- Toyota Tundra car insurance costs an average of $2,856 per year, or about $238 per month for a policy with full coverage.

- The Tundra SR Double Cab 2WD trim level is the cheapest to insure at around $2,548 per year. The most expensive trim is the Capstone Crew Max Hybrid 4WD at $3,096 per year.

- Out of seven vehicles in the full-size pickup truck segment, the Tundra ranks seventh for insurance affordability.

- On a state level, insurance rates range from a low of $2,372 per year in Ohio to $3,436 in Michigan. Rates in a few larger cities include $3,052 in Dallas, TX, $3,088 in Chicago, IL, and $3,504 in Baltimore, MD.

How much does Toyota Tundra insurance cost?

Toyota Tundra insurance rates average $2,856 per year for full coverage, or around $238 if paid each month. With the average full-size pickup truck costing $2,660 a year to insure, the Toyota Tundra is just slightly cheaper than average.

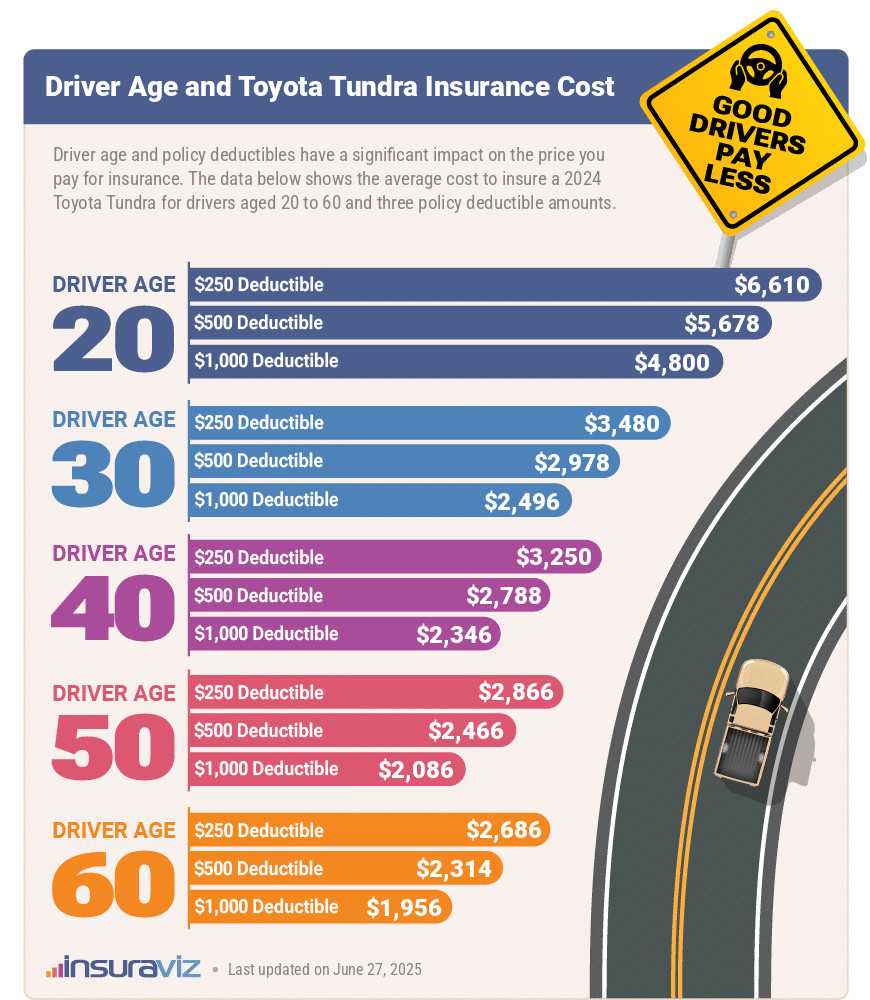

The image below showcases average 2024 Toyota Tundra insurance cost for different policy deductible levels and driver ages.

The infographic above averages rates across the entire Toyota Tundra lineup, but there is quite a bit of variation depending on the trim level being insured. The next section breaks out rates by trim level and option packages.

Is Toyota Tundra insurance cheap?

With Toyota Tundra insurance rates ranging from $2,548 to $3,096 annually, the cheapest trim levels to insure are the SR Double Cab 2WD and SR Crew Max 2WD models at an average cost of $2,548 and $2,612 per year, respectively.

On average, plan on paying around $212 per month for starters for full coverage Tundra insurance. However, this amount can vary quite a bit depending on the model year, coverages, and driver age.

The three highest-cost Tundra trim levels to insure are the Toyota Tundra 1794 Edition Crew Max Hybrid 4WD, the TRD Pro Crew Max Hybrid 4WD, and the Capstone Crew Max Hybrid 4WD trim levels, maxing out around $3,096 per year.

As the cost goes up with the different Tundra trims and packages, insurance goes up in step with it. Lower trim levels cost less and therefore have a lower replacement cost, resulting in cheaper insurance rates.

The table below shows average annual car insurance rates, in addition to a monthly budget amount, for each 2024 Toyota Tundra trim level.

| 2024 Toyota Tundra Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SR Double Cab 2WD | $2,548 | $212 |

| SR Crew Max 2WD | $2,612 | $218 |

| SR Double Cab 4WD | $2,626 | $219 |

| SR Crew Max 4WD | $2,674 | $223 |

| SR5 Double Cab 2WD | $2,682 | $224 |

| SR5 Crew Max 2WD | $2,726 | $227 |

| SR5 Double Cab 4WD | $2,744 | $229 |

| SR5 Crew Max 4WD | $2,782 | $232 |

| Limited Double Cab 2WD | $2,804 | $234 |

| Limited Crew Max 2WD | $2,840 | $237 |

| Limited Double Cab 4WD | $2,848 | $237 |

| Limited Crew Max 4WD | $2,880 | $240 |

| Limited Crew Max Hybrid 2WD | $2,890 | $241 |

| Limited Crew Max Hybrid 4WD | $2,930 | $244 |

| Platinum Crew Max 2WD | $2,936 | $245 |

| 1794 Edition Crew Max 2WD | $2,948 | $246 |

| Platinum Crew Max 4WD | $2,974 | $248 |

| 1794 Edition Crew Max 4WD | $2,980 | $248 |

| Platinum Crew Max Hybrid 2WD | $2,986 | $249 |

| 1794 Edition Crew Max Hybrid 2WD | $2,992 | $249 |

| Platinum Crew Max Hybrid 4WD | $3,014 | $251 |

| 1794 Edition Crew Max Hybrid 4WD | $3,018 | $252 |

| TRD Pro Crew Max Hybrid 4WD | $3,042 | $254 |

| Capstone Crew Max Hybrid 4WD | $3,096 | $258 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How does Tundra insurance cost compare?

When compared to other half-ton pickups, insurance rates for a 2024 Toyota Tundra cost $172 more per year than the Ford F150, $80 more than the Ram Truck, $202 more than the Chevrolet Silverado, and $206 more than the GMC Sierra.

The Toyota Tundra ranks seventh out of seven total vehicles in the large truck segment. The Tundra costs an estimated $2,856 per year to insure for full coverage and the segment median rate is $2,660 per year, a difference of $196 per year.

The chart below shows how average Toyota Tundra car insurance rates compare to all other half-ton large trucks for the 2024 model year.

Will a used Tundra save money on insurance?

Buying insurance for a Toyota Tundra with some age on it is definitely cheaper than a new model off the showroom floor. For example, insuring a 2013 Tundra instead of a 2024 model could save $1,218 each year at the very least.

The data table below details average insurance rates for the Tundra for the 2013 to 2024 model years and a range of driver ages. Prices range from the cheapest rate of $1,378 for a 60-year-old driver rated on a 2013 Toyota Tundra to the most expensive rate of $5,820 for a 20-year-old driver rated on a 2024 Tundra.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Toyota Tundra | $5,820 | $2,856 | $2,370 |

| 2023 Toyota Tundra | $4,952 | $2,456 | $2,030 |

| 2022 Toyota Tundra | $4,762 | $2,358 | $1,956 |

| 2021 Toyota Tundra | $4,470 | $2,206 | $1,834 |

| 2020 Toyota Tundra | $4,338 | $2,142 | $1,780 |

| 2019 Toyota Tundra | $4,050 | $1,992 | $1,658 |

| 2018 Toyota Tundra | $3,842 | $1,892 | $1,578 |

| 2017 Toyota Tundra | $3,598 | $1,774 | $1,484 |

| 2016 Toyota Tundra | $3,764 | $1,862 | $1,552 |

| 2015 Toyota Tundra | $3,432 | $1,698 | $1,422 |

| 2014 Toyota Tundra | $3,580 | $1,766 | $1,486 |

| 2013 Toyota Tundra | $3,304 | $1,638 | $1,378 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Toyota Tundra trim levels for each model year. Updated October 24, 2025

At some point down the road, it will probably be a good idea to drop physical damage coverage from the policy. As vehicles get older and lose value, the cost of maintaining comprehensive and collision coverage starts to outweigh the benefit of having it on the policy.

Dropping physical damage coverage on an older Toyota Tundra could save you around $860 a year, depending on what the comprehensive and collision deductibles were set to and the age of the rated driver.

Toyota Tundra insurance rates by U.S. city and state

Depending upon where you live, the insurance cost for a Tundra can vary from lower rates like $2,464 a year in Columbus, OH, or $2,226 in Raleigh, NC, to higher rates such as $4,158 a year in Las Vegas, NV, and $4,150 per year for car insurance in Los Angeles.

The cost of insurance for a Toyota Tundra in some other areas include Memphis, TN, costing $3,364 per year, San Francisco, CA, averaging $3,720, Austin, TX, at $2,758, and Albuquerque, NM, at $2,910.

The following chart visualizes average insurance rates for a Toyota Tundra in the most populated areas in the United States.

When analyzing Toyota Tundra auto insurance rates from a broader perspective, states like Iowa ($2,312), North Carolina ($2,222), and Idaho ($2,406) have cheaper Tundra insurance rates, while states like Michigan ($3,436), Louisiana ($3,210), and even to an extent Rhode Island ($3,496) have expensive car insurance rates.

Insurance rates in most states thankfully do not tend toward the high side. More average-leaning states like West Virginia, Wyoming, and Texas have rates of $2,774, $2,768, and $2,850 per year, respectively.

Average insurance rates on a 2024 Toyota Tundra are shown in the table below for all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,794 | $233 |

| Alaska | $2,494 | $208 |

| Arizona | $2,828 | $236 |

| Arkansas | $3,096 | $258 |

| California | $3,436 | $286 |

| Colorado | $3,150 | $263 |

| Connecticut | $3,236 | $270 |

| Delaware | $3,284 | $274 |

| Florida | $3,322 | $277 |

| Georgia | $3,044 | $254 |

| Hawaii | $2,338 | $195 |

| Idaho | $2,406 | $201 |

| Illinois | $2,742 | $229 |

| Indiana | $2,472 | $206 |

| Iowa | $2,312 | $193 |

| Kansas | $2,968 | $247 |

| Kentucky | $3,148 | $262 |

| Louisiana | $3,210 | $268 |

| Maine | $2,172 | $181 |

| Maryland | $2,852 | $238 |

| Massachusetts | $3,184 | $265 |

| Michigan | $3,436 | $286 |

| Minnesota | $2,704 | $225 |

| Mississippi | $2,948 | $246 |

| Missouri | $3,266 | $272 |

| Montana | $2,830 | $236 |

| Nebraska | $2,658 | $222 |

| Nevada | $3,408 | $284 |

| New Hampshire | $2,312 | $193 |

| New Jersey | $3,436 | $286 |

| New Mexico | $2,628 | $219 |

| New York | $3,328 | $277 |

| North Carolina | $2,222 | $185 |

| North Dakota | $2,644 | $220 |

| Ohio | $2,372 | $198 |

| Oklahoma | $3,214 | $268 |

| Oregon | $2,864 | $239 |

| Pennsylvania | $2,916 | $243 |

| Rhode Island | $3,496 | $291 |

| South Carolina | $2,664 | $222 |

| South Dakota | $3,056 | $255 |

| Tennessee | $2,898 | $242 |

| Texas | $2,850 | $238 |

| Utah | $2,742 | $229 |

| Vermont | $2,434 | $203 |

| Virginia | $2,304 | $192 |

| Washington | $2,798 | $233 |

| West Virginia | $2,774 | $231 |

| Wisconsin | $2,406 | $201 |

| Wyoming | $2,768 | $231 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Some other important insights as they relate to insurance costs on a Toyota Tundra include:

- Policy discounts mean cheaper Tundra insurance. Discounts may be available if the policyholders belong to certain professional organizations, are accident-free, insure multiple vehicles on the same policy, are away-from-home students, or other discounts which could save the average driver as much as $490 per year on the cost of insuring a Toyota Tundra.

- Tundra insurance for teen drivers is expensive. Average rates for full coverage Tundra insurance costs $10,344 per year for a 16-year-old driver, $10,027 per year for a 17-year-old driver, and $8,990 per year for an 18-year-old driver.

- Raise your credit score to score lower rates. In states that allow a driver’s credit history to be used for generating rates, having excellent credit of 800+ could save $448 per year compared to a decent credit rating of 670-739. Conversely, a weaker credit score could cost up to $520 more per year.

- Gender and age affect the rate you pay. For a 2024 Toyota Tundra, a 20-year-old man pays an estimated $5,820 per year, while a 20-year-old woman pays $4,150, a difference of $1,670 per year in the women’s favor by a large margin. But by age 50, male driver rates are $2,528 and female driver rates are $2,464, a difference of only $64.

- Prepare for sticker shock for high-risk insurance. For a 30-year-old driver, the requirement to buy a high-risk policy increases the cost by $3,594 or more per year.

- Being a good driver saves money. Too many at-fault accidents can raise rates, as much as $1,406 or more per year for a 30-year-old driver and as much as $886 per year for a 50-year-old driver.