- Average Hyundai Elantra insurance cost is $2,608 per year, or $217 per month for full coverage.

- The cheapest Elantra to insure is the N trim level at an average rate of $2,224 per year. The Elantra Blue Hybrid is the most expensive to insure at $2,874 per year.

- The Hyundai Elantra is one of the more expensive 2024 small cars to insure, costing $237 more per year on average when compared to other small cars.

How much does Hyundai Elantra insurance cost?

Ranked 13th out of 15 vehicles in the 2024 compact car class, Hyundai Elantra insurance rates average $2,608 a year for full coverage, or $217 a month.

With the average 2024 small car costing $2,371 per year to insure, the Hyundai Elantra could cost $237 more each year to insure when compared to the segment average rate.

The table below breaks down the average cost to insure the 2024, 2022, and 2020 Elantra model years for a range of driver ages. It also shows the cheapest and most expensive models to insure for each model year.

| 2024 Hyundai Elantra | 2022 Hyundai Elantra | 2020 Hyundai Elantra | |

|---|---|---|---|

| Average Insurance Cost Per Year | $2,608 | $2,466 | $2,284 |

| Insurance Cost Per Month | $217 | $206 | $190 |

| 16-year-old Driver | $9,370 | $9,038 | $8,478 |

| 18-year-old Driver | $7,988 | $7,606 | $7,076 |

| 20-year-old Driver | $5,218 | $4,964 | $4,618 |

| 25-year-old Driver | $3,024 | $3,024 | $3,024 |

| 30-year-old Driver | $2,770 | $2,614 | $2,416 |

| 40-year-old Driver | $2,608 | $2,466 | $2,284 |

| 50-year-old Driver | $2,324 | $2,206 | $2,048 |

| 60-year-old Driver | $2,170 | $2,060 | $1,912 |

| Cheapest Model to Insure | N | SEL | SEL Sedan |

| Cheapest Insurance Cost | $2,224 | $2,170 | $1,840 |

| Most Expensive Model to Insure | Blue Hybrid | N | GT N Line Sedan |

| Most Expensive Insurance Cost | $2,874 | $2,680 | $2,606 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Other driver ages also have no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated October 24, 2025

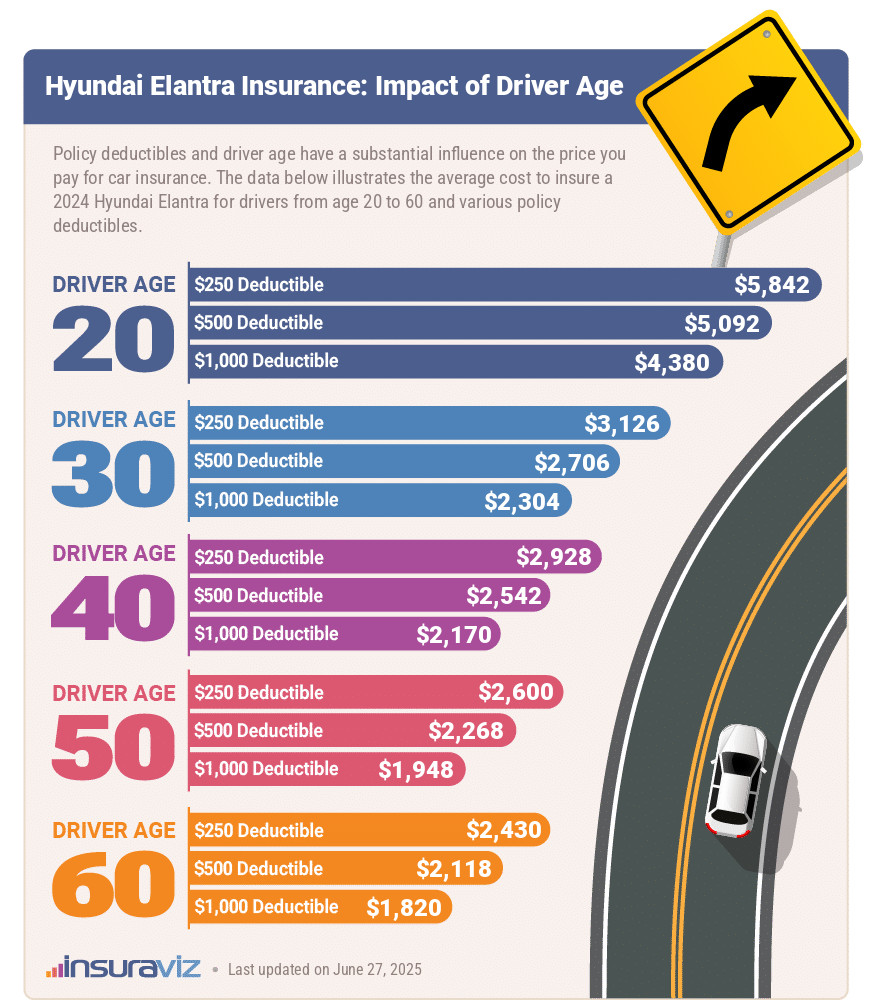

In addition to the age of the driver, another thing that can really affect the cost of insurance on an Elantra is the comprehensive and collision deductibles.

Lower deductibles make an insurance policy more expensive since the insurance company will have to pay more for a covered claim. High deductibles drive the cost of car insurance downward since the policyholder is shouldering more of the expense if they have a claim.

The graphic below details how average Hyundai Elantra car insurance rates vary depending on the policy deductibles. Rates are shown for drivers aged 20 to 60, along with three different deductible amounts, $250, $500, and $1,000.

To help you comprehend the full range of possible insurance rates, keep in mind that an Elantra car insurance policy with only liability coverage in the cheaper areas of Iowa or Illinois may be as cheap as $224 a year.

For an identical Elantra, a teen driver with an accident or two and a few driving infractions in some zip codes in New York City, NY, could total as much as $20,762 a year for full coverage.

More notable observations as they relate to insurance cost on a Hyundai Elantra include:

- Careless drivers pay higher rates. Causing frequent accidents will increase insurance costs, possibly up to $3,706 per year for a 20-year-old driver and as much as $658 per year for a 60-year-old driver.

- Earn a discount from your choice of occupation. Just about all insurance companies offer discounts for a job like emergency medical technicians, nurses, members of the military, accountants, college professors, and other occupations. Earning this discount could potentially save between $78 and $233 on your yearly auto insurance bill, depending on the policy coverages selected.

- Gender affects car insurance rates. For a 2024 Hyundai Elantra, a 20-year-old man pays an average price of $5,218 per year, while a 20-year-old female driver will pay an average of $3,770, a difference of $1,448 per year. The females get the cheaper rate by far. But by age 50, the rate for men is $2,324 and rates for female drivers are $2,256, a difference of only $68.

- Tickets and violations can cost a lot. If you want the cheapest price for Elantra insurance rates, it pays to be a safe driver. Not surprisingly, just one or two minor traffic violations could result in increasing rates by up to $694 per year. Major infractions like hit-and-run, DUI or reckless driving could raise rates by an additional $2,414 or more.

- Hyundai Elantra insurance rates for teenagers are high. Average rates for full coverage Elantra insurance costs $9,370 per year for a 16-year-old driver, $9,024 per year for a 17-year-old driver, and $7,988 per year for an 18-year-old driver.

- Get cheaper rates by researching discounts. Discounts may be available if the policyholders work in certain occupations, are claim-free, belong to certain professional organizations, sign their policy early, drive low annual mileage, or many other discounts which could save the average driver as much as $444 per year.

- Older drivers tend to pay less than younger drivers. The difference in insurance rates for a 2024 Hyundai Elantra between a 60-year-old driver ($2,170 per year) and a 20-year-old driver ($5,218 per year) is $3,048, or a savings of 82.5%.

Why are Hyundai Elantras so expensive to insure?

The Hyundai Elantra has higher than average car insurance rates primarily due to substantially higher historical insurance losses for all coverages other than property damage liability and comprehensive coverage.

According to the Insurance Institute for Highway Safety and the Highway Loss Data Institute, for the 2019 to 2021 reporting period, the Elantra has 70% higher than average collision losses, 87% higher personal injury liability losses, 80% higher medical payment losses, and 60% higher bodily injury liability losses.

For the 2016 to 2018 reporting period, the results are not quite as bad, but are still well above average. The Elantra has 29% higher than average collision losses, 59% higher personal injury liability losses, 76% higher medical payment losses, and 43% higher bodily injury liability losses.

To view these numbers yourself, and to see different reporting periods, visit the IIHS website and filter the results for small four-door cars.

Which Elantra models are the cheapest to insure?

With Hyundai Elantra car insurance rates ranging from $2,224 to $2,874 per year, the cheapest Elantra insurance is on the N trim. The second cheapest trim level to insure is the Limited at $2,578 per year. Anticipate paying at least $185 per month for a policy with full coverage for a 2024 model.

The priciest trim levels of Hyundai Elantra to insure are the Blue Hybrid at $2,874 and the SE at $2,774 per year. Those trims will cost an extra $550 to $650 to insure per year over the cheapest N model.

The next table details the average car insurance policy costs for each 2024 Hyundai Elantra model and trim level.

| 2024 Hyundai Elantra Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| N | $2,224 | $185 |

| Limited | $2,578 | $215 |

| Limited Hybrid | $2,586 | $216 |

| N Line | $2,608 | $217 |

| SEL | $2,618 | $218 |

| SE | $2,774 | $231 |

| Blue Hybrid | $2,874 | $240 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Elantra insurance compared to other small cars

The Hyundai Elantra ranks 13th out of 15 comparison vehicles in the 2024 compact car category. The Elantra costs an average of $2,608 per year for insurance, while the segment average cost is $2,371 annually, a difference of $237 more per year.

When rates are compared to other small cars, insurance for a Hyundai Elantra costs $484 more per year than the Honda Civic, $272 more than the Toyota Corolla, $408 more than the Nissan Sentra, and $182 more than the Volkswagen Jetta.

The table below illustrates how an Elantra ranks for car insurance affordability when compared to the rest of the compact car automotive segment for the 2024 model year.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Toyota GR Corolla | $2,084 | -$524 |

| 2 | Nissan Leaf | $2,100 | -$508 |

| 3 | Honda Civic | $2,124 | -$484 |

| 4 | Nissan Sentra | $2,200 | -$408 |

| 5 | Subaru Impreza | $2,204 | -$404 |

| 6 | Toyota Prius | $2,242 | -$366 |

| 7 | Toyota Corolla | $2,336 | -$272 |

| 8 | Kia Forte | $2,342 | -$266 |

| 9 | Nissan Versa | $2,364 | -$244 |

| 2024 Small Car Average | $2,371 | -$237 | |

| 10 | Mitsubishi Mirage G4 | $2,422 | -$186 |

| 11 | Volkswagen Jetta | $2,426 | -$182 |

| 12 | Mazda 3 | $2,480 | -$128 |

| 13 | Hyundai Elantra | $2,608 | -- |

| 14 | Volkswagen Golf | $2,650 | $42 |

| 15 | Toyota Mirai | $2,986 | $378 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each model. Updated October 24, 2025

The next table goes into more detail by taking the top three Hyundai Elantra competitors, the Honda Civic, Toyota Corolla, and Nissan Sentra, and comparing the cost of insurance for each.

It also breaks out both the cheapest and most expensive trim levels to insure for each model and compares the sticker prices for those models.

For more rate information for the Civic, Corolla, and Sentra, links are provided to the detailed articles for each model.

| 2024 Hyundai Elantra | 2024 Honda Civic | 2024 Toyota Corolla | 2024 Nissan Sentra | |

|---|---|---|---|---|

| Average Insurance Cost Per Year | $2,608 | $2,124 | $2,336 | $2,200 |

| Insurance Cost Per Month | $217 | $177 | $195 | $183 |

| Cheapest Model to Insure | N | LX | LE | S |

| Cheapest to Insure MSRP | $32,900 | $23,950 | $21,900 | $20,630 |

| Cheapest Insurance Cost | $2,224 | $1,900 | $2,128 | $2,150 |

| Most Expensive Model to Insure | Blue Hybrid | Type R | XSE Hatchback | SR |

| Most Expensive to Insure MSRP | $24,550 | $43,795 | $26,655 | $23,720 |

| Most Expensive Insurance Cost | $2,874 | $2,516 | $2,644 | $2,260 |

| Calculate Your Rates Custom rates based on your risk profile | Calculate | Calculate | Calculate | Calculate |

Data Methodology: Average cost is based on a 40-year-old male driver with a clean driving record. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle for that specific model year. Updated October 24, 2025

More detailed comparisons of these vehicles, including every trim level back to the 2015 model year, can be found in these articles:

2013 to 2024 Elantra insurance rates

Insuring a used Elantra, rather than a new 2024 model, could cut your insurance cost by as much as $1,240 per year. New vehicles have a higher replacement cost, and older models have less value which results in lower insurance rates.

The data below shows average insurance rates for 2013 to 2024 Hyundai Elantra model years and for drivers aged 20 to 60. Insurance cost ranges from the least expensive rate of $1,152 for a 60-year-old driver rated on a 2013 Hyundai Elantra to the most expensive rate of $5,218 for a 20-year-old driving a 2024 model year.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Hyundai Elantra | $5,218 | $2,608 | $2,170 |

| 2023 Hyundai Elantra | $5,078 | $2,542 | $2,120 |

| 2022 Hyundai Elantra | $4,964 | $2,466 | $2,060 |

| 2021 Hyundai Elantra | $4,758 | $2,356 | $1,972 |

| 2020 Hyundai Elantra | $4,618 | $2,284 | $1,912 |

| 2019 Hyundai Elantra | $4,346 | $2,148 | $1,798 |

| 2018 Hyundai Elantra | $4,274 | $2,114 | $1,776 |

| 2017 Hyundai Elantra | $4,292 | $2,124 | $1,786 |

| 2016 Hyundai Elantra | $3,626 | $1,804 | $1,518 |

| 2015 Hyundai Elantra | $3,122 | $1,568 | $1,322 |

| 2014 Hyundai Elantra | $2,856 | $1,436 | $1,206 |

| 2013 Hyundai Elantra | $2,722 | $1,368 | $1,152 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Hyundai Elantra trim levels for each model year. Updated October 24, 2025

Eventually, as a vehicle gets some miles on it, owners have to decide whether to eliminate one or both physical damage coverages from the insurance policy. As a vehicle loses value over time, the expense of having physical damage protection is more than the benefits provided by full coverage.

Eliminating physical damage insurance coverage on an older Hyundai Elantra may save $692 a year, depending on the level of physical damage deductibles and the age of the rated driver.

Average Elantra insurance rates by U.S. city and state

Depending on where you live, the cost of insuring your Elantra can range from cheaper amounts like $2,112 a year in Virginia Beach, VA, or $2,250 in Columbus, OH, to expensive rates like $4,180 a year in New York, NY and $3,804 per year for car insurance in Philadelphia.

Additional large metro area rates include Milwaukee, WI, at an estimated $2,690 per year, Chicago, IL, costing $2,818, Memphis, TN, at $3,068, and San Francisco, CA, at $3,396.

The following chart shows the average insurance policy premiums for a 2024 Hyundai Elantra for some of the largest cities in the U.S.

Average insurance rates by state

From a state perspective, states like Maine ($1,984) and Virginia ($2,104) have some of the cheapest auto insurance rates, while states like Florida ($3,034), Michigan ($3,136), and New York ($3,038) tend to have more expensive car insurance rates.

The large majority of states do not really trend toward either extreme, with states like Alabama, Montana, and Washington included in this group with average Hyundai Elantra insurance rates of $2,546, $2,584, and $2,552 per year, respectively.

The next table shows the average cost to insure a 2024 Hyundai Elantra in all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,546 | $212 |

| Alaska | $2,276 | $190 |

| Arizona | $2,580 | $215 |

| Arkansas | $2,826 | $236 |

| California | $3,132 | $261 |

| Colorado | $2,874 | $240 |

| Connecticut | $2,954 | $246 |

| Delaware | $2,996 | $250 |

| Florida | $3,034 | $253 |

| Georgia | $2,780 | $232 |

| Hawaii | $2,136 | $178 |

| Idaho | $2,192 | $183 |

| Illinois | $2,502 | $209 |

| Indiana | $2,256 | $188 |

| Iowa | $2,112 | $176 |

| Kansas | $2,710 | $226 |

| Kentucky | $2,870 | $239 |

| Louisiana | $2,930 | $244 |

| Maine | $1,984 | $165 |

| Maryland | $2,604 | $217 |

| Massachusetts | $2,906 | $242 |

| Michigan | $3,136 | $261 |

| Minnesota | $2,470 | $206 |

| Mississippi | $2,692 | $224 |

| Missouri | $2,980 | $248 |

| Montana | $2,584 | $215 |

| Nebraska | $2,424 | $202 |

| Nevada | $3,108 | $259 |

| New Hampshire | $2,112 | $176 |

| New Jersey | $3,136 | $261 |

| New Mexico | $2,400 | $200 |

| New York | $3,038 | $253 |

| North Carolina | $2,028 | $169 |

| North Dakota | $2,412 | $201 |

| Ohio | $2,164 | $180 |

| Oklahoma | $2,932 | $244 |

| Oregon | $2,612 | $218 |

| Pennsylvania | $2,662 | $222 |

| Rhode Island | $3,190 | $266 |

| South Carolina | $2,430 | $203 |

| South Dakota | $2,788 | $232 |

| Tennessee | $2,644 | $220 |

| Texas | $2,602 | $217 |

| Utah | $2,502 | $209 |

| Vermont | $2,220 | $185 |

| Virginia | $2,104 | $175 |

| Washington | $2,552 | $213 |

| West Virginia | $2,532 | $211 |

| Wisconsin | $2,192 | $183 |

| Wyoming | $2,526 | $211 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

During his career as an independent insurance agent,

During his career as an independent insurance agent,