- Average car insurance cost in Greensboro is $1,850 per year, or about $154 per month, for a full-coverage policy.

- Monthly car insurance rates for a few popular models in Greensboro include the Toyota Corolla at $150, Mazda CX-5 at $126, and Ram Truck at $178.

- For cheap car insurance in Greensboro, North Carolina, compact crossovers and SUVs like the Kia Soul, Chevrolet Trailblazer, Honda CR-V, and Volkswagen Tiguan have some of the best auto insurance rates.

How much does car insurance cost in Greensboro?

The average cost to insure a vehicle in Greensboro is $1,850 per year, which is 20.6% less than the overall national average rate of $2,276. Average car insurance cost per month in Greensboro is $154 for a full coverage policy.

In the state of North Carolina, the average cost to insure a vehicle is $1,866 per year, so the cost in Greensboro averages $16 less per year. The cost of insurance in Greensboro compared to other North Carolina cities is about $162 per year less than in Charlotte, $6 per year cheaper than in Durham, and $96 per year more than in Winston-Salem.

The chart below shows examples of average Greensboro auto insurance cost broken out for a range of driver ages, policy deductibles, and driver risk scenarios. Rates are averaged for all 2024 model year vehicles including luxury brand cars and SUVs.

In the chart above, the cost of car insurance in Greensboro ranges from $1,540 per year for a 40-year-old driver with a discount rate policy to $4,256 per year for a 30-year-old driver who has a subpar driving record and has to buy high risk car insurance. From a monthly budget standpoint, the average cost ranges from $128 to $355 per month.

Greensboro car insurance rates are extremely variable and can also be significantly different between companies. This variability stresses the need for accurate free auto insurance quotes when looking for more affordable auto insurance.

Driver age is the largest factor that influences the cost of auto insurance, so the list below details how age impacts cost by showing the difference in average car insurance rates based on the age of the driver.

Greensboro car insurance cost for drivers age 16 to 60

- 16 year old – $6,590 per year or $549 per month

- 17 year old – $6,385 per year or $532 per month

- 18 year old – $5,720 per year or $477 per month

- 19 year old – $5,210 per year or $434 per month

- 20 year old – $3,722 per year or $310 per month

- 30 year old – $1,974 per year or $165 per month

- 40 year old – $1,850 per year or $154 per month

- 50 year old – $1,642 per year or $137 per month

- 60 year old – $1,536 per year or $128 per month

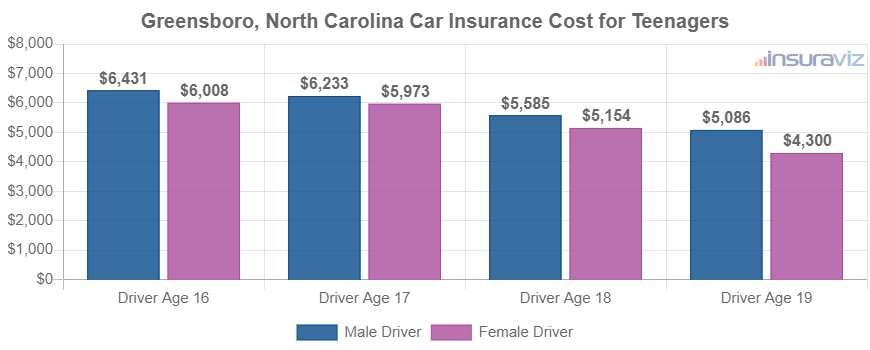

The rates in the list above for teen drivers were based on the driver being male. The next chart gets more specific and breaks out average car insurance rates for teenagers by gender. In general, females have cheaper auto insurance rates, in particular for ages 20 and below.

Car insurance for a 16-year-old female driver in Greensboro costs an average of $432 less per year than the cost to insure a 16-year-old male driver, while at age 19, it’s still $804 cheaper per year for females than males.

Greensboro’s favorite vehicles and the cost of auto insurance

The car insurance rates mentioned previously take all 2024 models and come up with an average cost, which is suitable for making generalized comparisons such as the difference in average auto insurance cost for two different locations in North Carolina. Average auto insurance rates are fantastic when presented with a question like “is Greensboro car insurance cheaper than Raleigh?” or “is car insurance cheaper in North Carolina or Florida?”.

But for more useful auto insurance comparisons, the rates will be more accurate if we perform a rate analysis for the specific model of vehicle being insured. Every car, truck, SUV and minivan has slightly different risk characteristics for calculating the cost of auto insurance and this data makes it possible to perform more detailed insurance cost analysis.

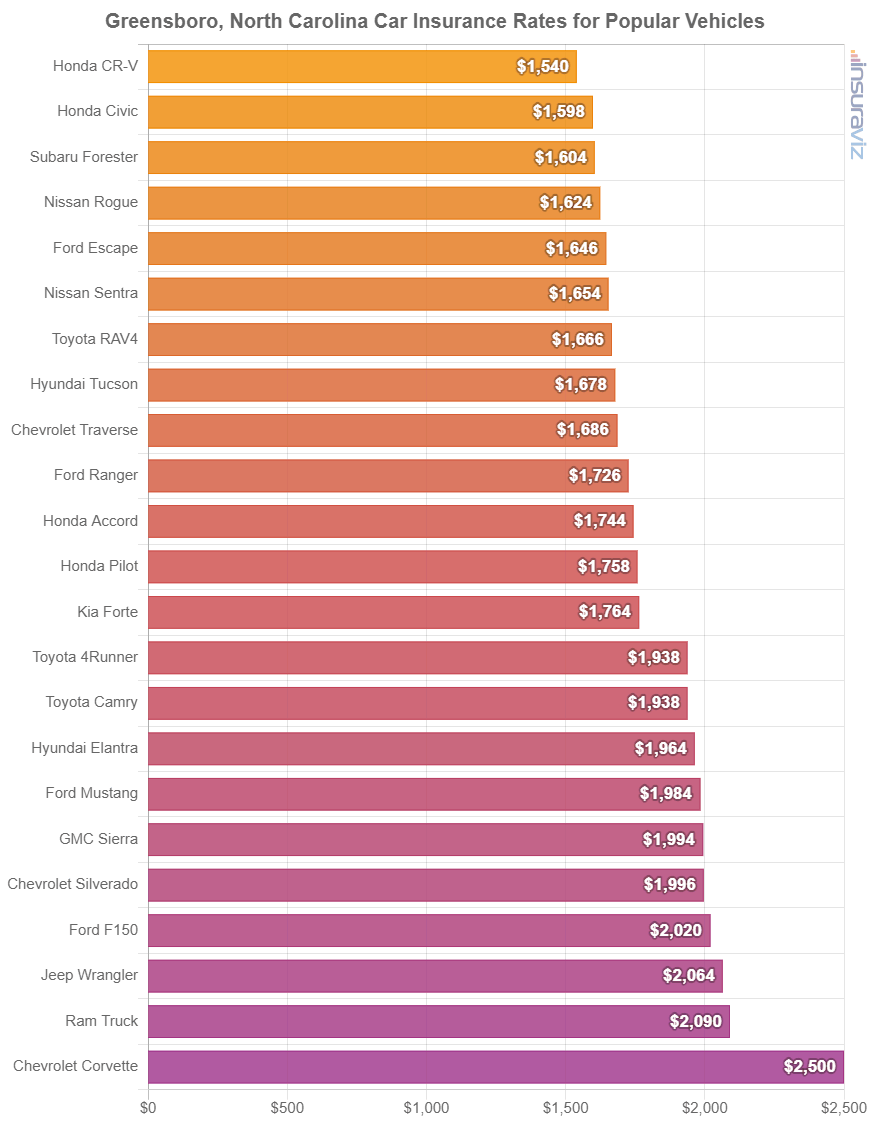

The chart below displays the cost of car insurance in Greensboro for some of the more popular vehicles. Towards the end of this article, we’ll explore rates for some of these vehicles in much more detail.

Popular vehicles in Greensboro tend to be compact or midsize sedans like the Nissan Sentra and Honda Accord and compact or midsize SUVs like the Honda CR-V and Subaru Outback.

A few additional popular models from other vehicle segments include luxury SUVs like the Acura MDX, BMW X5, and Lexus RX 350, luxury cars like the Tesla Model S, Lexus ES 350, and Acura ILX, and pickup trucks like the Toyota Tacoma, Ram 1500, and Ford Ranger.

We cover different rates in much more detail later in this article, but before we delve that deep, let’s look at the important concepts covered so far.

- Cost per month ranges from $128 to $549 – That’s the average car insurance cost range for drivers from age 16 to 60 in Greensboro.

- Insuring a teenager can be very expensive – Average cost ranges from $4,406 to $6,590 per year for car insurance for teens in Greensboro.

- Car insurance is generally cheaper the older you are – Average auto insurance rates for a 40-year-old driver in Greensboro are $1,872 per year cheaper than for a 20-year-old driver.

- Greensboro average car insurance cost is less than the U.S. average – $1,850 (Greensboro average) compared to $2,276 (U.S. average)

- Greensboro auto insurance rates are cheaper than the North Carolina state average – $1,850 (Greensboro average) compared to $1,866 (North Carolina average)

- Auto insurance rates drop considerably in your twenties – The average 30-year-old Greensboro, NC, driver will pay $1,748 less per year than a 20-year-old driver, $1,974 versus $3,722.

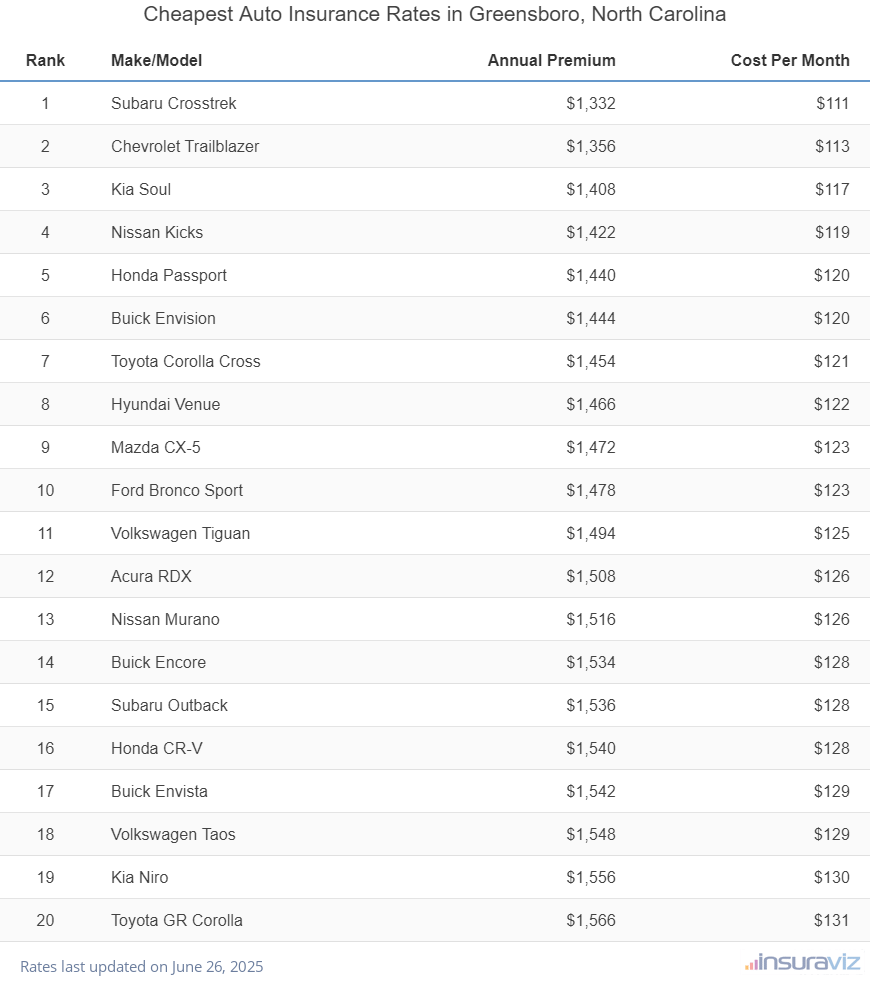

What vehicles have the cheapest car insurance in Greensboro?

When rates are compared for all vehicles, the models with the best auto insurance rates in Greensboro, NC, tend to be crossover SUVs like the Kia Soul, Subaru Crosstrek, and Hyundai Venue. Average insurance rates for those models cost $1,502 or less per year for a policy with full coverage.

Examples of other vehicles that have very good insurance prices in the comparison table below are the Buick Encore, Volkswagen Taos, Ford Bronco Sport, and Toyota GR Corolla. Average car insurance rates are marginally higher for those models than the crossovers and small SUVs that rank near the top, but they still have average rates of $134 or less per month.

The next table breaks down the top 20 cheapest vehicles to insure in Greensboro, sorted by annual and monthly insurance cost.

| Rank | Make/Model | Annual Premium | Cost Per Month |

|---|---|---|---|

| 1 | Subaru Crosstrek | $1,370 | $114 |

| 2 | Chevrolet Trailblazer | $1,390 | $116 |

| 3 | Kia Soul | $1,444 | $120 |

| 4 | Nissan Kicks | $1,456 | $121 |

| 5 | Honda Passport | $1,474 | $123 |

| 6 | Buick Envision | $1,486 | $124 |

| 7 | Toyota Corolla Cross | $1,492 | $124 |

| 8 | Hyundai Venue | $1,502 | $125 |

| 9 | Mazda CX-5 | $1,510 | $126 |

| 10 | Ford Bronco Sport | $1,516 | $126 |

| 11 | Volkswagen Tiguan | $1,534 | $128 |

| 12 | Acura RDX | $1,548 | $129 |

| 13 | Nissan Murano | $1,554 | $130 |

| 14 | Buick Encore | $1,572 | $131 |

| 15 | Honda CR-V | $1,576 | $131 |

| 16 | Subaru Outback | $1,578 | $132 |

| 17 | Buick Envista | $1,580 | $132 |

| 18 | Volkswagen Taos | $1,582 | $132 |

| 19 | Kia Niro | $1,594 | $133 |

| 20 | Honda HR-V | $1,608 | $134 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

The above table containing 20 vehicle rankings is not the best way to show a complete view of Greensboro insurance rates. A more useful way to group rates in a coherent manner is by breaking them out by their automotive segment. The sections below list the top 20 vehicles with the lowest cost insurance rates in Greensboro for the six main segments.

Cheapest car insurance rates in Greensboro

Taking the top spot in Greensboro for cheapest average insurance rates in the non-luxury sedan segment is the Toyota GR Corolla, costing an average of $1,610 per year. Second place is the Nissan Leaf costing $1,618 per year, ranking third is the Honda Civic, at an average of $1,638 per year, and the fourth cheapest is the Nissan Sentra, costing an average of $1,692 per year.

Other models that rank well in our comparison are the Kia K5, Toyota Prius, Honda Accord, and Toyota Corolla, with average rates of $1,804 per year or less.

Additional 2024 models on the list include the Volkswagen Jetta, Toyota Crown, Hyundai Ioniq 6, Mazda 3, and Subaru Legacy, which cost between $1,804 and $1,912 per year for insurance in Greensboro.

On a monthly basis, auto insurance on this segment in Greensboro for the average driver starts at an average of $134 per month, depending on the company and your location.

If vehicle size is considered, the most affordable non-luxury compact car to insure in Greensboro is the Toyota GR Corolla at $1,610 per year, or $134 per month. For midsize cars, the Kia K5 is cheapest to insure at $1,780 per year, or $148 per month. And for large cars, the Chrysler 300 is cheapest to insure at $1,762 per year, or $147 per month.

The rate comparison table below ranks the twenty cars with the lowest-cost average insurance rates in Greensboro.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Toyota GR Corolla | Compact | $1,610 | $134 |

| Nissan Leaf | Compact | $1,618 | $135 |

| Honda Civic | Compact | $1,638 | $137 |

| Nissan Sentra | Compact | $1,692 | $141 |

| Subaru Impreza | Compact | $1,698 | $142 |

| Toyota Prius | Compact | $1,728 | $144 |

| Kia K5 | Midsize | $1,780 | $148 |

| Honda Accord | Midsize | $1,786 | $149 |

| Chevrolet Malibu | Midsize | $1,792 | $149 |

| Kia Forte | Compact | $1,802 | $150 |

| Toyota Corolla | Compact | $1,804 | $150 |

| Volkswagen Arteon | Midsize | $1,820 | $152 |

| Nissan Versa | Compact | $1,824 | $152 |

| Subaru Legacy | Midsize | $1,824 | $152 |

| Hyundai Ioniq 6 | Midsize | $1,842 | $154 |

| Mitsubishi Mirage G4 | Compact | $1,868 | $156 |

| Volkswagen Jetta | Compact | $1,870 | $156 |

| Toyota Crown | Midsize | $1,872 | $156 |

| Hyundai Sonata | Midsize | $1,876 | $156 |

| Mazda 3 | Compact | $1,912 | $159 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

See our guides for compact car insurance, midsize car insurance, and full-size car insurance to compare rates for all makes and models.

Is your vehicle not in the list? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free Greensboro car insurance quotes from the best companies in North Carolina.

Cheapest SUVs to insure in Greensboro, NC

Sitting at number one in Greensboro for cheapest average insurance in the non-luxury SUV segment is the Subaru Crosstrek, at an average of $1,370 per year. Second place is the Chevrolet Trailblazer costing $1,390 per year, in third place is the Kia Soul, at an average of $1,444 per year, and in fourth place is the Nissan Kicks, at an average of $1,456 per year.

Additional SUVs that have cheaper rates include the Buick Envision, Toyota Corolla Cross, Ford Bronco Sport, and Mazda CX-5, with average cost of $1,516 per year or less.

Ranked lower than 10th place, but still in the top 20, models like the Subaru Ascent, Honda HR-V, Buick Envista, Honda CR-V, and Kia Niro cost between $1,516 and $1,610 per year for full-coverage insurance.

Full-coverage auto insurance in Greensboro for this segment for a middle-age safe driver starts at around $114 per month, depending on your company and location.

The most affordable compact SUV to insure in Greensboro is the Subaru Crosstrek at $1,370 per year. For midsize SUVs, the Honda Passport has the cheapest rates at $1,474 per year. And for large SUVs, the Chevrolet Tahoe has the cheapest rates at $1,736 per year.

The rate comparison table below ranks the twenty SUVs with the cheapest insurance rates in Greensboro, starting with the Subaru Crosstrek at $1,370 per year and ending with the Subaru Ascent at $1,610 per year.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Subaru Crosstrek | Compact | $1,370 | $114 |

| Chevrolet Trailblazer | Compact | $1,390 | $116 |

| Kia Soul | Compact | $1,444 | $120 |

| Nissan Kicks | Compact | $1,456 | $121 |

| Honda Passport | Midsize | $1,474 | $123 |

| Buick Envision | Compact | $1,486 | $124 |

| Toyota Corolla Cross | Compact | $1,492 | $124 |

| Hyundai Venue | Compact | $1,502 | $125 |

| Mazda CX-5 | Compact | $1,510 | $126 |

| Ford Bronco Sport | Compact | $1,516 | $126 |

| Volkswagen Tiguan | Compact | $1,534 | $128 |

| Nissan Murano | Midsize | $1,554 | $130 |

| Buick Encore | Compact | $1,572 | $131 |

| Honda CR-V | Compact | $1,576 | $131 |

| Subaru Outback | Midsize | $1,578 | $132 |

| Buick Envista | Midsize | $1,580 | $132 |

| Volkswagen Taos | Compact | $1,582 | $132 |

| Kia Niro | Compact | $1,594 | $133 |

| Honda HR-V | Compact | $1,608 | $134 |

| Subaru Ascent | Midsize | $1,610 | $134 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

See our comprehensive guides for compact SUV insurance, midsize SUV insurance, and full-size SUV insurance to view data for vehicles not featured in the table.

Don’t see rates for your SUV? No sweat! Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get cheap Greensboro car insurance quotes from top companies in North Carolina.

Cheapest sports car insurance rates in Greensboro

The cheapest sports cars to insure in Greensboro are the Mazda MX-5 Miata at $1,712 per year, the Toyota GR86 at $1,948 per year, and the Ford Mustang at $2,034 per year.

Not the cheapest in the list, but still ranking well, are cars like the BMW M2, Subaru BRZ, Lexus RC F, and Toyota GR Supra, with average insurance cost of $2,212 per year or less.

In the bottom half of the top 20, models like the Porsche 911, Lexus LC 500, Porsche Taycan, Chevrolet Camaro, and Porsche 718 average between $2,212 and $3,132 per year for auto insurance.

As a cost per month, full-coverage car insurance on this segment in Greensboro for a good driver starts at around $143 per month, depending on your location.

The table below ranks the sports cars with the most affordable car insurance rates in Greensboro.

| Make and Model | Vehicle Type | Annual Premium | Cost Per Month |

|---|---|---|---|

| Mazda MX-5 Miata | Sports Car | $1,712 | $143 |

| Toyota GR86 | Sports Car | $1,948 | $162 |

| Ford Mustang | Sports Car | $2,034 | $170 |

| BMW Z4 | Sports Car | $2,042 | $170 |

| Subaru WRX | Sports Car | $2,074 | $173 |

| Toyota GR Supra | Sports Car | $2,078 | $173 |

| BMW M2 | Sports Car | $2,140 | $178 |

| Nissan Z | Sports Car | $2,142 | $179 |

| Lexus RC F | Sports Car | $2,186 | $182 |

| Subaru BRZ | Sports Car | $2,212 | $184 |

| BMW M3 | Sports Car | $2,336 | $195 |

| Porsche 718 | Sports Car | $2,384 | $199 |

| Chevrolet Camaro | Sports Car | $2,404 | $200 |

| Chevrolet Corvette | Sports Car | $2,562 | $214 |

| Porsche 911 | Sports Car | $2,654 | $221 |

| BMW M4 | Sports Car | $2,764 | $230 |

| Lexus LC 500 | Sports Car | $2,778 | $232 |

| Jaguar F-Type | Sports Car | $2,920 | $243 |

| Mercedes-Benz AMG GT53 | Sports Car | $3,062 | $255 |

| Porsche Taycan | Sports Car | $3,132 | $261 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

Looking for rates for a different vehicle? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free car insurance quotes from top-rated auto insurance companies in Greensboro.

Cheapest pickups to insure in Greensboro, North Carolina

The Chevrolet Colorado ranks at #1 for the cheapest pickup truck to insure in Greensboro, followed closely by the Nissan Titan, Nissan Frontier, Ford Ranger, and Ford Maverick. The 2024 model costs an average of $1,628 per year for a full-coverage insurance policy.

Other pickups that have good average insurance rates include the Honda Ridgeline, GMC Canyon, Toyota Tacoma, and GMC Sierra 2500 HD, with an average cost to insure of $1,902 per year or less.

As a cost per month, full-coverage car insurance on this segment in Greensboro for a middle-age safe driver starts at around $136 per month, depending on the company. The table below ranks the pickups with the most affordable insurance in Greensboro, starting with the Chevrolet Colorado at $1,628 per year ($136 per month) and ending with the Ram Truck at $2,140 per year ($178 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Chevrolet Colorado | Midsize | $1,628 | $136 |

| Nissan Titan | Full-size | $1,730 | $144 |

| Nissan Frontier | Midsize | $1,752 | $146 |

| Ford Ranger | Midsize | $1,766 | $147 |

| Ford Maverick | Midsize | $1,794 | $150 |

| Honda Ridgeline | Midsize | $1,834 | $153 |

| Hyundai Santa Cruz | Midsize | $1,864 | $155 |

| Toyota Tacoma | Midsize | $1,872 | $156 |

| GMC Sierra 2500 HD | Heavy Duty | $1,882 | $157 |

| GMC Canyon | Midsize | $1,902 | $159 |

| Jeep Gladiator | Midsize | $1,946 | $162 |

| GMC Sierra 3500 | Heavy Duty | $1,962 | $164 |

| Chevrolet Silverado HD 3500 | Heavy Duty | $1,978 | $165 |

| Chevrolet Silverado HD 2500 | Heavy Duty | $2,030 | $169 |

| GMC Sierra | Full-size | $2,040 | $170 |

| Nissan Titan XD | Heavy Duty | $2,044 | $170 |

| Chevrolet Silverado | Full-size | $2,048 | $171 |

| Ford F150 | Full-size | $2,070 | $173 |

| GMC Hummer EV Pickup | Full-size | $2,120 | $177 |

| Ram Truck | Full-size | $2,140 | $178 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

See our comprehensive guides for midsize pickup insurance and large pickup insurance to view data for pickups not featured in the table.

Need rates for a different pickup model? No problem! Enter your zip code at the bottom of the above table and click the orange ‘GO’ button to get free car insurance quotes from top auto insurance companies in North Carolina.

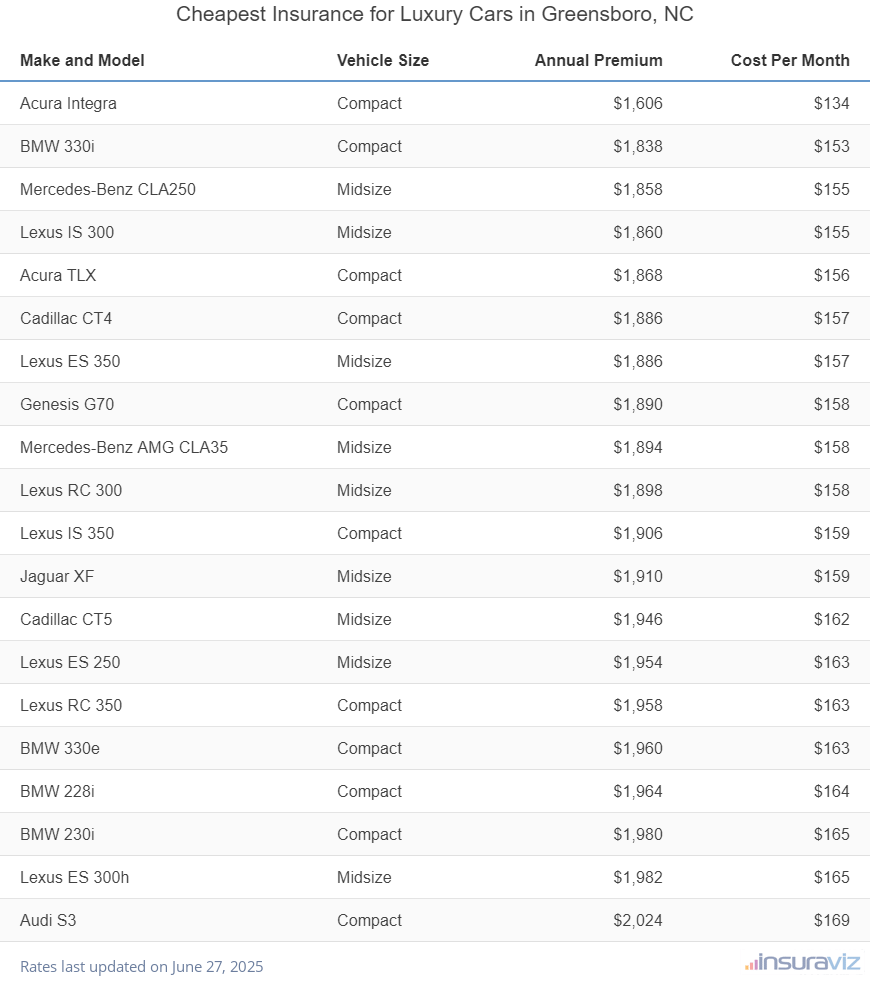

Cheapest luxury cars to insure in Greensboro

The Acura Integra comes in at #1 as the cheapest luxury car to insure in Greensboro, followed closely by the BMW 330i, Mercedes-Benz CLA250, Lexus IS 300, and Acura TLX. The 2024 model costs an average of $1,644 per year for a policy with full coverage.

Additional models that rank well are the Cadillac CT4, Lexus ES 350, Genesis G70, and Mercedes-Benz AMG CLA35, with average insurance cost of $1,944 per year or less.

Ranked in the bottom half of the top 20 cheapest luxury cars to insure, models like the Lexus ES 300h, Audi S3, BMW 230i, BMW 330e, and Cadillac CT5 average between $1,944 and $2,074 per year for insurance.

As a cost per month, car insurance on this segment in Greensboro for the average driver starts at around $137 per month, depending on your location and insurance company.

The comparison table below ranks the twenty cars with the cheapest auto insurance rates in Greensboro, starting with the Acura Integra at $137 per month and ending with the Audi S3 at $173 per month.

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura Integra | Compact | $1,644 | $137 |

| BMW 330i | Compact | $1,884 | $157 |

| Mercedes-Benz CLA250 | Midsize | $1,904 | $159 |

| Lexus IS 300 | Midsize | $1,908 | $159 |

| Acura TLX | Compact | $1,914 | $160 |

| Cadillac CT4 | Compact | $1,932 | $161 |

| Lexus ES 350 | Midsize | $1,932 | $161 |

| Genesis G70 | Compact | $1,936 | $161 |

| Mercedes-Benz AMG CLA35 | Midsize | $1,940 | $162 |

| Lexus RC 300 | Midsize | $1,944 | $162 |

| Lexus IS 350 | Compact | $1,954 | $163 |

| Jaguar XF | Midsize | $1,958 | $163 |

| Cadillac CT5 | Midsize | $1,992 | $166 |

| Lexus ES 250 | Midsize | $2,002 | $167 |

| BMW 330e | Compact | $2,006 | $167 |

| Lexus RC 350 | Compact | $2,006 | $167 |

| BMW 228i | Compact | $2,010 | $168 |

| BMW 230i | Compact | $2,026 | $169 |

| Lexus ES 300h | Midsize | $2,028 | $169 |

| Audi S3 | Compact | $2,074 | $173 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

For more luxury car insurance comparisons, see our complete guide for luxury car insurance.

Looking for rates for a different vehicle? Enter your zip code at the bottom of the table and click the orange ‘GO’ button to get free car insurance quotes from the best auto insurance companies in North Carolina.

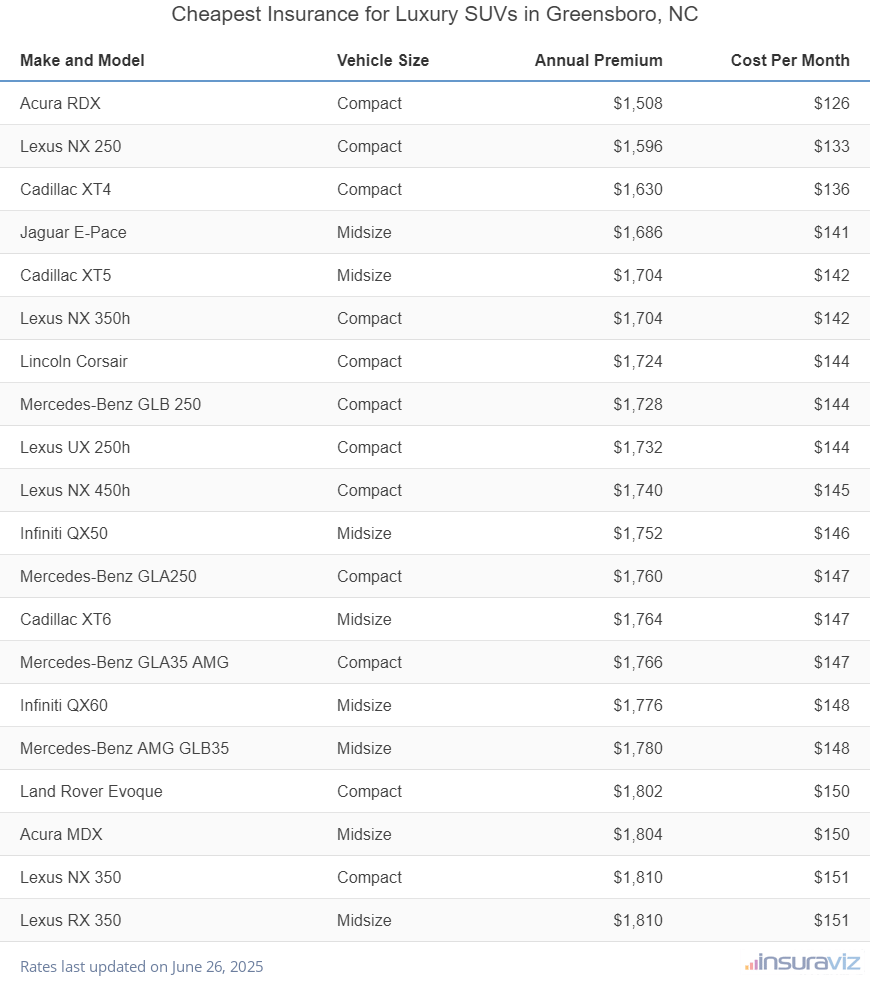

Cheapest luxury SUVs to insure in Greensboro

The Acura RDX takes the top ranking for the cheapest luxury SUV model to insure in Greensboro, followed by the Lexus NX 250, Cadillac XT4, Jaguar E-Pace, and Cadillac XT5. The 2024 model averages $1,548 per year for a full-coverage insurance policy.

Some other luxury SUVs that have cheaper rates are the Mercedes-Benz GLB 250, Lincoln Corsair, Lexus NX 350h, and Lexus UX 250h, with average insurance cost of $1,786 per year or less.

Ranked in the bottom half of the top 20 cheapest luxury SUVs to insure, models like the Acura MDX, Infiniti QX60, Mercedes-Benz GLA250, Cadillac XT6, and Lexus RX 350 cost between $1,786 and $1,860 to insure per year in Greensboro.

Car insurance in this segment for the average driver can cost as low as $129 per month, depending on the company and your location.

When rates are compared by vehicle size, the most affordable small luxury SUV to insure in Greensboro is the Acura RDX at $1,548 per year. For midsize luxury models, the Jaguar E-Pace is the cheapest model to insure at $1,732 per year. And for full-size luxury models, the Infiniti QX80 is the cheapest model to insure at $2,074 per year.

The rate comparison table below ranks the SUVs with the lowest-cost insurance rates in Greensboro, starting with the Acura RDX at $1,548 per year ($129 per month) and ending with the Lexus RX 350 at $1,860 per year ($155 per month).

| Make and Model | Vehicle Size | Annual Premium | Cost Per Month |

|---|---|---|---|

| Acura RDX | Compact | $1,548 | $129 |

| Lexus NX 250 | Compact | $1,638 | $137 |

| Cadillac XT4 | Compact | $1,670 | $139 |

| Jaguar E-Pace | Midsize | $1,732 | $144 |

| Lexus NX 350h | Compact | $1,744 | $145 |

| Cadillac XT5 | Midsize | $1,746 | $146 |

| Lincoln Corsair | Compact | $1,768 | $147 |

| Mercedes-Benz GLB 250 | Compact | $1,770 | $148 |

| Lexus UX 250h | Compact | $1,772 | $148 |

| Lexus NX 450h | Compact | $1,786 | $149 |

| Infiniti QX50 | Midsize | $1,800 | $150 |

| Mercedes-Benz GLA250 | Compact | $1,804 | $150 |

| Mercedes-Benz GLA35 AMG | Compact | $1,808 | $151 |

| Cadillac XT6 | Midsize | $1,812 | $151 |

| Infiniti QX60 | Midsize | $1,822 | $152 |

| Mercedes-Benz AMG GLB35 | Midsize | $1,822 | $152 |

| Land Rover Evoque | Compact | $1,846 | $154 |

| Acura MDX | Midsize | $1,852 | $154 |

| Lexus NX 350 | Compact | $1,856 | $155 |

| Lexus RX 350 | Midsize | $1,860 | $155 |

Data Methodology: Rated driver is a 40-year-old married male with no driving violations or at-fault accidents in the prior three years. Uninsured Motorist (UM), Underinsured Motorist (UIM) and medical payments coverages are included. Premium is averaged for all trim levels available for each vehicle and also for all Greensboro, NC Zip Codes. Updated October 24, 2025

See our comprehensive guide for luxury SUV insurance to view data for vehicles not featured in the table.

Don’t see insurance cost for your luxury SUV? Enter your zip code at the bottom of the table above and click the orange ‘GO’ button to get free Greensboro car insurance quotes from top auto insurance companies in North Carolina.

How to find cheaper Greensboro car insurance

Drivers are always searching for ways to reduce their monthly auto insurance expenses, so browse the money-saving ideas below and it’s very possible you can save a little dough on your next policy.

- Shop around for better rates. Setting aside 5-10 minutes to get free car insurance quotes can save more money than you might think. Rates change often and you can switch anytime.

- Get cheaper rates because of your employer. The large majority of auto insurance providers offer policy discounts for certain professions like members of the military, architects, engineers, doctors, firefighters, and others. If your job can earn you this discount, you could save between $56 and $180 on your yearly insurance cost, depending on the policy coverages selected.

- Lower the cost of your policy by increasing deductibles. Jacking up your deductibles from $500 to $1,000 could save around $382 per year for a 40-year-old driver and $742 per year for a 20-year-old driver.

- Avoid filing small claims. Insurance companies give a discounted rate for not filing any claims. Insurance is intended to be used to protect you from significant financial loss, not small claims that can be paid out-of-pocket.

- Compare insurance rates before buying a car. Different vehicle models can have very different insurance premiums, and companies can sell policies with very different rates. Check rates before you buy a different vehicle in order to prevent insurance sticker shock when buying insurance.