- Subaru Outback insurance costs an average of $2,042 per year or around $170 per month, depending on the trim level.

- Out of 34 vehicles in the 2024 model year midsize SUV segment, the Outback ranks third for insurance affordability.

- The Outback base trim level is the cheapest to insure at around $1,860 per year. The most expensive trim is the Touring XT at $2,142 per year.

- Subaru Outback car insurance rates in a few larger cities include $2,262 in San Diego, CA, $2,184 in Dallas, TX, and $2,290 in Phoenix, AZ.

How much does Subaru Outback insurance cost?

Subaru Outback insurance averages around $2,042 a year, or around $170 monthly. You can expect to pay about $328 less annually to insure a Subaru Outback compared to the average rate for midsize SUVs, and $234 less per year than the $2,276 average for all vehicles.

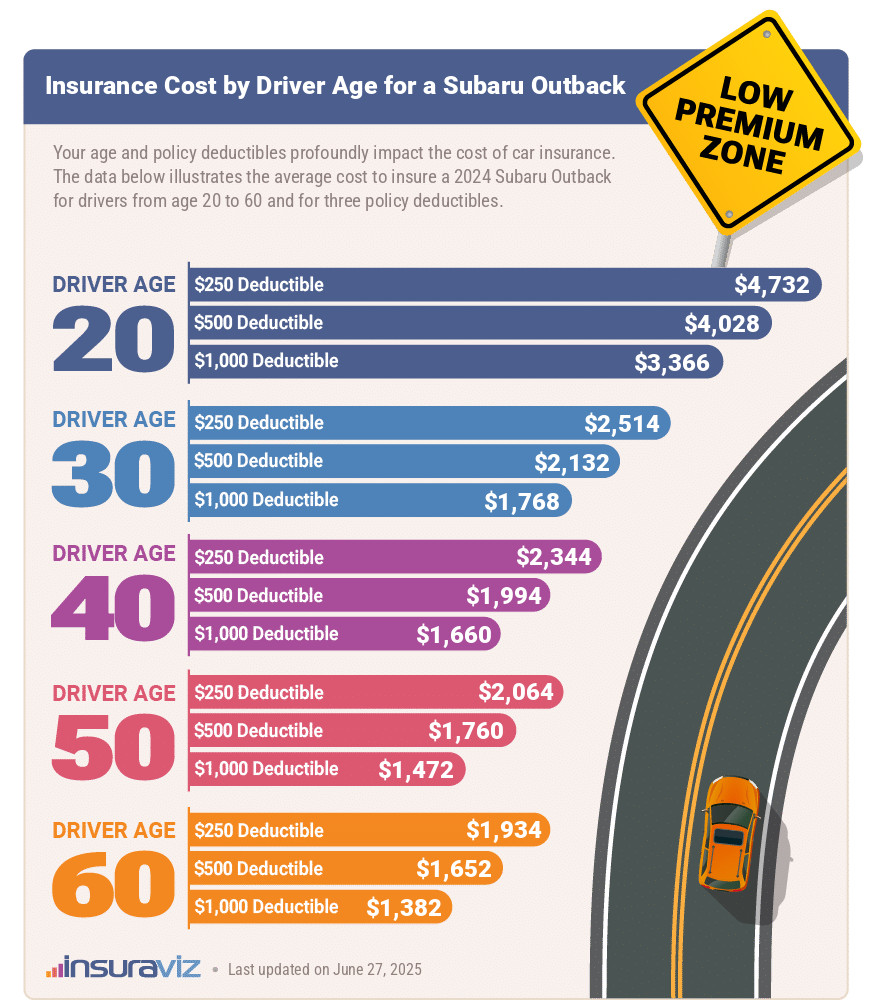

The image below shows how average car insurance rates for a 2024 Outback change based on driver age and a range of policy deductibles. Insurance rate averages vary from a low of $1,414 per year for a driver age 60 with high physical damage deductibles to the highest rate of $4,848 each year for a driver age 20 with low deductibles.

Your age and policy deductible are just two factors that impact the cost of insurance on your Outback. Another one is the age of your vehicle.

Generally, as your Outback gets older, insurance will tend to decrease. This is thanks to depreciation and a reduced vehicle value. This “replacement cost” has an inverse relationship to your premiums, so as your Outback gets cheaper to replace (in the eyes of your insurance company), you’ll pay less for coverage.

The following table demonstrates how vehicle age impacts insurance rates, showing average full coverage Subaru Outback car insurance rates for the 2013 to 2024 model years.

| Model Year and Vehicle | Annual Premium | Cost Per Month |

|---|---|---|

| 2024 Subaru Outback | $2,042 | $170 |

| 2023 Subaru Outback | $2,010 | $168 |

| 2022 Subaru Outback | $2,010 | $168 |

| 2021 Subaru Outback | $2,100 | $175 |

| 2020 Subaru Outback | $2,036 | $170 |

| 2019 Subaru Outback | $1,814 | $151 |

| 2018 Subaru Outback | $1,702 | $142 |

| 2017 Subaru Outback | $1,614 | $135 |

| 2016 Subaru Outback | $1,474 | $123 |

| 2015 Subaru Outback | $1,328 | $111 |

| 2014 Subaru Outback | $1,282 | $107 |

| 2013 Subaru Outback | $1,352 | $113 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all Subaru Outback trim levels for each model year. Updated October 24, 2025

How does Subaru Outback insurance cost compare?

When compared to the entire midsize SUV category, car insurance for a 2024 Subaru Outback costs $356 less per year than the Jeep Grand Cherokee, $138 less than the Toyota Highlander, $134 less than the Ford Explorer, and $132 more than the Honda Passport.

The Subaru Outback ranks third out of 34 total comparison vehicles in the midsize SUV segment. The Outback costs an average of $2,042 per year for full coverage insurance and the category median rate is $2,370 annually, a difference of $328 per year.

The table below shows how average Subaru Outback car insurance rates compare to the rest of the 2024 midsize SUV segment, ranked #1 through #34 for insurance affordability.

| Rank | Make and Model | Annual Premium | Difference |

|---|---|---|---|

| 1 | Honda Passport | $1,910 | -$132 |

| 2 | Nissan Murano | $2,016 | -$26 |

| 3 | Subaru Outback | $2,042 | -- |

| 4 | Buick Envista | $2,050 | $8 |

| 5 | Subaru Ascent | $2,088 | $46 |

| 6 | Volkswagen Atlas | $2,128 | $86 |

| 7 | Volkswagen Atlas Cross Sport | $2,136 | $94 |

| 8 | Ford Explorer | $2,176 | $134 |

| 9 | Toyota Highlander | $2,180 | $138 |

| 10 | Toyota Venza | $2,190 | $148 |

| 11 | Chevrolet Traverse | $2,238 | $196 |

| 12 | Mitsubishi Outlander Sport | $2,254 | $212 |

| 13 | Mitsubishi Outlander PHEV | $2,262 | $220 |

| 14 | Ford Edge | $2,270 | $228 |

| 15 | Kia Sorento | $2,278 | $236 |

| 16 | GMC Acadia | $2,316 | $274 |

| 17 | Buick Enclave | $2,320 | $278 |

| 18 | Honda Pilot | $2,336 | $294 |

| 19 | Mazda CX-9 | $2,342 | $300 |

| 20 | Jeep Grand Cherokee | $2,398 | $356 |

| 21 | Hyundai Santa Fe | $2,426 | $384 |

| 22 | Nissan Pathfinder | $2,440 | $398 |

| 23 | Hyundai Palisade | $2,450 | $408 |

| 24 | Chevrolet Blazer | $2,476 | $434 |

| 25 | Kia Telluride | $2,504 | $462 |

| 26 | Toyota 4Runner | $2,572 | $530 |

| 27 | Mazda CX-90 | $2,582 | $540 |

| 28 | Toyota Grand Highlander | $2,610 | $568 |

| 29 | Kia EV9 | $2,630 | $588 |

| 30 | Tesla Model Y | $2,654 | $612 |

| 31 | Ford Bronco | $2,662 | $620 |

| 32 | Jeep Wrangler | $2,740 | $698 |

| 33 | Dodge Durango | $2,942 | $900 |

| 34 | Rivian R1S | $2,950 | $908 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Premiums are averaged for all trim levels for each vehicle from the 2024 model year. Updated October 24, 2025

By factoring the MSRP for each vehicle in the segment, we can compare rates between the Outback and other SUV models that are closest in price. A 2024 Outback has an average purchase price of $37,183 and ranges from $28,895 to $42,795.

The midsize non-luxury SUVs that have the most similar average MSRP to the Outback for the 2024 model year are the Tesla Model Y, Toyota Venza, Kia Sorento, and Subaru Ascent.

The list below shows how those models compare to the Subaru Outback by sticker price and average insurance cost. For additional makes and models, please see our insurance rate comparison page.

- Compared to the Tesla Model Y – The 2024 Tesla Model Y sells for an average of $36,723 ($31,890 to $41,390), which is $460 cheaper than the average MSRP for the Subaru Outback. The cost to insure a 2024 Outback compared to the Tesla Model Y is $612 less per year on average.

- Compared to the Toyota Venza – The Toyota Venza sells for an average of $39,343, ranging from $31,890 to $43,065, which is $2,160 more expensive than the Subaru Outback. The cost to insure a 2024 Outback compared to the Toyota Venza is $148 less every 12 months on average.

- Compared to the Kia Sorento – Having an average MSRP of $40,818 ($32,000 to $52,000), the Kia Sorento costs $3,635 more than the average MSRP for the Subaru Outback. Car insurance on the Kia Sorento costs an average of $236 more each year than the Subaru Outback.

- Compared to the Subaru Ascent – For a new model, the sticker price on the Subaru Ascent averages $4,412 more than the average sticker price for the Subaru Outback ($41,595 compared to $37,183). Expect to pay an average of $46 more every 12 months for full-coverage insurance on the Subaru Ascent compared to an Outback.

What is the cheapest Outback to insure?

The cheapest Subaru Outback insurance rates can be found on the base model at $1,860 per year. The second cheapest trim is the Premium at $1,922 per year, and the third cheapest trim level to insure is the Limited at $2,028 per year.

For more well-appointed Outback trim levels, the most expensive car insurance rate is on the Outback Touring XT at $2,142 per year.

In most cases, as the vehicle cost increases with added options or features, the cost of insurance will increase as well. Some exceptions to this rule may occur when a particular trim level has additional safety features that actually bring the cost of collision and/or liability down. More safety features can mean fewer accidents (automatic braking) and fewer liability bodily injury claims (pedestrian warning).

The next table shows average car insurance rates for both annual and 6-month policy terms for each 2024 Subaru Outback trim level.

| 2024 Subaru Outback Trim Level | Annual Premium | Cost Per Month |

|---|---|---|

| Base | $1,860 | $155 |

| Premium | $1,922 | $160 |

| Limited | $2,028 | $169 |

| Onyx Edition | $2,032 | $169 |

| Onyx Edition XT | $2,090 | $174 |

| Wilderness | $2,102 | $175 |

| Limited XT | $2,106 | $176 |

| Touring | $2,106 | $176 |

| Touring XT | $2,142 | $179 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500 and UM/UIM and medical payments coverages are included. Updated October 24, 2025

Average Outback insurance rates where you live

Depending on where you live, auto insurance rates on an Outback vary considerably, from cheaper premiums like $1,712 a year in Charlotte, NC, or $1,762 in Columbus, OH, to higher rates such as $3,278 a year in New York City and $2,978 in Las Vegas, NV.

The cost to insure an Outback in some additional cities include Dallas, TX, at $2,184 per year, Omaha, NE, costing $1,996, Indianapolis, IN, at $1,858, and Nashville, TN, averaging $2,116.

The data below ranks average estimated Subaru Outback insurance cost in the highest populated cities in the United States.

Average Outback insurance cost by U.S. state

On a state level, some of the cheapest states to insure a Subaru Outback in include Iowa at an average cost of $1,556 per year, North Carolina at $1,654 per year, and Maine at $1,590 per year.

Subaru Outback car insurance rates in most states fall closer to the average, with states like Arizona, Texas, and Montana included in this group with average Subaru Outback insurance rates of $2,022, $2,038, and $2,024 per year, respectively.

| U.S. State | Annual Premium | Cost Per Month |

|---|---|---|

| Alabama | $1,996 | $166 |

| Alaska | $1,784 | $149 |

| Arizona | $2,022 | $169 |

| Arkansas | $2,216 | $185 |

| California | $2,456 | $205 |

| Colorado | $2,252 | $188 |

| Connecticut | $2,316 | $193 |

| Delaware | $2,350 | $196 |

| Florida | $2,376 | $198 |

| Georgia | $2,180 | $182 |

| Hawaii | $1,674 | $140 |

| Idaho | $1,718 | $143 |

| Illinois | $1,964 | $164 |

| Indiana | $1,770 | $148 |

| Iowa | $1,654 | $138 |

| Kansas | $2,122 | $177 |

| Kentucky | $2,252 | $188 |

| Louisiana | $2,296 | $191 |

| Maine | $1,556 | $130 |

| Maryland | $2,040 | $170 |

| Massachusetts | $2,278 | $190 |

| Michigan | $2,460 | $205 |

| Minnesota | $1,936 | $161 |

| Mississippi | $2,108 | $176 |

| Missouri | $2,336 | $195 |

| Montana | $2,024 | $169 |

| Nebraska | $1,902 | $159 |

| Nevada | $2,436 | $203 |

| New Hampshire | $1,654 | $138 |

| New Jersey | $2,462 | $205 |

| New Mexico | $1,882 | $157 |

| New York | $2,380 | $198 |

| North Carolina | $1,590 | $133 |

| North Dakota | $1,892 | $158 |

| Ohio | $1,694 | $141 |

| Oklahoma | $2,298 | $192 |

| Oregon | $2,048 | $171 |

| Pennsylvania | $2,088 | $174 |

| Rhode Island | $2,500 | $208 |

| South Carolina | $1,906 | $159 |

| South Dakota | $2,188 | $182 |

| Tennessee | $2,074 | $173 |

| Texas | $2,038 | $170 |

| Utah | $1,962 | $164 |

| Vermont | $1,740 | $145 |

| Virginia | $1,646 | $137 |

| Washington | $2,000 | $167 |

| West Virginia | $1,984 | $165 |

| Wisconsin | $1,722 | $144 |

| Wyoming | $1,982 | $165 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Comprehensive and collision deductibles are $500. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Updated October 24, 2025

Agent perspective when insuring your Outback

I may be a little biased but I love the Subaru Outback. It’s safe, versatile, spacious, and gets great fuel economy for an All-Wheel Drive vehicle.

The purchase price is definitely not a barrier when buying an Outback, so what’s not to love? There are not many vehicles that cost under $30,000 new from the dealer anymore, and you can be out the door in the Outback’s top-tier Touring XT trim for about $43,000.

With nine available trims available for the current model year, you should be able to find a model that has the perfect balance of features and price.

Subaru vehicles hold their value as well, so when it comes time to sell your current Outback and move up to the newest model, you’re not going to take a huge financial hit.

On the insurance side, it gets even better because the Outback is one of the most affordable compact SUVs to insure. Due to the excellent EyeSight suite and the Outback’s 5-star NHTSA overall safety rating (2024 model), you can drive with confidence knowing you’re in one of the safest vehicles in it’s class. The 2023 model also earned the a Top Safety Pick+ rating from the Insurance Institute for Highway Safety, which is the highest honor bestowed by that organization.

You really cannot go wrong purchasing an Outback from either a purchase price or insurance cost standpoint. There are few vehicles that have cheaper car insurance rates than you’ll find on the Outback, and even older models earn rankings near the top of the compact SUV segment.

If you’re in the market for a Subaru Outback, it is definitely on my shortlist for the best overall insurance value.

During his career as an independent insurance agent,

During his career as an independent insurance agent,