One question that pops up a lot is “Are Jeeps expensive to insure?“. Jeeps in general are just plain awesome, and if you disagree, then you either have never had one, or you just wish you did.

When comparing insurance costs for the different Jeep models, it just makes sense to do a head-on comparison between the off-road models. All Jeeps are able to go off-road, obviously, but for this comparison we are only talking about REAL off-roading.

The Compass and Renegade will be omitted in favor of the Cherokee, Grand Cherokee, Wrangler, and Gladiator in our initial comparisons, but annual insurance cost for those models can be seen in the small SUV comparison tables.

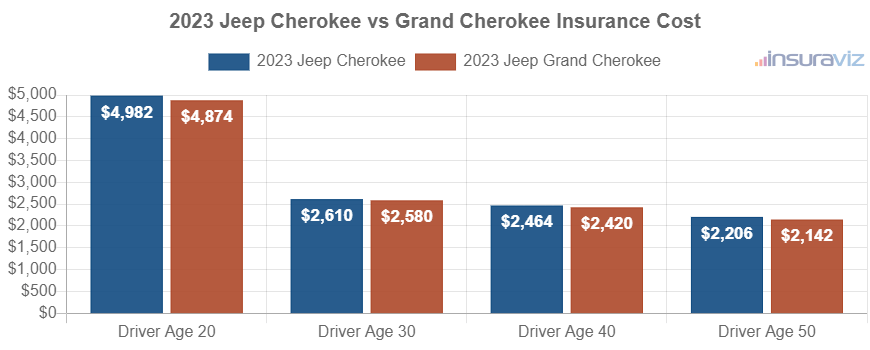

Jeep Cherokee vs. Grand Cherokee Insurance

For 2023 models (the Cherokee is not available for 2024), when comparing Jeep Cherokee insurance and Jeep Grand Cherokee insurance cost, the Cherokee has an average car insurance cost of $2,522 and the Grand Cherokee is $2,480, making the Jeep Grand Cherokee $42 cheaper overall.

See our complete comparison of Jeep Grand Cherokee vs Jeep Cherokee insurance for model year comparisons back to 2015.

The 2023 Jeep Cherokee has five trim levels available, with the cheapest model to insure being the X 4WD model at an average cost of $2,426 per year. For the 16 trim levels available for the no, the cheapest 2023 model to insure is the Laredo 2WD model at a cost of $2,224 per year, or $185 per month.

When rates for all 21 trim levels for both vehicles are compared, the most affordable model and trim level to insure is the Jeep Grand Cherokee Laredo 2WD at an average rate of $2,224 per year. The most expensive trim is the Jeep Grand Cherokee Summit Reserve 4xe at an average of $2,676 per year.

The next two rate tables illustrate the average cost to insure all 2023 trim levels, as well as the overall average rate for each model. The model with the cheapest overall car insurance rates for 2023 is the Jeep Grand Cherokee.

2023 Jeep Cherokee

$2,522

| 2023 Jeep Cherokee Trims | Rate |

|---|---|

| X 4WD | $2,426 |

| Latitude Lux 2WD | 2,508 |

| Latitude Lux 4WD | 2,542 |

| Trailhawk 4WD | 2,560 |

| Limited 4WD | 2,576 |

| 2023 Jeep Cherokee Average Rate | $2,522 |

2023 Jeep Grand Cherokee

$2,480

| 2023 Jeep Grand Cherokee Trims | Rate |

|---|---|

| Laredo 2WD | $2,224 |

| Laredo 4x4 | 2,266 |

| Altitude 2WD | 2,322 |

| Altitude 4x4 | 2,356 |

| Limited 2WD | 2,364 |

| Limited 4x4 | 2,398 |

| Overland 2WD | 2,496 |

| Overland 4x4 | 2,522 |

| 4xe | 2,530 |

| Summit 2WD | 2,552 |

| Summit 4x4 | 2,566 |

| 30th Anniversary 4xe | 2,580 |

| Trailhawk 4xe | 2,586 |

| Summit Reserve 4x4 | 2,606 |

| Overland 4xe | 2,606 |

| Summit Reserve 4xe | 2,676 |

| 2023 Jeep Grand Cherokee Average Rate | $2,480 |

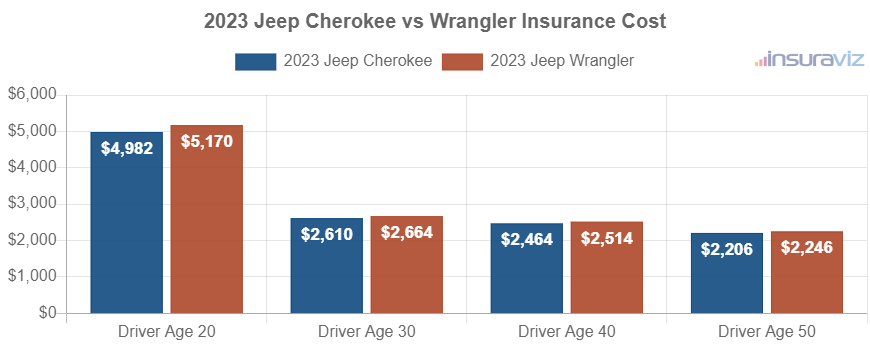

Jeep Cherokee vs. Wrangler Insurance

For the 2023 Cherokee and Wrangler models, the Cherokee has an overall insurance rate of $2,522 and the Wrangler comes in at $2,574, making the Jeep Cherokee $52 cheaper overall.

Out of five Jeep Cherokee trims, the cheapest 2023 trim level to insure is the X 4WD trim at an average cost of $2,426 per year, or about $202 per month. For the 22 trim levels available for the no, the cheapest 2023 trim to insure is the Sport 2-Door model at a cost of $2,332.

When comparing aggregated rates for both models from a trim-level perspective, the cheapest model and trim level to insure is the Jeep Wrangler Sport 2-Door at an average cost of $2,332 per year. The most expensive trim is the Jeep Wrangler Rubicon 392 at an average cost of $2,846 per year.

The tables below illustrate the average cost to insure all 2023 trim levels, along with an average cost for each model. The 2023 Jeep Cherokee is the winner over the 2023 Jeep Wrangler for cheapest car insurance rates.

2023 Jeep Cherokee

$2,522

| 2023 Jeep Cherokee Trims | Rate |

|---|---|

| X 4WD | $2,426 |

| Latitude Lux 2WD | 2,508 |

| Latitude Lux 4WD | 2,542 |

| Trailhawk 4WD | 2,560 |

| Limited 4WD | 2,576 |

| 2023 Jeep Cherokee Average Rate | $2,522 |

2023 Jeep Wrangler

$2,574

| 2023 Jeep Wrangler Trims | Rate |

|---|---|

| Sport 2-Door | $2,332 |

| Willys Sport 2-Door | 2,412 |

| Sport S 2-Door | 2,416 |

| Sport 4-Door | 2,436 |

| Freedom 2-Door | 2,474 |

| Willys Sport 4-Door | 2,490 |

| Sport S 4-Door | 2,490 |

| Willys 2-Door | 2,490 |

| Sport Altitude | 2,542 |

| Freedom 4-Door | 2,548 |

| Willys 4-Door | 2,554 |

| Rubicon 2-Door | 2,562 |

| Sahara | 2,598 |

| Sport RHD | 2,612 |

| Rubicon 4-Door | 2,618 |

| Sahara Altitude | 2,650 |

| Willys 4xe | 2,684 |

| High Altitude | 2,690 |

| Sahara 4xe | 2,704 |

| Rubicon 4xe | 2,736 |

| High Altitude 4xe | 2,748 |

| Rubicon 392 | 2,846 |

| 2023 Jeep Wrangler Average Rate | $2,574 |

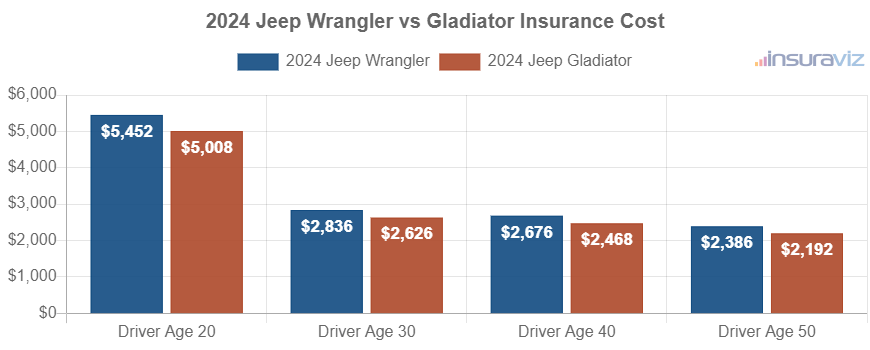

Jeep Wrangler vs. Gladiator Insurance

In a comparison of the 2024 Jeep Wrangler versus the Gladiator truck, the average Jeep Wrangler insurance cost is $2,740 and the Gladiator clocks in at $2,528, making the Jeep Gladiator the winner by $212 a year.

See our complete Jeep Wrangler vs Gladiator insurance cost comparison that includes average rate comparisons back to the first year of manufacturer for the Jeep Gladiator.

Out of 16 Jeep Cherokee trim levels, the cheapest 2024 model to insure is the Sport 2-Door model at an average cost of $2,436 per year.

For the seven trim levels available for the no, the cheapest 2024 model to insure is the Sport model at a cost of $2,356 per year, or about $196 per month.

When comparing both models at a trim-level basis, the lowest-cost model and trim level to insure is the Jeep Gladiator Sport at an average cost of $2,356 per year. The most expensive model and trim level is the Jeep Wrangler Rubicon 392 at an average cost of $3,004 per year.

The tables shown below show both 2024 models and all trim levels available for each one, including an overall average cost for each model. The winner for the 2024 car insurance cost comparison is the Jeep Gladiator.

2024 Jeep Wrangler

$2,740

| 2024 Jeep Wrangler Trims | Rate |

|---|---|

| Sport 2-Door | $2,436 |

| Sport S 2-Door | 2,520 |

| Sport 4-Door | 2,534 |

| Willys 2-Door | 2,616 |

| Sport S 4-Door | 2,616 |

| Willys 4-Door | 2,678 |

| Sahara | 2,736 |

| Sport S 4xe | 2,750 |

| Willys 4xe | 2,806 |

| Rubicon X 2-Door | 2,812 |

| Sahara 4xe | 2,824 |

| Rubicon X 4-Door | 2,846 |

| Rubicon 4xe | 2,852 |

| High Altitude 4xe | 2,894 |

| Rubicon X 4xe | 2,916 |

| Rubicon 392 | 3,004 |

| 2024 Jeep Wrangler Average Rate | $2,740 |

2024 Jeep Gladiator

$2,528

| 2024 Jeep Gladiator Trims | Rate |

|---|---|

| Sport | $2,356 |

| Willys | 2,426 |

| Sport S | 2,494 |

| Rubicon | 2,590 |

| Mojave | 2,590 |

| Rubicon X | 2,618 |

| Mojave X | 2,618 |

| 2024 Jeep Gladiator Average Rate | $2,528 |

Jeep Grand Cherokee vs. Wrangler Insurance Cost

At this point we can just look at the above data to figure out that the average insurance cost for a Grand Cherokee is $2,480 and the Wrangler is $2,574. That makes the Jeep Grand Cherokee victorious by $94 a year.

Jeep Grand Cherokee vs. Gladiator Insurance Cost

With the Grand Cherokee average insurance rate being $2,480 per year and the annual average rate for the Gladiator being $2,424, for this battle the Jeep Gladiator emerges the winner by $56 a year.

Jeeps versus the competition

It’s one thing to compare insurance rates between the different Jeep models, but how do rates compare to different models? Glad you asked.

The tables below compare Jeep Cherokee insurance rates, Grand Cherokee rates, and Wrangler rates to the entire midsize SUV segment, Compass and Renegade rates to small SUVs, and Gladiator rates to the midsize truck class.

Jeep Cherokee, Grand Cherokee, and Wrangler vs. Midsize SUVs

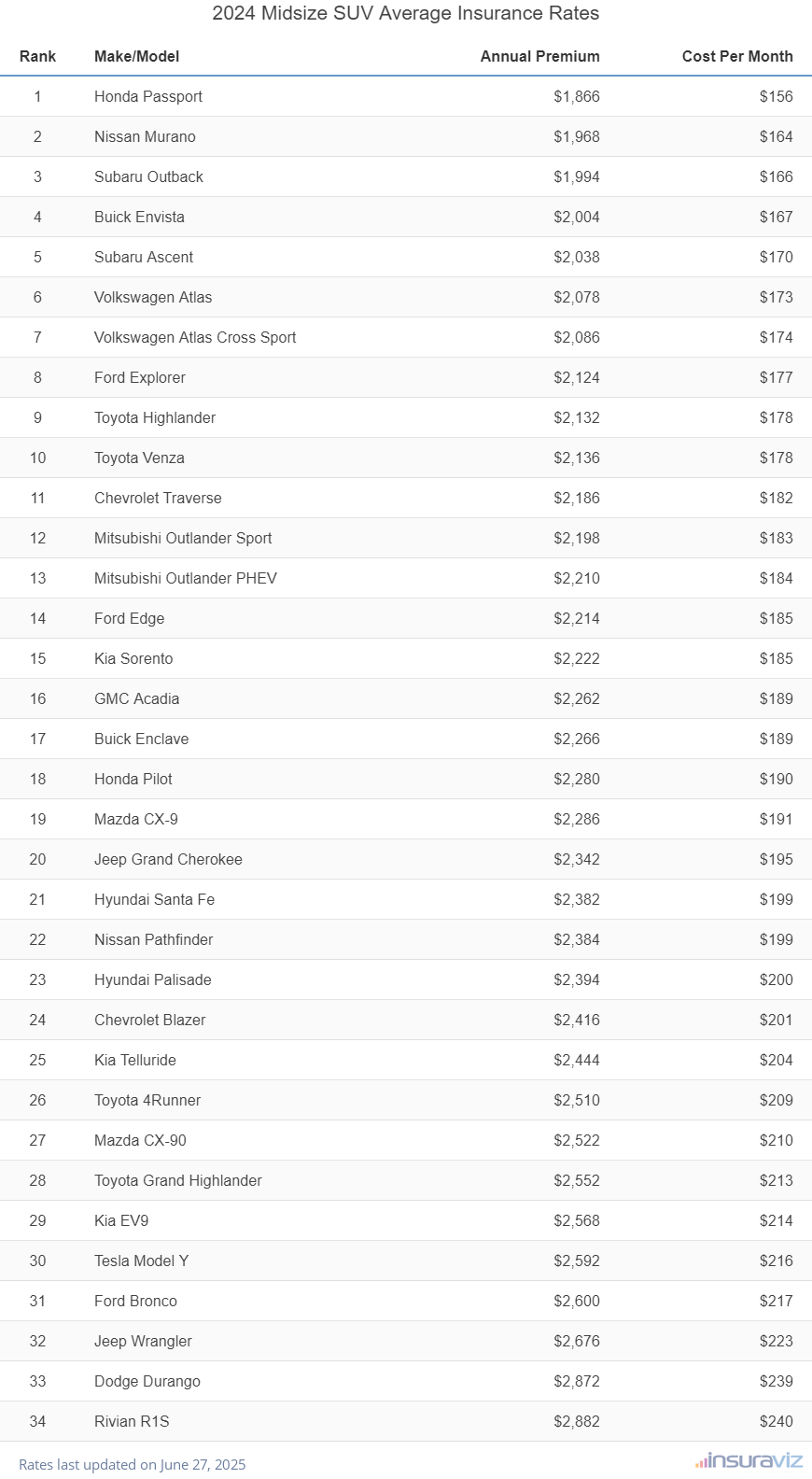

The table below shows the entire midsize SUV segment, which includes both the Grand Cherokee and Wrangler models.

The average insurance rate for the entire class is $2,370, with the Grand Cherokee ranking 20th, and the Wrangler ranking 32nd.

The Grand Cherokee costs $28 more on average per year than the average midsize SUV insurance rate, and the Wrangler costs $370 more on average per year.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | $159 |

| 2 | Nissan Murano | $2,016 | $168 |

| 3 | Subaru Outback | $2,042 | $170 |

| 4 | Buick Envista | $2,050 | $171 |

| 5 | Subaru Ascent | $2,088 | $174 |

| 6 | Volkswagen Atlas | $2,128 | $177 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | $178 |

| 8 | Ford Explorer | $2,176 | $181 |

| 9 | Toyota Highlander | $2,180 | $182 |

| 10 | Toyota Venza | $2,190 | $183 |

| 11 | Chevrolet Traverse | $2,238 | $187 |

| 12 | Mitsubishi Outlander Sport | $2,254 | $188 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | $189 |

| 14 | Ford Edge | $2,270 | $189 |

| 15 | Kia Sorento | $2,278 | $190 |

| 16 | GMC Acadia | $2,316 | $193 |

| 17 | Buick Enclave | $2,320 | $193 |

| 18 | Honda Pilot | $2,336 | $195 |

| 19 | Mazda CX-9 | $2,342 | $195 |

| 20 | Jeep Grand Cherokee | $2,398 | $200 |

| 21 | Hyundai Santa Fe | $2,426 | $202 |

| 22 | Nissan Pathfinder | $2,440 | $203 |

| 23 | Hyundai Palisade | $2,450 | $204 |

| 24 | Chevrolet Blazer | $2,476 | $206 |

| 25 | Kia Telluride | $2,504 | $209 |

| 26 | Toyota 4Runner | $2,572 | $214 |

| 27 | Mazda CX-90 | $2,582 | $215 |

| 28 | Toyota Grand Highlander | $2,610 | $218 |

| 29 | Kia EV9 | $2,630 | $219 |

| 30 | Tesla Model Y | $2,654 | $221 |

| 31 | Ford Bronco | $2,662 | $222 |

| 32 | Jeep Wrangler | $2,740 | $228 |

| 33 | Dodge Durango | $2,942 | $245 |

| 34 | Rivian R1S | $2,950 | $246 |

Data Methodology: Rates and models are for the 2024 model year. Driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated October 24, 2025

Jeep Compass and Renegade vs. Small SUVs

The table below shows the entire small SUV segment, which includes the Compass and Renegade models.

The average insurance rate for the entire class is $2,206, with the Compass ranking 45th and the Renegade coming in at 32nd.

The Compass costs $388 more and the Renegade costs $102 more on average per year.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,772 | $148 |

| 2 | Chevrolet Trailblazer | $1,804 | $150 |

| 3 | Kia Soul | $1,872 | $156 |

| 4 | Nissan Kicks | $1,888 | $157 |

| 5 | Buick Envision | $1,922 | $160 |

| 6 | Toyota Corolla Cross | $1,932 | $161 |

| 7 | Hyundai Venue | $1,950 | $163 |

| 8 | Mazda CX-5 | $1,956 | $163 |

| 9 | Ford Bronco Sport | $1,966 | $164 |

| 10 | Volkswagen Tiguan | $1,984 | $165 |

| 11 | Buick Encore | $2,038 | $170 |

| 12 | Honda CR-V | $2,046 | $171 |

| 13 | Volkswagen Taos | $2,056 | $171 |

| 14 | Kia Niro | $2,066 | $172 |

| 15 | Honda HR-V | $2,088 | $174 |

| 16 | Subaru Forester | $2,134 | $178 |

| 17 | Kia Seltos | $2,144 | $179 |

| 18 | GMC Terrain | $2,148 | $179 |

| 19 | Nissan Rogue | $2,154 | $180 |

| 20 | Hyundai Kona | $2,158 | $180 |

| 21 | Mazda CX-30 | $2,164 | $180 |

| 22 | Volkswagen ID4 | $2,176 | $181 |

| 23 | Ford Escape | $2,188 | $182 |

| 24 | Chevrolet Equinox | $2,210 | $184 |

| 25 | Toyota RAV4 | $2,212 | $184 |

| 26 | Mazda MX-30 | $2,226 | $186 |

| 27 | Hyundai Tucson | $2,232 | $186 |

| 28 | Chevrolet Trax | $2,264 | $189 |

| 29 | Mini Cooper Clubman | $2,274 | $190 |

| 30 | Mini Cooper | $2,278 | $190 |

| 31 | Mitsubishi Eclipse Cross | $2,302 | $192 |

| 32 | Jeep Renegade | $2,308 | $192 |

| 33 | Mitsubishi Outlander | $2,336 | $195 |

| 34 | Kia Sportage | $2,350 | $196 |

| 35 | Hyundai Ioniq 5 | $2,358 | $197 |

| 36 | Fiat 500X | $2,368 | $197 |

| 37 | Mini Cooper Countryman | $2,374 | $198 |

| 38 | Subaru Solterra | $2,376 | $198 |

| 39 | Mazda CX-50 | $2,380 | $198 |

| 40 | Nissan Ariya | $2,386 | $199 |

| 41 | Toyota bz4X | $2,390 | $199 |

| 42 | Mitsubishi Mirage | $2,398 | $200 |

| 43 | Kia EV6 | $2,474 | $206 |

| 44 | Dodge Hornet | $2,554 | $213 |

| 45 | Jeep Compass | $2,594 | $216 |

| 46 | Hyundai Nexo | $2,648 | $221 |

| 47 | Ford Mustang Mach-E | $2,806 | $234 |

Data Methodology: Rates and models are for the 2024 model year. Driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle. Updated October 24, 2025

Jeep Gladiator vs. Midsize Trucks

The Gladiator, Jeep’s midsize pickup truck model, ranks ninth in the midsize truck class for insurance affordability. The average rate for all midsize trucks in $2,422 and the Gladiator comes in at $2,528 per year, making the Gladiator $106 more than the class overall average rate.

Jeep Insurance Comparison Conclusion

Seeing the rate comparisons above, it should be clear that Jeeps do cost a little more for insurance when compared to other vehicles in their class. It really depends on the trim level of Jeep you’re buying insurance for, however.

Higher trims like the Grand Cherokee Trailhawk are just going to cost more to insure due to the higher sticker price. Base level trims for most vehicles fall closer to or even below the national average rate for all vehicles of $2,276.

For most Jeep enthusiasts, the cost of Jeep insurance is really secondary to just owning a Jeep, period.