- Lincoln Nautilus car insurance costs $2,534 per year ($211 per month) on average for a full coverage policy.

- Drivers can find the cheapest insurance on the Nautilus Premiere trim level at $2,400 per year. The Nautilus Black Label has the highest rates at $2,724 per year.

- When compared to other midsize luxury SUVs, the 2024 Lincoln Nautilus is one of the cheaper midsize luxury SUVs to insure, costing $316 less per year on average.

- Nautilus insurance rates range from $980 to $2,800 depending on the state you live in.

How much does Lincoln Nautilus car insurance cost?

Drivers should budget an average of $2,534 annually to insure a Lincoln Nautilus for full coverage, which is the equivalent of around $211 a month. Collision coverage will cost around $1,080 a year, liability and medical (or PIP) coverage costs approximately $856, and the remaining comprehensive (or other-than-collision) coverage is an estimated $598.

The chart below details how average Lincoln Nautilus car insurance rates fluctuate based on the age of the driver and $250, $500, and $1,000 physical damage coverage deductibles.

Which Nautilus has the cheapest insurance?

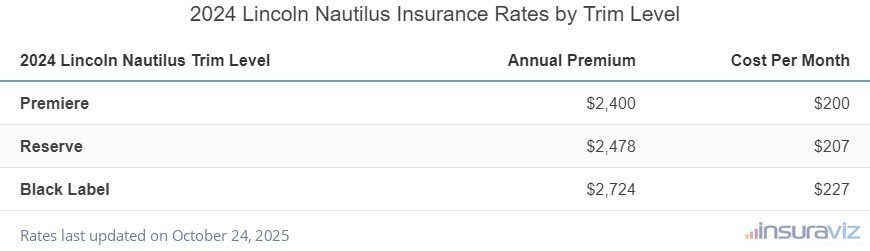

The cheapest trim level of Lincoln Nautilus to insure is the Premiere at an estimated $2,400 per year. The most expensive trim level of Lincoln Nautilus to insure is the Black Label at $2,724 per year.

The table below displays average annual and semi-annual Lincoln Nautilus car insurance rates, in addition to a monthly amount for budgeting, for each 2024 model and trim level.

| 2024 Lincoln Nautilus Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Premiere | $2,400 | $200 |

| Reserve | $2,478 | $207 |

| Black Label | $2,724 | $227 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Nautilus insurance rates vs. the competition

The Lincoln Nautilus ranks 13th out of 41 total vehicles in the midsize luxury SUV segment for auto insurance affordability. The Nautilus costs an average of $2,534 per year for full coverage insurance, while the segment median average cost is $2,850 annually, a difference of $316 per year.

When Nautilus car insurance cost is compared to other midsize luxury SUVs, the Nautilus costs $128 more per year than the Lexus RX 350, $534 less than the BMW X5, $138 more than the Acura MDX, and $270 more than the Cadillac XT5.

The chart below shows how average Lincoln Nautilus insurance rates compare to the other top-selling midsize luxury SUVs in America. We also included a more comprehensive rate table after the chart that compares average car insurance rates for every vehicle in the midsize luxury SUV segment.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Jaguar E-Pace | $2,242 | -$292 |

| 2 | Cadillac XT5 | $2,264 | -$270 |

| 3 | Infiniti QX50 | $2,330 | -$204 |

| 4 | Cadillac XT6 | $2,348 | -$186 |

| 5 | Infiniti QX60 | $2,358 | -$176 |

| 6 | Mercedes-Benz AMG GLB35 | $2,364 | -$170 |

| 7 | Acura MDX | $2,396 | -$138 |

| 8 | Lexus RX 350 | $2,406 | -$128 |

| 9 | Lexus TX 350 | $2,440 | -$94 |

| 10 | Lexus RX 350h | $2,468 | -$66 |

| 11 | Lexus TX 500h | $2,506 | -$28 |

| 12 | Lexus RX 500h | $2,514 | -$20 |

| 13 | Lincoln Nautilus | $2,534 | -- |

| 14 | Lexus RX 450h | $2,538 | $4 |

| 15 | Volvo V90 | $2,558 | $24 |

| 16 | Audi SQ5 | $2,646 | $112 |

| 17 | Mercedes-Benz GLE350 | $2,680 | $146 |

| 18 | Lincoln Aviator | $2,698 | $164 |

| 19 | Lexus GX 550 | $2,728 | $194 |

| 20 | Volvo V60 | $2,808 | $274 |

| 21 | Land Rover Discovery Sport | $2,814 | $280 |

| 22 | Mercedes-Benz GLE450 | $2,826 | $292 |

| 23 | Cadillac Lyriq | $2,852 | $318 |

| 24 | Volvo EX90 | $2,876 | $342 |

| 25 | Audi Q7 | $2,912 | $378 |

| 26 | Genesis GV80 | $2,926 | $392 |

| 27 | Mercedes-Benz AMG GLC43 | $2,938 | $404 |

| 28 | Audi e-tron | $2,994 | $460 |

| 29 | Tesla Model X | $3,016 | $482 |

| 30 | BMW X5 | $3,068 | $534 |

| 31 | Audi Q8 | $3,082 | $548 |

| 32 | Land Rover Discovery | $3,100 | $566 |

| 33 | Mercedes-Benz AMG GLE53 | $3,120 | $586 |

| 34 | Audi SQ7 | $3,224 | $690 |

| 35 | BMW iX | $3,272 | $738 |

| 36 | BMW X6 | $3,350 | $816 |

| 37 | Land Rover Range Rover Sport | $3,492 | $958 |

| 38 | Audi RS 6 | $3,564 | $1,030 |

| 39 | Porsche Cayenne | $3,594 | $1,060 |

| 40 | BMW XM | $3,938 | $1,404 |

| 41 | Mercedes-Benz AMG GLE63 | $4,046 | $1,512 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

Average insurance rates by location

The cost of insuring your Nautilus can cover a wide range, from lower rates like $2,050 a year in Virginia Beach, VA, or $2,124 in Charlotte, NC, to higher rates like $3,846 a year in New Orleans, LA, and $4,818 in Detroit, MI.

The average car insurance cost for a Lincoln Nautilus in some other cities include Jacksonville, FL, at $2,628 per year, El Paso, TX, at an estimated $2,464, Portland, OR, at $2,814, and San Francisco, CA, averaging $3,300.

The next chart shows average car insurance policy costs for a Lincoln Nautilus in the thirty largest cities in America.

From a state perspective, states like Idaho ($2,132), Iowa ($2,050), and Maine ($1,926) have cheaper car insurance rates, while states like Nevada ($3,022), Florida ($2,946), and Michigan ($3,048) have more expensive auto insurance.

The table below shows average insurance rates for a 2024 Lincoln Nautilus for all fifty U.S. states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,478 | $207 |

| Alaska | $2,214 | $185 |

| Arizona | $2,506 | $209 |

| Arkansas | $2,744 | $229 |

| California | $3,046 | $254 |

| Colorado | $2,792 | $233 |

| Connecticut | $2,870 | $239 |

| Delaware | $2,912 | $243 |

| Florida | $2,946 | $246 |

| Georgia | $2,700 | $225 |

| Hawaii | $2,072 | $173 |

| Idaho | $2,132 | $178 |

| Illinois | $2,434 | $203 |

| Indiana | $2,192 | $183 |

| Iowa | $2,050 | $171 |

| Kansas | $2,632 | $219 |

| Kentucky | $2,792 | $233 |

| Louisiana | $2,846 | $237 |

| Maine | $1,926 | $161 |

| Maryland | $2,530 | $211 |

| Massachusetts | $2,824 | $235 |

| Michigan | $3,048 | $254 |

| Minnesota | $2,398 | $200 |

| Mississippi | $2,614 | $218 |

| Missouri | $2,894 | $241 |

| Montana | $2,510 | $209 |

| Nebraska | $2,356 | $196 |

| Nevada | $3,022 | $252 |

| New Hampshire | $2,050 | $171 |

| New Jersey | $3,048 | $254 |

| New Mexico | $2,330 | $194 |

| New York | $2,952 | $246 |

| North Carolina | $1,970 | $164 |

| North Dakota | $2,346 | $196 |

| Ohio | $2,104 | $175 |

| Oklahoma | $2,852 | $238 |

| Oregon | $2,538 | $212 |

| Pennsylvania | $2,584 | $215 |

| Rhode Island | $3,100 | $258 |

| South Carolina | $2,362 | $197 |

| South Dakota | $2,710 | $226 |

| Tennessee | $2,570 | $214 |

| Texas | $2,528 | $211 |

| Utah | $2,430 | $203 |

| Vermont | $2,158 | $180 |

| Virginia | $2,042 | $170 |

| Washington | $2,482 | $207 |

| West Virginia | $2,458 | $205 |

| Wisconsin | $2,134 | $178 |

| Wyoming | $2,454 | $205 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Additional Rate Information

More rate information and different car insurance scenarios that affect policy cost are listed below.

- Teenage drivers are expensive to insure. Average rates for full coverage Nautilus insurance costs $9,143 per year for a 16-year-old driver, $8,826 per year for a 17-year-old driver, and $7,849 per year for an 18-year-old driver.

- Avoid accidents for cheaper rates. Multiple at-fault accidents raise rates, possibly as much as $1,234 per year for a 30-year-old driver and even as much as $642 per year for a 60-year-old driver.

- Increasing deductibles makes car insurance cheaper. Raising deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Lowering deductibles makes car insurance more expensive. Lowering your physical damage coverage deductibles from $500 to $250 could cost an additional $396 per year for a 40-year-old driver and $786 per year for a 20-year-old driver.

- As age goes up, auto insurance cost goes down. The difference in insurance rates for a Nautilus between a 40-year-old driver ($2,534 per year) and a 20-year-old driver ($5,108 per year) is $2,574, or a savings of 67.4%.

- Research discounts to lower the cost. Discounts may be available if the insureds sign their policy early, are homeowners, are good students, insure multiple vehicles on the same policy, or many other discounts which could save the average driver as much as $434 per year on Lincoln Nautilus insurance.

- Get cheaper rates because of your employer. Many car insurance providers offer discounts for working in professions like farmers, emergency medical technicians, accountants, nurses, college professors, and other occupations. Being employed in a qualifying profession could potentially save between $76 and $233 on your yearly auto insurance bill, subject to policy limits.