- For the cheapest auto insurance in Bossier City, LA, compact SUVs like the Kia Soul, Buick Envision, and Chevrolet Trailblazer cost less to insure than most other makes and models.

- A few models with segment-leading auto insurance rates in Bossier City include the Subaru Crosstrek, Honda Passport, Infiniti QX80, and Chrysler 300.

- Car insurance quotes in Bossier City can range significantly from as little as $38 per month for liability-only insurance to well over $682 per month for drivers requiring a high-risk policy.

Cheapest car insurance in Bossier City

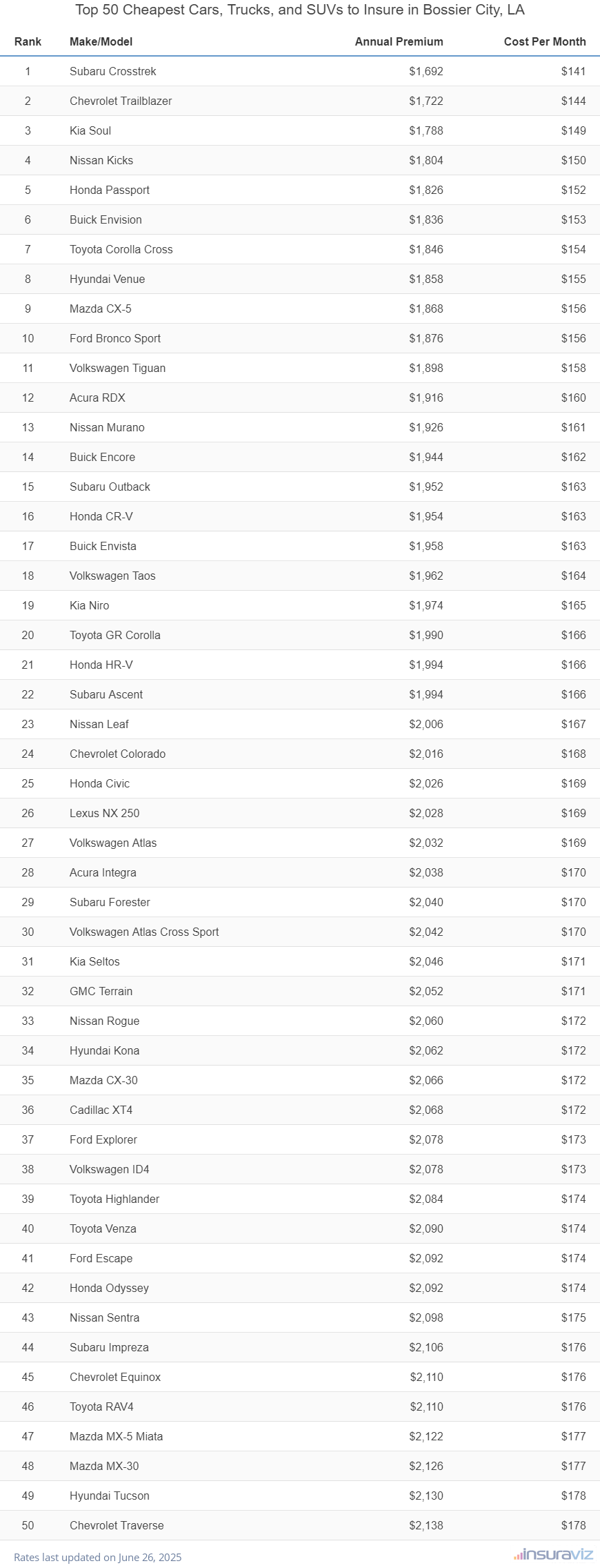

When all vehicles are compared, the models with the lowest cost average auto insurance prices in Bossier City, LA, tend to be crossovers and small SUVs like the Subaru Crosstrek, Kia Soul, Buick Envision, and Nissan Kicks.

Average insurance rates for cars and SUVs in the top 10 cost $1,904 or less per year to insure for full coverage in Bossier City.

A few other vehicles that rank very well in our cost comparison are the Volkswagen Tiguan, Acura RDX, Nissan Murano, and Toyota GR Corolla. Average insurance cost is a little bit more for those models than the compact SUVs at the top of the list, but they still have an average insurance cost of $2,022 or less per year ($169 per month).

The following table breaks down the vehicles with the cheapest overall insurance rates in Bossier City, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,720 | $143 |

| 2 | Chevrolet Trailblazer | $1,748 | $146 |

| 3 | Kia Soul | $1,816 | $151 |

| 4 | Nissan Kicks | $1,830 | $153 |

| 5 | Honda Passport | $1,852 | $154 |

| 6 | Buick Envision | $1,866 | $156 |

| 7 | Toyota Corolla Cross | $1,874 | $156 |

| 8 | Hyundai Venue | $1,886 | $157 |

| 9 | Mazda CX-5 | $1,898 | $158 |

| 10 | Ford Bronco Sport | $1,904 | $159 |

| 11 | Volkswagen Tiguan | $1,926 | $161 |

| 12 | Acura RDX | $1,944 | $162 |

| 13 | Nissan Murano | $1,954 | $163 |

| 14 | Buick Encore | $1,974 | $165 |

| 15 | Honda CR-V | $1,982 | $165 |

| 16 | Subaru Outback | $1,982 | $165 |

| 17 | Buick Envista | $1,988 | $166 |

| 18 | Volkswagen Taos | $1,992 | $166 |

| 19 | Kia Niro | $2,000 | $167 |

| 20 | Toyota GR Corolla | $2,022 | $169 |

| 21 | Honda HR-V | $2,024 | $169 |

| 22 | Subaru Ascent | $2,024 | $169 |

| 23 | Nissan Leaf | $2,038 | $170 |

| 24 | Chevrolet Colorado | $2,048 | $171 |

| 25 | Honda Civic | $2,060 | $172 |

| 26 | Lexus NX 250 | $2,060 | $172 |

| 27 | Volkswagen Atlas | $2,064 | $172 |

| 28 | Acura Integra | $2,068 | $172 |

| 29 | Subaru Forester | $2,070 | $173 |

| 30 | Volkswagen Atlas Cross Sport | $2,074 | $173 |

| 31 | Kia Seltos | $2,078 | $173 |

| 32 | GMC Terrain | $2,080 | $173 |

| 33 | Nissan Rogue | $2,090 | $174 |

| 34 | Hyundai Kona | $2,094 | $175 |

| 35 | Cadillac XT4 | $2,098 | $175 |

| 36 | Mazda CX-30 | $2,098 | $175 |

| 37 | Ford Explorer | $2,108 | $176 |

| 38 | Volkswagen ID4 | $2,108 | $176 |

| 39 | Toyota Highlander | $2,112 | $176 |

| 40 | Ford Escape | $2,120 | $177 |

| 41 | Toyota Venza | $2,122 | $177 |

| 42 | Honda Odyssey | $2,124 | $177 |

| 43 | Nissan Sentra | $2,132 | $178 |

| 44 | Subaru Impreza | $2,138 | $178 |

| 45 | Chevrolet Equinox | $2,142 | $179 |

| 46 | Toyota RAV4 | $2,146 | $179 |

| 47 | Mazda MX-5 Miata | $2,152 | $179 |

| 48 | Mazda MX-30 | $2,158 | $180 |

| 49 | Hyundai Tucson | $2,162 | $180 |

| 50 | Chevrolet Traverse | $2,170 | $181 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Bossier City, LA Zip Codes. Updated October 24, 2025

Additional vehicles making the top 50 table above include the Honda HR-V, the Kia Seltos, the Subaru Ascent, the Volkswagen Atlas, and the Chevrolet Equinox. Average rates for those vehicles fall between $2,022 and $2,176 per year in Bossier City.

In contrast to the vehicles with cheap rates, some examples of insurance that is considerably higher include the Tesla Model Y which averages $215 per month, the Subaru BRZ that costs $232, and the Audi e-tron that averages $242.

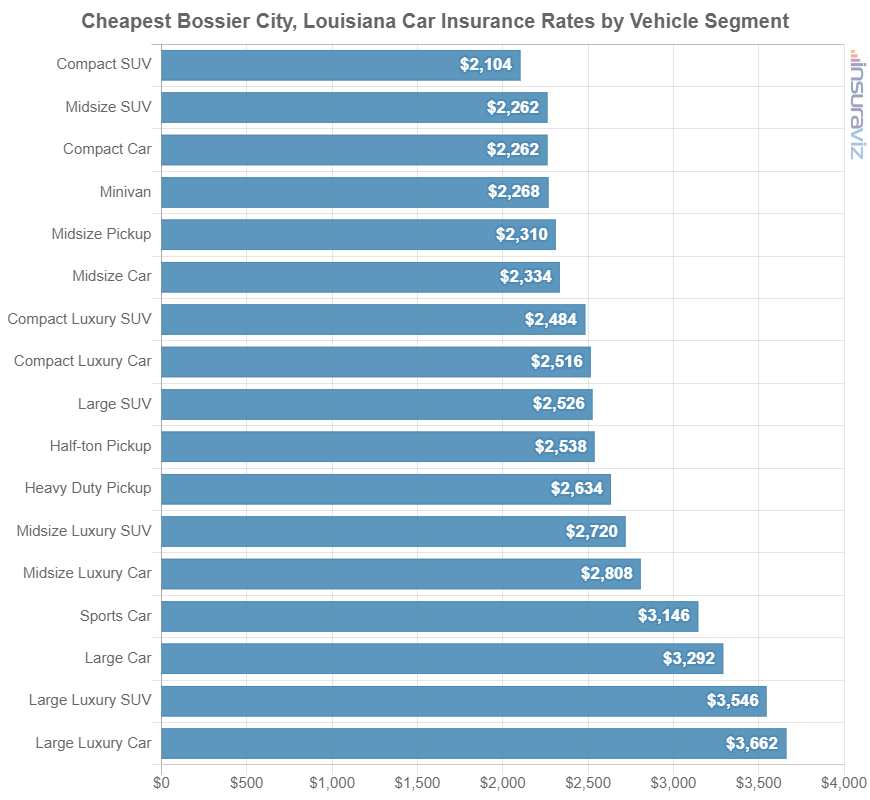

The next section showcases the average cost of auto insurance for each vehicle segment. The rates shown in the chart will give you a decent idea of the automotive segments that have the best rates.

Cost to insure by automotive segment

If you’re looking to buy a different vehicle, it’s useful to have an idea of which kinds of vehicles are less expensive to insure. To illustrate this, some people wonder if compact SUVs have more affordable insurance than minivans or if regular SUVs have cheaper car insurance than luxury SUVs.

The next chart displays average auto insurance rates by segment in Bossier City. From an overall average perspective, compact SUVs, midsize trucks, and minivans have the best rates, with luxury and performance models having the most expensive average insurance cost.

Rates by different vehicle segments are handy for overall comparisons, but car insurance cost varies quite a lot within each of the segments listed in the previous chart.

For example, in the small SUV segment, average rates range from the Subaru Crosstrek costing $1,720 per year for full coverage insurance up to the Ford Mustang Mach-E costing $2,720 per year, a difference of $1,000 just for that segment.

Also, in the midsize SUV segment, insurance rates can range from the Honda Passport costing $1,852 per year up to the Rivian R1S costing $2,860 per year.

Lastly, in the sports car segment, average rates range from the Mazda MX-5 Miata at $2,152 per year to the Mercedes-Benz SL 63 at $4,776 per year.

The list below breaks out the model with the cheapest overall insurance rates in Bossier City, LA, for each individual category.

- Cheapest compact car insurance – Toyota GR Corolla at $2,022 per year or $169 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $1,720 per year or $143 per month

- Cheapest midsize car insurance – Kia K5 at $2,240 per year or $187 per month

- Cheapest midsize SUV insurance – Honda Passport at $1,852 per year or $154 per month

- Cheapest full-size car insurance – Chrysler 300 at $2,212 per year or $184 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $2,182 per year or $182 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $2,048 per year or $171 per month

- Cheapest full-size pickup insurance – Nissan Titan at $2,176 per year or $181 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $2,364 per year or $197 per month

- Cheapest minivan insurance – Honda Odyssey at $2,124 per year or $177 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $2,152 per year or $179 per month

- Cheapest compact luxury car insurance – Acura Integra at $2,068 per year or $172 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $1,944 per year or $162 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $2,392 per year or $199 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $2,176 per year or $181 per month

- Cheapest full-size luxury car insurance – Audi A5 at $2,764 per year or $230 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $2,608 per year or $217 per month

How much does car insurance cost in Bossier City?

The average cost to insure a vehicle in Bossier City is $2,326 per year, or approximately $194 per month for a policy that provides full coverage. It costs 2.2% more to insure the average vehicle in Bossier City than the overall U.S. national average rate of $2,276.

In Louisiana, the average car insurance expense is $2,696 per year, so the cost of car insurance in Bossier City is $370 less per year. The cost of auto insurance in Bossier City compared to other Louisiana cities is approximately $720 per year cheaper than in Kenner, $284 per year cheaper than in Lafayette, and $638 per year less than in Baton Rouge.

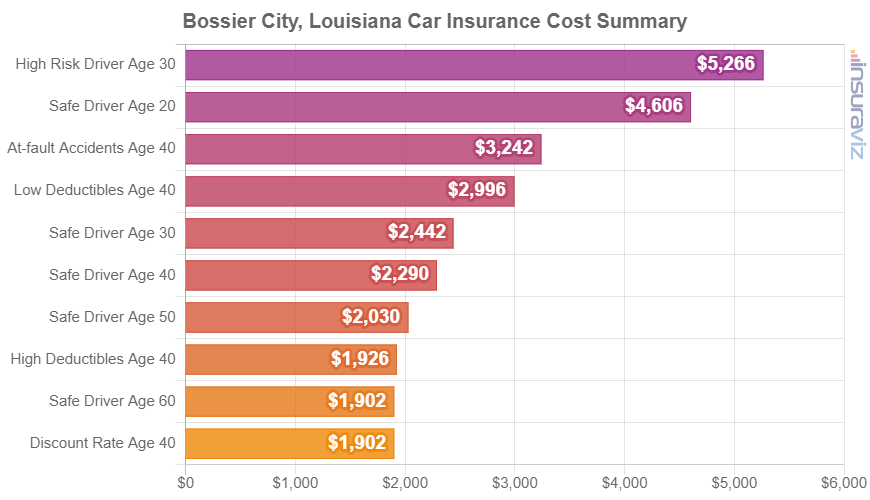

The chart below shows a summary of car insurance rates in Bossier City for 2024 model year vehicles, averaged for a variety of driver ages, physical damage coverage deductibles, and driver risk profiles.

The average cost of auto insurance per month in Bossier City is $194, with prices ranging from $161 to $446 for the average costs shown in the previous chart.

The age of the rated driver is probably the number one factor that determines the cost of car insurance, so the list below details how driver age influences cost by showing the difference in average car insurance rates in Bossier City for driver ages from 16 to 60.

Bossier City, Louisiana, car insurance cost by driver age

- 16 year old – $8,278 per year or $690 per month

- 17 year old – $8,020 per year or $668 per month

- 18 year old – $7,187 per year or $599 per month

- 19 year old – $6,546 per year or $546 per month

- 20 year old – $4,678 per year or $390 per month

- 30 year old – $2,482 per year or $207 per month

- 40 year old – $2,326 per year or $194 per month

- 50 year old – $2,062 per year or $172 per month

- 60 year old – $1,928 per year or $161 per month

In an effort to help illustrate the extent to which auto insurance cost can fluctuate between drivers (and also emphasize the importance of accurate rate quotes), the sections below show a wide range of rates for five popular vehicles in Bossier City: the Honda Civic, Honda CR-V, Honda Pilot, Kia K5, and Ford Mustang.

The example for each vehicle displays rates for a variety of different driver profiles to illustrate the potential cost difference with only minor risk factor changes.

Honda Civic insurance rates

With MSRP ranging from $23,950 to $43,795, average Bossier City car insurance rates on a 2024 Honda Civic range from $1,842 per year on the Honda Civic LX model up to $2,440 per year for the Honda Civic Type R trim.

As a cost per month, auto insurance rates on the Honda Civic can range from $154 to $203 per month, but your actual rate can vary based on where you live in Bossier City.

The next rate chart may help you understand how insurance rates on a Honda Civic can be very different based on a number of different driver ages, policy deductibles, and driver risk scenarios. The rates in the chart range from $1,712 to $4,672 per year, which is a cost difference of $2,960 per year to insure the same vehicle.

The Honda Civic belongs to the compact car segment, and other models in the same segment include the Volkswagen Jetta, Toyota Corolla, and Nissan Sentra.

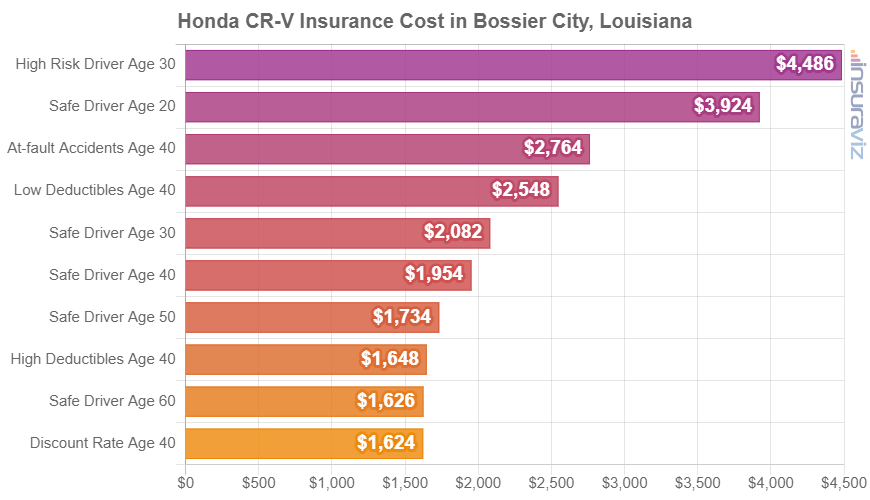

Honda CR-V insurance rates

Honda CR-V insurance in Bossier City costs an average of $1,982 per year, with rates ranging from a low of $1,880 per year on the Honda CR-V LX trim up to $2,092 per year on the Honda CR-V Sport Touring Hybrid AWD trim level.

When Bossier City insurance rates on the Honda CR-V are compared with national average insurance rates for the same model, rates are anywhere from $62 to $68 more expensive per year in Bossier City, depending on the exact model being insured.

From a cost per month standpoint, auto insurance for the Honda CR-V for a middle-age safe driver can range from $157 to $174 per month, depending on your company and exact Zip Code in Bossier City.

The rate chart below may be useful to help you comprehend how auto insurance quotes for a Honda CR-V can be quite different for different drivers, policy deductibles, and driver risk scenarios.

The Honda CR-V is classified as a compact SUV, and other similar models from the same segment include the Toyota RAV4, Ford Escape, Mazda CX-5, and Subaru Forester.

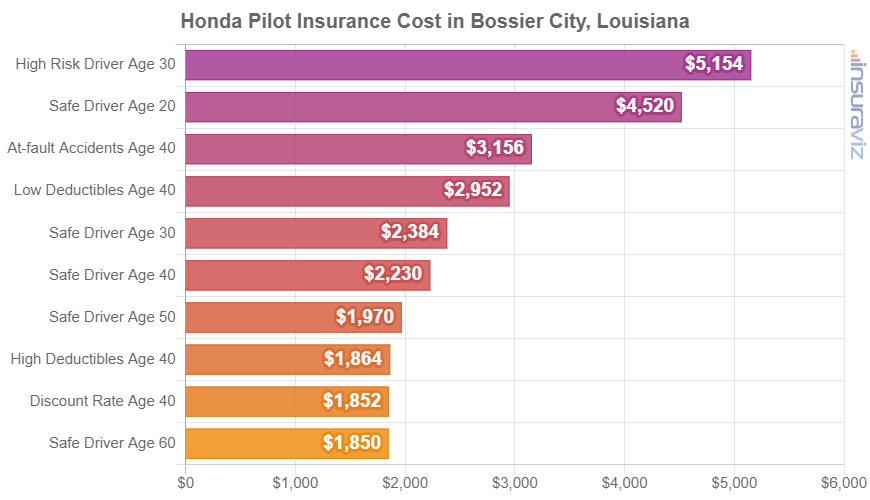

Honda Pilot insurance rates

The lowest-cost 2024 Honda Pilot trim level to insure in Bossier City is the LX model, costing an average of $2,116 per year, or around $176 per month. This model has a retail price of $37,090.

The most expensive 2022 Honda Pilot trim to insure in Bossier City is the Elite AWD, costing an average of $2,402 per year, or about $200 per month. The sticker price for this trim is $52,480, before charges and fees.

When Bossier City auto insurance rates for the Honda Pilot are compared to the cost averaged for the entire U.S. on the same model, rates are $70 to $80 more per year in Bossier City, depending on trim level.

As a cost per month, car insurance rates on a Honda Pilot for the average driver can range from $176 to $200 per month, depending on the insurance company you choose in Bossier City.

The rate chart below shows how car insurance rates for a Honda Pilot can be quite different for a variety of different driver ages, risk profiles, and policy deductibles.

In this example, cost varies from $1,882 to $5,232 per year, which is a difference of $3,350.

The Honda Pilot is considered a midsize SUV, and other models in the same segment include the Ford Explorer, Ford Edge, Jeep Grand Cherokee, and Kia Telluride.

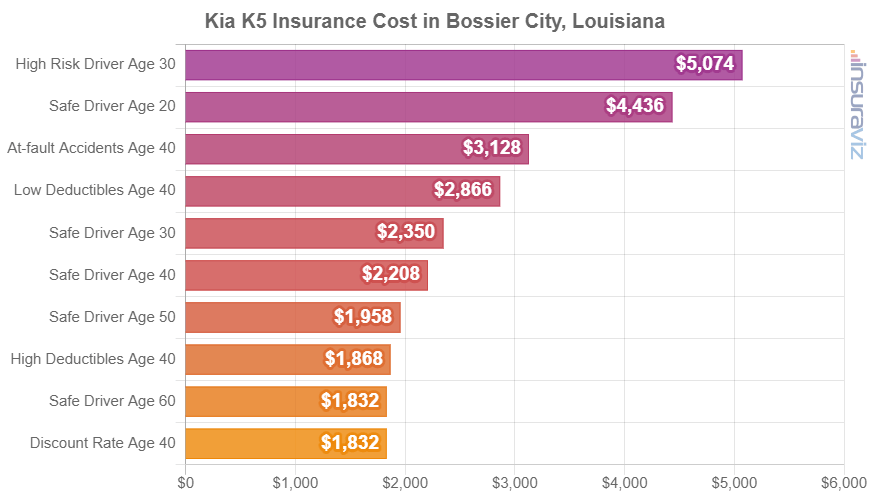

Kia K5 insurance rates

The average cost of Kia K5 insurance in Bossier City is $2,240 per year. With prices ranging from $25,090 to $31,490, average car insurance quotes for a Kia K5 range from $2,146 per year for the Kia K5 LXS model up to $2,334 per year for the Kia K5 GT trim level.

When Bossier City insurance rates for the Kia K5 are compared with the overall national average cost on the same vehicle, the cost is $70 to $76 more expensive per year in Bossier City, depending on trim level.

From a monthly standpoint, car insurance rates on the Kia K5 for a middle-age safe driver can cost from $179 to $195 per month, but your final cost can vary considerably based on your address in Bossier City.

The next chart demonstrates how the cost of insurance on a Kia K5 can be significantly different based on different driver ages, policy deductibles, and policy risk factors.

The Kia K5 is classified as a midsize car, and other popular models in the same segment include the Hyundai Sonata, Toyota Camry, Chevrolet Malibu, and Honda Accord.

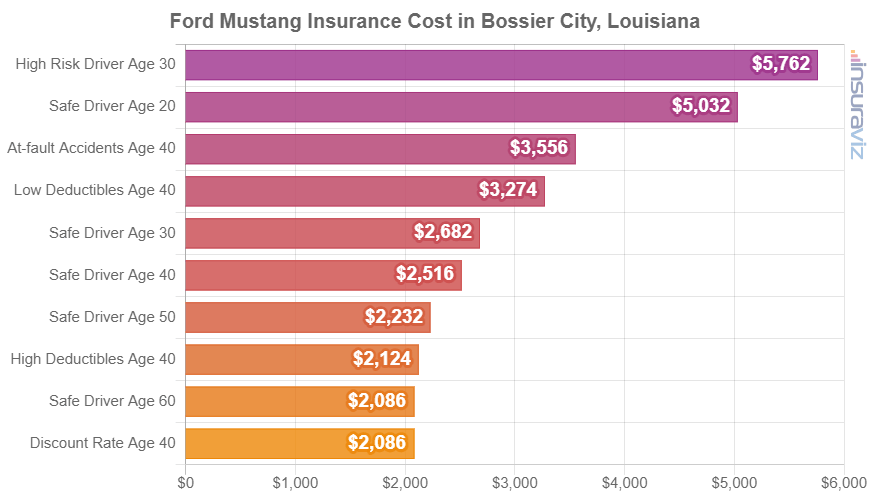

Ford Mustang insurance rates

The average price paid for Ford Mustang insurance in Bossier City is $2,554 per year. With prices ranging from $30,920 to $63,265, average insurance quotes for a 2024 Ford Mustang cost from $2,190 per year on the Ford Mustang Ecoboost Fastback model up to $2,786 per year for the Ford Mustang Dark Horse Premium.

When Bossier City auto insurance rates for a Ford Mustang are compared to the cost averaged for the entire U.S. on the same vehicle, the cost is anywhere from $70 to $90 more per year in Bossier City, depending on which trim level is insured.

The next chart visualizes how the cost of insurance on a Ford Mustang can change based on different driver ages and possible risk profiles. For this example, cost varies from $2,118 to $5,848 per year, which is a cost difference of $3,730 to insure the same vehicle with different rated drivers.

The Ford Mustang is considered a sports car, and other models in that segment include the Chevrolet Corvette, Nissan 370Z, and Subaru BRZ.

How to find cheaper auto insurance in Bossier City

Smart drivers are often looking to reduce their monthly insurance expenses. So take a minute to review the tips below and see if you can save a little dough on your next car insurance policy.

- Increasing deductibles lowers insurance cost. Increasing your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Obey the law to get lower policy cost. If you want to get cheap auto insurance in Bossier City, it pays to avoid traffic tickets. Just one or two minor infractions on your driving record have the consequences of raising policy rates by as much as $616 per year. Major convictions such as DWI or reckless driving could raise rates by an additional $2,160 or more.

- Earn a discount from your profession. Many insurance companies offer policy discounts for specific professions like engineers, members of the military, doctors, college professors, accountants, firefighters, and others. By qualifying for this discount, you could save between $70 and $226 on your car insurance bill, depending on the age of the driver.

- Pay small claims out-of-pocket. Auto insurance companies offer a discount for not filing any claims. Insurance is intended to be used for significant financial loss, not for minor claims.

- Buy vehicles with low cost insurance. The make and model of vehicle you drive has a big impact on the cost of car insurance. For example, a Kia Telluride costs $596 less per year to insure in Bossier City than a Chevrolet Camaro. Choose lower performance vehicles and save money.

- Good credit equals better rates. Having a high credit score of 800+ may save $365 per year when compared to a slightly lower credit rating between 670-739. Conversely, a below average credit score could cost up to $423 more per year. Not all states use credit score as a rating factor, so check with your agent or company.