- Alaska car insurance averages $2,096 per year for a full coverage policy, or around $175 on a monthly basis.

- When compared to West region states, Alaska ranks third out of 11 states for auto insurance affordability and ranks 12th for the entire U.S.

- The cheapest car insurance quotes in Alaska tend to be found on compact SUVs like the Nissan Kicks, Kia Soul, Hyundai Venue, and Honda CR-V.

- Average rates for popular 4-wheel drive and AWD models include the Subaru Forester at $1,864 per year, the Toyota Tacoma at $2,124 per year, and the Honda CR-V at $1,788 per year.

How much does car insurance cost in Alaska?

Car insurance for the average vehicle in Alaska costs $2,096 per year, or about $175 per month, which is 8.2% less than the U.S. average rate of $2,276.

Weather in Alaska is unpredictable, so 4-wheel drive and AWD vehicles are popular choices. Average car insurance rates for some of the more popular vehicles include:

- Toyota Tacoma – $2,124 per year ($177 per month)

- Toyota 4Runner – $2,248 per year ($187 per month)

- Toyota RAV4 – $1,932 per year ($161 per month)

- Subaru Forester – $1,864 per year ($155 per month)

- Subaru Crosstrek – $1,546 per year ($129 per month)

- Subaru Outback – $1,784 per year ($149 per month)

- Ford F-150 – $2,344 per year ($195 per month)

- Chevrolet Silverado – $2,318 per year ($193 per month)

- Ram 1500 – $2,424 per year ($202 per month)

- Honda CR-V – $1,788 per year ($149 per month)

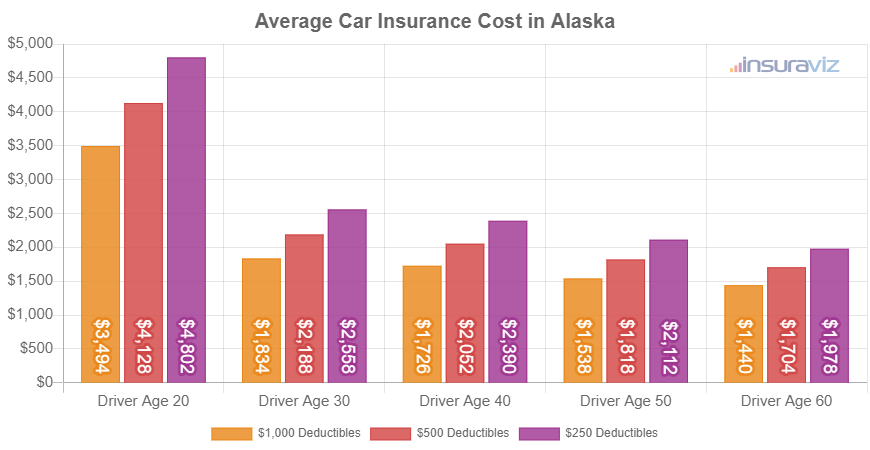

The chart below shows average car insurance rates in Alaska for the 2024 model year. Annual cost is included for driver ages 20 through 60 and for three different physical damage deductible amounts ($250, $500 and $1,000).

Rates in the chart above range from $1,470 per year for a 60-year-old driver with $1,000 deductibles to $4,906 per year for a 20-year-old driver with much lower $250 deductibles. For the same data, the average cost of car insurance per month in Alaska ranges from $123 to $409.

Car insurance quotes for teenage drivers in Alaska are not shown in the chart, but plan on paying considerably more to insure a 16 to 19-year-old. Average rates range from $4,992 per year for a 19-year-old female driver up to $7,468 per year for a 16-year-old male driver.

How does Alaska car insurance compare to other states?

When compared to other northwestern states, Alaska car insurance rates are 13.7% less than Oregon, 10.4% less than Wyoming, 12.5% less than Montana, 3.9% more than Idaho, and 11.4% less than Washington.

The chart below shows how auto insurance cost in Alaska compares to the other ten West region states. Alaska ranks third overall for the region for average car insurance affordability.

Nationally, Alaska ranks 12th for overall cheapest average car insurance rates. The average cost of car insurance in Alaska is 11.6% more expensive than North Carolina, 31.6% cheaper than California, 13.7% cheaper than Oregon, 28.5% cheaper than Florida, and 12.5% cheaper than Arizona.

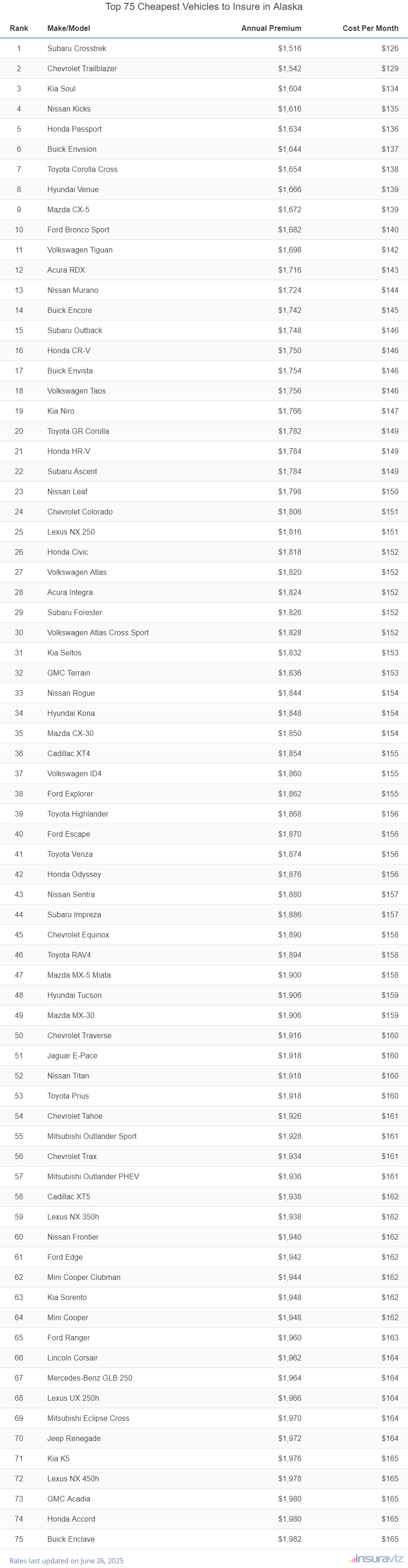

Which vehicles have cheap car insurance in Alaska?

Small SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, and Kia Soul tend to have the cheapest car insurance rates in Alaska. The Subaru Crosstrek ranks #1 overall, costing an average of $1,546 per year for full coverage insurance.

Other models that rank well for affordable car insurance in Alaska include the Nissan Kicks, Buick Envision, and Toyota Corolla Cross. For pickups, the cheapest model to insure in Alaska is the Chevrolet Colorado, costing an average of $1,846 per year and ranking in the top 20 overall.

The cheapest small, midsize, and full-size luxury car insurance can be found on the Acura Integra at $1,864 per year, the BMW 330i at $2,134 per year, and the Mercedes-Benz CLA250 at $2,156 per year.

Luxury SUVs cost slightly more to insure than their car counterparts, and the most affordable models to insure in Alaska are the Acura RDX at $1,752 per year, the Lexus NX 250 at $1,854 per year, and the Cadillac XT4 at $1,892 per year.

The table below takes every model from the 2024 model year and ranks the top 75 by average insurance cost to find the models that are most affordable.

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Alaska Zip Codes. Updated October 24, 2025

Car insurance cost for popular Alaska vehicles

The chart below shows average car insurance quotes in Alaska for not only the ten vehicles we featured earlier in the article, but also an additional 15 models.

Out of these 25 vehicles, less than ten made the table of the 75 cheapest vehicles to insure shown above.

The table icon below the chart allows you to view both annual and monthly average car insurance rates for all 25 vehicles.

Alaska car insurance rates by city

Shown in the list below are average annual and monthly car insurance costs for some of the larger cities in the state of Alaska. Visit any page to view detailed rate information, including average cost by automotive segment, rates by driver risk profile, and the vehicles with the cheapest car insurance quotes in each city.

- Anchorage Car Insurance - $2,392 per year or $199 per month

- Fairbanks Car Insurance - $2,216 per year or $185 per month

- Juneau Car Insurance - $1,960 per year or $163 per month

- Sitka Car Insurance - $1,948 per year or $162 per month

- Ketchikan Car Insurance - $1,924 per year or $160 per month

- Wasilla Car Insurance - $2,202 per year or $184 per month

Additional insights into car insurance in Alaska

It’s challenging to write one article that includes enough data to properly illustrate how variable car insurance rates are without being overwhelming. The list below includes a few additional points that can impact the cost of insurance not only in Alaska, but any state.

- The higher deductible you choose, the lower the policy cost. Increasing the physical damage deductibles on your policy from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver. Just be sure you have financial resources available to cover the extra cost in case of a claim.

- Conversely, lowering deductibles makes car insurance more expensive. Lowering your comprehensive and collision deductibles from $500 to $250 could cost an additional $396 per year for a 40-year-old driver and $1,396 per year for a 20-year-old driver. Since lower deductibles mean less out-of-pocket expense with a claim, you’ll pay more for the policy.

- Alaska car insurance is cheaper for safe drivers. Too many at-fault accidents can cost more, as much as $1,010 per year for a 30-year-old driver and even $634 per year for a 50-year-old driver. Avoid accidents and you’ll save money.

- Younger drivers pay higher rates. The difference in average car insurance cost between a 50-year-old driver ($1,858 per year) and a 20-year-old driver ($4,220 per year) is $2,362, or a difference of 77.7%.

- Earn policy discounts to save money. Discounts may be available for things like driving a vehicle with safety or anti-theft features, insuring multiple vehicles on the same policy, being accident-free, being a military or federal employee, or many other discounts which could save the average driver $102 or more each year.

- Improve your credit for cheaper car insurance. Drivers who maintain a credit score over 800 could save up to $329 per year when compared to a credit rating of 670-739. Conversely, a not-so-perfect credit rating could cost around $381 more per year.