- Average car insurance cost in Mississippi is $2,476 per year, or around $206 per month.

- Mississippi ranks seventh out of 12 Southeast region states for car insurance affordability and ranks 31st out of all 50 U.S. states.

- The cheapest car insurance in Mississippi tends to be found on compact SUVs like the Subaru Crosstrek, Nissan Kicks, and Buick Envision.

What is average car insurance cost in Mississippi?

The average cost to insure a car in Mississippi is $2,476 per year, or around $206 per month, which is 8.4% more than the national average rate of $2,276.

Average Mississippi car insurance quotes for some of the most popular vehicles include the Ram 1500 pickup at an average of $2,862 per year, the Ford Escape at $2,258, the Toyota RAV4 at $2,284, the Nissan Sentra at $2,270, and the Honda Accord at $2,392 per year.

The chart below shows average Mississippi car insurance cost when averaged for all 2024 model year vehicles, including luxury brands.

As shown in the above chart, the average cost of car insurance ranges from $1,738 per year for a high deductible policy for a 60-year-old driver to $5,794 per year for a low deductible policy for a 20-year-old driver.

When those numbers are converted to monthly cost, the average cost of car insurance per month in Mississippi ranges from $145 to $483 for full coverage.

Some additional factors and situations that can affect car insurance quotes in Mississippi include:

- Increasing policy deductibles from $100 to $1,000 could save $1,158 or more each year.

- Bundling your car insurance and homeowners insurance with the same company could save an average of $318 per year.

- Minor driving citations like a speeding ticket could increase the annual cost of auto insurance in Mississippi by $660 for a 40-year-old driver, depending on the company.

- A DUI or other major conviction could raise rates by $2,302 or more per year.

- An at-fault accident could cause a rate increase of $1,028 or more each year due to loss of a claim-free discount plus a chargeable claim.

Is car insurance expensive in Mississippi?

When compared to surrounding states, the average cost of car insurance in Mississippi is 8.5% cheaper than Louisiana, 4.9% cheaper than Arkansas, 1.8% more expensive than Tennessee, and 5.5% more expensive than Alabama.

When compared to some other noncontiguous Southeast region states, Mississippi auto insurance is 12% cheaper than Florida, 6.6% cheaper than Kentucky, 3.2% cheaper than Georgia, and 28.1% more expensive than North Carolina.

The chart below shows the average car insurance cost for all Southeast region states, with Mississippi highlighted in dark blue in seventh place.

When compared to states in other parts of the country, the average cost of auto insurance in Mississippi is 12.1% cheaper than New York, 14.4% cheaper than Nevada, 7.2% more expensive than Illinois, 6.6% cheaper than Colorado, and 15.2% cheaper than California.

Here’s an example that uses an actual vehicle (2024Toyota RAV4) and compares the average cost of insurance in Mississippi to some of the states mentioned prior.

Average full-coverage car insurance cost on a new Toyota RAV4 in Mississippi is $2,284 per year. This average rate is:

- $222 per year more expensive than insuring a RAV4 in South Carolina ($2,062)

- $74 per year cheaper than in Georgia ($2,358)

- $122 per year more expensive than in Alabama ($2,162)

- $290 per year cheaper than in Florida ($2,574)

- $114 per year cheaper than in Arkansas ($2,398)

- $500 per year more expensive than in Virginia ($1,784)

Cheapest models to insure by automotive segment

When shopping for a vehicle, it’s useful to know which models have the cheapest car insurance rates for each segment. That way, if affordable insurance is at the top of your priority list, you know which models to shop for.

The list below breaks out the one model in each automotive segment that has the overall cheapest car insurance rates in Mississippi. Each model is linked to a detailed article that analyzes rates at a trim level basis, so you can find out exactly which model and trim has the best rates.

- Compact car – Toyota GR Corolla insurance at $2,152 per year or $179 per month

- Compact SUV – Subaru Crosstrek insurance at $1,830 per year or $153 per month

- Midsize car – Kia K5 insurance at $2,386 per year or $199 per month

- Midsize SUV – Honda Passport insurance at $1,974 per year or $165 per month

- Full-size car – Chrysler 300 insurance at $2,358 per year or $197 per month

- Full-size SUV – Chevrolet Tahoe insurance at $2,326 per year or $194 per month

- Midsize pickup – Chevrolet Colorado insurance at $2,180 per year or $182 per month

- Full-size pickup – Nissan Titan insurance at $2,316 per year or $193 per month

- Heavy duty pickup – GMC Sierra 2500 HD insurance at $2,520 per year or $210 per month

- Minivan – Honda Odyssey insurance at $2,264 per year or $189 per month

- Sports car insurance – Mazda MX-5 Miata insurance at $2,292 per year or $191 per month

- Compact luxury car insurance – Acura Integra insurance at $2,202 per year or $184 per month

- Compact luxury SUV – Acura RDX insurance at $2,070 per year or $173 per month

- Midsize luxury car – Mercedes-Benz CLA250 insurance at $2,548 per year or $212 per month

- Midsize luxury SUV – Jaguar E-Pace insurance at $2,316 per year or $193 per month

- Full-size luxury car – Audi A5 insurance at $2,942 per year or $245 per month

- Full-size luxury SUV – Infiniti QX80 insurance at $2,778 per year or $232 per month

What are the cheapest vehicles to insure in Mississippi?

The models with the lowest cost average insurance quotes in Mississippi tend to be crossover SUVs like the Kia Soul, Subaru Crosstrek, and Toyota Corolla Cross. Average car insurance rates for those models cost $1,996 or less per year, or $166 per month, to get full coverage.

Other vehicles that are highly ranked in our auto insurance cost comparison are the Volkswagen Tiguan, Subaru Outback, Buick Envista, and Toyota GR Corolla. Insurance rates are a few dollars per month higher for those models than the cheapest small SUVs at the top of the rankings, but they still have an average insurance cost of $2,152 or less per year, or about $179 per month.

The table below ranks the 50 cheapest cars, pickups, vans, and SUVs to insure in Mississippi, and breaks down annual and monthly car insurance cost averages for each.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,830 | $153 |

| 2 | Chevrolet Trailblazer | $1,860 | $155 |

| 3 | Kia Soul | $1,932 | $161 |

| 4 | Nissan Kicks | $1,950 | $163 |

| 5 | Honda Passport | $1,974 | $165 |

| 6 | Buick Envision | $1,984 | $165 |

| 7 | Toyota Corolla Cross | $1,996 | $166 |

| 8 | Hyundai Venue | $2,014 | $168 |

| 9 | Mazda CX-5 | $2,020 | $168 |

| 10 | Ford Bronco Sport | $2,028 | $169 |

| 11 | Volkswagen Tiguan | $2,050 | $171 |

| 12 | Acura RDX | $2,070 | $173 |

| 13 | Nissan Murano | $2,082 | $174 |

| 14 | Buick Encore | $2,102 | $175 |

| 15 | Subaru Outback | $2,108 | $176 |

| 16 | Honda CR-V | $2,110 | $176 |

| 17 | Buick Envista | $2,118 | $177 |

| 18 | Volkswagen Taos | $2,122 | $177 |

| 19 | Kia Niro | $2,130 | $178 |

| 20 | Toyota GR Corolla | $2,152 | $179 |

| 21 | Subaru Ascent | $2,154 | $180 |

| 22 | Honda HR-V | $2,156 | $180 |

| 23 | Nissan Leaf | $2,168 | $181 |

| 24 | Chevrolet Colorado | $2,180 | $182 |

| 25 | Honda Civic | $2,192 | $183 |

| 26 | Lexus NX 250 | $2,192 | $183 |

| 27 | Volkswagen Atlas | $2,196 | $183 |

| 28 | Acura Integra | $2,202 | $184 |

| 29 | Subaru Forester | $2,204 | $184 |

| 30 | Volkswagen Atlas Cross Sport | $2,206 | $184 |

| 31 | Kia Seltos | $2,212 | $184 |

| 32 | GMC Terrain | $2,216 | $185 |

| 33 | Nissan Rogue | $2,224 | $185 |

| 34 | Hyundai Kona | $2,228 | $186 |

| 35 | Mazda CX-30 | $2,232 | $186 |

| 36 | Cadillac XT4 | $2,236 | $186 |

| 37 | Volkswagen ID4 | $2,246 | $187 |

| 38 | Ford Explorer | $2,248 | $187 |

| 39 | Toyota Highlander | $2,252 | $188 |

| 40 | Ford Escape | $2,258 | $188 |

| 41 | Toyota Venza | $2,262 | $189 |

| 42 | Honda Odyssey | $2,264 | $189 |

| 43 | Nissan Sentra | $2,270 | $189 |

| 44 | Subaru Impreza | $2,276 | $190 |

| 45 | Chevrolet Equinox | $2,280 | $190 |

| 46 | Toyota RAV4 | $2,284 | $190 |

| 47 | Mazda MX-5 Miata | $2,292 | $191 |

| 48 | Mazda MX-30 | $2,298 | $192 |

| 49 | Hyundai Tucson | $2,302 | $192 |

| 50 | Chevrolet Traverse | $2,310 | $193 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Mississippi Zip Codes. Updated October 24, 2025

Mississippi car insurance rates for popular vehicles

Car insurance rates have as many moving parts as the vehicle you’re insuring. There are an enormous number of factors that determine the rate you pay, like where you live, your age, your marital status, your driving record, and much, much more.

Insurance companies take all these factors and combine them in a formula that attempts to predict the likelihood that you will have an accident or claim. If you’re a safe driver and drive a safe vehicle, you’re going to pay better rates. If you have many prior driving offenses and drive a high-performance car, there is a good chance you will have future claims that require the company to pay. That means you pay more for car insurance.

We’ve talked about “average rates” a lot in this article, and the next five sections go into more detail for five of the more popular vehicles in Mississippi. Each vehicle has a chart that has rates for different scenarios like safe drivers of various ages, a high-risk driver, and a rate if you qualify for many policy discounts.

These charts are intended to provide you with a better understanding of how variable car insurance can be, and also the importance of not relying on an average rate, but to get some actual car insurance quotes in order to remove some of this variability.

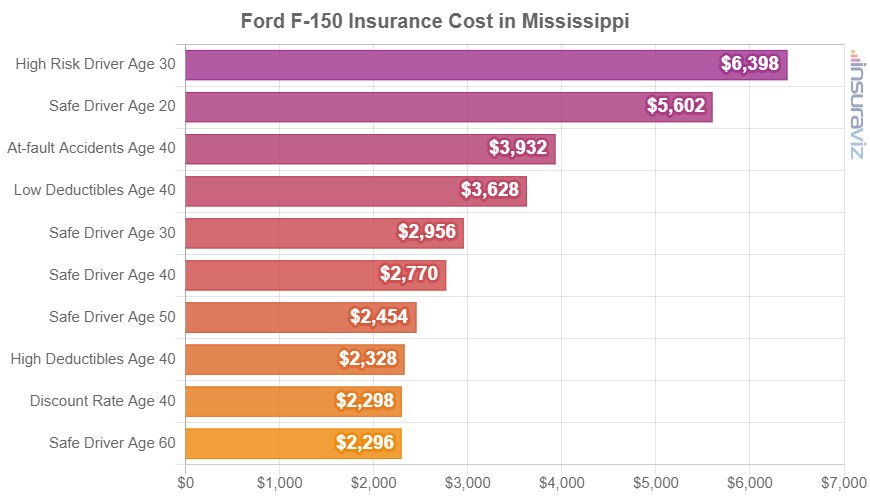

Ford F-150 insurance rates

Ford F-150 insurance in Mississippi costs an average of $2,770 per year and ranges from $2,298 to $6,398 per year for the sample driver risk profiles shown in the chart below.

The Ford F-150 is considered a full-size truck, and other popular models include the Nissan Titan, Toyota Tundra, Chevrolet Silverado, GMC Sierra, and Ram Truck.

Toyota Tacoma insurance rates

Toyota Tacoma car insurance rates in Mississippi range from $2,078 to $5,804 per year for the driver profiles in the chart below. Toyota Tacoma insurance costs an average of $2,508 per year or $209 per month in Mississippi.

The Toyota Tacoma belongs to the midsize truck segment, and other popular models include the Nissan Frontier, Honda Ridgeline, Jeep Gladiator, Chevrolet Colorado, and GMC Canyon.

Chevrolet Suburban insurance rates

The chart below shows average Chevrolet Suburban insurance rates in Mississippi for different driver ages and risk profiles. Annual cost ranges from $2,040 to $5,626 per year for the example driver risk profiles, with average cost being $2,454 per year.

The Chevrolet Suburban is a large SUV and other similar models include the GMC Yukon, Chevrolet Tahoe, Ford Expedition, Toyota Sequoia, and .

Toyota Camry insurance rates

Average Toyota Camry insurance rates in Mississippi as shown in the chart below range from $2,212 to $6,116 per year, with the average cost being $2,660.

The Toyota Camry is considered a midsize car, and other models in this segment include the Honda Accord, Hyundai Sonata, Chevrolet Malibu, Nissan Altima, and Kia K5.

Ford Mustang insurance rates

The average cost for Ford Mustang insurance in Mississippi is $2,720 per year. The chart below shows rates for additional driver profiles with prices ranging from $2,256 to $6,228 per year.

The Ford Mustang is a sports car and other vehicles in this segment include the Chevrolet Camaro, Chevrolet Corvette, Nissan 370Z, Subaru BRZ, and Toyota Supra.

Average rates in select Mississippi cities

Average car insurance rates per year and month are shown below for some of the larger cities in Mississippi. Feel free to visit any page for additional detailed rates including cost comparisons and the vehicles with the cheapest insurance rates in each city.

- Jackson Car Insurance - $2,626 per year or $219 per month

- Gulfport Car Insurance - $2,556 per year or $213 per month

- Southaven Car Insurance - $2,472 per year or $206 per month

- Hattiesburg Car Insurance - $2,422 per year or $202 per month

- Biloxi Car Insurance - $2,538 per year or $212 per month

- Meridian Car Insurance - $2,424 per year or $202 per month

- Tupelo Car Insurance - $2,294 per year or $191 per month

Concluding car insurance tips and insights

Below you’ll find some additional tips for saving money on your next car insurance policy.

- It’s expensive to buy high-risk car insurance. For a 40-year-old driver, having to buy a high-risk policy due to excessive accidents and/or violations can increase the cost by $3,004 or more per year. So drive safe and save.

- Your job could reduce your rates. The vast majority of insurance companies offer policy discounts for certain professions like firefighters, dentists, architects, members of the military, doctors, emergency medical technicians, and others. If you work in a qualifying profession, you may save between $74 and $241 on your car insurance premium, depending on the level of coverage purchased.

- Increase physical damage deductibles to save money. Increasing your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Polish up your credit rating for lower rates. Having an excellent credit rating above 800 could save $389 per year when compared to a rating of 670-739. Conversely, a credit rating below 579 could cost around $451 more per year.

- Qualify for policy discounts to save money. Discounts may be available if the policyholders belong to certain professional organizations, are claim-free, drive low annual mileage, are loyal customers, sign their policy early, or many other policy discounts which could save the average driver as much as $482 per year on the cost of car insurance