- Buick Encore insurance costs an average of $2,038 per year or around $170 per month, depending on the trim level.

- With an insurance cost range of $186, the cheapest Encore trim level to insure is the base GX Preferred model at around $1,964 per year, and the most expensive trim being the GX Avenir AWD at $2,150 annually.

- Out of 47 vehicles in the small SUV segment, the Encore ranks 11th for insurance affordability.

How much does Buick Encore car insurance cost?

2024 Buick Encore insurance costs an average of $2,038 a year for full coverage. Average insurance cost per month for a Buick Encore ranges from $164 to $179, depending on the trim level.

Comprehensive coverage will cost around $512 a year, liability/medical (or PIP) coverage will cost approximately $636, and the remaining collision coverage costs around $890.

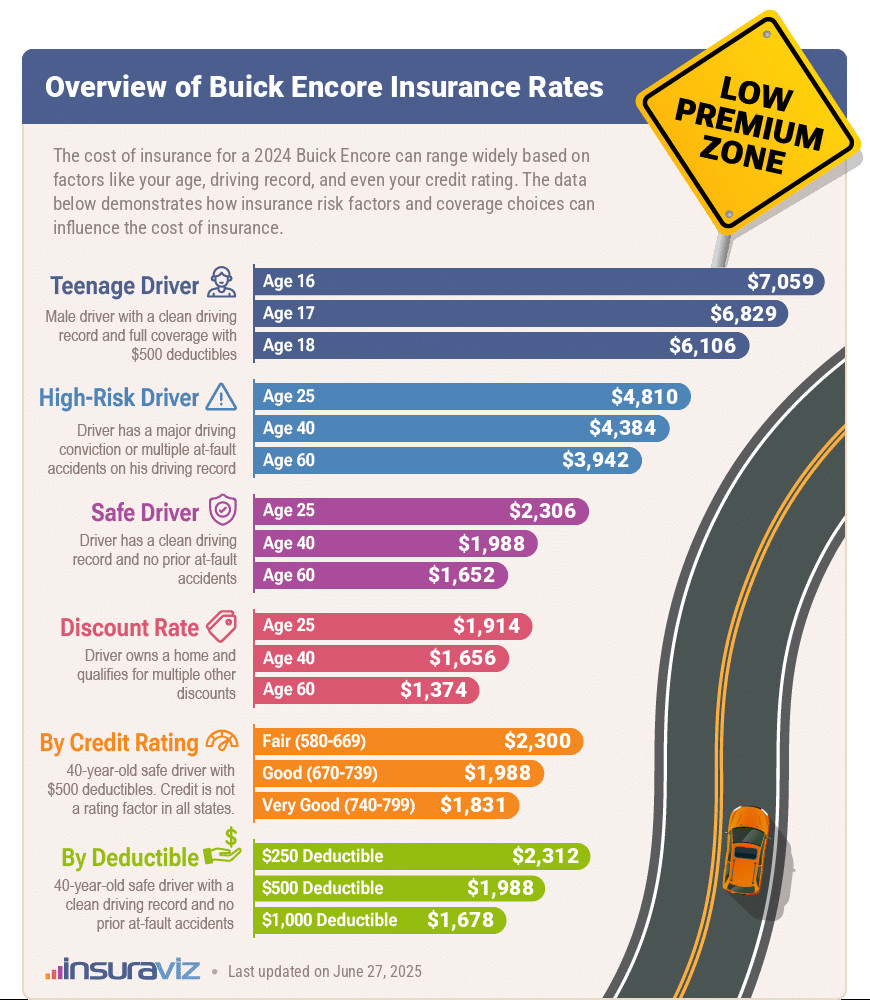

The image below illustrates the average car insurance cost per year on a 2024 Buick Encore using different driver ages and policy limits.

The infographic above displays a small set of car insurance rates from an enormous number of possibilities. If we included all rates for every possible combination of risk factors (driver age, home ownership, driving record, marital status, credit level, etc.), including all six different trim levels of Encore and all 41,000+ zip codes in the U.S., the chart would have approximately 580,608,000,000 possible policy rates.

Another example of how variable rates are for an Encore, an average driver can buy liability-only insurance for a Buick Encore in the most affordable parts of Iowa or Ohio for as cheap as $221 a year.

For an identical Encore, a 16-year-old driver with an at-fault accident and a few driving violations could get a bill for $14,582 a year for full coverage in some of the most expensive areas of the U.S.

That example is not meant to confuse you with all the rates that are available, but rather to reinforce to need to shop around occasionally. With that many possible rates, plus the fact that insurance companies change rates frequently based on loss history and profitability, it just proves that an annual car insurance quote or two is probably a good idea.

The following table shows average full coverage Buick Encore car insurance rates for the 2013 to 2024 model years. Rates are included for drivers aged 20 to 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Buick Encore | $4,080 | $2,038 | $1,694 |

| 2023 Buick Encore | $3,724 | $1,858 | $1,548 |

| 2022 Buick Encore | $3,626 | $1,810 | $1,510 |

| 2021 Buick Encore | $3,968 | $1,960 | $1,634 |

| 2020 Buick Encore | $3,704 | $1,844 | $1,540 |

| 2019 Buick Encore | $3,536 | $1,766 | $1,476 |

| 2018 Buick Encore | $3,408 | $1,706 | $1,428 |

| 2017 Buick Encore | $3,284 | $1,642 | $1,378 |

| 2016 Buick Encore | $2,780 | $1,410 | $1,176 |

| 2015 Buick Encore | $2,696 | $1,362 | $1,138 |

| 2014 Buick Encore | $2,868 | $1,434 | $1,202 |

| 2013 Buick Encore | $2,752 | $1,382 | $1,156 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Buick Encore trim levels for each model year. Updated October 24, 2025

Additional observations about insuring an Encore include:

- Young males pay a lot more for insurance. For 2024 Buick Encore insurance, a 20-year-old male driver pays an average of $4,080 per year, while a 20-year-old female will pay $2,938, a difference of $1,142 per year. But by age 50, the rate for males is $1,808 and the cost for women is $1,764, a difference of only $44.

- Teen drivers cost a lot to insure. Average rates for full coverage Encore insurance costs $7,232 per year for a 16-year-old driver, $7,000 per year for a 17-year-old driver, and $6,259 per year for an 18-year-old driver.

- Fewer violations mean cheaper insurance costs. To receive the most affordable Encore insurance rates, it’s necessary to follow the law. Just a couple of minor incidents on your driving report have the ramification of increasing insurance costs by at least $536 per year. Serious infractions such as reckless driving could raise rates by an additional $1,878 or more.

- High-risk drivers pay a lot more for insurance. For a 40-year-old driver, having to buy a high-risk insurance policy could trigger a rate increase of $2,452 or more per year.

- Don’t be a careless driver. Too many at-fault accidents can cost more, potentially as much as $2,886 per year for a 20-year-old driver and even as much as $490 per year for a 60-year-old driver.

Which Encore model is the cheapest to insure?

With Buick Encore car insurance cost ranging from $1,964 to $2,150 per year for an average driver, the most affordable trim level to insure is the base GX Preferred model. On average, plan on budgeting a minimum of $164 per month for full coverage insurance.

At the more expensive end of the Encore insurance cost range, the three most expensive models to insure are the Encore GX Sport Touring AWD, the GX Avenir, and the GX Avenir AWD trim levels at around $2,042, $2,114, and $2,150 per year, respectively.

The next table shows the average car insurance cost by trim level for the 2024 Buick Encore.

| 2024 Buick Encore Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| GX Preferred | $1,964 | $164 |

| GX Preferred AWD | $1,964 | $164 |

| GX Sport Touring | $1,998 | $167 |

| GX Sport Touring AWD | $2,042 | $170 |

| GX Avenir | $2,114 | $176 |

| GX Avenir AWD | $2,150 | $179 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Encore vs. all small SUVs: Which insurance is cheaper?

The Buick Encore ranks 11th out of 47 comparison vehicles in the 2024 small SUV class. The Encore costs an average of $2,038 per year to insure, while the segment average rate is $2,206 annually, a difference of only $168 per year.

When compared directly to popular vehicles in the compact SUV and crossover segment, auto insurance for a Buick Encore costs $174 less per year than the Toyota RAV4, $8 less than the Honda CR-V, $172 less than the Chevrolet Equinox, and $116 less than the Nissan Rogue.

The table below ranks average car insurance cost for all compact SUVs for the 2024 model year, with the price difference between each model and the Buick Encore noted in the ‘Difference’ table column.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$266 |

| 2 | Chevrolet Trailblazer | $1,804 | -$234 |

| 3 | Kia Soul | $1,872 | -$166 |

| 4 | Nissan Kicks | $1,888 | -$150 |

| 5 | Buick Envision | $1,922 | -$116 |

| 6 | Toyota Corolla Cross | $1,932 | -$106 |

| 7 | Hyundai Venue | $1,950 | -$88 |

| 8 | Mazda CX-5 | $1,956 | -$82 |

| 9 | Ford Bronco Sport | $1,966 | -$72 |

| 10 | Volkswagen Tiguan | $1,984 | -$54 |

| 11 | Buick Encore | $2,038 | -- |

| 12 | Honda CR-V | $2,046 | $8 |

| 13 | Volkswagen Taos | $2,056 | $18 |

| 14 | Kia Niro | $2,066 | $28 |

| 15 | Honda HR-V | $2,088 | $50 |

| 16 | Subaru Forester | $2,134 | $96 |

| 17 | Kia Seltos | $2,144 | $106 |

| 18 | GMC Terrain | $2,148 | $110 |

| 19 | Nissan Rogue | $2,154 | $116 |

| 20 | Hyundai Kona | $2,158 | $120 |

| 21 | Mazda CX-30 | $2,164 | $126 |

| 22 | Volkswagen ID4 | $2,176 | $138 |

| 23 | Ford Escape | $2,188 | $150 |

| 24 | Chevrolet Equinox | $2,210 | $172 |

| 25 | Toyota RAV4 | $2,212 | $174 |

| 26 | Mazda MX-30 | $2,226 | $188 |

| 27 | Hyundai Tucson | $2,232 | $194 |

| 28 | Chevrolet Trax | $2,264 | $226 |

| 29 | Mini Cooper Clubman | $2,274 | $236 |

| 30 | Mini Cooper | $2,278 | $240 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $264 |

| 32 | Jeep Renegade | $2,308 | $270 |

| 33 | Mitsubishi Outlander | $2,336 | $298 |

| 34 | Kia Sportage | $2,350 | $312 |

| 35 | Hyundai Ioniq 5 | $2,358 | $320 |

| 36 | Fiat 500X | $2,368 | $330 |

| 37 | Mini Cooper Countryman | $2,374 | $336 |

| 38 | Subaru Solterra | $2,376 | $338 |

| 39 | Mazda CX-50 | $2,380 | $342 |

| 40 | Nissan Ariya | $2,386 | $348 |

| 41 | Toyota bz4X | $2,390 | $352 |

| 42 | Mitsubishi Mirage | $2,398 | $360 |

| 43 | Kia EV6 | $2,474 | $436 |

| 44 | Dodge Hornet | $2,554 | $516 |

| 45 | Jeep Compass | $2,594 | $556 |

| 46 | Hyundai Nexo | $2,648 | $610 |

| 47 | Ford Mustang Mach-E | $2,806 | $768 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Buick Encore Insurance Cost by State

One of the largest factors that determine the price you pay for car insurance is where you live. Each state has its own laws and regulations that dramatically impact the cost.

The table below breaks down the average cost to insure a 2024 Buick Encore in all 50 U.S. states. Rates are sorted alphabetically by state, with annual and monthly policy average costs.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $1,992 | $166 |

| Alaska | $1,782 | $149 |

| Arizona | $2,014 | $168 |

| Arkansas | $2,208 | $184 |

| California | $2,450 | $204 |

| Colorado | $2,244 | $187 |

| Connecticut | $2,308 | $192 |

| Delaware | $2,344 | $195 |

| Florida | $2,370 | $198 |

| Georgia | $2,172 | $181 |

| Hawaii | $1,668 | $139 |

| Idaho | $1,714 | $143 |

| Illinois | $1,958 | $163 |

| Indiana | $1,764 | $147 |

| Iowa | $1,648 | $137 |

| Kansas | $2,116 | $176 |

| Kentucky | $2,244 | $187 |

| Louisiana | $2,290 | $191 |

| Maine | $1,552 | $129 |

| Maryland | $2,034 | $170 |

| Massachusetts | $2,272 | $189 |

| Michigan | $2,452 | $204 |

| Minnesota | $1,930 | $161 |

| Mississippi | $2,102 | $175 |

| Missouri | $2,328 | $194 |

| Montana | $2,016 | $168 |

| Nebraska | $1,894 | $158 |

| Nevada | $2,428 | $202 |

| New Hampshire | $1,650 | $138 |

| New Jersey | $2,452 | $204 |

| New Mexico | $1,876 | $156 |

| New York | $2,372 | $198 |

| North Carolina | $1,584 | $132 |

| North Dakota | $1,886 | $157 |

| Ohio | $1,692 | $141 |

| Oklahoma | $2,290 | $191 |

| Oregon | $2,042 | $170 |

| Pennsylvania | $2,080 | $173 |

| Rhode Island | $2,494 | $208 |

| South Carolina | $1,900 | $158 |

| South Dakota | $2,180 | $182 |

| Tennessee | $2,068 | $172 |

| Texas | $2,034 | $170 |

| Utah | $1,958 | $163 |

| Vermont | $1,736 | $145 |

| Virginia | $1,644 | $137 |

| Washington | $1,996 | $166 |

| West Virginia | $1,978 | $165 |

| Wisconsin | $1,718 | $143 |

| Wyoming | $1,974 | $165 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

It’s important to note that location is only one factor that impacts the cost of insurance for an Encore. Other factors like driver age, driving record, policy limits, and even credit rating in some states can cause significant swings in the cost of car insurance.

When shopping for a new policy, or just shopping around to cut the cost of an existing policy, we recommend getting multiple free car insurance quotes to have the best chance of saving money.

Comparing prices once a year, or at every policy renewal, helps ensure that you’re not overpaying for car insurance.