapest average auto insurance quotes in Oshkosh tend to be compact SUVs and crossovers like the Subaru Crosstrek, Chevrolet Trailblazer, and Hyundai Venue.

Average car insurance prices for models that make the top 10 cost $1,558 or less per year ($130 per month) to get full coverage.

Other models that rank towards the top in our overall cost comparison are the Kia Niro, Buick Encore, Acura RDX, and Honda CR-V.

Insurance is marginally higher for those models than the crossovers and small SUVs that rank near the top, but they still have an average cost of $138 or less per month in Oshkosh.

The next table lists the 50 cheapest vehicles to insure in Oshkosh, ordered starting with the cheapest.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,406 | $117 |

| 2 | Chevrolet Trailblazer | $1,430 | $119 |

| 3 | Kia Soul | $1,484 | $124 |

| 4 | Nissan Kicks | $1,498 | $125 |

| 5 | Honda Passport | $1,514 | $126 |

| 6 | Buick Envision | $1,524 | $127 |

| 7 | Toyota Corolla Cross | $1,532 | $128 |

| 8 | Hyundai Venue | $1,546 | $129 |

| 9 | Mazda CX-5 | $1,550 | $129 |

| 10 | Ford Bronco Sport | $1,558 | $130 |

| 11 | Volkswagen Tiguan | $1,574 | $131 |

| 12 | Acura RDX | $1,592 | $133 |

| 13 | Nissan Murano | $1,598 | $133 |

| 14 | Buick Encore | $1,614 | $135 |

| 15 | Honda CR-V | $1,620 | $135 |

| 16 | Subaru Outback | $1,620 | $135 |

| 17 | Buick Envista | $1,626 | $136 |

| 18 | Volkswagen Taos | $1,630 | $136 |

| 19 | Kia Niro | $1,636 | $136 |

| 20 | Toyota GR Corolla | $1,652 | $138 |

| 21 | Subaru Ascent | $1,654 | $138 |

| 22 | Honda HR-V | $1,656 | $138 |

| 23 | Nissan Leaf | $1,664 | $139 |

| 24 | Chevrolet Colorado | $1,672 | $139 |

| 25 | Lexus NX 250 | $1,682 | $140 |

| 26 | Honda Civic | $1,684 | $140 |

| 27 | Volkswagen Atlas | $1,686 | $141 |

| 28 | Acura Integra | $1,690 | $141 |

| 29 | Subaru Forester | $1,692 | $141 |

| 30 | Volkswagen Atlas Cross Sport | $1,694 | $141 |

| 31 | Kia Seltos | $1,698 | $142 |

| 32 | GMC Terrain | $1,702 | $142 |

| 33 | Nissan Rogue | $1,708 | $142 |

| 34 | Hyundai Kona | $1,712 | $143 |

| 35 | Mazda CX-30 | $1,714 | $143 |

| 36 | Cadillac XT4 | $1,718 | $143 |

| 37 | Volkswagen ID4 | $1,724 | $144 |

| 38 | Ford Explorer | $1,726 | $144 |

| 39 | Toyota Highlander | $1,728 | $144 |

| 40 | Ford Escape | $1,734 | $145 |

| 41 | Honda Odyssey | $1,736 | $145 |

| 42 | Toyota Venza | $1,736 | $145 |

| 43 | Nissan Sentra | $1,744 | $145 |

| 44 | Subaru Impreza | $1,748 | $146 |

| 45 | Chevrolet Equinox | $1,752 | $146 |

| 46 | Toyota RAV4 | $1,754 | $146 |

| 47 | Mazda MX-5 Miata | $1,760 | $147 |

| 48 | Mazda MX-30 | $1,764 | $147 |

| 49 | Hyundai Tucson | $1,766 | $147 |

| 50 | Chevrolet Traverse | $1,776 | $148 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Oshkosh, WI Zip Codes. Updated October 24, 2025

Additional models making the list of the top 50 table above include the Nissan Sentra, Acura Integra, Toyota Venza, and Mazda CX-30. Insurance rates for those models fall between $1,652 and $1,778 per year in Oshkosh, WI.

In contrast to the vehicles with cheap rates, a few examples of much higher insurance rates include the Toyota Mirai at $197 per month, the Subaru BRZ at $189, and the Infiniti Q50 which costs $179.

And for very high insurance rates in Oshkosh, high-performance luxury models like the Mercedes-Benz G63 AMG, BMW 750i, BMW M760i, and Aston Martin DBX have rates that cost at least double those of the cheapest models.

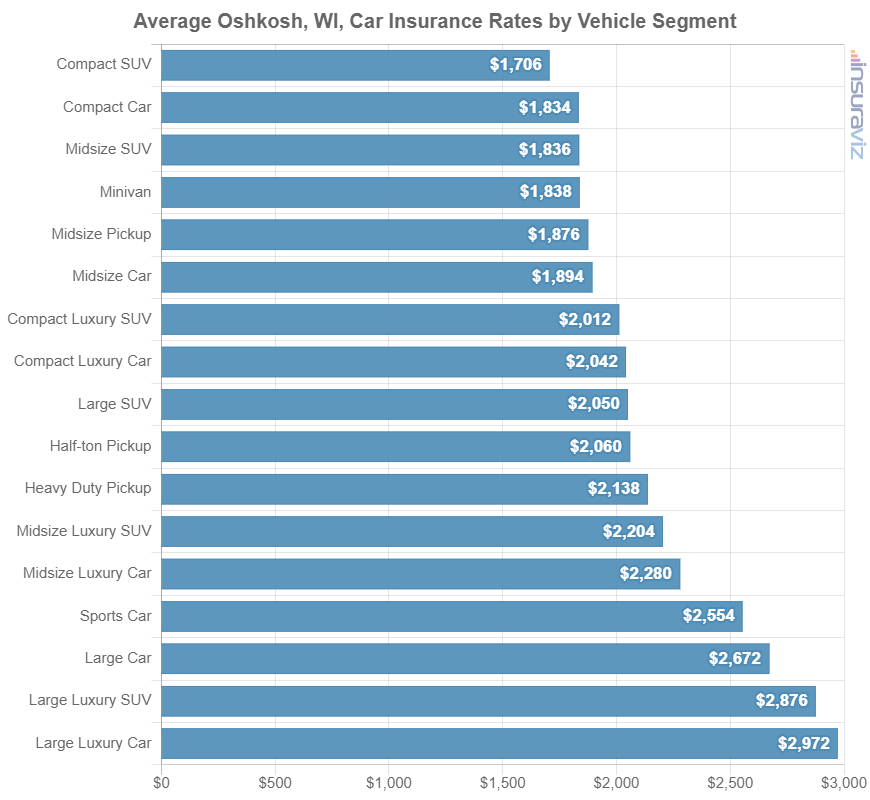

The section below goes into more detail about the average cost of auto insurance for each vehicle segment. The rates shown should give you a good understanding of which types of vehicles have the overall cheapest rates.

Average rates by vehicle type

If you’re shopping around for a different vehicle, it’s important to know which types of vehicles have more favorable auto insurance rates. As an example, maybe you’re curious if compact SUVs have cheaper insurance than minivans or if full-size SUVs have more expensive car insurance than midsize or compact SUVs.

The next chart displays average auto insurance cost by vehicle segment in Oshkosh. From a segment perspective, small SUVs, vans, and midsize pickups tend to have the best average rates, with sports cars and performance luxury models having the most expensive average cost to insure.

Average auto insurance rates by segment are handy for overall comparisons, but insurance cost varies quite a lot within each vehicle category listed in the previous chart.

For example, in the large luxury car segment, average Oshkosh car insurance rates range from the Audi A5 at $2,258 per year for full coverage insurance up to the Mercedes-Benz Maybach S680 costing $3,982 per year. As another example, in the midsize luxury car segment, insurance rates range from the Mercedes-Benz CLA250 at $1,956 per year up to the BMW M8 at $3,204 per year.

In the list shown below, you can find the specific model with the best car insurance rates in Oshkosh, WI, for each segment shown in the chart above. Follow any model link to view additional detailed rates by trim level.

- Cheapest compact car insurance – Toyota GR Corolla at $1,652 per year or $138 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,406 per year or $117 per month

- Cheapest midsize car insurance – Kia K5 at $1,832 per year or $153 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,514 per year or $126 per month

- Cheapest full-size car insurance – Chrysler 300 at $1,812 per year or $151 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $1,784 per year or $149 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $1,672 per year or $139 per month

- Cheapest full-size pickup insurance – Nissan Titan at $1,778 per year or $148 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $1,932 per year or $161 per month

- Cheapest minivan insurance – Honda Odyssey at $1,736 per year or $145 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $1,760 per year or $147 per month

- Cheapest compact luxury car insurance – Acura Integra at $1,690 per year or $141 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,592 per year or $133 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $1,956 per year or $163 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $1,778 per year or $148 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,258 per year or $188 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,132 per year or $178 per month

Insurance rate variation by driver risk

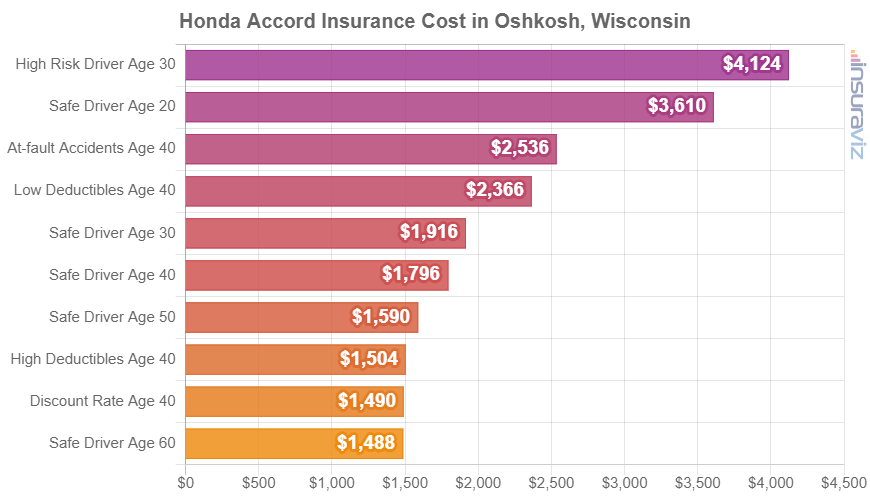

To help show how much auto insurance prices can fluctuate for different drivers, the charts below contain a wide range of rates for four popular models in Oshkosh: the Honda Civic, Honda CR-V, Toyota Highlander, and Honda Accord.

Each vehicle example uses a variety of risk profiles to illustrate the possible cost variation based on a number of different rated drivers.

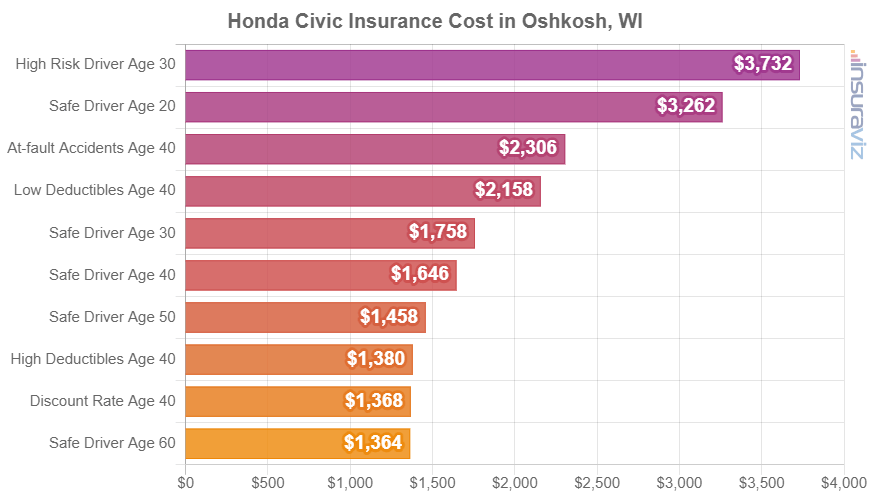

Honda Civic insurance rates

In Oshkosh, the most affordable insurance rates on a 2024 Honda Civic are on the LX trim version, costing an average of $1,506 per year, or about $126 per month. This model has a retail price of $23,950.

The most expensive 2022 Honda Civic model to insure in Oshkosh is the Type R model, costing an average of $1,994 per year, or around $166 per month. The cost for this model is $43,795, not including charges and fees.

When Oshkosh car insurance quotes for the Honda Civic are compared with the average cost for the entire U.S. on the same vehicle, the cost is anywhere from $394 to $522 cheaper per year in Oshkosh, depending on the exact trim being insured.

The bar chart below shows how insurance rates on a Honda Civic can be very different based on different driver ages and risk profiles.

For our sample risk profiles, rates range from $1,400 to $3,820 per year, which is a cost difference of $2,420 caused by changing the rated driver.

The Honda Civic is classified as a compact car, and additional models from the same segment that are popular in Oshkosh include the Toyota Corolla, Hyundai Elantra, and Nissan Sentra.

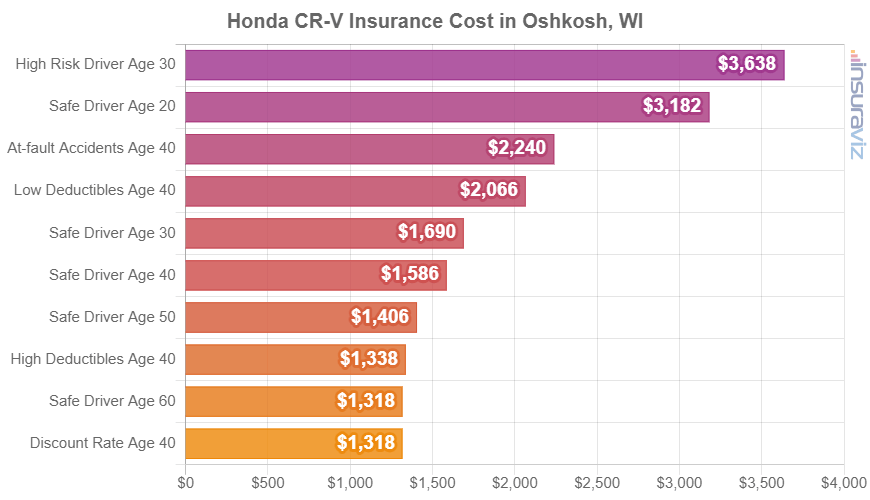

Honda CR-V insurance rates

Honda CR-V insurance in Oshkosh averages $1,620 per year, with a range of $1,538 per year on the Honda CR-V LX model (MSRP of $29,500) up to $1,710 per year on the Honda CR-V Sport Touring Hybrid AWD trim level (MSRP of $39,850).

When Oshkosh car insurance rates on the Honda CR-V are compared to the overall national average cost for the same model, the cost is anywhere from $404 to $450 less per year in Oshkosh, depending on the specific model being insured.

As a cost per month, full-coverage auto insurance on a 2024 Honda CR-V for a middle-age safe driver can cost from $128 to $143 per month, depending on your company and exact Zip Code in Oshkosh.

The bar chart below shows how the cost of insurance for a Honda CR-V can range significantly based on different driver ages, risk profiles, and policy deductibles.

In this example, cost varies from $1,348 to $3,726 per year, which is a price difference of $2,378.

The Honda CR-V is classified as a compact SUV, and other similar models include the Chevrolet Equinox, Mazda CX-5, and Toyota RAV4.

Toyota Highlander insurance rates

Costing from $37,625 to $43,825, average Oshkosh car insurance quotes on a 2024 Toyota Highlander cost from $1,590 per year for the Toyota Highlander LE 2WD model up to $1,880 per year on the Toyota Highlander Hybrid XLE AWD trim level.

When Oshkosh auto insurance rates for a Toyota Highlander are compared to the average cost for the entire U.S. on the same model, rates are $416 to $490 cheaper per year in Oshkosh, depending on the specific model being insured.

The chart below demonstrates how the prices of car insurance for a Toyota Highlander can vary based on driver age and risk profiles.

The Toyota Highlander is part of the midsize SUV segment, and additional models from the same segment that are popular in Oshkosh, WI, include the Kia Telluride, Kia Sorento, and Ford Edge.

Honda Accord insurance rates

The average cost for Honda Accord insurance in Oshkosh is $1,836 per year. Costing from $34,190 to $27,895, average insurance quotes for a Honda Accord cost from $1,770 per year on the Honda Accord EX-L Hybrid model up to $1,884 per year on the Honda Accord LX trim level.

When Oshkosh auto insurance rates for the Honda Accord are compared with the national average cost on the same model, the cost is $462 to $494 cheaper per year in Oshkosh, depending on the exact trim being insured.

The bar chart below may help you understand how insurance quotes on a Honda Accord can be quite different for different drivers and common risk profiles.

The Honda Accord is considered a midsize car, and other popular same-segment models include the Kia K5, Toyota Camry, and Chevrolet Malibu.

Six ways to save on auto insurance

Oshkosh drivers should always be thinking of ways to cut the monthly cost of insurance. The list below outlines some of the best ways to keep prices down while not sacrificing coverage.

- Qualify for discounts to lower insurance cost. Discounted rates may be available if the insured drivers belong to certain professional organizations, drive low annual mileage, work in certain occupations, drive a vehicle with safety or anti-theft features, choose electronic billing, or many other discounts which could save the average Oshkosh driver as much as $320 per year.

- Pay small claims out-of-pocket. Most auto insurance companies give a discount for not having any claims. Auto insurance should only be used in the case of significant claims, not for minor claims.

- Shop around. Taking a few minutes to get some free car insurance quotes is our best recommendation for saving money. Companies make rate modifications frequently and you can switch companies at any time.

- Be a careful driver and save. At-fault accidents raise insurance rates, as much as $2,716 per year for a 20-year-old driver and even $578 per year for a 50-year-old driver. So drive safe and save!

- Compare insurance costs before buying a car. Different vehicles have significantly different auto insurance rates, and companies can charge a wide range of prices. Get comparison quotes before you upgrade you car in order to prevent price shock when you receive your first bill.

- Higher physical damage deductibles lower policy cost. Increasing your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.