- Honda Ridgeline insurance averages $2,380 per year or around $198 per month, depending on the trim level.

- Ridgeline insurance rates range from $2,288 to $2,452 annually for an average driver, depending on trim level.

- The Honda Ridgeline is one of the cheaper 2024 midsize trucks to insure, costing $42 less per year on average as compared to other midsize trucks

- Honda Ridgeline car insurance rates in a few larger cities include $2,774 in Atlanta, GA, $2,536 in Houston, TX, and $2,858 in Tulsa, OK.

How much does Honda Ridgeline car insurance cost?

Honda Ridgeline insurance costs $2,380 annually for full coverage, which is the equivalent of $198 a month. Comprehensive coverage costs about $584 a year, collision coverage is approximately $1,052, and the remaining liability/medical (or PIP) coverage costs approximately $744.

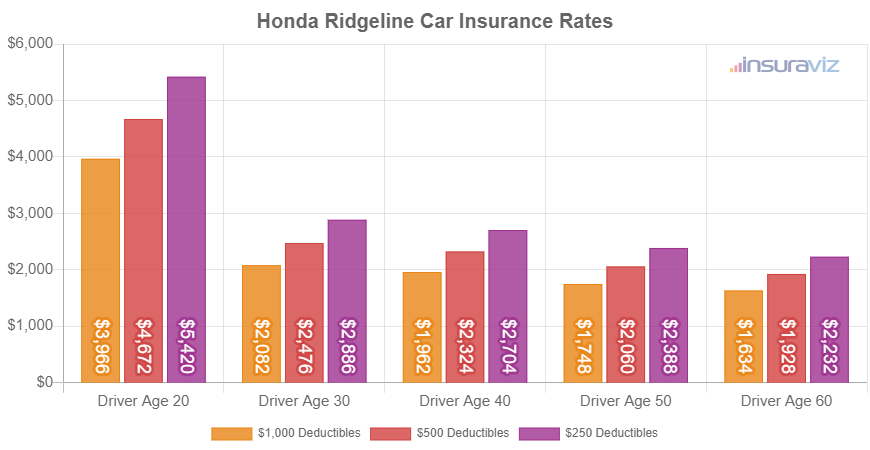

The chart below shows how average Ridgeline insurance cost changes based on the age of the driver and comprehensive and collision deductibles. The annual policy cost values shown range from the cheapest price of $1,674 per year for a driver age 60 with a $1,000 policy deductible to a high of $5,554 per year for a driver age 20 with $250 comprehensive and collision deductibles.

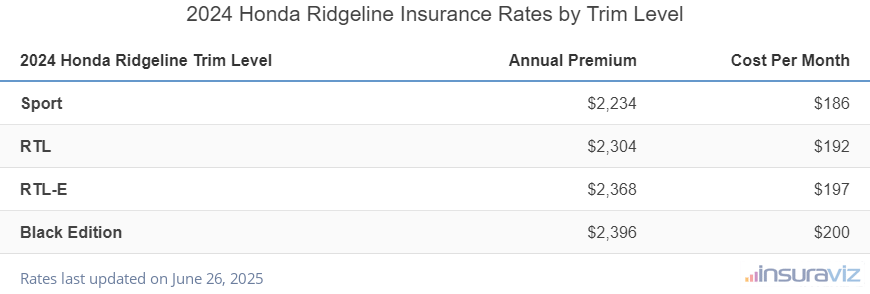

Do higher Ridgeline trims increase insurance cost?

With Honda Ridgeline insurance rates ranging from $2,288 to $2,452 per year on average, the most budget-friendly trim level to insure is the Ridgeline Sport. The three highest cost Ridgeline trim levels to insure are the Honda Ridgeline RTL, the RTL-E, and the Black Edition trim levels at an estimated $2,360, $2,424, and $2,452 per year, respectively.

The rate table below details the yearly and 6-month average car insurance rates, in addition to a monthly budget figure, for each Honda Ridgeline package and trim.

| 2024 Honda Ridgeline Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Sport | $2,288 | $191 |

| RTL | $2,360 | $197 |

| RTL-E | $2,424 | $202 |

| Black Edition | $2,452 | $204 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

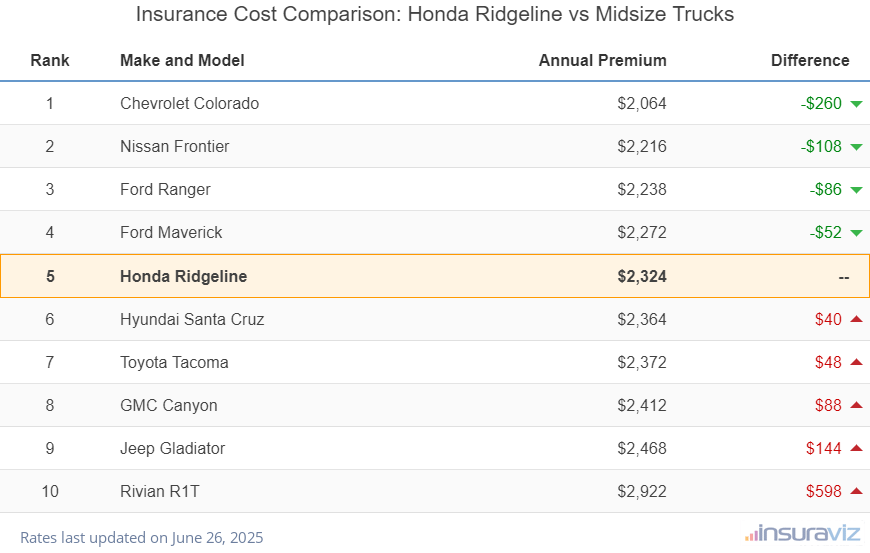

Ridgeline insurance cost vs. midsize truck segment

The Honda Ridgeline ranks fifth out of 10 total comparison vehicles in the 2024 midsize truck segment for insurance affordability. The Ridgeline costs an average of $2,380 per year for full coverage auto insurance, while the segment average rate is $2,422 per year, a difference of $42 per year.

When compared to the rest of the midsize truck segment, car insurance for a Honda Ridgeline costs $48 less per year than the Toyota Tacoma, $266 more than the Chevrolet Colorado, $88 more than the Ford Ranger, and $110 more than the Nissan Frontier.

The table below shows how Honda Ridgeline car insurance rates compare to those trucks plus the Jeep Gladiator and GMC Canyon.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Chevrolet Colorado | $2,114 | -$266 |

| 2 | Nissan Frontier | $2,270 | -$110 |

| 3 | Ford Ranger | $2,292 | -$88 |

| 4 | Ford Maverick | $2,328 | -$52 |

| 5 | Honda Ridgeline | $2,380 | -- |

| 6 | Hyundai Santa Cruz | $2,420 | $40 |

| 7 | Toyota Tacoma | $2,428 | $48 |

| 8 | GMC Canyon | $2,468 | $88 |

| 9 | Jeep Gladiator | $2,528 | $148 |

| 10 | Rivian R1T | $2,992 | $612 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

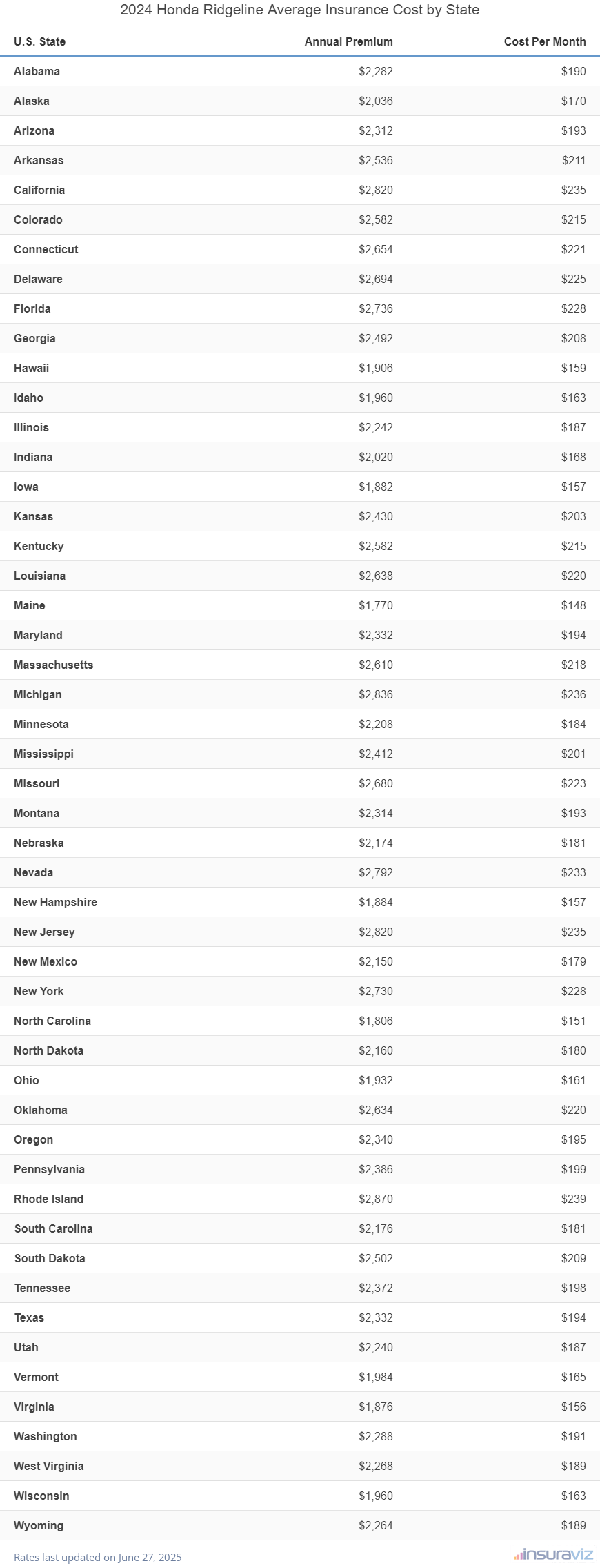

Ridgeline insurance rates by U.S. city and state

Depending upon where you live, the cost to insure a Ridgeline can vary from cheaper amounts like $1,928 a year in Virginia Beach, VA, or $2,054 in Columbus, OH, to higher rates like $3,472 a year in Philadelphia, PA, and $3,818 in New York City, NY.

Some additional examples of rates include Tucson, AZ, at $2,390 per year, Dallas, TX, averaging $2,544, San Antonio, TX, costing $2,372, and Mesa, AZ, at an estimated $2,450.

The next chart visualizes average insurance rates for a Honda Ridgeline in thirty of the largest metro areas in the United States.

When comparing state average Honda Ridgeline rates, states like Virginia ($1,920), Maine ($1,808), and Iowa ($1,928) have lower insurance rates, while states like Nevada ($2,838), Michigan ($2,866), and Louisiana ($2,674) have higher insurance rates.

More middle-ground states like Minnesota, Pennsylvania, and Oregon have Honda Ridgeline insurance rates of $2,256, $2,430, and $2,384 per year, respectively.

The next table details average Ridgeline insurance rates in all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,328 | $194 |

| Alaska | $2,078 | $173 |

| Arizona | $2,354 | $196 |

| Arkansas | $2,582 | $215 |

| California | $2,862 | $239 |

| Colorado | $2,624 | $219 |

| Connecticut | $2,698 | $225 |

| Delaware | $2,738 | $228 |

| Florida | $2,768 | $231 |

| Georgia | $2,536 | $211 |

| Hawaii | $1,950 | $163 |

| Idaho | $2,004 | $167 |

| Illinois | $2,288 | $191 |

| Indiana | $2,060 | $172 |

| Iowa | $1,928 | $161 |

| Kansas | $2,474 | $206 |

| Kentucky | $2,620 | $218 |

| Louisiana | $2,674 | $223 |

| Maine | $1,808 | $151 |

| Maryland | $2,376 | $198 |

| Massachusetts | $2,654 | $221 |

| Michigan | $2,866 | $239 |

| Minnesota | $2,256 | $188 |

| Mississippi | $2,458 | $205 |

| Missouri | $2,720 | $227 |

| Montana | $2,356 | $196 |

| Nebraska | $2,214 | $185 |

| Nevada | $2,838 | $237 |

| New Hampshire | $1,928 | $161 |

| New Jersey | $2,866 | $239 |

| New Mexico | $2,190 | $183 |

| New York | $2,772 | $231 |

| North Carolina | $1,852 | $154 |

| North Dakota | $2,202 | $184 |

| Ohio | $1,978 | $165 |

| Oklahoma | $2,680 | $223 |

| Oregon | $2,384 | $199 |

| Pennsylvania | $2,430 | $203 |

| Rhode Island | $2,914 | $243 |

| South Carolina | $2,218 | $185 |

| South Dakota | $2,548 | $212 |

| Tennessee | $2,416 | $201 |

| Texas | $2,376 | $198 |

| Utah | $2,284 | $190 |

| Vermont | $2,028 | $169 |

| Virginia | $1,920 | $160 |

| Washington | $2,330 | $194 |

| West Virginia | $2,312 | $193 |

| Wisconsin | $2,006 | $167 |

| Wyoming | $2,306 | $192 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional rate factors and information

Other cost data insights as they relate to different risks and discounts include:

- Gender and age are two big factors. For a 2024 Honda Ridgeline, a 20-year-old male driver pays an estimated $4,790 per year, while a 20-year-old female driver pays an average of $3,442, a difference of $1,348 per year in favor of the women by a long shot. But by age 50, the rate for men is $2,110 and female rates are $2,056, a difference of only $54.

- Insuring teen drivers is expensive. Average rates for full coverage Ridgeline insurance costs $8,506 per year for a 16-year-old driver, $8,231 per year for a 17-year-old driver, and $7,356 per year for an 18-year-old driver.

- Negligent driving raises insurance rates. Having at-fault accidents will cost you more, possibly up to $3,402 per year for a 20-year-old driver and even as much as $726 per year for a 50-year-old driver.

- Get a discount from your choice of occupation. Some auto insurance providers offer discounts for occupations like farmers, accountants, emergency medical technicians, doctors, lawyers, and others. If you work in a qualifying profession, you could save between $71 and $233 on your Ridgeline insurance cost, subject to the policy coverages selected.

- Obey the law to get lower rates. To get the cheapest Honda Ridgeline car insurance rates, you need to avoid traffic tickets. As a matter of fact, just one or two traffic violations could result in increasing the cost of a policy by as much as $634 per year. Serious misdemeanor violations such as DWI/DUI and reckless driving could raise rates by an additional $2,216 or more.

- Bring up your credit score and save. In states that have statutes allowing a driver’s credit rating to be used as a rate-generating factor, having a credit score over 800 could possibly save as much as $374 per year versus a rating of 670-739. Conversely, a credit score below 579 could cost as much as $433 more per year.