- Models like the Nissan Kicks, Subaru Crosstrek, Buick Envision, and Kia Soul have top rankings for the cheapest auto insurance in Brockton.

- A few models with the cheapest auto insurance in Brockton in their respective segments include the Jaguar E-Pace, Audi A5, Nissan Titan, and Subaru Crosstrek.

- Monthly car insurance rates for a few popular vehicles in Brockton include the Ram Truck at $318, GMC Sierra at $304, and Toyota Camry at $295.

Cheapest cars to insure in Brockton, Massachusetts

The models with the most affordable auto insurance prices in Brockton tend to be compact SUVs and crossovers like the Subaru Crosstrek, Kia Soul, and Toyota Corolla Cross.

Average car insurance prices for the models ranking in the top 10 cost $2,704 or less per year for a full-coverage insurance policy.

Additional vehicles that rank in the top 20 in our car insurance cost comparison are the Honda CR-V, Ford Bronco Sport, Buick Encore, and Toyota GR Corolla.

Average auto insurance rates are marginally higher for those models than the crossovers and compact SUVs at the top of the list, but they still have an average insurance cost of $2,866 or less per year.

The next table lists the 50 models with the cheapest car insurance in Brockton, sorted by average cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,438 | $203 |

| 2 | Chevrolet Trailblazer | $2,480 | $207 |

| 3 | Kia Soul | $2,576 | $215 |

| 4 | Nissan Kicks | $2,596 | $216 |

| 5 | Honda Passport | $2,628 | $219 |

| 6 | Buick Envision | $2,644 | $220 |

| 7 | Toyota Corolla Cross | $2,660 | $222 |

| 8 | Hyundai Venue | $2,676 | $223 |

| 9 | Mazda CX-5 | $2,690 | $224 |

| 10 | Ford Bronco Sport | $2,704 | $225 |

| 11 | Volkswagen Tiguan | $2,730 | $228 |

| 12 | Acura RDX | $2,758 | $230 |

| 13 | Nissan Murano | $2,774 | $231 |

| 14 | Buick Encore | $2,802 | $234 |

| 15 | Subaru Outback | $2,810 | $234 |

| 16 | Honda CR-V | $2,812 | $234 |

| 17 | Buick Envista | $2,820 | $235 |

| 18 | Volkswagen Taos | $2,826 | $236 |

| 19 | Kia Niro | $2,840 | $237 |

| 20 | Toyota GR Corolla | $2,866 | $239 |

| 21 | Subaru Ascent | $2,870 | $239 |

| 22 | Honda HR-V | $2,872 | $239 |

| 23 | Nissan Leaf | $2,888 | $241 |

| 24 | Chevrolet Colorado | $2,904 | $242 |

| 25 | Honda Civic | $2,920 | $243 |

| 26 | Lexus NX 250 | $2,920 | $243 |

| 27 | Volkswagen Atlas | $2,926 | $244 |

| 28 | Acura Integra | $2,934 | $245 |

| 29 | Subaru Forester | $2,936 | $245 |

| 30 | Volkswagen Atlas Cross Sport | $2,940 | $245 |

| 31 | Kia Seltos | $2,946 | $246 |

| 32 | GMC Terrain | $2,954 | $246 |

| 33 | Nissan Rogue | $2,964 | $247 |

| 34 | Hyundai Kona | $2,968 | $247 |

| 35 | Mazda CX-30 | $2,976 | $248 |

| 36 | Cadillac XT4 | $2,980 | $248 |

| 37 | Volkswagen ID4 | $2,992 | $249 |

| 38 | Ford Explorer | $2,994 | $250 |

| 39 | Toyota Highlander | $2,998 | $250 |

| 40 | Ford Escape | $3,008 | $251 |

| 41 | Toyota Venza | $3,010 | $251 |

| 42 | Honda Odyssey | $3,016 | $251 |

| 43 | Nissan Sentra | $3,020 | $252 |

| 44 | Subaru Impreza | $3,032 | $253 |

| 45 | Chevrolet Equinox | $3,038 | $253 |

| 46 | Toyota RAV4 | $3,044 | $254 |

| 47 | Mazda MX-5 Miata | $3,054 | $255 |

| 48 | Mazda MX-30 | $3,062 | $255 |

| 49 | Hyundai Tucson | $3,068 | $256 |

| 50 | Chevrolet Traverse | $3,080 | $257 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Brockton, MA Zip Codes. Updated October 24, 2025

Additional models ranking in the top 50 above include the Hyundai Kona, the Mazda MX-30, the Hyundai Tucson, and the Subaru Forester. Car insurance rates for those vehicles fall between $2,866 and $3,084 per year in Brockton.

In contrast to the cheapest vehicles to insure, some vehicles that cost considerably more to insure include the Jeep Wagoneer which costs $4,104 per year, the Audi A4 which costs $3,796, and the Mercedes-Benz S560 which averages $5,796.

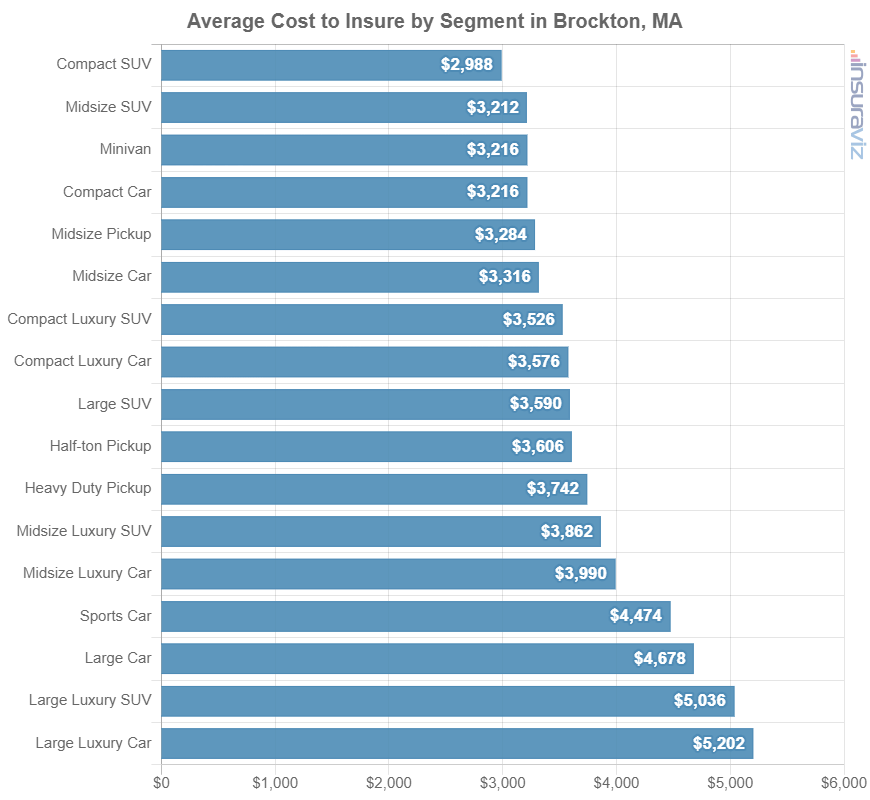

The section below talks about the cost of car insurance based on automotive segment. The average rates shown will provide a better understanding of the vehicle segments that have the best auto insurance rates in Brockton.

Best types of vehicles for the cheapest rates

If you’re looking to buy a different vehicle, it’s useful to know which types of vehicles have better insurance rates. To illustrate this, you may be curious if compact SUVs are more affordable to insure than minivans or if regular SUVs have cheaper auto insurance than luxury SUVs.

The chart below shows average car insurance cost by vehicle segment in Brockton. From an overal segment perspective, small SUVs and midsize pickups tend to have the least expensive average rates, while exotic models have the most expensive rates.

Due to rate variation inherent with each segment, view automotive segment averages more as a generality, as you’ll want to use model-level data to find the best insurance rates in a particular segment.

For example, in the midsize car segment, car insurance rates range from the Kia K5 at $3,178 per year up to the Tesla Model 3 costing $3,874 per year, a difference of $696 within that segment.

Also, in the small SUV segment, average rates can range from the Subaru Crosstrek costing $2,438 per year to the Ford Mustang Mach-E at $3,858 per year, a difference of $1,420 within that segment.

Lastly, in the small car segment, average insurance cost can vary from the Toyota GR Corolla costing $2,866 per year to the Toyota Mirai costing $4,104 per year.

The next list identifies the model with the overall cheapest car insurance rates in Brockton, MA, for each automotive category.

- Cheapest compact car insurance – Toyota GR Corolla at $2,866 per year or $239 per month

- Cheapest compact SUV insurance – Subaru Crosstrek at $2,438 per year or $203 per month

- Cheapest midsize car insurance – Kia K5 at $3,178 per year or $265 per month

- Cheapest midsize SUV insurance – Honda Passport at $2,628 per year or $219 per month

- Cheapest full-size car insurance – Chrysler 300 at $3,142 per year or $262 per month

- Cheapest full-size SUV insurance – Chevrolet Tahoe at $3,100 per year or $258 per month

- Cheapest midsize pickup insurance – Chevrolet Colorado at $2,904 per year or $242 per month

- Cheapest full-size pickup insurance – Nissan Titan at $3,082 per year or $257 per month

- Cheapest heavy duty pickup insurance – GMC Sierra 2500 HD at $3,354 per year or $280 per month

- Cheapest minivan insurance – Honda Odyssey at $3,016 per year or $251 per month

- Cheapest sports car insurance – Mazda MX-5 Miata at $3,054 per year or $255 per month

- Cheapest compact luxury car insurance – Acura Integra at $2,934 per year or $245 per month

- Cheapest compact luxury SUV insurance – Acura RDX at $2,758 per year or $230 per month

- Cheapest midsize luxury car insurance – Mercedes-Benz CLA250 at $3,396 per year or $283 per month

- Cheapest midsize luxury SUV insurance – Jaguar E-Pace at $3,084 per year or $257 per month

- Cheapest full-size luxury car insurance – Audi A5 at $3,916 per year or $326 per month

- Cheapest full-size luxury SUV insurance – Infiniti QX80 at $3,700 per year or $308 per month

How much does Brockton car insurance cost?

In Brockton, the average car insurance cost is $3,296 per year, which is 36.6% more than the U.S. overall average rate of $2,276. Per month, Brockton drivers can expect to pay an average of $275 for full coverage.

In the state of Massachusetts, the average car insurance expense is $2,676 per year, so the cost in Brockton averages $620 more per year. When prices are compared to other larger cities in Massachusetts, the average cost to insure a car in Brockton is around $404 per year more than in Springfield, $758 per year more expensive than in Lowell, and $646 per year more expensive than in Boston.

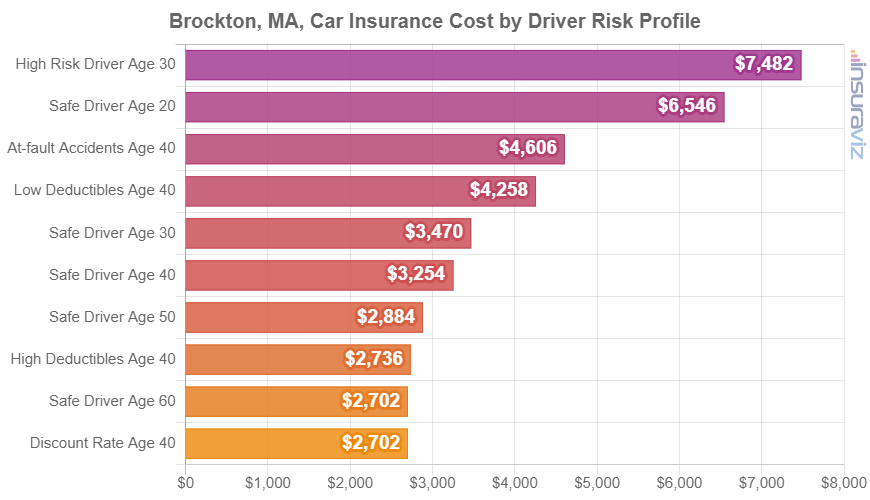

The chart below summarizes average auto insurance cost in Brockton, MA, broken out for a range of driver ages and policy risk profiles. Rates are averaged for all 2024 vehicle models including luxury brands.

Average rates in the chart above range from $2,738 per year for a 40-year-old driver who meets the requirements for many policy discounts to $7,582 per year for a 20-year-old driver who has a few accidents and violations and has to buy a high risk policy. The overall average rate we use to compare the cost between models and locations is the 40-year-old safe driver rate, which is an average cost of $3,296 per year in Brockton.

As a monthly cost, the average cost of car insurance in Brockton ranges from $228 to $632 for the same driver ages shown in the chart.

Brockton car insurance rates are not the same for everyone and can also be significantly different between companies. This variability emphasizes the need to get accurate auto insurance quotes when shopping for more affordable car insurance.

Driver age is the factor that has the most impact on the price of auto insurance, so the list below details how driver age influences cost by breaking out average car insurance rates depending on driver age.

Average car insurance cost for Brockton drivers age 16 to 60

- 16-year-old driver – $11,743 per year or $979 per month

- 17-year-old driver – $11,375 per year or $948 per month

- 18-year-old driver – $10,198 per year or $850 per month

- 19-year-old driver – $9,288 per year or $774 per month

- 20-year-old driver – $6,634 per year or $553 per month

- 30-year-old driver – $3,518 per year or $293 per month

- 40-year-old driver – $3,296 per year or $275 per month

- 50-year-old driver – $2,924 per year or $244 per month

- 60-year-old driver – $2,740 per year or $228 per month

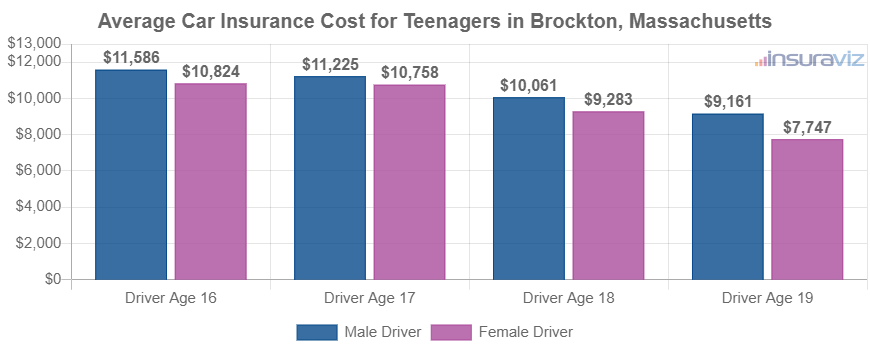

The rates in the list above for average cost of car insurance for teen drivers assumed the driver was male. The next chart breaks out average car insurance rates for teen drivers by gender. Females generally have cheaper auto insurance rates, especially as teenagers.

Car insurance for a 16-year-old female in Brockton costs an average of $773 less per year than the cost for a 16-year-old male driver, while at age 19, the cost difference is much less but is still $1,438 per year cheaper for females.

Insurance cost for popular vehicles

The rates mentioned previously take the cost to insure each 2024 vehicle model and average them, which is handy when making general comparisons like the cost difference between driver ages or locations.

But for a better comparison, we need to look at the specific model of vehicle being insured. Every make and model has slightly different risk exposures for physical damage and liability claims, so by taking this data into consideration, it allows rate comparisons for individual models.

The following chart details average car insurance cost in Brockton for the more popular vehicles.

The models that have high popularity in Brockton tend to be compact and midsize sedans like the Nissan Sentra, Toyota Corolla, and Toyota Camry and compact or midsize SUVs like the Nissan Rogue, Ford Escape, and Toyota Highlander.

Other popular models from other segments include luxury cars like the BMW 530i, Infiniti Q50, and Tesla Model S, luxury SUVs like the Infiniti QX60, Acura MDX, and Cadillac XT5, and pickup trucks like the Ford Ranger, Ford F-150, and Toyota Tacoma.

When this list of popular models is compared to the prior list of the top 50 vehicles with the cheapest average insurance quotes, most would not be considered cheap to insure.

Higher rates could be caused by buying a vehicle with a high MSRP, like a BMW X7 with an average MSRP of $81,900 or a BMW X5 that costs an average of $65,200. Another reason could be a historical likelihood of higher medical or liability claims like a Chevy Camaro or a Mitsubishi Mirage G4.

In order to reinforce the amount the cost of a car insurance policy can deviate for different drivers (and also stress the importance of multiple price quotes), the charts below present comprehensive rates for five popular models in Brockton: the Ram Truck, Honda Civic, Honda Pilot, Toyota Camry, and Toyota GR Supra.

Each illustration uses a variety of different driver profiles to show the difference in rates with only small risk factor changes.

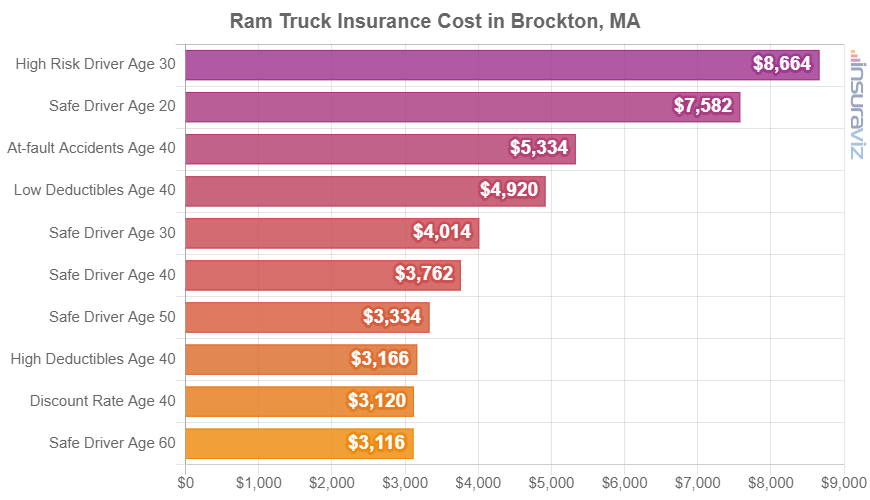

Ram Truck insurance rates

Ram Truck insurance in Brockton costs an average of $3,814 per year, with a range of $3,372 per year for the Ram Truck Tradesman Crew Cab 4WD trim up to $4,174 per year for the Ram Truck TRX Final Edition 4WD trim.

When Brockton car insurance rates for a Ram Truck are compared with the overall national average cost for the same model, rates are anywhere from $920 to $1,138 more expensive per year in Brockton, depending on the exact model being insured.

From a monthly standpoint, auto insurance rates for a Ram Truck can range from $281 to $348 per month, depending on your company and exact Zip Code in Brockton.

The chart below may help illustrate how the cost to insure a Ram Truck can range considerably for a number of different driver ages and policy risk profiles.

The Ram Truck is part of the full-size truck segment, and other models in that segment include the Toyota Tundra, GMC Sierra, Nissan Titan, and Chevrolet Silverado.

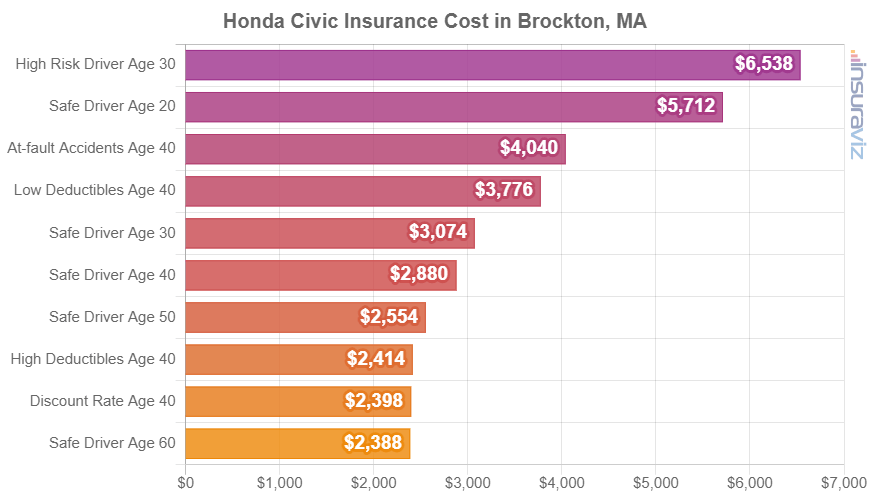

Honda Civic insurance rates

The most affordable 2024 Honda Civic trim to insure in Brockton is the LX model, costing an average of $2,612 per year, or around $218 per month. This trim has a sticker price of $23,950.

The most expensive 2022 Honda Civic trim level to insure in Brockton is the Type R, costing an average of $3,460 per year, or about $288 per month. The retail cost for this trim is $43,795, not including destination charges and documentation fees.

When Brockton auto insurance rates on the Honda Civic are compared to the average cost for the entire U.S. for the same model, the cost is anywhere from $712 to $944 more expensive per year in Brockton, depending on the model being insured.

On a monthly basis, auto insurance rates on a 2024 Honda Civic can range from $218 to $288 per month, but your exact cost can vary considerably based on your Zip Code in Brockton.

The next chart might help you understand how the prices of car insurance on a Honda Civic can be quite different based on a variety of driver ages and common policy situations.

In this example, cost varies from $2,432 to $6,626 per year, which is a difference of $4,194.

The Honda Civic is considered a compact car, and other models in the same segment include the Volkswagen Jetta, Kia Forte, Chevrolet Cruze, and Hyundai Elantra.

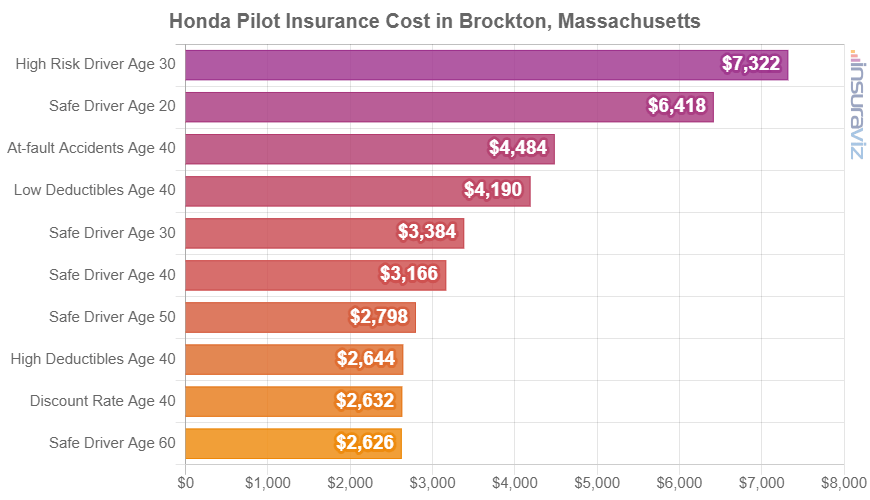

Honda Pilot insurance rates

With prices ranging from $37,090 to $52,480, average Brockton car insurance quotes for a Honda Pilot range from $3,002 per year on the Honda Pilot LX model up to $3,412 per year on the Honda Pilot Elite AWD model.

When Brockton car insurance quotes on a Honda Pilot are compared with the average cost for the entire U.S. on the same vehicle, the cost is anywhere from $816 to $930 more per year in Brockton, depending on which model is insured.

The rate chart below shows how the cost of insurance on a Honda Pilot can change based on a variety of different driver ages, physical damage coverage deductibles, and driver risk profiles.

The Honda Pilot is part of the midsize SUV segment, and other similar models include the Ford Edge, Kia Telluride, and Ford Explorer.

Toyota Camry insurance rates

The average cost for Toyota Camry insurance in Brockton is $3,544 per year. With sticker prices ranging from $26,420 to $33,120, average insurance rates for a Toyota Camry range from $3,262 per year on the Toyota Camry LE model up to $3,724 per year on the Toyota Camry XSE AWD.

When Brockton auto insurance rates for the Toyota Camry are compared to the national average cost on the same model, rates are anywhere from $890 to $1,016 more expensive per year in Brockton, depending on the specific trim level being insured.

As a cost per month, auto insurance rates on a 2024 Toyota Camry for an average middle-age driver can range from $272 to $310 per month, depending on your car insurance company and your Zip Code in Brockton.

The rate chart below can help visualize how the cost of insurance on a Toyota Camry can vary based on an assortment of driver ages and possible risk profiles.

The Toyota Camry belongs to the midsize car segment, and other similar models that are popular in Brockton include the Kia K5, Nissan Altima, Hyundai Sonata, and Honda Accord.

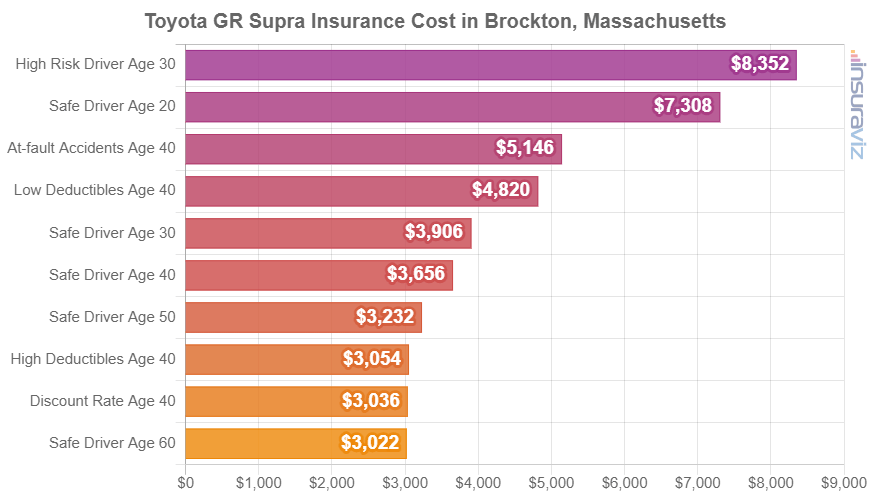

Toyota GR Supra insurance rates

The average price paid for Toyota GR Supra insurance in Brockton is $3,706 per year. Costing from $45,540 to $64,375, average car insurance rates on a 2024 Toyota GR Supra range from $3,502 per year on the Toyota GR Supra 2.0 Coupe model up to $3,980 per year on the Toyota GR Supra 45th Anniversary Edition trim.

When Brockton car insurance rates on the Toyota GR Supra are compared with the overall national average cost for the same vehicle, the cost is $956 to $1,084 more per year in Brockton, depending on the exact trim being insured.

The bar chart below should aid in understanding how insurance quotes for a Toyota GR Supra can be very different for a variety of different driver ages, policy deductibles, and risk profiles.

The Toyota GR Supra is considered a sports car, and other models in that segment include the Ford Mustang, Nissan 370Z, and Subaru BRZ.

Six tips for cheaper auto insurance

Nobody wants to pay too much for auto insurance, and there are some easy steps to take to ensure you’re getting a great rate. The list below shows six of the best ways to cut your car insurance premiums.

- Choose vehicles that have cheaper car insurance. The make and model of vehicle you drive is a primary factor in the cost of car insurance in Brockton. For example, a Hyundai Venue costs $3,684 less per year to insure in Brockton than a Audi R8. Lower performance vehicles cost less to insure.

- Shop around for better rates. Taking the time to get some free car insurance quotes is a fantastic way to save money. Rates are always changing and switching companies is very easy to do.

- Raising physical damage deductibles lowers cost. Jacking up your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Fewer accidents means cheaper car insurance rates. Having multiple accidents could cost you more, to the tune of $1,592 per year for a 30-year-old driver and even as much as $806 per year for a 60-year-old driver. So be a careful driver and save!

- Fewer violations means cheaper policy cost. In order to have the cheapest car insurance in Brockton, it’s necessary to not be aggressive behind the wheel. In fact, just one or two minor infractions can raise car insurance rates by as much as $880 per year. Major convictions such as reckless driving and leaving the scene of an accident, DUI, or driving on a revoked license could raise rates by an additional $3,064 or more.

- Keep your claim-free discount. Most insurers give a discounted rate if you have not filed any claims. Car insurance is intended to be used to protect you from significant financial loss, not for minor claims.