- The average Chrysler Pacifica car insurance cost is $2,370 per year, or $198 per month for full coverage.

- The Pacifica is one of the cheaper minivans to insure, costing $5 less per year on average as compared to the rest of the vehicles in the segment.

- The Pacifica Touring L trim level is the cheapest to insure at around $2,194 per year. The most expensive trim is the Limited AWD at $2,468 per year.

- Chrysler Pacifica insurance rates in a few larger cities include $2,616 in Boston, MA, $1,846 in Raleigh, NC, and $2,744 in Colorado Springs, CO.

How much is Chrysler Pacifica car insurance?

Ranked second out of four vehicles in the 2024 minivan class, full coverage Chrysler Pacifica car insurance averages around $2,370 a year, or $198 if paid each month.

With the average minivan costing $2,375 a year to insure, the Chrysler Pacifica costs $5 less per year than the segment average.

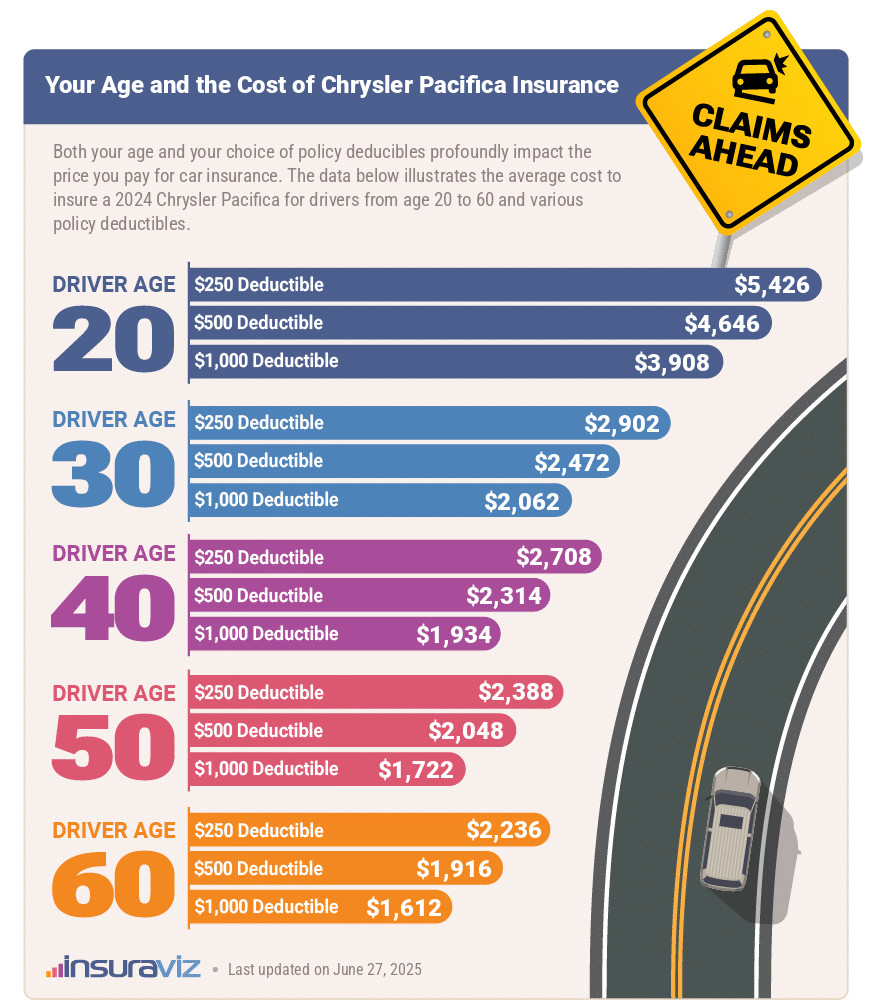

The following graphic demonstrates how average Pacifica car insurance rates fluctuate depending on driver age and the chosen policy deductibles.

Is Pacifica insurance cheaper than other minivans?

The Chrysler Pacifica ranks second out of four comparison vehicles in the midsize minivan class. The Pacifica costs an estimated $2,370 per year for insurance and the category average rate is $2,375 per year, a difference of $5 per year.

When minivan insurance rates are compared, Pacifica insurance costs $176 more per year than the Honda Odyssey, and $108 less than the Kia Carnival.

The table below shows the difference in car insurance rates between the Pacifica and the rest of the minivan class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Odyssey | $2,194 | -$176 |

| 2 | Chrysler Pacifica | $2,370 | -- |

| 3 | Toyota Sienna | $2,456 | $86 |

| 4 | Kia Carnival | $2,478 | $108 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

You may be wondering where the Dodge Grand Caravan is in this comparison. The table above is for 2024 models only, whereas the Grand Caravan ended production after the 2020 model year.

Does Chrysler Pacifica Hybrid insurance cost more?

The cheapest model of 2024 Chrysler Pacifica to insure is the Touring L at around $2,194 per year. The most expensive model to insure is the Limited AWD at an average of $2,468 per year.

Chrysler Pacifica Hybrid car insurance rates tend toward the higher end of the cost range, with the Hybrid Touring, the Hybrid Touring L, and Hybrid Limited models occupying three of the five most expensive models to insure.

The rate table below shows the difference in the price of car insurance for the different trim levels and packages available for the 2024 Pacifica.

| 2024 Chrysler Pacifica Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Touring L | $2,194 | $183 |

| Touring | $2,216 | $185 |

| Touring L AWD | $2,252 | $188 |

| Hybrid Select | $2,366 | $197 |

| Hybrid Road Tripper | $2,394 | $200 |

| Pinnacle | $2,402 | $200 |

| Hybrid S Appearance | $2,402 | $200 |

| Limited | $2,430 | $203 |

| Pinnacle AWD | $2,432 | $203 |

| Hybrid Premium S Appearance | $2,438 | $203 |

| Hybrid Pinnacle | $2,466 | $206 |

| Limited AWD | $2,468 | $206 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Chrysler Pacifica prior model year car insurance rates

Used vehicles are a great option for many reasons, but one of the main reasons is that insurance costs are cheaper on used models than on new ones in most cases.

In a few circumstances, new models can actually be cheaper than the prior year due to new safety features or a vehicle redesign that keeps occupants safer in an accident.

The following table details average Chrysler Pacifica insurance rates from the 2017 model year up to the current 2024 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Chrysler Pacifica | $4,760 | $2,370 | $1,964 |

| 2023 Chrysler Pacifica | $4,596 | $2,286 | $1,896 |

| 2022 Chrysler Pacifica | $4,432 | $2,194 | $1,824 |

| 2021 Chrysler Pacifica | $4,064 | $2,014 | $1,672 |

| 2020 Chrysler Pacifica | $3,938 | $1,954 | $1,622 |

| 2019 Chrysler Pacifica | $3,744 | $1,850 | $1,542 |

| 2018 Chrysler Pacifica | $3,356 | $1,666 | $1,384 |

| 2017 Chrysler Pacifica | $3,312 | $1,642 | $1,366 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Chrysler Pacifica trim levels for each model year. Updated October 24, 2025

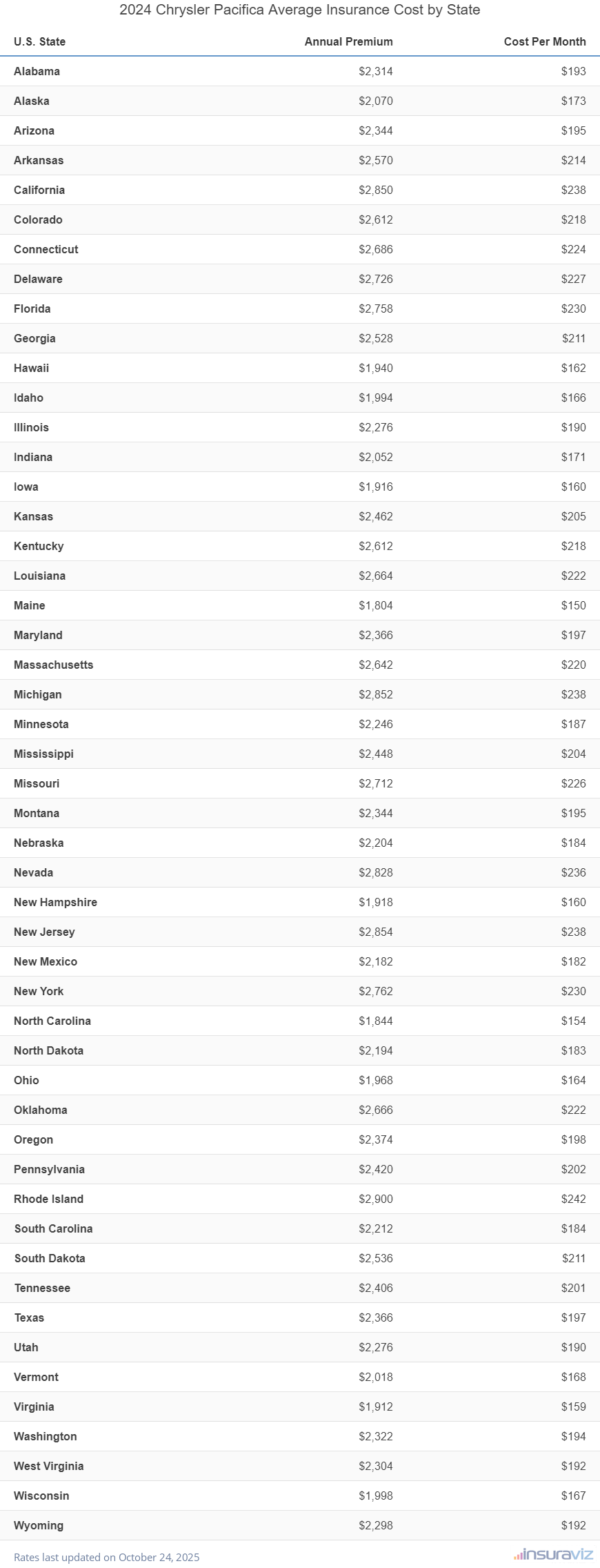

Average insurance rates by city and state

Location definitely makes a difference in insurance cost on a Pacifica. It can range from cheaper rates like $2,046 a year in Columbus, OH, or $1,918 in Virginia Beach, VA, to high rates such as $3,094 a year in Miami, FL, and $4,508 in Detroit, MI.

Insurance rates on a Pacifica in some additional locations include San Diego, CA, at $2,620 per year, Baltimore, MD, at $2,908, Colorado Springs, CO, averaging $2,744, and Kansas City, MO, costing $2,830.

The bar chart below ranks average Chrysler Pacifica insurance premiums in the most populated metro areas in America.

Taking a wider perspective, states like Virginia ($1,912), Maine ($1,804), and Iowa ($1,916) have the cheapest car insurance rates, while states like Florida ($2,758), Michigan ($2,852), and New York ($2,762) have more expensive Pacifica insurance rates.

Insurance rates in most states tend toward the middle, with states like Tennessee, Missouri, and Minnesota included in this group with average Chrysler Pacifica insurance rates of $2,406, $2,712, and $2,246 per year, respectively.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,314 | $193 |

| Alaska | $2,070 | $173 |

| Arizona | $2,344 | $195 |

| Arkansas | $2,570 | $214 |

| California | $2,850 | $238 |

| Colorado | $2,612 | $218 |

| Connecticut | $2,686 | $224 |

| Delaware | $2,726 | $227 |

| Florida | $2,758 | $230 |

| Georgia | $2,528 | $211 |

| Hawaii | $1,940 | $162 |

| Idaho | $1,994 | $166 |

| Illinois | $2,276 | $190 |

| Indiana | $2,052 | $171 |

| Iowa | $1,916 | $160 |

| Kansas | $2,462 | $205 |

| Kentucky | $2,612 | $218 |

| Louisiana | $2,664 | $222 |

| Maine | $1,804 | $150 |

| Maryland | $2,366 | $197 |

| Massachusetts | $2,642 | $220 |

| Michigan | $2,852 | $238 |

| Minnesota | $2,246 | $187 |

| Mississippi | $2,448 | $204 |

| Missouri | $2,712 | $226 |

| Montana | $2,344 | $195 |

| Nebraska | $2,204 | $184 |

| Nevada | $2,828 | $236 |

| New Hampshire | $1,918 | $160 |

| New Jersey | $2,854 | $238 |

| New Mexico | $2,182 | $182 |

| New York | $2,762 | $230 |

| North Carolina | $1,844 | $154 |

| North Dakota | $2,194 | $183 |

| Ohio | $1,968 | $164 |

| Oklahoma | $2,666 | $222 |

| Oregon | $2,374 | $198 |

| Pennsylvania | $2,420 | $202 |

| Rhode Island | $2,900 | $242 |

| South Carolina | $2,212 | $184 |

| South Dakota | $2,536 | $211 |

| Tennessee | $2,406 | $201 |

| Texas | $2,366 | $197 |

| Utah | $2,276 | $190 |

| Vermont | $2,018 | $168 |

| Virginia | $1,912 | $159 |

| Washington | $2,322 | $194 |

| West Virginia | $2,304 | $192 |

| Wisconsin | $1,998 | $167 |

| Wyoming | $2,298 | $192 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025