- Lake Charles car insurance cost averages $2,554 per year for a full coverage insurance policy.

- Vehicles like the Chevrolet Trailblazer, Subaru Crosstrek, Honda CR-V, and Volkswagen Tiguan are the top choices for cheap car insurance in Lake Charles.

- A few models with the most affordable auto insurance in their segment include the Nissan Titan at $2,388 per year, Subaru Crosstrek at $1,884 per year, Jaguar E-Pace at $2,384 per year, and Acura Integra at $2,268 per year.

- Auto insurance quotes in Lake Charles can range significantly from as low as $35 per month for minimum liability limits to well over $669 per month for drivers requiring high-risk coverage.

How much does car insurance cost in Lake Charles?

Average car insurance rates in Lake Charles cost $2,554 per year, or about $213 per month. That’s 11.5% more expensive than the overall U.S. overall average rate of $2,276 per year.

The average cost of car insurance in Louisiana is $2,696 per year, so Lake Charles, Louisiana, drivers pay an average of $142 less per year than the overall Louisiana state-wide average rate. When compared to other larger cities in Louisiana, the average cost of auto insurance in Lake Charles is approximately $56 per year less than in Lafayette, $104 per year more than in Shreveport, and $1,092 per year cheaper than in New Orleans.

The age of the driver makes a big difference in the price of auto insurance. The list below illustrates this point by breaking down average car insurance rates in Lake Charles for drivers from 16 to 60.

Average car insurance rates in Lake Charles for drivers age 16 to 60

- 16 year old – $9,085 per year or $757 per month

- 17 year old – $8,802 per year or $734 per month

- 18 year old – $7,890 per year or $658 per month

- 19 year old – $7,187 per year or $599 per month

- 20 year old – $5,134 per year or $428 per month

- 30 year old – $2,722 per year or $227 per month

- 40 year old – $2,554 per year or $213 per month

- 50 year old – $2,260 per year or $188 per month

- 60 year old – $2,118 per year or $177 per month

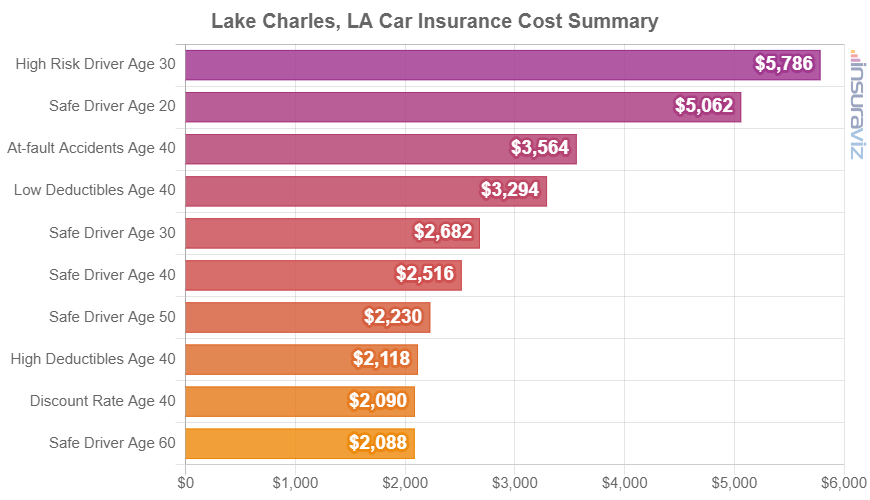

The chart below shows a summary of auto insurance rates in Lake Charles for 2024 model year vehicles, averaged based on a wide range of driver ages, policy deductibles, and potential risk scenarios.

The average cost of car insurance per month in Lake Charles is $213, and ranges from $177 to $489 for the data shown in the chart above.

Car insurance rates can vary considerably and depend on a lot of factors. The potential for large premium differences stresses the need to get multiple auto insurance quotes when shopping online for cheaper auto insurance.

In Lake Charles, which vehicles are cheapest to insure?

The models with the best car insurance rates in Lake Charles tend to be compact SUVs like the Subaru Crosstrek, Chevrolet Trailblazer, Buick Envision, and Toyota Corolla Cross.

Average car insurance quotes for those models cost $2,070 or less per year, or $173 per month, to get full coverage.

Some additional vehicles that rank in the top 20 in our auto insurance price comparison are the Ford Bronco Sport, Volkswagen Tiguan, Subaru Outback, and Buick Envista. Average auto insurance rates are slightly more for those models than the cheapest small SUVs that rank at the top, but they still have an average insurance cost of $2,216 or less per year ($185 per month) in Lake Charles.

The next table breaks down the vehicles with the cheapest overall insurance rates in Lake Charles, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,884 | $157 |

| 2 | Chevrolet Trailblazer | $1,918 | $160 |

| 3 | Kia Soul | $1,992 | $166 |

| 4 | Nissan Kicks | $2,008 | $167 |

| 5 | Honda Passport | $2,032 | $169 |

| 6 | Buick Envision | $2,044 | $170 |

| 7 | Toyota Corolla Cross | $2,052 | $171 |

| 8 | Hyundai Venue | $2,070 | $173 |

| 9 | Mazda CX-5 | $2,082 | $174 |

| 10 | Ford Bronco Sport | $2,088 | $174 |

| 11 | Volkswagen Tiguan | $2,110 | $176 |

| 12 | Acura RDX | $2,132 | $178 |

| 13 | Nissan Murano | $2,144 | $179 |

| 14 | Buick Encore | $2,166 | $181 |

| 15 | Subaru Outback | $2,172 | $181 |

| 16 | Honda CR-V | $2,176 | $181 |

| 17 | Buick Envista | $2,182 | $182 |

| 18 | Volkswagen Taos | $2,186 | $182 |

| 19 | Kia Niro | $2,196 | $183 |

| 20 | Toyota GR Corolla | $2,216 | $185 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

The above table containing 20 of the cheapest vehicles to insure in Lake Charles is probably not the best way to present a detailed summary of Lake Charles car insurance cost. A more useful way to analyze rates in a practical manner is to organize them by the segment they belong to.

This next section goes into detail about the average cost of car insurance by vehicle segment. This should provide a decent idea of the types of vehicles that have the overall best average auto insurance rates. If you read beyond the chart, the next six sections show the cheapest rates for individual models for each segment.

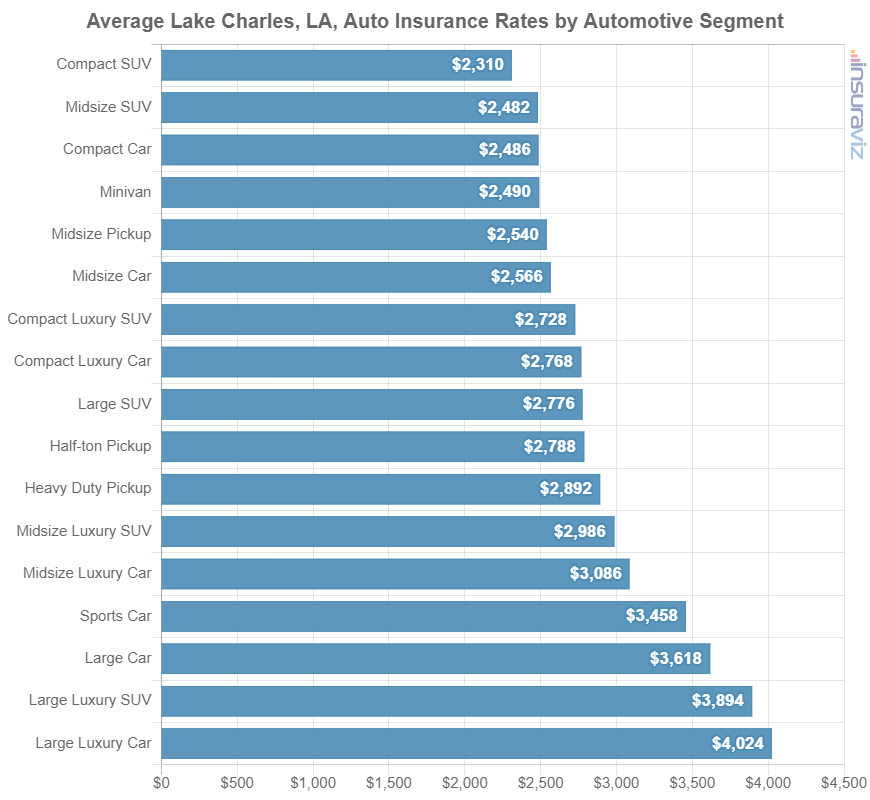

Cost to insure by automotive segment

If you’re looking around at new or used cars, it’s a good idea to have a basic understanding of which kinds of vehicles have less expensive insurance rates. For instance, maybe you’re curious if compact SUVs are cheaper to insure than compact cars or if full-size pickups are cheaper to insure than midsize pickups.

The next chart displays average car insurance rates by segment in Lake Charles. From a segment comparison perspective, small and midsize SUVs, vans and minivans, and midsize pickup trucks tend to have the least expensive average rates, while exotic models have the most expensive overall car insurance rates.

Average insurance rates by segment are handy to make a general comparison, but the insurance cost for specific vehicles ranges quite significantly within each of the segments listed above.

For example, in the small luxury car segment, Lake Charles insurance rates range from the Acura Integra at $2,268 per year for full coverage insurance to the BMW M340i at $3,116 per year, a difference of $848 within that segment.

In the large luxury SUV segment, the average insurance cost ranges from the Infiniti QX80 costing $2,860 per year to the Mercedes-Benz G63 AMG at $5,484 per year, a difference of $2,624 within that segment.

In the upcoming sections, we remove some of this variability by analyzing the cost of car insurance in Lake Charles for individual vehicle models.

Cars with the cheapest auto insurance in Lake Charles

Ranking at the top of the list for the lowest-cost Lake Charles auto insurance rates in the sedan or hatchback segment are the Nissan Sentra, Nissan Leaf, Subaru Impreza, Toyota GR Corolla, and Honda Civic. Insurance rates for these models average $195 or less per month.

Not the cheapest cars to insure, but still very reasonable, are cars like the Toyota Corolla, Honda Accord, Chevrolet Malibu, and Toyota Prius, with an average car insurance cost of $2,486 per year or less.

Some additional cars worth mentioning include the Hyundai Sonata, Volkswagen Arteon, Kia Forte, and Hyundai Ioniq 6, which average between $2,486 and $2,638 per year for auto insurance.

Car insurance for this segment in Lake Charles for a good driver can cost as low as $185 per month, depending on your company and location.

The next table ranks the cars with the lowest-cost average insurance rates in Lake Charles, starting with the Toyota GR Corolla at $2,216 per year ($185 per month) and ending with the Mazda 3 at $2,638 per year ($220 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $2,216 | $185 |

| Nissan Leaf | Compact | $2,236 | $186 |

| Honda Civic | Compact | $2,258 | $188 |

| Nissan Sentra | Compact | $2,338 | $195 |

| Subaru Impreza | Compact | $2,344 | $195 |

| Toyota Prius | Compact | $2,384 | $199 |

| Kia K5 | Midsize | $2,458 | $205 |

| Honda Accord | Midsize | $2,462 | $205 |

| Chevrolet Malibu | Midsize | $2,474 | $206 |

| Toyota Corolla | Compact | $2,486 | $207 |

| Kia Forte | Compact | $2,488 | $207 |

| Volkswagen Arteon | Midsize | $2,506 | $209 |

| Nissan Versa | Compact | $2,516 | $210 |

| Subaru Legacy | Midsize | $2,518 | $210 |

| Hyundai Ioniq 6 | Midsize | $2,538 | $212 |

| Mitsubishi Mirage G4 | Compact | $2,576 | $215 |

| Volkswagen Jetta | Compact | $2,580 | $215 |

| Toyota Crown | Midsize | $2,582 | $215 |

| Hyundai Sonata | Midsize | $2,586 | $216 |

| Mazda 3 | Compact | $2,638 | $220 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to compare rates for all makes and models.

Don’t see rates for your vehicle? No sweat! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free Lake Charles car insurance quotes from top-rated auto insurance companies in Louisiana.

SUVs with affordable car insurance

Ranking in the top five for the cheapest Lake Charles auto insurance rates in the SUV segment (excluding luxury models) are the Subaru Crosstrek, Kia Soul, Chevrolet Trailblazer, Honda Passport, and Nissan Kicks. Car insurance quotes for these 2024 models average $169 or less per month.

Also ranking well in our comparison are SUVs like the Buick Envision, Ford Bronco Sport, Mazda CX-5, and Hyundai Venue, with an average cost of $2,088 per year or less.

Some additional models that rank well include the Buick Encore, Subaru Ascent, Volkswagen Tiguan, and Kia Niro, which average between $2,088 and $2,218 per year for auto insurance.

Car insurance in Lake Charles for this segment for the average driver starts at an average of $157 per month, depending on your company and location.

When the SUV segment is analyzed by vehicle size, the lowest-cost non-luxury compact SUV to insure in Lake Charles is the Subaru Crosstrek at $1,884 per year. For midsize 2024 models, the Honda Passport has the cheapest rates at $2,032 per year. And for large SUVs, the Chevrolet Tahoe has the most affordable rates at $2,396 per year.

The table below ranks the twenty SUVs with the cheapest average car insurance rates in Lake Charles, starting with the Subaru Crosstrek at $1,884 per year and ending with the Subaru Ascent at $2,218 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,884 | $157 |

| Chevrolet Trailblazer | Compact | $1,918 | $160 |

| Kia Soul | Compact | $1,992 | $166 |

| Nissan Kicks | Compact | $2,008 | $167 |

| Honda Passport | Midsize | $2,032 | $169 |

| Buick Envision | Compact | $2,044 | $170 |

| Toyota Corolla Cross | Compact | $2,052 | $171 |

| Hyundai Venue | Compact | $2,070 | $173 |

| Mazda CX-5 | Compact | $2,082 | $174 |

| Ford Bronco Sport | Compact | $2,088 | $174 |

| Volkswagen Tiguan | Compact | $2,110 | $176 |

| Nissan Murano | Midsize | $2,144 | $179 |

| Buick Encore | Compact | $2,166 | $181 |

| Subaru Outback | Midsize | $2,172 | $181 |

| Honda CR-V | Compact | $2,176 | $181 |

| Buick Envista | Midsize | $2,182 | $182 |

| Volkswagen Taos | Compact | $2,186 | $182 |

| Kia Niro | Compact | $2,196 | $183 |

| Subaru Ascent | Midsize | $2,218 | $185 |

| Honda HR-V | Compact | $2,222 | $185 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

See our comprehensive guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view data for vehicles not featured in the table.

Looking for rates for a different SUV? No sweat! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get cheap Lake Charles car insurance quotes from the best auto insurance companies in Louisiana.

Cheap pickups to insure in Lake Charles, Louisiana

The four highest ranking pickups with the most affordable insurance rates in Lake Charles are the Chevrolet Colorado at $2,248 per year, Nissan Titan at $2,388 per year, Nissan Frontier at $2,414 per year, and Ford Ranger at $2,438 per year.

Not the cheapest in the list, but still ranking well, are trucks like the Honda Ridgeline, Toyota Tacoma, Hyundai Santa Cruz, and GMC Sierra 2500 HD, with an average cost of $2,626 per year or less.

From a monthly standpoint, full-coverage insurance on this segment in Lake Charles for a middle-age safe driver can cost as low as $187 per month, depending on the company and where you live.

The comparison table below ranks the twenty pickups with the lowest-cost average car insurance rates in Lake Charles, starting with the Chevrolet Colorado at $187 per month and ending with the Ram Truck at $246 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $2,248 | $187 |

| Nissan Titan | Full-size | $2,388 | $199 |

| Nissan Frontier | Midsize | $2,414 | $201 |

| Ford Ranger | Midsize | $2,438 | $203 |

| Ford Maverick | Midsize | $2,474 | $206 |

| Honda Ridgeline | Midsize | $2,532 | $211 |

| Hyundai Santa Cruz | Midsize | $2,574 | $215 |

| Toyota Tacoma | Midsize | $2,584 | $215 |

| GMC Sierra 2500 HD | Heavy Duty | $2,596 | $216 |

| GMC Canyon | Midsize | $2,626 | $219 |

| Jeep Gladiator | Midsize | $2,688 | $224 |

| GMC Sierra 3500 | Heavy Duty | $2,702 | $225 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $2,728 | $227 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,798 | $233 |

| GMC Sierra | Full-size | $2,818 | $235 |

| Chevrolet Silverado | Full-size | $2,822 | $235 |

| Nissan Titan XD | Heavy Duty | $2,822 | $235 |

| Ford F150 | Full-size | $2,856 | $238 |

| GMC Hummer EV Pickup | Full-size | $2,926 | $244 |

| Ram Truck | Full-size | $2,950 | $246 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

See our guides for midsize pickup insurance and large pickup insurance to view any trucks not shown in the table.

Don’t see your pickup in the list? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Lake Charles car insurance quotes from top-rated companies in Louisiana.

Most affordable sports cars to insure in Lake Charles

The Mazda MX-5 Miata ranks #1 as the cheapest sports car to insure in Lake Charles, followed closely by the Toyota GR86, Ford Mustang, BMW Z4, and Subaru WRX. The 2024 model has an average cost of $2,360 per year for full-coverage insurance.

Rounding out the top 10 are cars like the BMW M2, Subaru BRZ, Nissan Z, and Lexus RC F, with average annual insurance rates of $3,050 per year or less.

From a monthly standpoint, auto insurance rates in Lake Charles on this segment for a middle-age safe driver can cost as low as $197 per month, depending on where you live and the company you use. The table below ranks the sports cars with the lowest-cost average auto insurance rates in Lake Charles, starting with the Mazda MX-5 Miata at $2,360 per year ($197 per month) and ending with the Porsche Taycan at $4,322 per year ($360 per month).

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $2,360 | $197 |

| Toyota GR86 | Sports Car | $2,688 | $224 |

| Ford Mustang | Sports Car | $2,804 | $234 |

| BMW Z4 | Sports Car | $2,818 | $235 |

| Subaru WRX | Sports Car | $2,860 | $238 |

| Toyota GR Supra | Sports Car | $2,866 | $239 |

| BMW M2 | Sports Car | $2,950 | $246 |

| Nissan Z | Sports Car | $2,956 | $246 |

| Lexus RC F | Sports Car | $3,014 | $251 |

| Subaru BRZ | Sports Car | $3,050 | $254 |

| BMW M3 | Sports Car | $3,222 | $269 |

| Porsche 718 | Sports Car | $3,284 | $274 |

| Chevrolet Camaro | Sports Car | $3,316 | $276 |

| Chevrolet Corvette | Sports Car | $3,534 | $295 |

| Porsche 911 | Sports Car | $3,654 | $305 |

| BMW M4 | Sports Car | $3,808 | $317 |

| Lexus LC 500 | Sports Car | $3,828 | $319 |

| Jaguar F-Type | Sports Car | $4,026 | $336 |

| Mercedes-Benz AMG GT53 | Sports Car | $4,222 | $352 |

| Porsche Taycan | Sports Car | $4,322 | $360 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

Don’t see your sports car? Not a problem! Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in Louisiana.

Luxury cars with cheap insurance

The #1 ranking in Lake Charles for the lowest-cost average insurance in the luxury sedan segment is the Acura Integra, costing $2,268 per year. Second place is the BMW 330i at $2,598 per year, the third most affordable is the Mercedes-Benz CLA250, costing an average of $2,626 per year, and the fourth cheapest is the Lexus IS 300, costing an average of $2,628 per year.

Additional models that rank well in our comparison are the Mercedes-Benz AMG CLA35, Lexus ES 350, Lexus RC 300, and Cadillac CT4, with average annual insurance rates of $2,682 per year or less.

Auto insurance rates in Lake Charles for this segment for a middle-age safe driver can cost as low as $189 per month, depending on where you live and the company you use. The next table ranks the twenty cars with the most affordable average auto insurance rates in Lake Charles, starting with the Acura Integra at $189 per month and ending with the Audi S3 at $238 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $2,268 | $189 |

| BMW 330i | Compact | $2,598 | $217 |

| Mercedes-Benz CLA250 | Midsize | $2,626 | $219 |

| Lexus IS 300 | Midsize | $2,628 | $219 |

| Acura TLX | Compact | $2,638 | $220 |

| Cadillac CT4 | Compact | $2,664 | $222 |

| Lexus ES 350 | Midsize | $2,664 | $222 |

| Genesis G70 | Compact | $2,670 | $223 |

| Mercedes-Benz AMG CLA35 | Midsize | $2,676 | $223 |

| Lexus RC 300 | Midsize | $2,682 | $224 |

| Lexus IS 350 | Compact | $2,694 | $225 |

| Jaguar XF | Midsize | $2,698 | $225 |

| Cadillac CT5 | Midsize | $2,748 | $229 |

| Lexus ES 250 | Midsize | $2,758 | $230 |

| Lexus RC 350 | Compact | $2,768 | $231 |

| BMW 330e | Compact | $2,772 | $231 |

| BMW 228i | Compact | $2,774 | $231 |

| BMW 230i | Compact | $2,798 | $233 |

| Lexus ES 300h | Midsize | $2,800 | $233 |

| Audi S3 | Compact | $2,860 | $238 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

For more luxury car insurance comparisons, see our complete guide for luxury car insurance.

Don’t see insurance rates for your vehicle? That’s no problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Lake Charles car insurance quotes from top-rated auto insurance companies in Louisiana.

Cheap luxury SUVs to insure in Lake Charles, LA

Ranking at the top for the lowest-cost Lake Charles car insurance rates in the luxury SUV segment are the Cadillac XT4, Cadillac XT5, Acura RDX, Jaguar E-Pace, and Lexus NX 250. Insurance rates for these models average $2,408 or less per year, or around $201 per month.

Some other luxury SUVs that have affordable average insurance rates include the Mercedes-Benz GLB 250, Lexus NX 450h, Lexus NX 350h, and Lexus UX 250h, with average annual insurance rates of $2,460 per year or less.

Additional 2024 models that made the list include the Mercedes-Benz GLA250, Acura MDX, Mercedes-Benz AMG GLB35, Infiniti QX60, and Infiniti QX50, which average between $2,460 and $2,560 per year for auto insurance in Lake Charles.

As a cost per month, auto insurance rates in this segment for a good driver will start around $178 per month, depending on your location and insurance company.

The next table ranks the twenty SUVs with the most affordable car insurance rates in Lake Charles, starting with the Acura RDX at $2,132 per year ($178 per month) and ending with the Lexus RX 350 at $2,560 per year ($213 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $2,132 | $178 |

| Lexus NX 250 | Compact | $2,258 | $188 |

| Cadillac XT4 | Compact | $2,304 | $192 |

| Jaguar E-Pace | Midsize | $2,384 | $199 |

| Cadillac XT5 | Midsize | $2,408 | $201 |

| Lexus NX 350h | Compact | $2,408 | $201 |

| Lincoln Corsair | Compact | $2,436 | $203 |

| Mercedes-Benz GLB 250 | Compact | $2,442 | $204 |

| Lexus UX 250h | Compact | $2,448 | $204 |

| Lexus NX 450h | Compact | $2,460 | $205 |

| Infiniti QX50 | Midsize | $2,480 | $207 |

| Mercedes-Benz GLA250 | Compact | $2,486 | $207 |

| Cadillac XT6 | Midsize | $2,494 | $208 |

| Mercedes-Benz GLA35 AMG | Compact | $2,496 | $208 |

| Infiniti QX60 | Midsize | $2,508 | $209 |

| Mercedes-Benz AMG GLB35 | Midsize | $2,512 | $209 |

| Land Rover Evoque | Compact | $2,546 | $212 |

| Acura MDX | Midsize | $2,550 | $213 |

| Lexus NX 350 | Compact | $2,558 | $213 |

| Lexus RX 350 | Midsize | $2,560 | $213 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Lake Charles, LA Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Looking for rates for a different model? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get cheap Lake Charles car insurance quotes from top-rated companies in Louisiana.

Helpful tips to save on car insurance

Smart drivers in Lake Charles should always be looking to reduce the monthly expense for auto insurance So glance at the money-saving ideas in the list below and maybe you’ll find a way to save a few bucks when buying auto insurance.

- Keep your claim-free discount. Most car insurance companies give a discounted rate for not having any claims. Car insurance should only be used for significant claims, not for small claims.

- Remove unneeded coverage on older cars. Dropping comprehensive and collision coverage from vehicles that are older can reduce the cost of auto insurance considerably.

- Obey the law to get lower rates. If you want to get affordable auto insurance in Lake Charles, it pays to avoid traffic citations. Just one or two minor driving offenses could raise insurance policy rates by at least $672 per year.

- Check your credit score. Having a credit score over 800 may save $401 per year over a rating of 670-739. Conversely, a subpar credit score could cost up to $465 more per year. Not all states use credit score as a rating factor, so check with your agent or company.

- Policy discounts equal cheaper auto insurance rates. Discounts may be available if the insureds are loyal customers, drive a vehicle with safety or anti-theft features, are good students, are accident-free, are homeowners, or many other discounts which could save the average Lake Charles driver as much as $436 per year on their insurance cost.

- Buy vehicles with low cost insurance. Vehicle type is a big factor in the cost of insurance. For example, a Kia Soul costs $1,542 less per year to insure in Lake Charles than a Chevrolet Corvette. Lower performance vehicles cost less to insure.