- Average Nissan Rogue insurance cost is $2,154 per year, or $180 per month for full coverage.

- Rogue insurance cost ranges from $2,044 to $2,258 per year on average, depending on trim level.

- Eliminating comprehensive and collision coverage on an older Nissan Rogue may save you around $694 annually, depending on the policy deductibles and the driver age.

- Rogue insurance rates in a few larger cities include $2,230 in Nashville, TN, $3,040 in Louisville, KY, and $2,098 in El Paso, TX.

How much does Nissan Rogue car insurance cost?

Nissan Rogue insurance costs on average $2,154 a year for full coverage, or $180 a month. Overall, the Rogue costs just a little more than the small SUV class average rate of $2,206 per year.

When compared to all 2024 model year vehicles, however, insurance on a Rogue starts to look pretty affordable. For all 2024 models, the average cost of car insurance is $2,572. That makes the Rogue 17.7% cheaper than the all-vehicle average.

Depending on the trim level being insured, average monthly car insurance cost for a Nissan Rogue ranges from $170 to $188.

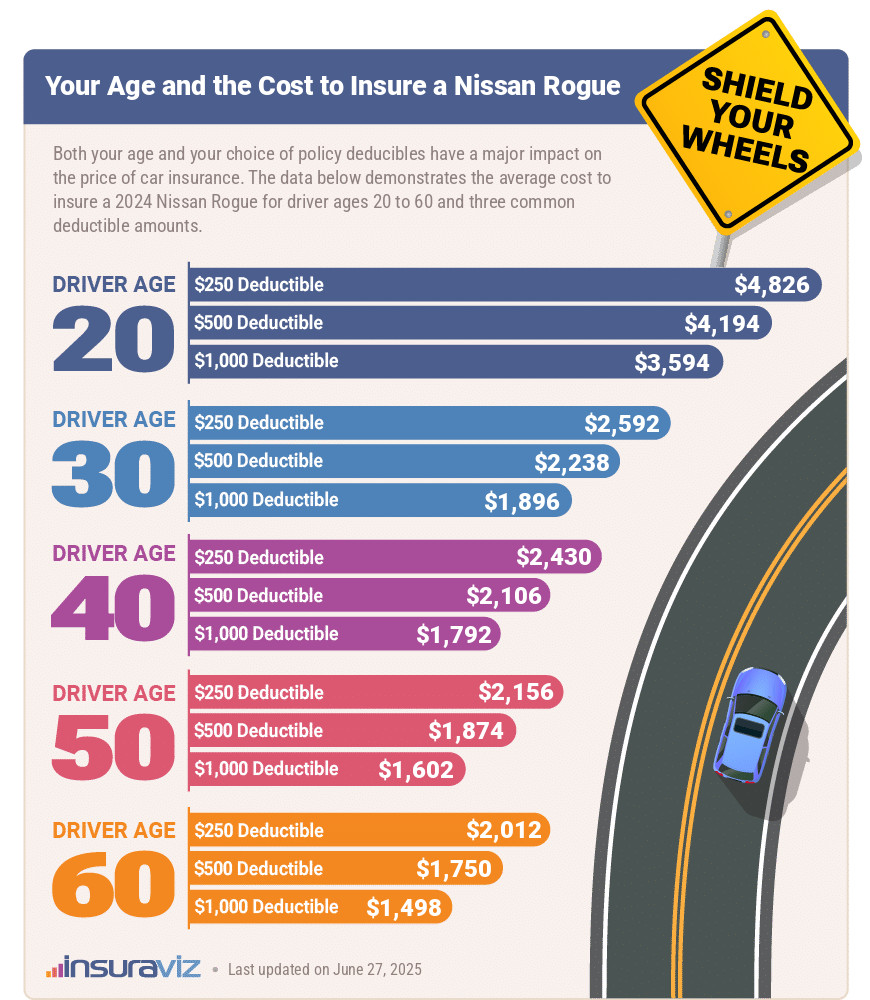

The next infographic demonstrates how average 2024 Nissan Rogue insurance cost changes based on the age of the rated driver and comprehensive and collision deductibles.

Prices range from $1,532 per year for a 60-year-old driver with $1,000 comprehensive and collision deductibles up to $4,948 per year for a 20-year-old driver with $250 comprehensive and collision deductibles.

The data in the image above assumes full-coverage insurance, but to help you grasp how variable Nissan Rogue insurance rates can be, consider that a liability-only policy for a Nissan Rogue in the cheaper areas of Wisconsin or Idaho may be as cheap as $248 a year.

And on the high side, a newly-licensed teen driver with a heavy foot or a few accidents in some California zip codes might be as much as $15,420 a year for full coverage on a 2024 Rogue.

Some other insights as they relate to insurance cost on a Nissan Rogue include:

- Be a careful driver and pay less for insurance. Having frequent accidents may increase rates, as much as $3,040 per year for a 20-year-old driver and as much as $902 per year for a 40-year-old driver. The more at-fault accidents you have, the higher your rates will go.

- Driving violations increase insurance rates. Just one or two minor incidents on your driving report could result in increasing rates by up to $574 per year. Being convicted of a serious infraction such as DUI and hit-and-run could raise rates by an additional $1,984 or more and even result in non-renewal of your policy.

- Your profession could save you a few bucks. Most insurance companies offer discounts for specific professions like architects, lawyers, doctors, high school and elementary teachers, emergency medical technicians, farmers, and other occupations. By working in a job that qualifies, you could save between $65 and $233 on your annual Rogue insurance bill, subject to the policy coverages selected.

- Qualify for discounts to save money. Discounts may be available if your vehicle has safety or anti-theft features, you work in certain occupations, are claim-free, are a good student, are a loyal customer, or many other discounts which could save as much as $364 per year on their insurance cost.

- Improve your credit for cheaper car insurance. In states that have car insurance regulations that allow a policyholder’s credit score to be used to calculate an insurance rate, drivers with high 800+ credit scores could save as much as $338 per year versus a credit rating of 670-739. On the flip side of that coin, a poor credit rating could cost you up to $392 more per year.

- Rogue insurance for teen drivers is expensive. Average rates for full coverage Nissan Rogue insurance for teenagers costs $7,683 per year for a 16-year-old driver, $7,408 per year for a 17-year-old driver, and $6,574 per year for an 18-year-old driver.

Nissan was founded in 1911 in Tokyo, Japan, and originally produced vehicles under the Datsun brand. The Nissan name wasn’t used until the 1930s and they now produce vehicles under both the Infiniti and Nissan nameplates.

Which Nissan Rogue has the cheapest insurance?

The cheapest model of Nissan Rogue to insure for the 2024 model year is the base S 2WD model at $2,044 per year. The next cheapest model is the S AWD at $2,086 per year, and the third cheapest model to insure is the SV 2WD also at $2,088 per year.

The highest cost trim levels are the Platinum AWD and the Platinum 2WD, at $2,258 and $2,230 per year, respectively.

Average Nissan Rogue insurance essentially mirrors the overall cost of the vehicle by trim level. The S 2WD trim model has the lowest base MSRP of $29,360 along with the cheapest insurance rates. As the cost goes up with each trim level, insurance cost also increases.

The next table shows average annual and semi-annual car insurance rates for a 2024 Nissan Rogue, plus a monthly amount for budgeting, for each available trim level and powertrain option.

| 2024 Nissan Rogue Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| S 2WD | $2,044 | $170 |

| S AWD | $2,086 | $174 |

| SV 2WD | $2,088 | $174 |

| SV AWD | $2,124 | $177 |

| SL 2WD | $2,194 | $183 |

| SL AWD | $2,224 | $185 |

| Platinum 2WD | $2,230 | $186 |

| Platinum AWD | $2,258 | $188 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Used models can save money on insurance

Insuring a used 2013 Nissan Rogue instead of a new 2024 model could reduce the cost of insurance by $682 per year or more, depending on the age of the vehicle and policy limits.

The following data table shows average Nissan Rogue car insurance rates for the 2013 to 2024 model years and also for different driver ages. Insurance rates range from the cheapest price of $1,188 for a 60-year-old driver rated on a 2014 Nissan Rogue to the most expensive rate of $4,324 for a 20-year-old driving a 2022 model.

| Model Year and Vehicle | Driver Age 20 | Driver Age 40 | Driver Age 60 |

|---|---|---|---|

| 2024 Nissan Rogue | $4,300 | $2,154 | $1,794 |

| 2023 Nissan Rogue | $4,316 | $2,144 | $1,782 |

| 2022 Nissan Rogue | $4,324 | $2,142 | $1,784 |

| 2021 Nissan Rogue | $3,824 | $1,910 | $1,588 |

| 2020 Nissan Rogue | $3,712 | $1,852 | $1,542 |

| 2019 Nissan Rogue | $3,618 | $1,802 | $1,504 |

| 2018 Nissan Rogue | $3,396 | $1,696 | $1,420 |

| 2017 Nissan Rogue | $3,322 | $1,658 | $1,388 |

| 2016 Nissan Rogue | $3,114 | $1,556 | $1,306 |

| 2015 Nissan Rogue | $2,932 | $1,466 | $1,234 |

| 2014 Nissan Rogue | $2,816 | $1,410 | $1,188 |

| 2013 Nissan Rogue | $2,950 | $1,472 | $1,244 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Nissan Rogue trim levels for each model year. Updated October 24, 2025

At some point down the road, owners have to decide whether to remove either comprehensive or collision or both from an insurance policy. As a Nissan Rogue depreciates over time, the expense of carrying physical damage coverage outweighs the added benefit.

Deleting physical damage coverage on an older Nissan Rogue could save the average driver $694 a year, depending on the coverage deductibles and the age of the driver.

If you’re a safe driver, a usage-based car insurance program could save you money on car insurance. Drivers can save an average of $200 per year when insuring a 2024 Nissan Rogue.

Is Rogue insurance cheaper than the CR-V or RAV4?

When compared to top-selling vehicles in the 2024 small SUV class, insurance for a Nissan Rogue costs $58 less per year than the Toyota RAV4, $108 more than the Honda CR-V, $56 less than the Chevrolet Equinox, and $34 less than the Ford Escape.

The Nissan Rogue ranks 19th out of 47 total comparison vehicles in the 2024 compact utility vehicle segment. The Rogue costs an average of $2,154 per year for insurance, while the segment average rate is $2,206 annually.

The chart below shows how average Nissan Rogue car insurance rates compare to the top 10 selling compact SUVs and crossovers for the 2024 model year. The Nissan Rogue is highlighted in orange and the segment average is dark blue.

Clicking or tapping on the table icon in the lower-left corner of the chart allows you to view a table detailing insurance rate rankings for the entire 2024 small SUV class.

With an average MSRP of $34,225, the cost to buy a new 2024 Nissan Rogue ranges from the S 2WD trim at $29,360 to the Platinum AWD trim at $39,230, before documentation fees and delivery charges.

The vehicles that are closest in purchase price to the Nissan Rogue for the 2024 model year are the Volkswagen Tiguan, Chevrolet Equinox, Honda CR-V, and Ford Bronco Sport.

The list below shows how those models compare to the Rogue both for average MSRP and average cost to insure. For a complete list of comparisons for the Rogue and many other vehicles, see our car insurance cost comparisons page.

- Compared to the Volkswagen Tiguan – The MSRP for the 2024 Volkswagen Tiguan averages $101 more than the MSRP for the Rogue ($34,326 compared to $34,225). Expect to pay approximately $170 less every 12 months to insure the Volkswagen Tiguan compared to a Rogue.

- Compared to the Chevrolet Equinox – The average MSRP for a 2024 Nissan Rogue is $129 more expensive than the Chevrolet Equinox, at $34,225 compared to $34,096. The cost to insure a Nissan Rogue compared to the Chevrolet Equinox is $56 less per year on average.

- Compared to the Honda CR-V – The 2024 Honda CR-V has an average retail price of $33,954 ($29,500 to $39,850), which is $271 cheaper than the average cost of the Rogue. The average insurance cost for a 2024 Nissan Rogue compared to the Honda CR-V is $108 more each year.

- Compared to the Ford Bronco Sport – The 2024 Nissan Rogue has an average MSRP that is $368 cheaper than the Ford Bronco Sport ($34,225 versus $34,593). The average insurance cost for a 2024 Rogue compared to the Ford Bronco Sport is $188 more every 12 months.

For 2022, 186,480 Nissan Rogues were sold. In comparison, Toyota sold 399,941 RAV4s and the Honda sold 238,155 CR-Vs in the same timeframe.

Insurance rates by U.S. city

Depending on your location, the cost of insurance for a Nissan Rogue spans a wide range, from cheaper premiums like $1,810 a year in Charlotte, NC, or $1,744 in Virginia Beach, VA, to expensive rates like $2,816 a year in Miami, FL, and $3,274 in New Orleans, LA.

Costs in some other cities include Seattle, WA, at $2,292 per year, San Francisco, CA, costing $2,808, Chicago, IL, at an estimated $2,330, and San Antonio, TX, averaging $2,148.

Rates within each of those cities can vary substantially, however. Living in a high-crime neighborhood can cause rates to increase substantially.

The chart data below shows average insurance cost for a Nissan Rogue for the thirty cities with the largest population in the U.S.

During his career as an independent insurance agent,

During his career as an independent insurance agent,