- Kia Sedona car insurance costs an average of $1,796 per year, or around $150 per month for full coverage.

- The cheapest Sedona model to insure is the L 2WD trim level at an estimated $1,614 per year, while the Sedona SX 2WD is the most expensive to insure at $1,944 per year.

- The Sedona is one of the cheaper midsize minivans to insure, costing $242 less per year on average as compared to the rest of the vehicles in the segment.

- For the 2022 model year, the U.S. model is now named the Carnival to match the name used in other international markets. See our Kia Carnival insurance cost article for more information.

How much does Kia Sedona car insurance cost?

Kia Sedona car insurance rates average $1,796 annually for full coverage, or about $150 each month. With the average midsize minivan costing $2,038 a year to insure, the Kia Sedona may save around $242 or more every 12 months.

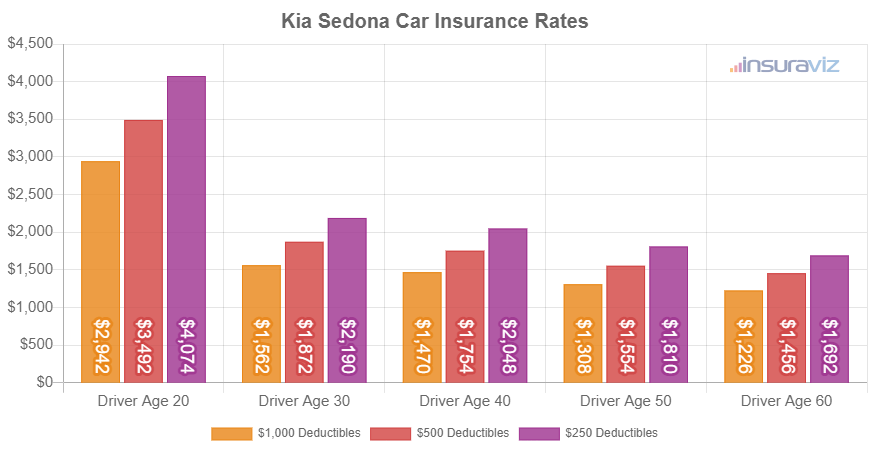

The chart below demonstrates how average Sedona car insurance cost varies based on the age of the driver and different policy deductibles. The annual policy rates shown range from a low of $1,256 per year for a 60-year-old driver with $1,000 deductibles to the highest price of $4,176 annually for a driver age 20 with low physical damage deductibles.

In order to help visualize how much insurance rates can vary, consider that buying a liability-only policy on an older Kia Sedona in the most affordable parts of North Carolina or Wisconsin may be as low as $244 a year.

For a new 2021 Kia Sedona, a 16-year-old male driver with an accident or two in some urban areas in California could be footing the bill for $12,625 a year for full coverage.

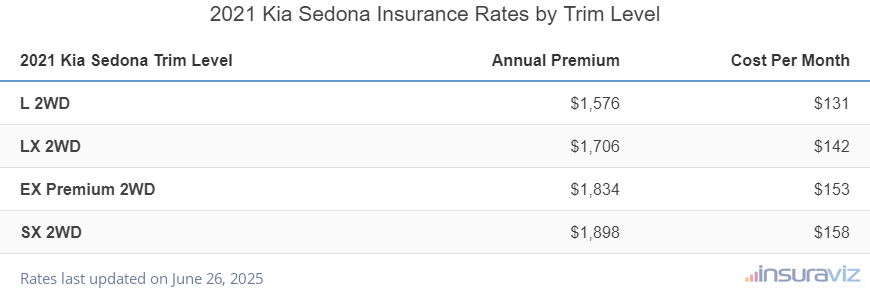

Are insurance rates affected by vehicle trim level?

With Kia Sedona car insurance rates ranging from $1,614 to $1,944 annually on average, the most affordable model to insure is the L 2WD. The second cheapest trim level to insure is the LX 2WD at $1,746 per year. On average, plan on paying a minimum of $135 per month to insure a Sedona.

The two most expensive trim levels of Kia Sedona to insure are the SX 2WD at $1,944 and the EX Premium 2WD at $1,880 per year. Those trims will cost an extra $330 and $266 per year, respectively, over the lowest cost L 2WD model.

The rate table below displays average car insurance rates for each 2021 model year Kia Sedona package and trim level.

| 2021 Kia Sedona Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| L 2WD | $1,614 | $135 |

| LX 2WD | $1,746 | $146 |

| EX Premium 2WD | $1,880 | $157 |

| SX 2WD | $1,944 | $162 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

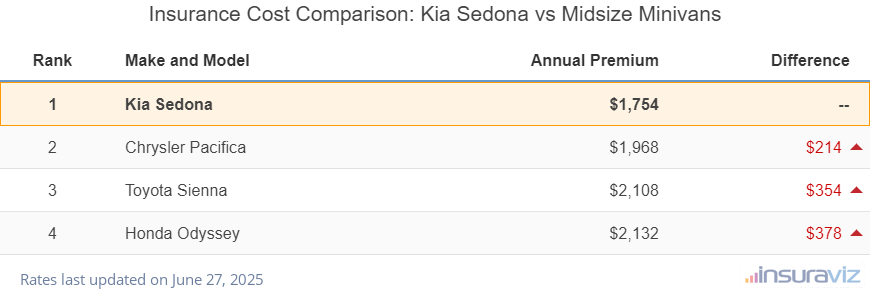

How do Kia Sedona insurance rates compare?

When compared to all other minivans, car insurance for a Kia Sedona costs $386 less per year than the Honda Odyssey, $218 less than the Chrysler Pacifica, and $364 less than the Toyota Sienna.

The Sedona ranks first out of four comparison vehicles in the midsize minivan class. It costs an average of $1,796 per year to insure a Sedona and the segment average is $2,038 per year, a difference of $242 per year.

The table below shows how average car insurance rates for a Sedona minivan compare to other similar vehicles.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Kia Sedona | $1,796 | -- |

| 2 | Chrysler Pacifica | $2,014 | $218 |

| 3 | Toyota Sienna | $2,160 | $364 |

| 4 | Honda Odyssey | $2,182 | $386 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2021 model year. Updated October 24, 2025

Does location influence insurance rates on a Sedona?

Insurance rates on a Kia Sedona can cover a wide range, from cheaper rates like $1,550 a year in Columbus, OH, or $1,456 in Virginia Beach, VA, to expensive rates such as $2,344 a year in Miami, FL, and $2,610 in Los Angeles, CA. Insurance cost for a Kia Sedona in some additional cities include Portland, OR, at an estimated $1,994 per year, Fresno, CA, at $2,062, Nashville, TN, at $1,858, and Denver, CO, costing $2,114.

The next chart visualizes average estimated insurance policy premiums for a Kia Sedona in thirty larger metro areas in America.

Average Kia Sedona insurance rates by state

When evaluating Kia Sedona insurance at the state level, states like Maine ($1,368) and Iowa ($1,452) tend to be on the lower side, while states like Nevada ($2,142), Michigan ($2,162), and Louisiana ($2,018) have higher insurance rates for a Kia Sedona.

Auto insurance rates in most states do not fall as far from the median, with states like Arkansas, Alabama, and Mississippi included in this group with average Kia Sedona insurance rates of $1,948, $1,756, and $1,856 per year, respectively.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $1,756 | $146 |

| Alaska | $1,568 | $131 |

| Arizona | $1,776 | $148 |

| Arkansas | $1,948 | $162 |

| California | $2,160 | $180 |

| Colorado | $1,980 | $165 |

| Connecticut | $2,034 | $170 |

| Delaware | $2,064 | $172 |

| Florida | $2,088 | $174 |

| Georgia | $1,918 | $160 |

| Hawaii | $1,470 | $123 |

| Idaho | $1,510 | $126 |

| Illinois | $1,726 | $144 |

| Indiana | $1,554 | $130 |

| Iowa | $1,452 | $121 |

| Kansas | $1,866 | $156 |

| Kentucky | $1,978 | $165 |

| Louisiana | $2,018 | $168 |

| Maine | $1,368 | $114 |

| Maryland | $1,794 | $150 |

| Massachusetts | $2,002 | $167 |

| Michigan | $2,162 | $180 |

| Minnesota | $1,702 | $142 |

| Mississippi | $1,856 | $155 |

| Missouri | $2,054 | $171 |

| Montana | $1,778 | $148 |

| Nebraska | $1,672 | $139 |

| Nevada | $2,142 | $179 |

| New Hampshire | $1,454 | $121 |

| New Jersey | $2,164 | $180 |

| New Mexico | $1,654 | $138 |

| New York | $2,092 | $174 |

| North Carolina | $1,396 | $116 |

| North Dakota | $1,662 | $139 |

| Ohio | $1,492 | $124 |

| Oklahoma | $2,020 | $168 |

| Oregon | $1,800 | $150 |

| Pennsylvania | $1,834 | $153 |

| Rhode Island | $2,196 | $183 |

| South Carolina | $1,672 | $139 |

| South Dakota | $1,922 | $160 |

| Tennessee | $1,826 | $152 |

| Texas | $1,792 | $149 |

| Utah | $1,724 | $144 |

| Vermont | $1,530 | $128 |

| Virginia | $1,448 | $121 |

| Washington | $1,756 | $146 |

| West Virginia | $1,746 | $146 |

| Wisconsin | $1,514 | $126 |

| Wyoming | $1,740 | $145 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Some additional points to make about insurance rates include:

- Younger drivers pay higher rates. The difference in 2021 Sedona insurance cost between a 60-year-old driver ($1,490 per year) and a 30-year-old driver ($1,918 per year) is $428, or a savings of 25.1%.

- Careless drivers spend more for insurance. Having frequent at-fault accidents will raise rates, as much as $2,512 per year for a 20-year-old driver and even $520 per year for a 50-year-old driver.

- Increase deductibles to save money. Increasing your policy deductibles from $500 to $1,000 could save around $292 per year for a 40-year-old driver and $562 per year for a 20-year-old driver.

- Low physical damage deductibles may be wasting money. Dropping your deductibles from $500 to $250 could cost an additional $304 per year for a 40-year-old driver and $598 per year for a 20-year-old driver.

- Prepare for sticker shock for high risk insurance. For a 40-year-old driver, having to buy a high-risk policy due to excessive accidents and/or violations could end up with a rate increase of $2,134 or more per year.

- Fewer violations means cheaper insurance rates. To get the best price on Sedona insurance rates, it pays off to be a safe driver. In fact, just a couple minor incidents on your driving report can potentially raise rates by up to $462 per year. Serious misdemeanors such as driving under the influence or reckless driving could raise rates by an additional $1,634 or more.