The Santa Fe was Hyundai’s first entry into the SUV market way back in 2000. Since then, it has positioned itself strongly in the midsize SUV market, selling over 100,000 units per year in the United States.

Featuring both two and three-row configurations, a new plug-in variant, HTRAC All-Wheel Drive system, Hyundai’s SmartSense safety suite, and a starting MSRP of $29,360, the Santa Fe is looking to make waves.

But how does the cost to insure a Santa Fe measure up to competitors like the Honda CR-V, Toyota RAV4, and the Mazda CX-5?

We aim to answer that question and a lot more as we break down insurance rates for the Hyundai Santa Fe.

Factors Affecting Hyundai Santa Fe Insurance Rates

Did you know that being married can lower your car insurance rates? How about parking your car in the garage? Or even having a good credit score?

There are many different factors that go into car insurance rate calculations.

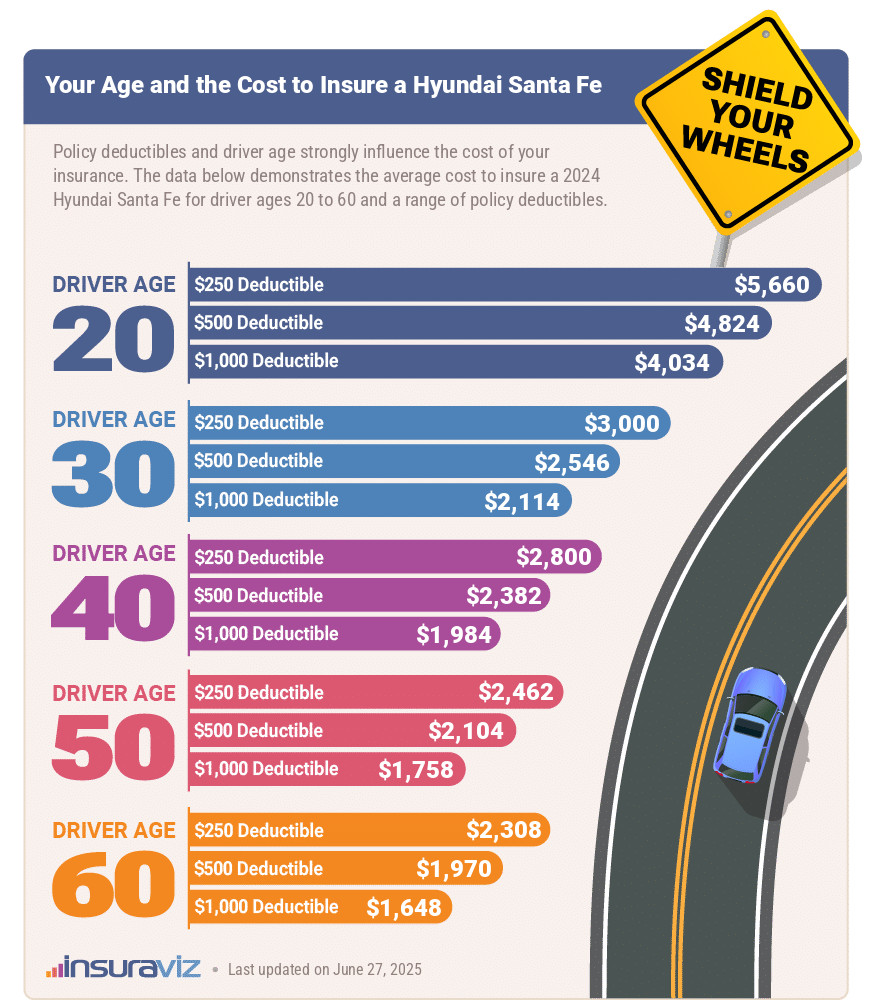

Two of the larger ones are your age and the deductible you choose for your policy.

The following graphic illustrates how insurance on your Santa Fe can vary based on differences in driver age and physical damage deductibles.

Hyundai Santa Fe car insurance rates average $2,426 annually, or about $202 if paid each month. In the graphic above, the average rate is the Drive Age 40 group with the $500 deductible.

Chances are good that you’re not exactly 40, so if you’re younger, you can expect higher rates. If you’re older, your rates should be a little less. If you’re over the age of 65, you’re most likely seeing prices increase a little each year.

Policy deductibles are a pretty big factor when it comes to car insurance rates. This is the amount that you’ll have to pay out-of-pocket if you have a claim. So if you have a lower deductible policy, you’re going to pay more each year or month for your coverage.

Conversely, if you chose a higher deductible like $1,000 or even $1,500, then you’re saving money each month over a lower deductible policy.

Another factor that directly impacts your Santa Fe insurance rates is the model year of your vehicle. Older models cost less to insure due to a lower vehicle value.

The next table shows average full coverage car insurance rates for the 2013 through 2024 Santa Fe models.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Hyundai Santa Fe | $2,426 | $202 |

| 2023 Hyundai Santa Fe | $2,392 | $199 |

| 2022 Hyundai Santa Fe | $2,282 | $190 |

| 2021 Hyundai Santa Fe | $2,264 | $189 |

| 2020 Hyundai Santa Fe | $2,200 | $183 |

| 2019 Hyundai Santa Fe | $2,066 | $172 |

| 2018 Hyundai Santa Fe | $2,102 | $175 |

| 2017 Hyundai Santa Fe | $1,962 | $164 |

| 2016 Hyundai Santa Fe | $1,732 | $144 |

| 2015 Hyundai Santa Fe | $1,644 | $137 |

| 2014 Hyundai Santa Fe | $1,584 | $132 |

| 2013 Hyundai Santa Fe | $1,564 | $130 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Hyundai Santa Fe trim levels for each model year. Updated October 24, 2025

Competitor Analysis: Midsize SUV Segment

The Hyundai Santa Fe ranks 21st out of 34 total comparison vehicles in the 2024 midsize SUV segment for insurance cost. The Santa Fe costs an average of $2,426 per year to insure for full coverage and the category median rate is $2,370 annually, a difference of $56 per year.

When compared to other popular models, the average cost of insurance for a Hyundai Santa Fe is $250 more per year than the Ford Explorer, $384 more per year than the Subaru Outback, $78 less per year than the Kia Telluride, and $228 less per year than the Tesla Model Y.

The table below shows how average car insurance rates for a 2024 Hyundai Santa Fe compare to all 34 models in the midsize SUV class.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$516 |

| 2 | Nissan Murano | $2,016 | -$410 |

| 3 | Subaru Outback | $2,042 | -$384 |

| 4 | Buick Envista | $2,050 | -$376 |

| 5 | Subaru Ascent | $2,088 | -$338 |

| 6 | Volkswagen Atlas | $2,128 | -$298 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | -$290 |

| 8 | Ford Explorer | $2,176 | -$250 |

| 9 | Toyota Highlander | $2,180 | -$246 |

| 10 | Toyota Venza | $2,190 | -$236 |

| 11 | Chevrolet Traverse | $2,238 | -$188 |

| 12 | Mitsubishi Outlander Sport | $2,254 | -$172 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | -$164 |

| 14 | Ford Edge | $2,270 | -$156 |

| 15 | Kia Sorento | $2,278 | -$148 |

| 16 | GMC Acadia | $2,316 | -$110 |

| 17 | Buick Enclave | $2,320 | -$106 |

| 18 | Honda Pilot | $2,336 | -$90 |

| 19 | Mazda CX-9 | $2,342 | -$84 |

| 20 | Jeep Grand Cherokee | $2,398 | -$28 |

| 21 | Hyundai Santa Fe | $2,426 | -- |

| 22 | Nissan Pathfinder | $2,440 | $14 |

| 23 | Hyundai Palisade | $2,450 | $24 |

| 24 | Chevrolet Blazer | $2,476 | $50 |

| 25 | Kia Telluride | $2,504 | $78 |

| 26 | Toyota 4Runner | $2,572 | $146 |

| 27 | Mazda CX-90 | $2,582 | $156 |

| 28 | Toyota Grand Highlander | $2,610 | $184 |

| 29 | Kia EV9 | $2,630 | $204 |

| 30 | Tesla Model Y | $2,654 | $228 |

| 31 | Ford Bronco | $2,662 | $236 |

| 32 | Jeep Wrangler | $2,740 | $314 |

| 33 | Dodge Durango | $2,942 | $516 |

| 34 | Rivian R1S | $2,950 | $524 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

When we factor vehicle price (MSRP) into the comparison, it enables us to see how average car insurance cost compares between the Santa Fe and midsize non-luxury SUV models that are closest in purchase price.

For the 2024 model year, the average purchase price for a Santa Fe is $43,591, which ranges from $32,500 to $53,000, depending on the trim level being purchased.

The four SUV models closest in price to the Santa Fe are the Mazda CX-9, Volkswagen Atlas Cross Sport, Volkswagen Atlas, and Honda Pilot. The data below shows how those models compare to a 2024 Santa Fe by both sticker price and the cost to insure.

- Compared to the Mazda CX-9 – The 2024 Mazda CX-9 retails for an average of $43,796 ($38,750 to $48,460), which is $205 more expensive than the MSRP for the Hyundai Santa Fe. The cost to insure a Santa Fe compared to the Mazda CX-9 is $84 more each year on average.

- Compared to the Volkswagen Atlas Cross Sport – Having an average sticker price of $43,927 and ranging from $36,715 to $51,840, the Volkswagen Atlas Cross Sport costs $336 more than the MSRP for the Hyundai Santa Fe. The cost to insure a 2024 Hyundai Santa Fe compared to the Volkswagen Atlas Cross Sport is $290 more annually on average.

- Compared to the Volkswagen Atlas – The Volkswagen Atlas has an average sticker price of $44,111, ranging from $37,725 to $52,850, which is $520 more expensive than the MSRP for the Hyundai Santa Fe. Anticipate paying around $298 less each year to insure the Volkswagen Atlas compared to a Santa Fe.

- Compared to the Honda Pilot – The 2024 Honda Pilot has an average sticker price of $44,166, ranging from $37,090 to $52,480, which is $575 more expensive than the average cost of the Hyundai Santa Fe. Car insurance for the Honda Pilot costs an average of $90 less each year than the Hyundai Santa Fe.

Insurance Rates by Trim Level

With Hyundai Santa Fe auto insurance rates ranging from $2,184 to $2,578 per year on average, the most economical trim level to insure is the SE. The second cheapest trim level to insure is the SEL also at $2,300 per year. On average, plan on paying at least $182 per month for a policy with full coverage.

The two most expensive models of Hyundai Santa Fe to insure are the Plug-in Hybrid Limited the Calligraphy at $2,516 per year. Those trim levels will cost an extra $394 per year over the least expensive SE model.

Why does trim level affect the cost of car insurance? This is mainly due to the additional cost added to the vehicle as options are added with each trim. The more options you add, the more risk your insurance company assumes when you get behind the wheel.

The next table shows the average annual premium and cost per month for each Hyundai Santa Fe trim level.

| 2024 Hyundai Santa Fe Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| SE | $2,184 | $182 |

| SEL | $2,300 | $192 |

| XRT | $2,348 | $196 |

| Hybrid Blue | $2,396 | $200 |

| Hybrid SEL Premium | $2,474 | $206 |

| Limited | $2,482 | $207 |

| Plug-in Hybrid SEL Convenience | $2,482 | $207 |

| Hybrid Limited | $2,508 | $209 |

| Calligraphy | $2,516 | $210 |

| Plug-in Hybrid Limited | $2,578 | $215 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Average rates by U.S. city and state

The cost to insure a Hyundai Santa Fe can range widely depending on where you live. Different states have different laws, legal systems, and regulations that impact the cost of coverage.

In addition, if you live in an area that gets severe weather like flooding, hail, or even wildfires, then chances are you’re paying more to cover that extra risk.

If you live in a neighborhood that has a high rate of vehicle theft or vandalism, then, again, you’re probably paying more because of it.

The chart below visualizes Hyundai Santa Fe car insurance rates for the most populated metro areas in America.

When comparing Hyundai Santa Fe insurance rates from a broader perspective, states like Maine ($1,848) and Virginia ($1,956) have cheaper car insurance rates, while states like Nevada ($2,892), Florida ($2,822), and Michigan ($2,920) have expensive car insurance rates.

The table below shows average annual, semi-annual, and monthly insurance rates for a 2024 Hyundai Santa Fe in all 50 states.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $2,370 | $198 |

| Alaska | $2,120 | $177 |

| Arizona | $2,400 | $200 |

| Arkansas | $2,628 | $219 |

| California | $2,916 | $243 |

| Colorado | $2,674 | $223 |

| Connecticut | $2,748 | $229 |

| Delaware | $2,790 | $233 |

| Florida | $2,822 | $235 |

| Georgia | $2,586 | $216 |

| Hawaii | $1,986 | $166 |

| Idaho | $2,040 | $170 |

| Illinois | $2,330 | $194 |

| Indiana | $2,100 | $175 |

| Iowa | $1,964 | $164 |

| Kansas | $2,520 | $210 |

| Kentucky | $2,672 | $223 |

| Louisiana | $2,724 | $227 |

| Maine | $1,848 | $154 |

| Maryland | $2,420 | $202 |

| Massachusetts | $2,704 | $225 |

| Michigan | $2,920 | $243 |

| Minnesota | $2,296 | $191 |

| Mississippi | $2,504 | $209 |

| Missouri | $2,772 | $231 |

| Montana | $2,400 | $200 |

| Nebraska | $2,254 | $188 |

| Nevada | $2,892 | $241 |

| New Hampshire | $1,966 | $164 |

| New Jersey | $2,922 | $244 |

| New Mexico | $2,234 | $186 |

| New York | $2,824 | $235 |

| North Carolina | $1,884 | $157 |

| North Dakota | $2,244 | $187 |

| Ohio | $2,014 | $168 |

| Oklahoma | $2,728 | $227 |

| Oregon | $2,428 | $202 |

| Pennsylvania | $2,476 | $206 |

| Rhode Island | $2,970 | $248 |

| South Carolina | $2,262 | $189 |

| South Dakota | $2,594 | $216 |

| Tennessee | $2,462 | $205 |

| Texas | $2,420 | $202 |

| Utah | $2,330 | $194 |

| Vermont | $2,066 | $172 |

| Virginia | $1,956 | $163 |

| Washington | $2,376 | $198 |

| West Virginia | $2,354 | $196 |

| Wisconsin | $2,046 | $171 |

| Wyoming | $2,350 | $196 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

In conclusion, here are a few additional rate figures as well as some ways to reduce insurance costs, if that’s your goal.

- Santa Fe insurance rates for teenagers are high. Average rates for full coverage Santa Fe insurance costs $8,621 per year for a 16-year-old driver, $8,389 per year for a 17-year-old driver, and $7,578 per year for an 18-year-old driver.

- Choosing a higher physical damage deductible lowers rates. Increasing your policy deductibles from $500 to $1,000 could save around $406 per year for a 40-year-old driver and $802 per year for a 20-year-old driver.

- The lower deductible you choose, the higher the policy cost. Lowering your physical damage coverage deductibles from $500 to $250 could cost an additional $426 per year for a 40-year-old driver and $850 per year for a 20-year-old driver.

- Earn policy discounts to save money. Discounts may be available if the insureds take a defensive driving course, are senior citizens, sign their policy early, are military or federal employees, drive a vehicle with safety or anti-theft features, or many other policy discounts which could save the average driver as much as $412 per year.

- As driver age goes up, rates trend downward. The difference in insurance cost for a Hyundai Santa Fe between a 60-year-old driver ($2,008 per year) and a 30-year-old driver ($2,592 per year) is $584, or a savings of 25.4%.

- Raise your credit score for cheaper insurance rates. Having a good credit rating over 800 could save as much as $381 per year versus a rating of 670-739. Conversely, a below-average credit rating could cost around $442 more per year. Some states do not allow credit scores to be used as a rating factor, so this discount may not be available to you depending on where you live.