- Average car insurance cost in Missouri is $2,742 per year, or about $229 per month.

- Missouri ranks 11th out of 12 Midwest states for cheapest auto insurance and ranks 41st out of all 50 states.

- Some of the cheaper Missouri car insurance rates are $2,026 per year for the Subaru Crosstrek, $2,448 for the Kia Seltos, and $2,658 for the Ford Maverick.

What is average car insurance cost in Missouri?

Ranking 41st out of 50 states, the average cost of car insurance in Missouri is $2,742 per year, which is around $229 per month. Missouri car insurance costs 18.6% more than the national average rate of $2,276.

Average annual and monthly car insurance rates in Missouri for the top five most popular vehicles in the state are shown below.

- Ford F-150 pickup – $3,066 per year ($256 per month)

- Toyota RAV4 compact SUV – $2,532 per year ($211 per month)

- Chevrolet Silverado pickup – $3,030 per year ($253 per month)

- Honda CR-V compact SUV – $2,338 per year ($195 per month)

- Nissan Rogue compact SUV – $2,464 per year ($205 per month)

Other top-selling vehicles in Missouri and their average annual car insurance cost include the Honda Accord at $2,650 per year, the Toyota Camry at $2,948, the Ford Edge at $2,592, and the Ford Explorer with an average cost of $2,488 per year.

The next chart takes the average rate for all 2024 model year vehicles and shows how changes in driver age and policy deductible level affects annual premium.

Missouri car insurance quotes for teenage drivers (age 16 to 19) are not shown above, but expect a much higher cost for that age group.

Average car insurance for 16-year-olds in Missouri ranges from $9,125 to $9,768 per year.

For 17 and 18-year-olds, expect rates between $9,066 to $9,464 per year for 17-year-olds and $7,826 to $8,480 per year for 18-year-old drivers.

Car insurance for a 19-year-old ranges from $6,530 to $7,723 per year.

Is car insurance expensive in Missouri?

When compared to neighboring states, Missourians can expect to pay around 3.6% more than Kentucky, 5.3% more than Arkansas, and 1.6% more than Oklahoma.

When looking at some of the other surrounding states, average car insurance quotes in Missouri are:

- 34.2% more expensive than Iowa

- 17.4% more expensive than Illinois

- 12% more expensive than Tennessee

- 9.5% more expensive than Kansas

- 20.4% more expensive than Nebraska

The chart below shows how average auto insurance cost in Missouri compares to other Midwest U.S. states. Missouri ranks 11th out of 12 states in the Midwest region for cheapest car insurance rates.

When compared to states in other parts of the country, Missouri car insurance cost doesn’t seem quite as expensive as when compared to just the Midwest region. The average cost in Missouri is 14.3% more expensive than Arizona, 2% cheaper than New York, 5% cheaper than California, 1.8% cheaper than Florida, and 13.6% more expensive than Texas.

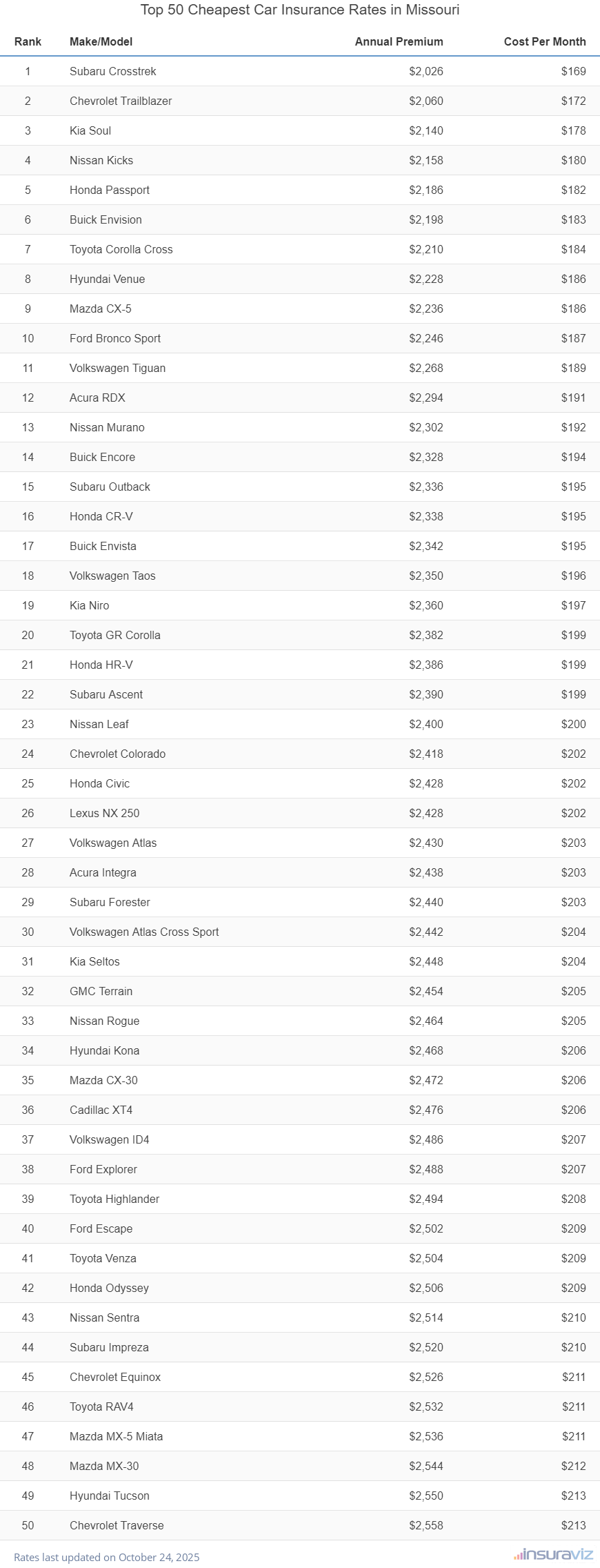

Which vehicles are cheapest to insure in Missouri?

When all car, SUV, and pickup insurance rates are compared, the models with the most affordable insurance prices in Missouri, tend to be crossovers and compact SUVs like the Chevrolet Trailblazer, Subaru Crosstrek, and Buick Envision.

Average car insurance quotes for those models cost $2,228 or less per year, or $186 per month, for full coverage.

Some other vehicles that have affordable insurance quotes in our car insurance cost comparison are the Volkswagen Taos, Kia Niro, Buick Envista, and Acura RDX.

The average rates are marginally higher for those models than the cheapest compact SUVs at the top of the list, but they still have an average insurance cost of $199 or less per month.

The table below shows the full ranking for the top 50 cheapest vehicles to insure in Missouri from the 2024 model year.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $2,026 | $169 |

| 2 | Chevrolet Trailblazer | $2,060 | $172 |

| 3 | Kia Soul | $2,140 | $178 |

| 4 | Nissan Kicks | $2,158 | $180 |

| 5 | Honda Passport | $2,186 | $182 |

| 6 | Buick Envision | $2,198 | $183 |

| 7 | Toyota Corolla Cross | $2,210 | $184 |

| 8 | Hyundai Venue | $2,228 | $186 |

| 9 | Mazda CX-5 | $2,236 | $186 |

| 10 | Ford Bronco Sport | $2,246 | $187 |

| 11 | Volkswagen Tiguan | $2,268 | $189 |

| 12 | Acura RDX | $2,294 | $191 |

| 13 | Nissan Murano | $2,302 | $192 |

| 14 | Buick Encore | $2,328 | $194 |

| 15 | Subaru Outback | $2,336 | $195 |

| 16 | Honda CR-V | $2,338 | $195 |

| 17 | Buick Envista | $2,342 | $195 |

| 18 | Volkswagen Taos | $2,350 | $196 |

| 19 | Kia Niro | $2,360 | $197 |

| 20 | Toyota GR Corolla | $2,382 | $199 |

| 21 | Honda HR-V | $2,386 | $199 |

| 22 | Subaru Ascent | $2,390 | $199 |

| 23 | Nissan Leaf | $2,400 | $200 |

| 24 | Chevrolet Colorado | $2,418 | $202 |

| 25 | Honda Civic | $2,428 | $202 |

| 26 | Lexus NX 250 | $2,428 | $202 |

| 27 | Volkswagen Atlas | $2,430 | $203 |

| 28 | Acura Integra | $2,438 | $203 |

| 29 | Subaru Forester | $2,440 | $203 |

| 30 | Volkswagen Atlas Cross Sport | $2,442 | $204 |

| 31 | Kia Seltos | $2,448 | $204 |

| 32 | GMC Terrain | $2,454 | $205 |

| 33 | Nissan Rogue | $2,464 | $205 |

| 34 | Hyundai Kona | $2,468 | $206 |

| 35 | Mazda CX-30 | $2,472 | $206 |

| 36 | Cadillac XT4 | $2,476 | $206 |

| 37 | Volkswagen ID4 | $2,486 | $207 |

| 38 | Ford Explorer | $2,488 | $207 |

| 39 | Toyota Highlander | $2,494 | $208 |

| 40 | Ford Escape | $2,502 | $209 |

| 41 | Toyota Venza | $2,504 | $209 |

| 42 | Honda Odyssey | $2,506 | $209 |

| 43 | Nissan Sentra | $2,514 | $210 |

| 44 | Subaru Impreza | $2,520 | $210 |

| 45 | Chevrolet Equinox | $2,526 | $211 |

| 46 | Toyota RAV4 | $2,532 | $211 |

| 47 | Mazda MX-5 Miata | $2,536 | $211 |

| 48 | Mazda MX-30 | $2,544 | $212 |

| 49 | Hyundai Tucson | $2,550 | $213 |

| 50 | Chevrolet Traverse | $2,558 | $213 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Missouri Zip Codes. Updated October 24, 2025

Cheapest car insurance rates by vehicle segment

Sometimes when shopping for a new or used vehicle, it’s nice to know which models have the cheapest car insurance rates in a particular segment. The list below breaks out the one model for each segment that has the cheapest car insurance cost, both annual and monthly.

- Toyota GR Corolla insurance – Cheapest compact car at $2,382 per year or $199 per month

- Subaru Crosstrek insurance – Cheapest compact SUV at $2,026 per year or $169 per month

- Kia K5 insurance – Cheapest midsize car at $2,642 per year or $220 per month

- Honda Passport insurance – Cheapest midsize SUV at $2,186 per year or $182 per month

- Chrysler 300 insurance – Cheapest full-size car at $2,612 per year or $218 per month

- Chevrolet Tahoe insurance – Cheapest full-size SUV at $2,576 per year or $215 per month

- Chevrolet Colorado insurance – Cheapest midsize pickup at $2,418 per year or $202 per month

- Nissan Titan insurance – Cheapest full-size pickup at $2,566 per year or $214 per month

- GMC Sierra 2500 HD insurance – Cheapest heavy duty pickup at $2,790 per year or $233 per month

- Honda Odyssey insurance – Cheapest minivan at $2,506 per year or $209 per month

- Mazda MX-5 Miata insurance – Cheapest sports car at $2,536 per year or $211 per month

- Acura Integra insurance – Cheapest compact luxury car at $2,438 per year or $203 per month

- Acura RDX insurance – Cheapest compact luxury SUV at $2,294 per year or $191 per month

- Mercedes-Benz CLA250 insurance – Cheapest midsize luxury car at $2,822 per year or $235 per month

- Jaguar E-Pace insurance – Cheapest midsize luxury SUV at $2,564 per year or $214 per month

- Audi A5 insurance – Cheapest full-size luxury car at $3,260 per year or $272 per month

- Infiniti QX80 insurance – Cheapest full-size luxury SUV at $3,074 per year or $256 per month

Average insurance rates for popular vehicles in Missouri

Average rates are nice for comparisons between models, but there are much more detailed rates available. If you view any of our car insurance guides for individual models, you’ll find rate comparisons down to the trim level.

The charts below don’t take it quite that far, but they do break out rates for some different scenarios such as high-risk drivers, rates for younger and older drivers, and different policy deductibles.

We chose five of the most popular vehicles in Missouri in order to give a more detailed look into how variable car insurance rates can be based on different rating criteria.

Ford F150 insurance rates

Ford F150 insurance in Missouri costs an average of $3,066 per year and ranges from $2,546 to $7,086 per year for the sample driver risk profiles shown in the chart below.

The Ford F150 is considered a full-size truck, and other popular models include the Chevrolet Silverado, Toyota Tundra, GMC Sierra, Ram Truck, and Nissan Titan.

Nissan Rogue insurance rates

Nissan Rogue car insurance rates in Missouri range from $2,050 to $5,632 per year for the driver profiles in the chart below. Nissan Rogue insurance costs an average of $2,464 per year or $205 per month in Missouri.

The Nissan Rogue belongs to the compact SUV segment, and other popular models include the Subaru Forester, Mazda CX-5, Toyota RAV4, Ford Escape, and Honda CR-V.

Honda Pilot insurance rates

The chart below shows average Honda Pilot insurance rates in Missouri for different driver ages and risk profiles. Annual cost ranges from $2,220 to $6,172 per year for the example driver risk profiles, with average cost being $2,668 per year.

The Honda Pilot is a midsize SUV and other similar models include the Kia Telluride, Ford Explorer, Toyota Highlander, Jeep Grand Cherokee, and Ford Edge.

Chevrolet Tahoe insurance rates

Average Chevrolet Tahoe insurance rates in Missouri as shown in the chart below range from $2,142 to $5,894 per year, with the average cost being $2,576.

The Chevrolet Tahoe is considered a large SUV, and other models in this segment include the GMC Yukon, Chevrolet Suburban, Toyota Sequoia, Ford Expedition, and .

Toyota Supra insurance rates

The average cost for Toyota Supra insurance in Missouri is $2,994 per year. The chart below shows rates for additional driver profiles with prices ranging from $2,316 to $6,400 per year.

The Toyota Supra is a sports car and other vehicles in this segment include the Chevrolet Camaro, Chevrolet Corvette, Subaru BRZ, Nissan 370Z, and Ford Mustang.

Average insurance rates in large Missouri cities

Listed below are average auto insurance rates for some of the larger cities in the state of Missouri. Visit any page to view detailed rate information, including the cheapest vehicles to insure and cost comparisons by automotive segment.

- Kansas City Car Insurance - $2,866 per year or $239 per month

- St. Louis Car Insurance - $3,400 per year or $283 per month

- Springfield Car Insurance - $2,562 per year or $214 per month

- Independence Car Insurance - $2,746 per year or $229 per month

- Columbia Car Insurance - $2,536 per year or $211 per month

- O'Fallon Car Insurance - $2,774 per year or $231 per month

- St. Joseph Car Insurance - $2,734 per year or $228 per month