- Michigan car insurance rates average $2,886 per year for full coverage, or about $241 on a monthly basis.

- When compared to other midwestern states, Michigan ranks last out of 12 total states. It also ranks 50th when compared to all 50 U.S. states.

- As if car insurance for middle-age drivers wasn’t already expensive enough, the average cost to insure teen drivers in Michigan ranges from $6,875 to $10,280 per year, depending on age and gender.

How much does car insurance cost in Michigan?

The average cost of car insurance in Michigan is $2,886 per year, which is 23.6% higher than the U.S. average car insurance rate of $2,276.

The cost of car insurance per month in Michigan can range from $169 to $563. Rates are dependent on the make, model, and year of vehicle you are insuring, as well as factors like your driving record, age, previous insurer, and coverage limits.

Average annual and monthly car insurance rates for the top five most popular vehicles in the state of Michigan are shown below.

- Ford F-150 pickup – $3,230 per year ($269 per month)

- Chevrolet Equinox compact SUV – $2,658 per year ($222 per month)

- Ram 1500 pickup – $3,338 per year ($278 per month)

- Chevrolet Silverado pickup – $3,194 per year ($266 per month)

- Chevrolet Blazer – $2,978 per year ($248 per month)

Other common models found on the road include the Nissan Sentra at an average cost of $2,646 per year, the Subaru Outback at $2,460, the Toyota Highlander at $2,626, the Honda Accord at $2,790, and the Jeep Grand Cherokee at $2,886 per year.

Luxury models like the BMW X5, the Audi A8, and the Tesla Model S have an average car insurance cost of $3,692 per year for the X5, $4,906 per year for the A8, and $3,784 per year for the Tesla Model S.

The chart below shows average auto insurance cost in Michigan broken out by driver age and policy deductible limits. Rates are averaged for all 2024 vehicle models including luxury cars and SUVs.

As shown in the chart, the average cost of auto insurance ranges from $2,026 per year for a 60-year-old driver with a policy with high deductibles to $6,754 per year for a 20-year-old driver with low physical damage deductibles. From a monthly standpoint, the data above ranges from $169 to $563 per month.

Car insurance costs for teenagers in Michigan are not included in the data above, but average rates range from $6,875 per year for a 19-year-old female driver up to $10,280 per year for a 16-year-old male driver.

For 17 and 18-year-old drivers, average car insurance in Michigan will cost $9,546 to $9,961 per year for 17-year-olds and $8,239 to $8,926 per year for 18-year-olds. Rates will fluctuate considerably based on the vehicle driven, and insuring an older model vehicle for a teen driver will generally cost less than insuring a newer model.

Why is car insurance in Michigan so expensive?

When compared to surrounding states, Michigan car insurance costs 36.7% more than Ohio, 32.5% more than Indiana, 23.8% more than Minnesota, 22.4% more than Illinois, and 35.2% more than Wisconsin.

When compared to states outside of the northern midwest region, the average cost of car insurance in Michigan is 3.3% more expensive than Florida, 18.2% more than Oregon, 45% more than Maine, 12.1% more than Georgia, and 18.6% more expensive than Texas.

Why is it so expensive to buy car insurance in Michigan? There are several reasons.

- Michigan is a no-fault car insurance state, which means your insurance company pays even if an accident was not your fault. Car insurance in no-fault states tends to be higher than states which use a traditional tort liability system.

- Michigan requires Personal Injury Protection (PIP) coverage. This coverage can pay unlimited lifetime medical benefits, which averages over $500,000 for injured people.

- Due to Michigan’s no-fault system and mandatory PIP coverage, there is wide-spread insurance fraud which ends up pushing rates even higher.

- Michigan has some of the highest incidents of uninsured drivers. Almost 20% of drivers in Michigan are uninsured, which means law-abiding policyholders have to foot the bill for those drivers as well.

The chart below illustrates the excessive cost of Michigan car insurance and why reform is needed to curb the burden placed on drivers. It’s no wonder so many drivers go without car insurance, as the monthly cost of car insurance in Michigan can be as high as the car payment itself.

Michigan car insurance cost by vehicle segment

The chart below shows average car insurance rates in Michigan for different vehicle segments like compact cars, midsize pickups, and full-size SUVs.

Rates range from an average of around $2,652 per year for the compact SUV segment, which includes models like the Honda CR-V, Toyota RAV4, and Ford Escape, up to the most expensive average rates that range from $3,968 to $4,616 per year on sports cars and luxury cars like the Porsche 911, Acura NSX, and Mercedes-Benz AMG series of vehicles.

The list below shows the cheapest vehicles to insure in Michigan for each automotive segment.

- Compact car – Toyota GR Corolla insurance at $2,508 per year or $209 per month

- Compact SUV – Subaru Crosstrek insurance at $2,132 per year or $178 per month

- Midsize car – Kia K5 insurance at $2,782 per year or $232 per month

- Midsize SUV – Honda Passport insurance at $2,300 per year or $192 per month

- Full-size car – Chrysler 300 insurance at $2,750 per year or $229 per month

- Full-size SUV – Chevrolet Tahoe insurance at $2,712 per year or $226 per month

- Midsize pickup – Chevrolet Colorado insurance at $2,542 per year or $212 per month

- Full-size pickup – Nissan Titan insurance at $2,700 per year or $225 per month

- Heavy duty pickup – GMC Sierra 2500 HD insurance at $2,936 per year or $245 per month

- Minivan – Honda Odyssey insurance at $2,638 per year or $220 per month

- Sports car insurance – Mazda MX-5 Miata insurance at $2,674 per year or $223 per month

- Compact luxury car insurance – Acura Integra insurance at $2,568 per year or $214 per month

- Compact luxury SUV – Acura RDX insurance at $2,412 per year or $201 per month

- Midsize luxury car – Mercedes-Benz CLA250 insurance at $2,972 per year or $248 per month

- Midsize luxury SUV – Jaguar E-Pace insurance at $2,700 per year or $225 per month

- Full-size luxury car – Audi A5 insurance at $3,430 per year or $286 per month

- Full-size luxury SUV – Infiniti QX80 insurance at $3,238 per year or $270 per month

Which vehicles have cheap car insurance in Michigan?

With the high cost of car insurance in Michigan, it makes sense to buy a car that has cheap insurance rates. Compact SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, Kia Soul, and Nissan Kicks will have some of the cheapest car insurance quotes in Michigan.

Average car insurance prices for those crossover SUVs cost $2,272 or less per year, or $189 per month, to have full coverage.

Additional models that have affordable insurance prices in our cost comparison are the Ford Bronco Sport, Kia Niro, Subaru Outback, and Buick Envista. The average cost is a little bit more for those models than the cheapest crossover SUVs at the top of the rankings, but they still have an average cost of $2,508 or less per year ($209 per month) in Michigan.

The table below ranks the top 50 cheapest vehicles to insure in Michigan for the 2024 model year.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,132 | $178 |

| 2 | Chevrolet Trailblazer | $2,172 | $181 |

| 3 | Kia Soul | $2,256 | $188 |

| 4 | Nissan Kicks | $2,272 | $189 |

| 5 | Honda Passport | $2,300 | $192 |

| 6 | Buick Envision | $2,312 | $193 |

| 7 | Toyota Corolla Cross | $2,328 | $194 |

| 8 | Hyundai Venue | $2,348 | $196 |

| 9 | Mazda CX-5 | $2,354 | $196 |

| 10 | Ford Bronco Sport | $2,366 | $197 |

| 11 | Volkswagen Tiguan | $2,390 | $199 |

| 12 | Acura RDX | $2,412 | $201 |

| 13 | Nissan Murano | $2,428 | $202 |

| 14 | Buick Encore | $2,452 | $204 |

| 15 | Subaru Outback | $2,460 | $205 |

| 16 | Honda CR-V | $2,462 | $205 |

| 17 | Buick Envista | $2,468 | $206 |

| 18 | Volkswagen Taos | $2,474 | $206 |

| 19 | Kia Niro | $2,486 | $207 |

| 20 | Toyota GR Corolla | $2,508 | $209 |

| 21 | Subaru Ascent | $2,512 | $209 |

| 22 | Honda HR-V | $2,514 | $210 |

| 23 | Nissan Leaf | $2,530 | $211 |

| 24 | Chevrolet Colorado | $2,542 | $212 |

| 25 | Lexus NX 250 | $2,554 | $213 |

| 26 | Honda Civic | $2,556 | $213 |

| 27 | Volkswagen Atlas | $2,560 | $213 |

| 28 | Acura Integra | $2,568 | $214 |

| 29 | Subaru Forester | $2,570 | $214 |

| 30 | Volkswagen Atlas Cross Sport | $2,572 | $214 |

| 31 | Kia Seltos | $2,580 | $215 |

| 32 | GMC Terrain | $2,586 | $216 |

| 33 | Nissan Rogue | $2,594 | $216 |

| 34 | Hyundai Kona | $2,600 | $217 |

| 35 | Mazda CX-30 | $2,602 | $217 |

| 36 | Cadillac XT4 | $2,608 | $217 |

| 37 | Volkswagen ID4 | $2,618 | $218 |

| 38 | Ford Explorer | $2,620 | $218 |

| 39 | Toyota Highlander | $2,626 | $219 |

| 40 | Ford Escape | $2,634 | $220 |

| 41 | Toyota Venza | $2,634 | $220 |

| 42 | Honda Odyssey | $2,638 | $220 |

| 43 | Nissan Sentra | $2,646 | $221 |

| 44 | Subaru Impreza | $2,654 | $221 |

| 45 | Chevrolet Equinox | $2,658 | $222 |

| 46 | Toyota RAV4 | $2,664 | $222 |

| 47 | Mazda MX-5 Miata | $2,674 | $223 |

| 48 | Mazda MX-30 | $2,680 | $223 |

| 49 | Hyundai Tucson | $2,684 | $224 |

| 50 | Chevrolet Traverse | $2,694 | $225 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Michigan Zip Codes. Updated October 24, 2025

Michigan car insurance rates for popular vehicles

The charts below show average auto insurance rates for five of the more common vehicles you’ll find driving on Michigan roads. We analyze rates in detail for the Chevrolet Silverado, Toyota RAV4, Ford Expedition, Honda Accord, and Ford Mustang.

Chevrolet Silverado insurance rates

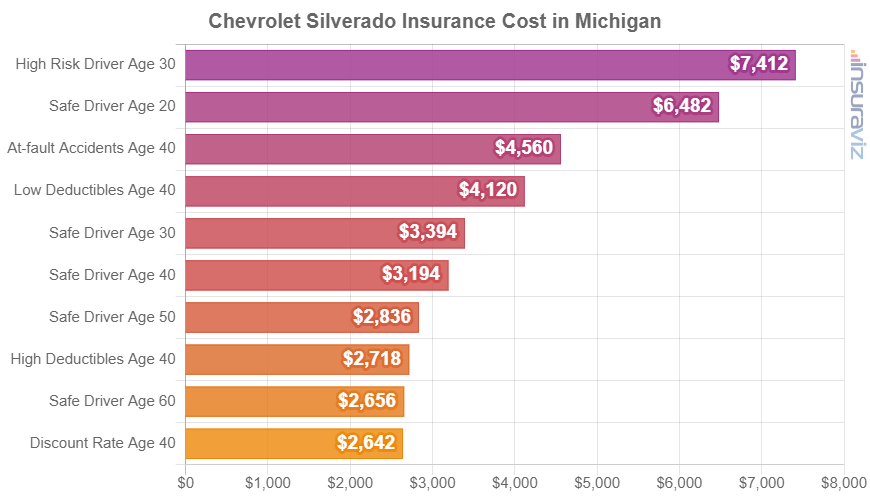

Chevrolet Silverado insurance in Michigan costs an average of $3,194 per year and ranges from $2,642 to $7,412 per year for the sample driver risk profiles shown in the chart below.

The Chevrolet Silverado is considered a full-size truck, and other popular models include the Ford F150, Toyota Tundra, Ram Truck, GMC Sierra, and Nissan Titan.

Toyota RAV4 insurance rates

Toyota RAV4 car insurance rates in Michigan range from $2,214 to $6,126 per year for the driver profiles in the chart below. Toyota RAV4 insurance costs an average of $2,664 per year or $222 per month in Michigan.

The Toyota RAV4 is part of the compact SUV segment, and other popular models include the Chevrolet Equinox, Mazda CX-5, Nissan Rogue, Ford Escape, and Subaru Forester.

Ford Expedition insurance rates

The chart below shows average Ford Expedition insurance rates in Michigan for different driver ages and risk profiles. Annual cost for this full-size SUV ranges from $2,586 to $7,126 per year for the example driver risk profiles, with average cost being $3,112 per year.

The Ford Expedition is definitely a large SUV and other similar models include the GMC Yukon, Chevrolet Suburban, Chevrolet Tahoe, Toyota Sequoia, and .

Honda Accord insurance rates

Average Honda Accord insurance rates in Michigan as shown in the chart below range from $2,318 to $6,410 per year, with the average yearly cost for full coverage insurance being $2,790.

The Honda Accord is considered a midsize car, and other models in this segment include the Chevrolet Malibu, Kia K5, Toyota Camry, Hyundai Sonata, and Nissan Altima.

Ford Mustang insurance rates

The average cost for Ford Mustang insurance in Michigan is $3,172 per year. The chart below shows rates for additional driver profiles with prices ranging from $2,632 to $7,262 per year.

The Ford Mustang is in the sports car segment which includes other models like the Subaru BRZ, Toyota Supra, Chevrolet Corvette, Chevrolet Camaro, and Nissan 370Z.

Average rates in larger Michigan cities

Average annual and monthly car insurance rates are shown below for some of the larger cities in Michigan. Visit any page to see more detailed rate information, including the vehicles with the cheapest car insurance in each city.

- Detroit Car Insurance - $4,564 per year or $380 per month

- Grand Rapids Car Insurance - $2,300 per year or $192 per month

- Warren Car Insurance - $3,398 per year or $283 per month

- Sterling Heights Car Insurance - $3,196 per year or $266 per month

- Lansing Car Insurance - $2,434 per year or $203 per month

- Ann Arbor Car Insurance - $2,270 per year or $189 per month

- Flint Car Insurance - $3,068 per year or $256 per month

- Dearborn Car Insurance - $3,852 per year or $321 per month

Additional information and insurance insights

We covered a lot of ground regarding average car insurance rates in Michigan in this article. The list below includes some additional tidbits of data that readers may find useful when trying to save a few bucks on their next policy.

- Car insurance is cheaper with higher deductibles. Raising your policy deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Decreasing deductibles costs more money. Decreasing your policy deductibles from $500 to $250 could cost an additional $396 per year for a 40-year-old driver and $192 per year for a 20-year-old driver.

- Earn discounts to save money. Discounts may be available if you drive a vehicle with certain safety or anti-theft features, are claim-free, are a military or federal employee, belong to certain professional organizations, or many other discounts which could save as much as $892 per year on the average cost of Michigan car insurance

- Save money due to your occupation. Just about all car insurance companies offer discounts for specific professions like engineers, scientists, members of the military, dentists, college professors, and others. Having this discount applied to your policy may save between $87 and $281 on your annual car insurance bill, depending on the age of the rated driver.

- A good driving record pays dividends. To get the cheapest auto insurance rates in Michigan, it’s necessary to drive safe. Just one or two blemishes on your driving record could raise policy rates as much as $770 per year.