- Insurance on a Volkswagen Tiguan costs around $1,984 per year, $992 for a 6-month policy, or $165 per month.

- The Tiguan S 2WD trim level is the cheapest to insure at around $1,878 per year. The most expensive trim is the SEL R-Line 4Motion at $2,098 per year.

- The Tiguan is one of the cheaper small SUVs to insure, costing $222 less per year on average as compared to other small SUVs

- On a state level, insurance rates range from a low of $1,512 per year in Maine to $2,390 in Michigan. Rates in a few larger cities include $1,932 in El Paso, TX, $3,018 in New Orleans, LA, and $1,766 in Cleveland, OH.

How much does VW Tiguan insurance cost?

Volkswagen Tiguan insurance costs an average of $1,984 per year for full-coverage insurance, or about $165 a month. Depending on the trim level being insured, average monthly payments range from $157 to $175.

From an individual coverage perspective, liability and medical coverage will cost an estimated $528 a year, collision coverage is around $910, and the remaining comprehensive coverage costs around $546.

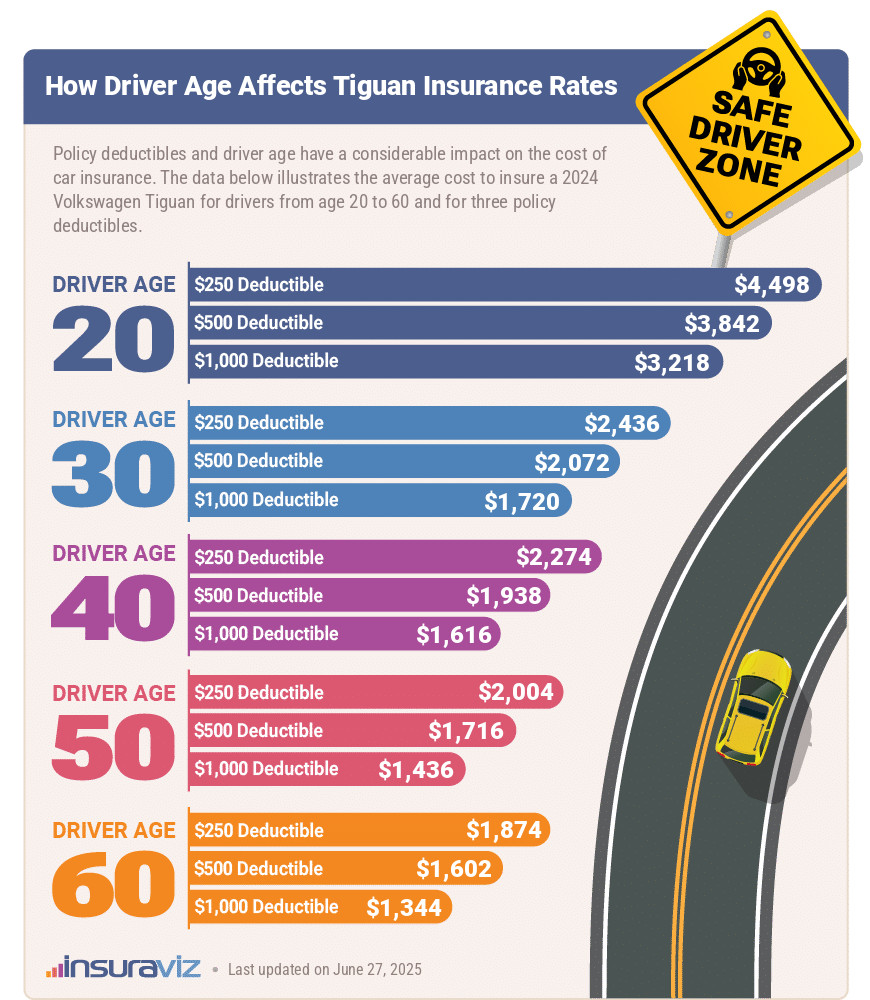

The following infographic shows how average Tiguan car insurance rates vary depending on driver age and the policy deductibles.

From a deductible standpoint, the higher the deductible, the lower the policy cost. In the chart above, car insurance rates range from an average rate for a 20-year-old driver of $3,936 to the average rate for a 60-year-old driver of $1,644.

Teenage drivers would have much higher insurance rates when rated on a VW Tiguan. For example, a 16-year-old male driver with a clean driving record would pay around $6,870 while a 16-year-old female would pay about $6,421.

The following table shows average VW Tiguan car insurance rates for 2013 to 2024 model years and for drivers aged 20 to 60.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Volkswagen Tiguan | $3,936 | $1,984 | $1,644 |

| 2023 Volkswagen Tiguan | $4,062 | $2,026 | $1,682 |

| 2022 Volkswagen Tiguan | $3,834 | $1,906 | $1,588 |

| 2021 Volkswagen Tiguan | $3,768 | $1,872 | $1,562 |

| 2020 Volkswagen Tiguan | $3,660 | $1,820 | $1,514 |

| 2019 Volkswagen Tiguan | $3,766 | $1,864 | $1,556 |

| 2018 Volkswagen Tiguan | $3,544 | $1,758 | $1,470 |

| 2017 Volkswagen Tiguan | $3,556 | $1,766 | $1,476 |

| 2016 Volkswagen Tiguan | $3,576 | $1,782 | $1,496 |

| 2015 Volkswagen Tiguan | $3,124 | $1,558 | $1,304 |

| 2014 Volkswagen Tiguan | $3,198 | $1,588 | $1,330 |

| 2013 Volkswagen Tiguan | $3,050 | $1,520 | $1,274 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Volkswagen Tiguan trim levels for each model year. Updated October 24, 2025

Insurance rates by Tiguan trim level

Choosing the lowest cost Tiguan trim level over the highest trim would save approximately $220 per year on insurance, since average cost ranges from $1,878 to $2,098 per year on auto insurance for the average driver.

The most affordable 2024 model year trim level to insure is the Tiguan S 2WD. The next cheapest trim level to insure is the Tiguan S 4Motion at $1,920 per year. Expect to pay at a minimum $157 per month to insure a Tiguan for full coverage.

At the top end of the Tiguan trims, the three most expensive Tiguan models to insure are the Tiguan SE R-Line Black, the SE R-Line Black 4Motion, and the SEL R-Line 4Motion trim levels at an estimated $2,016, $2,046, and $2,098 per year, respectively.

The table below details the average car insurance cost for each 2024 Volkswagen Tiguan package and trim level.

| 2024 Volkswagen Tiguan Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S 2WD | $1,878 | $157 |

| S 4Motion | $1,920 | $160 |

| SE 2WD | $1,952 | $163 |

| SE 4Motion | $1,986 | $166 |

| SE R-Line Black | $2,016 | $168 |

| SE R-Line Black 4Motion | $2,046 | $171 |

| SEL R-Line 4Motion | $2,098 | $175 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

How do Tiguan insurance rates compare to other SUVs?

The Volkswagen Tiguan ranks 10th out of 47 total comparison vehicles in the small SUV class. The Tiguan costs an average of $1,984 per year for full coverage insurance and the class average rate is $2,206 annually, making the Tiguan $222 less per year.

When compared to other small SUVs, car insurance rates for a 2024 Volkswagen Tiguan cost $228 less per year than the Toyota RAV4, $62 less than the Honda CR-V, $226 less than the Chevrolet Equinox, and $170 less than the Nissan Rogue.

The table below shows how average insurance rates for a Tiguan compare to additional small SUVs like the Subaru Forester, the Nissan Rogue, and the Honda CR-V.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | -$212 |

| 2 | Chevrolet Trailblazer | $1,804 | -$180 |

| 3 | Kia Soul | $1,872 | -$112 |

| 4 | Nissan Kicks | $1,888 | -$96 |

| 5 | Buick Envision | $1,922 | -$62 |

| 6 | Toyota Corolla Cross | $1,932 | -$52 |

| 7 | Hyundai Venue | $1,950 | -$34 |

| 8 | Mazda CX-5 | $1,956 | -$28 |

| 9 | Ford Bronco Sport | $1,966 | -$18 |

| 10 | Volkswagen Tiguan | $1,984 | -- |

| 11 | Buick Encore | $2,038 | $54 |

| 12 | Honda CR-V | $2,046 | $62 |

| 13 | Volkswagen Taos | $2,056 | $72 |

| 14 | Kia Niro | $2,066 | $82 |

| 15 | Honda HR-V | $2,088 | $104 |

| 16 | Subaru Forester | $2,134 | $150 |

| 17 | Kia Seltos | $2,144 | $160 |

| 18 | GMC Terrain | $2,148 | $164 |

| 19 | Nissan Rogue | $2,154 | $170 |

| 20 | Hyundai Kona | $2,158 | $174 |

| 21 | Mazda CX-30 | $2,164 | $180 |

| 22 | Volkswagen ID4 | $2,176 | $192 |

| 23 | Ford Escape | $2,188 | $204 |

| 24 | Chevrolet Equinox | $2,210 | $226 |

| 25 | Toyota RAV4 | $2,212 | $228 |

| 26 | Mazda MX-30 | $2,226 | $242 |

| 27 | Hyundai Tucson | $2,232 | $248 |

| 28 | Chevrolet Trax | $2,264 | $280 |

| 29 | Mini Cooper Clubman | $2,274 | $290 |

| 30 | Mini Cooper | $2,278 | $294 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $318 |

| 32 | Jeep Renegade | $2,308 | $324 |

| 33 | Mitsubishi Outlander | $2,336 | $352 |

| 34 | Kia Sportage | $2,350 | $366 |

| 35 | Hyundai Ioniq 5 | $2,358 | $374 |

| 36 | Fiat 500X | $2,368 | $384 |

| 37 | Mini Cooper Countryman | $2,374 | $390 |

| 38 | Subaru Solterra | $2,376 | $392 |

| 39 | Mazda CX-50 | $2,380 | $396 |

| 40 | Nissan Ariya | $2,386 | $402 |

| 41 | Toyota bz4X | $2,390 | $406 |

| 42 | Mitsubishi Mirage | $2,398 | $414 |

| 43 | Kia EV6 | $2,474 | $490 |

| 44 | Dodge Hornet | $2,554 | $570 |

| 45 | Jeep Compass | $2,594 | $610 |

| 46 | Hyundai Nexo | $2,648 | $664 |

| 47 | Ford Mustang Mach-E | $2,806 | $822 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Volkswagen Tiguan insurance cost state averages

When analyzing Volkswagen Tiguan insurance rates on a state level, states like Iowa ($1,608), North Carolina ($1,544), and Idaho ($1,670) have cheaper insurance rates on a Volkswagen Tiguan, while states like Louisiana ($2,230), Michigan ($2,390), and Florida ($2,310) have more expensive insurance rates on a Volkswagen Tiguan.

The table below shows the average cost to insure a 2024 Volkswagen Tiguan in all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $1,940 | $162 |

| Alaska | $1,734 | $145 |

| Arizona | $1,962 | $164 |

| Arkansas | $2,152 | $179 |

| California | $2,386 | $199 |

| Colorado | $2,188 | $182 |

| Connecticut | $2,250 | $188 |

| Delaware | $2,284 | $190 |

| Florida | $2,310 | $193 |

| Georgia | $2,116 | $176 |

| Hawaii | $1,626 | $136 |

| Idaho | $1,670 | $139 |

| Illinois | $1,906 | $159 |

| Indiana | $1,718 | $143 |

| Iowa | $1,608 | $134 |

| Kansas | $2,062 | $172 |

| Kentucky | $2,188 | $182 |

| Louisiana | $2,230 | $186 |

| Maine | $1,512 | $126 |

| Maryland | $1,982 | $165 |

| Massachusetts | $2,212 | $184 |

| Michigan | $2,390 | $199 |

| Minnesota | $1,880 | $157 |

| Mississippi | $2,050 | $171 |

| Missouri | $2,268 | $189 |

| Montana | $1,966 | $164 |

| Nebraska | $1,848 | $154 |

| Nevada | $2,368 | $197 |

| New Hampshire | $1,608 | $134 |

| New Jersey | $2,392 | $199 |

| New Mexico | $1,826 | $152 |

| New York | $2,312 | $193 |

| North Carolina | $1,544 | $129 |

| North Dakota | $1,838 | $153 |

| Ohio | $1,648 | $137 |

| Oklahoma | $2,232 | $186 |

| Oregon | $1,990 | $166 |

| Pennsylvania | $2,028 | $169 |

| Rhode Island | $2,428 | $202 |

| South Carolina | $1,850 | $154 |

| South Dakota | $2,124 | $177 |

| Tennessee | $2,016 | $168 |

| Texas | $1,978 | $165 |

| Utah | $1,906 | $159 |

| Vermont | $1,692 | $141 |

| Virginia | $1,600 | $133 |

| Washington | $1,944 | $162 |

| West Virginia | $1,928 | $161 |

| Wisconsin | $1,674 | $140 |

| Wyoming | $1,926 | $161 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional Rates and Insights

A few additional rates and tips on how to avoid expensive insurance are as follows.

- Be a careful driver and pay less for insurance. Causing too many accidents will raise rates, to the tune of $928 per year for a 30-year-old driver and even as much as $446 per year for a 60-year-old driver.

- Earn discounts to save money. Discounts may be available if you are accident-free, insure multiple vehicles on the same policy, are a loyal customer, insure your home and car with the same company, or many other discounts which could save you as much as $332 per year on the cost of insuring a Tiguan.

- Driving violations increase insurance rates. To get the lowest Tiguan insurance rates, it pays to be an excellent driver. Not surprisingly, just a couple of minor infractions on your motor vehicle report can raise Tiguan insurance rates by as much as $508 per year. Being convicted of a serious infraction such as a DWI could raise rates by an additional $1,792 or more.

- Raise your credit for better rates. In states that allow a policyholder’s credit rating to be used as a factor in determining car insurance rates, having a high credit rating of over 800 can possibly save as much as $311 per year versus a slightly lower credit rating between 670-739. Conversely, a less-than-perfect credit history could cost up to $361 more per year.

- High-risk drivers pay extremely high rates. For a 20-year-old driver, the requirement to buy a high-risk policy could increase the cost by $3,042 or more per year.